Key Insights

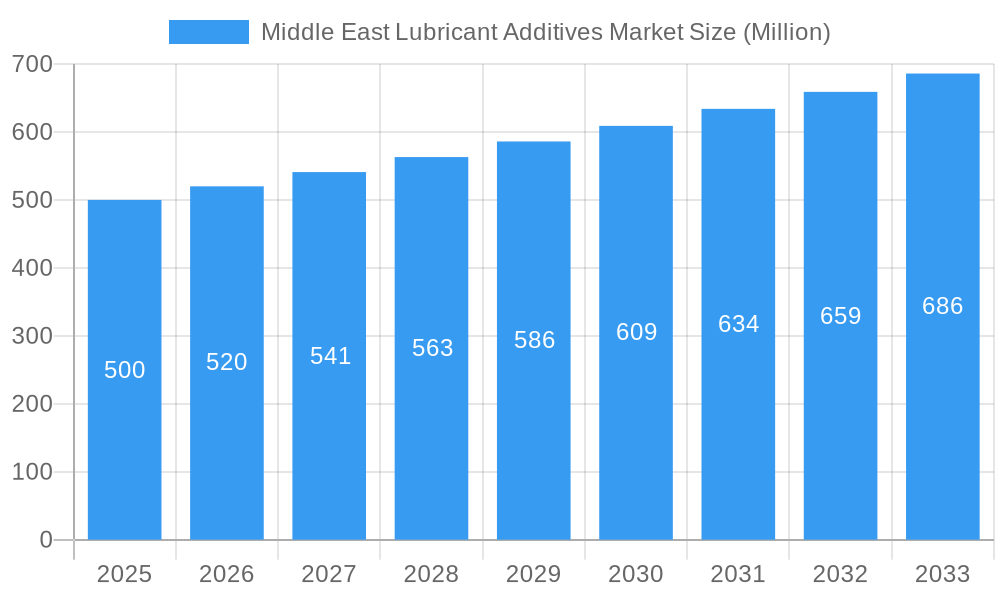

The Middle East Lubricant Additives Market is experiencing robust growth, driven by the burgeoning automotive and transportation sectors, expanding industrialization, and a rising demand for high-performance lubricants in heavy equipment and power generation. The market's Compound Annual Growth Rate (CAGR) exceeding 4% from 2019 to 2024 indicates a significant upward trajectory. Key drivers include the increasing adoption of advanced lubricant formulations to enhance engine efficiency, fuel economy, and extend equipment lifespan. Growth is further fueled by stringent emission regulations prompting the use of additives that minimize environmental impact. The market is segmented by function (dispersants & emulsifiers, viscosity index improvers, etc.), product type (engine oil, gear oil, grease, etc.), and end-user industry (automotive, construction, power generation, etc.). While precise market size figures for 2019-2024 are not provided, extrapolating from the given CAGR and a reasonable estimated 2025 market size of $500 million (this is a reasonable assumption based on similar regional markets and industry reports), we can infer substantial growth throughout the historical period and into the forecast period. The significant presence of major oil and gas companies, alongside established chemical companies, further underscores the market's potential.

Middle East Lubricant Additives Market Market Size (In Million)

The forecast period (2025-2033) promises continued expansion, though potential restraints like fluctuating oil prices and economic downturns could influence growth rates. However, government initiatives promoting infrastructure development and industrial diversification across the Middle East region, coupled with ongoing advancements in lubricant additive technology, suggest sustained demand. Leading companies like Infineum, ExxonMobil, and Lubrizol are actively engaged in the region, indicating strong competition and a focus on innovation to cater to diverse end-user needs. Future growth will likely be shaped by the increasing adoption of electric vehicles, which may impact the demand for certain types of additives, while potentially creating opportunities in other segments like those related to battery performance and electric motor lubrication. Specific segment growth within the market will likely be driven by factors such as government regulations on emissions, cost considerations, and technological advancements in lubricant formulations.

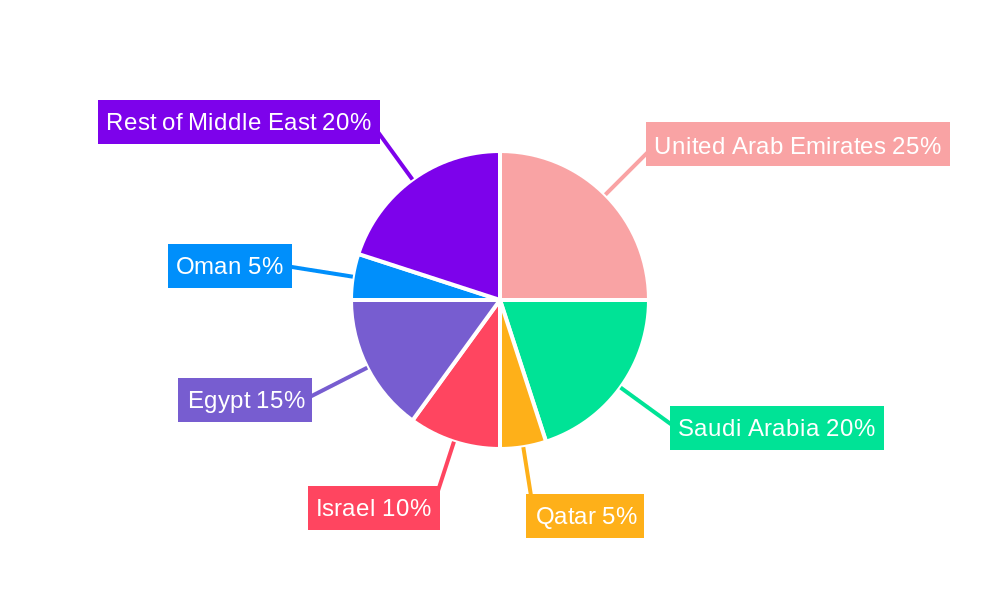

Middle East Lubricant Additives Market Company Market Share

Middle East Lubricant Additives Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Middle East lubricant additives market, offering a comprehensive overview of its current state, future trends, and key players. Covering the period from 2019 to 2033, with 2025 as the base year, this research provides invaluable insights for stakeholders seeking to navigate this dynamic market. The market size in 2025 is estimated at xx Million, projected to reach xx Million by 2033. This report is crucial for strategic decision-making, investment planning, and competitive analysis within the Middle East lubricant additives sector.

Middle East Lubricant Additives Market Composition & Trends

The Middle East lubricant additives market exhibits a moderately concentrated landscape, with a handful of multinational corporations holding significant market share. However, regional players and specialized additive manufacturers are also contributing to the market’s dynamism. Innovation is driven by stricter emission regulations, the growing demand for fuel-efficient vehicles, and the increasing adoption of advanced lubricant technologies. The regulatory environment is becoming increasingly stringent, pushing manufacturers towards developing environmentally friendly additives. Substitute products, such as bio-based additives, are gradually gaining traction, posing a challenge to conventional offerings. End-user profiles reveal a diverse landscape encompassing automotive, construction, power generation, and industrial sectors. M&A activity has been notable, with several significant deals reshaping the market landscape. For example, Aramco's acquisition of Valvoline Global Products significantly altered market dynamics. The total value of M&A deals in the historical period (2019-2024) was approximately xx Million.

- Market Share Distribution (2025): Top 5 players hold approximately xx% of the market.

- M&A Deal Value (2019-2024): Approximately xx Million.

- Key Regulatory Factors: Stringent emission norms and environmental regulations.

- Substitute Products: Bio-based additives and other environmentally friendly alternatives.

Middle East Lubricant Additives Market Industry Evolution

The Middle East lubricant additives market has witnessed substantial growth over the past five years (2019-2024), driven by the region's expanding industrial sector, particularly in construction and infrastructure development. The automotive sector, a major end-user, also contributes significantly to market growth. Technological advancements, such as the development of more efficient and environmentally friendly additives, are shaping market trends. The demand for high-performance lubricants with enhanced fuel economy and extended lifespan is on the rise. Consumer demand for environmentally conscious products is further accelerating the adoption of bio-based and sustainable additives. The compound annual growth rate (CAGR) for the historical period (2019-2024) was approximately xx%, while the projected CAGR for the forecast period (2025-2033) is estimated at xx%. This growth reflects increased investments in research and development, leading to superior lubricant technologies and performance enhancements. Adoption of advanced additives has increased by xx% in the past five years, showing a positive outlook for future growth.

Leading Regions, Countries, or Segments in Middle East Lubricant Additives Market

The automotive & transportation sector dominates the end-user industry segment, accounting for approximately xx% of the market share in 2025. Amongst the function segments, Dispersants & Emulsifiers hold the largest market share, followed closely by Viscosity Index Improvers. The UAE and Saudi Arabia are the leading countries driving market growth, fueled by robust infrastructure development and a burgeoning automotive sector.

Key Drivers for Automotive & Transportation: Growing vehicle population, stringent emission regulations, and increased demand for fuel-efficient vehicles.

Key Drivers for Dispersants & Emulsifiers: Their critical role in maintaining engine cleanliness and preventing sludge formation.

Key Drivers for UAE & Saudi Arabia: Significant investments in infrastructure projects and a large automotive market.

Dominant Region: UAE and Saudi Arabia

Dominant Function: Dispersants & Emulsifiers

Dominant Product Type: Engine Oil

Dominant End-user Industry: Automotive & Transportation

Middle East Lubricant Additives Market Product Innovations

Recent innovations focus on developing environmentally friendly additives with enhanced performance characteristics. This includes bio-based additives, additives that improve fuel efficiency, and those that extend lubricant lifespan. Manufacturers are emphasizing the unique selling propositions of their products, highlighting features such as improved engine protection, reduced emissions, and enhanced fuel economy. Technological advancements like nanotechnology are being incorporated to improve additive efficacy and longevity.

Propelling Factors for Middle East Lubricant Additives Market Growth

The market's growth is fueled by several factors: rising demand from the automotive sector, increased industrialization, stringent government regulations promoting energy efficiency and environmental protection, and growing investments in infrastructure development. The increasing adoption of advanced engine technologies and the need for high-performance lubricants are key drivers. Furthermore, supportive government policies incentivizing the use of eco-friendly additives further contribute to the market's expansion.

Obstacles in the Middle East Lubricant Additives Market

The market faces challenges such as volatile crude oil prices, fluctuating demand from end-user industries, and potential supply chain disruptions. Stringent environmental regulations, while promoting growth in some areas, also impose additional costs and complexities for manufacturers. Competitive pressures from both domestic and international players pose a constant challenge. These factors can impact the profitability and market share of individual companies.

Future Opportunities in Middle East Lubricant Additives Market

Significant opportunities lie in the development and adoption of bio-based and sustainable additives. The expanding renewable energy sector offers potential applications for specialized lubricants and additives. Furthermore, growing demand for high-performance lubricants in emerging industrial sectors presents significant potential for market expansion. Focus on research and development of advanced additives with enhanced performance characteristics will further unlock opportunities.

Major Players in the Middle East Lubricant Additives Market Ecosystem

- Qhatran Kaveh Motor Oil Company

- Nouryon

- Infineum International

- Exxon Mobil Corporation

- TotalEnergies SE

- Evonik Industries AG

- LANXESS

- Croda International PLC

- Kemipex

- BASF SE

- Chevron Corporation

- The Lubrizol Corporation

- Gunash Chemistry Industry Co-Ltd

- ENOC Company

- Abu Dhabi National Oil Company (ADNOC)

- Afton Chemical

Key Developments in Middle East Lubricant Additives Market Industry

- March 2022: ADNOC launched a new Voyager Green Series range of lubricant products formulated with 100% plant-derived base oil for the UAE market.

- August 2022: Aramco acquired Valvoline Global Products, expanding its business, research and development activities, and its partnership with original equipment manufacturers (OEMs).

- September 2022: SI Group announced the expansion of its lubricant additive portfolio with new aminic antioxidants primarily used in lubricants, greases, and industrial, automotive, and heat transfer fluids.

These developments indicate a shift towards sustainable and high-performance lubricant additives, signifying significant changes in the market's competitive landscape and technological advancements.

Strategic Middle East Lubricant Additives Market Forecast

The Middle East lubricant additives market is poised for substantial growth, driven by increased industrial activity, a growing automotive sector, and supportive government policies. The focus on sustainability and environmental concerns will further fuel the demand for eco-friendly additives. The market is expected to witness significant innovation and consolidation, with major players investing heavily in research and development to maintain their market positions. The forecast period promises strong growth potential, driven by both regional and global market trends.

Middle East Lubricant Additives Market Segmentation

-

1. Function

- 1.1. Dispersants & Emulsifiers

- 1.2. Viscosity Index Improvers

- 1.3. Detergents

- 1.4. Corrosion Inhibitors

- 1.5. Oxidation Inhibitors

- 1.6. Extreme-Pressure Additives

- 1.7. Friction Modifiers

- 1.8. Other Functions

-

2. Product Type

- 2.1. Engine Oil

- 2.2. Transmission and Hydraulic Fluid

- 2.3. Metalworking Fluid

- 2.4. General Industrial Oil

- 2.5. Gear Oil

- 2.6. Grease

- 2.7. Process Oil

- 2.8. Other Product Types

-

3. End-user Industry

- 3.1. Automotive & Transportation

- 3.2. Construction

- 3.3. Power Generation

- 3.4. Heavy Equipment

- 3.5. Metallurgy & Metal Working

- 3.6. Food & Beverage

- 3.7. Other End-user Industries

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Iran

- 4.4. Qatar

- 4.5. Rest of Middle-East

Middle East Lubricant Additives Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Iran

- 4. Qatar

- 5. Rest of Middle East

Middle East Lubricant Additives Market Regional Market Share

Geographic Coverage of Middle East Lubricant Additives Market

Middle East Lubricant Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Synthetic Oil Penetration in the Region; Growing Automotive Sector in the Middle East

- 3.3. Market Restrains

- 3.3.1. Rising Raw Material Costs; Supply Chain Disruptions

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of Lubricant Additives in the Automotive and Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Lubricant Additives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Dispersants & Emulsifiers

- 5.1.2. Viscosity Index Improvers

- 5.1.3. Detergents

- 5.1.4. Corrosion Inhibitors

- 5.1.5. Oxidation Inhibitors

- 5.1.6. Extreme-Pressure Additives

- 5.1.7. Friction Modifiers

- 5.1.8. Other Functions

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Engine Oil

- 5.2.2. Transmission and Hydraulic Fluid

- 5.2.3. Metalworking Fluid

- 5.2.4. General Industrial Oil

- 5.2.5. Gear Oil

- 5.2.6. Grease

- 5.2.7. Process Oil

- 5.2.8. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive & Transportation

- 5.3.2. Construction

- 5.3.3. Power Generation

- 5.3.4. Heavy Equipment

- 5.3.5. Metallurgy & Metal Working

- 5.3.6. Food & Beverage

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Iran

- 5.4.4. Qatar

- 5.4.5. Rest of Middle-East

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Iran

- 5.5.4. Qatar

- 5.5.5. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Saudi Arabia Middle East Lubricant Additives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Dispersants & Emulsifiers

- 6.1.2. Viscosity Index Improvers

- 6.1.3. Detergents

- 6.1.4. Corrosion Inhibitors

- 6.1.5. Oxidation Inhibitors

- 6.1.6. Extreme-Pressure Additives

- 6.1.7. Friction Modifiers

- 6.1.8. Other Functions

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Engine Oil

- 6.2.2. Transmission and Hydraulic Fluid

- 6.2.3. Metalworking Fluid

- 6.2.4. General Industrial Oil

- 6.2.5. Gear Oil

- 6.2.6. Grease

- 6.2.7. Process Oil

- 6.2.8. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive & Transportation

- 6.3.2. Construction

- 6.3.3. Power Generation

- 6.3.4. Heavy Equipment

- 6.3.5. Metallurgy & Metal Working

- 6.3.6. Food & Beverage

- 6.3.7. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. Iran

- 6.4.4. Qatar

- 6.4.5. Rest of Middle-East

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. United Arab Emirates Middle East Lubricant Additives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Dispersants & Emulsifiers

- 7.1.2. Viscosity Index Improvers

- 7.1.3. Detergents

- 7.1.4. Corrosion Inhibitors

- 7.1.5. Oxidation Inhibitors

- 7.1.6. Extreme-Pressure Additives

- 7.1.7. Friction Modifiers

- 7.1.8. Other Functions

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Engine Oil

- 7.2.2. Transmission and Hydraulic Fluid

- 7.2.3. Metalworking Fluid

- 7.2.4. General Industrial Oil

- 7.2.5. Gear Oil

- 7.2.6. Grease

- 7.2.7. Process Oil

- 7.2.8. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive & Transportation

- 7.3.2. Construction

- 7.3.3. Power Generation

- 7.3.4. Heavy Equipment

- 7.3.5. Metallurgy & Metal Working

- 7.3.6. Food & Beverage

- 7.3.7. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. Iran

- 7.4.4. Qatar

- 7.4.5. Rest of Middle-East

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Iran Middle East Lubricant Additives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Dispersants & Emulsifiers

- 8.1.2. Viscosity Index Improvers

- 8.1.3. Detergents

- 8.1.4. Corrosion Inhibitors

- 8.1.5. Oxidation Inhibitors

- 8.1.6. Extreme-Pressure Additives

- 8.1.7. Friction Modifiers

- 8.1.8. Other Functions

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Engine Oil

- 8.2.2. Transmission and Hydraulic Fluid

- 8.2.3. Metalworking Fluid

- 8.2.4. General Industrial Oil

- 8.2.5. Gear Oil

- 8.2.6. Grease

- 8.2.7. Process Oil

- 8.2.8. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive & Transportation

- 8.3.2. Construction

- 8.3.3. Power Generation

- 8.3.4. Heavy Equipment

- 8.3.5. Metallurgy & Metal Working

- 8.3.6. Food & Beverage

- 8.3.7. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. Iran

- 8.4.4. Qatar

- 8.4.5. Rest of Middle-East

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Qatar Middle East Lubricant Additives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Dispersants & Emulsifiers

- 9.1.2. Viscosity Index Improvers

- 9.1.3. Detergents

- 9.1.4. Corrosion Inhibitors

- 9.1.5. Oxidation Inhibitors

- 9.1.6. Extreme-Pressure Additives

- 9.1.7. Friction Modifiers

- 9.1.8. Other Functions

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Engine Oil

- 9.2.2. Transmission and Hydraulic Fluid

- 9.2.3. Metalworking Fluid

- 9.2.4. General Industrial Oil

- 9.2.5. Gear Oil

- 9.2.6. Grease

- 9.2.7. Process Oil

- 9.2.8. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive & Transportation

- 9.3.2. Construction

- 9.3.3. Power Generation

- 9.3.4. Heavy Equipment

- 9.3.5. Metallurgy & Metal Working

- 9.3.6. Food & Beverage

- 9.3.7. Other End-user Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. Iran

- 9.4.4. Qatar

- 9.4.5. Rest of Middle-East

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Rest of Middle East Middle East Lubricant Additives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Dispersants & Emulsifiers

- 10.1.2. Viscosity Index Improvers

- 10.1.3. Detergents

- 10.1.4. Corrosion Inhibitors

- 10.1.5. Oxidation Inhibitors

- 10.1.6. Extreme-Pressure Additives

- 10.1.7. Friction Modifiers

- 10.1.8. Other Functions

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Engine Oil

- 10.2.2. Transmission and Hydraulic Fluid

- 10.2.3. Metalworking Fluid

- 10.2.4. General Industrial Oil

- 10.2.5. Gear Oil

- 10.2.6. Grease

- 10.2.7. Process Oil

- 10.2.8. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive & Transportation

- 10.3.2. Construction

- 10.3.3. Power Generation

- 10.3.4. Heavy Equipment

- 10.3.5. Metallurgy & Metal Working

- 10.3.6. Food & Beverage

- 10.3.7. Other End-user Industries

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Saudi Arabia

- 10.4.2. United Arab Emirates

- 10.4.3. Iran

- 10.4.4. Qatar

- 10.4.5. Rest of Middle-East

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Qhatran Kaveh Motor Oil Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nouryon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Infineum International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Exxon Mobil Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TotalEnergies SE*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Evonik Industries AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LANXESS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Croda International PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kemipex

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BASF SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Chevron Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Lubrizol Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Gunash Chemistry Industry Co-Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ENOC Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Abu Dhabi National Oil Company (ADNOC)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Afton Chemical

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Qhatran Kaveh Motor Oil Company

List of Figures

- Figure 1: Middle East Lubricant Additives Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Lubricant Additives Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Lubricant Additives Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 2: Middle East Lubricant Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: Middle East Lubricant Additives Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Middle East Lubricant Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: Middle East Lubricant Additives Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Middle East Lubricant Additives Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 7: Middle East Lubricant Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: Middle East Lubricant Additives Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Middle East Lubricant Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Middle East Lubricant Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Middle East Lubricant Additives Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 12: Middle East Lubricant Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 13: Middle East Lubricant Additives Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Middle East Lubricant Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Middle East Lubricant Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Middle East Lubricant Additives Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 17: Middle East Lubricant Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 18: Middle East Lubricant Additives Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 19: Middle East Lubricant Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Middle East Lubricant Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Middle East Lubricant Additives Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 22: Middle East Lubricant Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 23: Middle East Lubricant Additives Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Middle East Lubricant Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 25: Middle East Lubricant Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Middle East Lubricant Additives Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 27: Middle East Lubricant Additives Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 28: Middle East Lubricant Additives Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 29: Middle East Lubricant Additives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Middle East Lubricant Additives Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Lubricant Additives Market?

The projected CAGR is approximately 2.43%.

2. Which companies are prominent players in the Middle East Lubricant Additives Market?

Key companies in the market include Qhatran Kaveh Motor Oil Company, Nouryon, Infineum International, Exxon Mobil Corporation, TotalEnergies SE*List Not Exhaustive, Evonik Industries AG, LANXESS, Croda International PLC, Kemipex, BASF SE, Chevron Corporation, The Lubrizol Corporation, Gunash Chemistry Industry Co-Ltd, ENOC Company, Abu Dhabi National Oil Company (ADNOC), Afton Chemical.

3. What are the main segments of the Middle East Lubricant Additives Market?

The market segments include Function, Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Synthetic Oil Penetration in the Region; Growing Automotive Sector in the Middle East.

6. What are the notable trends driving market growth?

Increasing Consumption of Lubricant Additives in the Automotive and Construction Industry.

7. Are there any restraints impacting market growth?

Rising Raw Material Costs; Supply Chain Disruptions.

8. Can you provide examples of recent developments in the market?

September 2022 : SI Group announced the expansion of its lubricant additive portfolio with new aminic antioxidants primarily used in lubricants, greases, and industrial, automotive, and heat transfer fluids.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Lubricant Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Lubricant Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Lubricant Additives Market?

To stay informed about further developments, trends, and reports in the Middle East Lubricant Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence