Key Insights

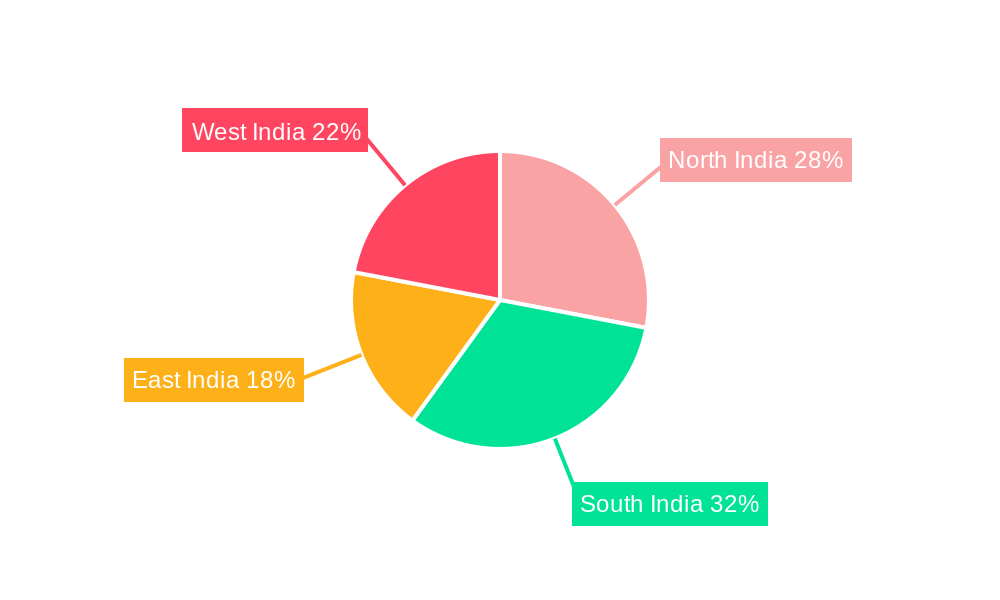

The Indian precipitated silica market, projected at $3.42 billion in 2025, is set for significant expansion with a Compound Annual Growth Rate (CAGR) of 5% between 2025 and 2033. This growth is propelled by escalating demand from key industries including agriculture, where it enhances soil and crop yield; cosmetics, for its thickening and mattifying properties in personal care; and automotive, for tire manufacturing. The electronics sector's adoption and other emerging applications further bolster market prospects. Leading players such as Solvay and Tata Chemicals Ltd, alongside domestic manufacturers, shape the competitive arena. Regional market dynamics vary across North, South, East, and West India, influenced by industrial concentration and infrastructure.

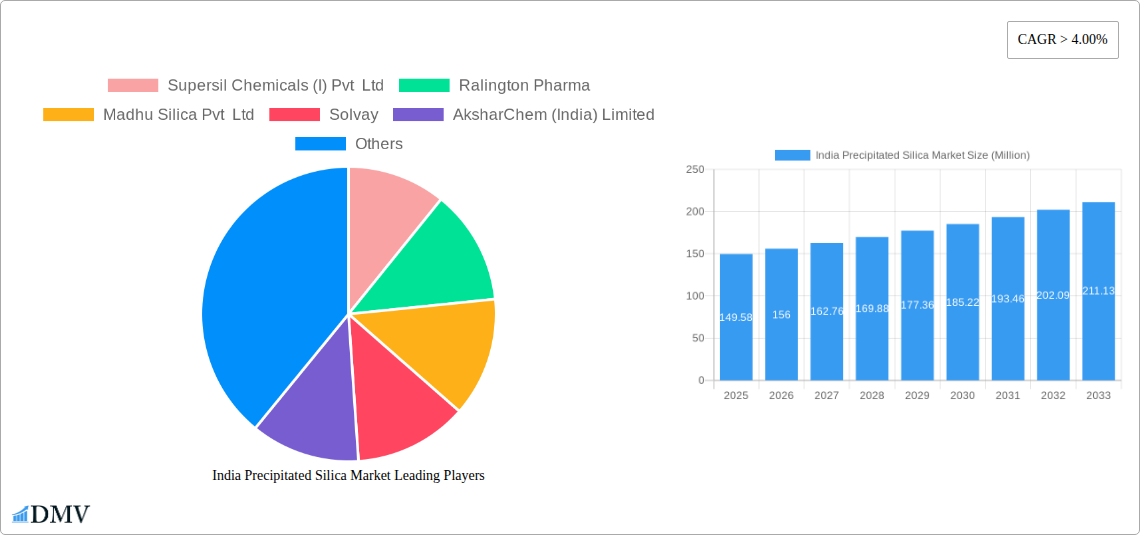

India Precipitated Silica Market Market Size (In Billion)

The forecast period (2025-2033) anticipates substantial expansion, driven by supportive government policies, infrastructure investments, and advanced technology adoption. Potential challenges include raw material price volatility and global economic influences. Strategic analysis of segment and regional growth is crucial for businesses to capitalize on opportunities within this evolving Indian precipitated silica market. Differentiated offerings through innovation, cost-efficiency, and strategic alliances will be key for market leaders.

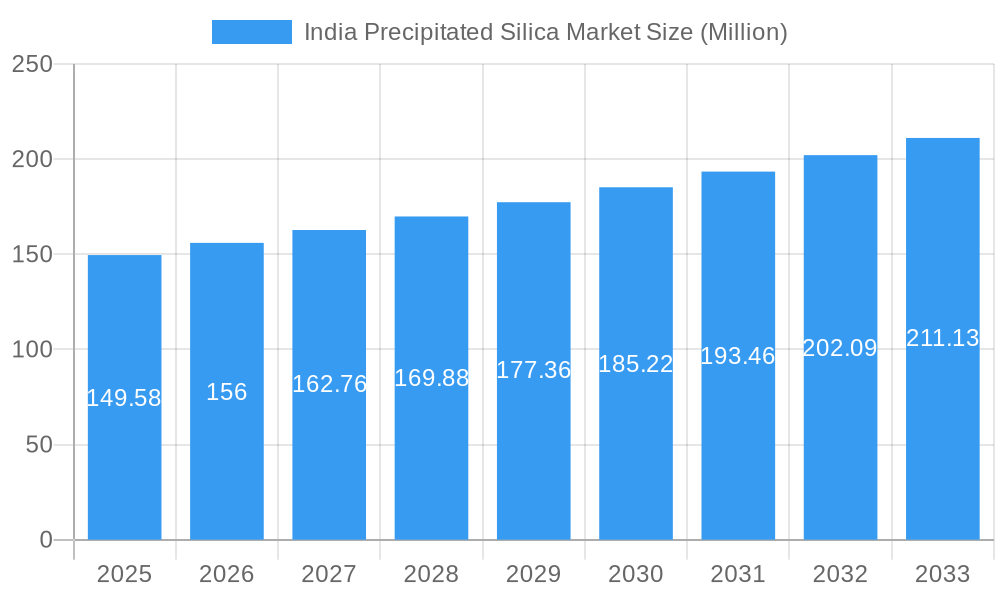

India Precipitated Silica Market Company Market Share

India Precipitated Silica Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the India precipitated silica market, offering a comprehensive overview of market dynamics, growth drivers, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is invaluable for stakeholders seeking to understand the current landscape and navigate future market trends in this rapidly evolving sector. The market size is expected to reach xx Million by 2033.

India Precipitated Silica Market Composition & Trends

This section delves into the intricate composition of the India precipitated silica market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market is characterized by a moderately concentrated landscape, with key players such as Supersil Chemicals (I) Pvt Ltd, Ralington Pharma, Madhu Silica Pvt Ltd, Solvay, AksharChem (India) Limited, MLA Group of Industries, PPG Industries Inc, PCIPL, JAY DINESH CHEMICALS, Tirupati Chemical Corporation, Tata Chemicals Ltd, and Regoj Chemical Industries holding significant market share. However, the presence of numerous smaller players indicates a competitive market dynamic.

Market Share Distribution: Supersil Chemicals and Solvay are projected to hold approximately xx% and xx% market share respectively in 2025, while other major players share the remaining xx%. Smaller players collectively contribute to the remaining market share.

Innovation Catalysts: Continuous research and development in enhancing silica properties (e.g., surface area, particle size distribution) for improved performance in various applications are driving innovation.

Regulatory Landscape: Stringent environmental regulations related to silica production and usage are shaping market practices.

Substitute Products: Alternatives like fumed silica and other reinforcing agents exert competitive pressure.

End-User Profiles: The market is driven by diverse end-user industries, including agriculture, cosmetics, automotive, and electronics, each with specific requirements influencing product demand.

M&A Activities: The past five years have witnessed xx M&A deals, with average deal values estimated around xx Million, reflecting industry consolidation and expansion strategies.

India Precipitated Silica Market Industry Evolution

This section meticulously traces the evolution of the India precipitated silica market, meticulously examining market growth trajectories, technological advancements, and evolving consumer demands. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven by factors like increasing demand from the automotive and construction sectors. Technological advancements, particularly in surface modification techniques, have enhanced the performance characteristics of precipitated silica, leading to wider adoption across various applications. Changing consumer preferences for high-performance, sustainable products are also influencing market trends. The forecast period (2025-2033) anticipates a CAGR of xx%, fueled by the continued growth of key end-user industries and ongoing technological advancements. Increased investments in R&D and the emergence of novel applications are projected to further propel market expansion. Adoption of advanced precipitated silica in high-value applications like electronics and pharmaceuticals is anticipated to significantly impact market growth in the coming years.

Leading Regions, Countries, or Segments in India Precipitated Silica Market

The Indian precipitated silica market exhibits varied regional and segmental growth dynamics. While precise market share data by region is unavailable, this section assesses dominant segments based on end-user industries.

Automotive Sector Dominance: The automotive industry emerges as a leading segment, driven by its substantial demand for high-performance tires and other automotive components.

Key Drivers for Automotive Sector Dominance:

- Rapid growth of the Indian automotive industry.

- Increasing demand for fuel-efficient vehicles leading to increased use of precipitated silica in tire manufacturing.

- Government initiatives promoting automotive manufacturing in India.

Cosmetics and other sectors: The cosmetics and personal care sector represents another significant segment, utilizing precipitated silica as a rheological agent and thickening agent. Other end-user industries, such as agriculture and electronics, also contribute significantly to market demand, showcasing the versatility of precipitated silica.

The dominance of the automotive sector is underpinned by the significant growth in vehicle production and sales in India. The sector's demand for higher performance tires, incorporating advanced precipitated silica technologies, contributes substantially to the overall market growth. Further expansion is anticipated due to continuous advancements in tire technology and increased fuel efficiency standards.

India Precipitated Silica Market Product Innovations

Recent innovations in precipitated silica encompass enhanced surface modification techniques, resulting in improved dispersion and rheological properties. This translates to enhanced performance in various applications, such as improved tire grip and reduced rolling resistance in the automotive sector, and enhanced texture and stability in cosmetics. These advancements offer unique selling propositions by meeting specific end-user needs and outperforming conventional silica options.

Propelling Factors for India Precipitated Silica Market Growth

The growth of the India precipitated silica market is fueled by several key drivers. Firstly, the burgeoning automotive industry, particularly tire manufacturing, demands large quantities of high-performance precipitated silica. Secondly, increasing demand from the cosmetics and personal care sector for rheological agents further boosts market growth. Technological advancements leading to improved product properties and cost efficiencies also play a significant role. Finally, favorable government policies and infrastructure development in India contribute positively to the overall market growth.

Obstacles in the India Precipitated Silica Market

Despite significant growth potential, certain challenges hinder the market's expansion. Fluctuations in raw material prices pose a considerable risk, affecting production costs and profitability. Intense competition among established players and the emergence of new entrants can lead to price pressures. Additionally, environmental regulations necessitate stringent production methods, increasing compliance costs for manufacturers.

Future Opportunities in India Precipitated Silica Market

Future opportunities abound in the India precipitated silica market. The expansion of emerging end-user industries such as electronics and pharmaceuticals presents significant growth potential. Advancements in nanotechnology and surface modification techniques offer opportunities to develop innovative precipitated silica products with enhanced performance characteristics. Furthermore, exploring sustainable and eco-friendly production methods can create new market niches and attract environmentally conscious consumers.

Major Players in the India Precipitated Silica Market Ecosystem

- Supersil Chemicals (I) Pvt Ltd

- Ralington Pharma

- Madhu Silica Pvt Ltd

- Solvay

- AksharChem (India) Limited

- MLA Group of Industries

- PPG Industries Inc (PPG Industries Inc)

- PCIPL

- JAY DINESH CHEMICALS

- Tirupati Chemical Corporation

- Tata Chemicals Ltd

- Regoj Chemical Industries

Key Developments in India Precipitated Silica Market Industry

July 2023: PPG Industries Inc. announced new research highlighting energy savings and manufacturing benefits for tire makers using PPG Agilon performance silica technology. This development signifies advancements in precipitated silica technology and underscores its potential to enhance manufacturing efficiency.

August 2022: Markan Global Enterprises expanded its product portfolio to include precipitated silica through a partnership with Madhu Silica Pvt. Ltd. This collaboration enhances market accessibility and intensifies competition.

Strategic India Precipitated Silica Market Forecast

The India precipitated silica market is poised for robust growth, driven by increasing demand from key end-user sectors, technological advancements, and favorable government policies. The market is expected to continue its upward trajectory, with significant opportunities arising from emerging applications and the adoption of innovative silica-based products. This growth potential positions the market as a lucrative investment destination for stakeholders.

India Precipitated Silica Market Segmentation

-

1. End-user Industry

- 1.1. Agriculture

- 1.2. Cosmetics

- 1.3. Automotive

- 1.4. Electronics

- 1.5. Other End-user Industries

India Precipitated Silica Market Segmentation By Geography

- 1. India

India Precipitated Silica Market Regional Market Share

Geographic Coverage of India Precipitated Silica Market

India Precipitated Silica Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from Automotive Industry; Growing Cosmetics Industry; Increasing Investments in the Electronics Sector

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations; Availability of Substitute

- 3.4. Market Trends

- 3.4.1. Automotive Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Precipitated Silica Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Agriculture

- 5.1.2. Cosmetics

- 5.1.3. Automotive

- 5.1.4. Electronics

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Supersil Chemicals (I) Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ralington Pharma

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Madhu Silica Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Solvay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AksharChem (India) Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MLA Group of Industries

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PPG Industries Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PCIPL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JAY DINESH CHEMICALS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tirupati Chemical Corporation*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tata Chemicals Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Regoj Chemical Industries

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Supersil Chemicals (I) Pvt Ltd

List of Figures

- Figure 1: India Precipitated Silica Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Precipitated Silica Market Share (%) by Company 2025

List of Tables

- Table 1: India Precipitated Silica Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: India Precipitated Silica Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 3: India Precipitated Silica Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Precipitated Silica Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: India Precipitated Silica Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: India Precipitated Silica Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: India Precipitated Silica Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: India Precipitated Silica Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Precipitated Silica Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the India Precipitated Silica Market?

Key companies in the market include Supersil Chemicals (I) Pvt Ltd, Ralington Pharma, Madhu Silica Pvt Ltd, Solvay, AksharChem (India) Limited, MLA Group of Industries, PPG Industries Inc, PCIPL, JAY DINESH CHEMICALS, Tirupati Chemical Corporation*List Not Exhaustive, Tata Chemicals Ltd, Regoj Chemical Industries.

3. What are the main segments of the India Precipitated Silica Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.42 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from Automotive Industry; Growing Cosmetics Industry; Increasing Investments in the Electronics Sector.

6. What are the notable trends driving market growth?

Automotive Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations; Availability of Substitute.

8. Can you provide examples of recent developments in the market?

Jul 2023: PPG Industries Inc. announced the release of new research demonstrating energy savings and other manufacturing benefits for tire makers using PPG Agilon performance silica technology. PPG Agilon precipitated silica is chemically modified, enabling tire makers to eliminate a manufacturing step required in conventional technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Precipitated Silica Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Precipitated Silica Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Precipitated Silica Market?

To stay informed about further developments, trends, and reports in the India Precipitated Silica Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence