Key Insights

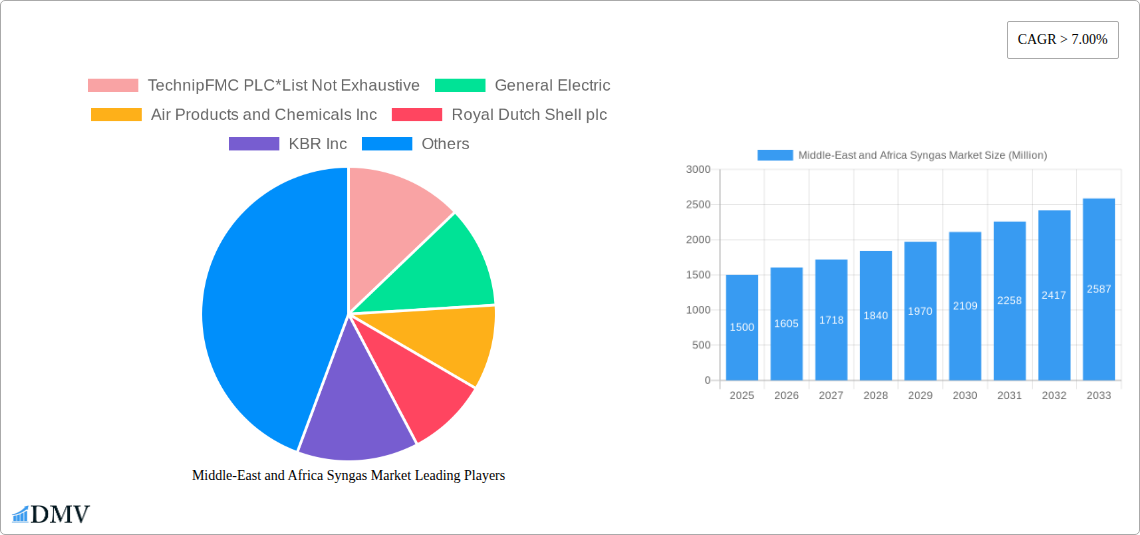

The Middle East and Africa (MEA) syngas market is exhibiting strong growth, propelled by escalating energy needs, industrial expansion, and a drive for cleaner energy solutions. With a projected Compound Annual Growth Rate (CAGR) of 8%, the market is set to expand from a size of 258.1 billion in the base year of 2025. Key growth catalysts include the burgeoning power generation sector, particularly in rapidly developing economies, and the chemical industry's increasing utilization of syngas as a vital feedstock for producing dimethyl ether (DME) and other high-value chemicals. The global transition towards sustainable energy sources is augmenting demand for syngas derived from biomass, though fossil fuels like coal and natural gas remain dominant. Innovations in gasification technologies, such as auto-thermal and combined reforming, are enhancing operational efficiencies and cost-competitiveness. Despite challenges like significant initial capital investment for gasification facilities and potential emission concerns, the MEA syngas market outlook remains exceptionally positive, supported by abundant untapped resources and robust government backing for industrial development.

Middle-East and Africa Syngas Market Market Size (In Billion)

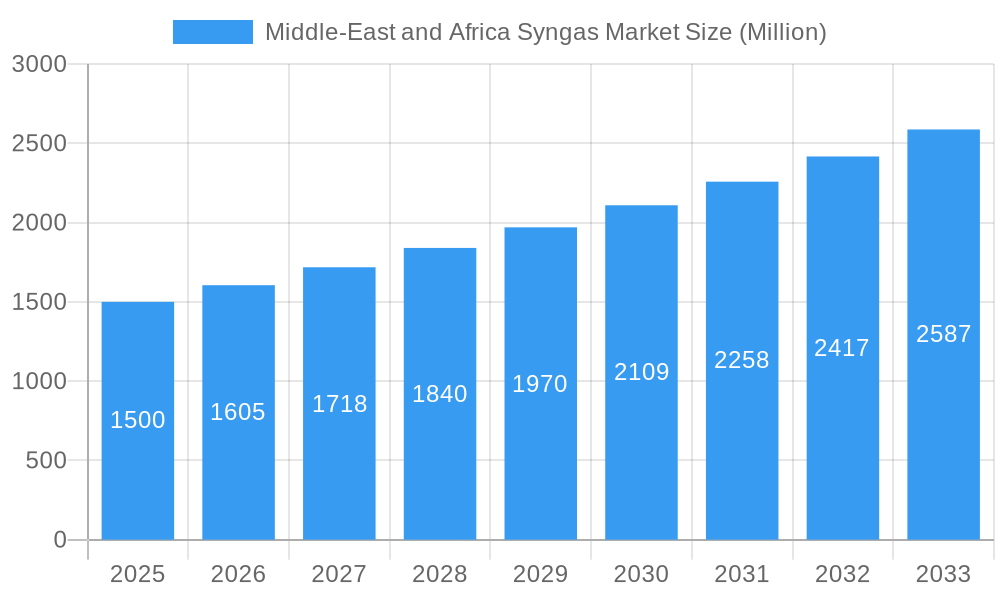

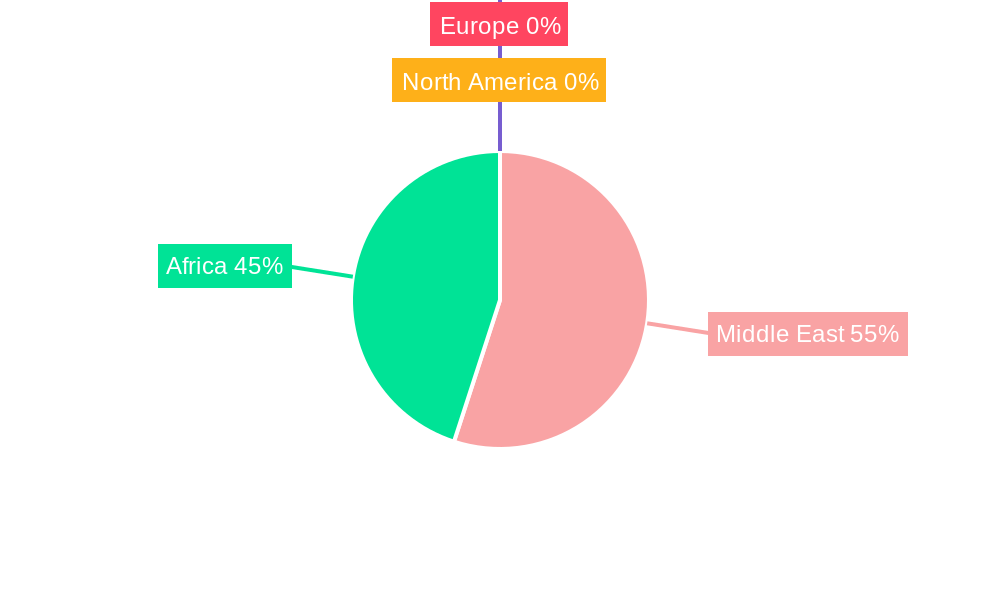

Regional market dynamics within MEA are anticipated to vary. South Africa, with its established industrial infrastructure, is expected to be a primary consumer. Other nations like Sudan, Uganda, Tanzania, and Kenya also present substantial growth potential, driven by ongoing economic development and infrastructure enhancement. The selection of gasifier types—fixed bed, entrained flow, or fluidized bed—will be contingent upon feedstock availability and project scope. Similarly, preferred feedstocks will differ across regions based on resource accessibility and economic viability. Intensified competition is expected among leading global players including TechnipFMC, General Electric, Air Products, Shell, KBR, BASF, Linde, Air Liquide, BP, and SABIC, fueled by market expansion and strategic project acquisition. Detailed regional analysis and regulatory insights are essential for precise market forecasting and strategic business planning. The MEA syngas market is undeniably positioned for significant expansion, offering diverse opportunities across its entire value chain.

Middle-East and Africa Syngas Market Company Market Share

Middle-East and Africa Syngas Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Middle East and Africa syngas market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025, this research delivers critical market intelligence for stakeholders seeking to navigate this dynamic sector. The report meticulously examines various segments, including gasifier types (Fixed Bed, Entrained Flow, Fluidized Bed), applications (Power Generation, Chemicals, Dimethyl Ether, Liquid Fuels, Gaseous Fuels), feedstocks (Coal, Natural Gas, Petroleum, Pet-coke, Biomass), and technologies (Steam Reforming, Partial Oxidation, Auto-thermal Reforming, Combined/Two-step Reforming, Biomass Gasification). The market size is projected to reach xx Million by 2033.

Middle-East and Africa Syngas Market Composition & Trends

This section delves into the competitive landscape of the Middle East and Africa syngas market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. We analyze the market share distribution amongst key players, highlighting the strategies employed by companies like TechnipFMC PLC, General Electric, Air Products and Chemicals Inc, Royal Dutch Shell plc, KBR Inc, BASF SE, Linde plc, Air Liquide, BP plc, and SABIC. The report also quantifies M&A deal values in the region, providing insights into market consolidation trends. The analysis considers the impact of government regulations on market growth and the emergence of substitute products that could influence market dynamics. We will assess the end-user profile across various sectors like power generation and chemicals, revealing their specific needs and impact on market demand.

- Market Concentration: Analysis of market share held by top 5 players, revealing concentration levels. xx% market share held by top 5 players in 2024.

- M&A Activity: Detailed overview of significant M&A deals (2019-2024), including deal values and their impact on market dynamics. Total deal value in 2024 estimated at xx Million.

- Regulatory Landscape: Assessment of key regulations impacting market growth across different countries in the Middle East and Africa.

- Substitute Products: Identification and evaluation of potential substitute products and their competitive impact.

Middle-East and Africa Syngas Market Industry Evolution

This section charts the evolution of the Middle East and Africa syngas market, analyzing growth trajectories from 2019 to 2033. We examine technological advancements, such as improvements in gasification technologies and carbon capture utilization, and how these have influenced market growth. The impact of shifting consumer demands for cleaner energy sources on market adoption will be explored. Specific data points, including compound annual growth rates (CAGR) and adoption rates for various syngas technologies, are provided. The increasing demand for syngas derived from renewable sources, driven by global sustainability goals, is also analyzed, providing insights into future trends and potential opportunities. The report further examines the changing preferences of end-users across different application sectors. The influence of government policies promoting renewable energy and carbon reduction initiatives is also discussed.

Leading Regions, Countries, or Segments in Middle-East and Africa Syngas Market

This section identifies the dominant regions, countries, and segments within the Middle East and Africa syngas market. We will analyze leading segments based on gasifier type, application, feedstock, and technology, pinpointing the key drivers behind their dominance. This analysis will include investment trends, regulatory support, and other factors contributing to the success of specific segments.

- Dominant Region: [Name of dominant region] – Reasons for dominance are explored in detail.

- Dominant Country: [Name of dominant country] – In-depth analysis of market dynamics and contributing factors.

- Dominant Gasifier Type: [Name of dominant gasifier type] – Key drivers include [reasons for dominance].

- Dominant Application: [Name of dominant application] – Analysis of market demand and growth drivers.

- Dominant Feedstock: [Name of dominant feedstock] – Reasons for prevalence and future prospects.

- Dominant Technology: [Name of dominant technology] – Analysis of its efficiency and market adoption.

Middle-East and Africa Syngas Market Product Innovations

This section highlights recent product innovations in syngas technology, focusing on advancements in gasification processes, improved efficiency, and reduced emissions. The analysis will include details on new applications, performance metrics, and unique selling propositions (USPs) of innovative products. We will explore how these innovations are shaping market competition and driving adoption of syngas technology.

Propelling Factors for Middle-East and Africa Syngas Market Growth

Key growth drivers are identified, encompassing technological advancements (e.g., improved efficiency of gasification processes), economic factors (e.g., favorable pricing of feedstocks), and regulatory influences (e.g., government incentives for clean energy). Specific examples are provided to illustrate the impact of these factors.

Obstacles in the Middle-East and Africa Syngas Market Market

This section analyzes barriers and restraints, including regulatory challenges (e.g., permitting processes), supply chain disruptions, and competitive pressures (e.g., competition from other energy sources). The quantifiable impact of these challenges on market growth is evaluated.

Future Opportunities in Middle-East and Africa Syngas Market

This section highlights emerging opportunities, focusing on new markets (e.g., emerging economies), innovative technologies (e.g., carbon capture and utilization), and evolving consumer trends (e.g., increasing demand for clean energy).

Major Players in the Middle-East and Africa Syngas Market Ecosystem

- TechnipFMC PLC

- General Electric

- Air Products and Chemicals Inc

- Royal Dutch Shell plc

- KBR Inc

- BASF SE

- Linde plc

- Air Liquide

- BP plc

- SABIC

Key Developments in Middle-East and Africa Syngas Market Industry

- [Month, Year]: Partnership announced between [Company A] and [Company B] for the development of a new syngas technology.

- [Month, Year]: [Company X] acquires [Company Y], expanding its presence in the syngas market.

- [Month, Year]: Significant investment in R&D for carbon capture and utilization technologies by [Company Z].

- [Month, Year]: Government of [Country A] launches initiative to promote syngas as a clean energy source.

Strategic Middle-East and Africa Syngas Market Market Forecast

This section summarizes the growth catalysts, emphasizing future opportunities and market potential. The analysis considers the convergence of technological advancements, favorable policy environments, and growing demand for sustainable energy solutions. The report projects strong growth for the syngas market in the Middle East and Africa over the forecast period (2025-2033), driven by several factors discussed throughout the report. The potential for further market expansion through technological advancements and strategic partnerships is also highlighted.

Middle-East and Africa Syngas Market Segmentation

-

1. Feedstock

- 1.1. Coal

- 1.2. Natural Gas

- 1.3. Petroleum

- 1.4. Pet-coke

- 1.5. Biomass

-

2. Technology

- 2.1. Steam Reforming

- 2.2. Partial Oxidation

- 2.3. Auto-thermal Reforming

- 2.4. Combined or Two-step Reforming

- 2.5. Biomass Gasification

-

3. Gasifier Type

- 3.1. Fixed Bed

- 3.2. Entrained Flow

- 3.3. Fluidized Bed

-

4. Application

- 4.1. Power Generation

-

4.2. Chemicals

- 4.2.1. Methanol

- 4.2.2. Ammonia

- 4.2.3. Oxo Chemicals

- 4.2.4. n-Butanol

- 4.2.5. Hydrogen

- 4.2.6. Dimethyl Ether

- 4.3. Liquid Fuels

- 4.4. Gaseous Fuels

-

5. Geography

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle-East and Africa

Middle-East and Africa Syngas Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Rest of Middle East and Africa

Middle-East and Africa Syngas Market Regional Market Share

Geographic Coverage of Middle-East and Africa Syngas Market

Middle-East and Africa Syngas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Electricity; Growing Chemical Industry

- 3.3. Market Restrains

- 3.3.1. ; High Capital Investment and Funding

- 3.4. Market Trends

- 3.4.1. Increasing Usage in Power Generation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 5.1.1. Coal

- 5.1.2. Natural Gas

- 5.1.3. Petroleum

- 5.1.4. Pet-coke

- 5.1.5. Biomass

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Steam Reforming

- 5.2.2. Partial Oxidation

- 5.2.3. Auto-thermal Reforming

- 5.2.4. Combined or Two-step Reforming

- 5.2.5. Biomass Gasification

- 5.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 5.3.1. Fixed Bed

- 5.3.2. Entrained Flow

- 5.3.3. Fluidized Bed

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Power Generation

- 5.4.2. Chemicals

- 5.4.2.1. Methanol

- 5.4.2.2. Ammonia

- 5.4.2.3. Oxo Chemicals

- 5.4.2.4. n-Butanol

- 5.4.2.5. Hydrogen

- 5.4.2.6. Dimethyl Ether

- 5.4.3. Liquid Fuels

- 5.4.4. Gaseous Fuels

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Saudi Arabia

- 5.5.2. South Africa

- 5.5.3. Rest of Middle-East and Africa

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.6.2. South Africa

- 5.6.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 6. Saudi Arabia Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Feedstock

- 6.1.1. Coal

- 6.1.2. Natural Gas

- 6.1.3. Petroleum

- 6.1.4. Pet-coke

- 6.1.5. Biomass

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Steam Reforming

- 6.2.2. Partial Oxidation

- 6.2.3. Auto-thermal Reforming

- 6.2.4. Combined or Two-step Reforming

- 6.2.5. Biomass Gasification

- 6.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 6.3.1. Fixed Bed

- 6.3.2. Entrained Flow

- 6.3.3. Fluidized Bed

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Power Generation

- 6.4.2. Chemicals

- 6.4.2.1. Methanol

- 6.4.2.2. Ammonia

- 6.4.2.3. Oxo Chemicals

- 6.4.2.4. n-Butanol

- 6.4.2.5. Hydrogen

- 6.4.2.6. Dimethyl Ether

- 6.4.3. Liquid Fuels

- 6.4.4. Gaseous Fuels

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Saudi Arabia

- 6.5.2. South Africa

- 6.5.3. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Feedstock

- 7. South Africa Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Feedstock

- 7.1.1. Coal

- 7.1.2. Natural Gas

- 7.1.3. Petroleum

- 7.1.4. Pet-coke

- 7.1.5. Biomass

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Steam Reforming

- 7.2.2. Partial Oxidation

- 7.2.3. Auto-thermal Reforming

- 7.2.4. Combined or Two-step Reforming

- 7.2.5. Biomass Gasification

- 7.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 7.3.1. Fixed Bed

- 7.3.2. Entrained Flow

- 7.3.3. Fluidized Bed

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Power Generation

- 7.4.2. Chemicals

- 7.4.2.1. Methanol

- 7.4.2.2. Ammonia

- 7.4.2.3. Oxo Chemicals

- 7.4.2.4. n-Butanol

- 7.4.2.5. Hydrogen

- 7.4.2.6. Dimethyl Ether

- 7.4.3. Liquid Fuels

- 7.4.4. Gaseous Fuels

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Saudi Arabia

- 7.5.2. South Africa

- 7.5.3. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Feedstock

- 8. Rest of Middle East and Africa Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Feedstock

- 8.1.1. Coal

- 8.1.2. Natural Gas

- 8.1.3. Petroleum

- 8.1.4. Pet-coke

- 8.1.5. Biomass

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Steam Reforming

- 8.2.2. Partial Oxidation

- 8.2.3. Auto-thermal Reforming

- 8.2.4. Combined or Two-step Reforming

- 8.2.5. Biomass Gasification

- 8.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 8.3.1. Fixed Bed

- 8.3.2. Entrained Flow

- 8.3.3. Fluidized Bed

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Power Generation

- 8.4.2. Chemicals

- 8.4.2.1. Methanol

- 8.4.2.2. Ammonia

- 8.4.2.3. Oxo Chemicals

- 8.4.2.4. n-Butanol

- 8.4.2.5. Hydrogen

- 8.4.2.6. Dimethyl Ether

- 8.4.3. Liquid Fuels

- 8.4.4. Gaseous Fuels

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Saudi Arabia

- 8.5.2. South Africa

- 8.5.3. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Feedstock

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 TechnipFMC PLC*List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 General Electric

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Air Products and Chemicals Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Royal Dutch Shell plc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 KBR Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 BASF SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Linde plc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Air Liquide

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 BP p l c

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 SABIC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 TechnipFMC PLC*List Not Exhaustive

List of Figures

- Figure 1: Middle-East and Africa Syngas Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Syngas Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 2: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 3: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 6: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 7: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 11: Middle-East and Africa Syngas Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 13: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 14: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 15: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 16: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 17: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 18: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 19: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Middle-East and Africa Syngas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 26: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 27: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 28: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 29: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 30: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 31: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 33: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 34: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 35: Middle-East and Africa Syngas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 38: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 39: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 40: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 41: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 42: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 43: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 44: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 45: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: Middle-East and Africa Syngas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Syngas Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Middle-East and Africa Syngas Market?

Key companies in the market include TechnipFMC PLC*List Not Exhaustive, General Electric, Air Products and Chemicals Inc, Royal Dutch Shell plc, KBR Inc, BASF SE, Linde plc, Air Liquide, BP p l c, SABIC.

3. What are the main segments of the Middle-East and Africa Syngas Market?

The market segments include Feedstock, Technology, Gasifier Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 258.1 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Electricity; Growing Chemical Industry.

6. What are the notable trends driving market growth?

Increasing Usage in Power Generation Industry.

7. Are there any restraints impacting market growth?

; High Capital Investment and Funding.

8. Can you provide examples of recent developments in the market?

Partnerships between companies for syngas technology development

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Syngas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Syngas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Syngas Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Syngas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence