Key Insights

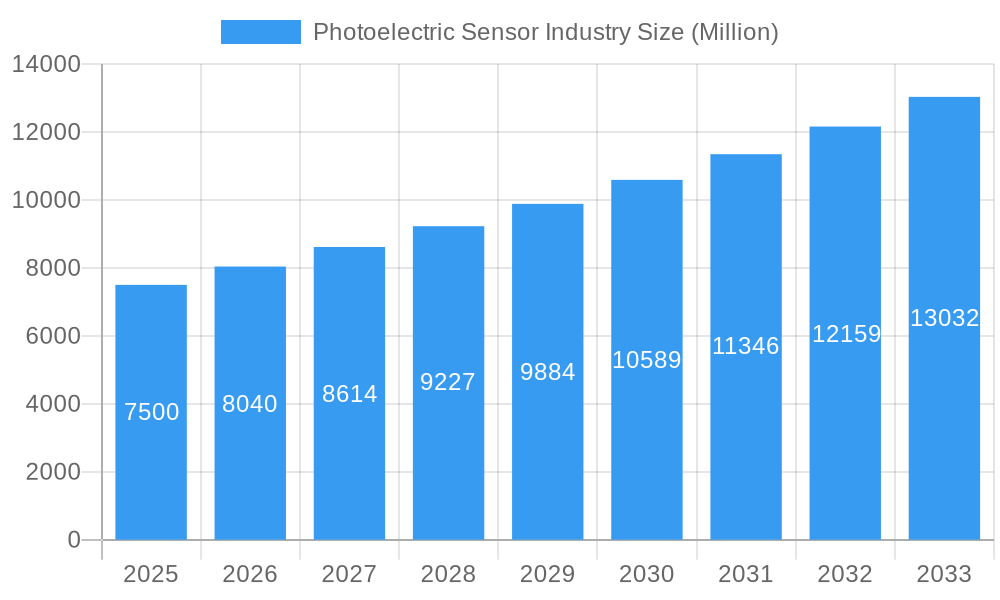

The global photoelectric sensor market is poised for significant expansion, projected to reach a substantial market size of approximately $7,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.20%. This impressive growth trajectory is fueled by a confluence of dynamic drivers, chief among them the escalating demand for automation across diverse end-user industries. Key sectors like consumer electronics, automotive and transportation, and packaging are increasingly integrating photoelectric sensors to enhance precision, efficiency, and safety in their manufacturing processes. The burgeoning adoption of Industry 4.0 principles, characterized by smart factories and interconnected systems, further propels the market as photoelectric sensors form a foundational element for data acquisition and real-time monitoring. Moreover, advancements in sensor technology, including improved detection capabilities, miniaturization, and enhanced environmental resilience, are creating new application frontiers and stimulating market penetration. The market also benefits from the growing need for quality control and defect detection in sectors such as pharmaceuticals and food and beverages, where accuracy is paramount.

Photoelectric Sensor Industry Market Size (In Billion)

The market landscape for photoelectric sensors is characterized by a diverse range of technologies and types, catering to a broad spectrum of applications. Within the 'Type' segment, Laser photoelectric sensors are expected to witness accelerated adoption due to their high precision and long-range detection capabilities, crucial for intricate automated tasks. Simultaneously, Fiber optics photoelectric sensors will continue to be indispensable in environments requiring extreme flexibility and resistance to harsh conditions. The 'Technology' segmentation reveals a strong preference for Through-Beam sensors for reliable detection over longer distances, while Reflective and Diffuse sensors cater to applications where the object itself provides the sensing surface. The 'End-user Industry' segmentation highlights the dominance of Consumer Electronics, Automotive and Transportation, and Packaging as primary growth engines, collectively accounting for a significant portion of the market share. Emerging trends like the integration of AI and machine learning with sensor data for predictive maintenance and advanced analytics, coupled with the increasing adoption of wireless sensor technologies, are set to redefine the market dynamics in the coming years. However, challenges such as the high initial cost of sophisticated sensor systems and the need for skilled personnel for installation and maintenance could present some restraints.

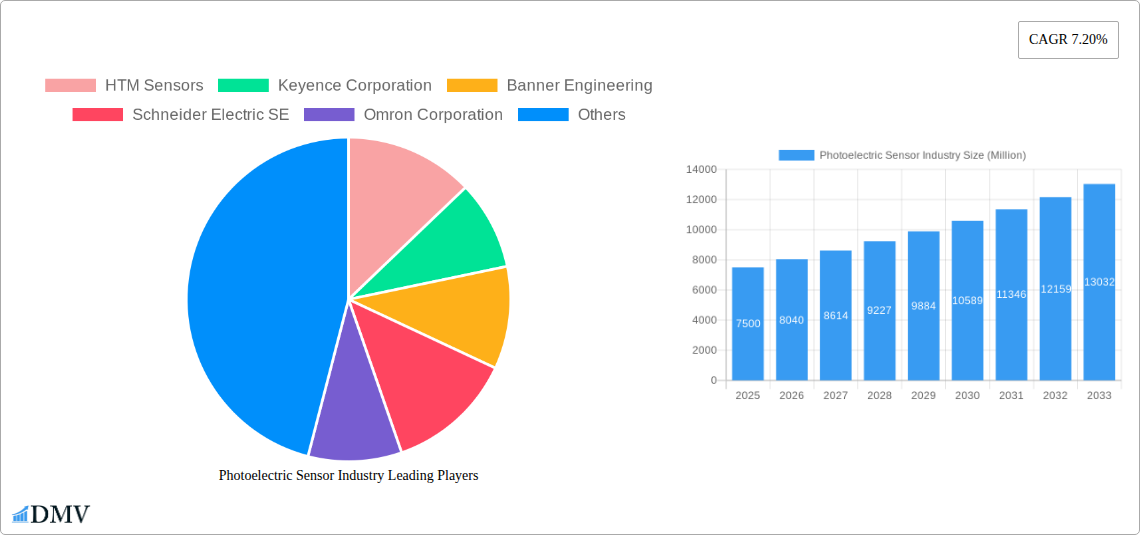

Photoelectric Sensor Industry Company Market Share

Here's the SEO-optimized and insightful report description for the Photoelectric Sensor Industry, with all requested elements and no placeholders:

This in-depth photoelectric sensor industry report provides a definitive analysis of the global market, encompassing a detailed examination of current trends, historical performance, and future projections. Spanning the study period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report offers unparalleled insights for stakeholders seeking to understand and capitalize on the evolving landscape of industrial automation and machine vision. The report delves into the intricate market composition, industry evolution, leading regional dynamics, groundbreaking product innovations, key growth drivers, significant obstacles, and emerging opportunities, culminating in a strategic market forecast. With a focus on high-ranking keywords such as industrial sensors, automation solutions, machine vision, IoT sensors, smart manufacturing, and factory automation, this report is your essential guide to navigating the complexities and unlocking the potential of the photoelectric sensor market.

Photoelectric Sensor Industry Market Composition & Trends

The global photoelectric sensor market exhibits a moderately concentrated structure, with leading players such as Keyence Corporation, Omron Corporation, and Sick AG holding significant market shares, estimated to collectively account for approximately 35% of the total market value in 2025. Innovation remains a critical catalyst, driven by the increasing demand for precision sensing and real-time data acquisition in industries like automotive and transportation and consumer electronics. The market is further shaped by evolving regulatory landscapes, particularly concerning industrial safety standards and data privacy, impacting the development and adoption of new sensor technologies. While substitute products exist, the unique advantages of photoelectric sensors in terms of speed, accuracy, and non-contact operation ensure their continued dominance in critical applications. End-user profiles are increasingly sophisticated, demanding integrated solutions that support smart manufacturing and the Industrial Internet of Things (IIoT). Mergers and acquisitions (M&A) activity, with an estimated M&A deal value of $500 Million in 2024, are likely to continue as key players seek to expand their product portfolios and geographic reach. Key M&A trends focus on acquiring companies with expertise in advanced sensor technologies and software integration.

Photoelectric Sensor Industry Industry Evolution

The photoelectric sensor industry has witnessed a robust growth trajectory, driven by a confluence of technological advancements and shifting consumer demands, charting a CAGR of approximately 7.5% from 2019 to 2033. Historically, the market for industrial automation sensors experienced steady growth, fueled by the gradual adoption of automated processes in manufacturing. The study period 2019–2024 saw significant advancements, particularly in the integration of AI and machine learning capabilities into photoelectric sensors, enabling predictive maintenance and enhanced quality control. This period also marked a surge in demand from the packaging industry and the food and beverage sector for high-speed, accurate detection and sorting.

Looking ahead, the forecast period 2025–2033 is poised for accelerated growth, primarily due to the widespread implementation of Industry 4.0 principles and the increasing need for sophisticated smart factory solutions. Technological advancements are focusing on miniaturization, increased sensing range, improved resolution, and enhanced immunity to environmental factors such as dust and vibration. The adoption of technologies like laser photoelectric sensors and advanced fiber optics photoelectric sensors is expected to rise significantly. Consumer demand is evolving towards more flexible and adaptable production lines, requiring sensors that can seamlessly integrate with robotic systems and IoT platforms. The automotive and transportation industry is a key driver, adopting photoelectric sensors for advanced driver-assistance systems (ADAS) and automated assembly processes. The pharmaceuticals and medical industry is also a growing segment, requiring highly precise and reliable sensors for automated drug dispensing and diagnostic equipment. The market's evolution is characterized by a continuous push for higher performance, greater connectivity, and more intelligent sensing capabilities, making it a dynamic and promising sector for innovation and investment.

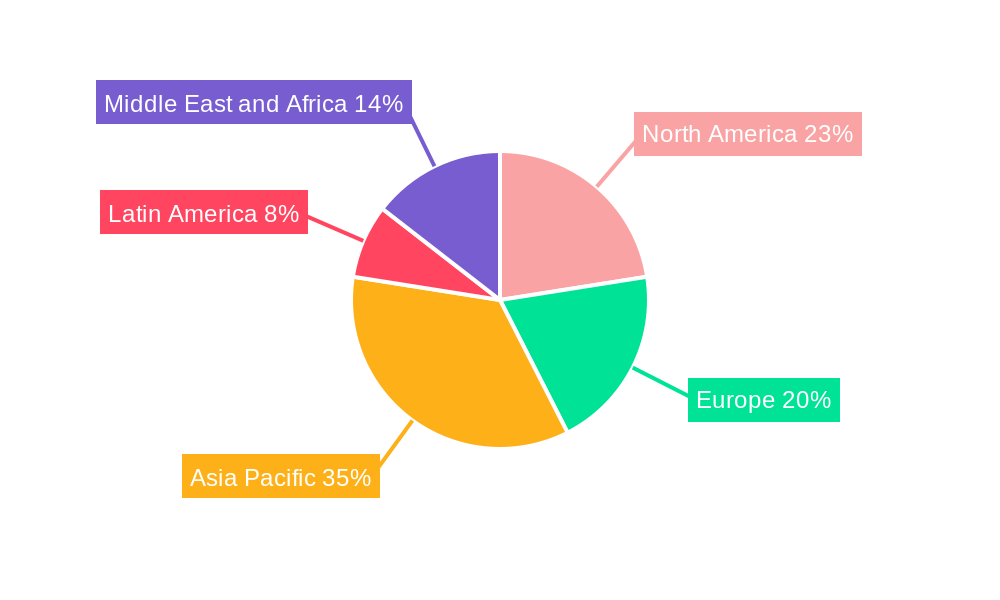

Leading Regions, Countries, or Segments in Photoelectric Sensor Industry

North America currently stands as a dominant region in the photoelectric sensor industry, driven by substantial investments in smart manufacturing, a robust automotive and transportation sector, and a strong emphasis on technological innovation. The region's leadership is further bolstered by significant adoption rates across key end-user industries including consumer electronics, packaging, and building automation.

Key Growth Drivers in North America:

- Investment Trends: Substantial capital expenditure by major industrial players in upgrading manufacturing facilities with advanced automation technologies. For instance, automotive manufacturers are investing heavily in robotic assembly lines, necessitating sophisticated sensing solutions.

- Regulatory Support: Government initiatives promoting advanced manufacturing and domestic production are indirectly fostering the demand for high-performance photoelectric sensors.

- Technological Adoption: A high propensity to adopt cutting-edge technologies like AI-powered sensors and IoT-enabled devices, leading to increased demand for advanced laser photoelectric sensor and fiber optics photoelectric sensor solutions.

- End-User Industry Dominance: The automotive and transportation industry is a major consumer, utilizing sensors for everything from assembly line robotics to ADAS. The packaging industry also contributes significantly due to the need for high-speed product identification and quality control. The building automation sector is experiencing growth with smart building initiatives.

Dominance Factors in the North American Market: The region's leadership is underpinned by its established industrial base, a highly skilled workforce capable of integrating complex automation systems, and a strong ecosystem of technology providers and research institutions. The demand for Through-Beam, Reflective, and Diffuse sensor technologies is high across various applications, with a particular emphasis on precision and reliability. The consumer electronics sector also plays a crucial role, requiring highly accurate sensors for intricate assembly processes. The continued focus on efficiency, safety, and data-driven decision-making within North American industries solidifies its position as a leading market for photoelectric sensors.

Photoelectric Sensor Industry Product Innovations

Recent product innovations in the photoelectric sensor market are revolutionizing industrial automation. Manufacturers are introducing intelligent sensors with embedded AI capabilities for enhanced object recognition, anomaly detection, and predictive maintenance, pushing the boundaries of machine vision and IIoT integration. Advancements in laser photoelectric sensors offer unparalleled precision and longer sensing distances, crucial for high-speed, complex applications in sectors like automotive and transportation and packaging. Simultaneously, the development of ruggedized and miniaturized fiber optics photoelectric sensors enhances performance and adaptability in harsh environments and space-constrained applications. These innovations are characterized by improved resolution, faster response times, and enhanced connectivity, enabling seamless integration into existing automation architectures and driving the "smart factory" paradigm.

Propelling Factors for Photoelectric Sensor Industry Growth

The photoelectric sensor industry is propelled by several key growth drivers. The relentless push towards Industry 4.0 and the smart factory concept is a primary catalyst, necessitating advanced sensing solutions for data acquisition and automation. Rapid advancements in machine vision technology, coupled with the proliferation of the Industrial Internet of Things (IIoT), are driving demand for high-precision, interconnected sensors. Economic factors, such as global manufacturing output and increased investment in automation technologies by industries like automotive and transportation and packaging, also play a crucial role. Furthermore, evolving regulatory frameworks that mandate improved safety and efficiency standards in industrial settings indirectly fuel the adoption of sophisticated photoelectric sensors.

Obstacles in the Photoelectric Sensor Industry Market

Despite robust growth, the photoelectric sensor industry faces several obstacles. Intense competition among established players and emerging low-cost manufacturers can lead to price erosion, impacting profit margins. Supply chain disruptions, exacerbated by geopolitical events and component shortages, can affect production timelines and product availability, leading to delivery delays. The high initial investment required for advanced industrial automation systems can be a deterrent for small and medium-sized enterprises (SMEs). Additionally, the need for specialized technical expertise for installation, calibration, and maintenance of complex sensor systems can pose a challenge, particularly in regions with a less developed technical workforce. The continuous need for product upgrades to keep pace with rapidly evolving technological standards also presents a significant challenge.

Future Opportunities in Photoelectric Sensor Industry

The photoelectric sensor industry is ripe with future opportunities. The burgeoning demand for automation in emerging economies presents a significant growth avenue. The increasing adoption of AI and machine learning in sensor technology opens doors for more intelligent and predictive sensing applications. The growing trend of predictive maintenance across various industries will drive demand for sensors that can provide early warnings of potential equipment failures. Furthermore, the expansion of the consumer electronics market and the increasing complexity of its manufacturing processes will require more sophisticated and precise sensing solutions. The development of energy-efficient and wirelessly connected photoelectric sensors is also poised to capture significant market share as the IIoT ecosystem expands.

Major Players in the Photoelectric Sensor Industry Ecosystem

- HTM Sensors

- Keyence Corporation

- Banner Engineering

- Schneider Electric SE

- Omron Corporation

- Sick AG

- Leuze Electronic

- Pepperl + Fuchs

- Rockwell Automation Inc

- Cntd Electric Technology

- Fargo Controls

- Sensopart Industriesensorik

- Panasonic Corporation

Key Developments in Photoelectric Sensor Industry Industry

- 2023/2024: Introduction of AI-powered photoelectric sensors with advanced object recognition capabilities by leading manufacturers, enabling sophisticated quality control and defect detection.

- 2023: Expansion of product lines by Keyence Corporation to include ultra-high-speed photoelectric sensors for demanding applications in the automotive and electronics sectors.

- 2022: Banner Engineering's launch of enhanced IIoT-enabled photoelectric sensors with integrated cloud connectivity for remote monitoring and data analytics.

- 2021: Omron Corporation's significant investment in R&D for miniaturized photoelectric sensors with improved performance for compact automation solutions.

- 2020: Sick AG's acquisition of a specialized provider of 3D vision technology, enhancing its capabilities in advanced photoelectric sensing solutions.

- 2019: Schneider Electric SE's strategic partnerships to integrate its photoelectric sensor offerings with broader industrial automation platforms, focusing on smart building applications.

Strategic Photoelectric Sensor Industry Market Forecast

The photoelectric sensor industry is projected for substantial growth, driven by the pervasive adoption of Industry 4.0 and the increasing sophistication of machine vision and IIoT applications. Future opportunities lie in developing highly intelligent, miniaturized, and connected sensors that cater to the evolving demands of smart manufacturing. The integration of AI for predictive maintenance and advanced anomaly detection will be a key differentiator. Emerging markets and the continuous demand for efficiency and precision across industries such as automotive and transportation, packaging, and pharmaceuticals and medical will fuel this expansion, promising a dynamic and rewarding landscape for stakeholders.

Photoelectric Sensor Industry Segmentation

-

1. Type

- 1.1. Laser photoelectric sensor

- 1.2. Fiber optics photoelectric sensor

-

2. Technology

- 2.1. Through-Beam

- 2.2. Reflective

- 2.3. Diffuse

-

3. End-user Industry

- 3.1. Consumer Electronics

- 3.2. Automotive and Transportation

- 3.3. Packaging

- 3.4. Pharmaceuticals and Medical

- 3.5. Food and Beverages

- 3.6. Building Automation

- 3.7. Others

Photoelectric Sensor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Photoelectric Sensor Industry Regional Market Share

Geographic Coverage of Photoelectric Sensor Industry

Photoelectric Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Adoption of Industrial Automation; Increasing Government Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Competent Alternative Technologies; Required High Maintenance

- 3.4. Market Trends

- 3.4.1. Industrial Automation to Drive the Growth of The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Photoelectric Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Laser photoelectric sensor

- 5.1.2. Fiber optics photoelectric sensor

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Through-Beam

- 5.2.2. Reflective

- 5.2.3. Diffuse

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Consumer Electronics

- 5.3.2. Automotive and Transportation

- 5.3.3. Packaging

- 5.3.4. Pharmaceuticals and Medical

- 5.3.5. Food and Beverages

- 5.3.6. Building Automation

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Photoelectric Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Laser photoelectric sensor

- 6.1.2. Fiber optics photoelectric sensor

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Through-Beam

- 6.2.2. Reflective

- 6.2.3. Diffuse

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Consumer Electronics

- 6.3.2. Automotive and Transportation

- 6.3.3. Packaging

- 6.3.4. Pharmaceuticals and Medical

- 6.3.5. Food and Beverages

- 6.3.6. Building Automation

- 6.3.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Photoelectric Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Laser photoelectric sensor

- 7.1.2. Fiber optics photoelectric sensor

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Through-Beam

- 7.2.2. Reflective

- 7.2.3. Diffuse

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Consumer Electronics

- 7.3.2. Automotive and Transportation

- 7.3.3. Packaging

- 7.3.4. Pharmaceuticals and Medical

- 7.3.5. Food and Beverages

- 7.3.6. Building Automation

- 7.3.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Photoelectric Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Laser photoelectric sensor

- 8.1.2. Fiber optics photoelectric sensor

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Through-Beam

- 8.2.2. Reflective

- 8.2.3. Diffuse

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Consumer Electronics

- 8.3.2. Automotive and Transportation

- 8.3.3. Packaging

- 8.3.4. Pharmaceuticals and Medical

- 8.3.5. Food and Beverages

- 8.3.6. Building Automation

- 8.3.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Photoelectric Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Laser photoelectric sensor

- 9.1.2. Fiber optics photoelectric sensor

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Through-Beam

- 9.2.2. Reflective

- 9.2.3. Diffuse

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Consumer Electronics

- 9.3.2. Automotive and Transportation

- 9.3.3. Packaging

- 9.3.4. Pharmaceuticals and Medical

- 9.3.5. Food and Beverages

- 9.3.6. Building Automation

- 9.3.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Photoelectric Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Laser photoelectric sensor

- 10.1.2. Fiber optics photoelectric sensor

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Through-Beam

- 10.2.2. Reflective

- 10.2.3. Diffuse

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Consumer Electronics

- 10.3.2. Automotive and Transportation

- 10.3.3. Packaging

- 10.3.4. Pharmaceuticals and Medical

- 10.3.5. Food and Beverages

- 10.3.6. Building Automation

- 10.3.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 HTM Sensors

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Keyence Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Banner Engineering

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Schneider Electric SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Omron Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sick AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Leuze Electronic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pepperl + Fuchs

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rockwell Automation Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cntd Electric Technology*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fargo Controls

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sensopart Industriesensorik

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Panasonic Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 HTM Sensors

List of Figures

- Figure 1: Global Photoelectric Sensor Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Photoelectric Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Photoelectric Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Photoelectric Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Photoelectric Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Photoelectric Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Photoelectric Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Photoelectric Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Photoelectric Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Photoelectric Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Photoelectric Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Photoelectric Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 13: Europe Photoelectric Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Photoelectric Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Photoelectric Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Photoelectric Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Photoelectric Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Photoelectric Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Photoelectric Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Photoelectric Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Asia Pacific Photoelectric Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Photoelectric Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Photoelectric Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Photoelectric Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Photoelectric Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Photoelectric Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Photoelectric Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Photoelectric Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 29: Latin America Photoelectric Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Latin America Photoelectric Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Photoelectric Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Photoelectric Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Photoelectric Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Photoelectric Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Photoelectric Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Photoelectric Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 37: Middle East and Africa Photoelectric Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Middle East and Africa Photoelectric Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Photoelectric Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Photoelectric Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Photoelectric Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Photoelectric Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Photoelectric Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Photoelectric Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Photoelectric Sensor Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Photoelectric Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Photoelectric Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Global Photoelectric Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Photoelectric Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Photoelectric Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Photoelectric Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Photoelectric Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Photoelectric Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Photoelectric Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Photoelectric Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 15: Global Photoelectric Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Photoelectric Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Photoelectric Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Photoelectric Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 19: Global Photoelectric Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Photoelectric Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Photoelectric Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Photoelectric Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 23: Global Photoelectric Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Photoelectric Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Photoelectric Sensor Industry?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Photoelectric Sensor Industry?

Key companies in the market include HTM Sensors, Keyence Corporation, Banner Engineering, Schneider Electric SE, Omron Corporation, Sick AG, Leuze Electronic, Pepperl + Fuchs, Rockwell Automation Inc, Cntd Electric Technology*List Not Exhaustive, Fargo Controls, Sensopart Industriesensorik, Panasonic Corporation.

3. What are the main segments of the Photoelectric Sensor Industry?

The market segments include Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Adoption of Industrial Automation; Increasing Government Initiatives.

6. What are the notable trends driving market growth?

Industrial Automation to Drive the Growth of The Market.

7. Are there any restraints impacting market growth?

; Competent Alternative Technologies; Required High Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Photoelectric Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Photoelectric Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Photoelectric Sensor Industry?

To stay informed about further developments, trends, and reports in the Photoelectric Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence