Key Insights

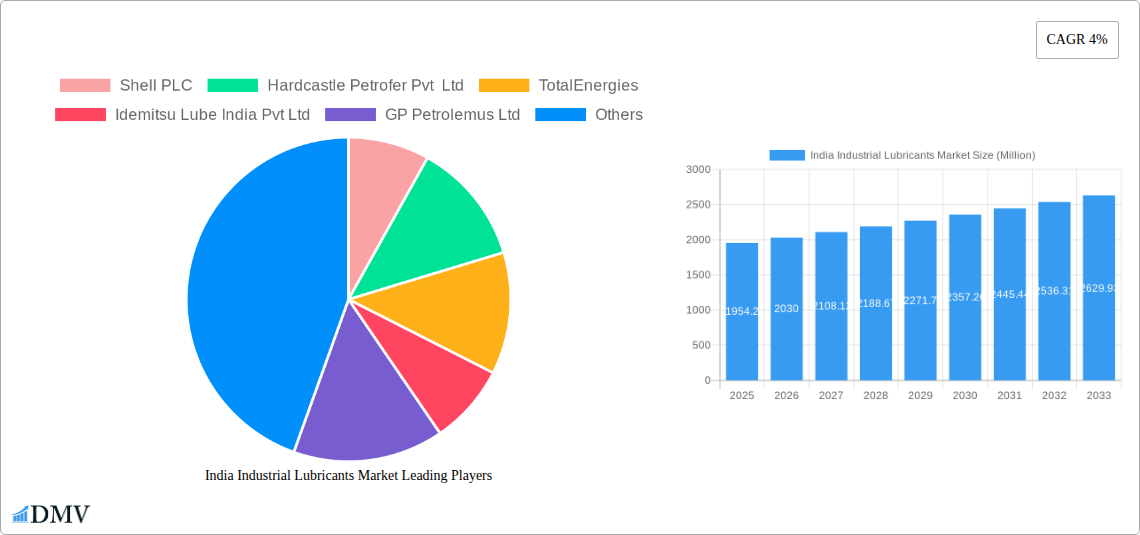

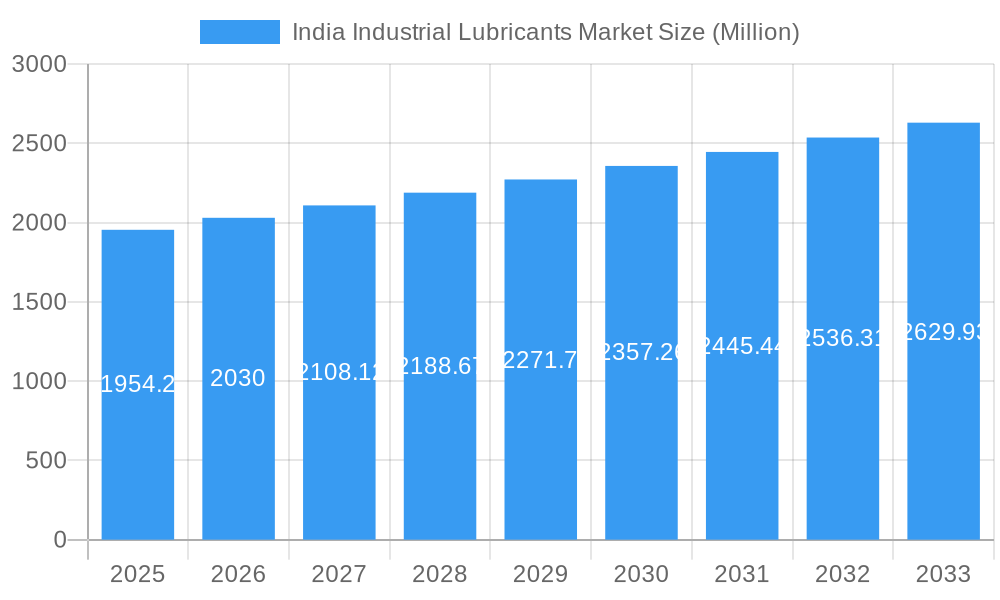

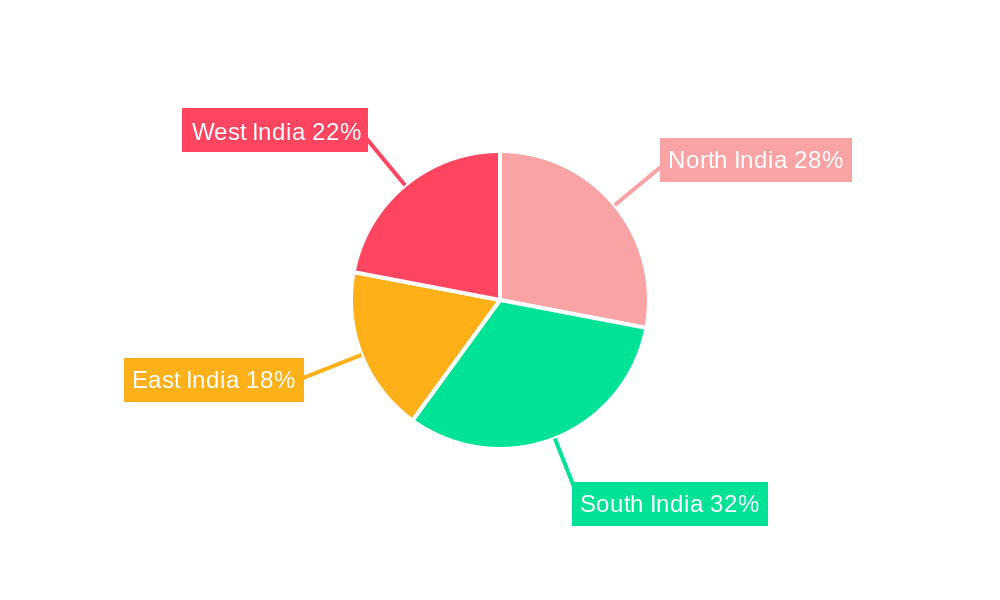

The India Industrial Lubricants Market, valued at 13045 million in 2024, is projected for significant expansion, propelled by India's growing industrial base, particularly in power generation, heavy machinery manufacturing, and chemical processing. A compound annual growth rate (CAGR) of 4.12% from 2024 to 2033 forecasts sustained demand for diverse lubricant categories, including engine oils, gear oils, greases, and specialized fluids such as metalworking and hydraulic fluids. Market growth is accelerated by escalating industrial automation, stringent emission regulations necessitating superior lubricants, and government-backed infrastructure development initiatives. The shift towards synthetic oils from mineral oils underscores a trend toward improved performance and extended product life. However, volatile crude oil prices present a market stability challenge, potentially impacting production costs and pricing. The market is segmented by product type, end-user industry, and base oil, with key players competing through online and offline channels. Regional market distribution across North, South, East, and West India reflects varying demand based on industrial concentration and economic activity.

India Industrial Lubricants Market Market Size (In Billion)

The competitive environment features a blend of multinational corporations (e.g., Shell, TotalEnergies, ExxonMobil) and prominent domestic companies (e.g., Bharat Petroleum, Hindustan Petroleum). These entities are actively pursuing strategic objectives, including product innovation, distribution network expansion, and mergers and acquisitions to solidify market positions. Future market growth is contingent upon consistent Indian economic expansion, advancements in lubricant technology, and the increasing adoption of sustainable, eco-friendly lubricants. This demand is further amplified by a growing emphasis on preventative maintenance strategies across industries, enhancing machinery longevity and reducing total ownership costs. Growth is anticipated to be steady across segments, with higher-value categories like synthetic and specialized industrial lubricants potentially experiencing accelerated growth compared to mineral oil-based commodities.

India Industrial Lubricants Market Company Market Share

India Industrial Lubricants Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the India Industrial Lubricants Market, offering a comprehensive overview of its current state, future trends, and growth potential. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this study is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is projected to reach xx Million by 2033.

India Industrial Lubricants Market Composition & Trends

The Indian industrial lubricants market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller regional players creates a competitive environment. Innovation is driven by the need for improved efficiency, reduced environmental impact, and adherence to stricter emission norms. The regulatory landscape is evolving, with increasing emphasis on sustainability and environmental protection. Substitute products, such as bio-based lubricants, are gaining traction, posing both challenges and opportunities for traditional players. The end-user profile is diverse, encompassing various sectors with differing lubrication needs and preferences. M&A activity has been moderate in recent years, with deal values averaging xx Million.

- Market Concentration: Top 5 players hold approximately xx% market share.

- Innovation Catalysts: Stringent emission norms, demand for enhanced equipment lifespan, and growing focus on sustainability.

- Regulatory Landscape: Emphasis on environmental regulations and safety standards.

- Substitute Products: Growing adoption of bio-based and synthetic lubricants.

- M&A Activity: Average deal value in recent years estimated at xx Million.

India Industrial Lubricants Market Industry Evolution

The Indian industrial lubricants market has witnessed robust growth over the historical period (2019-2024), driven primarily by the expansion of key end-user industries like manufacturing, power generation, and construction. This growth trajectory is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace. Technological advancements, such as the development of high-performance lubricants with extended drain intervals and improved efficiency, are playing a significant role in shaping market dynamics. Consumer demand is increasingly focused on sustainability and environmentally friendly options, leading to greater adoption of bio-based and synthetic lubricants. The market has experienced a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024 and is projected to grow at a CAGR of xx% from 2025 to 2033.

Leading Regions, Countries, or Segments in India Industrial Lubricants Market

The Indian industrial lubricants market demonstrates strong regional variations in growth and segment dominance. While specific data on regional breakdown requires further investigation, several key segments and drivers are identifiable.

- Product Type: Engine oil constitutes the largest segment, driven by the substantial presence of the automotive and industrial machinery sectors. Growth is also observed in specialized lubricants such as metalworking fluids and greases.

- End-user Industry: The manufacturing sector, particularly heavy equipment, metallurgy, and chemical manufacturing, consumes a significant portion of industrial lubricants. Power generation and food & beverage sectors also contribute substantially.

- Base Oil: Mineral oil currently holds the largest market share, due to its cost-effectiveness. However, synthetic and bio-based oils are gaining traction due to their performance advantages and environmental benefits.

- Sales Channel: Offline sales channels currently dominate, but online sales are gradually increasing.

Key Drivers:

- Significant investments in infrastructure development across various sectors.

- Government initiatives promoting industrial growth and modernization.

- Growing adoption of advanced manufacturing technologies.

India Industrial Lubricants Market Product Innovations

Recent innovations in industrial lubricants focus on enhancing performance, extending equipment lifespan, and reducing environmental impact. This includes the development of energy-efficient lubricants, biodegradable options, and advanced formulations tailored to specific applications. Unique selling propositions include improved viscosity index, enhanced wear protection, and reduced friction. Technological advancements such as nanotechnology and additive chemistry are playing a crucial role in creating superior lubricant solutions.

Propelling Factors for India Industrial Lubricants Market Growth

The growth of the Indian industrial lubricants market is fueled by several factors. The expansion of the manufacturing sector, particularly in automotive and heavy machinery, creates a significant demand for lubricants. Government initiatives promoting infrastructure development and industrial growth further boost market expansion. Technological advancements leading to high-performance, energy-efficient lubricants also contribute to growth. The increasing awareness of environmental concerns is driving the adoption of sustainable lubricant options.

Obstacles in the India Industrial Lubricants Market

The market faces challenges such as price volatility of base oils, supply chain disruptions, and intense competition among existing players. Regulatory compliance and environmental concerns pose additional hurdles. The fluctuating exchange rates also impact the cost of imported raw materials. These factors can affect profitability and market growth if not effectively managed.

Future Opportunities in India Industrial Lubricants Market

Future opportunities lie in the growing demand for high-performance, eco-friendly lubricants, particularly in emerging sectors like renewable energy and electric vehicles. Expanding into underserved rural markets and leveraging digital platforms for sales and distribution present significant potential. Focus on customized lubricant solutions for specific industry needs can lead to increased market share.

Major Players in the India Industrial Lubricants Market Ecosystem

- Shell PLC

- Hardcastle Petrofer Pvt Ltd

- TotalEnergies

- Idemitsu Lube India Pvt Ltd

- GP Petrolemus Ltd

- Exxon Mobil Corporation

- Castrol Limited (BP)

- Kluber Lubrication

- Tide Water Oil Co (India) Ltd (Veedol)

- Balmer Lawrie & Co Ltd

- Gulf Oil Lubricants India

- Bharat Petroleum Corporation Limited (BPCL)

- Blaser Swisslube India Pvt Ltd

- Fuchs Lubricants Pvt Ltd

- Panama Petrochem Ltd

- Amsoil Inc

- Apar Industries Ltd

- Hindustan Petroleum Corporation Limited (HPCL)

- Continental Petroleums Limited

- Indian Oil Corporation Ltd

- Bechem

Key Developments in India Industrial Lubricants Market Industry

- December 2022: Indian Oil Corporation Ltd. (IOCL) partnered with FuelBuddy for PAN India marketing of SERVO automotive and industrial lubricants. This significantly expands IOCL's reach and distribution network.

- February 2022: Gulf Oil Lubricant (India) partnered with SCHWING, enhancing its presence in the construction equipment lubricant market. This strategic move strengthens Gulf Oil's product portfolio and market penetration.

Strategic India Industrial Lubricants Market Forecast

The India industrial lubricants market is poised for continued growth, driven by robust industrial expansion, technological advancements, and increasing demand for high-performance and sustainable lubricants. The market's future potential is substantial, particularly in emerging sectors and with the adoption of innovative distribution strategies. Opportunities exist for players who can effectively address the evolving needs of diverse end-user industries.

India Industrial Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Transmission and Hydraulic Fluid

- 1.3. Metalworking Fluid

- 1.4. General Industrial Oil

- 1.5. Gear Oil

- 1.6. Grease

- 1.7. Process Oil

- 1.8. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Heavy Equipment

- 2.3. Food and Beverage

- 2.4. Metallurgy and Metalworking

- 2.5. Chemical Manufacturing

- 2.6. Other En

India Industrial Lubricants Market Segmentation By Geography

- 1. India

India Industrial Lubricants Market Regional Market Share

Geographic Coverage of India Industrial Lubricants Market

India Industrial Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand from the Growing Wind Energy Sector4.1.2 'Make in India' Initiative Expanding Industrial Base

- 3.3. Market Restrains

- 3.3.1. Increased Environmental Pollution Leading to Growing Industrial Regulations

- 3.4. Market Trends

- 3.4.1. Heavy Equipment Segment to Dominate the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Industrial Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Transmission and Hydraulic Fluid

- 5.1.3. Metalworking Fluid

- 5.1.4. General Industrial Oil

- 5.1.5. Gear Oil

- 5.1.6. Grease

- 5.1.7. Process Oil

- 5.1.8. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Heavy Equipment

- 5.2.3. Food and Beverage

- 5.2.4. Metallurgy and Metalworking

- 5.2.5. Chemical Manufacturing

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hardcastle Petrofer Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TotalEnergies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Idemitsu Lube India Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GP Petrolemus Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Exxon Mobil Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Castrol Limited (BP)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kluber Lubrication

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tide Water Oil Co (India) Ltd (Veedol)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Balmer Lawrie & Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gulf Oil Lubricants India

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bharat Petroleum Corporation Limited (BPCL)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Blaser Swisslube India Pvt Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Fuchs Lubricants Pvt Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Panama Petrochem Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Amsoil Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Apar Industries Ltd

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Hindustan Petroleum Corporation Limited (HPCL)

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Continental Petroleums Limited

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Indian Oil Corporation Ltd

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Bechem

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: India Industrial Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Industrial Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: India Industrial Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: India Industrial Lubricants Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: India Industrial Lubricants Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: India Industrial Lubricants Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: India Industrial Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: India Industrial Lubricants Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: India Industrial Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 8: India Industrial Lubricants Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: India Industrial Lubricants Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 10: India Industrial Lubricants Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: India Industrial Lubricants Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: India Industrial Lubricants Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Industrial Lubricants Market?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the India Industrial Lubricants Market?

Key companies in the market include Shell PLC, Hardcastle Petrofer Pvt Ltd, TotalEnergies, Idemitsu Lube India Pvt Ltd, GP Petrolemus Ltd, Exxon Mobil Corporation, Castrol Limited (BP), Kluber Lubrication, Tide Water Oil Co (India) Ltd (Veedol), Balmer Lawrie & Co Ltd, Gulf Oil Lubricants India, Bharat Petroleum Corporation Limited (BPCL), Blaser Swisslube India Pvt Ltd, Fuchs Lubricants Pvt Ltd, Panama Petrochem Ltd, Amsoil Inc, Apar Industries Ltd, Hindustan Petroleum Corporation Limited (HPCL), Continental Petroleums Limited, Indian Oil Corporation Ltd, Bechem.

3. What are the main segments of the India Industrial Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 13045 million as of 2022.

5. What are some drivers contributing to market growth?

Demand from the Growing Wind Energy Sector4.1.2 'Make in India' Initiative Expanding Industrial Base.

6. What are the notable trends driving market growth?

Heavy Equipment Segment to Dominate the Market Demand.

7. Are there any restraints impacting market growth?

Increased Environmental Pollution Leading to Growing Industrial Regulations.

8. Can you provide examples of recent developments in the market?

December 2022: Indian Oil Corporation Ltd. (IOCL) partnered with FuelBuddy, which is India's largest legal doorstep fuel delivery service for the marketing of automotive and industrial lubricants (SERVO, PAN India).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Industrial Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Industrial Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Industrial Lubricants Market?

To stay informed about further developments, trends, and reports in the India Industrial Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence