Key Insights

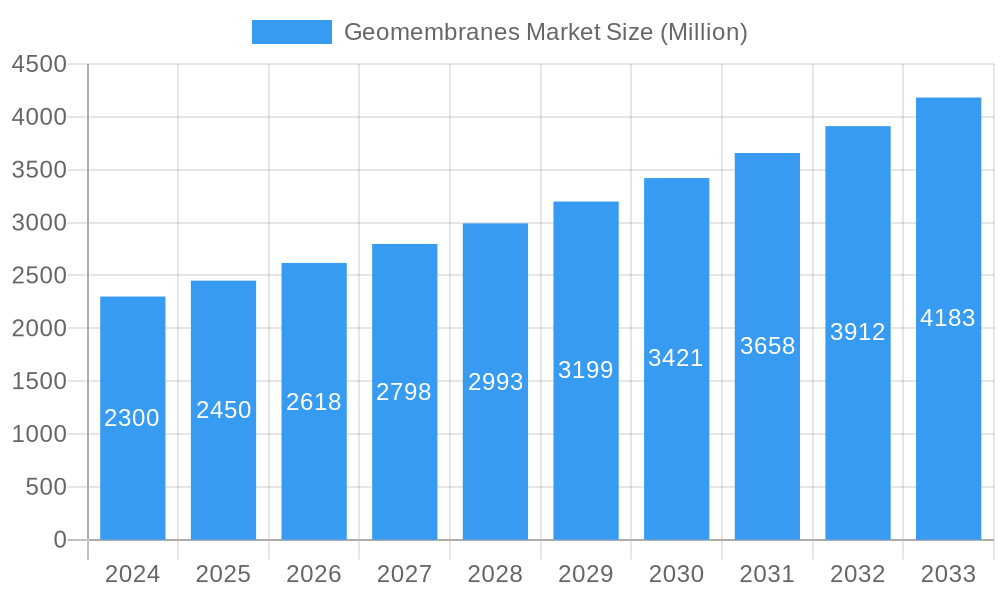

The global Geomembranes Market is poised for significant expansion, projected to reach a substantial USD 2.45 billion in value. This growth is fueled by an estimated Compound Annual Growth Rate (CAGR) of 6.61% between the study period of 2019-2033, with the base and estimated year being 2025. The increasing global focus on environmental protection and sustainable resource management, particularly in water and waste management applications, serves as a primary driver for this market. The construction sector's robust demand for durable and leak-proof lining solutions in infrastructure projects, such as dams, canals, and landfills, further bolsters market expansion. Moreover, the mining industry's reliance on geomembranes for containment and environmental compliance in tailings management and heap leaching operations contributes significantly to market dynamics. Emerging economies are witnessing accelerated adoption due to heavy investments in infrastructure development and stricter environmental regulations.

Geomembranes Market Market Size (In Billion)

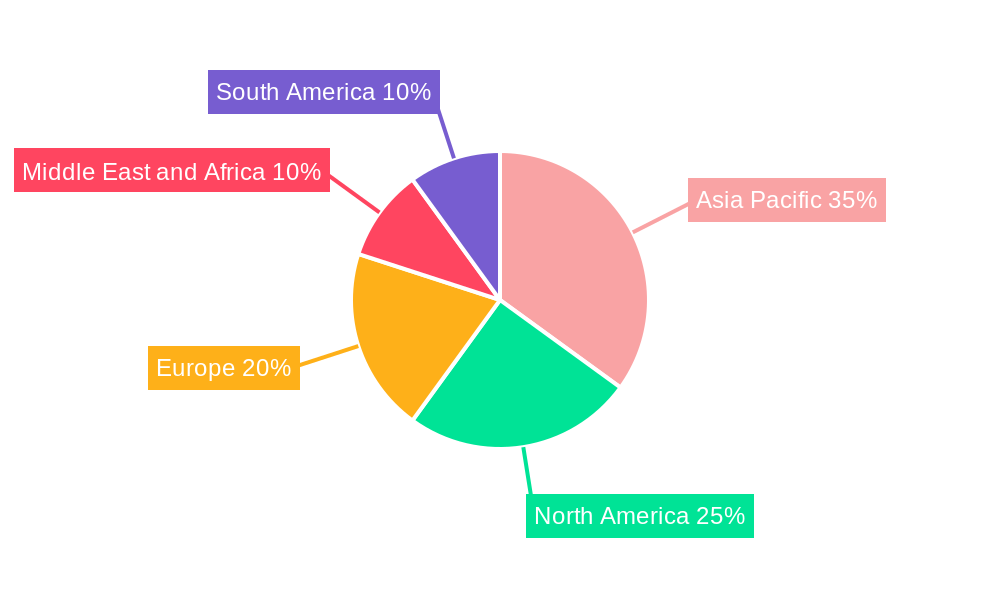

The market is segmented by a variety of raw materials, with High-density Polyethylene (HDPE), Low-density Polyethylene (LDPE), and Linear Low-density Polyethylene (LLDPE) currently dominating due to their superior strength, flexibility, and chemical resistance. Polyvinyl Chloride (PVC) and Ethylene Propylene Diene Monomer (EPDM) also hold significant shares, catering to specific application requirements. Key applications driving growth include water management, where geomembranes are crucial for pond liners, canals, and reservoirs, and waste management for landfill liners and containment systems. The construction and mining sectors are also substantial consumers. Geographically, the Asia Pacific region, led by China and India, is anticipated to exhibit the fastest growth owing to rapid industrialization, urbanization, and government initiatives promoting environmental infrastructure. North America and Europe remain mature markets with steady demand driven by stringent environmental regulations and ongoing infrastructure upgrades. Prominent players in the geomembranes market are actively engaged in product innovation and strategic expansions to capture market share.

Geomembranes Market Company Market Share

Unlocking the global geomembranes market from a projected USD XX Billion in 2025 to USD XX Billion by 2033, exhibiting a robust CAGR of XX% from 2025 to 2033. This in-depth report offers a strategic overview of the geomembranes industry, covering market dynamics, key players, technological advancements, and future projections. We delve into the intricate details of geomembranes market analysis, geomembranes market trends, and geomembranes market size, providing actionable intelligence for stakeholders across various sectors.

Geomembranes Market Market Composition & Trends

The geomembranes market exhibits a moderate to high concentration, driven by specialized manufacturers and a growing demand for engineered solutions in environmental protection and infrastructure development. Innovation catalysts include advancements in polymer science for enhanced durability, chemical resistance, and UV stability, alongside the development of specialized geomembrane types for niche applications. Regulatory landscapes play a crucial role, with stringent environmental mandates for waste containment, water resource management, and mining operations acting as significant drivers for geomembranes adoption. Substitute products, such as compacted clay liners, present a lower initial cost but often fall short in terms of long-term performance, containment reliability, and installation efficiency, especially in challenging environments. End-user profiles are diverse, ranging from municipal waste management authorities and large-scale agricultural operations to prominent players in the mining and construction sectors. Merger and acquisition (M&A) activities are steadily increasing as larger entities seek to consolidate market share and expand their product portfolios. For instance, the reported M&A deal value in the historical period (2019-2024) is estimated to be in the range of USD XX Million. Key trends include a growing preference for high-performance geomembranes, the rise of sustainable manufacturing practices, and the increasing use of geomembranes in hydraulic engineering projects.

- Market Share Distribution: Dominated by key raw materials such as HDPE and PVC, with increasing traction for EPDM in specific applications.

- M&A Activities: Driven by strategic consolidation, market expansion, and vertical integration.

Geomembranes Market Industry Evolution

The geomembranes market has witnessed a significant evolution driven by increasing global awareness of environmental protection, stringent regulations, and advancements in material science. Over the historical period (2019-2024), the market experienced steady growth, with an estimated compound annual growth rate (CAGR) of XX%. This trajectory is largely attributed to the escalating need for secure containment solutions in waste management, particularly in landfill liners and caps, to prevent groundwater contamination. Furthermore, the expansion of water management infrastructure, including reservoirs, canals, and wastewater treatment facilities, has fueled demand for durable and impermeable geomembranes. Technological advancements have been pivotal, leading to the development of geomembranes with superior tensile strength, puncture resistance, and longevity. For example, the introduction of textured geomembranes for improved frictional properties in steep slope applications has significantly broadened their utility. Shifting consumer demands are also influencing the market, with an increasing emphasis on cost-effectiveness without compromising on performance and environmental sustainability. The forecast period (2025-2033) is expected to see continued expansion, with an estimated CAGR of XX%, propelled by ongoing infrastructure development, climate change adaptation strategies, and a growing focus on resource conservation. Adoption metrics for advanced geomembranes have seen a year-on-year increase of approximately XX% in key application segments.

Leading Regions, Countries, or Segments in Geomembranes Market

The geomembranes market's dominance is shaped by a confluence of factors including robust infrastructure development, stringent environmental regulations, and the presence of major end-use industries.

Dominant Region: North America

North America stands out as a leading region in the global geomembranes market, driven by substantial investments in waste management infrastructure, a mature construction sector, and proactive environmental policies. The region’s focus on landfill remediation and the expansion of water containment systems for both municipal and industrial use significantly contributes to this leadership. The United States, in particular, accounts for a substantial market share due to its vast landmass, extensive mining operations requiring reliable containment, and ongoing efforts in water resource management.

Key Drivers for North American Dominance:

- High Investment in Waste Management: Extensive development and upgrading of landfills, requiring high-performance geomembranes for effective containment and leachate collection.

- Robust Construction and Infrastructure: Continuous investment in civil engineering projects, including dams, canals, and tunnels, where geomembranes are crucial for waterproofing and seepage control.

- Stringent Environmental Regulations: Government mandates for environmental protection and pollution prevention drive the adoption of advanced containment solutions.

- Significant Mining Sector: Large-scale mining operations necessitate robust geomembranes for tailing ponds and heap leach pad containment.

Dominant Segment: Water Management

Within the application segments, Water Management emerges as a primary growth engine for the geomembranes market. This segment encompasses a broad range of applications, including:

- Potable Water Reservoirs and Tanks: Ensuring the integrity and purity of drinking water supplies.

- Wastewater Treatment Plants: Lining clarifiers, lagoons, and containment areas.

- Canals and Irrigation Systems: Preventing water loss through seepage and improving water distribution efficiency.

- Dams and Reservoirs: Providing impermeable barriers to store and manage water resources.

- Pond Liners: For agricultural, industrial, and decorative purposes.

The increasing global demand for clean water, coupled with the necessity of efficient water resource management in arid regions and areas prone to drought, fuels the demand for durable and cost-effective geomembrane solutions. The high longevity and chemical resistance of geomembranes make them ideal for these critical applications, ensuring long-term water security and environmental compliance. The market for geomembranes in Water Management is projected to grow at a CAGR of XX% during the forecast period.

Geomembranes Market Product Innovations

Product innovation in the geomembranes market focuses on enhancing performance characteristics and expanding application possibilities. Manufacturers are developing geomembranes with superior chemical resistance to aggressive media, increased UV stability for prolonged outdoor exposure, and higher tensile and tear strengths for demanding environmental conditions. Innovations include the integration of recycled materials without compromising quality, the development of self-healing geomembranes, and the introduction of specialized textured surfaces for improved shear resistance in steep slope applications. These advancements lead to extended service life, reduced maintenance costs, and greater reliability in critical infrastructure projects.

Propelling Factors for Geomembranes Market Growth

The geomembranes market is propelled by several key factors, including increasing global investments in waste management infrastructure, driven by stricter environmental regulations and a growing population. The expanding construction and mining sectors, particularly in emerging economies, also contribute significantly, necessitating robust containment and waterproofing solutions. Technological advancements in polymer science leading to more durable, resilient, and cost-effective geomembranes further fuel market growth. Furthermore, the critical role of geomembranes in water resource management, including the development of reservoirs, canals, and wastewater treatment facilities, especially in regions facing water scarcity, is a major growth catalyst. The industry is also benefiting from growing awareness of the environmental benefits of geomembranes in preventing soil and groundwater contamination.

Obstacles in the Geomembranes Market Market

Despite robust growth, the geomembranes market faces certain obstacles. Fluctuations in raw material prices, primarily linked to crude oil derivatives, can impact manufacturing costs and product pricing. Stringent and evolving environmental regulations, while driving demand, can also create compliance challenges and require continuous investment in product development and certification. Supply chain disruptions, particularly in the procurement of key raw materials and the logistics of delivering large-scale products, can affect project timelines and costs. Moreover, the presence of lower-cost, less durable alternatives in certain segments can pose a competitive challenge, requiring manufacturers to continually emphasize the long-term value proposition and superior performance of their geomembrane solutions.

Future Opportunities in Geomembranes Market

Future opportunities in the geomembranes market lie in the increasing demand for advanced geomembranes in renewable energy projects, such as lining solar panel containment areas and agricultural biogas digesters. The growing focus on circular economy principles presents opportunities for the development and adoption of geomembranes made from recycled polymers. Emerging markets in developing countries, with significant infrastructure development needs and increasing environmental awareness, offer substantial untapped potential. Furthermore, innovations in smart geomembranes, incorporating sensors for real-time monitoring of integrity and performance, are poised to open new avenues for high-value applications in critical infrastructure. The expanding use of geomembranes in hydraulic engineering for coastal protection and flood defense also represents a significant growth area.

Major Players in the Geomembranes Market Ecosystem

- AGRU America Inc

- Plastika Kritis SA

- Istanbul Teknik

- NAUE GmbH & Co KG

- Shanghai Yingfan Engineering Material Co Ltd

- Jutta Ltd

- Nilex Inc

- Firestone Building Products Company LLC

- SOLMAX

- RENOLIT SE

- Officine Maccaferri Spa

- Sotrafa

- Texel Industries

- ATARFIL S L

- Raven Industries Inc

Key Developments in Geomembranes Market Industry

- April 2021: SOLMAX, a prominent manufacturer of polyethylene geomembranes, announced a significant strategic agreement to acquire TenCate Geosynthetics, thereby expanding its global footprint and product portfolio.

- July 2019 (operational by January 2021): RENOLIT SE, a leading German film manufacturer, established a joint venture in India for the production of geomembranes, specifically targeting the construction and civil engineering sectors. This venture, based in Pune, Maharashtra, aimed to strengthen their presence in the rapidly growing Indian market.

Strategic Geomembranes Market Market Forecast

The strategic geomembranes market forecast indicates sustained and robust growth driven by escalating global infrastructure development and stringent environmental regulations. Key growth catalysts include the increasing demand for effective waste containment solutions, the imperative for reliable water management systems, and the expanding footprint of the mining and construction industries worldwide. Technological advancements, leading to the development of high-performance, durable, and sustainable geomembranes, will continue to be a pivotal factor. Emerging markets, coupled with a heightened global focus on environmental protection and resource conservation, are expected to unlock significant new opportunities. The market is poised for continued expansion, with a projected market size of USD XX Billion by 2033, reflecting the indispensable role of geomembranes in safeguarding the environment and enabling critical infrastructure projects.

Geomembranes Market Segmentation

-

1. Raw Material

- 1.1. High-density Polyethylene (HDPE)

- 1.2. Low-density Polyethylene (LDPE)

- 1.3. Linear Low-density Polyethylene (LLDPE)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Propylene Diene Monomer (EPDM)

- 1.6. Polypropylene (PP)

- 1.7. Other Raw Materials

-

2. Application

- 2.1. Water Management

- 2.2. Waste Management

- 2.3. Mining

- 2.4. Construction

- 2.5. Agriculture

- 2.6. Soil Management

- 2.7. Other Applications

Geomembranes Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Chile

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Geomembranes Market Regional Market Share

Geographic Coverage of Geomembranes Market

Geomembranes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Use in Lining Applications; Increased Use of Geomembranes in Mining Applications

- 3.3. Market Restrains

- 3.3.1. Increasing Use of Geosynthetic Clay Liner in Lining Systems and Landfill

- 3.4. Market Trends

- 3.4.1. Waste Management Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Geomembranes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. High-density Polyethylene (HDPE)

- 5.1.2. Low-density Polyethylene (LDPE)

- 5.1.3. Linear Low-density Polyethylene (LLDPE)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Propylene Diene Monomer (EPDM)

- 5.1.6. Polypropylene (PP)

- 5.1.7. Other Raw Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Water Management

- 5.2.2. Waste Management

- 5.2.3. Mining

- 5.2.4. Construction

- 5.2.5. Agriculture

- 5.2.6. Soil Management

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Asia Pacific Geomembranes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. High-density Polyethylene (HDPE)

- 6.1.2. Low-density Polyethylene (LDPE)

- 6.1.3. Linear Low-density Polyethylene (LLDPE)

- 6.1.4. Polyvinyl Chloride (PVC)

- 6.1.5. Ethylene Propylene Diene Monomer (EPDM)

- 6.1.6. Polypropylene (PP)

- 6.1.7. Other Raw Materials

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Water Management

- 6.2.2. Waste Management

- 6.2.3. Mining

- 6.2.4. Construction

- 6.2.5. Agriculture

- 6.2.6. Soil Management

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. North America Geomembranes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. High-density Polyethylene (HDPE)

- 7.1.2. Low-density Polyethylene (LDPE)

- 7.1.3. Linear Low-density Polyethylene (LLDPE)

- 7.1.4. Polyvinyl Chloride (PVC)

- 7.1.5. Ethylene Propylene Diene Monomer (EPDM)

- 7.1.6. Polypropylene (PP)

- 7.1.7. Other Raw Materials

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Water Management

- 7.2.2. Waste Management

- 7.2.3. Mining

- 7.2.4. Construction

- 7.2.5. Agriculture

- 7.2.6. Soil Management

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Europe Geomembranes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. High-density Polyethylene (HDPE)

- 8.1.2. Low-density Polyethylene (LDPE)

- 8.1.3. Linear Low-density Polyethylene (LLDPE)

- 8.1.4. Polyvinyl Chloride (PVC)

- 8.1.5. Ethylene Propylene Diene Monomer (EPDM)

- 8.1.6. Polypropylene (PP)

- 8.1.7. Other Raw Materials

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Water Management

- 8.2.2. Waste Management

- 8.2.3. Mining

- 8.2.4. Construction

- 8.2.5. Agriculture

- 8.2.6. Soil Management

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. South America Geomembranes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. High-density Polyethylene (HDPE)

- 9.1.2. Low-density Polyethylene (LDPE)

- 9.1.3. Linear Low-density Polyethylene (LLDPE)

- 9.1.4. Polyvinyl Chloride (PVC)

- 9.1.5. Ethylene Propylene Diene Monomer (EPDM)

- 9.1.6. Polypropylene (PP)

- 9.1.7. Other Raw Materials

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Water Management

- 9.2.2. Waste Management

- 9.2.3. Mining

- 9.2.4. Construction

- 9.2.5. Agriculture

- 9.2.6. Soil Management

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. Middle East and Africa Geomembranes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. High-density Polyethylene (HDPE)

- 10.1.2. Low-density Polyethylene (LDPE)

- 10.1.3. Linear Low-density Polyethylene (LLDPE)

- 10.1.4. Polyvinyl Chloride (PVC)

- 10.1.5. Ethylene Propylene Diene Monomer (EPDM)

- 10.1.6. Polypropylene (PP)

- 10.1.7. Other Raw Materials

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Water Management

- 10.2.2. Waste Management

- 10.2.3. Mining

- 10.2.4. Construction

- 10.2.5. Agriculture

- 10.2.6. Soil Management

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AGRU America Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Plastika Kritis SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Istanbul Teknik

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NAUE GmbH & Co KG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shanghai Yingfan Engineering Material Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jutta Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nilex Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Firestone Building Products Company LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SOLMAX

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 RENOLIT SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Officine Maccaferri Spa

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sotrafa

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Texel Industries*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ATARFIL S L

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Raven Industries Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 AGRU America Inc

List of Figures

- Figure 1: Global Geomembranes Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Geomembranes Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 3: Asia Pacific Geomembranes Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 4: Asia Pacific Geomembranes Market Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Geomembranes Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Geomembranes Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Geomembranes Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Geomembranes Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 9: North America Geomembranes Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 10: North America Geomembranes Market Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Geomembranes Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Geomembranes Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Geomembranes Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Geomembranes Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 15: Europe Geomembranes Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 16: Europe Geomembranes Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Geomembranes Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Geomembranes Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Geomembranes Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Geomembranes Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 21: South America Geomembranes Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 22: South America Geomembranes Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Geomembranes Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Geomembranes Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Geomembranes Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Geomembranes Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 27: Middle East and Africa Geomembranes Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 28: Middle East and Africa Geomembranes Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Geomembranes Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Geomembranes Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Geomembranes Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Geomembranes Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 2: Global Geomembranes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Geomembranes Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Geomembranes Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 5: Global Geomembranes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Geomembranes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Geomembranes Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 13: Global Geomembranes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Geomembranes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Geomembranes Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 19: Global Geomembranes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Geomembranes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Spain Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Geomembranes Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 28: Global Geomembranes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global Geomembranes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Chile Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Geomembranes Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 35: Global Geomembranes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Geomembranes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Saudi Arabia Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: South Africa Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Geomembranes Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Geomembranes Market?

The projected CAGR is approximately 6.61%.

2. Which companies are prominent players in the Geomembranes Market?

Key companies in the market include AGRU America Inc, Plastika Kritis SA, Istanbul Teknik, NAUE GmbH & Co KG, Shanghai Yingfan Engineering Material Co Ltd, Jutta Ltd, Nilex Inc, Firestone Building Products Company LLC, SOLMAX, RENOLIT SE, Officine Maccaferri Spa, Sotrafa, Texel Industries*List Not Exhaustive, ATARFIL S L, Raven Industries Inc.

3. What are the main segments of the Geomembranes Market?

The market segments include Raw Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Use in Lining Applications; Increased Use of Geomembranes in Mining Applications.

6. What are the notable trends driving market growth?

Waste Management Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Use of Geosynthetic Clay Liner in Lining Systems and Landfill.

8. Can you provide examples of recent developments in the market?

In April 2021, SOLMAX, a manufacturer of polyethylene geomembranes, has announced that the company has signed an agreement with Koninklijke Ten Cate to acquire TenCate Geosynthetics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Geomembranes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Geomembranes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Geomembranes Market?

To stay informed about further developments, trends, and reports in the Geomembranes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence