Key Insights

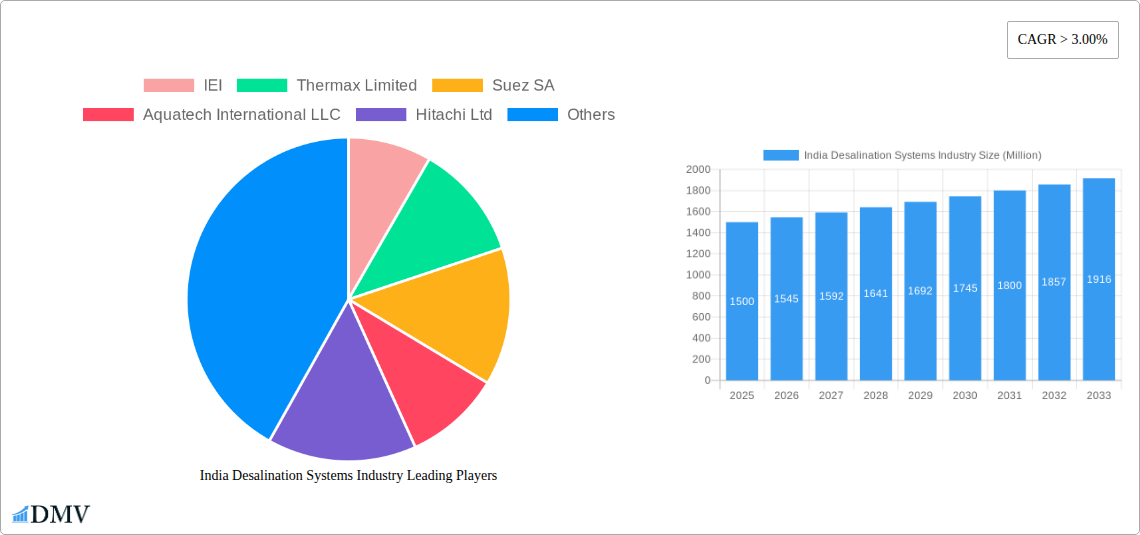

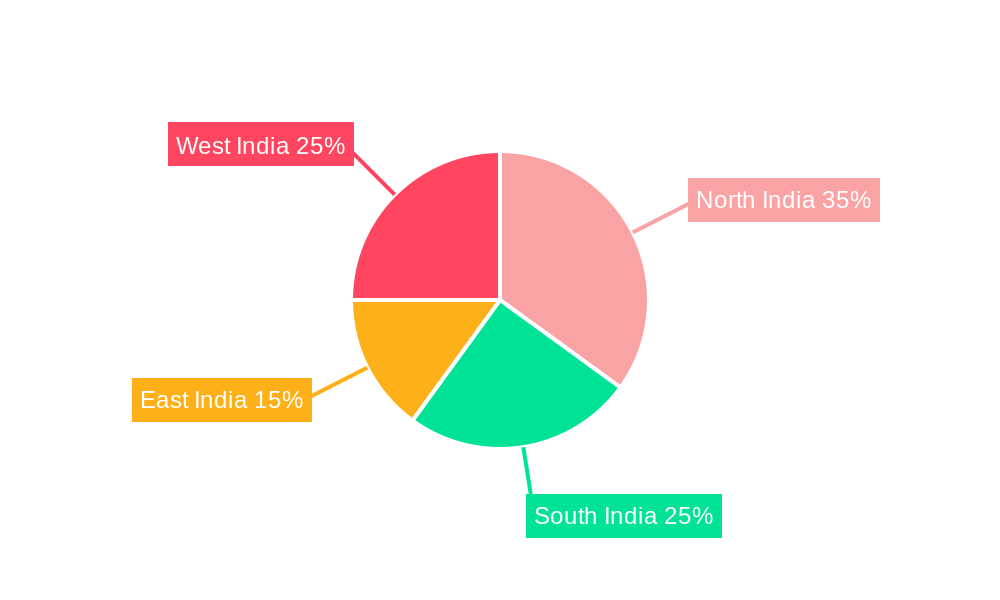

The India desalination systems market is experiencing robust growth, driven by increasing water scarcity, particularly in coastal regions and arid areas like North and West India. The market, valued at approximately ₹1500 million (estimated) in 2025, is projected to expand significantly over the forecast period (2025-2033), fueled by a CAGR exceeding 3%. Several factors contribute to this growth: rising industrial water demand, especially from sectors like power generation and manufacturing, coupled with expanding municipal water requirements in rapidly urbanizing areas. Technological advancements in desalination, such as the adoption of more energy-efficient thermal and membrane technologies, are further enhancing market prospects. While high capital investment and operational costs remain a constraint, government initiatives promoting water security and private sector investment in water infrastructure are mitigating these challenges. The market is segmented by technology (thermal, vapor compression distillation, membrane) and application (municipal, industrial), with membrane technology expected to witness substantial growth owing to its lower energy consumption compared to thermal methods. Key players like Thermax Limited, Suez SA, and IDE Technologies Ltd. are actively shaping the market through technological innovation and project development, catering to both large-scale industrial projects and smaller-scale municipal installations. The regional distribution reflects the intensity of water stress, with North and West India showcasing higher growth potential.

India Desalination Systems Industry Market Size (In Billion)

The forecast for the Indian desalination market remains positive, indicating strong potential for continued expansion beyond 2033. Further growth will be driven by increasing awareness regarding water conservation and sustainable water management, government policies incentivizing desalination projects, and potential advancements in desalination technologies that further reduce costs and improve efficiency. The diverse range of applications, from supplying potable water to industrial processes, contributes to the resilience of the market and its long-term sustainability. The presence of established global and domestic players reinforces the market's competitiveness and ensures the availability of a wide array of solutions tailored to specific needs and budgetary constraints.

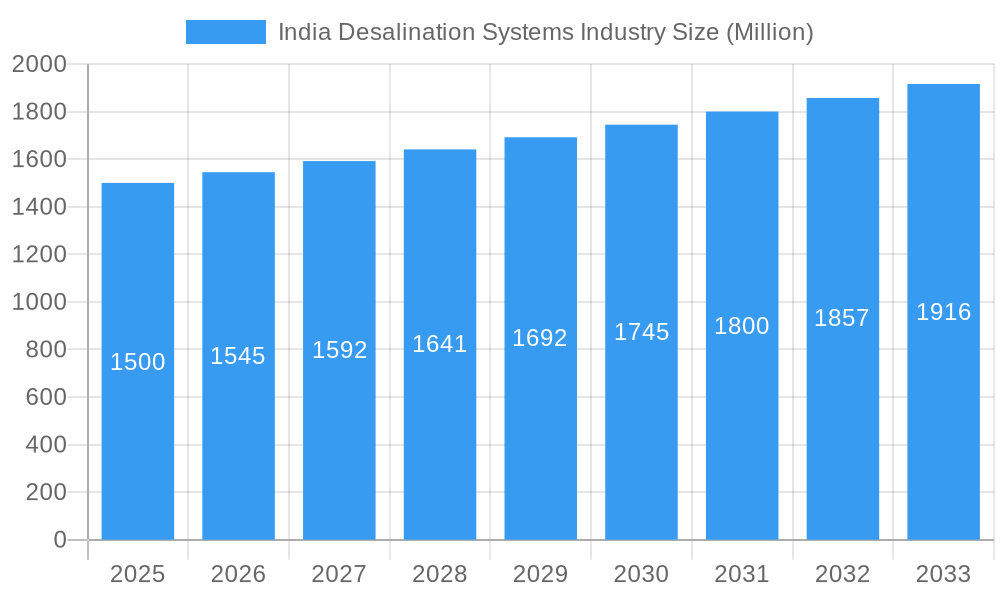

India Desalination Systems Industry Company Market Share

India Desalination Systems Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the India desalination systems industry, offering crucial insights for stakeholders seeking to navigate this dynamic market. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report projects a market valued at xx Million by 2033, fueled by increasing water scarcity and government initiatives. Expect in-depth coverage of technological advancements, market segmentation, competitive landscape, and future growth prospects.

India Desalination Systems Industry Market Composition & Trends

The Indian desalination systems market exhibits a moderately concentrated structure, with key players like Thermax Limited, Suez SA, Aquatech International LLC, Hitachi Ltd, Evoqua Water Technologies, Abengoa, DuPont, VA Tech Wabag Ltd, Veolia Environnement SA, IDE Technologies Ltd, and IEI holding significant market share. Market share distribution is estimated at xx% for the top 5 players in 2025. Innovation is driven by the need for energy-efficient and cost-effective solutions, particularly in membrane technology. Favorable government policies and increasing private sector investment are key catalysts. Substitute products include rainwater harvesting and water reuse systems, although desalination remains crucial in water-stressed regions. End-users primarily include municipal authorities and industrial sectors, with the latter segment exhibiting faster growth. M&A activity has been moderate, with recent deals focusing on technological integration and expansion into new markets. The total value of M&A deals in the period 2019-2024 is estimated at xx Million.

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Innovation Catalysts: Government policies, private investment, and demand for cost-effective solutions.

- Regulatory Landscape: Supportive policies promoting desalination adoption.

- Substitute Products: Rainwater harvesting, water reuse.

- End-User Profiles: Municipal and industrial sectors.

- M&A Activities: Moderate activity, focused on technological integration and market expansion.

India Desalination Systems Industry Industry Evolution

The Indian desalination systems market has witnessed significant growth over the past five years, driven by factors such as increasing water scarcity, rising industrial demands, and supportive government initiatives. The market's compound annual growth rate (CAGR) during 2019-2024 is estimated at xx%. Technological advancements, particularly in reverse osmosis (RO) and other membrane-based technologies, have significantly improved desalination efficiency and reduced costs. Consumer demand is shifting towards sustainable and energy-efficient desalination solutions. Adoption of renewable energy sources for powering desalination plants is gaining momentum. This trend aligns with the government's focus on sustainable development and water security. The market is expected to continue its growth trajectory in the forecast period, driven by increasing investments in large-scale desalination projects, particularly in coastal regions. The adoption rate of membrane technologies, specifically RO, is expected to increase at a CAGR of xx% during the forecast period.

Leading Regions, Countries, or Segments in India Desalination Systems Industry

Coastal states with high water stress are dominating the Indian desalination market. Gujarat, Maharashtra, and Tamil Nadu are leading regions due to their high industrial activity and population density. The industrial segment is expected to witness faster growth compared to the municipal segment, driven by increased industrial water demand.

- Key Drivers for Coastal States:

- High water stress.

- Significant industrial activity.

- Government support for desalination projects.

- Key Drivers for Industrial Segment:

- Increasing industrial water demand.

- Stringent water quality standards.

- High willingness to invest in reliable water sources.

Membrane technology, specifically reverse osmosis (RO), dominates the technology segment due to its high efficiency, lower energy consumption compared to thermal methods, and suitability for various applications. The dominance of RO is fueled by ongoing technological advancements leading to enhanced performance and reduced costs.

India Desalination Systems Industry Product Innovations

Recent innovations focus on energy efficiency, modular designs for easier deployment, and improved membrane technologies to enhance efficiency and reduce costs. Plug-and-play RO systems, like Veolia’s Barrel, are gaining traction due to their ease of installation and rapid deployment. The focus is on developing sustainable solutions utilizing renewable energy sources, decreasing the carbon footprint of desalination processes. Improved pre-treatment techniques are crucial in reducing membrane fouling and extending operational lifespan.

Propelling Factors for India Desalination Systems Industry Growth

The industry's growth is propelled by several factors: increasing water scarcity in many regions, rising industrial water demands from sectors like power generation and manufacturing, supportive government policies and initiatives promoting water conservation and desalination, increasing investments from both public and private sectors in desalination projects, and technological advancements leading to more efficient and cost-effective desalination technologies.

Obstacles in the India Desalination Systems Industry Market

Challenges include high initial investment costs, the need for reliable and sustainable energy sources, concerns about environmental impact (e.g., brine discharge), potential supply chain disruptions affecting component availability, and intense competition among established players and new entrants. Regulatory hurdles in some regions can also delay project implementation.

Future Opportunities in India Desalination Systems Industry

Future opportunities lie in exploring innovative financing models, integrating desalination with renewable energy sources (e.g., solar, wind), developing advanced water treatment technologies to reduce brine discharge and improve water quality, expanding desalination capacity in underserved regions, and focusing on smaller, modular desalination systems for diverse applications.

Major Players in the India Desalination Systems Industry Ecosystem

Key Developments in India Desalination Systems Industry Industry

- January 2022: SUEZ acquired Sentinel Monitoring Systems, enhancing its real-time water quality monitoring capabilities.

- April 2022: Veolia launched Barrel, a plug-and-play RO technology, addressing the growing demand for efficient desalination solutions in Asia Pacific.

- June 2022: ENOWA, ITOCHU, and Veolia partnered to develop a 100% renewable energy-powered desalination plant in NEOM, showcasing a commitment to sustainable desalination.

Strategic India Desalination Systems Industry Market Forecast

The Indian desalination systems market is poised for robust growth driven by increasing water stress, technological advancements, and supportive government policies. The focus on sustainable and energy-efficient solutions will drive market expansion, with significant opportunities in both municipal and industrial sectors. Strategic partnerships and investments in innovative technologies will be crucial for success in this growing market.

India Desalination Systems Industry Segmentation

-

1. Technology

-

1.1. Thermal Technology

- 1.1.1. Multi-stage Flash Distillation (MSF)

- 1.1.2. Multi-effect Distillation (MED)

- 1.1.3. Vapor Compression Distillation

-

1.2. Membrane Technology

- 1.2.1. Electrodialysis (ED)

- 1.2.2. Electrodialysis Reversal (EDR)

- 1.2.3. Reverse Osmosis (RO)

- 1.2.4. Other Me

-

1.1. Thermal Technology

-

2. Application

- 2.1. Municipal

- 2.2. Industrial

India Desalination Systems Industry Segmentation By Geography

- 1. India

India Desalination Systems Industry Regional Market Share

Geographic Coverage of India Desalination Systems Industry

India Desalination Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Gap Between Water Supply and Demand; Lack of Existence of Water Infrastructure

- 3.3. Market Restrains

- 3.3.1. High Cost Compared to Water Treatment Plant; Other Restraints

- 3.4. Market Trends

- 3.4.1. Rising Demand from the Municipal Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Desalination Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Thermal Technology

- 5.1.1.1. Multi-stage Flash Distillation (MSF)

- 5.1.1.2. Multi-effect Distillation (MED)

- 5.1.1.3. Vapor Compression Distillation

- 5.1.2. Membrane Technology

- 5.1.2.1. Electrodialysis (ED)

- 5.1.2.2. Electrodialysis Reversal (EDR)

- 5.1.2.3. Reverse Osmosis (RO)

- 5.1.2.4. Other Me

- 5.1.1. Thermal Technology

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Municipal

- 5.2.2. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IEI

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Thermax Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Suez SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aquatech International LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Evoqua Water Technologies

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abengoa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DuPont

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 VA Tech Wabag Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Veolia Environnement SA*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IDE Technologies Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 IEI

List of Figures

- Figure 1: India Desalination Systems Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Desalination Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: India Desalination Systems Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: India Desalination Systems Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: India Desalination Systems Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Desalination Systems Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 5: India Desalination Systems Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: India Desalination Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Desalination Systems Industry?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the India Desalination Systems Industry?

Key companies in the market include IEI, Thermax Limited, Suez SA, Aquatech International LLC, Hitachi Ltd, Evoqua Water Technologies, Abengoa, DuPont, VA Tech Wabag Ltd, Veolia Environnement SA*List Not Exhaustive, IDE Technologies Ltd.

3. What are the main segments of the India Desalination Systems Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Gap Between Water Supply and Demand; Lack of Existence of Water Infrastructure.

6. What are the notable trends driving market growth?

Rising Demand from the Municipal Segment.

7. Are there any restraints impacting market growth?

High Cost Compared to Water Treatment Plant; Other Restraints.

8. Can you provide examples of recent developments in the market?

June 2022: ENOWA, the energy, water, and hydrogen subsidiary of NEOM, signed a Memorandum of Understanding (MoU) with ITOCHU and Veolia. As part of the MoU, the companies have agreed to collaborate to develop a first-of-its-kind selective desalination plant powered by 100% renewable energy in Oxagon, NEOM's advanced manufacturing and innovation city.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Desalination Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Desalination Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Desalination Systems Industry?

To stay informed about further developments, trends, and reports in the India Desalination Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence