Key Insights

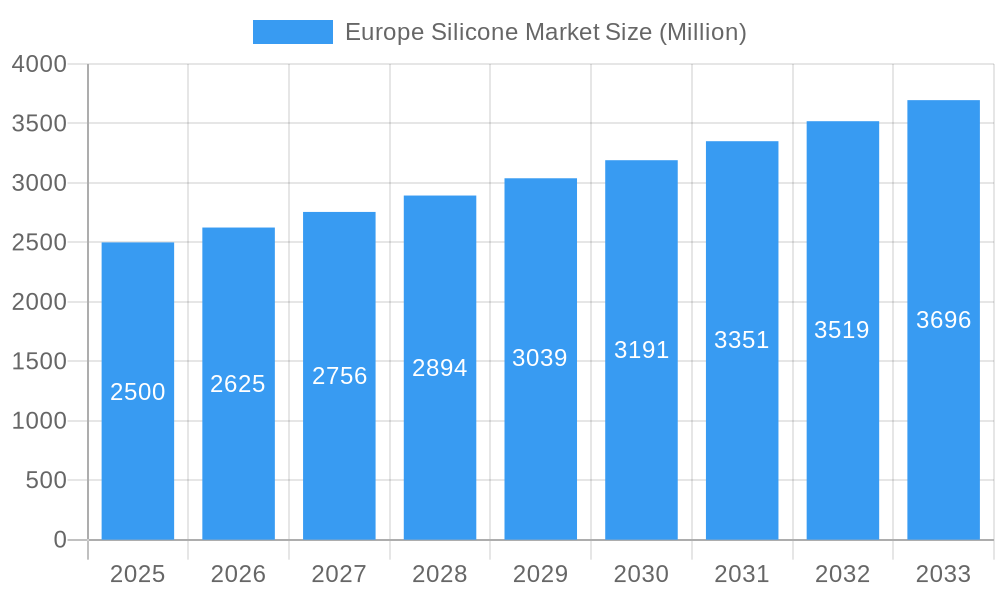

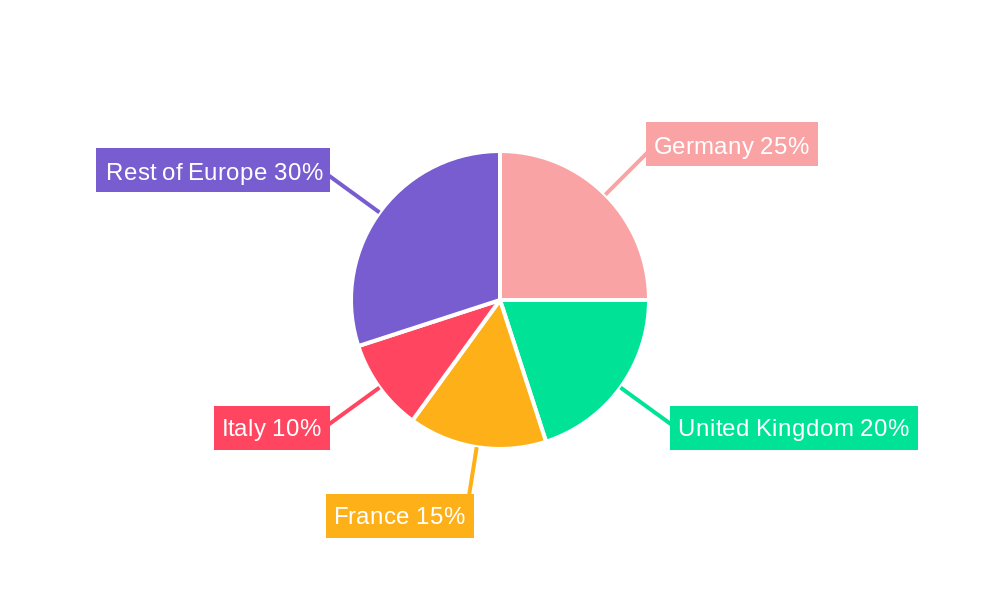

The European silicone market, valued at approximately €3.3 billion in 2025, is projected for significant expansion, forecasting a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This growth trajectory is propelled by several key demand drivers. The automotive sector's increasing need for advanced silicone sealants and gaskets is a primary contributor. Concurrently, the construction industry's adoption of durable and weather-resistant silicone-based sealants and coatings fuels market momentum. The electronics industry's reliance on silicones for essential insulation and encapsulation further bolsters demand. Additionally, the personal care and consumer products segment experiences robust growth due to the rising preference for silicone ingredients in cosmetics and everyday items. Germany, the United Kingdom, and France represent the leading markets within Europe, driven by strong manufacturing bases and substantial end-user industry presence. However, market expansion may face headwinds from fluctuating raw material costs and environmental considerations associated with silicone production. Strategic focus on sustainable manufacturing and innovative applications will be critical for maintaining market competitiveness.

Europe Silicone Market Market Size (In Billion)

Market segmentation highlights a diversified landscape. Elastomers command a substantial share within the technology segment, owing to their extensive application versatility. Transportation and construction materials emerge as the dominant end-user industries, reflecting high product demand. Leading players such as Dow Chemical, Wacker Chemie, and Momentive Performance Materials are at the forefront of innovation, continuously enhancing their product offerings to address evolving industry requirements. The competitive environment features a blend of established global corporations and specialized manufacturers, fostering a dynamic market characterized by ongoing consolidation and technological advancements. Future market expansion will be intrinsically linked to progress in silicone technology, the success of sustainability initiatives, and the overall economic performance of key European end-user sectors.

Europe Silicone Market Company Market Share

Europe Silicone Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe silicone market, covering market size, growth drivers, challenges, key players, and future trends. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for stakeholders including manufacturers, distributors, investors, and researchers seeking a comprehensive understanding of this dynamic market. The total market value in 2025 is estimated at xx Million and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

Europe Silicone Market Composition & Trends

The Europe silicone market is characterized by a moderately concentrated landscape, with key players like Dow Chemical Company, Wacker Chemie AG, and Evonik Industries AG holding significant market share. However, the market also features several smaller, specialized players catering to niche applications. Innovation is driven by the need for improved performance characteristics, such as enhanced durability, flexibility, and biocompatibility, across diverse end-use industries. Stringent environmental regulations, particularly concerning the use of volatile organic compounds (VOCs) and hazardous substances, are shaping product development and manufacturing processes. Substitute materials, including plastics and other polymers, pose a competitive threat, although silicone’s unique properties often ensure its continued preference in specific applications. The end-user profiles are diverse, encompassing sectors like transportation, construction, electronics, healthcare, and personal care. M&A activity in the sector has been moderate, with deal values typically ranging from xx Million to xx Million, driven by companies seeking to expand their product portfolios and geographic reach.

- Market Share Distribution (2025): Dow Chemical Company (xx%), Wacker Chemie AG (xx%), Evonik Industries AG (xx%), Others (xx%).

- Recent M&A Activity: Details of significant mergers and acquisitions, including deal values where available, will be outlined within the full report.

- Regulatory Landscape: A detailed examination of relevant EU regulations impacting the silicone market.

Europe Silicone Market Industry Evolution

The Europe silicone market has witnessed significant growth over the past few years, driven by increasing demand from diverse end-use sectors. The growth trajectory is expected to continue, fueled by technological advancements resulting in improved silicone performance and the development of new applications. Shifting consumer preferences towards sustainable and environmentally friendly products are also influencing the market. The adoption of innovative silicone-based materials, such as high-performance elastomers and specialized sealants, is accelerating across industries. For example, the adoption rate of silicone-based sealants in the construction industry increased by xx% between 2019 and 2024. This evolution is further propelled by ongoing research and development efforts focused on enhancing silicone's properties and expanding its applications in emerging fields, such as renewable energy and advanced medical devices. The market growth rate is projected to be xx% from 2025 to 2033.

Leading Regions, Countries, or Segments in Europe Silicone Market

Germany, the United Kingdom, and France constitute the leading regional markets within Europe, fueled by robust industrial activity and a high concentration of silicone manufacturers. Within the technology segments, elastomers maintain a dominant position due to their widespread use in diverse applications. In end-user industries, the transportation and construction sectors are significant consumers, reflecting large-scale infrastructure projects and automotive production. The healthcare sector is also a key driver, owing to the biocompatibility and performance benefits of silicone in medical devices.

- Key Drivers:

- Germany: Strong automotive and chemical industries, substantial R&D investment, favorable regulatory environment.

- United Kingdom: Significant presence of major silicone manufacturers, expanding construction sector.

- France: Strong industrial base, significant investment in infrastructure projects.

- Elastomer Segment: Versatility, high performance, widespread applications across various industries.

- Transportation Sector: Growing demand for high-performance sealants and components in automobiles and aerospace.

Europe Silicone Market Product Innovations

Recent innovations in silicone technology encompass the development of high-performance elastomers with enhanced durability and resistance to extreme temperatures, specialized sealants with superior adhesion and weather resistance, and biocompatible silicones for medical applications. These advancements are improving the performance characteristics of silicone-based products, driving adoption across various industries. For example, the launch of Dow's SILASTIC LCF 9600 M textile printing ink base exemplifies the innovation in silicone materials for specialized applications. This innovation offers improved matte effect, hand feel, and wash durability.

Propelling Factors for Europe Silicone Market Growth

Several factors contribute to the market's growth trajectory. Firstly, technological advancements lead to improved silicone properties, driving adoption across various industries. Secondly, strong economic growth in several European countries boosts demand for construction materials, automotive components, and other products using silicones. Finally, favorable regulatory environments in certain regions support the market's expansion.

Obstacles in the Europe Silicone Market

The market faces challenges, including stringent environmental regulations that may raise manufacturing costs. Supply chain disruptions, particularly concerning raw material availability, can impact production and pricing. Intense competition among established players and new entrants also creates pressure on profit margins.

Future Opportunities in Europe Silicone Market

Emerging opportunities lie in the increasing demand for silicone-based products in renewable energy applications and advanced medical devices. The development of new silicone materials with enhanced properties, coupled with the growth of specialized applications, will continue to propel market growth. Furthermore, expansion into new geographic markets within Europe holds significant potential.

Major Players in the Europe Silicone Market Ecosystem

- ACSIC Ingredients

- Evonik Industries AG (Evonik Industries AG)

- Momentive Performance Materials Inc (Momentive Performance Materials Inc)

- Elkem Silicones (Elkem)

- AB Specialty Silicones

- DuPont (DuPont)

- Chengdu Silike Technology Co Ltd

- Silteq Ltd Avient (Avient)

- Shin-Etsu Chemical Co Ltd (Shin-Etsu Chemical Co Ltd)

- SILCOLORS

- Dow Chemical Company (Dow Chemical Company)

- Wacker Chemie AG (Wacker Chemie AG)

- List Not Exhaustive

Key Developments in Europe Silicone Market Industry

- October 2022: Dow launched SILASTIC LCF 9600 M Textile Printing Ink Base, a patented silicone ink with enhanced matte effect, improved hand feel, and excellent wash durability, promoting safer textile development.

- October 2021: Elkem invested approximately USD 37.76 Million to upgrade its silicone factory in Roussillon, France, boosting specialist silicone supply for European clients.

Strategic Europe Silicone Market Forecast

The Europe silicone market is poised for robust growth in the coming years. Continued technological advancements, expanding end-use applications, and favorable economic conditions will drive market expansion. The focus on sustainable and environmentally friendly silicone products will further shape market trends. New market entry opportunities and strategic partnerships will contribute to the overall market dynamism and growth potential.

Europe Silicone Market Segmentation

-

1. Technology

- 1.1. Elastomer

- 1.2. Paper

-

2. End-User Industry

- 2.1. Transportation

- 2.2. Construction Materials

- 2.3. Electronics

- 2.4. Healthcare

- 2.5. Industrial Processes

- 2.6. Personal Care and Consumer Products

- 2.7. Other End-user Industry

Europe Silicone Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Silicone Market Regional Market Share

Geographic Coverage of Europe Silicone Market

Europe Silicone Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High demand for Lightweight Silicones in the Transportation and Vehicle Industries; Increased Application in the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. Silicone's Negative Health Impact; Fluctuating Raw Materials

- 3.4. Market Trends

- 3.4.1. Increasing Application in Industrial Processes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Silicone Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Elastomer

- 5.1.2. Paper

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Transportation

- 5.2.2. Construction Materials

- 5.2.3. Electronics

- 5.2.4. Healthcare

- 5.2.5. Industrial Processes

- 5.2.6. Personal Care and Consumer Products

- 5.2.7. Other End-user Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ACSIC Ingredients

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Evonik Industries AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Momentive Performance Materials Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Elkem Silicones

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AB Specialty Silicones

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DuPont

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chengdu Silike Technology Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Silteq Ltd Avient

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shin-Etsu Chemical Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SILCOLORS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dow Chemical Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Wacker Chemie AG*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 ACSIC Ingredients

List of Figures

- Figure 1: Europe Silicone Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Silicone Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Silicone Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Europe Silicone Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 3: Europe Silicone Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Silicone Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: Europe Silicone Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: Europe Silicone Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Silicone Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Silicone Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Silicone Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Silicone Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Silicone Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Silicone Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Silicone Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Silicone Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Silicone Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Silicone Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Silicone Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Silicone Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the Europe Silicone Market?

Key companies in the market include ACSIC Ingredients, Evonik Industries AG, Momentive Performance Materials Inc, Elkem Silicones, AB Specialty Silicones, DuPont, Chengdu Silike Technology Co Ltd, Silteq Ltd Avient, Shin-Etsu Chemical Co Ltd, SILCOLORS, Dow Chemical Company, Wacker Chemie AG*List Not Exhaustive.

3. What are the main segments of the Europe Silicone Market?

The market segments include Technology, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.3 billion as of 2022.

5. What are some drivers contributing to market growth?

High demand for Lightweight Silicones in the Transportation and Vehicle Industries; Increased Application in the Healthcare Industry.

6. What are the notable trends driving market growth?

Increasing Application in Industrial Processes.

7. Are there any restraints impacting market growth?

Silicone's Negative Health Impact; Fluctuating Raw Materials.

8. Can you provide examples of recent developments in the market?

October 2022: Dow launched SILASTIC LCF 9600 M Textile Printing Ink Base, a patented silicone ink used for printing on synthetic and cotton fabrics, particularly highly elastic garments. The patented SILASTIC LCF 9600 M, designed for an increased matte effect and improved hand feel, offers excellent wash durability and high elongation. SILASTIC LCF 9600 M also allows for safer textile development due to its ability to be formulated without the use of PVC, phthalates, solvents, organotins, or formaldehyde.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Silicone Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Silicone Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Silicone Market?

To stay informed about further developments, trends, and reports in the Europe Silicone Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence