Key Insights

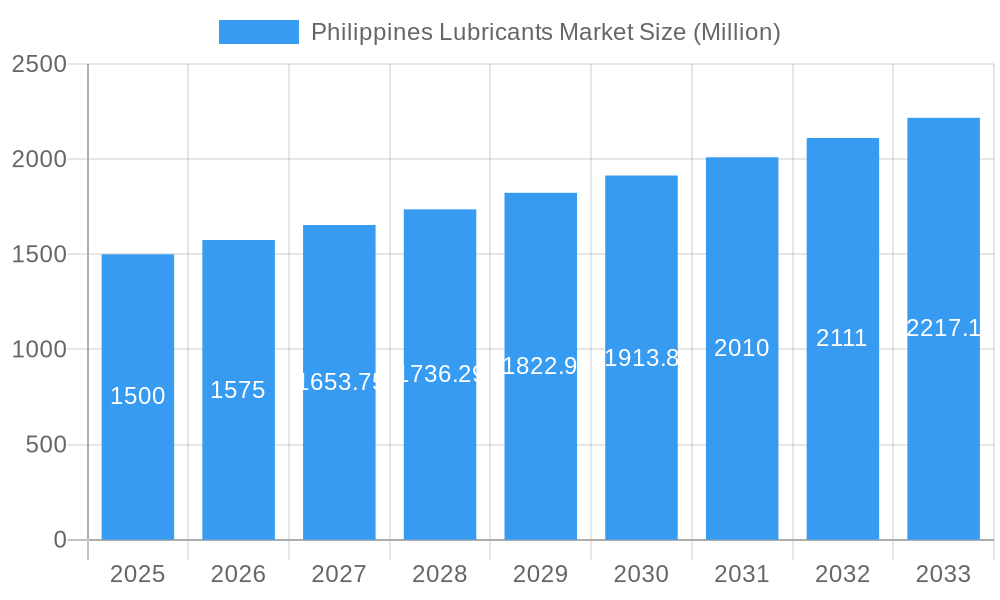

The Philippines lubricants market, covering automotive, industrial, and marine applications, is projected for substantial expansion. Fueled by a dynamic automotive sector and escalating industrialization, the market is set to grow at a Compound Annual Growth Rate (CAGR) of 2.9%. The market size is estimated at 182900.4 million in the base year 2025. This growth is underpinned by rising vehicle ownership, particularly motorcycles and passenger cars, alongside expanding manufacturing and construction activities.

Philippines Lubricants Market Market Size (In Billion)

Demand for high-performance lubricants, including synthetic oils and specialized greases, is a key driver, reflecting a global shift towards enhanced vehicle efficiency and extended equipment lifespan. Stricter emission regulations and a growing focus on sustainability within industries further reinforce this trend. Looking ahead, the forecast period (2025-2033) anticipates continued growth, driven by infrastructure development, sustained economic expansion, and the adoption of advanced lubrication technologies. Key challenges include potential fluctuations in crude oil prices and global economic uncertainties. The market is expected to experience intensified competition, leading to a greater emphasis on value-added services and strategic innovations for sustained market presence.

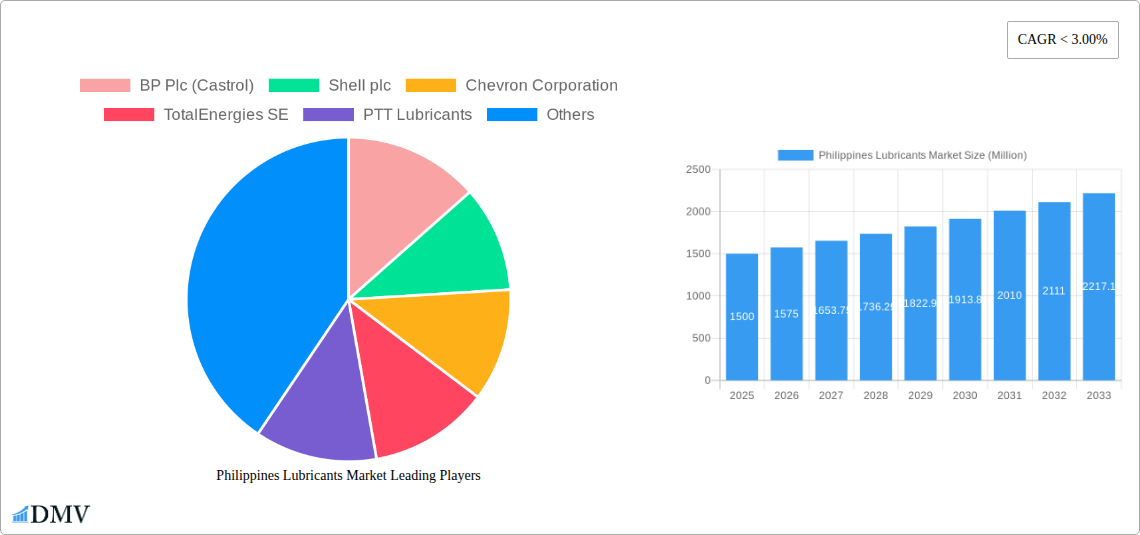

Philippines Lubricants Market Company Market Share

Philippines Lubricants Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Philippines lubricants market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report values are expressed in Millions.

Philippines Lubricants Market Composition & Trends

This section delves into the intricate composition of the Philippines lubricants market, analyzing market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and M&A activities. We examine the market share distribution amongst key players, revealing the competitive landscape and identifying potential areas for disruption. The analysis incorporates data on M&A deal values, shedding light on strategic investments and market consolidation trends. The report also explores the influence of government regulations, the availability of substitute products, and the evolving needs of various end-users on market dynamics. This comprehensive analysis reveals the key factors shaping the present and future trajectories of the Philippines lubricants market. The market concentration is estimated at xx%, indicating a (describe concentration – e.g., highly concentrated or fragmented) market. Significant M&A activities, valued at approximately xx Million in the past five years, have influenced market consolidation.

- Market Share Distribution: BP Plc (Castrol) holds an estimated xx% market share, followed by Shell plc at xx%, Chevron Corporation at xx%, and other players.

- Innovation Catalysts: Stringent emission norms and growing demand for high-performance lubricants are driving innovation.

- Regulatory Landscape: The report analyzes the impact of environmental regulations and standards on market players.

- Substitute Products: The emergence of bio-lubricants and other sustainable alternatives is impacting the market.

- End-User Profiles: The report profiles key end-users, including automotive, industrial, and agricultural sectors.

- M&A Activities: Recent mergers and acquisitions are analyzed, highlighting their impact on market structure.

Philippines Lubricants Market Industry Evolution

This section provides a detailed analysis of the Philippines lubricants market’s evolutionary path, examining market growth trajectories, technological advancements, and shifting consumer preferences. We analyze historical growth rates from 2019-2024, projecting future growth rates for the forecast period (2025-2033). The report explores the adoption rates of new technologies, such as synthetic lubricants and specialized formulations, and how consumer demand for environmentally friendly and high-performance lubricants influences market trends. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. The increasing adoption of advanced engine technologies and stringent emission regulations are significant drivers of market evolution.

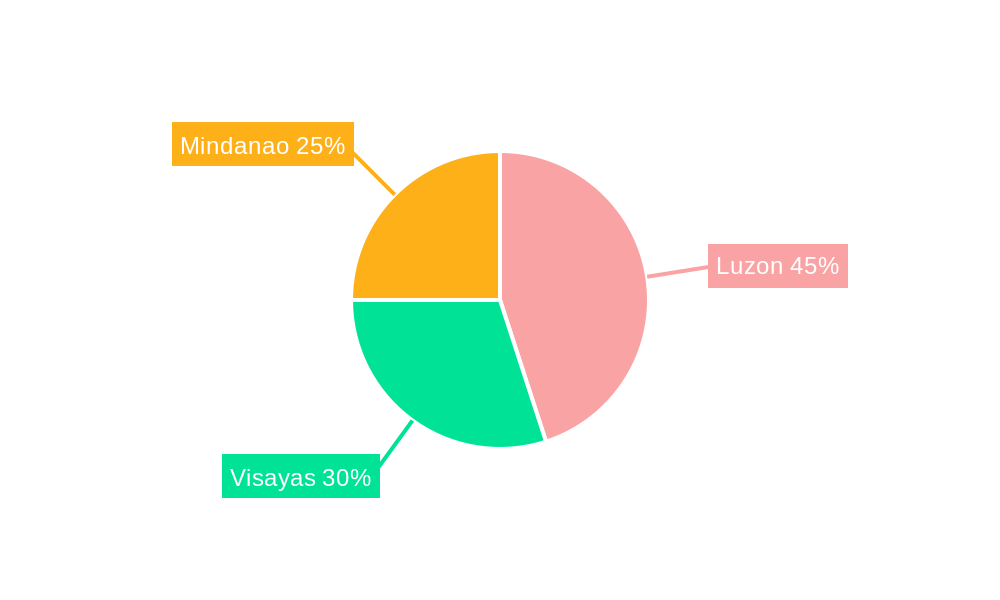

Leading Regions, Countries, or Segments in Philippines Lubricants Market

This section identifies the dominant regions, countries, or segments within the Philippines lubricants market. The analysis focuses on the factors contributing to their leading positions, including investment trends, government support, and unique market characteristics. The report analyzes regional disparities in lubricant consumption, highlighting growth potential in specific areas. The National Capital Region (NCR) currently dominates the market due to high industrial activity and vehicle density.

- Key Drivers for NCR Dominance:

- High concentration of industries and manufacturing facilities.

- Significant vehicle population and transportation activity.

- Government investments in infrastructure development.

Philippines Lubricants Market Product Innovations

This section highlights recent product innovations, their applications, and performance metrics. The focus is on unique selling propositions and technological advancements that are reshaping the competitive landscape. Recent innovations include the introduction of high-performance synthetic lubricants, bio-based lubricants, and specialized formulations catering to specific engine types and operating conditions. These advancements promise improved fuel efficiency, reduced emissions, and enhanced engine performance.

Propelling Factors for Philippines Lubricants Market Growth

This section identifies and analyzes the key drivers of growth in the Philippines lubricants market. The analysis includes the influence of technological advancements (e.g., the adoption of advanced engine technologies requiring specialized lubricants), economic factors (e.g., rising disposable incomes leading to increased vehicle ownership), and government regulations (e.g., stricter emission standards driving demand for cleaner lubricants). The expanding automotive sector and industrialization are major contributors to market growth.

Obstacles in the Philippines Lubricants Market

This section addresses the challenges and barriers hindering growth in the Philippines lubricants market. These include regulatory hurdles (e.g., complex import-export regulations), supply chain disruptions (e.g., potential impacts of geopolitical events), and intense competition from both domestic and international players. Price fluctuations of base oils and additives also pose a significant challenge.

Future Opportunities in Philippines Lubricants Market

This section highlights emerging opportunities for growth in the Philippines lubricants market. These include the expansion into new market segments (e.g., renewable energy sectors), the adoption of innovative technologies (e.g., nanotechnology-enhanced lubricants), and catering to evolving consumer preferences (e.g., demand for eco-friendly lubricants). The growth of the e-commerce sector presents an opportunity for efficient lubricant distribution.

Major Players in the Philippines Lubricants Market Ecosystem

- BP Plc (Castrol)

- Shell plc

- Chevron Corporation

- TotalEnergies SE

- PTT Lubricants

- Petron Corporation

- Gulf Oil International

- Phoenix Petroleum

- SEAOIL Philippines Inc

- ExxonMobil Corporation

- *List Not Exhaustive

Key Developments in Philippines Lubricants Market Industry

- November 2022: ENEOS Motor Oil launched a complete line-up of lubricants for cars and motorcycles, enhancing its market presence.

- August 2022: Chevron Philippines Inc. signed an agreement with Aboitiz Power Corp. to supply diesel fuel to its power facilities. This strengthens Chevron's position in the industrial lubricants segment.

Strategic Philippines Lubricants Market Forecast

The Philippines lubricants market is poised for significant growth, driven by increasing vehicle ownership, industrial expansion, and the adoption of advanced technologies. The forecast period is expected to witness robust growth, fueled by supportive government policies, and increased investment in infrastructure. The market's future is bright, with ample opportunities for both established players and new entrants.

Philippines Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Transmission And Gear Oils

- 1.3. Hydraulic Fluid

- 1.4. Metalworking Fluid

- 1.5. Greases

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Automotive

- 2.3. Heavy Equipment

- 2.4. Metallurgy And Metalworking

- 2.5. Other End-user Industries

Philippines Lubricants Market Segmentation By Geography

- 1. Philippines

Philippines Lubricants Market Regional Market Share

Geographic Coverage of Philippines Lubricants Market

Philippines Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction Activities; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Construction Activities; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Construction Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Transmission And Gear Oils

- 5.1.3. Hydraulic Fluid

- 5.1.4. Metalworking Fluid

- 5.1.5. Greases

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Automotive

- 5.2.3. Heavy Equipment

- 5.2.4. Metallurgy And Metalworking

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BP Plc (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shell plc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chevron Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TotalEnergies SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PTT Lubricants

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Petron Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gulf Oil International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Phoenix Petroleum

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SEAOIL Philippines Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ExxonMobil Corporation*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BP Plc (Castrol)

List of Figures

- Figure 1: Philippines Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Philippines Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Philippines Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Philippines Lubricants Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 3: Philippines Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Philippines Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Philippines Lubricants Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: Philippines Lubricants Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Lubricants Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the Philippines Lubricants Market?

Key companies in the market include BP Plc (Castrol), Shell plc, Chevron Corporation, TotalEnergies SE, PTT Lubricants, Petron Corporation, Gulf Oil International, Phoenix Petroleum, SEAOIL Philippines Inc, ExxonMobil Corporation*List Not Exhaustive.

3. What are the main segments of the Philippines Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 182900.4 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction Activities; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Construction Activities.

7. Are there any restraints impacting market growth?

Increasing Construction Activities; Other Drivers.

8. Can you provide examples of recent developments in the market?

November 2022: ENEOS Motor Oil company launched a complete line-up of lubricants for cars and motorcycles to enhance its presence in the Philippines market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Lubricants Market?

To stay informed about further developments, trends, and reports in the Philippines Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence