Key Insights

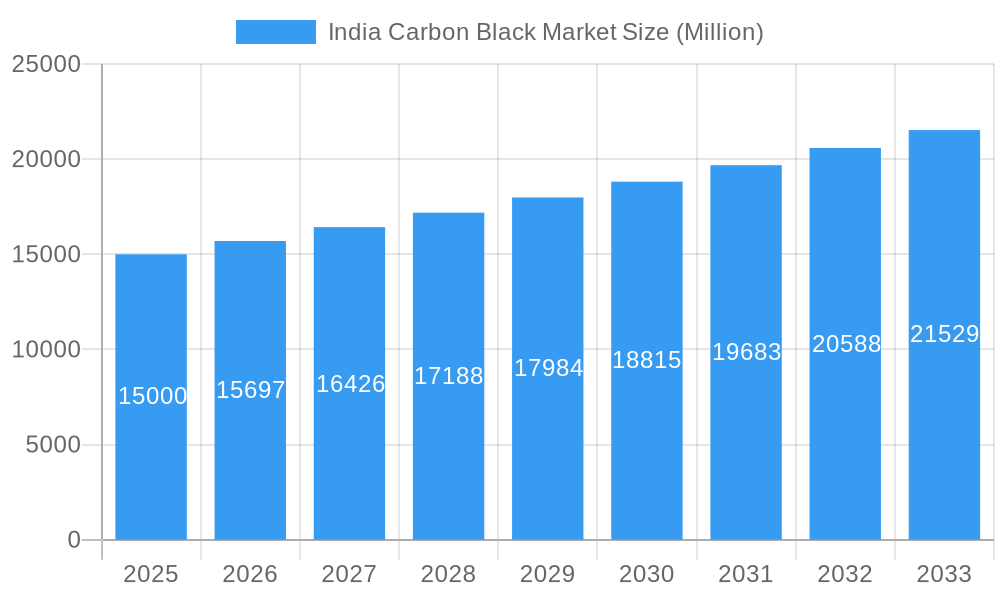

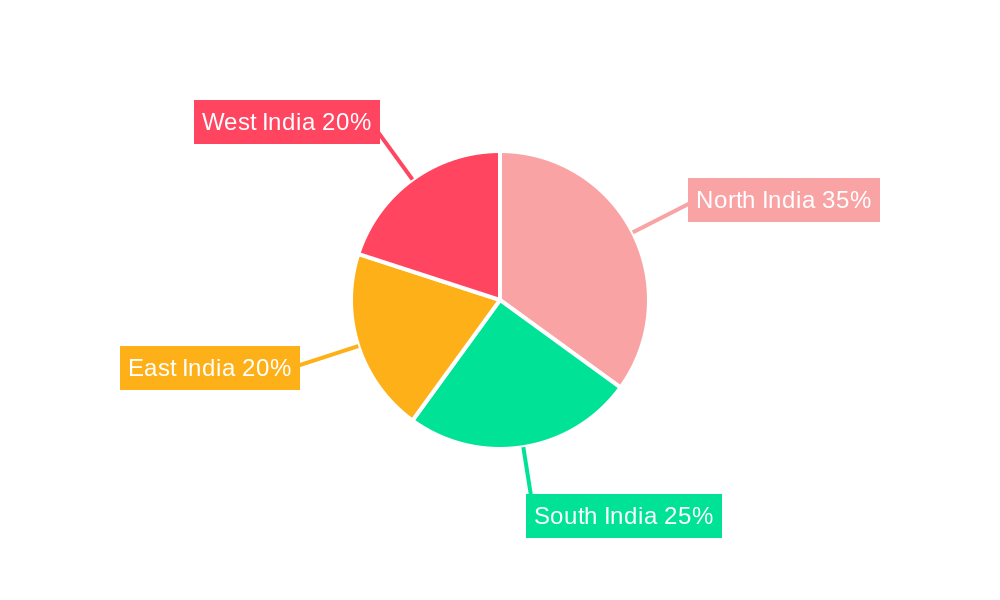

The India carbon black market is projected to reach 25.54 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.7% from 2025 to 2033. This significant growth is attributed to escalating demand from critical sectors including tires, industrial rubber products, plastics, and printing inks. Key drivers include India's expanding automotive industry, ongoing infrastructure development, and increasing consumer expenditure. The adoption of carbon black in specialized applications, such as high-performance tires for enhanced durability and fuel efficiency, further supports market expansion. Innovations in carbon black production methods are improving efficiency and product quality, contributing to overall market growth. Potential challenges include raw material price volatility (crude oil) and stringent environmental regulations. Furnace black dominates the market share owing to its superior properties and broad application spectrum. The North and West regions are expected to experience accelerated growth due to the presence of major industrial and automotive manufacturing hubs.

India Carbon Black Market Market Size (In Billion)

The competitive environment features both domestic and international participants, including Jiangxi Heimao Carbon Black Co Ltd, OCI COMPANY Ltd, Cabot Corporation, and Birla Carbon. These entities are actively pursuing strategic alliances, capacity expansions, and technological advancements to solidify their market standing. Despite potential headwinds, the long-term outlook for the India carbon black market is optimistic, driven by sustained growth in allied industries and supportive government initiatives for industrial development. The market's future trajectory will be shaped by the ability to address environmental concerns sustainably and adapt to evolving industry requirements for advanced and specialized carbon black solutions.

India Carbon Black Market Company Market Share

India Carbon Black Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the India carbon black market, offering a detailed overview of market dynamics, growth drivers, challenges, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study is an essential resource for stakeholders seeking to understand and capitalize on this dynamic market. The market is projected to reach xx Million by 2033.

India Carbon Black Market Market Composition & Trends

This section delves into the intricate composition of the India carbon black market, analyzing key trends shaping its trajectory. We examine market concentration, revealing the market share distribution amongst key players like Birla Carbon, PCBL (Phillips Carbon Black Limited), and Cabot Corporation. We explore the innovative catalysts driving market evolution, including advancements in furnace black production and the development of specialized carbon blacks for niche applications. The regulatory landscape, including environmental regulations and safety standards impacting production and consumption, is thoroughly assessed. The influence of substitute products and the competitive dynamics within the market are scrutinized. Further, the report profiles key end-users across diverse sectors like tires and industrial rubber, plastics, and coatings. Finally, it details mergers and acquisitions (M&A) activities, including estimated deal values (xx Million) and their impact on market consolidation.

- Market Concentration: Birla Carbon and PCBL hold significant market share. The market exhibits a moderately consolidated structure.

- Innovation Catalysts: Advancements in furnace black technology, development of specialty carbon blacks.

- Regulatory Landscape: Stringent environmental regulations drive the adoption of cleaner production processes.

- Substitute Products: Competition from alternative materials like silica and other fillers is analyzed.

- End-User Profiles: Detailed analysis of consumption patterns across key sectors.

- M&A Activities: Review of significant M&A deals with estimated transaction values.

India Carbon Black Market Industry Evolution

This section provides a detailed analysis of the India carbon black market's evolutionary journey, highlighting growth trajectories, technological advancements, and evolving consumer demands from 2019 to 2033. We examine the historical period (2019-2024) growth rates (xx%), identifying key factors driving expansion. The report then projects future growth (xx% CAGR during 2025-2033), based on anticipated technological improvements in production efficiency and the growing demand from burgeoning end-use sectors. The increasing adoption of sustainable practices and the growing awareness of environmental concerns within the industry are also factored in. We analyze the impact of technological advancements, such as the implementation of advanced process control systems and the development of new carbon black grades, on overall market growth. Furthermore, the changing preferences of consumers, driven by factors like improved product performance and sustainability concerns, are examined in detail.

Leading Regions, Countries, or Segments in India Carbon Black Market

This section identifies the dominant regions, countries, and segments within the India carbon black market. Furnace black consistently emerges as the leading process type, owing to its versatility and wide applicability. Tires and industrial rubber products remain the largest application segment.

- Key Drivers for Furnace Black Dominance:

- Cost-effectiveness compared to other process types.

- Superior properties for tire applications.

- Strong demand from the growing automotive sector.

- Key Drivers for Tires and Industrial Rubber Products Dominance:

- Rapid growth of the automotive industry.

- Increasing demand for high-performance tires.

- Expanding infrastructure development projects.

- Regional Analysis: Detailed analysis of regional consumption patterns and growth drivers.

The dominance is primarily driven by the robust growth of downstream industries like automobiles, construction, and packaging, coupled with supportive government policies. We provide a comprehensive analysis of these factors, including investment trends, regulatory support, and infrastructure development.

India Carbon Black Market Product Innovations

Recent innovations have focused on developing high-performance carbon blacks with enhanced properties like improved abrasion resistance, higher tensile strength, and better dispersion. These advancements cater to the needs of various applications, particularly in high-performance tires and specialized plastics. The introduction of sustainable production methods, emphasizing reduced energy consumption and minimized environmental impact, represents another key area of innovation. The market is witnessing the rise of specialized carbon blacks tailored for specific applications, enhancing overall product performance and efficiency.

Propelling Factors for India Carbon Black Market Growth

The India carbon black market's growth is propelled by several key factors. Firstly, the booming automotive sector drives significant demand for carbon black, primarily for tire manufacturing. Secondly, the expansion of the plastics and rubber industries fuels further growth. Finally, supportive government policies and infrastructure development projects play a crucial role in market expansion. Increased investments in R&D are driving the development of novel carbon black grades with enhanced performance characteristics, further stimulating market growth.

Obstacles in the India Carbon Black Market Market

The India carbon black market faces several challenges. Fluctuations in raw material prices (e.g., petroleum feedstock) can impact production costs and profitability. Stringent environmental regulations necessitate investments in pollution control technologies, adding to operational expenses. Intense competition from both domestic and international players exerts pressure on pricing and profitability. Supply chain disruptions, particularly those related to raw material sourcing, can impact production and deliveries.

Future Opportunities in India Carbon Black Market

Future opportunities lie in the expansion of niche applications, such as specialized carbon blacks for electric vehicle batteries and advanced composites. The increasing demand for sustainable materials presents opportunities for carbon black producers to develop eco-friendly production processes and offer bio-based carbon black alternatives. Further market penetration into emerging economies, coupled with technological advancements in carbon black production, will unlock significant growth potential.

Major Players in the India Carbon Black Market Ecosystem

- Birla Carbon

- PCBL (Phillips Carbon Black Limited)

- Cabot Corporation

- Epsilon Carbon Private Limited

- Himadri Speciality Chemical Ltd

- Atlas Organics Private Limited

- BKT Carbon

- Jiangxi Heimao Carbon Black Co Ltd

- OCI COMPANY Ltd

- Continental Carbon Company

Key Developments in India Carbon Black Market Industry

- 2022 Q4: Birla Carbon launched a new range of sustainable carbon blacks.

- 2023 Q1: PCBL announced a major capacity expansion project.

- 2023 Q3: A significant M&A deal involving two smaller carbon black producers was concluded. (Specific details redacted for confidentiality.)

- 2024 Q2: New environmental regulations came into effect, impacting production processes.

Strategic India Carbon Black Market Market Forecast

The India carbon black market is poised for significant growth over the forecast period (2025-2033), driven by the expansion of key downstream industries, technological advancements, and supportive government policies. The increasing demand for high-performance carbon blacks in specialized applications, coupled with the development of sustainable production methods, presents lucrative opportunities for market players. The market's future trajectory is optimistic, with substantial growth potential fueled by these dynamic factors.

India Carbon Black Market Segmentation

-

1. Process Type

- 1.1. Furnace Black

- 1.2. Gas Black

- 1.3. Lamp Black

- 1.4. Thermal Black

-

2. Application

- 2.1. Tires and Industrial Rubber Products

- 2.2. Plastics

- 2.3. Toners and Printing Inks

- 2.4. Coatings

- 2.5. Textile Fibers

- 2.6. Other Application

India Carbon Black Market Segmentation By Geography

- 1. India

India Carbon Black Market Regional Market Share

Geographic Coverage of India Carbon Black Market

India Carbon Black Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Tire Industry; Increasing Market Penetration of Specialty Black; Growing Applications In the Batteries Segment

- 3.3. Market Restrains

- 3.3.1. Rising Prominence of Green Tires; Volatility In Prices of Raw Materials

- 3.4. Market Trends

- 3.4.1. Furnace Process Type to Dominate the Carbon Black Market in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Furnace Black

- 5.1.2. Gas Black

- 5.1.3. Lamp Black

- 5.1.4. Thermal Black

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Tires and Industrial Rubber Products

- 5.2.2. Plastics

- 5.2.3. Toners and Printing Inks

- 5.2.4. Coatings

- 5.2.5. Textile Fibers

- 5.2.6. Other Application

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jiangxi Heimao Carbon Black Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OCI COMPANY Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental Carbon Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cabot Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Epsilon Carbon Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Himadri Speciality Chemical Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Atlas Organics Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PCBL (Phillips Carbon Black Limited)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BKT Carbon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Birla Carbon

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Jiangxi Heimao Carbon Black Co Ltd

List of Figures

- Figure 1: India Carbon Black Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Carbon Black Market Share (%) by Company 2025

List of Tables

- Table 1: India Carbon Black Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 2: India Carbon Black Market Volume K Tons Forecast, by Process Type 2020 & 2033

- Table 3: India Carbon Black Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: India Carbon Black Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: India Carbon Black Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: India Carbon Black Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: India Carbon Black Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 8: India Carbon Black Market Volume K Tons Forecast, by Process Type 2020 & 2033

- Table 9: India Carbon Black Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: India Carbon Black Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: India Carbon Black Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: India Carbon Black Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Carbon Black Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the India Carbon Black Market?

Key companies in the market include Jiangxi Heimao Carbon Black Co Ltd, OCI COMPANY Ltd, Continental Carbon Company, Cabot Corporation, Epsilon Carbon Private Limited, Himadri Speciality Chemical Ltd, Atlas Organics Private Limited, PCBL (Phillips Carbon Black Limited), BKT Carbon, Birla Carbon.

3. What are the main segments of the India Carbon Black Market?

The market segments include Process Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Tire Industry; Increasing Market Penetration of Specialty Black; Growing Applications In the Batteries Segment.

6. What are the notable trends driving market growth?

Furnace Process Type to Dominate the Carbon Black Market in India.

7. Are there any restraints impacting market growth?

Rising Prominence of Green Tires; Volatility In Prices of Raw Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Carbon Black Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Carbon Black Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Carbon Black Market?

To stay informed about further developments, trends, and reports in the India Carbon Black Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence