Key Insights

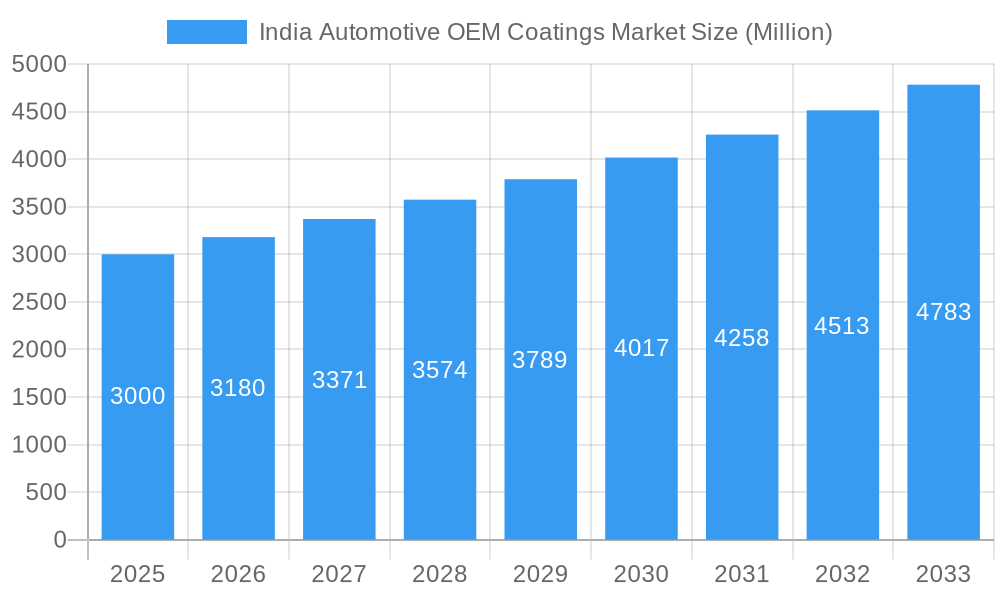

The India Automotive OEM Coatings market is poised for significant expansion, driven by the robust growth of the automotive sector and escalating demand for premium, long-lasting finishes. The forecast period (2025-2033) projects a Compound Annual Growth Rate (CAGR) of 5.09%. This growth is underpinned by increasing passenger vehicle and two-wheeler ownership, the adoption of advanced coating technologies for enhanced durability and aesthetics, and supportive government initiatives promoting domestic automotive manufacturing. The trend towards fuel-efficient and lightweight vehicles also drives demand for specialized coatings that improve performance. Furthermore, a notable shift towards eco-friendly water-based coatings is evident, aligning with environmental consciousness and stringent emission regulations.

India Automotive OEM Coatings Market Market Size (In Billion)

As of the base year 2024, the market size is estimated at 1616.8 million. The historical period (2019-2024) demonstrated consistent growth, leading to the current market valuation. The forecast period anticipates sustained expansion, with potential for accelerated growth contingent on continued government support for automotive manufacturing and infrastructure development. Key market participants are prioritizing innovation, strategic partnerships, and market expansion to leverage these growth opportunities.

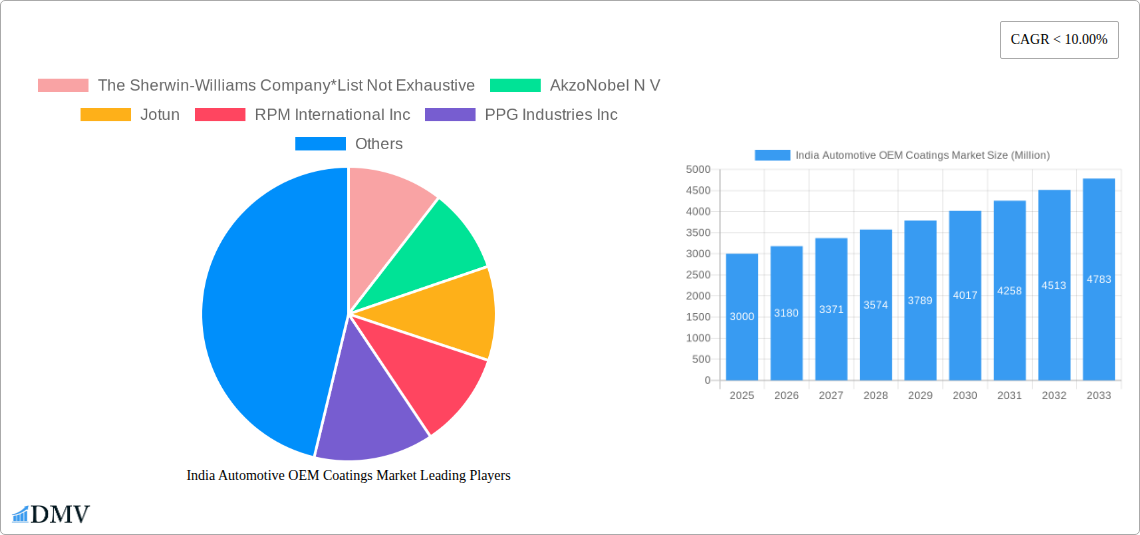

India Automotive OEM Coatings Market Company Market Share

India Automotive OEM Coatings Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the India Automotive OEM Coatings Market, offering a comprehensive overview of market dynamics, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report covers key segments including resin type (Epoxy, Acrylic, Alkyd, Polyurethane, Polyester, Other Resin Type), technology (Water-borne, Solvent-borne, Others), and end-user industry (Passenger Cars, Commercial Vehicles, ACE). Market size is projected in Millions.

India Automotive OEM Coatings Market Composition & Trends

This section delves into the competitive landscape of the Indian automotive OEM coatings market, analyzing market concentration, innovation drivers, regulatory influences, and substitute product impacts. We examine end-user profiles and M&A activities, providing a comprehensive understanding of the market’s structure and evolution. Market share distribution among key players like The Sherwin-Williams Company, AkzoNobel N.V., Jotun, RPM International Inc, PPG Industries Inc, Beckers Group, Nippon Paint Holdings Co Ltd, BASF SE, Kansai Nerolac Paints Limited, Teknos Group, and Axalta Coating Systems LLC is assessed. The report also quantifies M&A deal values, highlighting significant transactions that have shaped the market landscape. The analysis incorporates data on market concentration ratios and identifies key trends such as the increasing adoption of sustainable coatings and the growing demand for high-performance coatings. Regulatory changes influencing material composition and emission standards are also factored in, along with an assessment of substitute products and their potential impact on market share. End-user profiles including passenger car manufacturers, commercial vehicle producers, and the ACE sector (Aftermarket Collision Repair sector), and their coating needs are comprehensively addressed, contributing to a detailed understanding of market demand.

- Market Share Distribution: (Detailed breakdown of market share for each major player - data needs to be filled in based on research, estimated if precise figures are unavailable. Example: AkzoNobel – xx%, BASF – xx%, PPG – xx%, etc.)

- M&A Activity: (Summary of significant M&A deals with approximate values - data needs to be filled in based on research. Example: Acquisition of X company by Y company in 2022 for xx Million USD.)

- Regulatory Landscape: (Summary of key regulations impacting the market, mentioning specific laws and their implications. Example: Impact of new emission standards on the demand for water-borne coatings.)

- Substitute Products: (Discussion of alternative coatings and their market penetration, and their potential to disrupt the market.)

India Automotive OEM Coatings Market Industry Evolution

This section provides a detailed analysis of the India Automotive OEM Coatings Market's growth trajectory, exploring historical data (2019-2024) and forecasting market trends (2025-2033). We examine technological advancements, such as the increasing adoption of water-borne coatings and the development of new high-performance formulations. The influence of shifting consumer preferences for eco-friendly and durable coatings is also discussed, offering insights into the factors driving market growth. Specific data points such as compound annual growth rates (CAGR) for different segments and adoption rates of new technologies are incorporated to illustrate the market's dynamic evolution. The growth and its factors are carefully dissected to showcase the market's historical progression and what the future holds. The influence of macro-economic factors and shifts in consumer preferences, especially the growing demand for sustainable and high-performance coatings, is also explained with accurate market insights. The trends in technology adoption, such as the shift from solvent-borne to water-borne coatings, is evaluated to predict and provide a concrete analysis of the market's future growth. (This section requires extensive research to fill in the data points. Example: CAGR for water-borne coatings between 2025-2033: xx%, Adoption rate of UV-curable coatings in passenger cars by 2030: xx%)

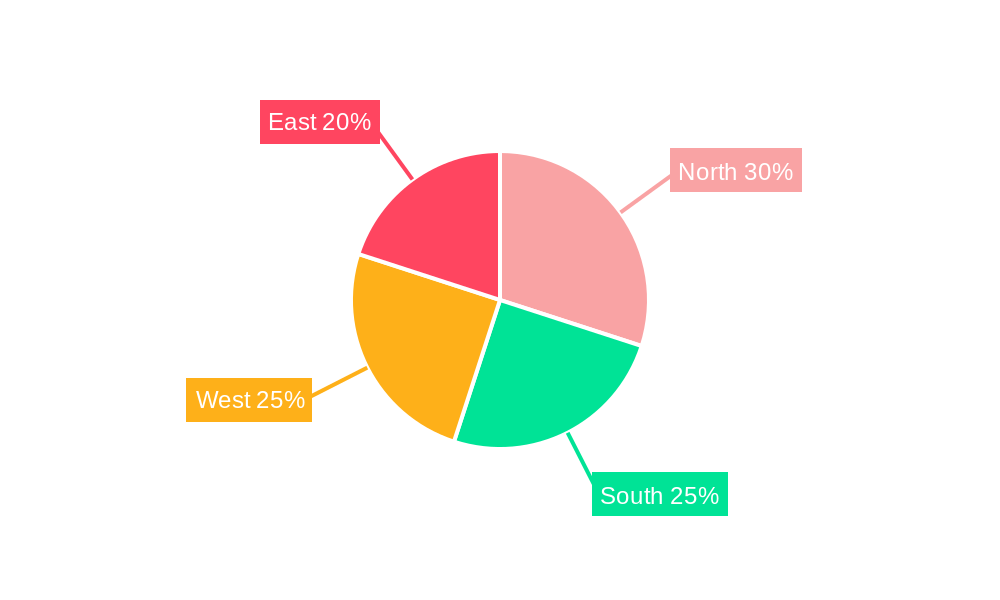

Leading Regions, Countries, or Segments in India Automotive OEM Coatings Market

This section identifies the leading regions, countries, and segments within the Indian automotive OEM coatings market. We analyze market dominance factors for each key segment (Resin Type, Technology, End-user Industry) using a combination of in-depth analysis and bullet points highlighting key drivers. The influence of investment patterns, regulatory support, and regional economic factors on market share is addressed for each segment. (This section needs detailed market segmentation data. For example, the analysis could show that the passenger car segment is the largest, driven by high vehicle production rates and consumer preference for specific coating technologies).

- Key Drivers for Dominant Segments:

- Passenger Cars: High vehicle production, increasing disposable income, and growing preference for aesthetics and durability.

- Water-borne Technology: Stringent environmental regulations, health concerns related to solvents, and cost-effectiveness.

- Acrylic Resin Type: Versatile properties, cost-effectiveness, and suitability for various applications. (Further detailed bullet points for each segment – data needs to be filled in based on research.)

India Automotive OEM Coatings Market Product Innovations

This section highlights recent product innovations in the Indian automotive OEM coatings market. We describe new coating formulations, their applications, and performance characteristics, focusing on unique selling propositions (USPs) and technological advancements. Examples include the introduction of coatings with enhanced durability, scratch resistance, and UV protection. (This section requires information on specific product launches and their features).

Propelling Factors for India Automotive OEM Coatings Market Growth

This section outlines the key drivers propelling the growth of the India Automotive OEM Coatings Market. We focus on technological advancements (e.g., the adoption of water-borne coatings), economic factors (e.g., growing automotive production), and regulatory influences (e.g., stricter emission norms). (Specific examples needed here – e.g., data on automotive production growth rates).

Obstacles in the India Automotive OEM Coatings Market

This section identifies the major challenges facing the Indian automotive OEM coatings market. We discuss regulatory hurdles, potential supply chain disruptions, and the intense competitive pressure from both domestic and international players. The section will quantify the impact of these challenges where possible. (Specific examples and data on the impact of each challenge are required).

Future Opportunities in India Automotive OEM Coatings Market

This section explores promising future opportunities in the Indian automotive OEM coatings market. We highlight potential growth areas, such as the expansion into new market segments (e.g., electric vehicles), the adoption of advanced coating technologies (e.g., self-healing coatings), and evolving consumer preferences. (Specific examples are required).

Major Players in the India Automotive OEM Coatings Market Ecosystem

- The Sherwin-Williams Company

- AkzoNobel N.V.

- Jotun

- RPM International Inc

- PPG Industries Inc

- Beckers Group

- Nippon Paint Holdings Co Ltd

- BASF SE

- Kansai Nerolac Paints Limited

- Teknos Group

- Axalta Coating Systems LLC

Key Developments in India Automotive OEM Coatings Market Industry

- May 2022: BASF announced the expansion of its Automotive Coatings Application Center in Mangalore, India, to enhance customer service and develop innovative solutions. (Further details and impact on market dynamics should be included here. Add other relevant developments with year/month and impact descriptions).

Strategic India Automotive OEM Coatings Market Forecast

This section summarizes the key growth catalysts and their potential impact on the future of the India Automotive OEM Coatings Market. We offer a concise overview of the market's projected trajectory, highlighting significant growth opportunities and the overall market potential during the forecast period (2025-2033). (This section needs to summarize the findings from the previous sections and provide a concluding perspective on future growth potential).

India Automotive OEM Coatings Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Acrylic

- 1.3. Alkyd

- 1.4. Polyurethane

- 1.5. Polyester

- 1.6. Other Resin Type

-

2. Technology

- 2.1. Water-borne

- 2.2. Solvent-borne

- 2.3. Others

-

3. End-user Industry

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

- 3.3. ACE

India Automotive OEM Coatings Market Segmentation By Geography

- 1. India

India Automotive OEM Coatings Market Regional Market Share

Geographic Coverage of India Automotive OEM Coatings Market

India Automotive OEM Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Passenger Cars to Dominate the Market; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Ongoing Shortage of Semiconductors; Other Restraints

- 3.4. Market Trends

- 3.4.1. Passenger Vehicles Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automotive OEM Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Acrylic

- 5.1.3. Alkyd

- 5.1.4. Polyurethane

- 5.1.5. Polyester

- 5.1.6. Other Resin Type

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Solvent-borne

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.3.3. ACE

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Sherwin-Williams Company*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AkzoNobel N V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jotun

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RPM International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PPG Industries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Beckers Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nippon Paint Holdings Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kansai Nerolac Paints Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Teknos Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Axalta Coating Systems LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 The Sherwin-Williams Company*List Not Exhaustive

List of Figures

- Figure 1: India Automotive OEM Coatings Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Automotive OEM Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: India Automotive OEM Coatings Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 2: India Automotive OEM Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 3: India Automotive OEM Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 4: India Automotive OEM Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 5: India Automotive OEM Coatings Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: India Automotive OEM Coatings Market Volume liter Forecast, by End-user Industry 2020 & 2033

- Table 7: India Automotive OEM Coatings Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: India Automotive OEM Coatings Market Volume liter Forecast, by Region 2020 & 2033

- Table 9: India Automotive OEM Coatings Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 10: India Automotive OEM Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 11: India Automotive OEM Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 12: India Automotive OEM Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 13: India Automotive OEM Coatings Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 14: India Automotive OEM Coatings Market Volume liter Forecast, by End-user Industry 2020 & 2033

- Table 15: India Automotive OEM Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: India Automotive OEM Coatings Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automotive OEM Coatings Market?

The projected CAGR is approximately 5.09%.

2. Which companies are prominent players in the India Automotive OEM Coatings Market?

Key companies in the market include The Sherwin-Williams Company*List Not Exhaustive, AkzoNobel N V, Jotun, RPM International Inc, PPG Industries Inc, Beckers Group, Nippon Paint Holdings Co Ltd, BASF SE, Kansai Nerolac Paints Limited, Teknos Group, Axalta Coating Systems LLC.

3. What are the main segments of the India Automotive OEM Coatings Market?

The market segments include Resin Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1616.8 million as of 2022.

5. What are some drivers contributing to market growth?

Passenger Cars to Dominate the Market; Other Drivers.

6. What are the notable trends driving market growth?

Passenger Vehicles Dominate the Market.

7. Are there any restraints impacting market growth?

Ongoing Shortage of Semiconductors; Other Restraints.

8. Can you provide examples of recent developments in the market?

In May 2022, BASF recently announced the expansion of its Automotive Coatings Application Center in Mangalore (India) in order to improve customer service and develop innovative solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automotive OEM Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automotive OEM Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automotive OEM Coatings Market?

To stay informed about further developments, trends, and reports in the India Automotive OEM Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence