Key Insights

France's silica sand market, estimated at €11.69 billion in 2025, is projected for significant expansion, forecasting a compound annual growth rate (CAGR) of 10.92% from 2025 to 2033. This growth is driven by strong demand across key sectors, including glass manufacturing, construction, and chemical production. The increasing adoption of silica sand in specialized applications, such as high-performance ceramics and refractories, further propels market development. France's ongoing infrastructure development and a rising commitment to sustainable construction practices present substantial opportunities for silica sand providers.

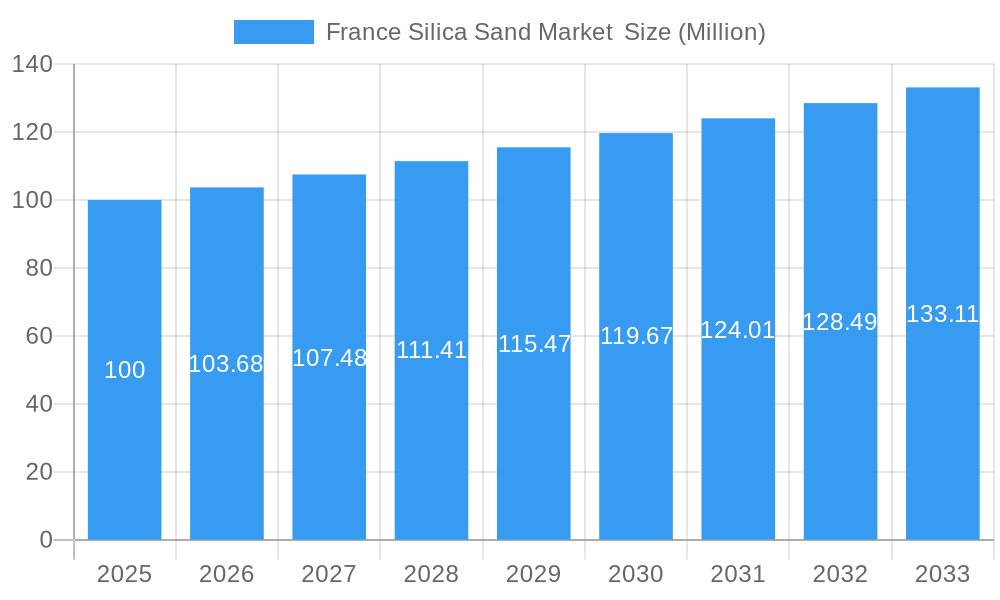

France Silica Sand Market Market Size (In Billion)

Challenges such as raw material price volatility and environmental considerations linked to extraction and processing temper market growth. Stringent environmental regulations and a focus on responsible sourcing necessitate sustainable mining techniques and investment in advanced processing technologies. Nevertheless, the market's upward trajectory is supported by sustained growth in primary end-use industries and the emergence of innovative applications, including advanced materials and filtration systems. The competitive environment includes global leaders like Solvay S.A. and Imerys S.A., alongside regional entities such as Quartzwerke GmbH and Equoquarz GmbH, reflecting a robust and evolving market structure in France.

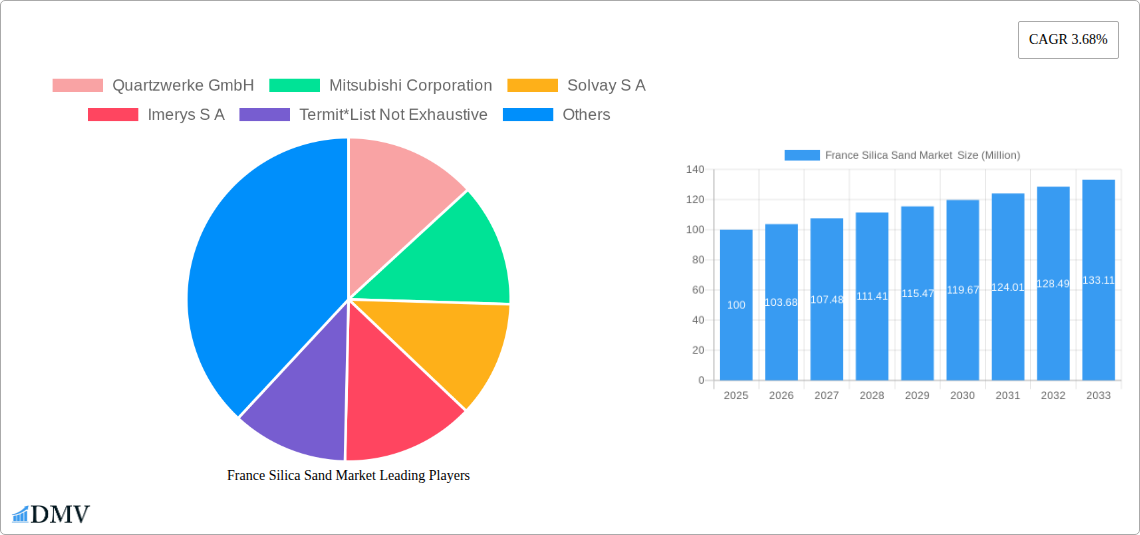

France Silica Sand Market Company Market Share

France Silica Sand Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the France silica sand market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report is valued at xx Million and projects a xx% CAGR during the forecast period.

France Silica Sand Market Composition & Trends

This section delves into the intricate landscape of the France silica sand market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute materials, end-user profiles, and significant M&A activities. The market is characterized by a moderately concentrated structure, with key players such as Imerys S.A., Sibelco, and SAMIN (Saint-Gobain) holding significant market share. However, the presence of numerous smaller, regional players ensures a competitive dynamic.

- Market Share Distribution (2024): Imerys S.A. (25%), Sibelco (20%), SAMIN (Saint-Gobain) (15%), Others (40%). (Note: These figures are estimates.)

- Innovation Catalysts: Growing demand for high-purity silica sand in specialized applications like electronics and solar energy is driving innovation in processing and purification technologies.

- Regulatory Landscape: Environmental regulations concerning sand mining and transportation are shaping market dynamics, influencing production practices and costs.

- Substitute Products: While silica sand possesses unique properties, alternative materials are emerging in niche applications, creating competitive pressure.

- End-User Profiles: The report provides detailed profiles of end-users across various sectors, including glass manufacturing, construction, and chemicals.

- M&A Activities: The recent acquisition of Recyverre by Sibelco in 2022, along with other acquisitions in Europe demonstrates consolidation trends within the industry. Total M&A deal value for the period 2019-2024 is estimated at xx Million.

France Silica Sand Market Industry Evolution

This section analyzes the evolutionary trajectory of the France silica sand market, examining growth patterns, technological advancements, and evolving consumer preferences. The historical period (2019-2024) witnessed moderate growth, primarily driven by construction activities and the chemical industry. However, the forecast period (2025-2033) is anticipated to see accelerated growth fueled by the rising demand for advanced materials in diverse sectors. Technological improvements in sand processing and purification are enabling the production of higher-quality silica sand, catering to the demands of specialized industries. Shifting consumer preferences towards sustainable building materials are also playing a role. The market is expected to reach xx Million by 2033. Specific data points on growth rates and adoption metrics for various technologies are presented within the full report.

Leading Regions, Countries, or Segments in France Silica Sand Market

The Glass Manufacturing sector emerges as a dominant segment in the France silica sand market. This is underpinned by the thriving glass industry in France, both in construction and packaging applications.

- Key Drivers for Glass Manufacturing Dominance:

- Significant investments in new glass manufacturing plants and expansion of existing facilities.

- Stringent quality standards for glass production driving demand for high-purity silica sand.

- Government support for sustainable glass manufacturing practices.

The detailed analysis explores the factors contributing to the dominance of Glass Manufacturing, while also providing insights into the growth potential of other segments, including construction, chemical production, and other specialized industrial applications.

France Silica Sand Market Product Innovations

Recent innovations in silica sand processing have focused on enhancing purity levels, particle size control, and surface modification to improve performance characteristics in diverse applications. These advancements cater to the stringent requirements of high-tech industries and deliver unique selling propositions, such as enhanced durability, improved optical properties, and superior reactivity in chemical processes. The adoption of advanced technologies like laser-induced breakdown spectroscopy for quality control is also on the rise.

Propelling Factors for France Silica Sand Market Growth

The France silica sand market's growth is propelled by several factors. The burgeoning construction sector consistently drives demand, while the expansion of the chemical and glass industries further fuels market growth. Furthermore, government initiatives promoting sustainable construction practices and advancements in silica sand processing technologies create additional momentum.

Obstacles in the France Silica Sand Market

The France silica sand market faces several challenges, including stringent environmental regulations impacting mining operations, potential supply chain disruptions due to geopolitical factors, and intense competition from both domestic and international players. These factors can constrain market growth and profitability.

Future Opportunities in France Silica Sand Market

Future opportunities lie in specialized applications like solar energy, electronics, and advanced ceramics, where high-purity silica sand is crucial. Expansion into new geographical markets and leveraging technological advancements to enhance product offerings present significant growth potential.

Major Players in the France Silica Sand Market Ecosystem

- Quartzwerke GmbH

- Mitsubishi Corporation

- Solvay S.A.

- Imerys S.A.

- Termit

- Sibelco

- Argeco Développement

- Fulchiron Industrielle

- Equoquarz GmbH

- SAMIN (Saint-Gobain)

Key Developments in France Silica Sand Market Industry

- April 2022: Sibelco's acquisition of Krynicki Recykling S.A. (Poland) and Recyverre (France) significantly expands its footprint in the European silica sand and glass recycling markets. This strategic move demonstrates consolidation within the industry and positions Sibelco for future growth. Further acquisitions of Kremer (Netherlands), Echave (Spain), and Bassanetti (Italy) reinforce this expansion strategy.

Strategic France Silica Sand Market Forecast

The France silica sand market is poised for robust growth driven by sustained demand from key end-use sectors and technological advancements. The strategic focus on product innovation and sustainable practices will shape the future of the market, creating ample opportunities for existing and new players. The market's evolution will be heavily influenced by environmental regulations and global economic trends.

France Silica Sand Market Segmentation

-

1. End-User Industry

- 1.1. Glass Manufacturing

- 1.2. Foundry

- 1.3. Chemical Production

- 1.4. Construction

- 1.5. Paints and Coatings

- 1.6. Ceramics and Refractories

- 1.7. Filtration

- 1.8. Oil and Gas Recovery

- 1.9. Other En

France Silica Sand Market Segmentation By Geography

- 1. France

France Silica Sand Market Regional Market Share

Geographic Coverage of France Silica Sand Market

France Silica Sand Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Construction Industry; Increasing Consumption in the Glass and Ceramics Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes; Illegal Mining of Sand

- 3.4. Market Trends

- 3.4.1. Construction Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Glass Manufacturing

- 5.1.2. Foundry

- 5.1.3. Chemical Production

- 5.1.4. Construction

- 5.1.5. Paints and Coatings

- 5.1.6. Ceramics and Refractories

- 5.1.7. Filtration

- 5.1.8. Oil and Gas Recovery

- 5.1.9. Other En

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Quartzwerke GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Solvay S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Imerys S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Termit*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sibelco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Argeco Développement

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fulchiron Industrielle

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Equoquarz GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SAMIN (Saint-Gobain)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Quartzwerke GmbH

List of Figures

- Figure 1: France Silica Sand Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Silica Sand Market Share (%) by Company 2025

List of Tables

- Table 1: France Silica Sand Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 2: France Silica Sand Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 3: France Silica Sand Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Silica Sand Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: France Silica Sand Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: France Silica Sand Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 7: France Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: France Silica Sand Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Silica Sand Market ?

The projected CAGR is approximately 10.92%.

2. Which companies are prominent players in the France Silica Sand Market ?

Key companies in the market include Quartzwerke GmbH, Mitsubishi Corporation, Solvay S A, Imerys S A, Termit*List Not Exhaustive, Sibelco, Argeco Développement, Fulchiron Industrielle, Equoquarz GmbH, SAMIN (Saint-Gobain).

3. What are the main segments of the France Silica Sand Market ?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.69 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Construction Industry; Increasing Consumption in the Glass and Ceramics Industry; Other Drivers.

6. What are the notable trends driving market growth?

Construction Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

Availability of Substitutes; Illegal Mining of Sand.

8. Can you provide examples of recent developments in the market?

April 2022: Sibelco announced the acquisition of Krynicki Recykling S.A., one of the leading glass recyclers in Poland, after acquiring 100% of Recyverre, a flat glass recycler in France. This announcement came in addition to Sibelco announcing the acquisition of Kremer (Netherlands), Echave (Spain), and Bassanetti (Italy) silica sand operations. Both the glass and silica sand business units have helped in the expansion of Sibelco's operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Silica Sand Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Silica Sand Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Silica Sand Market ?

To stay informed about further developments, trends, and reports in the France Silica Sand Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence