Key Insights

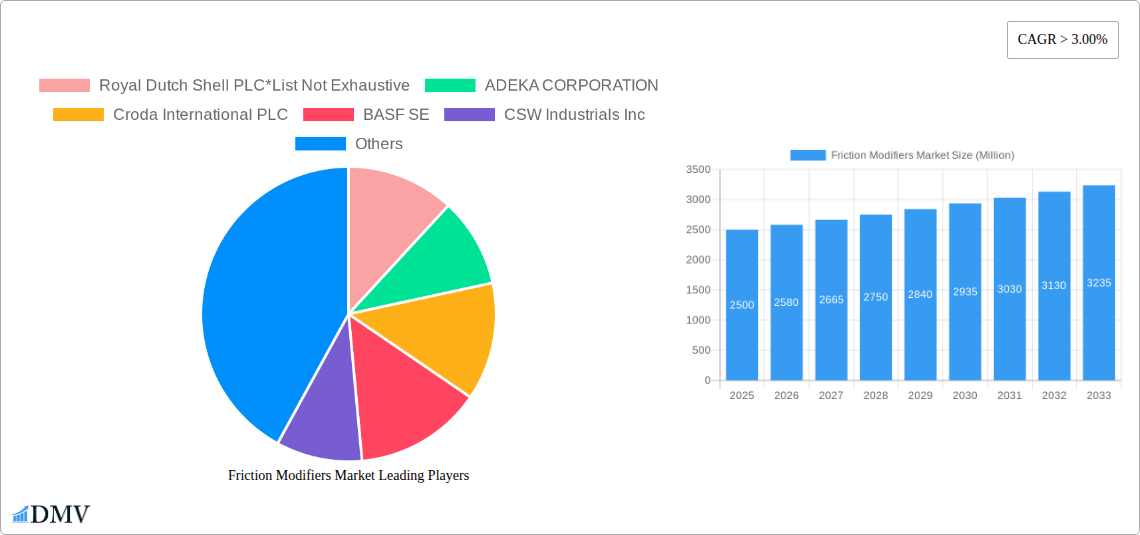

The global Friction Modifiers Market is poised for robust expansion, projected to reach a substantial market size of approximately USD 2.5 billion in 2025 and exhibit a Compound Annual Growth Rate (CAGR) exceeding 3.00% through 2033. This growth is primarily propelled by the increasing demand for enhanced fuel efficiency and reduced wear in a variety of applications. Key drivers include stringent automotive emission regulations, the burgeoning automotive sector in emerging economies, and the growing adoption of advanced lubrication technologies across industrial and marine sectors. The market is witnessing a significant trend towards the development and adoption of organic friction modifiers, which offer superior performance characteristics and are generally more environmentally friendly compared to their inorganic counterparts. These advanced formulations are critical for meeting evolving OEM specifications and consumer expectations for performance and sustainability.

Friction Modifiers Market Market Size (In Billion)

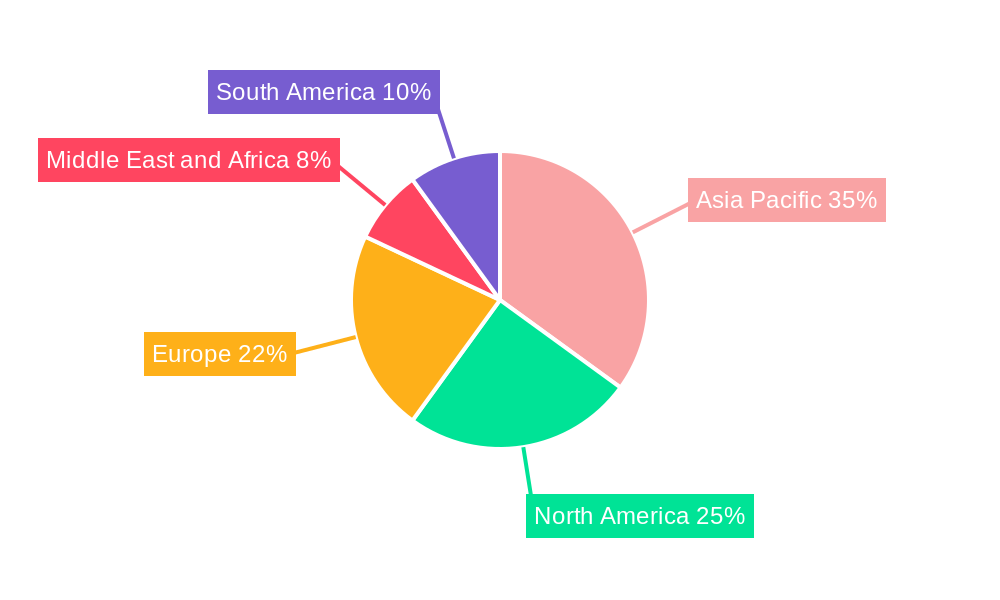

The market's trajectory is further shaped by the dynamic interplay of segmentation and regional demand. In terms of types, the market is broadly divided into organic and inorganic friction modifiers, with organic variants gaining considerable traction due to their enhanced biodegradability and performance benefits. The end-user industry segmentation reveals a strong contribution from the automotive sector, driven by the continuous innovation in vehicle powertrains and the increasing complexity of engine designs. The industrial and marine sectors also represent significant application areas, where the need for optimized equipment performance and extended lifespan fuels demand. Geographically, the Asia Pacific region, led by China and India, is emerging as a powerhouse, owing to rapid industrialization and a massive automotive production base. North America and Europe remain crucial markets, driven by technological advancements and a strong focus on sustainability and performance enhancement. While growth is substantial, certain restraints such as the volatility of raw material prices and intense competition from alternative solutions may influence market dynamics.

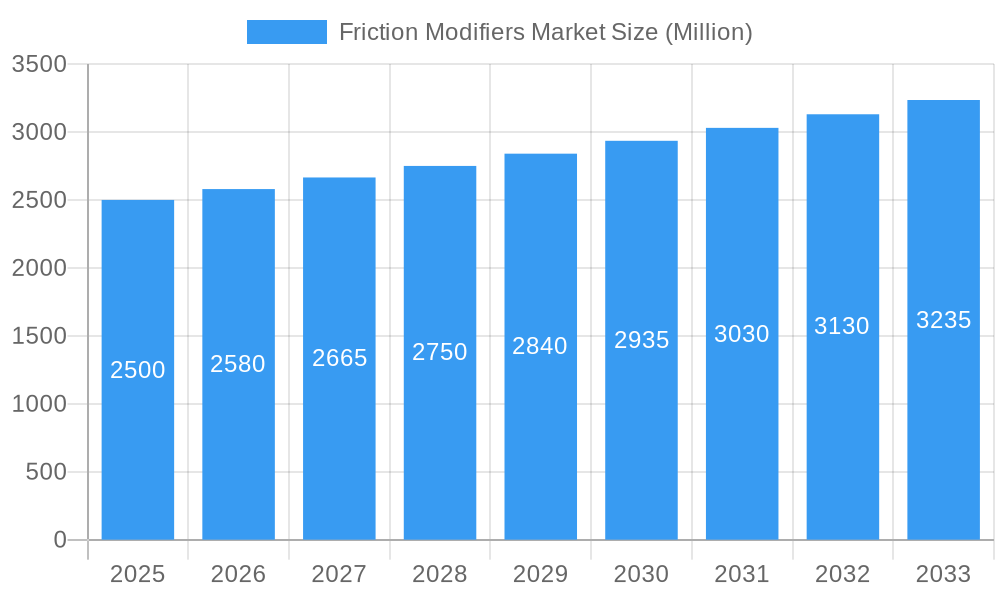

Friction Modifiers Market Company Market Share

This in-depth report provides a thorough examination of the global Friction Modifiers Market, offering critical insights into market dynamics, growth drivers, emerging trends, and future opportunities. Analyzing the period from 2019 to 2033, with a base year of 2025, this report leverages historical data and advanced forecasting to equip stakeholders with actionable intelligence. Delve into the intricate workings of the friction modifiers industry, understand its competitive landscape, and identify strategic avenues for growth in this vital sector. This report is essential for lubricant manufacturers, additive suppliers, automotive OEMs, industrial equipment producers, and investors seeking to capitalize on the evolving friction modifiers market.

Friction Modifiers Market Market Composition & Trends

The friction modifiers market exhibits a dynamic composition, characterized by a moderate level of market concentration driven by key players investing heavily in research and development to enhance product performance and sustainability. Innovation is a crucial catalyst, with ongoing efforts focused on developing novel organic friction modifiers and advanced inorganic friction modifiers that offer superior wear protection and fuel efficiency. The regulatory landscape, particularly concerning environmental impact and emissions standards, is increasingly influencing product formulations and market access. Substitute products, while present, are finding it challenging to match the specific performance benefits and cost-effectiveness of tailored friction modifier solutions. End-user profiles span across the automotive industry (for engine oils, transmissions, and drivelines), industrial applications (including manufacturing equipment, hydraulics, and gears), and the marine sector (for lubricants in harsh environments). Mergers and acquisitions (M&A) activities are significant indicators of strategic expansion and market consolidation. For instance, the Royal Dutch Shell PLC and CSW Industrials Inc. joint venture in January 2021 signifies a strategic move to bolster market presence in the North American rail and US mining sectors. The total M&A deal value in the friction modifiers sector is estimated to be in the range of several hundred million dollars annually, reflecting the high strategic importance of these additive technologies. The market share distribution is led by major chemical and oil & gas companies, with a combined share exceeding 60%.

Friction Modifiers Market Industry Evolution

The friction modifiers market has undergone significant evolution driven by technological advancements, shifting consumer demands, and stringent environmental regulations. Historically, the market was primarily focused on basic lubrication, but has since transitioned towards sophisticated additive technologies designed to optimize performance, enhance durability, and reduce operational costs. The forecast period, 2025-2033, is expected to witness sustained growth, with an estimated compound annual growth rate (CAGR) of approximately 5.5%. This upward trajectory is underpinned by several key factors. Firstly, the increasing demand for fuel-efficient vehicles in the automotive industry is a major impetus. Modern automotive engines and transmissions require advanced lubricants containing highly effective friction modifiers to minimize energy loss and improve miles per gallon. The market for organic friction modifiers is projected to grow at a faster pace due to their biodegradability and lower environmental impact, aligning with global sustainability initiatives.

Secondly, the industrial sector's continuous pursuit of enhanced machinery lifespan and reduced maintenance expenses fuels the adoption of sophisticated friction modifiers. From heavy-duty industrial gears to precision manufacturing equipment, the need for superior wear protection and reduced friction is paramount. The market size for industrial applications is expected to reach over USD 5,000 million by 2033.

Technological advancements in the synthesis and application of friction modifiers are also playing a crucial role. Researchers are developing new classes of compounds, including nanostructured materials and advanced organometallic complexes, that offer unprecedented levels of performance. These innovations allow for tailored solutions for specific operating conditions and material pairings. For example, advancements in molybdenum dithiocarbamates (MoDTC) and borate ester friction modifiers have significantly improved their efficacy in reducing friction and wear across a wider temperature range.

Furthermore, the growing awareness of the environmental impact of industrial processes is driving the demand for eco-friendly lubricant additives. This has led to a surge in the development and adoption of sustainable friction modifiers, contributing to a greener and more efficient industrial landscape. The shift towards electric vehicles (EVs) also presents a nuanced opportunity, with the demand for specialized friction modifiers for EV transmissions and e-axles expected to grow significantly, even as traditional engine oil additive needs evolve. The overall market size for friction modifiers is projected to exceed USD 12,000 million by 2033, demonstrating a robust expansion driven by these multifaceted factors.

Leading Regions, Countries, or Segments in Friction Modifiers Market

The friction modifiers market is experiencing leadership and dominance across various regions and segments, driven by distinct economic, industrial, and regulatory landscapes.

Dominant Segment by Type: Organic Friction Modifiers

- Market Share: Organic friction modifiers are projected to hold a significant market share, estimated at over 65% by 2033.

- Key Drivers:

- Environmental Regulations: Stricter environmental regulations worldwide, promoting biodegradability and reduced toxicity, strongly favor organic compounds.

- Performance Enhancements: Continuous R&D in organic chemistry leads to the development of novel molecules offering superior friction reduction and anti-wear properties tailored for modern applications.

- Fuel Efficiency Demands: The automotive sector's relentless pursuit of fuel economy directly translates to a higher demand for efficient organic friction modifiers in engine oils and driveline fluids.

- Cost-Effectiveness: In many applications, advanced organic friction modifiers offer a competitive balance of performance and cost compared to certain inorganic alternatives.

- Versatility: Organic friction modifiers are highly versatile, finding extensive use across diverse end-user industries.

Dominant End-User Industry: Automotive

- Market Size: The automotive segment is the largest consumer of friction modifiers, with its market size expected to reach over USD 7,000 million by 2033.

- Key Drivers:

- Vehicle Production & Sales: Global vehicle production and sales directly correlate with the demand for engine oils, transmission fluids, and other lubricants that incorporate friction modifiers.

- Stricter Emission Standards: Mandates for lower CO2 emissions and improved fuel efficiency in vehicles necessitate the use of advanced friction modifiers to reduce internal friction and optimize powertrain performance.

- Evolution of Powertrain Technologies: The development of sophisticated transmissions, hybrid powertrains, and electric vehicle drivetrains requires specialized friction modifier formulations to ensure optimal lubrication and longevity.

- Aftermarket Demand: The substantial global vehicle parc ensures consistent demand for maintenance lubricants and fluids containing friction modifiers in the aftermarket.

- OEM Specifications: Stringent performance specifications set by Original Equipment Manufacturers (OEMs) drive the adoption of high-performance friction modifiers.

Leading Region: Asia Pacific

- Market Dominance: Asia Pacific is anticipated to be the largest and fastest-growing regional market for friction modifiers, accounting for approximately 35% of the global market share by 2033.

- Key Drivers:

- Robust Automotive Manufacturing Hubs: Countries like China, India, South Korea, and Japan are major global centers for automotive production, driving substantial demand for lubricant additives.

- Industrialization and Infrastructure Development: Rapid industrialization across the region fuels the demand for friction modifiers in heavy machinery, manufacturing equipment, and construction vehicles.

- Growing Middle Class and Disposable Income: An expanding middle class in emerging economies leads to increased vehicle ownership and demand for automotive lubricants.

- Favorable Government Policies: Supportive government initiatives promoting manufacturing and technological advancements in sectors like automotive and heavy industry contribute to market growth.

- Increasing Investment in R&D: Local and international companies are investing in research and development within the region to cater to the specific needs of the burgeoning markets.

While organic friction modifiers and the automotive industry are leading segments, and Asia Pacific dominates geographically, it is important to note the significant contributions and growth potential in inorganic friction modifiers, industrial applications, and other regions such as North America and Europe, driven by their own unique market dynamics and technological advancements.

Friction Modifiers Market Product Innovations

Product innovation in the friction modifiers market is predominantly focused on enhancing performance metrics and addressing environmental concerns. Companies are developing advanced organic friction modifiers such as esters and amides with improved thermal stability and lubricity, offering up to 10% reduction in friction coefficients in high-temperature engine applications. Innovations in inorganic friction modifiers, including advanced molybdenum disulfide (MoS2) nano-coatings and boron nitride derivatives, are delivering exceptional wear resistance and load-carrying capacities, extending equipment life by an estimated 20%. Furthermore, the development of multi-functional additives that combine friction modification with anti-wear, anti-corrosion, and detergency properties is gaining traction, providing more comprehensive lubricant solutions. The adoption of these innovative products is crucial for meeting the evolving demands of the automotive and industrial sectors for greater efficiency and durability.

Propelling Factors for Friction Modifiers Market Growth

Several key factors are propelling the growth of the friction modifiers market. The relentless pursuit of fuel efficiency in the automotive industry, driven by stringent global regulations and consumer demand, is a primary growth catalyst. This necessitates the use of advanced organic friction modifiers that reduce internal engine friction. Secondly, the industrial sector's increasing focus on equipment longevity and reduced maintenance costs fuels demand for high-performance inorganic friction modifiers offering superior wear protection. Technological advancements in lubricant formulations, leading to the development of specialized additives for evolving powertrains, including those in electric vehicles, also contribute significantly. Finally, growing environmental consciousness and the demand for sustainable solutions are driving the adoption of biodegradable and eco-friendly friction modifiers.

Obstacles in the Friction Modifiers Market Market

Despite robust growth prospects, the friction modifiers market faces several obstacles. Stringent and evolving regulatory landscapes, particularly concerning the environmental impact and biodegradability of additives, can pose significant compliance challenges and necessitate costly reformulation. Supply chain disruptions, exacerbated by geopolitical uncertainties and raw material price volatility, can impact the availability and cost-effectiveness of key chemical components used in friction modifier production. Intense competitive pressures among established players and emerging manufacturers can lead to price erosion and reduced profit margins. Furthermore, the high cost of research and development for novel, high-performance friction modifiers can be a barrier to entry for smaller companies, limiting innovation to a few key players. The transition towards electric vehicles also presents a unique challenge, as the lubricant needs for EVs differ from those of internal combustion engine vehicles, requiring specialized additive packages.

Future Opportunities in Friction Modifiers Market

The friction modifiers market presents numerous future opportunities. The accelerating adoption of electric vehicles (EVs) is creating a demand for specialized friction modifiers for EV transmissions and e-axles, offering a new avenue for growth. The increasing emphasis on sustainability is driving opportunities for biodegradable and environmentally friendly friction modifiers, aligning with circular economy principles. Expansion into emerging economies with growing automotive and industrial sectors, such as Southeast Asia and Africa, offers significant market potential. Furthermore, the development of advanced nanotechnology-based friction modifiers promises unprecedented performance enhancements, opening doors for high-value applications. The growing trend of predictive maintenance in industrial settings also creates opportunities for friction modifiers that can contribute to early detection of wear and degradation.

Major Players in the Friction Modifiers Market Ecosystem

- Royal Dutch Shell PLC

- ADEKA CORPORATION

- Croda International PLC

- BASF SE

- CSW Industrials Inc

- Chevron Corporation

- ABITEC

- The Lubrizol Corporation

- Multisol

- BRB International

- Afton Chemical

Key Developments in Friction Modifiers Market Industry

- January 2021: Royal Dutch Shell PLC and Whitmore Manufacturing LLC, a wholly-owned subsidiary of CSW Industrials, Inc., announced a definitive agreement to form a joint venture, Shell & Whitmore Reliability Solutions LLC, to market, distribute, and sell lubricants, friction modifiers, greases, and other reliability products, and related industrial services to the North American rail and US mining sectors. This strategic alliance aims to strengthen their market presence and expand their product offerings in specialized industrial segments.

- July 2019: Croda International Plc announced the acquisition of Rewitec GmbH, a manufacturer of friction and wear-reducing lubricant additives. This acquisition significantly enhances Croda's product portfolio and expands its additives business, particularly in high-performance friction modifier solutions for various industrial applications.

Strategic Friction Modifiers Market Market Forecast

The strategic outlook for the friction modifiers market is highly promising, driven by a confluence of technological innovation and escalating demand across key sectors. The continuous evolution towards higher fuel efficiency standards in the automotive industry, coupled with the burgeoning demand for electric vehicle lubricants, presents substantial growth avenues. Industrial applications, characterized by a growing emphasis on equipment lifespan and operational efficiency, will continue to be a significant market driver. The increasing focus on sustainability and biodegradability is also poised to reshape the product landscape, favoring the adoption of advanced organic friction modifiers. Strategic investments in research and development by major players like BASF SE, The Lubrizol Corporation, and Afton Chemical will further fuel the introduction of novel, high-performance additives. The market's future is also shaped by geographical expansion into rapidly industrializing regions and the potential for new applications emerging from advancements in material science and tribology, suggesting a robust and dynamic growth trajectory through 2033.

Friction Modifiers Market Segmentation

-

1. Types

- 1.1. Organic

- 1.2. Inorganic

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Marine

- 2.4. Other End-user Industries

Friction Modifiers Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Friction Modifiers Market Regional Market Share

Geographic Coverage of Friction Modifiers Market

Friction Modifiers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications for Fuel Efficient Lubricants; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Declining Automotive Industry; Growing Electric Vehicles Usage; Negative Impact of COVID-; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Industrial Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Friction Modifiers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Organic

- 5.1.2. Inorganic

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Marine

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Asia Pacific Friction Modifiers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Types

- 6.1.1. Organic

- 6.1.2. Inorganic

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Industrial

- 6.2.3. Marine

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Types

- 7. North America Friction Modifiers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Types

- 7.1.1. Organic

- 7.1.2. Inorganic

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Industrial

- 7.2.3. Marine

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Types

- 8. Europe Friction Modifiers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Types

- 8.1.1. Organic

- 8.1.2. Inorganic

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Industrial

- 8.2.3. Marine

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Types

- 9. South America Friction Modifiers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Types

- 9.1.1. Organic

- 9.1.2. Inorganic

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Industrial

- 9.2.3. Marine

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Types

- 10. Middle East and Africa Friction Modifiers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Types

- 10.1.1. Organic

- 10.1.2. Inorganic

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Industrial

- 10.2.3. Marine

- 10.2.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Types

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Royal Dutch Shell PLC*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ADEKA CORPORATION

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Croda International PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CSW Industrials Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chevron Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ABITEC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Lubrizol Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Multisol

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BRB International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Afton Chemical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Royal Dutch Shell PLC*List Not Exhaustive

List of Figures

- Figure 1: Global Friction Modifiers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Friction Modifiers Market Revenue (Million), by Types 2025 & 2033

- Figure 3: Asia Pacific Friction Modifiers Market Revenue Share (%), by Types 2025 & 2033

- Figure 4: Asia Pacific Friction Modifiers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Friction Modifiers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Friction Modifiers Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Friction Modifiers Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Friction Modifiers Market Revenue (Million), by Types 2025 & 2033

- Figure 9: North America Friction Modifiers Market Revenue Share (%), by Types 2025 & 2033

- Figure 10: North America Friction Modifiers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Friction Modifiers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Friction Modifiers Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Friction Modifiers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Friction Modifiers Market Revenue (Million), by Types 2025 & 2033

- Figure 15: Europe Friction Modifiers Market Revenue Share (%), by Types 2025 & 2033

- Figure 16: Europe Friction Modifiers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Friction Modifiers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Friction Modifiers Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Friction Modifiers Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Friction Modifiers Market Revenue (Million), by Types 2025 & 2033

- Figure 21: South America Friction Modifiers Market Revenue Share (%), by Types 2025 & 2033

- Figure 22: South America Friction Modifiers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Friction Modifiers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Friction Modifiers Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Friction Modifiers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Friction Modifiers Market Revenue (Million), by Types 2025 & 2033

- Figure 27: Middle East and Africa Friction Modifiers Market Revenue Share (%), by Types 2025 & 2033

- Figure 28: Middle East and Africa Friction Modifiers Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Friction Modifiers Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Friction Modifiers Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Friction Modifiers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Friction Modifiers Market Revenue Million Forecast, by Types 2020 & 2033

- Table 2: Global Friction Modifiers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Friction Modifiers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Friction Modifiers Market Revenue Million Forecast, by Types 2020 & 2033

- Table 5: Global Friction Modifiers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Friction Modifiers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Friction Modifiers Market Revenue Million Forecast, by Types 2020 & 2033

- Table 13: Global Friction Modifiers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Friction Modifiers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Friction Modifiers Market Revenue Million Forecast, by Types 2020 & 2033

- Table 19: Global Friction Modifiers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Friction Modifiers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Friction Modifiers Market Revenue Million Forecast, by Types 2020 & 2033

- Table 27: Global Friction Modifiers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Friction Modifiers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Friction Modifiers Market Revenue Million Forecast, by Types 2020 & 2033

- Table 33: Global Friction Modifiers Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Friction Modifiers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Friction Modifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Friction Modifiers Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Friction Modifiers Market?

Key companies in the market include Royal Dutch Shell PLC*List Not Exhaustive, ADEKA CORPORATION, Croda International PLC, BASF SE, CSW Industrials Inc, Chevron Corporation, ABITEC, The Lubrizol Corporation, Multisol, BRB International, Afton Chemical.

3. What are the main segments of the Friction Modifiers Market?

The market segments include Types, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications for Fuel Efficient Lubricants; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Usage in the Industrial Sector.

7. Are there any restraints impacting market growth?

Declining Automotive Industry; Growing Electric Vehicles Usage; Negative Impact of COVID-; Other Restraints.

8. Can you provide examples of recent developments in the market?

In January 2021, Royal Dutch Shell PLC and Whitmore Manufacturing LLC, a wholly-owned subsidiary of CSW Industrials, Inc., announced a definitive agreement to form a joint venture, Shell & Whitmore Reliability Solutions LLC, to market, distribute, and sell lubricants, friction modifiers, greases, and other reliability products, and related industrial services to the North American rail and US mining sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Friction Modifiers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Friction Modifiers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Friction Modifiers Market?

To stay informed about further developments, trends, and reports in the Friction Modifiers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence