Key Insights

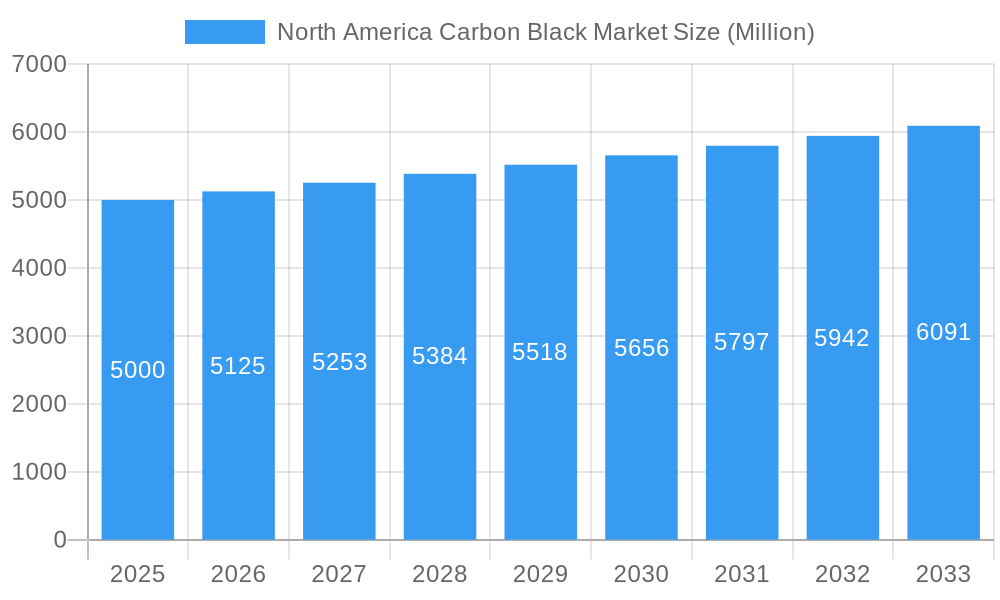

The North American carbon black market is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 6.14%. The market size is estimated at $1145.71 billion in the base year 2024. This robust growth is primarily propelled by the automotive sector's escalating demand for high-performance tires, which require exceptional abrasion resistance and tensile strength. Beyond tires, carbon black's essential role as a reinforcing agent and pigment is driving its increased adoption in inks, plastics, and diverse rubber products. While automotive industry expansion is a key driver, emerging challenges include the imperative for sustainable manufacturing practices and rising raw material costs. Consequently, market participants are actively pursuing innovative production methodologies and exploring alternative feedstocks to address these constraints. Market segmentation within North America is anticipated to encompass various carbon black grades defined by particle size and surface area, each tailored to specific industrial applications and requirements. Geographic variations in demand are also evident, with concentrated automotive and industrial manufacturing hubs likely exhibiting higher consumption rates.

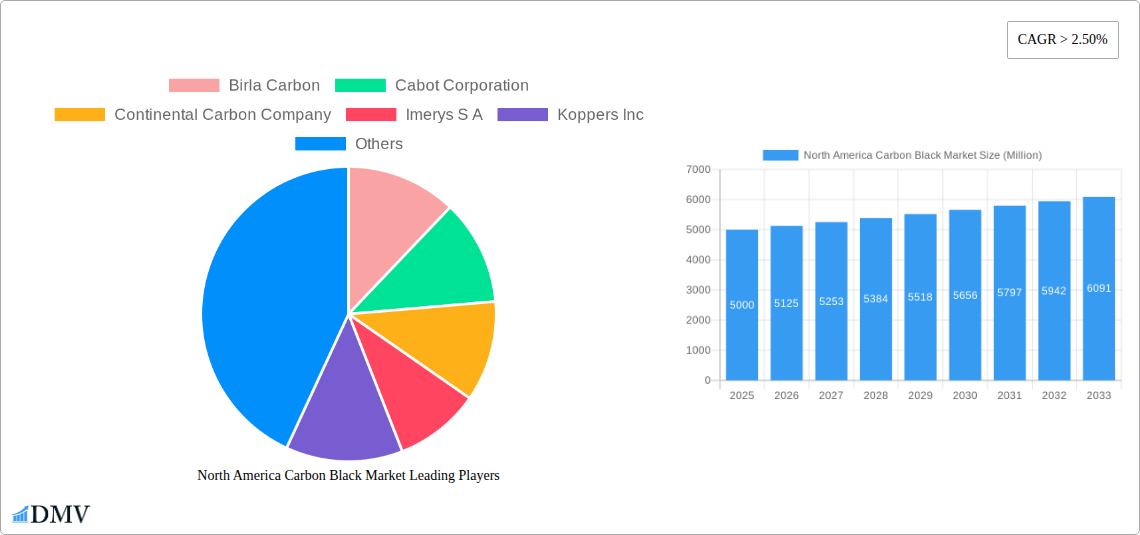

North America Carbon Black Market Market Size (In Million)

Market growth is influenced by several critical factors. Fluctuations in crude oil prices, a fundamental raw material, directly impact production expenses. Stringent environmental regulations governing emissions and waste management necessitate substantial investments in advanced, cleaner technologies, thereby shaping market dynamics. Furthermore, the emergence of alternative reinforcing agents and pigments intensifies the competitive landscape. Despite these challenges, sustained demand from established applications, coupled with the potential for new applications in burgeoning sectors such as advanced materials and energy storage, is expected to maintain the positive growth trajectory of the North American carbon black market throughout the forecast period. The competitive environment is characterized by the presence of established multinational corporations and regional manufacturers, fostering dynamic market interactions that influence pricing and innovation.

North America Carbon Black Market Company Market Share

This comprehensive report offers an in-depth analysis of the North America carbon black market, providing critical insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a specific focus on 2025, this research details market trends, competitive intelligence, and future growth opportunities. Expect granular analysis of key industry players, including but not limited to Birla Carbon, Cabot Corporation, Continental Carbon Company, Imerys S.A., Koppers Inc., Mitsubishi Chemical Corporation, OMSK Carbon Group, Orion Engineered Carbons, Phillips Carbon Black Limited, Pyrolyx AG, and Tokai Carbon Co. Ltd. This report is indispensable for strategic planning and navigating the evolving landscape of this essential industry.

North America Carbon Black Market Composition & Trends

This section delves into the market's intricate structure, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The analysis covers the period from 2019 to 2024, projecting trends through 2033.

- Market Concentration: The North American carbon black market exhibits a moderately concentrated landscape, with the top five players commanding approximately xx% of the market share in 2024. This is expected to slightly shift to xx% by 2033, driven by M&A activities and organic growth.

- Innovation Catalysts: Growing demand for high-performance tires, enhanced conductive inks, and specialized plastics fuels innovation in carbon black production processes and materials science. Developments in nanotechnology and surface modification are key drivers.

- Regulatory Landscape: Stringent environmental regulations concerning emissions, waste disposal, and worker safety significantly influence operational costs and market dynamics. Compliance costs are expected to remain a major factor affecting profitability.

- Substitute Products: Alternative materials, such as graphene and other conductive fillers, pose a potential threat, though their widespread adoption remains limited due to cost and performance challenges.

- End-User Profiles: The primary end-use sectors include tires, rubber products, plastics, inks, and coatings. The automotive sector accounts for the largest segment, representing approximately xx% of total demand in 2024. This share is projected to remain stable through 2033.

- M&A Activities: Significant M&A activity has shaped the market landscape. Total deal value over the period 2019-2024 reached approximately USD xx Million. Further consolidation is anticipated in the forecast period.

North America Carbon Black Market Industry Evolution

This section offers a comprehensive analysis of the North America carbon black market's growth trajectory from 2019 to 2033. It investigates the interplay of technological advancements, shifting consumer demands, and evolving market trends, providing granular insights into growth rates and adoption metrics. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). The growth is predominantly driven by the automotive industry's robust expansion, coupled with the burgeoning demand for high-performance tires and other specialized applications. This growth, however, is influenced by environmental regulations and the emergence of alternative materials.

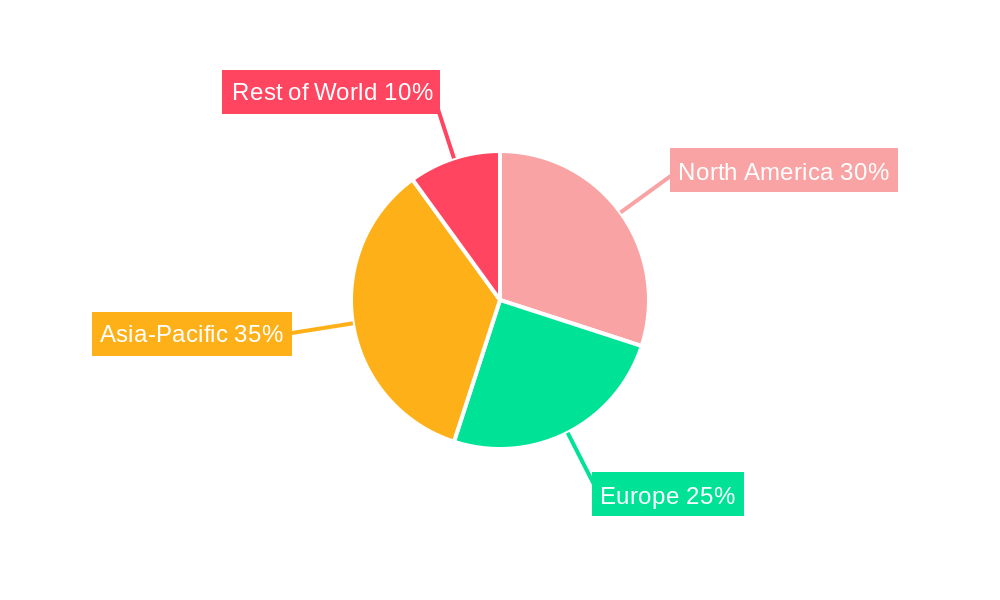

Leading Regions, Countries, or Segments in North America Carbon Black Market

This section identifies the dominant regions, countries, and segments within the North American carbon black market, providing a detailed analysis of their market share and key success factors. The analysis considers factors like investment trends and regulatory support. The United States dominates the market, accounting for approximately xx% of the total market value in 2024, with this share projected to remain relatively stable until 2033.

- Key Drivers for US Dominance:

- Large Automotive Manufacturing Base: The substantial presence of major automobile manufacturers in the US fuels high demand for carbon black.

- Established Production Infrastructure: The US boasts a well-established network of carbon black production facilities.

- Government Support for Innovation: Government initiatives promoting sustainable manufacturing practices and technological advancements are creating favorable conditions for growth.

Further regional analysis reveals that Canada holds a significant share. Mexico is showing gradual growth, but environmental regulations pose challenges.

North America Carbon Black Market Product Innovations

Recent innovations focus on enhancing carbon black's performance characteristics, including improved dispersion, increased conductivity, and reduced environmental impact. This includes the development of specialized grades tailored for specific applications, like high-performance tires requiring enhanced abrasion resistance and superior wet grip. The adoption of these advanced materials leads to superior performance and better efficiency in various end-use industries.

Propelling Factors for North America Carbon Black Market Growth

The North American carbon black market's growth is propelled by several key factors. The burgeoning automotive industry, particularly the demand for high-performance tires and lightweight vehicles, fuels significant growth. Furthermore, the expanding construction industry and the increasing use of carbon black in plastics and coatings contribute significantly. Government regulations promoting sustainable manufacturing practices also support market expansion by encouraging the adoption of eco-friendly production technologies.

Obstacles in the North America Carbon Black Market

The market faces significant challenges, primarily stringent environmental regulations. Compliance with emission standards and waste disposal regulations increases operational costs, impacting profitability. Furthermore, fluctuations in raw material prices and potential supply chain disruptions due to geopolitical factors pose considerable risks. Intense competition among established players also creates pressure on pricing and profit margins.

Future Opportunities in North America Carbon Black Market

Emerging opportunities lie in the development of sustainable and high-performance carbon black grades. The growing demand for electric vehicles (EVs) presents a promising avenue for growth, as carbon black is crucial in EV battery components and tires. Furthermore, exploration of novel applications in emerging industries like renewable energy and advanced materials holds substantial potential.

Major Players in the North America Carbon Black Market Ecosystem

- Birla Carbon

- Cabot Corporation (https://www.cabotcorp.com/)

- Continental Carbon Company

- Imerys S.A. (https://www.imerys.com/)

- Koppers Inc. (https://www.koppers.com/)

- Mitsubishi Chemical Corporation (https://www.m-kagaku.co.jp/en/)

- OMSK Carbon Group

- Orion Engineered Carbons (https://www.orioncarbons.com/)

- Phillips Carbon Black Limited

- Pyrolyx AG

- Tokai Carbon Co. Ltd

Key Developments in North America Carbon Black Market Industry

- January 2023: Orion Engineered Carbons invested USD 60 Million to reduce emissions at its Borger, Texas plant, eliminating nearly 23 tons of sulfur dioxide and nitrogen oxide daily. This demonstrates a commitment to environmental sustainability and highlights the industry's response to regulatory pressures.

- December 2022: Continental Carbon Company closed its Phenix City, Alabama plant due to the denial of an environmental remediation extension. This signifies the significant impact of regulatory compliance on market dynamics and underscores the increasing costs associated with meeting environmental standards.

Strategic North America Carbon Black Market Forecast

The North America carbon black market is poised for continued growth, driven by the automotive industry's expansion, increased demand for high-performance materials, and the development of sustainable production technologies. While regulatory pressures and competition remain significant challenges, the market's inherent resilience and the emergence of novel applications promise a robust outlook for the forecast period. The market is expected to reach USD xx Million by 2033, presenting significant opportunities for both established players and new entrants.

North America Carbon Black Market Segmentation

-

1. Process Type

- 1.1. Furnace Black

- 1.2. Gas Black

- 1.3. Lamp Black

- 1.4. Thermal Black

-

2. Application

- 2.1. Tires and Industrial Rubber Products

- 2.2. Plastics

- 2.3. Toners and Printing Inks

- 2.4. Coatings

- 2.5. Textile Fibers

- 2.6. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Carbon Black Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Carbon Black Market Regional Market Share

Geographic Coverage of North America Carbon Black Market

North America Carbon Black Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tire Industry; Increasing Penetration of Specialty Carbon Black

- 3.3. Market Restrains

- 3.3.1. Growing Tire Industry; Increasing Penetration of Specialty Carbon Black

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Tire Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Furnace Black

- 5.1.2. Gas Black

- 5.1.3. Lamp Black

- 5.1.4. Thermal Black

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Tires and Industrial Rubber Products

- 5.2.2. Plastics

- 5.2.3. Toners and Printing Inks

- 5.2.4. Coatings

- 5.2.5. Textile Fibers

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. United States North America Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process Type

- 6.1.1. Furnace Black

- 6.1.2. Gas Black

- 6.1.3. Lamp Black

- 6.1.4. Thermal Black

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Tires and Industrial Rubber Products

- 6.2.2. Plastics

- 6.2.3. Toners and Printing Inks

- 6.2.4. Coatings

- 6.2.5. Textile Fibers

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Process Type

- 7. Canada North America Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process Type

- 7.1.1. Furnace Black

- 7.1.2. Gas Black

- 7.1.3. Lamp Black

- 7.1.4. Thermal Black

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Tires and Industrial Rubber Products

- 7.2.2. Plastics

- 7.2.3. Toners and Printing Inks

- 7.2.4. Coatings

- 7.2.5. Textile Fibers

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Process Type

- 8. Mexico North America Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process Type

- 8.1.1. Furnace Black

- 8.1.2. Gas Black

- 8.1.3. Lamp Black

- 8.1.4. Thermal Black

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Tires and Industrial Rubber Products

- 8.2.2. Plastics

- 8.2.3. Toners and Printing Inks

- 8.2.4. Coatings

- 8.2.5. Textile Fibers

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Process Type

- 9. Rest of North America North America Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process Type

- 9.1.1. Furnace Black

- 9.1.2. Gas Black

- 9.1.3. Lamp Black

- 9.1.4. Thermal Black

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Tires and Industrial Rubber Products

- 9.2.2. Plastics

- 9.2.3. Toners and Printing Inks

- 9.2.4. Coatings

- 9.2.5. Textile Fibers

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Process Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Birla Carbon

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Cabot Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Continental Carbon Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Imerys S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Koppers Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mitsubishi Chemical Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 OMSK Carbon Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Orion Engineered Carbons

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Phillips Carbon Black Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Pyrolyx AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Tokai Carbon Co Ltd *List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Birla Carbon

List of Figures

- Figure 1: Global North America Carbon Black Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: United States North America Carbon Black Market Revenue (billion), by Process Type 2025 & 2033

- Figure 3: United States North America Carbon Black Market Revenue Share (%), by Process Type 2025 & 2033

- Figure 4: United States North America Carbon Black Market Revenue (billion), by Application 2025 & 2033

- Figure 5: United States North America Carbon Black Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: United States North America Carbon Black Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: United States North America Carbon Black Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: United States North America Carbon Black Market Revenue (billion), by Country 2025 & 2033

- Figure 9: United States North America Carbon Black Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Canada North America Carbon Black Market Revenue (billion), by Process Type 2025 & 2033

- Figure 11: Canada North America Carbon Black Market Revenue Share (%), by Process Type 2025 & 2033

- Figure 12: Canada North America Carbon Black Market Revenue (billion), by Application 2025 & 2033

- Figure 13: Canada North America Carbon Black Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Canada North America Carbon Black Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: Canada North America Carbon Black Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Canada North America Carbon Black Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Canada North America Carbon Black Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Mexico North America Carbon Black Market Revenue (billion), by Process Type 2025 & 2033

- Figure 19: Mexico North America Carbon Black Market Revenue Share (%), by Process Type 2025 & 2033

- Figure 20: Mexico North America Carbon Black Market Revenue (billion), by Application 2025 & 2033

- Figure 21: Mexico North America Carbon Black Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Mexico North America Carbon Black Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Mexico North America Carbon Black Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Mexico North America Carbon Black Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Mexico North America Carbon Black Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of North America North America Carbon Black Market Revenue (billion), by Process Type 2025 & 2033

- Figure 27: Rest of North America North America Carbon Black Market Revenue Share (%), by Process Type 2025 & 2033

- Figure 28: Rest of North America North America Carbon Black Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Rest of North America North America Carbon Black Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of North America North America Carbon Black Market Revenue (billion), by Geography 2025 & 2033

- Figure 31: Rest of North America North America Carbon Black Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of North America North America Carbon Black Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of North America North America Carbon Black Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Carbon Black Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 2: Global North America Carbon Black Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global North America Carbon Black Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global North America Carbon Black Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global North America Carbon Black Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 6: Global North America Carbon Black Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global North America Carbon Black Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global North America Carbon Black Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global North America Carbon Black Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 10: Global North America Carbon Black Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global North America Carbon Black Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global North America Carbon Black Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global North America Carbon Black Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 14: Global North America Carbon Black Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global North America Carbon Black Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global North America Carbon Black Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global North America Carbon Black Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 18: Global North America Carbon Black Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global North America Carbon Black Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global North America Carbon Black Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Carbon Black Market?

The projected CAGR is approximately 6.14%.

2. Which companies are prominent players in the North America Carbon Black Market?

Key companies in the market include Birla Carbon, Cabot Corporation, Continental Carbon Company, Imerys S A, Koppers Inc, Mitsubishi Chemical Corporation, OMSK Carbon Group, Orion Engineered Carbons, Phillips Carbon Black Limited, Pyrolyx AG, Tokai Carbon Co Ltd *List Not Exhaustive.

3. What are the main segments of the North America Carbon Black Market?

The market segments include Process Type , Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1145.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Tire Industry; Increasing Penetration of Specialty Carbon Black.

6. What are the notable trends driving market growth?

Increasing Usage in the Tire Industry.

7. Are there any restraints impacting market growth?

Growing Tire Industry; Increasing Penetration of Specialty Carbon Black.

8. Can you provide examples of recent developments in the market?

January 2023: Orion Engineered Carbons announced an investment of USD 60 million for reducing the emissions of its carbon black production plant in Borger, Texas, the United States. By installing a new emissions reduction technology in its carbon black production facility, the company aims to improve the surrounding air quality by eliminating nearly 23 tons (or 90%) of the sulfur dioxide and nitrogen oxide emissions produced by the black carbon plant every day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Carbon Black Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Carbon Black Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Carbon Black Market?

To stay informed about further developments, trends, and reports in the North America Carbon Black Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence