Key Insights

The North American ceramic coatings market is experiencing robust growth, driven by increasing demand across diverse sectors. The market's expansion is fueled by several key factors. Firstly, the aerospace and defense industry's continued reliance on high-performance, durable materials is a significant driver. Ceramic coatings offer superior resistance to extreme temperatures, wear, and corrosion, making them indispensable in aircraft engines, spacecraft components, and military applications. Secondly, the transportation sector, particularly the automotive industry, is adopting ceramic coatings to enhance fuel efficiency, reduce emissions, and improve engine lifespan. This trend is further propelled by the rising popularity of electric vehicles, which require components with exceptional thermal management properties. The healthcare industry also contributes to market growth, with applications in medical implants and devices demanding biocompatible and durable ceramic coatings. Furthermore, the energy and power sector utilizes ceramic coatings for corrosion protection in power generation and transmission equipment.

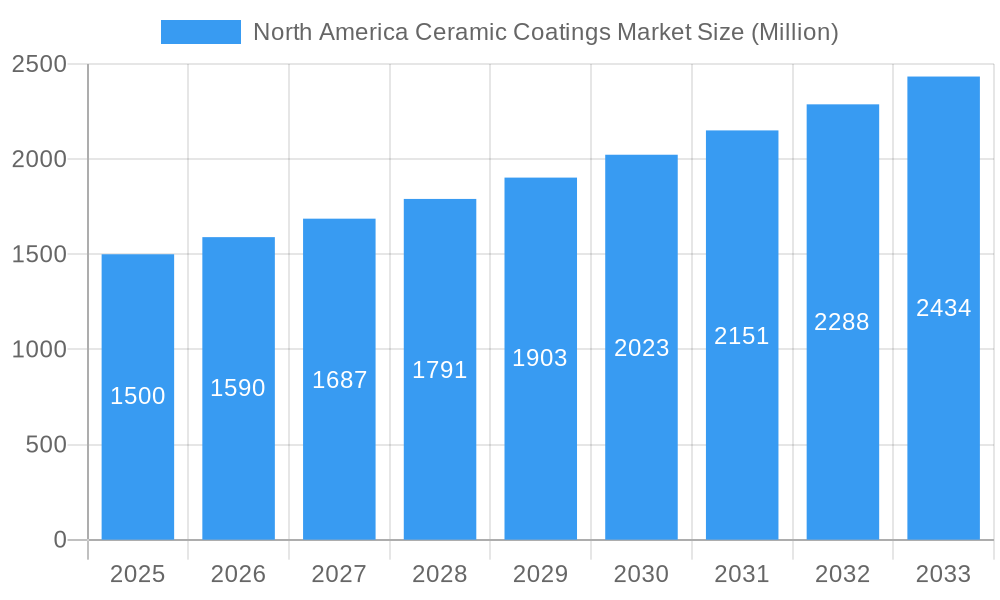

North America Ceramic Coatings Market Market Size (In Billion)

While the market demonstrates strong growth potential, certain challenges exist. The high cost associated with some ceramic coating application techniques, particularly advanced methods like physical vapor deposition (PVD), might limit widespread adoption in price-sensitive industries. Moreover, the development and implementation of new, environmentally friendly coating processes are crucial to address potential concerns about the ecological impact of certain ceramic materials and coating techniques. Despite these restraints, the North American ceramic coatings market is poised for substantial expansion over the next decade, with the projected CAGR exceeding 6%. This positive outlook is reinforced by ongoing technological advancements leading to improved coating properties, increased efficiency in application methods, and the expansion of applications into emerging sectors. The market segmentation by coating type (carbide, nitride, oxide, etc.) and technology (thermal spray, CVD, PVD, etc.) reflects the diverse range of solutions available to meet the specific requirements of different end-user industries.

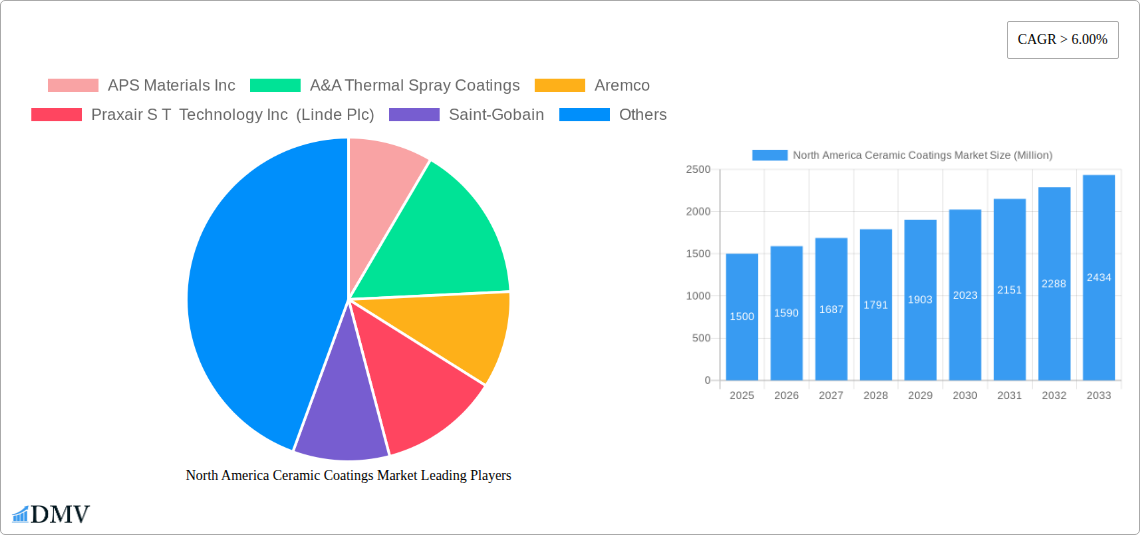

North America Ceramic Coatings Market Company Market Share

North America Ceramic Coatings Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America ceramic coatings market, offering a comprehensive overview of market trends, competitive landscape, and future growth prospects. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes extensive data analysis to forecast market trends from 2025 to 2033, providing invaluable insights for stakeholders across the ceramic coatings value chain. The market size is projected to reach xx Million by 2033.

North America Ceramic Coatings Market Composition & Trends

This section delves into the intricate dynamics of the North America ceramic coatings market, examining key aspects that influence its evolution. The market is segmented by type (Carbide, Nitride, Oxide, Other Types), technology (Thermal Spray, Physical Vapor Deposition, Chemical Vapor Deposition, Atmospheric Outer Spray, Other Technologies), and end-user industry (Aerospace and Defense, Transportation, Healthcare, Energy and Power, Industrial, Other End-user Industries).

Market Concentration: The North American ceramic coatings market exhibits a moderately consolidated structure, with several major players holding significant market share. The top five companies account for approximately xx% of the total market revenue in 2025. Further analysis will detail the market share distribution among key players such as APS Materials Inc, A&A Thermal Spray Coatings, Aremco, Praxair S T Technology Inc (Linde Plc), Saint-Gobain, Fosbel Inc, OC Oerlikon Management AG, Kurt J Lesker Company, Swain Tech Coatings Inc, Bodycote, and Waipolon International Co Ltd.

Innovation Catalysts: Continuous advancements in materials science and coating technologies are driving innovation within the market. This includes the development of novel ceramic compositions with enhanced properties, such as improved wear resistance, high-temperature stability, and corrosion resistance.

Regulatory Landscape: Government regulations regarding environmental protection and worker safety influence the adoption of specific coating technologies and materials. Stringent emission standards are pushing the industry to develop eco-friendly solutions.

Substitute Products: The market faces competition from alternative coating materials, such as polymeric coatings and metallic coatings. However, ceramic coatings often maintain a competitive edge due to their superior performance characteristics in high-temperature and harsh environments.

End-User Profiles: The report provides a detailed analysis of end-user industries, highlighting their specific coating requirements and preferences. The aerospace and defense sectors, for example, demand coatings with exceptional durability and thermal protection.

M&A Activities: Mergers and acquisitions have played a significant role in shaping the market landscape. The report analyzes past M&A activities, providing data on deal values and their impact on market consolidation. The total value of M&A deals in the North America ceramic coatings market from 2019 to 2024 is estimated at xx Million.

North America Ceramic Coatings Market Industry Evolution

The North America ceramic coatings market has witnessed significant growth over the past five years (2019-2024), driven by technological advancements and increasing demand from various end-user industries. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is largely attributed to several key factors:

Technological Advancements: The development of advanced coating techniques, such as atmospheric plasma spray and physical vapor deposition, has significantly improved the quality and performance of ceramic coatings. This has broadened the application scope of ceramic coatings in various sectors.

Expanding End-User Industries: The growing demand for ceramic coatings from sectors such as aerospace, automotive, and energy is a primary driver of market growth. The increasing adoption of ceramic coatings in high-performance applications, such as gas turbines and aerospace components, is fueling demand.

Shifting Consumer Demands: Consumers are increasingly demanding high-quality, durable products, leading to the adoption of ceramic coatings that offer superior performance compared to traditional coatings. This demand is particularly pronounced in applications requiring enhanced wear resistance, corrosion resistance, and thermal stability. For instance, the automotive industry's shift towards lightweight vehicles has increased the demand for coatings that enhance the durability and performance of lightweight components.

Government Regulations and Initiatives: Government initiatives to promote energy efficiency and reduce emissions have driven demand for ceramic coatings in energy-related applications.

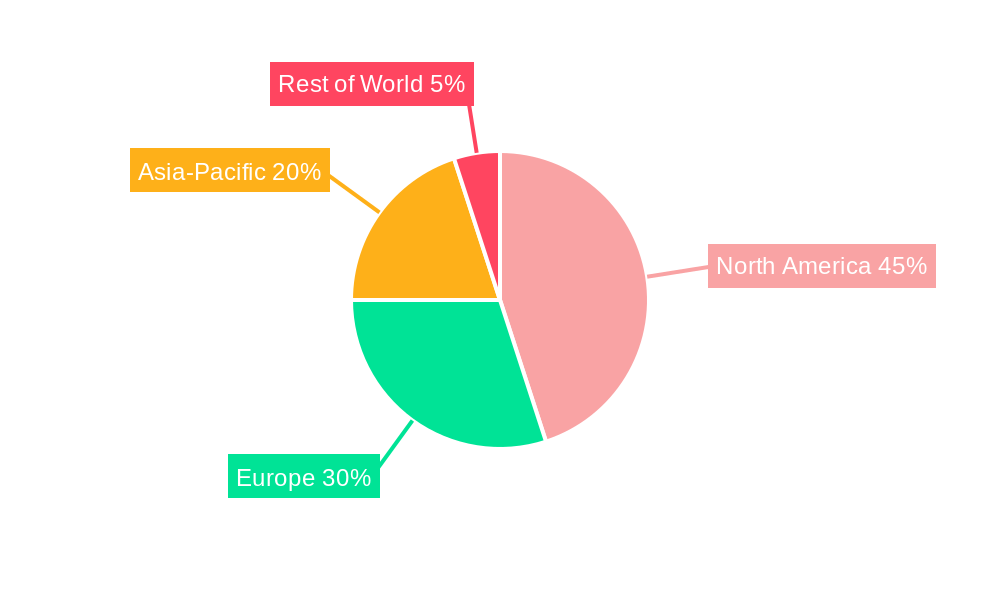

Leading Regions, Countries, or Segments in North America Ceramic Coatings Market

The United States dominates the North America ceramic coatings market, accounting for xx% of the total market revenue in 2025. This dominance is primarily attributed to factors such as:

Strong presence of major players: The US is home to several key players in the ceramic coatings industry, leading to intense competition and innovation.

Significant investments in R&D: The substantial investments in research and development in the US have resulted in advanced coating technologies and innovative products.

High demand from key end-user industries: The aerospace and defense sector in the US is a major consumer of ceramic coatings, driving market growth.

Dominant Segments:

By Type: Oxide coatings hold the largest market share due to their versatility and cost-effectiveness. Nitride coatings are also witnessing significant growth due to their exceptional hardness and wear resistance.

By Technology: Thermal Spray is the most widely used technology due to its relative simplicity and cost-effectiveness for large-scale applications. However, Physical Vapor Deposition (PVD) is gaining traction due to its ability to produce high-quality coatings with precise control over thickness and composition.

By End-user Industry: The Aerospace and Defense sector presents a significant demand driver, followed by the Transportation and Energy sectors.

North America Ceramic Coatings Market Product Innovations

Recent innovations in ceramic coatings have focused on developing materials with enhanced properties, such as higher hardness, improved wear resistance, and enhanced thermal stability. New coating techniques are also being developed to improve coating adhesion and reduce defects. These advancements are broadening the application of ceramic coatings into high-value applications such as advanced electronics, biomedical devices, and next-generation energy systems. Key innovations include nanostructured ceramic coatings and the integration of advanced functionalities, such as self-healing properties.

Propelling Factors for North America Ceramic Coatings Market Growth

The North America ceramic coatings market is experiencing robust growth fueled by several key factors:

Technological advancements: Developments in coating techniques and material science are leading to superior coatings with enhanced performance characteristics.

Increasing demand from diverse end-use industries: Growth in sectors like aerospace, automotive, and energy translates to higher demand for protective and functional coatings.

Government regulations: Environmental regulations are pushing the adoption of coatings with improved durability and reduced environmental impact.

Obstacles in the North America Ceramic Coatings Market

Several challenges hinder the growth of the North America ceramic coatings market:

High production costs: The production process of certain ceramic coatings can be expensive, limiting its adoption in cost-sensitive applications.

Supply chain disruptions: Disruptions in raw material supply can affect production and lead to price volatility.

Intense competition: The market is characterized by intense competition among numerous players, both domestic and international.

Future Opportunities in North America Ceramic Coatings Market

Future opportunities for growth lie in:

Expanding into emerging applications: Exploring new applications in sectors like renewable energy, 3D printing, and biomedical engineering.

Developing advanced coating techniques: Researching and developing more efficient and cost-effective coating methods, such as additive manufacturing techniques.

Focusing on sustainability: Developing eco-friendly coatings with reduced environmental impact.

Major Players in the North America Ceramic Coatings Market Ecosystem

- APS Materials Inc

- A&A Thermal Spray Coatings

- Aremco

- Praxair S T Technology Inc (Linde Plc)

- Saint-Gobain

- Fosbel Inc

- OC Oerlikon Management AG

- Kurt J Lesker Company

- Swain Tech Coatings Inc

- Bodycote

- Waipolon International Co Ltd

Key Developments in North America Ceramic Coatings Market Industry

- Jan 2023: Aremco launches a new high-temperature ceramic coating for aerospace applications.

- Apr 2022: Linde Plc announces a strategic partnership to expand its ceramic coating production capabilities.

- Oct 2021: Saint-Gobain acquires a smaller ceramic coating company, expanding its product portfolio. (Further details on specific developments will be included in the full report)

Strategic North America Ceramic Coatings Market Forecast

The North America ceramic coatings market is poised for continued growth over the forecast period. Driven by technological advancements, increasing demand from diverse industries, and supportive government policies, the market is expected to witness a substantial expansion in the coming years. This growth will be underpinned by the adoption of innovative coating technologies and the emergence of novel applications across diverse sectors. The market is expected to reach xx Million by 2033, representing a significant increase compared to the 2025 market size.

North America Ceramic Coatings Market Segmentation

-

1. Type

- 1.1. Carbide

- 1.2. Nitride

- 1.3. Oxide

- 1.4. Other Types

-

2. Technology

- 2.1. Thermal Spray

- 2.2. Physical Vapor Deposition

- 2.3. Chemical Vapor Deposition

- 2.4. Atmospheric Outer Spray

- 2.5. Other Technologies

-

3. End-user Industry

- 3.1. Aerospace and Defense

- 3.2. Transportation

- 3.3. Healthcare

- 3.4. Energy and Power

- 3.5. Industrial

- 3.6. Other End-user Industries

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

North America Ceramic Coatings Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Ceramic Coatings Market Regional Market Share

Geographic Coverage of North America Ceramic Coatings Market

North America Ceramic Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Aerospace Thermal Applications; Increasing Usage in Medical Devices

- 3.3. Market Restrains

- 3.3.1. ; Higher Costs of Ceramic Coatings; Capital Intensive Production Setup; Issues Regarding Thermal Spray Process Reliability and Consistency

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense Segment to Dominate the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Ceramic Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carbide

- 5.1.2. Nitride

- 5.1.3. Oxide

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Thermal Spray

- 5.2.2. Physical Vapor Deposition

- 5.2.3. Chemical Vapor Deposition

- 5.2.4. Atmospheric Outer Spray

- 5.2.5. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Aerospace and Defense

- 5.3.2. Transportation

- 5.3.3. Healthcare

- 5.3.4. Energy and Power

- 5.3.5. Industrial

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Ceramic Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Carbide

- 6.1.2. Nitride

- 6.1.3. Oxide

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Thermal Spray

- 6.2.2. Physical Vapor Deposition

- 6.2.3. Chemical Vapor Deposition

- 6.2.4. Atmospheric Outer Spray

- 6.2.5. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Aerospace and Defense

- 6.3.2. Transportation

- 6.3.3. Healthcare

- 6.3.4. Energy and Power

- 6.3.5. Industrial

- 6.3.6. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Ceramic Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Carbide

- 7.1.2. Nitride

- 7.1.3. Oxide

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Thermal Spray

- 7.2.2. Physical Vapor Deposition

- 7.2.3. Chemical Vapor Deposition

- 7.2.4. Atmospheric Outer Spray

- 7.2.5. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Aerospace and Defense

- 7.3.2. Transportation

- 7.3.3. Healthcare

- 7.3.4. Energy and Power

- 7.3.5. Industrial

- 7.3.6. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Ceramic Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Carbide

- 8.1.2. Nitride

- 8.1.3. Oxide

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Thermal Spray

- 8.2.2. Physical Vapor Deposition

- 8.2.3. Chemical Vapor Deposition

- 8.2.4. Atmospheric Outer Spray

- 8.2.5. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Aerospace and Defense

- 8.3.2. Transportation

- 8.3.3. Healthcare

- 8.3.4. Energy and Power

- 8.3.5. Industrial

- 8.3.6. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Ceramic Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Carbide

- 9.1.2. Nitride

- 9.1.3. Oxide

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Thermal Spray

- 9.2.2. Physical Vapor Deposition

- 9.2.3. Chemical Vapor Deposition

- 9.2.4. Atmospheric Outer Spray

- 9.2.5. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Aerospace and Defense

- 9.3.2. Transportation

- 9.3.3. Healthcare

- 9.3.4. Energy and Power

- 9.3.5. Industrial

- 9.3.6. Other End-user Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 APS Materials Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 A&A Thermal Spray Coatings

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aremco

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Praxair S T Technology Inc (Linde Plc)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Saint-Gobain

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Fosbel Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 OC Oerlikon Management AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kurt J Lesker Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Swain Tech Coatings Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bodycote

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Waipolon International Co Ltd*List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 APS Materials Inc

List of Figures

- Figure 1: North America Ceramic Coatings Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Ceramic Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: North America Ceramic Coatings Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: North America Ceramic Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 3: North America Ceramic Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Ceramic Coatings Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: North America Ceramic Coatings Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: North America Ceramic Coatings Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: North America Ceramic Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 8: North America Ceramic Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: North America Ceramic Coatings Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: North America Ceramic Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: North America Ceramic Coatings Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: North America Ceramic Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 13: North America Ceramic Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: North America Ceramic Coatings Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: North America Ceramic Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: North America Ceramic Coatings Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: North America Ceramic Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 18: North America Ceramic Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 19: North America Ceramic Coatings Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: North America Ceramic Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: North America Ceramic Coatings Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: North America Ceramic Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 23: North America Ceramic Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: North America Ceramic Coatings Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 25: North America Ceramic Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Ceramic Coatings Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the North America Ceramic Coatings Market?

Key companies in the market include APS Materials Inc, A&A Thermal Spray Coatings, Aremco, Praxair S T Technology Inc (Linde Plc), Saint-Gobain, Fosbel Inc, OC Oerlikon Management AG, Kurt J Lesker Company, Swain Tech Coatings Inc, Bodycote, Waipolon International Co Ltd*List Not Exhaustive.

3. What are the main segments of the North America Ceramic Coatings Market?

The market segments include Type, Technology, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Aerospace Thermal Applications; Increasing Usage in Medical Devices.

6. What are the notable trends driving market growth?

Aerospace and Defense Segment to Dominate the Market Demand.

7. Are there any restraints impacting market growth?

; Higher Costs of Ceramic Coatings; Capital Intensive Production Setup; Issues Regarding Thermal Spray Process Reliability and Consistency.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Ceramic Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Ceramic Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Ceramic Coatings Market?

To stay informed about further developments, trends, and reports in the North America Ceramic Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence