Key Insights

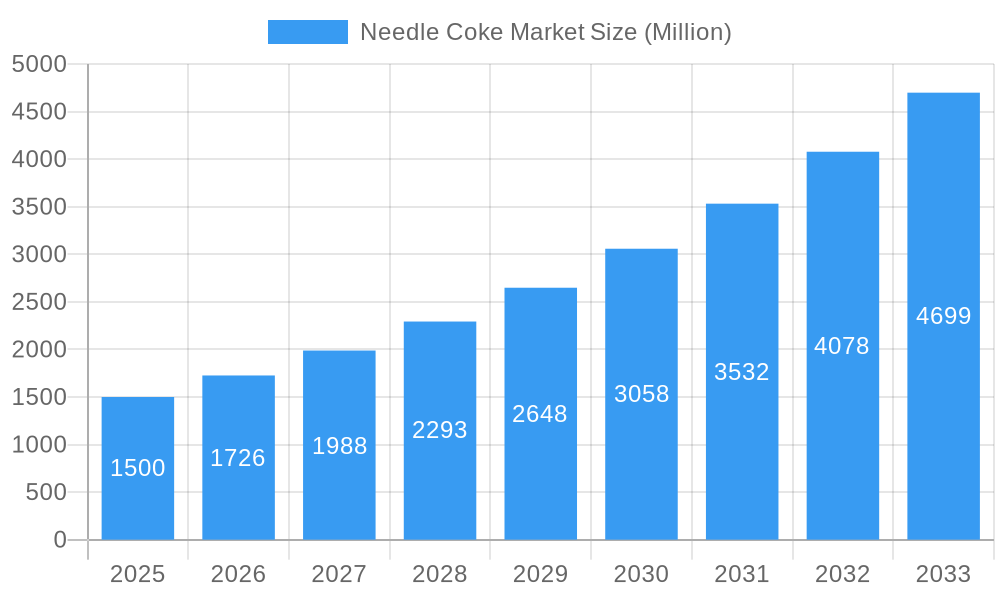

The global needle coke market, valued at 4.191 billion in 2025, is poised for substantial growth, projected at a CAGR of 6.49% through 2033. This upward trajectory is fueled by increasing demand for high-grade carbon materials, particularly within the steel and aluminum industries, and the expanding production of anode materials for lithium-ion batteries. Technological innovations enhancing production efficiency and minimizing environmental impact are further accelerating market expansion. Key industry players are actively investing in capacity and R&D to leverage this growth. However, the market faces challenges from volatile raw material prices and environmental concerns associated with coke production, necessitating adoption of cleaner technologies and presenting initial investment hurdles. The market is segmented by application (aluminum, steel, others), type (calcined, uncalcined), and region, each contributing to market dynamics.

Needle Coke Market Market Size (In Billion)

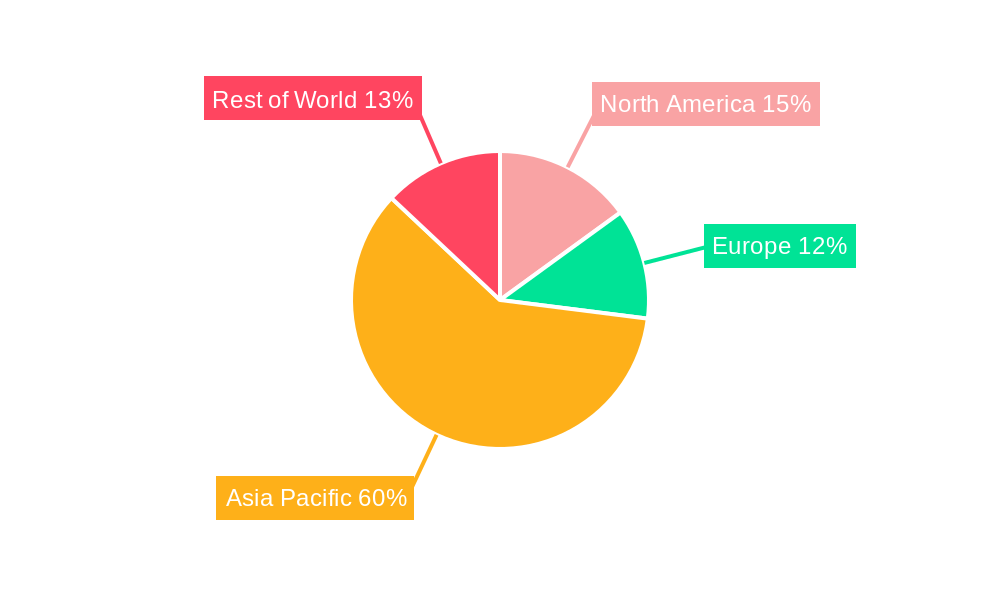

The Asia Pacific, led by China, currently dominates the needle coke market due to its robust steel and aluminum sectors. Other regions are also experiencing heightened demand driven by infrastructure development and the proliferation of energy storage solutions. The competitive environment features a blend of large-scale integrated producers and specialized manufacturers, with anticipated mergers and acquisitions to consolidate market share and expand geographical reach. Future growth will be influenced by advancements in battery technology, the development of sustainable production methods, and the industry's adaptability to fluctuating energy prices and regulatory shifts. A thorough understanding of these market dynamics is crucial for stakeholders formulating long-term strategies in this evolving sector.

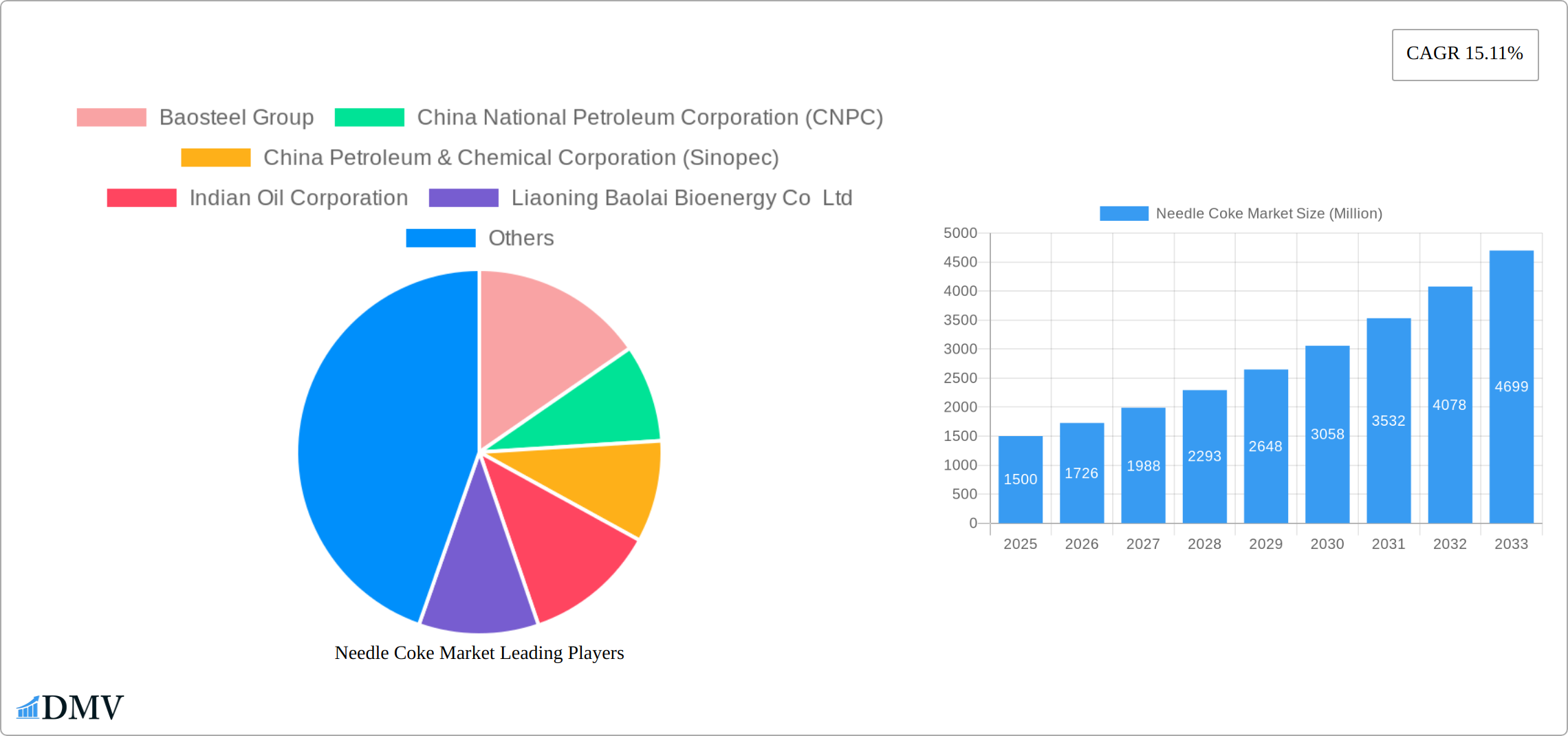

Needle Coke Market Company Market Share

Needle Coke Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Needle Coke Market, offering a comprehensive overview of its current state and future trajectory. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages rigorous research methodologies to forecast market dynamics from 2025 to 2033, offering invaluable insights for stakeholders across the value chain. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Needle Coke Market Composition & Trends

This section delves into the intricate structure of the Needle Coke market, analyzing key aspects influencing its evolution. We examine market concentration, identifying major players and their respective market shares. The report assesses the influence of innovation catalysts, regulatory landscapes (including anticipated changes), and the presence of substitute products on market dynamics. We also profile key end-users and analyze the impact of M&A activities, including deal values, on market consolidation and competitive landscapes.

- Market Share Distribution: A detailed breakdown of market share held by leading players, including Baosteel Group, China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corporation (Sinopec), and others. We will quantify market share percentages for the top 5 players.

- M&A Activity: Analysis of significant mergers and acquisitions in the needle coke industry during the historical period, including deal values and their impact on market structure (e.g., xx Million deal between Company A and Company B).

- Innovation Catalysts: Discussion of technological advancements driving innovation, such as improved production processes and enhanced product properties.

- Regulatory Landscape: Analysis of existing and upcoming regulations impacting the production, distribution, and use of needle coke.

- Substitute Products: Examination of alternative materials that compete with needle coke and their potential impact on market share.

- End-User Profiles: Identification and analysis of major end-user segments, including their specific needs and preferences impacting the demand for needle coke.

Needle Coke Market Industry Evolution

This section provides an in-depth analysis of the historical trajectory and future projections for the needle coke market. We meticulously trace the market's expansion and contraction phases, identifying pivotal periods of growth and potential setbacks. Our research incorporates the significant influence of technological breakthroughs, such as novel production methodologies and enhanced quality control measures, alongside dynamic shifts in consumer preferences. A key driver of demand, particularly the burgeoning electric vehicle (EV) battery industry, will be thoroughly examined. We will present specific quantitative data, including historical and projected growth rates, and elaborate on the adoption patterns of advanced technologies across various market segments. Furthermore, the analysis will encompass the pervasive impact of global economic trends and nuanced regional demand variations.

Leading Regions, Countries, or Segments in Needle Coke Market

This section pinpoints the dominant regions, countries, or segments within the global needle coke market. We analyze the factors driving this dominance, providing a comprehensive understanding of market leadership.

- Key Drivers for Dominance:

- Investment Trends: Analysis of investment patterns in specific regions/countries, highlighting infrastructure development and production capacity expansions.

- Regulatory Support: Examination of supportive government policies and regulations driving industry growth in specific geographic locations.

- Access to Raw Materials: Evaluation of the availability and cost of raw materials influencing regional production capabilities.

- Demand Dynamics: Analysis of end-user concentration and growth rates in specific regions influencing market demand.

The analysis will include a detailed assessment of market size, growth rates, and key trends in the dominant region/country/segment, offering a granular view of its leading position.

Needle Coke Market Product Innovations

This section showcases recent product innovations within the needle coke market, highlighting unique selling propositions (USPs) and the technological advancements driving these innovations. We detail new applications of needle coke and analyze their performance metrics, demonstrating the ongoing evolution of this crucial material in diverse industries. The discussion will focus on improvements in quality, efficiency, and sustainability.

Propelling Factors for Needle Coke Market Growth

Several factors are driving the growth of the needle coke market. The rising demand for lithium-ion batteries in the electric vehicle (EV) sector is a key driver, as needle coke is a critical component in the production of graphite anodes. Furthermore, advancements in production technologies are leading to improved quality and efficiency, further bolstering market growth. Governmental support for renewable energy initiatives is also creating a favorable environment for expansion.

Obstacles in the Needle Coke Market

While the needle coke market demonstrates considerable growth potential, it is not without its inherent challenges. Volatility in raw material pricing presents a persistent threat to profit margins. Furthermore, disruptions within the global supply chain can lead to significant production delays and escalated operational costs. The increasing stringency of environmental regulations necessitates substantial investment in and adoption of more sustainable production practices, posing a challenge to established operational models. The competitive landscape, characterized by intense rivalry among established key players, further amplifies the difficulties associated with market expansion and increased market share acquisition.

Future Opportunities in Needle Coke Market

The needle coke market is poised to capitalize on a spectrum of promising future opportunities. The exploration and penetration into new application areas, such as the development of advanced composite materials and highly specialized carbon-based products, are expected to be significant growth engines. The imperative to develop and implement more sustainable and environmentally friendly production methodologies will not only address regulatory pressures but also unlock new market segments and foster greater industry acceptance. Moreover, the rapidly industrializing economies across emerging markets represent substantial untapped potential for increased needle coke consumption, driven by their expanding manufacturing sectors and infrastructure development.

Major Players in the Needle Coke Market Ecosystem

- Baosteel Group

- China National Petroleum Corporation (CNPC)

- China Petroleum & Chemical Corporation (Sinopec)

- Indian Oil Corporation

- Liaoning Baolai Bioenergy Co Ltd

- Mitsubishi Chemical Corporation

- Nippon Steel Corporation

- Phillips 66

- Posco Mc Materials

- Seadrift Coke LP (Graftech International)

- Shandong Dongyang Technology Co Ltd

- Shandong Yida New Materials Co Ltd

- Shanxi Hongte Coal Chemical Co Ltd

- List Not Exhaustive

Key Developments in Needle Coke Market Industry

- January 2024: China National Petroleum Corporation (CNPC) celebrated the successful completion of its 400,000 tons/year needle coke facility in Jinzhou, China. This landmark development substantially elevates global production capacity and solidifies China's pivotal role in the international needle coke market.

- December 2022: Gazprom Neft unveiled ambitious plans to commence needle coke production at its Omsk refinery. This strategic move, targeting the high-demand Li-ion battery and graphite electrode sectors, underscores a broader industry trend towards vertical integration and diversification in response to evolving market needs.

- December 2022: POSCO Chemical's strategic agreement with Ultium Cells LLC for the supply of graphite anode material for EV batteries powerfully illustrates the escalating demand for needle coke, directly propelled by the exponential growth of the electric vehicle industry and its critical component requirements.

Strategic Needle Coke Market Forecast

The needle coke market is poised for continued growth driven by the increasing demand from the EV battery industry and the exploration of new applications in advanced materials. Technological advancements leading to greater efficiency and sustainability will further fuel market expansion. The ongoing shift towards electric vehicles and renewable energy will solidify the need for needle coke, creating a positive outlook for the years ahead.

Needle Coke Market Segmentation

-

1. Product Type

- 1.1. Petroleum Based

- 1.2. Coal-tar Pitch Based

-

2. Application

- 2.1. Graphite Electrodes

- 2.2. Lithium-ion Batteries

- 2.3. Other Applications

Needle Coke Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Needle Coke Market Regional Market Share

Geographic Coverage of Needle Coke Market

Needle Coke Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investments in EAF Steel Manufacturing; Government Policies to Increase Scrap Steel Consumption

- 3.3. Market Restrains

- 3.3.1. Increasing Investments in EAF Steel Manufacturing; Government Policies to Increase Scrap Steel Consumption

- 3.4. Market Trends

- 3.4.1. Graphite Electrodes Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Needle Coke Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Petroleum Based

- 5.1.2. Coal-tar Pitch Based

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Graphite Electrodes

- 5.2.2. Lithium-ion Batteries

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Needle Coke Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Petroleum Based

- 6.1.2. Coal-tar Pitch Based

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Graphite Electrodes

- 6.2.2. Lithium-ion Batteries

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Needle Coke Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Petroleum Based

- 7.1.2. Coal-tar Pitch Based

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Graphite Electrodes

- 7.2.2. Lithium-ion Batteries

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Needle Coke Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Petroleum Based

- 8.1.2. Coal-tar Pitch Based

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Graphite Electrodes

- 8.2.2. Lithium-ion Batteries

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Needle Coke Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Petroleum Based

- 9.1.2. Coal-tar Pitch Based

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Graphite Electrodes

- 9.2.2. Lithium-ion Batteries

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Needle Coke Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Petroleum Based

- 10.1.2. Coal-tar Pitch Based

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Graphite Electrodes

- 10.2.2. Lithium-ion Batteries

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Baosteel Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China National Petroleum Corporation (CNPC)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China Petroleum & Chemical Corporation (Sinopec)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Indian Oil Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Liaoning Baolai Bioenergy Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsubishi Chemical Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nippon Steel Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Phillips 66

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Posco Mc Materials

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Seadrift Coke LP (Graftech International)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shandong Dongyang Technology Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shandong Yida New Materials Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shanxi Hongte Coal Chemical Co Ltd *List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Baosteel Group

List of Figures

- Figure 1: Global Needle Coke Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Needle Coke Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Needle Coke Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Needle Coke Market Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific Needle Coke Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Needle Coke Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Needle Coke Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Needle Coke Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: North America Needle Coke Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Needle Coke Market Revenue (billion), by Application 2025 & 2033

- Figure 11: North America Needle Coke Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Needle Coke Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Needle Coke Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Needle Coke Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Europe Needle Coke Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Needle Coke Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Needle Coke Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Needle Coke Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Needle Coke Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Needle Coke Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Needle Coke Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Needle Coke Market Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Needle Coke Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Needle Coke Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Needle Coke Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Needle Coke Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Needle Coke Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Needle Coke Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Needle Coke Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Needle Coke Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Needle Coke Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Needle Coke Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Needle Coke Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Needle Coke Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Needle Coke Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Needle Coke Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Needle Coke Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Needle Coke Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Needle Coke Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Needle Coke Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Needle Coke Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 19: Global Needle Coke Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Needle Coke Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Needle Coke Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 27: Global Needle Coke Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Needle Coke Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Needle Coke Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Needle Coke Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Needle Coke Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Needle Coke Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Needle Coke Market?

The projected CAGR is approximately 6.49%.

2. Which companies are prominent players in the Needle Coke Market?

Key companies in the market include Baosteel Group, China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corporation (Sinopec), Indian Oil Corporation, Liaoning Baolai Bioenergy Co Ltd, Mitsubishi Chemical Corporation, Nippon Steel Corporation, Phillips 66, Posco Mc Materials, Seadrift Coke LP (Graftech International), Shandong Dongyang Technology Co Ltd, Shandong Yida New Materials Co Ltd, Shanxi Hongte Coal Chemical Co Ltd *List Not Exhaustive.

3. What are the main segments of the Needle Coke Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.191 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in EAF Steel Manufacturing; Government Policies to Increase Scrap Steel Consumption.

6. What are the notable trends driving market growth?

Graphite Electrodes Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Investments in EAF Steel Manufacturing; Government Policies to Increase Scrap Steel Consumption.

8. Can you provide examples of recent developments in the market?

• January 2024: CNPC hoisted and docked the top tower of the 400,000 tons/year of needle coke at the construction site in Jinzhou, China. The project is likely to be completed in the coming years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Needle Coke Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Needle Coke Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Needle Coke Market?

To stay informed about further developments, trends, and reports in the Needle Coke Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence