Key Insights

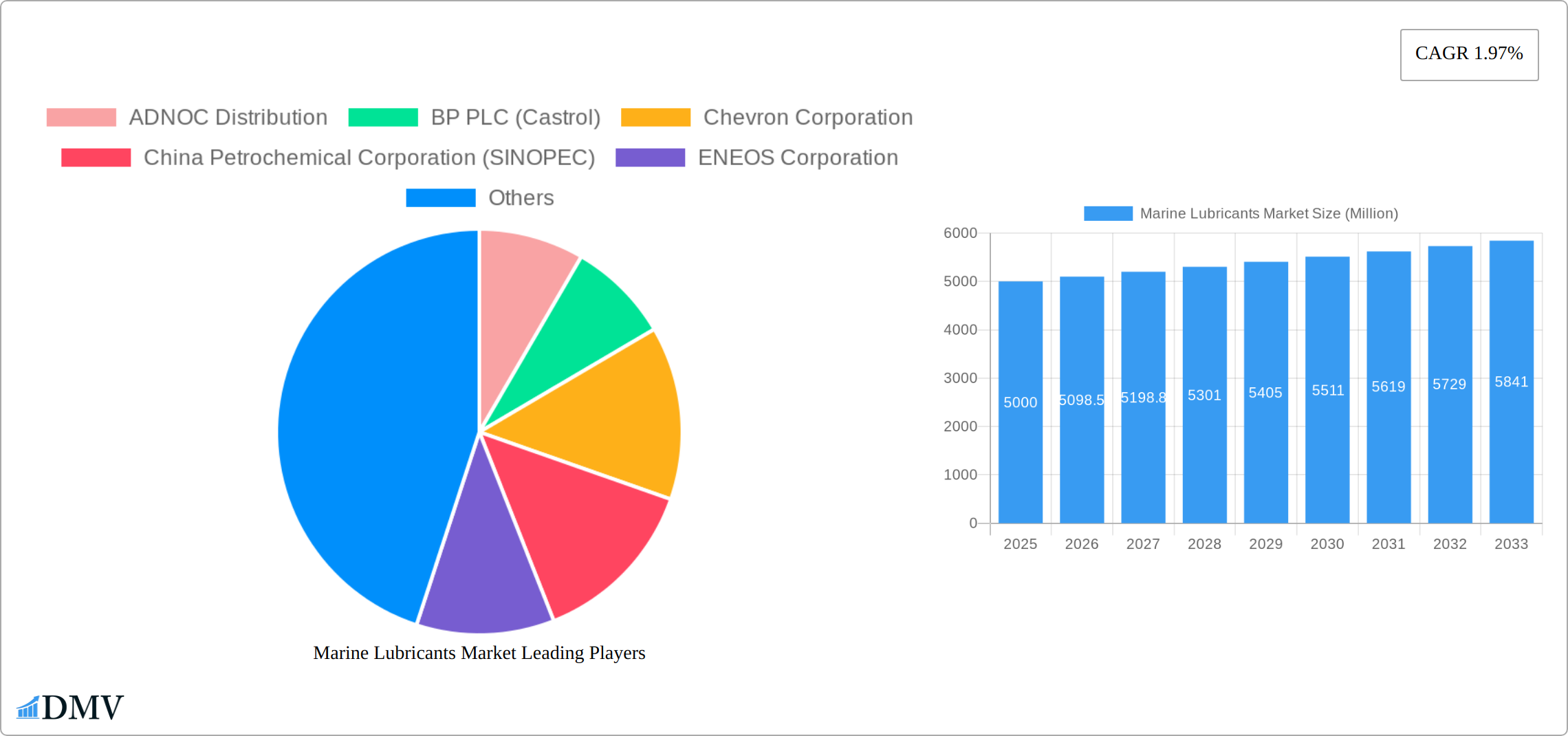

The global marine lubricants market, valued at approximately $6.2 billion in 2025, is poised for steady expansion. This growth is primarily attributed to the surge in global maritime trade and the implementation of stringent environmental regulations within the shipping industry. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 1.5%. Key growth drivers include the increasing demand for fuel-efficient lubricants that reduce emissions and adhere to International Maritime Organization (IMO) standards for sulfur content and greenhouse gas emissions. The adoption of advanced lubricants enhancing engine performance and extending equipment life also fuels market growth. Leading companies are investing in R&D to develop innovative solutions for the evolving maritime sector. Market segmentation likely includes various lubricant types and vessel categories, each influenced by vessel size and operational intensity.

Marine Lubricants Market Market Size (In Billion)

Despite the positive outlook, the marine lubricants market encounters challenges. Volatile crude oil prices directly affect production costs and lubricant pricing. Geopolitical instability and trade uncertainties can disrupt supply chains. The growing adoption of alternative fuels such as LNG and hydrogen in shipping presents both opportunities and long-term challenges for marine lubricants. As the industry shifts towards greener fuels, lubricant demand will adapt, necessitating portfolio adjustments and technological investments from manufacturers. The forecast period anticipates continued, moderate expansion driven by sustained global trade and ongoing technological advancements.

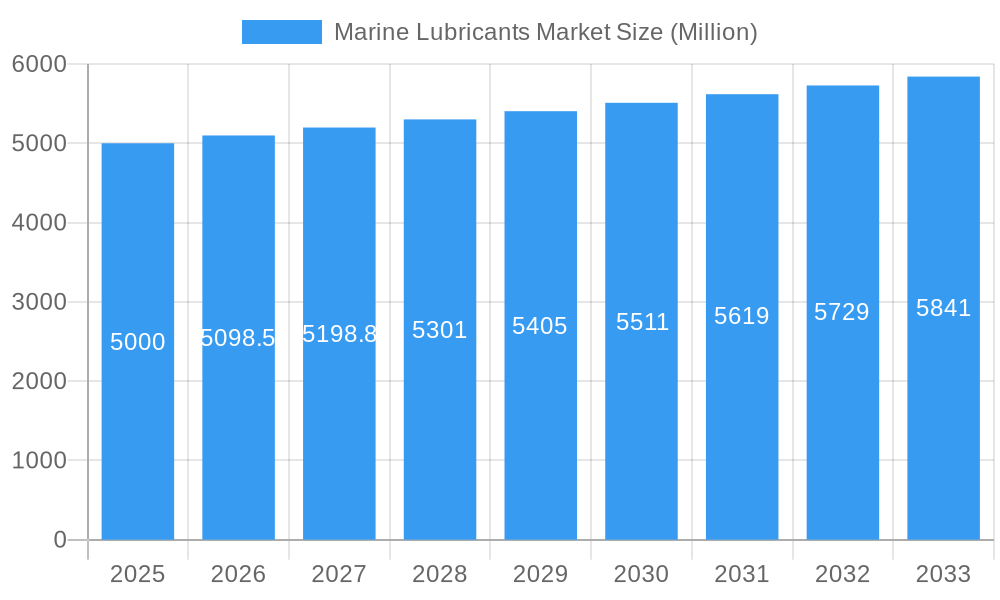

Marine Lubricants Market Company Market Share

Marine Lubricants Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the global Marine Lubricants Market, offering valuable insights for stakeholders seeking to understand market dynamics, future trends, and strategic opportunities. The report covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The market size is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This comprehensive study incorporates detailed analysis of leading players such as ADNOC Distribution, BP PLC (Castrol), Chevron Corporation, China Petrochemical Corporation (SINOPEC), ENEOS Corporation, Exxon Mobil Corporation, FUCHS, Gazprom Neft PJSC, Gulf Oil International Ltd, Idemitsu Kosan Co Ltd, Indian Oil Corporation Ltd, LUKOIL, Shell PLC, and Total Energies SE.

Marine Lubricants Market Composition & Trends

The global marine lubricants market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller regional players contributes to increased competition. Innovation is a key driver, fueled by the need for lubricants compatible with evolving fuel types (LNG, methanol) and stricter environmental regulations. The regulatory landscape is continuously evolving, with international bodies like the IMO setting emission standards that directly impact lubricant formulations. Substitute products are limited, primarily focusing on bio-based alternatives which are gradually gaining traction. End-users primarily comprise shipping companies, shipyards, and port facilities, with varying needs depending on vessel type and operational requirements. Significant M&A activity has been observed in the base oil production sector, driven by the need to secure supply chains and expand production capacity. Market share distribution amongst the top 5 players is estimated to be around xx%, with M&A deal values totaling approximately xx Million in the last five years.

- Market Concentration: Moderately concentrated with significant regional players.

- Innovation Catalysts: Stringent environmental regulations and adoption of cleaner fuels.

- Regulatory Landscape: IMO regulations and regional emission standards drive innovation.

- Substitute Products: Bio-based lubricants are emerging as a viable alternative.

- End-User Profile: Shipping companies, shipyards, port facilities.

- M&A Activity: Significant activity in base oil production, focused on supply chain consolidation.

Marine Lubricants Market Industry Evolution

The marine lubricants market has experienced significant growth over the historical period (2019-2024), primarily driven by increasing global maritime trade and the expansion of the shipping fleet. Technological advancements, particularly in lubricant formulations and additive packages, are enhancing performance and efficiency. The shift towards cleaner fuels (LNG, methanol) has created demand for specialized lubricants that meet the specific requirements of these new technologies. Consumer demand is also shifting towards sustainable and environmentally friendly products, placing pressure on manufacturers to develop bio-based and low-emission solutions. The market is projected to maintain a robust growth trajectory throughout the forecast period (2025-2033), driven by continued growth in global trade, technological advancements, and the increasing adoption of environmentally friendly solutions. Market growth rates are projected to average xx% annually during the forecast period, with the highest growth observed in the segment of xx. Adoption of new technologies such as xx is expected to increase by xx% by 2033.

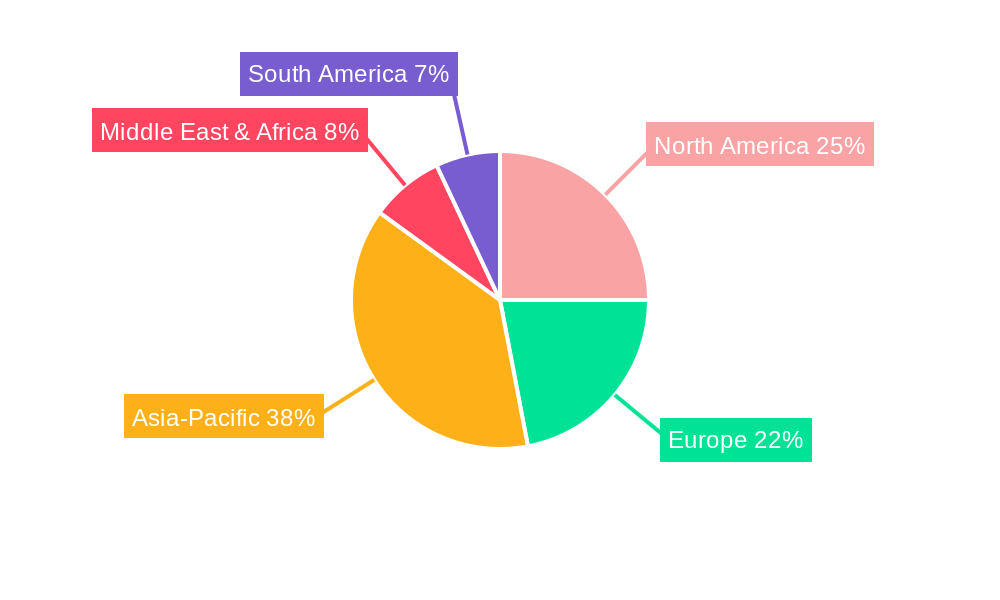

Leading Regions, Countries, or Segments in Marine Lubricants Market

Dominant Region: Asia-Pacific, driven by strong economic growth, substantial shipping activity, and significant investment in port infrastructure.

Key Drivers (Asia-Pacific):

- High volume of maritime trade and growing fleet size.

- Significant investments in port infrastructure development.

- Government initiatives promoting sustainable shipping practices.

In-depth Analysis: The Asia-Pacific region's dominance stems from its strategic location as a major hub for global maritime trade. The region's rapid economic growth fuels demand for marine transportation services, driving significant demand for marine lubricants. Furthermore, considerable investments in port infrastructure and the expansion of shipping fleets further contribute to the region's market leadership. Stringent environmental regulations implemented by governments are also prompting the adoption of eco-friendly lubricants, contributing to market growth.

Marine Lubricants Market Product Innovations

Recent innovations in marine lubricants are driven by the shift towards cleaner fuels and stricter environmental regulations. Formulations optimized for alternative fuels like LNG, methanol, and ammonia are at the forefront, addressing the unique challenges these fuels present to engine performance and longevity. These advanced lubricants are engineered to minimize emissions, reduce wear and tear, and enhance fuel efficiency. The incorporation of bio-based components represents a significant step towards sustainability, offering a compelling alternative to traditional petroleum-based products. These bio-lubricants often demonstrate superior performance characteristics, including improved oxidation stability, reduced friction coefficients, and extended drain intervals, leading to lower maintenance costs and a smaller environmental footprint. Key selling propositions now emphasize not only cost savings but also a commitment to reduced greenhouse gas emissions and improved overall operational efficiency for shipping companies. Furthermore, research and development continues to focus on extending the lifespan of lubricants and enhancing their ability to withstand extreme pressures and temperatures found in modern marine engines.

Propelling Factors for Marine Lubricants Market Growth

The marine lubricants market is experiencing robust growth fueled by several key factors. The ongoing expansion of global maritime trade and the increasing size of the global fleet are primary drivers of increased lubricant demand. Stringent environmental regulations, particularly those implemented by the International Maritime Organization (IMO) to reduce sulfur oxide (SOx) and nitrogen oxide (NOx) emissions, are forcing a significant shift towards low-sulfur and environmentally friendly lubricants. This regulatory pressure is further accelerated by growing awareness of the environmental impact of shipping and the need for decarbonization. Concurrently, the economic imperative to maximize fuel efficiency and minimize operational expenses is prompting widespread adoption of advanced lubricant technologies that deliver superior performance and extended service life. Technological advancements in lubricant formulations are directly responding to these needs, offering improved fuel economy, reduced maintenance, and extended equipment lifespan, making them increasingly attractive to shipping companies worldwide.

Obstacles in the Marine Lubricants Market

Despite the growth potential, the marine lubricants market faces several challenges. The ever-evolving landscape of international and regional regulations requires manufacturers to invest heavily in research, development, and compliance, adding significant costs. Furthermore, volatility in the supply chain, particularly concerning base oil sourcing and raw material availability, poses a significant risk to production, leading to price fluctuations and potential shortages. Intense competition among established players and the emergence of new bio-lubricant producers create downward pressure on pricing, impacting profitability. Geopolitical instability and trade restrictions can further complicate supply chains and exacerbate these challenges. These combined factors can lead to decreased market profitability in specific segments and necessitate strategic agility from manufacturers to navigate these complexities successfully.

Future Opportunities in Marine Lubricants Market

Growing adoption of LNG and methanol-fueled vessels creates significant opportunities for specialized lubricant manufacturers. The expanding market for sustainable and bio-based lubricants represents substantial growth potential. Technological innovations focused on improving fuel efficiency and reducing emissions will shape future market demand. Emerging markets in developing economies also present opportunities for market expansion.

Major Players in the Marine Lubricants Market Ecosystem

Key Developments in Marine Lubricants Market Industry

- April 2024: AD Ports Group partners with ADNOC Distribution to expand the global distribution network for marine lubricants, enhancing accessibility for shipping companies across diverse regions.

- March 2023: Castrol launches Castrol Cyltech 40 XDC marine cylinder oil, specifically formulated for LNG and methanol-fueled vessels, showcasing the industry's focus on alternative fuel compatibility.

- February 2023: Luberef expands its base oil plant in Yanbu' al Bahr, Saudi Arabia, significantly increasing its annual production capacity by 230,000 metric tons, bolstering the supply of a crucial lubricant component.

- [Add another recent development here with date and brief description]

Strategic Marine Lubricants Market Forecast

The marine lubricants market is poised for continued growth, driven by the expansion of global maritime trade, the adoption of cleaner fuels, and technological advancements. The increasing focus on sustainability and reduced emissions will fuel demand for bio-based and environmentally friendly lubricants. New market opportunities are emerging in developing economies and specialized segments, offering considerable potential for market expansion and profitability. The long-term outlook remains positive, anticipating a sustained period of market growth driven by these factors.

Marine Lubricants Market Segmentation

-

1. Lubricant Type

- 1.1. System Oil

- 1.2. Marine Cylinder Lubricant

- 1.3. Trunk Piston Engine Oil

- 1.4. Other Lubricant Types

-

2. Ship Type

- 2.1. Bulker

- 2.2. Tanker

- 2.3. Container

- 2.4. Other Ship Types

Marine Lubricants Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. NORDIC Countries

- 3.7. Turkey

- 3.8. Russia

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Qatar

- 5.3. United Arab Emirates

- 5.4. Nigeria

- 5.5. Egypt

- 5.6. South Africa

- 5.7. Rest of Middle East and Africa

Marine Lubricants Market Regional Market Share

Geographic Coverage of Marine Lubricants Market

Marine Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Marine Transport; Growing Shipbuilding Activities; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Marine Transport; Growing Shipbuilding Activities; Other Drivers

- 3.4. Market Trends

- 3.4.1. Marine Cylinder Lubricant Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 5.1.1. System Oil

- 5.1.2. Marine Cylinder Lubricant

- 5.1.3. Trunk Piston Engine Oil

- 5.1.4. Other Lubricant Types

- 5.2. Market Analysis, Insights and Forecast - by Ship Type

- 5.2.1. Bulker

- 5.2.2. Tanker

- 5.2.3. Container

- 5.2.4. Other Ship Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 6. Asia Pacific Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 6.1.1. System Oil

- 6.1.2. Marine Cylinder Lubricant

- 6.1.3. Trunk Piston Engine Oil

- 6.1.4. Other Lubricant Types

- 6.2. Market Analysis, Insights and Forecast - by Ship Type

- 6.2.1. Bulker

- 6.2.2. Tanker

- 6.2.3. Container

- 6.2.4. Other Ship Types

- 6.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 7. North America Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 7.1.1. System Oil

- 7.1.2. Marine Cylinder Lubricant

- 7.1.3. Trunk Piston Engine Oil

- 7.1.4. Other Lubricant Types

- 7.2. Market Analysis, Insights and Forecast - by Ship Type

- 7.2.1. Bulker

- 7.2.2. Tanker

- 7.2.3. Container

- 7.2.4. Other Ship Types

- 7.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 8. Europe Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 8.1.1. System Oil

- 8.1.2. Marine Cylinder Lubricant

- 8.1.3. Trunk Piston Engine Oil

- 8.1.4. Other Lubricant Types

- 8.2. Market Analysis, Insights and Forecast - by Ship Type

- 8.2.1. Bulker

- 8.2.2. Tanker

- 8.2.3. Container

- 8.2.4. Other Ship Types

- 8.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 9. South America Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 9.1.1. System Oil

- 9.1.2. Marine Cylinder Lubricant

- 9.1.3. Trunk Piston Engine Oil

- 9.1.4. Other Lubricant Types

- 9.2. Market Analysis, Insights and Forecast - by Ship Type

- 9.2.1. Bulker

- 9.2.2. Tanker

- 9.2.3. Container

- 9.2.4. Other Ship Types

- 9.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 10. Middle East and Africa Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 10.1.1. System Oil

- 10.1.2. Marine Cylinder Lubricant

- 10.1.3. Trunk Piston Engine Oil

- 10.1.4. Other Lubricant Types

- 10.2. Market Analysis, Insights and Forecast - by Ship Type

- 10.2.1. Bulker

- 10.2.2. Tanker

- 10.2.3. Container

- 10.2.4. Other Ship Types

- 10.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ADNOC Distribution

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BP PLC (Castrol)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chevron Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Petrochemical Corporation (SINOPEC)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ENEOS Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Exxon Mobil Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FUCHS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gazprom Neft PJSC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gulf Oil International Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Idemitsu Kosan Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Indian Oil Corporation Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LUKOIL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shell PLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Total Energies SE*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 ADNOC Distribution

List of Figures

- Figure 1: Global Marine Lubricants Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Marine Lubricants Market Revenue (billion), by Lubricant Type 2025 & 2033

- Figure 3: Asia Pacific Marine Lubricants Market Revenue Share (%), by Lubricant Type 2025 & 2033

- Figure 4: Asia Pacific Marine Lubricants Market Revenue (billion), by Ship Type 2025 & 2033

- Figure 5: Asia Pacific Marine Lubricants Market Revenue Share (%), by Ship Type 2025 & 2033

- Figure 6: Asia Pacific Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Marine Lubricants Market Revenue (billion), by Lubricant Type 2025 & 2033

- Figure 9: North America Marine Lubricants Market Revenue Share (%), by Lubricant Type 2025 & 2033

- Figure 10: North America Marine Lubricants Market Revenue (billion), by Ship Type 2025 & 2033

- Figure 11: North America Marine Lubricants Market Revenue Share (%), by Ship Type 2025 & 2033

- Figure 12: North America Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Marine Lubricants Market Revenue (billion), by Lubricant Type 2025 & 2033

- Figure 15: Europe Marine Lubricants Market Revenue Share (%), by Lubricant Type 2025 & 2033

- Figure 16: Europe Marine Lubricants Market Revenue (billion), by Ship Type 2025 & 2033

- Figure 17: Europe Marine Lubricants Market Revenue Share (%), by Ship Type 2025 & 2033

- Figure 18: Europe Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Marine Lubricants Market Revenue (billion), by Lubricant Type 2025 & 2033

- Figure 21: South America Marine Lubricants Market Revenue Share (%), by Lubricant Type 2025 & 2033

- Figure 22: South America Marine Lubricants Market Revenue (billion), by Ship Type 2025 & 2033

- Figure 23: South America Marine Lubricants Market Revenue Share (%), by Ship Type 2025 & 2033

- Figure 24: South America Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Marine Lubricants Market Revenue (billion), by Lubricant Type 2025 & 2033

- Figure 27: Middle East and Africa Marine Lubricants Market Revenue Share (%), by Lubricant Type 2025 & 2033

- Figure 28: Middle East and Africa Marine Lubricants Market Revenue (billion), by Ship Type 2025 & 2033

- Figure 29: Middle East and Africa Marine Lubricants Market Revenue Share (%), by Ship Type 2025 & 2033

- Figure 30: Middle East and Africa Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Marine Lubricants Market Revenue billion Forecast, by Lubricant Type 2020 & 2033

- Table 2: Global Marine Lubricants Market Revenue billion Forecast, by Ship Type 2020 & 2033

- Table 3: Global Marine Lubricants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Marine Lubricants Market Revenue billion Forecast, by Lubricant Type 2020 & 2033

- Table 5: Global Marine Lubricants Market Revenue billion Forecast, by Ship Type 2020 & 2033

- Table 6: Global Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Malaysia Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Thailand Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Vietnam Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Marine Lubricants Market Revenue billion Forecast, by Lubricant Type 2020 & 2033

- Table 17: Global Marine Lubricants Market Revenue billion Forecast, by Ship Type 2020 & 2033

- Table 18: Global Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United States Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Marine Lubricants Market Revenue billion Forecast, by Lubricant Type 2020 & 2033

- Table 23: Global Marine Lubricants Market Revenue billion Forecast, by Ship Type 2020 & 2033

- Table 24: Global Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Germany Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: France Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Italy Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: NORDIC Countries Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Turkey Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Marine Lubricants Market Revenue billion Forecast, by Lubricant Type 2020 & 2033

- Table 35: Global Marine Lubricants Market Revenue billion Forecast, by Ship Type 2020 & 2033

- Table 36: Global Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Colombia Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of South America Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Global Marine Lubricants Market Revenue billion Forecast, by Lubricant Type 2020 & 2033

- Table 42: Global Marine Lubricants Market Revenue billion Forecast, by Ship Type 2020 & 2033

- Table 43: Global Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Saudi Arabia Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Qatar Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: United Arab Emirates Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Nigeria Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Egypt Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Africa Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Rest of Middle East and Africa Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Marine Lubricants Market?

The projected CAGR is approximately 1.5%.

2. Which companies are prominent players in the Marine Lubricants Market?

Key companies in the market include ADNOC Distribution, BP PLC (Castrol), Chevron Corporation, China Petrochemical Corporation (SINOPEC), ENEOS Corporation, Exxon Mobil Corporation, FUCHS, Gazprom Neft PJSC, Gulf Oil International Ltd, Idemitsu Kosan Co Ltd, Indian Oil Corporation Ltd, LUKOIL, Shell PLC, Total Energies SE*List Not Exhaustive.

3. What are the main segments of the Marine Lubricants Market?

The market segments include Lubricant Type, Ship Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Marine Transport; Growing Shipbuilding Activities; Other Drivers.

6. What are the notable trends driving market growth?

Marine Cylinder Lubricant Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Rising Demand for Marine Transport; Growing Shipbuilding Activities; Other Drivers.

8. Can you provide examples of recent developments in the market?

April 2024: AD Ports Group, a key player in global trade, logistics, and industry, revealed that its Ports Cluster was broadening its scope to include the worldwide distribution of marine lubricants. This move follows a strategic partnership formed with ADNOC Distribution, the foremost manufacturer of marine and automotive lubricants in the United Arab Emirates. As per the agreement, Ports Cluster will utilize its established connections and state-of-the-art infrastructure to distribute globally recognized lubricants to customers in the United Arab Emirates. It plans to widen this distribution network globally.March 2023: Castrol unveiled its latest offering: the marine cylinder oil, Castrol Cyltech 40 XDC (eXtra Deposit Control). This new oil is designed for LNG and methanol-fueled vessels but is equally compatible with ships utilizing traditional marine fuels. The introduction of Castrol Cyltech 40 XDC underscores Castrol's dedication to aiding the marine sector's shift toward cleaner fuels and advanced engine technologies while guaranteeing optimal engine performance and reliability.February 2023: Luberef, a subsidiary of Saudi Aramco, revealed plans to expand its base oil plant in Yanbu' al Bahr, Saudi Arabia, boosting its capacity by 230,000 metric tons annually. The project will upgrade the facility, allowing it to produce API Group III base stocks. The expansion will elevate the Yanbu plant to a size nearly matching that of the Pearl gas-to-liquids joint venture, the largest base oil plant in the Middle East.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Marine Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Marine Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Marine Lubricants Market?

To stay informed about further developments, trends, and reports in the Marine Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence