Key Insights

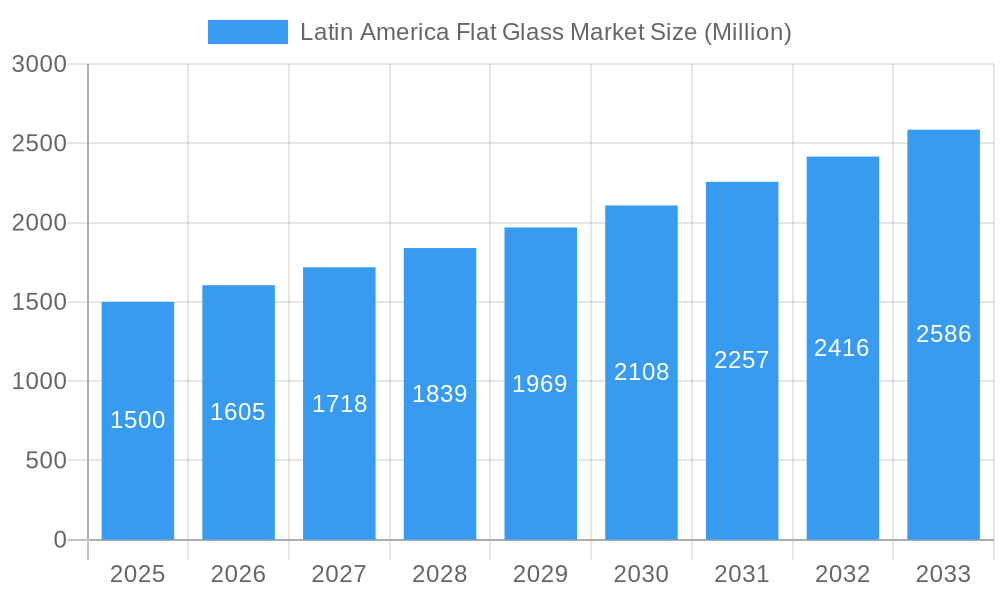

The Latin American flat glass market, currently valued at $155.58 billion in the base year 2024, is poised for substantial growth with a projected Compound Annual Growth Rate (CAGR) of 8.52% from 2025 to 2033. This expansion is propelled by key industry drivers. The rapidly developing construction sector across major Latin American economies, including Brazil, Mexico, and Argentina, is a primary catalyst. This surge in construction necessitates significant volumes of annealed, coated, and reflective glass for residential, commercial, and infrastructure projects. Concurrently, the automotive industry's expansion, particularly in Mexico, is driving robust demand for automotive glass. The increasing adoption of solar energy solutions throughout the region further contributes to market growth, fueling demand for specialized solar glass. Challenges to sustained market expansion include economic volatility in certain Latin American nations and potential supply chain disruptions. The market is segmented by product type, encompassing annealed glass (including tinted glass), coated glass, reflective glass, processed glass, and mirrors, and by end-user industry, including building and construction, automotive, solar glass, and other sectors. Leading players such as Saint-Gobain, Vitro, Guardian Glass LLC, AGC Inc, Tempermax, and SCHOTT AG are actively engaged in this dynamic market, leveraging their technological expertise and market presence to capitalize on emerging opportunities. The future trajectory of this market will be shaped by sustained regional economic growth, government infrastructure investments, and advancements in glass production and application technologies.

Latin America Flat Glass Market Market Size (In Billion)

The competitive environment is characterized by the presence of both large multinational corporations and established regional players. These companies are strategically prioritizing product innovation, expanding manufacturing capabilities, and forming strategic alliances to address escalating demand. A significant trend is the increasing adoption of energy-efficient glass solutions, driven by growing environmental consciousness and concerns about energy consumption. Companies are intensifying their investment in research and development to engineer innovative glass products that meet these evolving requirements. Future growth is anticipated to be influenced by supportive government policies for sustainable building practices, technological breakthroughs enhancing glass properties, and fluctuations in raw material prices. Brazil, Mexico, and Argentina are expected to maintain their positions as dominant markets within Latin America, owing to their substantial economies and ongoing construction activities.

Latin America Flat Glass Market Company Market Share

Latin America Flat Glass Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Latin America flat glass market, encompassing market size, trends, competitive landscape, and future forecasts from 2019 to 2033. The study meticulously examines key segments, including annealed glass, coated glass, reflective glass, processed glass, and mirrors, across diverse end-user industries such as building and construction, automotive, and solar energy. The report utilizes data from 2019-2024 (historical period), with 2025 as the base year and forecasts extending to 2033. Expect valuable insights into market dynamics, major players like Saint-Gobain, Vitro, GUARDIAN GLASS LLC, AGC Inc, TEMPERMAX, and SCHOTT AG (list not exhaustive), and emerging opportunities for stakeholders.

Latin America Flat Glass Market Composition & Trends

The Latin American flat glass market exhibits a moderately concentrated structure, with a few major players commanding significant market share. Saint-Gobain and Vitro, for instance, hold a combined xx% share in 2025 (estimated year), while other key players such as Guardian Glass and AGC Inc. contribute substantially. Innovation in the region is driven by the increasing demand for energy-efficient glass and advanced architectural solutions. Regulatory landscapes vary across countries, influencing product standards and import/export policies. Substitute products, such as polymeric materials, present a niche competitive threat. End-user profiles reveal a strong dependence on the building and construction sector, but the automotive and solar industries are emerging as significant growth drivers. Recent M&A activities, such as Guardian Glass’ acquisition of Vortex Glass in January 2023, indicate a consolidating market. The total value of M&A deals in the past five years is estimated at $xx Million.

- Market Share Distribution (2025): Saint-Gobain (xx%), Vitro (xx%), Guardian Glass (xx%), AGC Inc. (xx%), Others (xx%)

- Major M&A Deals (2019-2024): Guardian Glass acquisition of Vortex Glass ($xx Million), other transactions totaling $xx Million.

- Innovation Catalysts: Demand for energy efficiency, architectural advancements, and government support for green building initiatives.

- Regulatory Landscape: Variable across countries, impacting product standards and import/export.

Latin America Flat Glass Market Industry Evolution

The Latin American flat glass market has witnessed significant evolution, driven by a confluence of economic development, technological innovation, and growing environmental consciousness. During the historical period (2019-2024), the market experienced a robust Compound Annual Growth Rate (CAGR) of **[Insert Historical CAGR Here]%**. This growth was predominantly fueled by a booming construction sector across key economies such as Brazil, Mexico, and Colombia, where expanding urban centers and infrastructure projects created substantial demand for flat glass products.

Technological advancements have been a pivotal force, particularly in the development and adoption of energy-efficient coatings and sophisticated processing techniques. These innovations are not only enhancing the performance of flat glass but also shaping market dynamics by enabling new applications and improving sustainability credentials. In response to increasing consumer awareness and regulatory pressures, there's a discernible shift towards sustainable and high-performance glass solutions. This trend is directly fueling growth in specialized segments like coated, reflective, and low-emissivity (low-E) glass. The adoption rates for energy-efficient glass are on an upward trajectory, with penetration estimated to reach **[Insert 2025 Penetration Rate Here]%** by 2025.

Looking ahead, the forecast period (2025-2033) projects a sustained CAGR of **[Insert Forecast CAGR Here]%**. This optimistic outlook is underpinned by ongoing infrastructure development initiatives across the region, the persistent trend of increasing urbanization, and supportive government policies that actively promote sustainable building practices. Furthermore, the growing automotive production in select Latin American countries is also contributing positively to the overall market demand for flat glass.

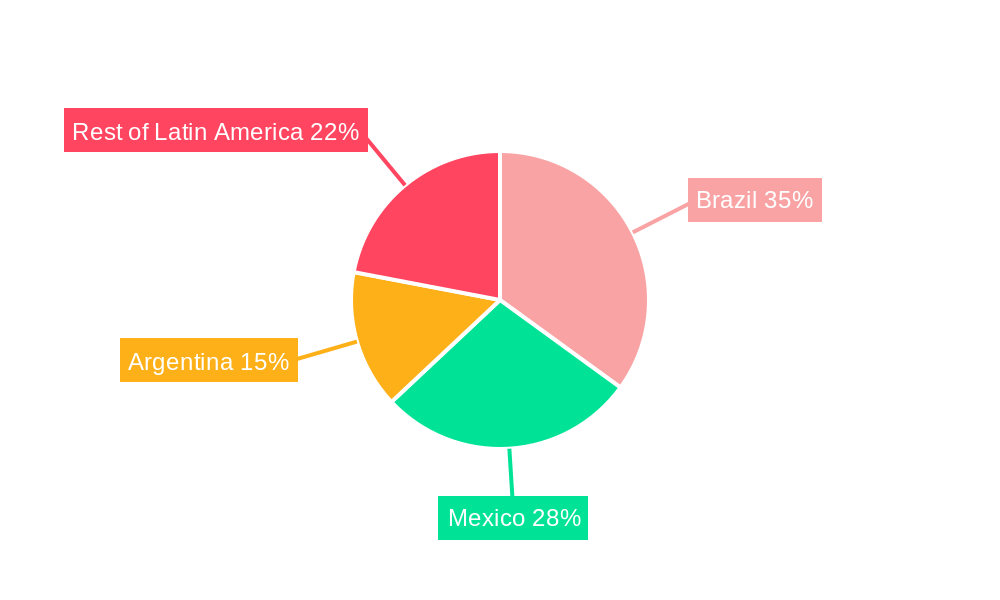

Leading Regions, Countries, or Segments in Latin America Flat Glass Market

Brazil and Mexico stand out as the dominant markets within the Latin America flat glass landscape, collectively commanding approximately **[Insert Market Share Here]%** of the total market volume. The Building and Construction end-user industry unequivocally remains the primary driver of demand, propelled by a continuous pipeline of large-scale infrastructure projects, significant investments in residential construction, and the development of commercial spaces.

Key Drivers for Brazil & Mexico:

- Extensive Infrastructure Investment: Transformative, large-scale government and private sector projects are creating sustained demand for a wide array of flat glass products.

- Accelerated Urbanization: The rapid growth of metropolitan areas necessitates a significant increase in both residential housing and commercial facilities, directly boosting flat glass consumption.

- Government Endorsement of Sustainable Building: Proactive government policies and incentives are actively encouraging the adoption of energy-efficient glass solutions, aligning with regional sustainability goals.

Dominant Product Type:

Currently, annealed glass, particularly its tinted variants, holds the largest market share due to its versatility and widespread application across diverse sectors including construction and automotive. However, the escalating demand for enhanced energy efficiency is acting as a powerful catalyst for the rapid growth of the coated and reflective glass segments. These advanced products offer superior thermal performance and glare reduction, meeting the evolving needs of modern construction and design.

In-depth Analysis:

Brazil's vast population and ongoing rapid urbanization present an immense and consistent demand for flat glass across a multitude of applications, from high-rise buildings to residential homes. Mexico, benefiting from its strategic proximity to the United States and substantial inbound investment in its burgeoning infrastructure, is experiencing a parallel surge in demand for both basic and specialized flat glass products.

Latin America Flat Glass Market Product Innovations

Recent innovations in the Latin American flat glass market include advancements in low-E coatings to enhance energy efficiency, self-cleaning glass technologies reducing maintenance costs, and the integration of smart features for improved functionality. These innovations focus on improving energy performance, durability, and aesthetics, offering unique selling propositions and capturing the growing preference for high-performance building materials.

Propelling Factors for Latin America Flat Glass Market Growth

The growth trajectory of the Latin American flat glass market is primarily propelled by the sustained and vigorous expansion of construction activities across the region's major economies. This surge in construction is a result of both significant residential development and ambitious infrastructure projects that are reshaping urban and rural landscapes. Complementing this construction boom, the overall economic growth experienced across Latin America, coupled with rising disposable incomes, is empowering consumers and businesses to invest in improved housing and modern commercial spaces that increasingly incorporate high-quality and aesthetically pleasing glass products.

Furthermore, government regulations that champion energy efficiency and advocate for sustainable building practices are playing a crucial role in stimulating market expansion. These regulations often create tangible incentives and mandates for the use of energy-efficient glass solutions, thereby driving demand for products that reduce energy consumption and contribute to a greener built environment. Technological advancements in manufacturing processes and product development are also contributing by offering more durable, versatile, and performant flat glass options.

Obstacles in the Latin America Flat Glass Market

Despite its robust growth, the Latin American flat glass market navigates a landscape fraught with several significant challenges. The inherent volatility of raw material prices, such as silica sand, soda ash, and limestone, poses a persistent threat, directly impacting production costs and influencing profit margins for manufacturers. Compounding these cost pressures are ongoing supply chain disruptions, a concern amplified by recent global events, which can complicate production schedules and delay delivery timelines, affecting market responsiveness.

The competitive environment is also intensifying. A market characterized by the presence of established global and regional players, alongside the dynamic entry of new participants, leads to considerable pricing pressures. This fierce competition necessitates continuous innovation and cost optimization strategies for market players. Moreover, navigating the increasingly stringent environmental regulations implemented in various Latin American countries adds another layer of complexity, often requiring substantial investments in compliance and potentially increasing operational expenditures. Fluctuations in currency exchange rates can also present challenges for businesses operating across different national economies within the region.

Future Opportunities in Latin America Flat Glass Market

Future opportunities lie in expanding into niche applications such as smart glass technology for buildings, increased penetration into the renewable energy sector (solar glass), and the development of specialized glass solutions for the automotive industry. The growing focus on sustainability presents opportunities for producers to capitalize on the demand for eco-friendly products by offering recycled glass content and energy-efficient glass solutions.

Major Players in the Latin America Flat Glass Market Ecosystem

- Saint-Gobain

- Vitro

- GUARDIAN GLASS LLC

- AGC Inc

- TEMPERMAX

- SCHOTT AG

- CRISEL

- CEFSA

- Vitrocsa

Key Developments in Latin America Flat Glass Market Industry

- January 2023: Guardian Glass acquired the assets of Vortex Glass, expanding its fabrication capabilities in the region. This significantly enhanced Guardian's market presence and manufacturing capacity.

- May 2022: Saint-Gobain achieved zero-carbon flat glass production, showcasing its commitment to sustainability and potentially attracting environmentally conscious customers. This initiative positions Saint-Gobain as a leader in sustainable manufacturing practices.

Strategic Latin America Flat Glass Market Forecast

The Latin American flat glass market is poised for sustained growth throughout the forecast period (2025-2033), driven by continued infrastructure development, urbanization, and the increasing adoption of energy-efficient building materials. Opportunities exist in leveraging technological advancements, expanding into new applications, and meeting the growing demand for sustainable glass solutions. The market's growth trajectory will be influenced by macroeconomic factors, government policies, and the competitive landscape. The projected market value for 2033 is estimated at $xx Million.

Latin America Flat Glass Market Segmentation

-

1. Product Type

- 1.1. Annealed Glass (Including Tinted Glass)

- 1.2. Coater Glass

- 1.3. Reflective Glass

- 1.4. Processed Glass

- 1.5. Mirrors

-

2. End-user Industry

- 2.1. Building and Construction

- 2.2. Automotive

- 2.3. Solar Glass

- 2.4. Other End-user Industries

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Mexico

- 3.4. Rest of Latin America

Latin America Flat Glass Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Mexico

- 4. Rest of Latin America

Latin America Flat Glass Market Regional Market Share

Geographic Coverage of Latin America Flat Glass Market

Latin America Flat Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction Activities in the Region; Growing Demand for Electronic Displays

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices; Other Restraints

- 3.4. Market Trends

- 3.4.1. Construction Industry to Drive the Demand for Flat Glass

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Flat Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Annealed Glass (Including Tinted Glass)

- 5.1.2. Coater Glass

- 5.1.3. Reflective Glass

- 5.1.4. Processed Glass

- 5.1.5. Mirrors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building and Construction

- 5.2.2. Automotive

- 5.2.3. Solar Glass

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Mexico

- 5.3.4. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Mexico

- 5.4.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil Latin America Flat Glass Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Annealed Glass (Including Tinted Glass)

- 6.1.2. Coater Glass

- 6.1.3. Reflective Glass

- 6.1.4. Processed Glass

- 6.1.5. Mirrors

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Building and Construction

- 6.2.2. Automotive

- 6.2.3. Solar Glass

- 6.2.4. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Mexico

- 6.3.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina Latin America Flat Glass Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Annealed Glass (Including Tinted Glass)

- 7.1.2. Coater Glass

- 7.1.3. Reflective Glass

- 7.1.4. Processed Glass

- 7.1.5. Mirrors

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Building and Construction

- 7.2.2. Automotive

- 7.2.3. Solar Glass

- 7.2.4. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Mexico

- 7.3.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico Latin America Flat Glass Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Annealed Glass (Including Tinted Glass)

- 8.1.2. Coater Glass

- 8.1.3. Reflective Glass

- 8.1.4. Processed Glass

- 8.1.5. Mirrors

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Building and Construction

- 8.2.2. Automotive

- 8.2.3. Solar Glass

- 8.2.4. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Mexico

- 8.3.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Latin America Latin America Flat Glass Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Annealed Glass (Including Tinted Glass)

- 9.1.2. Coater Glass

- 9.1.3. Reflective Glass

- 9.1.4. Processed Glass

- 9.1.5. Mirrors

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Building and Construction

- 9.2.2. Automotive

- 9.2.3. Solar Glass

- 9.2.4. Other End-user Industries

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Mexico

- 9.3.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Saint-Gobain

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vitro*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 GUARDIAN GLASS LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 AGC Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 TEMPERMAX

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SCHOTT AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Saint-Gobain

List of Figures

- Figure 1: Latin America Flat Glass Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Flat Glass Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Flat Glass Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Latin America Flat Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Latin America Flat Glass Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Latin America Flat Glass Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Latin America Flat Glass Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Latin America Flat Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Latin America Flat Glass Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Latin America Flat Glass Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Latin America Flat Glass Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Latin America Flat Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Latin America Flat Glass Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Latin America Flat Glass Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Latin America Flat Glass Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Latin America Flat Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Latin America Flat Glass Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Latin America Flat Glass Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Latin America Flat Glass Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Latin America Flat Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 19: Latin America Flat Glass Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin America Flat Glass Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Flat Glass Market?

The projected CAGR is approximately 8.52%.

2. Which companies are prominent players in the Latin America Flat Glass Market?

Key companies in the market include Saint-Gobain, Vitro*List Not Exhaustive, GUARDIAN GLASS LLC, AGC Inc, TEMPERMAX, SCHOTT AG.

3. What are the main segments of the Latin America Flat Glass Market?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 155.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction Activities in the Region; Growing Demand for Electronic Displays.

6. What are the notable trends driving market growth?

Construction Industry to Drive the Demand for Flat Glass.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices; Other Restraints.

8. Can you provide examples of recent developments in the market?

January 2023: Guardian Glass and Vortex Glass announced an agreement for Guardian to acquire the assets of Vortex, a Miami, Florida, fabrication business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Flat Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Flat Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Flat Glass Market?

To stay informed about further developments, trends, and reports in the Latin America Flat Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence