Key Insights

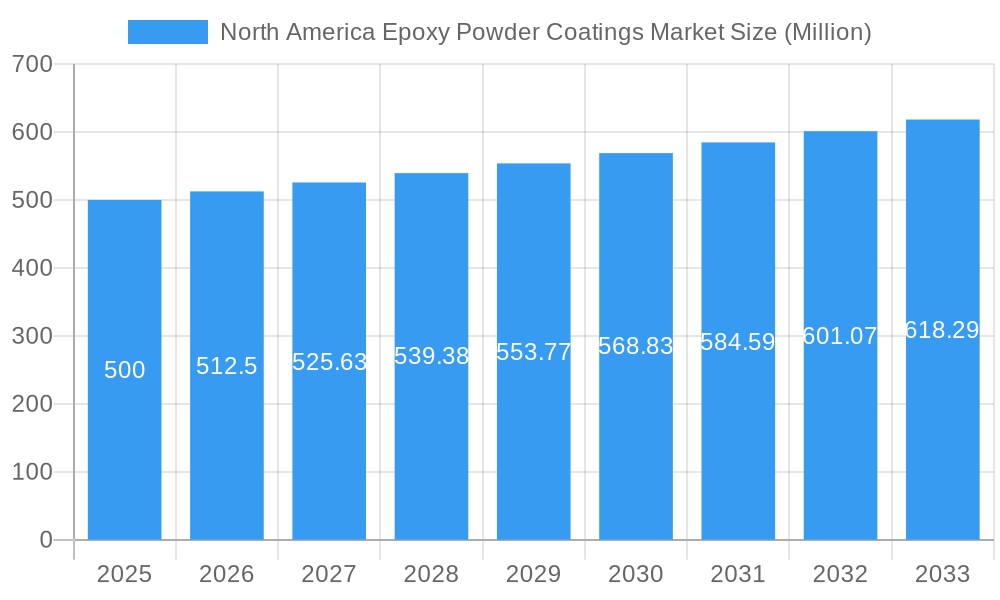

The North America epoxy powder coatings market is experiencing robust growth, driven by the increasing demand from diverse end-use industries. The market's compound annual growth rate (CAGR) exceeding 2.50% signifies a consistently expanding market size. Key drivers include the superior corrosion resistance, durability, and cost-effectiveness of epoxy powder coatings compared to other coating types. The automotive, aerospace, and building & construction sectors are major consumers, leveraging these properties for enhanced product lifespan and reduced maintenance costs. Growing environmental concerns are further propelling the market, as powder coatings are environmentally friendly, generating minimal waste and VOC emissions compared to liquid coatings. Market segmentation reveals a significant share held by protective coatings, reflecting the predominant need for durable and long-lasting surface protection across various applications. While the exact market size for 2025 is unavailable, considering a conservative estimate based on a 2.5% CAGR from a base year before 2019, and factoring in the strong market drivers, we can project a market value of approximately $500 million USD for North America in 2025. This is a preliminary estimation based on general market trends and should be further investigated to establish a concrete figure. The forecast period of 2025-2033 promises continued expansion, particularly fueled by innovative coating formulations offering enhanced performance characteristics and broadened applications.

North America Epoxy Powder Coatings Market Market Size (In Million)

The major players in the North American epoxy powder coatings market, including Sherwin-Williams, PPG Industries, Axalta Coating Systems, and BASF, are actively investing in research and development to introduce new products with improved properties. This competitive landscape ensures a continuous improvement in product quality and expands market opportunities. The market faces some restraints including fluctuating raw material prices and potential supply chain disruptions. However, the overall positive market dynamics, including strong demand across key sectors and the environmental benefits, significantly outweigh these challenges, projecting a sustained period of growth through 2033. Further market segmentation by geographic location within North America (US, Canada, and Mexico) would offer more granular insights into regional performance and growth potential.

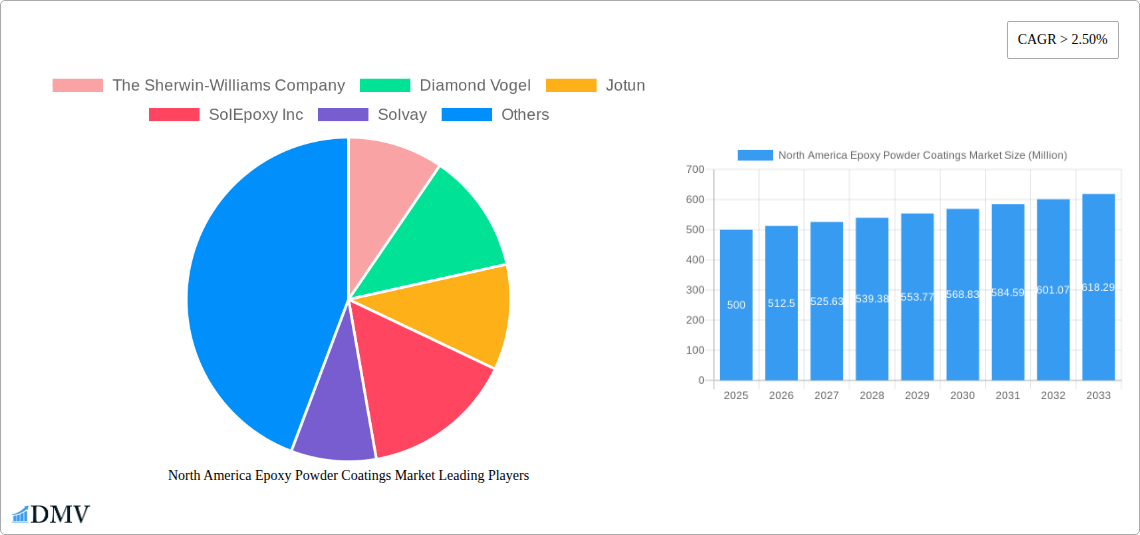

North America Epoxy Powder Coatings Market Company Market Share

North America Epoxy Powder Coatings Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America epoxy powder coatings market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market size, segmentation, growth drivers, challenges, and opportunities, equipping stakeholders with the knowledge needed to navigate this dynamic landscape. The market is projected to reach xx Million by 2033.

North America Epoxy Powder Coatings Market Market Composition & Trends

This section delves into the competitive landscape of the North America epoxy powder coatings market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market is moderately fragmented, with key players such as The Sherwin-Williams Company, PPG Industries Inc, and Axalta Coating Systems holding significant market share. However, smaller, specialized companies are also making inroads with niche product offerings.

- Market Share Distribution: The top 5 players account for approximately xx% of the market share in 2025. The remaining share is distributed among numerous smaller players.

- Innovation Catalysts: Continuous advancements in resin technology, focusing on improved durability, corrosion resistance, and sustainability, are driving market innovation. The demand for high-performance coatings in diverse end-user sectors fuels this trend.

- Regulatory Landscape: Stringent environmental regulations regarding VOC emissions are shaping product development, pushing manufacturers to adopt more sustainable formulations.

- Substitute Products: Other coating types, such as liquid coatings and polyurethane powders, pose some competitive pressure, but epoxy powder coatings maintain a strong position due to their superior performance characteristics in specific applications.

- End-User Profiles: The Buildings and Construction, Automotive, and Industrial sectors are major consumers, each exhibiting unique application needs and preferences.

- M&A Activities: The past five years have witnessed a moderate level of M&A activity, with deal values averaging xx Million per transaction. These activities are primarily aimed at expanding product portfolios and market reach.

North America Epoxy Powder Coatings Market Industry Evolution

This section provides a detailed analysis of the North America epoxy powder coatings market's growth trajectory, technological advancements, and shifting consumer demands from 2019 to 2033. The market witnessed robust growth during the historical period (2019-2024), driven by increasing infrastructure development, rising automotive production, and the growing adoption of epoxy powder coatings in various industrial applications. The market's Compound Annual Growth Rate (CAGR) during this period was approximately xx%. The forecast period (2025-2033) anticipates continued growth, albeit at a slightly moderated pace due to factors like economic fluctuations and potential supply chain constraints. Technological advancements such as the development of higher-performance, eco-friendly formulations and improved application technologies are expected to support market expansion. Shifting consumer preferences towards sustainable and durable products also play a pivotal role.

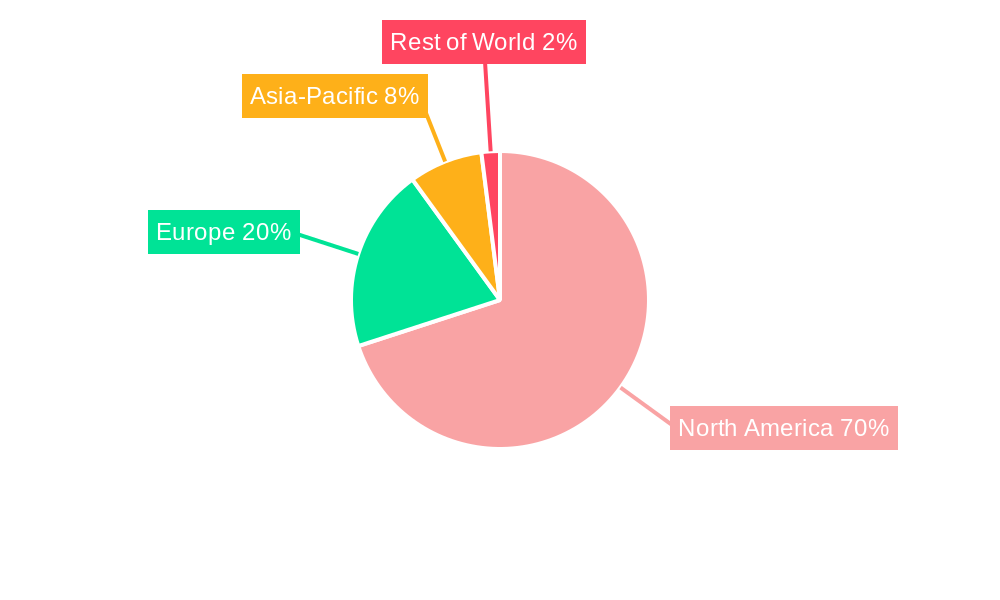

Leading Regions, Countries, or Segments in North America Epoxy Powder Coatings Market

The North American epoxy powder coatings market is geographically diverse, with certain regions and segments showcasing greater dominance.

- Dominant Region/Country: The United States holds the largest market share within North America, driven by a robust construction sector and a large automotive industry.

- Dominant Coating Type: Protective coatings constitute the largest segment, reflecting the crucial role of epoxy powder coatings in preventing corrosion and enhancing durability across various applications.

- Dominant End-user Industry: The Buildings and Construction sector holds the largest market share due to the extensive use of epoxy powder coatings in architectural and industrial applications.

Key Drivers:

- Buildings and Construction: High investment in infrastructure projects and increasing construction activity.

- Automotive: Demand for lightweight yet durable coatings in automotive components.

- Protective Coatings: Superior corrosion resistance and longevity compared to other coating types.

North America Epoxy Powder Coatings Market Product Innovations

Recent innovations include the development of epoxy powder coatings with enhanced UV resistance, improved chemical resistance, and superior flexibility. These advancements cater to the increasing demand for high-performance coatings that can withstand harsh environments. The incorporation of nanotechnology and other advanced materials has led to the creation of coatings with unique selling propositions such as self-healing properties and improved scratch resistance.

Propelling Factors for North America Epoxy Powder Coatings Market Growth

Several factors fuel the growth of the North America epoxy powder coatings market. These include:

- Technological Advancements: The development of sustainable and high-performance formulations is a major driver.

- Economic Growth: Infrastructure investments and industrial expansion stimulate demand.

- Stringent Regulations: Regulations promoting durable and eco-friendly coatings drive adoption.

Obstacles in the North America Epoxy Powder Coatings Market Market

Challenges include:

- Raw Material Costs: Fluctuations in raw material prices can impact profitability.

- Supply Chain Disruptions: Geopolitical instability and supply chain issues can cause delays and shortages.

- Intense Competition: The presence of numerous players leads to intense competition, putting pressure on pricing.

Future Opportunities in North America Epoxy Powder Coatings Market

Emerging opportunities lie in:

- Specialized Applications: Expanding into niche applications like renewable energy infrastructure and aerospace.

- Sustainable Formulations: Development of bio-based and low-VOC coatings.

- Advanced Technologies: Integration of smart coatings and other innovative technologies.

Major Players in the North America Epoxy Powder Coatings Market Ecosystem

- The Sherwin-Williams Company

- Diamond Vogel

- Jotun

- SolEpoxy Inc

- Solvay

- CARPOLY

- Evonik Industries AG

- 3M

- PPG Industries Inc

- BASF SE

- Axalta Coating Systems

- Hempel A/S

- Akzo Nobel N V

- NIPSEA GROUP

- Wacker Chemie AG

Key Developments in North America Epoxy Powder Coatings Market Industry

- 2022-Q4: Axalta Coating Systems launched a new range of high-performance epoxy powder coatings for industrial applications.

- 2023-Q1: PPG Industries Inc announced a significant investment in expanding its epoxy powder coating production capacity.

- 2023-Q3: Merger between two smaller epoxy powder coating manufacturers resulted in expanded market reach. (Further details are available within the full report.)

Strategic North America Epoxy Powder Coatings Market Market Forecast

The North America epoxy powder coatings market is poised for continued growth, fueled by technological advancements, increasing industrial activity, and a growing focus on sustainable solutions. The market's positive outlook is underpinned by strong demand from key end-user sectors and ongoing innovations in epoxy powder coating technology. The market is expected to maintain a healthy growth trajectory throughout the forecast period (2025-2033), presenting significant opportunities for established players and new entrants alike.

North America Epoxy Powder Coatings Market Segmentation

-

1. Coating Type

- 1.1. Protective Coatings

- 1.2. Other Coating Types

-

2. End-user Industry

- 2.1. Aerospace

- 2.2. Automotive

- 2.3. Buildings and Construction

- 2.4. Energy

- 2.5. Marine

- 2.6. Oil and Gas

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Epoxy Powder Coatings Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Epoxy Powder Coatings Market Regional Market Share

Geographic Coverage of North America Epoxy Powder Coatings Market

North America Epoxy Powder Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Demand from the Building & Construction Industry; Soaring Demand for Eco-friendly Coatings; Rising Uses in the Pipeline Industry

- 3.3. Market Restrains

- 3.3.1. ; Regulations on the Usage of Bisphenol A; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Epoxy Powder Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coating Type

- 5.1.1. Protective Coatings

- 5.1.2. Other Coating Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Aerospace

- 5.2.2. Automotive

- 5.2.3. Buildings and Construction

- 5.2.4. Energy

- 5.2.5. Marine

- 5.2.6. Oil and Gas

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Coating Type

- 6. United States North America Epoxy Powder Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Coating Type

- 6.1.1. Protective Coatings

- 6.1.2. Other Coating Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Aerospace

- 6.2.2. Automotive

- 6.2.3. Buildings and Construction

- 6.2.4. Energy

- 6.2.5. Marine

- 6.2.6. Oil and Gas

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Coating Type

- 7. Canada North America Epoxy Powder Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Coating Type

- 7.1.1. Protective Coatings

- 7.1.2. Other Coating Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Aerospace

- 7.2.2. Automotive

- 7.2.3. Buildings and Construction

- 7.2.4. Energy

- 7.2.5. Marine

- 7.2.6. Oil and Gas

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Coating Type

- 8. Mexico North America Epoxy Powder Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Coating Type

- 8.1.1. Protective Coatings

- 8.1.2. Other Coating Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Aerospace

- 8.2.2. Automotive

- 8.2.3. Buildings and Construction

- 8.2.4. Energy

- 8.2.5. Marine

- 8.2.6. Oil and Gas

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Coating Type

- 9. Rest of North America North America Epoxy Powder Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Coating Type

- 9.1.1. Protective Coatings

- 9.1.2. Other Coating Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Aerospace

- 9.2.2. Automotive

- 9.2.3. Buildings and Construction

- 9.2.4. Energy

- 9.2.5. Marine

- 9.2.6. Oil and Gas

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Coating Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 The Sherwin-Williams Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Diamond Vogel

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jotun

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SolEpoxy Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Solvay

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CARPOLY

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Evonik Industries AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 3M

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 PPG Industries Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 BASF SE

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Axalta Coating Systems

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Hempel A/S

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Akzo Nobel N V

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 NIPSEA GROUP

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Wacker Chemie AG*List Not Exhaustive

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 The Sherwin-Williams Company

List of Figures

- Figure 1: North America Epoxy Powder Coatings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Epoxy Powder Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Coating Type 2020 & 2033

- Table 2: North America Epoxy Powder Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Coating Type 2020 & 2033

- Table 6: North America Epoxy Powder Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 7: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Coating Type 2020 & 2033

- Table 10: North America Epoxy Powder Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Coating Type 2020 & 2033

- Table 14: North America Epoxy Powder Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Coating Type 2020 & 2033

- Table 18: North America Epoxy Powder Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 19: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Epoxy Powder Coatings Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Epoxy Powder Coatings Market?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the North America Epoxy Powder Coatings Market?

Key companies in the market include The Sherwin-Williams Company, Diamond Vogel, Jotun, SolEpoxy Inc, Solvay, CARPOLY, Evonik Industries AG, 3M, PPG Industries Inc, BASF SE, Axalta Coating Systems, Hempel A/S, Akzo Nobel N V, NIPSEA GROUP, Wacker Chemie AG*List Not Exhaustive.

3. What are the main segments of the North America Epoxy Powder Coatings Market?

The market segments include Coating Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Demand from the Building & Construction Industry; Soaring Demand for Eco-friendly Coatings; Rising Uses in the Pipeline Industry.

6. What are the notable trends driving market growth?

Increasing Usage in the Automotive Industry.

7. Are there any restraints impacting market growth?

; Regulations on the Usage of Bisphenol A; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Epoxy Powder Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Epoxy Powder Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Epoxy Powder Coatings Market?

To stay informed about further developments, trends, and reports in the North America Epoxy Powder Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence