Key Insights

The South American ready-mix concrete market is experiencing robust growth, driven by significant infrastructure development projects across Brazil, Argentina, and the rest of the region. A Compound Annual Growth Rate (CAGR) exceeding 5.50% from 2019 to 2024 indicates a consistently expanding market. This growth is fueled by rising urbanization, increasing construction activity in both residential and commercial sectors, and governmental initiatives aimed at improving infrastructure, particularly in transportation and utilities. The market is segmented by end-use sector (commercial, industrial & institutional, infrastructure, residential) and product type (central mixed, shrink mixed, transit mixed). Brazil, with its large population and extensive construction activity, commands the largest market share within South America. However, Argentina and other South American nations are also contributing to overall market expansion, demonstrating considerable potential for future growth. The competitive landscape includes both multinational players like Holcim and CEMEX, and regional producers such as Votorantim Cimento and ULTRACEM S A S, reflecting a dynamic mix of established players and local businesses. While challenges such as fluctuating raw material prices and economic volatility exist, the overall positive growth trajectory suggests a promising outlook for the South American ready-mix concrete market.

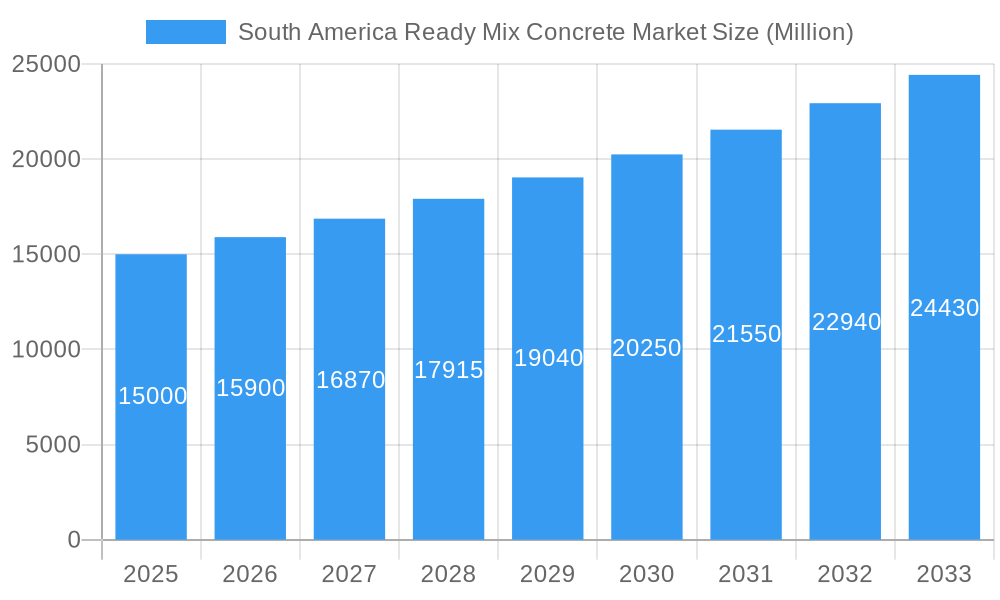

South America Ready Mix Concrete Market Market Size (In Billion)

The continued growth in the South American ready-mix concrete market is projected to continue throughout the forecast period (2025-2033). Expansion will be influenced by factors such as increasing government spending on infrastructure projects, a burgeoning middle class driving residential construction, and ongoing industrial development in key economic hubs. The market is expected to see a rise in the demand for high-performance concrete due to the need for improved durability and sustainability. Technological advancements, including the adoption of automated batching plants and improved concrete delivery systems, will also shape market dynamics. While competition remains intense, companies are focusing on strategic partnerships, mergers, and acquisitions to strengthen their market position and expand their geographical reach. Furthermore, the emphasis on sustainable concrete solutions, such as the use of recycled materials and low-carbon cement, is expected to gain traction, contributing to future market growth and shaping the industry's future trajectory.

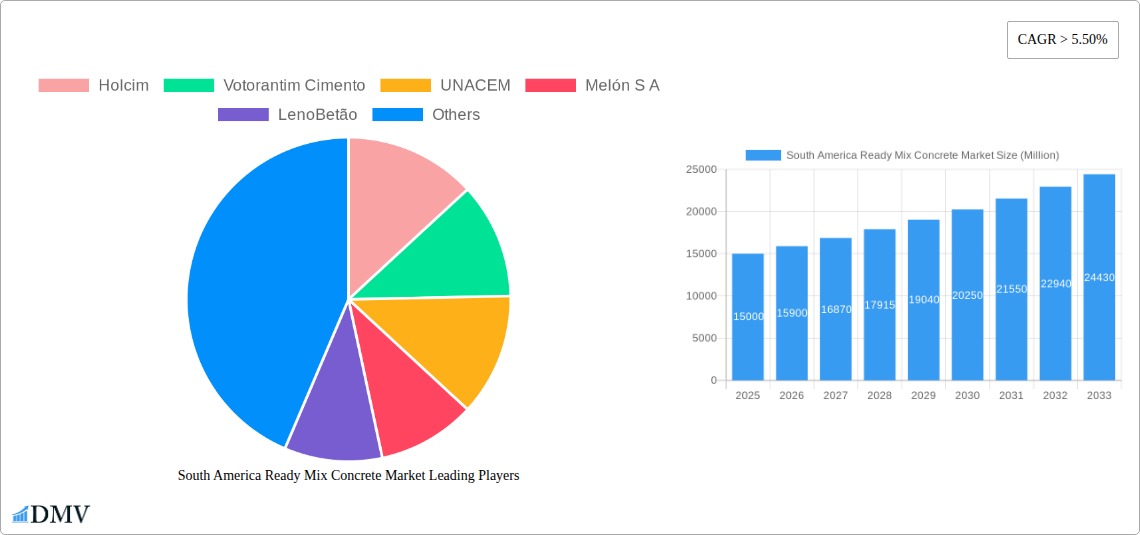

South America Ready Mix Concrete Market Company Market Share

South America Ready Mix Concrete Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the South America ready-mix concrete market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The report covers key segments including Central Mixed, Shrink Mixed, and Transit Mixed concrete, and analyzes market performance across various end-use sectors: Commercial, Industrial & Institutional, Infrastructure, and Residential. The total market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

South America Ready Mix Concrete Market Composition & Trends

The South American ready-mix concrete market exhibits a moderately concentrated landscape, with key players like Holcim, Votorantim Cimento, and CEMEX holding significant market share. However, regional players and smaller companies also contribute significantly to the overall market volume. Market share distribution in 2025 is estimated as follows: Holcim (xx%), Votorantim Cimento (xx%), CEMEX (xx%), others (xx%). Innovation in this market is driven by the need for sustainable and high-performance concrete solutions, along with advancements in mixing technologies and delivery systems. Regulatory landscapes vary across South American countries, impacting both production and distribution. Substitute products, like precast concrete elements, pose a competitive challenge. The market witnesses consistent M&A activity, with deal values ranging from tens to hundreds of Millions USD. For example, Holcim's divestment in Brazil in 2022 for USD 1.025 Billion significantly reshaped the market landscape.

- Market Concentration: Moderately concentrated, with major players controlling a significant portion of the market.

- Innovation Catalysts: Sustainable concrete solutions, advanced mixing technologies, efficient delivery systems.

- Regulatory Landscape: Varies across countries, influencing production and distribution.

- Substitute Products: Precast concrete poses a competitive threat.

- M&A Activity: Significant activity with deals reaching several hundred Million USD in value.

- End-User Profiles: Diverse, encompassing construction firms, infrastructure projects, and individual homeowners.

South America Ready Mix Concrete Market Industry Evolution

The South American ready-mix concrete market has witnessed robust growth in the historical period (2019-2024), driven by significant infrastructure development projects and expanding construction activities across various sectors. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during this period. Technological advancements, such as the adoption of high-performance concrete mixes and digitalized supply chain management, have improved efficiency and product quality. Changing consumer demands towards sustainable and environmentally friendly construction materials are pushing manufacturers to adopt greener practices. Growth is expected to continue, though at a slightly moderated pace, throughout the forecast period (2025-2033), reaching a CAGR of xx%. This moderated growth reflects factors such as economic fluctuations and potential supply chain constraints. The adoption of new technologies, however, is anticipated to offset some of these challenges, ensuring continued overall market expansion.

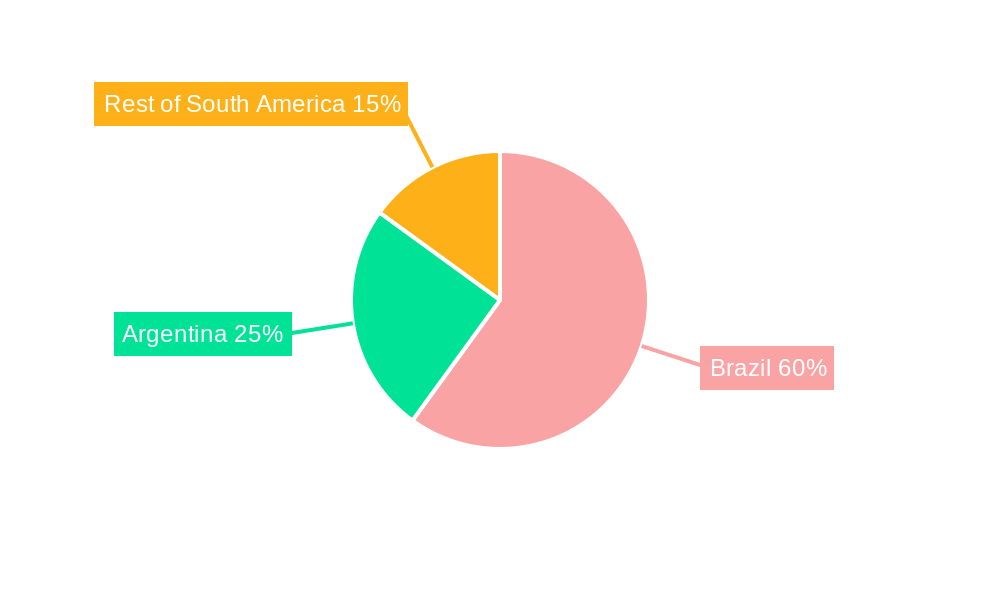

Leading Regions, Countries, or Segments in South America Ready Mix Concrete Market

Brazil stands as the dominant market for ready-mix concrete in South America, driven by large-scale infrastructure projects and robust residential construction activity. Other key countries include Colombia, Argentina, and Mexico. Within end-use sectors, Infrastructure projects account for the largest market share, followed by Residential and Commercial/Industrial sectors. Central Mixed concrete dominates the product segment due to its cost-effectiveness and widespread applicability.

- Key Drivers in Brazil: Extensive infrastructure development, government initiatives, rising urbanization.

- Key Drivers in Colombia: Increasing urbanization, government investment in infrastructure.

- Key Drivers in Argentina: Fluctuating economic conditions influence market growth, albeit significant investment in infrastructure is often undertaken.

- Dominant End-Use Sector: Infrastructure projects.

- Dominant Product Type: Central Mixed concrete.

South America Ready Mix Concrete Market Product Innovations

Recent innovations focus on high-performance, sustainable, and self-consolidating concrete mixes. These advancements cater to the increasing demand for durable, environmentally friendly, and easily workable concrete solutions. Emphasis is also placed on improving the efficiency of concrete delivery and mixing processes, leading to optimized construction timelines and reduced environmental impact. Some manufacturers are integrating advanced admixtures and supplementary cementitious materials to enhance concrete properties.

Propelling Factors for South America Ready Mix Concrete Market Growth

Several factors propel the growth of the South American ready-mix concrete market: substantial government investments in infrastructure projects (like roads, bridges, and public buildings); a growing construction sector stimulated by increasing urbanization and population growth; the rising demand for high-quality housing; and the growing adoption of sustainable construction practices. Economic growth across several South American countries also contributes to market expansion.

Obstacles in the South America Ready Mix Concrete Market

Challenges include fluctuating raw material prices, potential supply chain disruptions, intense competition from existing and emerging players, and complex regulatory landscapes that vary across different countries within South America. These factors can lead to price volatility and affect profit margins for ready-mix concrete producers. Furthermore, infrastructure limitations in some regions may hinder the efficient transport of materials.

Future Opportunities in South America Ready Mix Concrete Market

Significant growth potential exists in expanding into less developed regions, introducing innovative, eco-friendly concrete solutions, and focusing on high-value construction projects. Smart city initiatives and the increasing adoption of prefabricated and modular construction are expected to drive demand for specialized concrete products.

Major Players in the South America Ready Mix Concrete Market Ecosystem

- Holcim

- Votorantim Cimento

- UNACEM

- Melón S A

- LenoBetão

- ULTRACEM S A S

- CEMEX S A B de C V

- Argos Group

- Polimix Concreto

- Supermix

Key Developments in South America Ready Mix Concrete Market Industry

- September 2022: Holcim completed the divestment of its Brazilian business to Companhia Siderúrgica Nacional for USD 1.025 billion, impacting market share distribution.

- May 2023: Polimix Concreto commissioned a new manufacturing facility in Mooca, Sao Paulo, expanding its production capacity.

- August 2023: Polimix Concreto inaugurated a new ready-mix concrete production facility in Campinas, Sao Paulo, further strengthening its market position.

Strategic South America Ready Mix Concrete Market Forecast

The South American ready-mix concrete market is poised for continued growth, fueled by robust infrastructure development, expanding urbanization, and rising construction activities. The focus on sustainable and high-performance concrete solutions will drive innovation and open new market segments. Government initiatives and private investments will continue to play a vital role in shaping the market's future trajectory, leading to significant expansion in the coming years.

South America Ready Mix Concrete Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

- 2.1. Central Mixed

- 2.2. Shrink Mixed

- 2.3. Transit Mixed

South America Ready Mix Concrete Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Ready Mix Concrete Market Regional Market Share

Geographic Coverage of South America Ready Mix Concrete Market

South America Ready Mix Concrete Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption for Polyethylene Terephthalate in the Packaging Sector; Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific

- 3.3. Market Restrains

- 3.3.1. Toxic Effects of Terephthalic Acid

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Ready Mix Concrete Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Central Mixed

- 5.2.2. Shrink Mixed

- 5.2.3. Transit Mixed

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Holcim

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Votorantim Cimento

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UNACEM

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Melón S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LenoBetão

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ULTRACEM S A S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEMEX S A B de C V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Argos Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Polimix Concreto

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Supermix

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Holcim

List of Figures

- Figure 1: South America Ready Mix Concrete Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Ready Mix Concrete Market Share (%) by Company 2025

List of Tables

- Table 1: South America Ready Mix Concrete Market Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 2: South America Ready Mix Concrete Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: South America Ready Mix Concrete Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: South America Ready Mix Concrete Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 5: South America Ready Mix Concrete Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South America Ready Mix Concrete Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: South America Ready Mix Concrete Market Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 8: South America Ready Mix Concrete Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: South America Ready Mix Concrete Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: South America Ready Mix Concrete Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 11: South America Ready Mix Concrete Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South America Ready Mix Concrete Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Argentina South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Argentina South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Chile South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Colombia South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Colombia South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Peru South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Peru South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Venezuela South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Venezuela South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Ecuador South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ecuador South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Bolivia South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Bolivia South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Paraguay South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Paraguay South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Uruguay South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Uruguay South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Ready Mix Concrete Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the South America Ready Mix Concrete Market?

Key companies in the market include Holcim, Votorantim Cimento, UNACEM, Melón S A, LenoBetão, ULTRACEM S A S, CEMEX S A B de C V, Argos Group, Polimix Concreto, Supermix.

3. What are the main segments of the South America Ready Mix Concrete Market?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption for Polyethylene Terephthalate in the Packaging Sector; Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Toxic Effects of Terephthalic Acid.

8. Can you provide examples of recent developments in the market?

August 2023: Polimix Concreto augmented its presence in Brazil's concrete market by inaugurating a new production facility for ready-mix concrete in Campinas, Sao Paulo.May 2023: Polimix Concreto expanded its presence in Brazil's concrete market by commissioning a new manufacturing facility in Mooca, Sao Paulo. Polimix Concreto aims to cater to more customers through this expansion.September 2022: Holcim completed divesting its business in Brazil to Companhia Siderúrgica Nacional for USD 1.025 billion. The divestment includes Holcim's 19 ready-mix concrete plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Ready Mix Concrete Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Ready Mix Concrete Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Ready Mix Concrete Market?

To stay informed about further developments, trends, and reports in the South America Ready Mix Concrete Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence