Key Insights

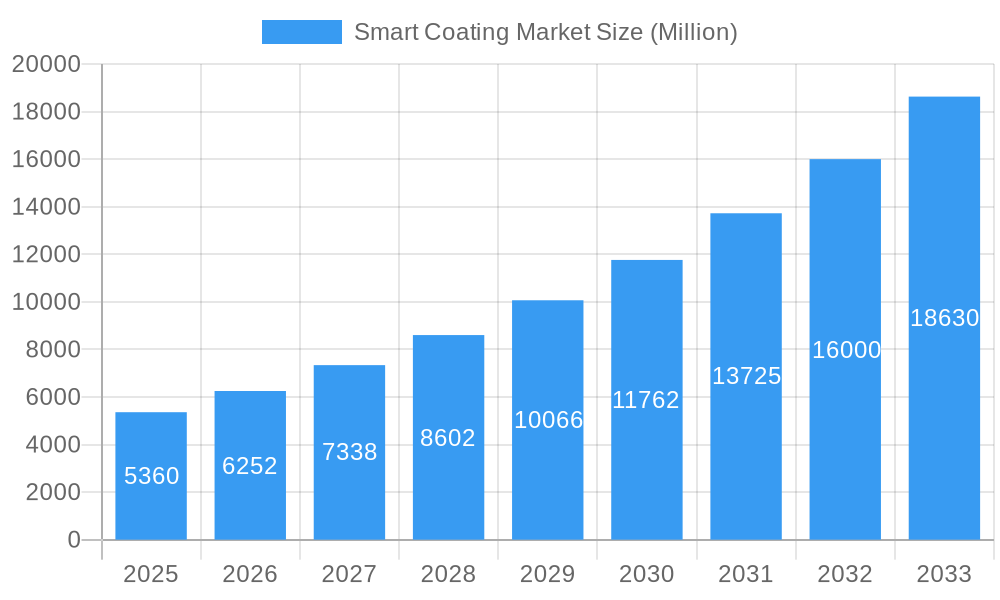

The smart coatings market, valued at $5.36 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 16.95% from 2025 to 2033. This surge is driven by several key factors. Increasing demand for energy-efficient buildings and infrastructure is fueling adoption of self-cleaning and anti-icing coatings in construction. The automotive industry's pursuit of lighter, more durable vehicles is driving demand for anti-corrosion and anti-fouling coatings. Similarly, the aerospace and defense sectors are adopting smart coatings for improved aircraft performance and enhanced durability of military equipment. Technological advancements, leading to the development of more sophisticated and specialized coatings with improved functionalities, further contribute to market expansion. The growing awareness of environmental concerns is also driving demand for eco-friendly, sustainable smart coating solutions. Competition among major players like Jotun, Sherwin-Williams, RPM International, and 3M is fostering innovation and driving down costs, making these advanced coatings accessible to a wider range of applications.

Smart Coating Market Market Size (In Billion)

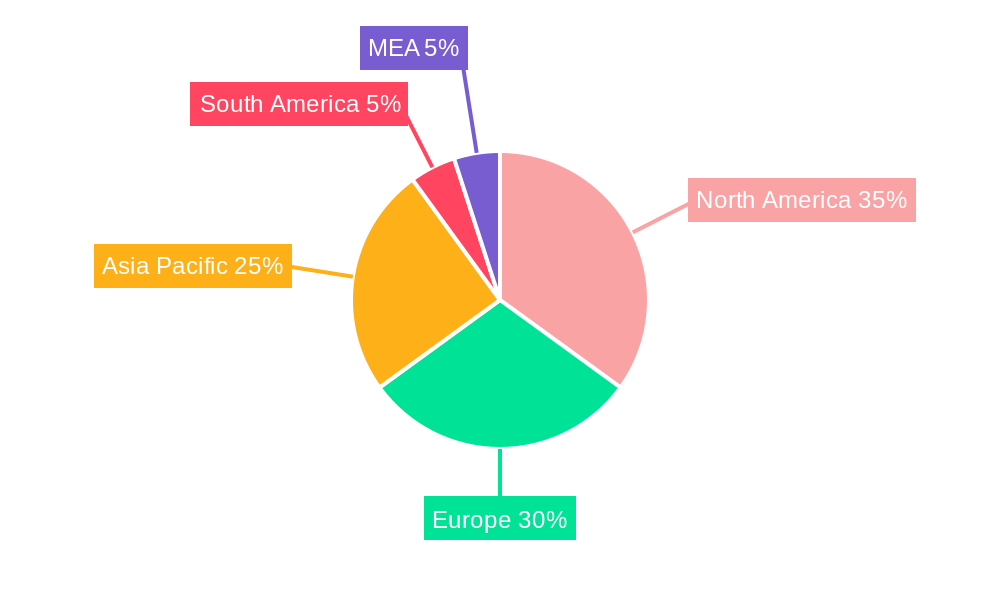

Regional growth patterns are diverse. North America and Europe currently hold significant market share, driven by strong regulatory frameworks and early adoption of advanced technologies. However, the Asia-Pacific region is projected to witness the fastest growth during the forecast period, fueled by rapid industrialization, infrastructure development, and rising disposable incomes. This region’s expanding automotive and construction sectors are key drivers of this growth. While the market faces challenges such as high initial costs and the need for specialized application techniques, the long-term benefits in terms of cost savings, enhanced durability, and improved functionality are overcoming these obstacles, ensuring continued market expansion. The market segmentation across various functions (anti-fouling, anti-microbial, etc.) and end-user industries highlights the diverse applications and potential for future growth in niche segments.

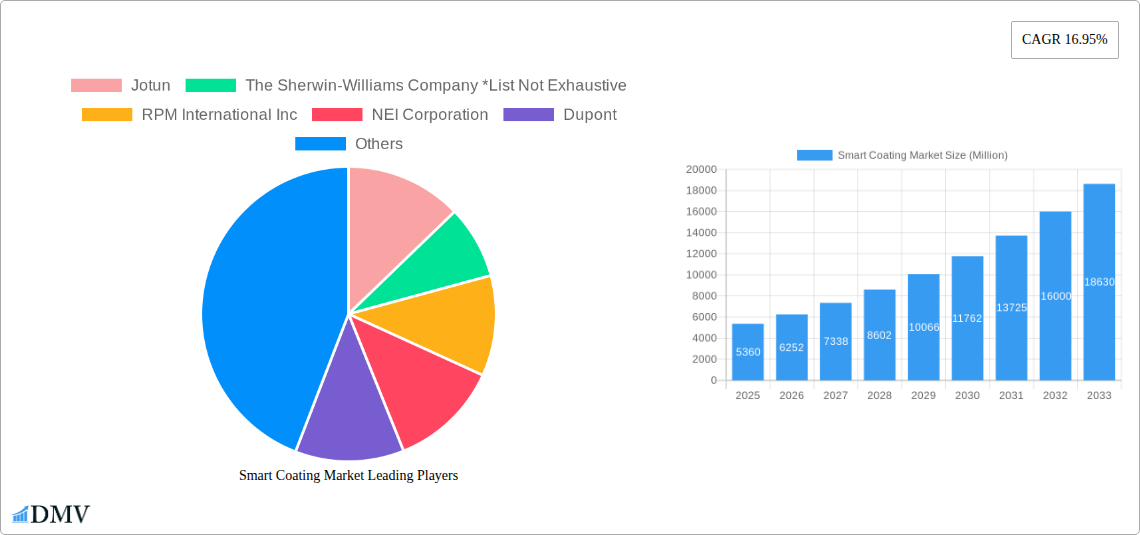

Smart Coating Market Company Market Share

Smart Coating Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global Smart Coating Market, projecting a significant expansion from 2025 to 2033. Valued at XXX Million in 2025, the market is poised for robust growth, driven by technological advancements and increasing demand across diverse end-user industries. The report covers the period from 2019 to 2033, with 2025 serving as the base year and encompassing historical data (2019-2024), estimated figures (2025), and future projections (2025-2033). This comprehensive study is essential for stakeholders seeking to understand market dynamics, identify growth opportunities, and make informed strategic decisions.

Smart Coating Market Composition & Trends

The Smart Coating Market is characterized by a moderately concentrated landscape, with key players such as Jotun, The Sherwin-Williams Company, RPM International Inc, NEI Corporation, Dupont, Akzo Nobel NV, 3M, PPG Industries Inc, Axalta Coating Systems LLC, and Hempel AS vying for market share. Innovation is a critical driver, with companies investing heavily in developing coatings with enhanced functionalities, like self-cleaning and anti-microbial properties. Stringent environmental regulations are shaping the market, pushing companies toward eco-friendly solutions. Substitute products, including traditional coatings, pose a competitive challenge, while mergers and acquisitions (M&A) activities are reshaping the market landscape.

- Market Share Distribution: The top five players account for approximately xx% of the global market share in 2025.

- M&A Activity: Recent deals, such as The Sherwin-Williams Company's acquisition of Sika AG's European industrial coatings business in April 2022, valued at xx Million, demonstrate the consolidation trend within the market. This deal significantly expanded Sherwin-Williams' presence in corrosion-resistant coatings.

- Innovation Catalysts: Advancements in nanotechnology, bio-based materials, and smart sensor integration are driving the development of next-generation smart coatings.

- Regulatory Landscape: Growing environmental concerns and stricter regulations regarding VOC emissions are influencing product development and market trends.

Smart Coating Market Industry Evolution

The Smart Coating Market has witnessed robust growth over the past few years, propelled by rising demand from the building & construction, automotive, and marine sectors. Technological advancements, such as the integration of nanomaterials and sensors, have enabled the development of coatings with enhanced durability, self-cleaning capabilities, and other advanced functions. The market is also experiencing a shift in consumer preferences, with a growing emphasis on sustainable and environmentally friendly coatings. From 2019 to 2024, the market registered a Compound Annual Growth Rate (CAGR) of xx%, and it is projected to grow at a CAGR of xx% from 2025 to 2033, reaching a value of xx Million by 2033. This growth is being fueled by increasing adoption of smart coatings in various applications, particularly in infrastructure development and advanced manufacturing. The increasing awareness about the benefits of smart coatings, such as enhanced durability and reduced maintenance costs, is further contributing to market expansion.

Leading Regions, Countries, or Segments in Smart Coating Market

The Building and Construction segment currently dominates the Smart Coating Market, driven by the extensive use of smart coatings in infrastructure projects globally. North America and Europe represent the leading regional markets, with strong demand from developed economies and a robust construction industry. The Anti-corrosion segment holds a significant market share due to its critical role in protecting infrastructure from environmental damage.

Key Drivers for Building & Construction Segment Dominance: High infrastructure investment, particularly in developing nations, is a key driver for market expansion within this segment. Stringent building codes and regulations emphasizing durability and longevity are also contributing to growth.

Key Drivers for Anti-corrosion Segment Dominance: Increasing investments in infrastructure projects, especially in marine and industrial settings, where corrosion is a significant concern, are boosting the demand for anti-corrosion smart coatings.

Key Drivers for North America and Europe Dominance: High levels of disposable income, robust industrial infrastructure, advanced technological adoption rates, and stringent environmental regulations contribute to high market penetration.

Smart Coating Market Product Innovations

Recent innovations in smart coatings include self-healing coatings that repair minor scratches and abrasions, and photocatalytic coatings that purify air by breaking down pollutants. These advancements are expanding the applications of smart coatings to various industries and improving their performance metrics. The unique selling proposition of smart coatings lies in their ability to enhance the durability, longevity, and functionality of various materials, leading to cost savings and improved performance in diverse applications. Integration of nanotechnology and sensors contributes to significant improvements in coating properties, enhancing performance and creating new market opportunities.

Propelling Factors for Smart Coating Market Growth

Technological advancements, primarily in nanotechnology and materials science, are driving the development of smart coatings with enhanced properties. Favorable economic conditions, particularly in developing countries, are stimulating investments in infrastructure projects, thereby fueling demand. Furthermore, stringent environmental regulations are pushing for the adoption of eco-friendly coatings, boosting market growth. For instance, the implementation of policies encouraging sustainable construction practices is significantly impacting the demand for sustainable smart coatings within the building and construction sector.

Obstacles in the Smart Coating Market

High initial costs associated with smart coatings can pose a significant barrier to adoption, particularly for smaller companies or projects with limited budgets. Supply chain disruptions, including raw material shortages and logistical challenges, can impact production and market availability. Intense competition among existing players, both established giants and emerging startups, also poses a challenge for market participants. Furthermore, regulatory hurdles and variations in regulatory requirements across different geographic regions may increase the complexity of product development and market access. The variability in the quality of raw materials used can affect the overall performance of the coating, which in turn can affect the end-users' confidence in these products.

Future Opportunities in Smart Coating Market

Emerging markets in Asia and Africa present significant growth potential. Advancements in biotechnology are expected to pave the way for bio-based smart coatings with enhanced sustainability. Growing consumer awareness regarding environmentally friendly products will further drive the adoption of sustainable smart coatings. Expansion into niche applications such as flexible electronics and biomedical devices could unlock new opportunities for growth.

Major Players in the Smart Coating Market Ecosystem

- Jotun

- The Sherwin-Williams Company

- RPM International Inc

- NEI Corporation

- Dupont

- Akzo Nobel NV

- 3M

- PPG Industries Inc

- Axalta Coating Systems LLC

- Hempel AS

Key Developments in Smart Coating Market Industry

- April 2022: The Sherwin-Williams Company acquired the European industrial coatings business of Sika AG, expanding its presence in corrosion-resistant coatings for various infrastructure applications.

- April 2021: AkzoNobel collaborated with Qlayers and invested in automated industrial coating application technology, enhancing efficiency and safety in the coating process.

Strategic Smart Coating Market Forecast

The Smart Coating Market is poised for significant expansion over the forecast period, driven by ongoing technological advancements, increasing demand from various end-user industries, and the growing adoption of sustainable practices. The market's future growth will be significantly influenced by the development and commercialization of innovative coating technologies, coupled with government policies supporting sustainable construction and industrial practices. The continued expansion into new geographic markets and applications is expected to drive further market expansion and create substantial opportunities for market participants.

Smart Coating Market Segmentation

-

1. Function

- 1.1. Anti-fouling

- 1.2. Anti-microbial

- 1.3. Anti-corrosion

- 1.4. Anti-icing

- 1.5. Self-cleaning

- 1.6. Color-shifting

- 1.7. Other Functions

-

2. End-user Industry

- 2.1. Building and Construction

- 2.2. Automotive

- 2.3. Marine

- 2.4. Aerospace and Defense

- 2.5. Other End-user Industries

Smart Coating Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Smart Coating Market Regional Market Share

Geographic Coverage of Smart Coating Market

Smart Coating Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Superior Properties Over Traditional Coatings; Growing Demand from the Construction Sector

- 3.3. Market Restrains

- 3.3.1. High Cost of Smart Coatings

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Building and Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Coating Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Anti-fouling

- 5.1.2. Anti-microbial

- 5.1.3. Anti-corrosion

- 5.1.4. Anti-icing

- 5.1.5. Self-cleaning

- 5.1.6. Color-shifting

- 5.1.7. Other Functions

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building and Construction

- 5.2.2. Automotive

- 5.2.3. Marine

- 5.2.4. Aerospace and Defense

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Asia Pacific Smart Coating Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Anti-fouling

- 6.1.2. Anti-microbial

- 6.1.3. Anti-corrosion

- 6.1.4. Anti-icing

- 6.1.5. Self-cleaning

- 6.1.6. Color-shifting

- 6.1.7. Other Functions

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Building and Construction

- 6.2.2. Automotive

- 6.2.3. Marine

- 6.2.4. Aerospace and Defense

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. North America Smart Coating Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Anti-fouling

- 7.1.2. Anti-microbial

- 7.1.3. Anti-corrosion

- 7.1.4. Anti-icing

- 7.1.5. Self-cleaning

- 7.1.6. Color-shifting

- 7.1.7. Other Functions

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Building and Construction

- 7.2.2. Automotive

- 7.2.3. Marine

- 7.2.4. Aerospace and Defense

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Europe Smart Coating Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Anti-fouling

- 8.1.2. Anti-microbial

- 8.1.3. Anti-corrosion

- 8.1.4. Anti-icing

- 8.1.5. Self-cleaning

- 8.1.6. Color-shifting

- 8.1.7. Other Functions

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Building and Construction

- 8.2.2. Automotive

- 8.2.3. Marine

- 8.2.4. Aerospace and Defense

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Rest of the World Smart Coating Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Anti-fouling

- 9.1.2. Anti-microbial

- 9.1.3. Anti-corrosion

- 9.1.4. Anti-icing

- 9.1.5. Self-cleaning

- 9.1.6. Color-shifting

- 9.1.7. Other Functions

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Building and Construction

- 9.2.2. Automotive

- 9.2.3. Marine

- 9.2.4. Aerospace and Defense

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Jotun

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 The Sherwin-Williams Company *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 RPM International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 NEI Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dupont

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Akzo Nobel NV

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 3M

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 PPG Industries Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Axalta Coating Systems LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Hempel AS

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Jotun

List of Figures

- Figure 1: Global Smart Coating Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Smart Coating Market Revenue (Million), by Function 2025 & 2033

- Figure 3: Asia Pacific Smart Coating Market Revenue Share (%), by Function 2025 & 2033

- Figure 4: Asia Pacific Smart Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Smart Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Smart Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Smart Coating Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Smart Coating Market Revenue (Million), by Function 2025 & 2033

- Figure 9: North America Smart Coating Market Revenue Share (%), by Function 2025 & 2033

- Figure 10: North America Smart Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Smart Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Smart Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Smart Coating Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Smart Coating Market Revenue (Million), by Function 2025 & 2033

- Figure 15: Europe Smart Coating Market Revenue Share (%), by Function 2025 & 2033

- Figure 16: Europe Smart Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Smart Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Smart Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Smart Coating Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Smart Coating Market Revenue (Million), by Function 2025 & 2033

- Figure 21: Rest of the World Smart Coating Market Revenue Share (%), by Function 2025 & 2033

- Figure 22: Rest of the World Smart Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Smart Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Smart Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Smart Coating Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Coating Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Global Smart Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Smart Coating Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Smart Coating Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: Global Smart Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Smart Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Smart Coating Market Revenue Million Forecast, by Function 2020 & 2033

- Table 13: Global Smart Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Smart Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Smart Coating Market Revenue Million Forecast, by Function 2020 & 2033

- Table 19: Global Smart Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Smart Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Smart Coating Market Revenue Million Forecast, by Function 2020 & 2033

- Table 27: Global Smart Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Smart Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: South America Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Coating Market?

The projected CAGR is approximately 16.95%.

2. Which companies are prominent players in the Smart Coating Market?

Key companies in the market include Jotun, The Sherwin-Williams Company *List Not Exhaustive, RPM International Inc, NEI Corporation, Dupont, Akzo Nobel NV, 3M, PPG Industries Inc, Axalta Coating Systems LLC, Hempel AS.

3. What are the main segments of the Smart Coating Market?

The market segments include Function, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Superior Properties Over Traditional Coatings; Growing Demand from the Construction Sector.

6. What are the notable trends driving market growth?

Increasing Demand from Building and Construction Industry.

7. Are there any restraints impacting market growth?

High Cost of Smart Coatings.

8. Can you provide examples of recent developments in the market?

On April 2022, The Sherwin-Williams Company acquired the European industrial coatings business of Sika AG. Sika AG manufactures and sells coating systems that are corrosion-resistant. These coatings are included in the Performance Coatings segment of the company. They are used in interior and exterior steel infrastructure, bridges, airports and rails, wind and energy, chemicals, power transmission, interior linings for oil and gas tanks, vessels, pipework, and water and wastewater applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Coating Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Coating Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Coating Market?

To stay informed about further developments, trends, and reports in the Smart Coating Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence