Key Insights

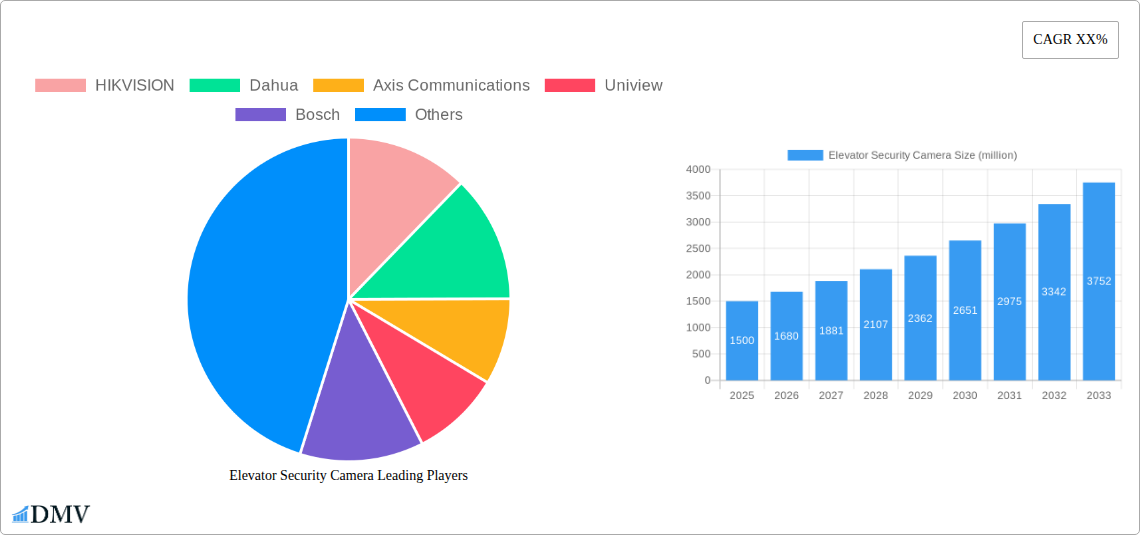

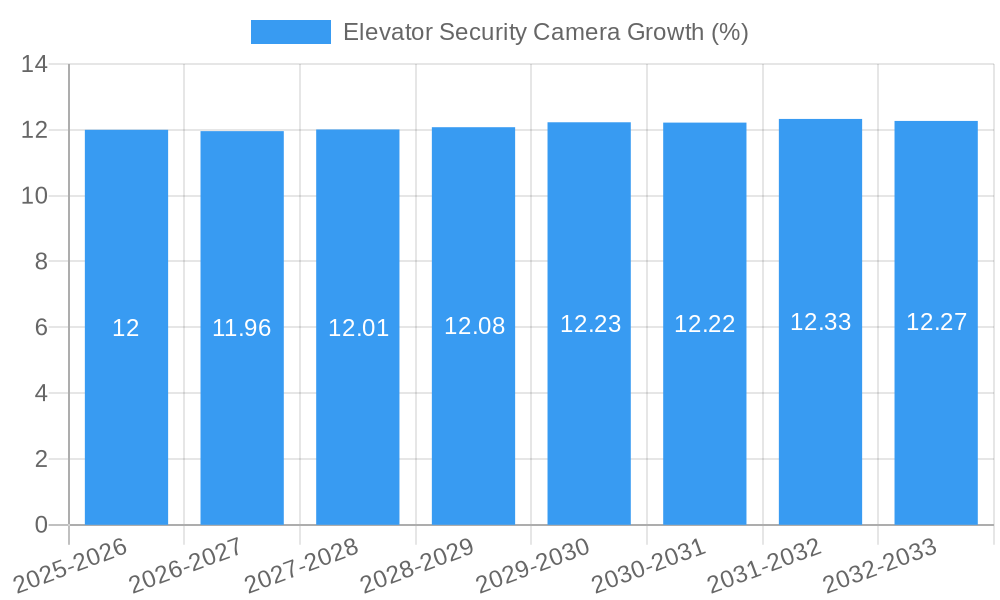

The global Elevator Security Camera market is experiencing robust growth, projected to reach approximately USD 1,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 12% expected to propel it to over USD 3,000 million by 2033. This expansion is significantly driven by the escalating need for enhanced security and surveillance in both residential and commercial spaces. As urbanization intensifies and the number of elevators in operation continues to rise, the demand for sophisticated monitoring solutions becomes paramount. Mini-dome and pinhole cameras, favored for their discreet design and effectiveness in capturing clear footage within confined elevator spaces, are leading the charge in this market. Industry giants like HIKVISION, Dahua, and Axis Communications are at the forefront, innovating with features such as high-definition video, low-light performance, and integrated analytics to meet evolving security demands. The increasing adoption of smart building technologies and the growing awareness of crime prevention are further bolstering market expansion, making elevator security cameras an indispensable component of modern infrastructure.

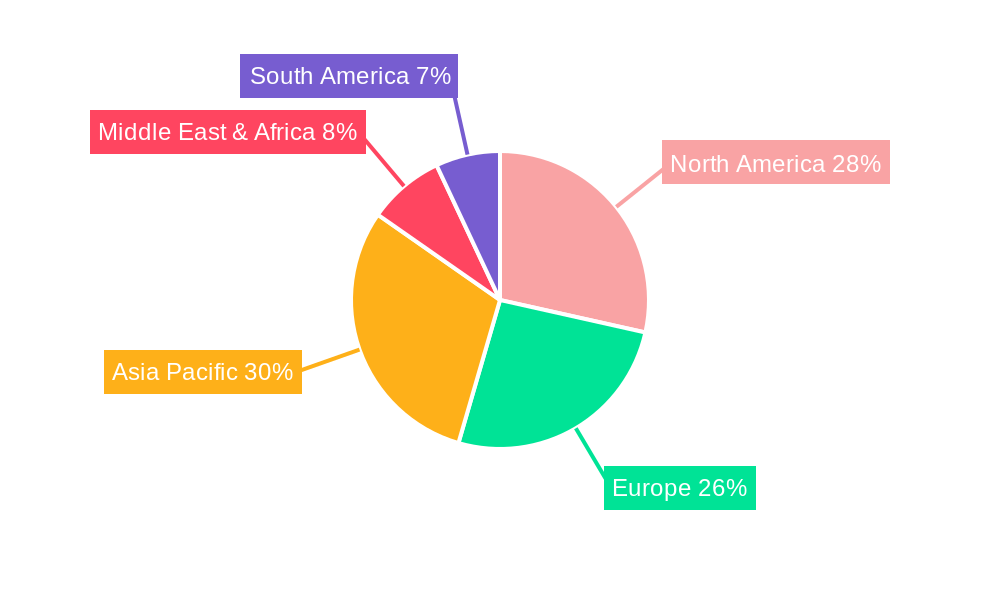

The market's trajectory is further shaped by a dynamic interplay of drivers and restraints. Key growth drivers include the rising incidence of vandalism and petty theft within elevator environments, coupled with stringent regulatory mandates for safety and surveillance in public and commercial buildings. The technological advancements in camera resolution, artificial intelligence for anomaly detection, and cloud-based storage solutions are also significantly contributing to market penetration. However, the market faces certain restraints, such as the initial cost of installation and maintenance, and concerns regarding data privacy and storage regulations in specific regions. Despite these challenges, the long-term outlook remains highly positive, with significant opportunities emerging in developing economies and the integration of these cameras with broader building management systems. Asia Pacific, particularly China and India, is expected to be a major growth engine due to rapid infrastructure development and increasing disposable incomes, while North America and Europe continue to represent mature yet strong markets driven by technological adoption and security consciousness.

Elevator Security Camera Market Composition & Trends

The global elevator security camera market is characterized by a moderate to high concentration of key players, with HIKVISION, Dahua, and Axis Communications consistently holding significant market share, estimated to be upwards of 40 million within this segment. Innovation remains a primary catalyst for growth, driven by advancements in AI-powered analytics, high-resolution imaging, and miniaturized form factors. The regulatory landscape is increasingly stringent, with a growing emphasis on passenger safety and data privacy, pushing manufacturers to comply with international standards. Substitute products, such as basic surveillance systems not specifically designed for elevators, present a minor threat due to their limited functionality and lack of integration. End-user profiles are diverse, encompassing building management companies, facility operators, residential complex administrators, and hospitality sectors, all prioritizing enhanced security and passenger experience. Merger and acquisition (M&A) activities, while not rampant, have been strategic, with several smaller players being absorbed by larger entities to expand product portfolios and market reach. For instance, an estimated XXX million in M&A deals have been observed over the historical period, consolidating market power and driving technological integration.

- Market Concentration: Dominated by a few leading players, with significant market share held by HIKVISION, Dahua, and Axis Communications.

- Innovation Drivers: AI analytics, HD imaging, compact design, and remote monitoring capabilities.

- Regulatory Influence: Growing emphasis on passenger safety, data privacy, and compliance with international standards.

- Substitute Products: Basic surveillance systems, offering limited specialized elevator features.

- End-User Segments: Commercial buildings, residential complexes, hotels, public transportation hubs.

- M&A Activities: Strategic consolidation to enhance product offerings and market penetration, with an estimated XXX million in deals during the historical period.

Elevator Security Camera Industry Evolution

The elevator security camera industry has witnessed a dynamic evolution over the historical period of 2019–2024, with a projected continued upward trajectory through the forecast period of 2025–2033. Driven by an escalating global awareness of public safety and the increasing adoption of smart building technologies, the market has experienced a compound annual growth rate (CAGR) of approximately 12.5% from 2019 to 2024. This robust growth is intrinsically linked to technological advancements that have transformed surveillance capabilities within confined elevator spaces. Early CCTV systems have given way to high-definition (HD) and ultra-high-definition (UHD) cameras, offering superior image clarity essential for identifying individuals and events. The integration of Artificial Intelligence (AI) has been a game-changer, enabling features like intelligent motion detection, facial recognition, and anomaly detection, which significantly enhance the proactive security capabilities of these systems. The base year of 2025 sees an estimated market valuation of over 500 million, with projections indicating a reach exceeding 1.2 billion by 2033.

Consumer demand has shifted dramatically from basic video recording to sophisticated, integrated security solutions. Building managers and property owners are increasingly prioritizing systems that offer real-time monitoring, remote access via mobile applications, and seamless integration with broader building management systems (BMS). This demand is fueled by a desire to deter crime, ensure passenger well-being, and provide irrefutable evidence in case of incidents. The adoption of technologies like fisheye lenses for panoramic views within elevator cabins and pinhole cameras for discreet surveillance has also broadened the application scope. Furthermore, the development of specialized, robust cameras designed to withstand the unique environmental conditions within an elevator shaft, including varying temperatures and vibrations, has been crucial. The market has also seen increased investment in cloud-based storage and analytics, offering scalability and accessibility for video footage. The transition from analog to IP-based cameras has also been a significant evolutionary step, providing enhanced features, improved network connectivity, and greater flexibility in deployment. The estimated adoption rate of smart elevator security cameras, encompassing AI and IP technologies, has surged from approximately 30% in 2019 to an estimated 65% in 2024, with a further increase anticipated as the forecast period unfolds.

Leading Regions, Countries, or Segments in Elevator Security Camera

The Commercial Elevator segment stands as the dominant force within the global elevator security camera market, projected to maintain its leadership through the forecast period of 2025–2033. This dominance is driven by the sheer volume of commercial buildings, including office complexes, shopping malls, hotels, and airports, which are equipped with multiple elevators requiring robust security solutions. The higher disposable income and greater emphasis on security in commercial environments translate into larger investments in advanced surveillance technologies. For instance, in 2024, the commercial elevator segment accounted for an estimated 70% of the total market revenue, with a projected valuation of over 350 million.

North America, particularly the United States, emerges as the leading region, fueled by its established smart building infrastructure, stringent safety regulations, and a proactive approach to adopting new technologies. In 2025, North America is estimated to contribute over 30% of the global market revenue. Key drivers in this region include:

- Technological Adoption: High penetration of IP-based cameras and AI analytics, with an estimated adoption rate of over 75% for advanced features.

- Regulatory Support: Government initiatives and building codes that mandate enhanced security measures in public and commercial spaces.

- Investment Trends: Significant investment from real estate developers and facility management companies in upgrading existing elevator systems with sophisticated security cameras, with an average investment per elevator ranging from 500 to 1500.

- Key Players: Strong presence of leading companies like Verkada, Bosch, and Honeywell actively catering to the commercial sector.

Within the Types of elevator security cameras, the Mini-dome Camera has captured a significant market share, estimated at around 45% in 2025. Their discreet design, wide-angle coverage, and ease of installation make them ideal for the confined spaces of elevators. However, the market is also witnessing a growing demand for specialized Other types, including fisheye cameras and compact vandal-proof cameras, which collectively are projected to grow at a faster CAGR of 14% due to their enhanced functionalities and niche applications. The Residential Elevator segment, while smaller, is experiencing substantial growth, driven by increasing homeowner awareness of security and the rising adoption of smart home technologies, with an estimated CAGR of 10%.

Elevator Security Camera Product Innovations

Product innovation in the elevator security camera market is rapidly advancing, focusing on enhancing surveillance capabilities and integration within smart building ecosystems. Manufacturers are increasingly incorporating AI-powered features such as people counting, loitering detection, and abnormal behavior analysis, providing building managers with proactive security insights. High-resolution imaging, with cameras now offering 4K resolution and beyond, ensures unparalleled clarity for identification and evidence collection, crucial for any incident. Miniaturization and discreet design, exemplified by ultra-compact pinhole cameras and aesthetically integrated mini-dome cameras, are paramount for maintaining the interior aesthetics of elevators while ensuring comprehensive coverage. Furthermore, advancements in low-light performance and Wide Dynamic Range (WDR) technology ensure clear footage even in challenging lighting conditions within elevator shafts and cabins. Integration with cloud platforms for remote monitoring, data storage, and analytics is becoming a standard offering, providing seamless access and management for stakeholders. Performance metrics such as frame rates exceeding 30fps and lens options offering wide fields of view (e.g., 180-degree panoramic) are becoming commonplace, bolstering the effectiveness of these security devices.

Propelling Factors for Elevator Security Camera Growth

The elevator security camera market is propelled by a confluence of technological advancements, economic imperatives, and evolving regulatory frameworks. The increasing sophistication of AI and machine learning algorithms, enabling intelligent video analytics for anomaly detection and threat identification, is a significant growth driver. Economic factors, such as the rising global construction of smart buildings and the need for enhanced safety in commercial and residential spaces to deter crime and ensure passenger well-being, are also contributing to market expansion. Furthermore, government mandates and stricter building codes worldwide are increasingly requiring advanced security surveillance systems in elevators, acting as a powerful regulatory push. The growing adoption of the Internet of Things (IoT) in buildings also fosters demand for connected security devices, including elevator cameras that integrate with broader smart building management systems, estimated to increase market penetration by 15% annually.

Obstacles in the Elevator Security Camera Market

Despite the robust growth, the elevator security camera market faces several obstacles. Stringent data privacy regulations and concerns over the storage and usage of surveillance footage pose significant challenges for manufacturers and operators, potentially limiting data collection and analysis capabilities. The initial high cost of advanced, AI-enabled security camera systems can be a barrier for smaller building owners and residential complexes, impacting widespread adoption. Supply chain disruptions, particularly those related to semiconductor availability, can affect production timelines and increase manufacturing costs, leading to price fluctuations. Moreover, the competitive landscape, with numerous players vying for market share, intensifies price pressures and demands continuous innovation to differentiate products. The integration complexity with existing building infrastructure for older installations also presents a technical hurdle.

Future Opportunities in Elevator Security Camera

The future of the elevator security camera market is ripe with opportunities, particularly in emerging markets with a rapidly developing urban infrastructure and increasing smart building adoption. The integration of facial recognition technology for access control and personalized elevator experiences presents a significant growth avenue, estimated to boost market demand by 20% in the commercial sector by 2030. Advancements in edge computing, allowing for on-device processing of video analytics, will reduce reliance on cloud infrastructure and enhance real-time responsiveness. The development of more cost-effective and energy-efficient camera solutions will also broaden market accessibility to a wider range of customers. Furthermore, the growing trend of retrofitting older elevators with advanced security features, driven by security concerns and technological upgrades, opens up a substantial market segment for innovative solutions.

Major Players in the Elevator Security Camera Ecosystem

- HIKVISION

- Dahua

- Axis Communications

- Uniview

- Bosch

- Honeywell

- HanwhaTechwin

- Tiandy Technologies

- Infinova

- Kedacom

- ZTE

- Teledyne FLIR

- Verkada

- SafeTech Security

- First Security Protection Services

- ATSS

Key Developments in Elevator Security Camera Industry

- 2023 Q1: Launch of AI-powered elevator cameras with enhanced anomaly detection by Axis Communications, improving proactive security measures.

- 2023 Q2: Dahua introduces ultra-low-light technology for elevator cameras, significantly improving visibility in dimly lit elevator shafts.

- 2023 Q3: Verkada announces cloud-based integration for their elevator camera systems, streamlining remote monitoring and data management for building operators.

- 2023 Q4: HIKVISION expands its portfolio with compact, wide-angle fisheye cameras specifically designed for residential elevators, increasing adoption in the home segment.

- 2024 Q1: Honeywell releases advanced vandal-proof elevator cameras with built-in analytics, enhancing durability and security in high-traffic commercial areas.

- 2024 Q2: The industry sees a surge in M&A activity, with ATSS acquiring a smaller player to bolster its service offerings in commercial elevator security, valued at an estimated 15 million.

- 2024 Q3: SafeTech Security rolls out a new generation of energy-efficient elevator cameras, reducing operational costs for building management.

Strategic Elevator Security Camera Market Forecast

The strategic forecast for the elevator security camera market anticipates continued robust growth driven by increasing urbanization, smart city initiatives, and a heightened global focus on safety and security. Technological advancements, particularly in AI analytics and IoT integration, will be pivotal in shaping market trends, enabling more intelligent and proactive surveillance solutions. The growing demand for seamless integration with existing building management systems and the expanding adoption of cloud-based services will further fuel market expansion. Emerging economies represent significant growth potential, driven by increasing construction of modern buildings and a rising awareness of security needs. The market is poised for innovation in discreet and high-performance camera designs, catering to diverse applications from residential to commercial settings. The continued emphasis on passenger safety and crime deterrence will ensure sustained investment in advanced elevator security camera systems, projecting a future market valuation exceeding 1.2 billion by 2033.

Elevator Security Camera Segmentation

-

1. Application

- 1.1. Residential Elevator

- 1.2. Commercial Elevator

-

2. Types

- 2.1. Mini-dome Camera

- 2.2. Pinhole Camera

- 2.3. Others

Elevator Security Camera Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Elevator Security Camera REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Elevator Security Camera Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential Elevator

- 5.1.2. Commercial Elevator

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Mini-dome Camera

- 5.2.2. Pinhole Camera

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Elevator Security Camera Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential Elevator

- 6.1.2. Commercial Elevator

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Mini-dome Camera

- 6.2.2. Pinhole Camera

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Elevator Security Camera Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential Elevator

- 7.1.2. Commercial Elevator

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Mini-dome Camera

- 7.2.2. Pinhole Camera

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Elevator Security Camera Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential Elevator

- 8.1.2. Commercial Elevator

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Mini-dome Camera

- 8.2.2. Pinhole Camera

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Elevator Security Camera Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential Elevator

- 9.1.2. Commercial Elevator

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Mini-dome Camera

- 9.2.2. Pinhole Camera

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Elevator Security Camera Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential Elevator

- 10.1.2. Commercial Elevator

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Mini-dome Camera

- 10.2.2. Pinhole Camera

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 HIKVISION

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dahua

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Axis Communications

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Uniview

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bosch

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Honeywell

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HanwhaTechwln

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tiandy Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Infinova

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kedacom

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ZTE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Teledyne FLIR

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Verkada

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 SafeTech Security

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 First Security Protection Services

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ATSS

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 HIKVISION

List of Figures

- Figure 1: Global Elevator Security Camera Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Elevator Security Camera Revenue (million), by Application 2024 & 2032

- Figure 3: North America Elevator Security Camera Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Elevator Security Camera Revenue (million), by Types 2024 & 2032

- Figure 5: North America Elevator Security Camera Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Elevator Security Camera Revenue (million), by Country 2024 & 2032

- Figure 7: North America Elevator Security Camera Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Elevator Security Camera Revenue (million), by Application 2024 & 2032

- Figure 9: South America Elevator Security Camera Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Elevator Security Camera Revenue (million), by Types 2024 & 2032

- Figure 11: South America Elevator Security Camera Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Elevator Security Camera Revenue (million), by Country 2024 & 2032

- Figure 13: South America Elevator Security Camera Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Elevator Security Camera Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Elevator Security Camera Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Elevator Security Camera Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Elevator Security Camera Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Elevator Security Camera Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Elevator Security Camera Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Elevator Security Camera Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Elevator Security Camera Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Elevator Security Camera Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Elevator Security Camera Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Elevator Security Camera Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Elevator Security Camera Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Elevator Security Camera Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Elevator Security Camera Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Elevator Security Camera Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Elevator Security Camera Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Elevator Security Camera Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Elevator Security Camera Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Elevator Security Camera Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Elevator Security Camera Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Elevator Security Camera Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Elevator Security Camera Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Elevator Security Camera Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Elevator Security Camera Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Elevator Security Camera Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Elevator Security Camera Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Elevator Security Camera Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Elevator Security Camera Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Elevator Security Camera Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Elevator Security Camera Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Elevator Security Camera Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Elevator Security Camera Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Elevator Security Camera Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Elevator Security Camera Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Elevator Security Camera Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Elevator Security Camera Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Elevator Security Camera Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Elevator Security Camera Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Elevator Security Camera?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Elevator Security Camera?

Key companies in the market include HIKVISION, Dahua, Axis Communications, Uniview, Bosch, Honeywell, HanwhaTechwln, Tiandy Technologies, Infinova, Kedacom, ZTE, Teledyne FLIR, Verkada, SafeTech Security, First Security Protection Services, ATSS.

3. What are the main segments of the Elevator Security Camera?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Elevator Security Camera," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Elevator Security Camera report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Elevator Security Camera?

To stay informed about further developments, trends, and reports in the Elevator Security Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence