Key Insights

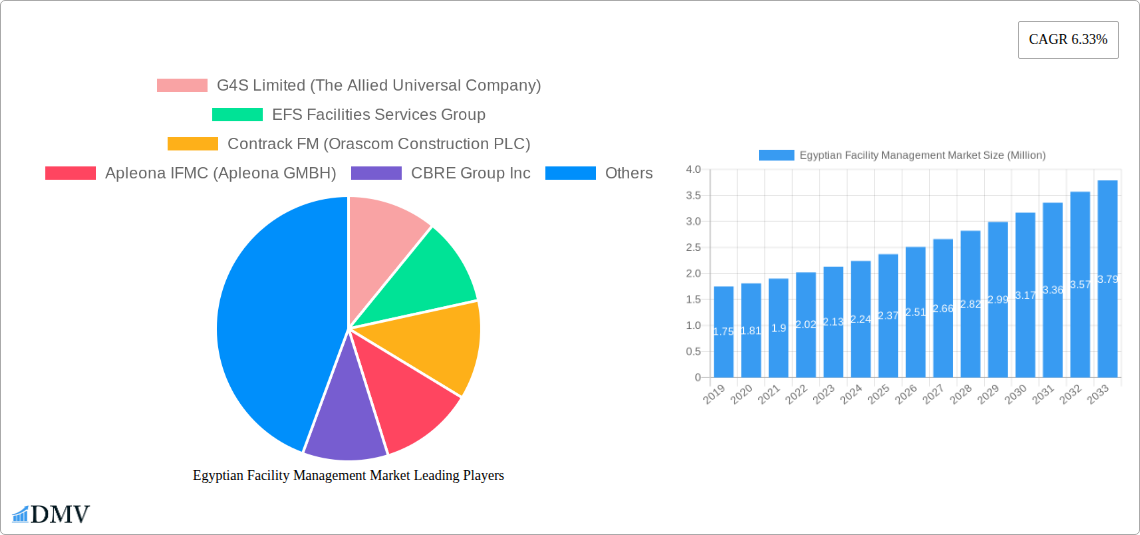

The Egyptian Facility Management market is poised for significant expansion, projected to reach USD 2.25 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.33% anticipated through 2033. This growth is propelled by several key drivers, including increasing urbanization, a burgeoning construction sector, and a growing awareness among businesses and institutions about the benefits of professional facility management for operational efficiency, cost optimization, and enhanced asset longevity. The market is segmented across various offerings and end-user verticals, highlighting a diverse demand landscape. "Hard FM" services, encompassing maintenance, repair, and technical building operations, are expected to witness sustained demand due to the ongoing development and upkeep of commercial and industrial infrastructure. Simultaneously, "Soft FM" services, covering areas like cleaning, security, and catering, are also crucial for ensuring a comfortable and productive environment in workplaces and public spaces. The trend towards integrated and bundled facility management solutions is a significant development, as clients seek to streamline operations and achieve economies of scale by consolidating service providers.

Egyptian Facility Management Market Market Size (In Million)

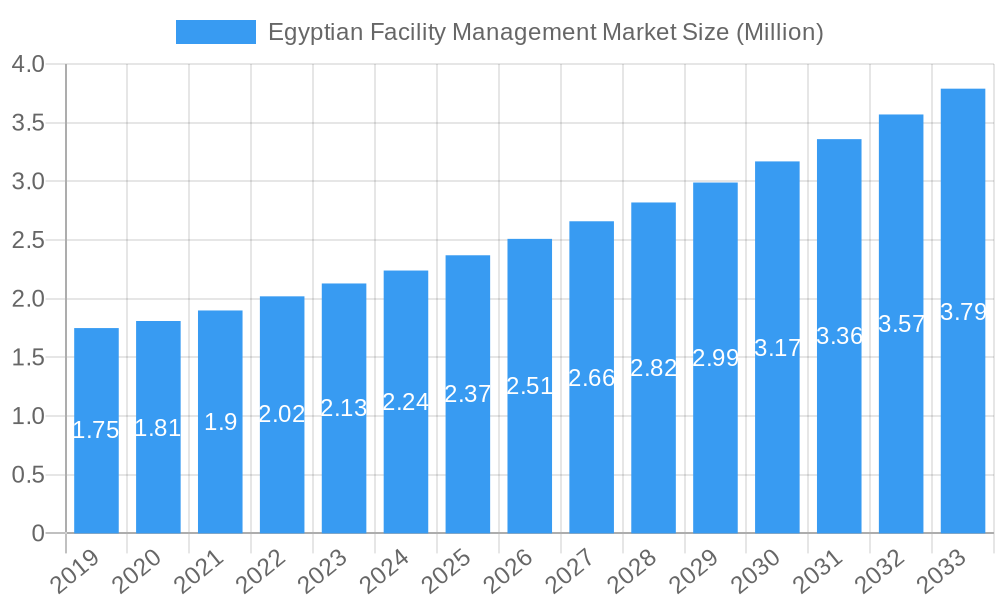

The market's upward trajectory is further supported by a wave of foreign investment and government initiatives aimed at developing infrastructure and attracting businesses, particularly in the commercial and industrial sectors. This influx necessitates sophisticated facility management to maintain high operational standards and safety protocols. While the market enjoys strong growth drivers, potential restraints include a shortage of skilled labor in specialized facility management roles and the initial capital investment required for advanced technology adoption. However, the increasing participation of leading global and local players, such as G4S Limited, CBRE Group Inc., and Savills PLC, alongside emerging Egyptian companies, indicates a competitive and dynamic market environment. These companies are actively investing in technology and training to meet the evolving demands for integrated and sustainable facility management solutions across commercial, institutional, public, and industrial segments within Egypt.

Egyptian Facility Management Market Company Market Share

Egyptian Facility Management Market: Comprehensive Growth Insights & Forecast (2019-2033)

This in-depth report provides a definitive analysis of the Egyptian Facility Management market, forecasting robust growth and highlighting critical trends from 2019 to 2033. Covering the Base Year of 2025 and a Forecast Period of 2025-2033, this report is essential for stakeholders seeking to capitalize on the burgeoning demand for integrated, outsourced, and hard/soft FM solutions across Commercial, Institutional, Public/Infrastructure, and Industrial sectors. Uncover key market drivers, emerging opportunities, leading players like G4S Limited, EFS Facilities Services Group, and CBRE Group Inc., and pivotal industry developments, including significant real estate investments poised to fuel FM service demand. Gain unparalleled insights into market composition, technological advancements, and strategic opportunities within Egypt's dynamic facility management landscape.

Egyptian Facility Management Market Market Composition & Trends

The Egyptian Facility Management market, projected to witness substantial growth, exhibits a dynamic composition shaped by evolving end-user needs and increasing adoption of outsourced services. Market concentration is moderate, with a blend of established international players and growing local service providers. Innovation is primarily driven by the integration of technology for enhanced efficiency and sustainability in FM operations, including smart building solutions and digital asset management. The regulatory landscape is gradually evolving to support professionalized FM practices, encouraging adherence to international standards. Substitute products, such as in-house management, are gradually yielding to the cost-effectiveness and specialized expertise offered by outsourced FM. End-user profiles are diversifying, with a significant surge in demand from the commercial and institutional sectors, driven by new project developments. Mergers and acquisitions (M&A) are becoming more prevalent as larger entities consolidate their market presence and expand service offerings.

- Market Share Distribution: Fragmented with key players holding substantial, yet not dominant, shares.

- M&A Deal Values: Anticipated to increase as market consolidation accelerates.

- Innovation Catalysts: Smart building technology, energy efficiency solutions, and digital platforms.

- Regulatory Landscape: Evolving standards for safety, environmental compliance, and service quality.

- End-User Profiles: Increasing demand from commercial real estate, healthcare, education, and government infrastructure projects.

Egyptian Facility Management Market Industry Evolution

The Egyptian Facility Management industry has undergone a significant evolution, transforming from a nascent sector to a critical component of the nation's infrastructure development and operational efficiency. Over the Historical Period of 2019-2024, the market has witnessed a steady upward trajectory, fueled by increasing foreign investment and a growing awareness of the benefits of professional FM services. The Base Year of 2025 marks a crucial point in this evolution, with the market poised for accelerated expansion during the Forecast Period of 2025-2033. Technological advancements have been a key enabler, with the adoption of Building Information Modeling (BIM), Internet of Things (IoT) for predictive maintenance, and advanced energy management systems becoming more widespread. These technologies are not only enhancing the efficiency and effectiveness of FM operations but also contributing to significant cost savings for clients.

Shifting consumer demands are also playing a pivotal role. Businesses and institutions are increasingly prioritizing a safe, sustainable, and efficient working environment, recognizing that effective facility management directly impacts employee productivity, occupant well-being, and operational resilience. This has led to a growing preference for integrated facility management (IFM) solutions, which offer a holistic approach to managing all aspects of a facility, from hard services like building maintenance and security to soft services such as cleaning, catering, and reception. The growth rates in the adoption of specialized FM services, particularly outsourced models, have been consistently high, indicating a strong market appetite for expertise that goes beyond basic maintenance. Furthermore, government initiatives aimed at developing smart cities and modern infrastructure are creating a fertile ground for the expansion of the FM sector, demanding sophisticated and scalable service provisions. The industry's evolution is characterized by a move towards greater professionalization, with a focus on service quality, client satisfaction, and the adoption of best practices.

Leading Regions, Countries, or Segments in Egyptian Facility Management Market

The Egyptian Facility Management market exhibits a clear dominance within specific segments, driven by overarching economic trends, investment patterns, and governmental priorities. Outsourced Facility Management, as a whole, is emerging as the leading segment, surpassing In-house Facility Management. This shift is attributed to the increasing realization among businesses and institutions of the cost efficiencies, specialized expertise, and operational flexibility that outsourcing provides. Within the Outsourced Facility Management category, Integrated Facility Management (IFM) is gaining significant traction, offering a comprehensive suite of services that streamline operations and enhance value.

The Commercial end-user vertical represents a dominant force, driven by ongoing development in office spaces, retail centers, and hospitality projects. The recent surge in real estate investments, such as Naia Real Estate Development Company's EGP 30 billion investment and the launch of BABA H MALL with an investment of EGP 600 million, directly translates into a higher demand for sophisticated FM services to manage these new and existing commercial assets. The Public/Infrastructure segment is also a key contributor, with government investments in new administrative capitals, urban development projects, and public amenities necessitating extensive FM support.

- Dominant Segment (Type): Outsourced Facility Management, with Integrated Facility Management leading its sub-segments.

- Key Drivers: Cost-effectiveness, access to specialized skills, focus on core business, and enhanced operational efficiency.

- Investment Trends: Significant private and public sector investments in commercial and infrastructure projects create sustained demand for FM.

- Regulatory Support: Government focus on modernization and development projects indirectly fosters demand for professional FM.

- Dominant Segment (Offering Type): A balanced demand for both Hard FM and Soft FM services, with a growing emphasis on bundled and integrated solutions.

- Hard FM Drivers: Need for reliable building maintenance, HVAC, electrical, and plumbing services, especially in newly constructed or aging infrastructure.

- Soft FM Drivers: Focus on creating conducive environments for occupants, including cleaning, security, and catering, paramount in commercial and institutional settings.

- Dominant Segment (End-User Vertical): Commercial and Public/Infrastructure sectors are leading the charge.

- Commercial Drivers: Expansion of retail, office, and hospitality sectors, requiring comprehensive facility upkeep and enhancement.

- Public/Infrastructure Drivers: Government-led mega-projects, including new cities and transportation networks, demanding long-term, high-quality FM.

Egyptian Facility Management Market Product Innovations

Product innovations in the Egyptian Facility Management market are increasingly centered on leveraging technology for efficiency and sustainability. Smart building solutions, incorporating IoT sensors for real-time monitoring of energy consumption, air quality, and security, are gaining prominence. Predictive maintenance software, utilizing AI and machine learning to anticipate equipment failures, is reducing downtime and operational costs. Furthermore, advancements in green cleaning technologies and sustainable waste management systems are catering to the growing environmental consciousness of clients. These innovations enhance performance metrics by optimizing resource allocation, improving occupant comfort, and ensuring compliance with evolving environmental regulations.

Propelling Factors for Egyptian Facility Management Market Growth

The Egyptian Facility Management market is experiencing robust growth, propelled by several interconnected factors. Significant foreign and domestic investment in real estate and infrastructure development, particularly in areas like New Sheikh Zayed and the New Administrative Capital, directly translates into a sustained demand for FM services. Technological advancements, including the adoption of smart building solutions and digital platforms, are enhancing the efficiency and attractiveness of outsourced FM. Furthermore, a growing awareness among businesses and institutions of the cost savings and operational benefits associated with professional FM services is driving the shift from in-house management to outsourced models. Supportive government initiatives focused on modernization and infrastructure enhancement also play a crucial role in stimulating market expansion.

Obstacles in the Egyptian Facility Management Market Market

Despite its promising growth, the Egyptian Facility Management market faces several obstacles. A primary challenge is the lack of standardized regulations and certifications for FM service providers, which can lead to inconsistencies in service quality and trust. Skilled labor shortages in specialized areas of FM, such as advanced technical maintenance and sustainable practices, pose a significant restraint. Furthermore, initial high capital investment required for implementing advanced technologies and training personnel can be a barrier for smaller players. Price-sensitive clients sometimes prioritize cost over quality, leading to competitive pressures that can impact profit margins. Finally, supply chain disruptions for specialized equipment and materials can affect the timely delivery of services.

Future Opportunities in Egyptian Facility Management Market

The future of the Egyptian Facility Management market is rich with opportunity. The continuous pipeline of real estate development, including commercial, residential, and mixed-use projects, will fuel demand for comprehensive FM solutions. Emerging smart city initiatives present a significant avenue for the adoption of integrated technology-driven FM services. There is also a growing opportunity in retrofitting existing buildings with sustainable and energy-efficient technologies. The increasing focus on health and safety protocols post-pandemic will further drive demand for specialized cleaning and hygiene management services. Expanding into emerging geographic regions within Egypt and diversifying service offerings to include niche sectors like healthcare and education also present substantial growth potential.

Major Players in the Egyptian Facility Management Market Ecosystem

- G4S Limited (The Allied Universal Company)

- EFS Facilities Services Group

- Contrack FM (Orascom Construction PLC)

- Apleona IFMC (Apleona GMBH)

- CBRE Group Inc

- Eden Facility Management

- Energy & Contracting Solutions Company

- Savills PLC

- Egypro FME Joint Stock Company

- Kharafi National

- Proservice For Engineering Consultation

- Alkan CIT

- Encorp International Engineers and Contractors

- Jones Lang Lasalle Ip Inc

- Enova Facilities Management Services LLC

Key Developments in Egyptian Facility Management Market Industry

- November 2022: Naia Real Estate Development Company announced plans to invest EGP 30 billion (USD 1.21 billion) in real estate developments over three years, including EGP 11 billion (USD 0.45 billion) for Naia West in New Sheikh Zayed, set to begin construction in Q1 2023. This investment is expected to significantly boost demand for FM services.

- September 2022: BABA H MALL was launched in the New Administrative Capital with an investment of EGP 600 million (USD 24.35 million) by White Eagle Developments. Estimated completion by Q1 2025, this surge in mall construction will drive demand for building infrastructure FM services.

- September 2022: EFS MISR, part of EFS International, was selected by Capital Hills Developments to manage and operate its projects in the New Administrative Capital (NAC), specifically for Point 9 and 11, covering 2,400 square meters each.

Strategic Egyptian Facility Management Market Market Forecast

The strategic forecast for the Egyptian Facility Management market is exceptionally positive, driven by sustained real estate investment and a clear market shift towards outsourced and integrated FM solutions. The forecast period of 2025-2033 anticipates accelerated growth, with key catalysts including the ongoing development of new cities and commercial hubs, significant foreign direct investment, and a heightened emphasis on operational efficiency and sustainability by businesses. The increasing adoption of smart technologies and a growing understanding of the value proposition of professional FM services will continue to propel market expansion. Opportunities lie in capitalizing on the demand for specialized services, such as energy management, security, and integrated building operations, within the burgeoning commercial, institutional, and public infrastructure sectors. This dynamic market presents substantial potential for both established and emerging FM providers.

Egyptian Facility Management Market Segmentation

-

1. Type

- 1.1. Inhouse Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single Facility Management

- 1.2.2. Bundled Facility Management

- 1.2.3. Integrated Facility Management

-

2. Offering Type

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End-User Vertical

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Other End-User Verticals

Egyptian Facility Management Market Segmentation By Geography

- 1. Egypt

Egyptian Facility Management Market Regional Market Share

Geographic Coverage of Egyptian Facility Management Market

Egyptian Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand For FM Services In Retail Outlets; Growing Construction Sector

- 3.3. Market Restrains

- 3.3.1. Diminishing Profit Margins and Ongoing Changes in Macro-environment

- 3.4. Market Trends

- 3.4.1. Growing Construction Sector in Egypt Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egyptian Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inhouse Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single Facility Management

- 5.1.2.2. Bundled Facility Management

- 5.1.2.3. Integrated Facility Management

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Other End-User Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 G4S Limited (The Allied Universal Company)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EFS Facilities Services Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Contrack FM (Orascom Construction PLC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Apleona IFMC (Apleona GMBH)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CBRE Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eden Facility Management

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Energy & Contracting Solutions Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Savills PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Egypro FME Joint Stock Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kharafi National

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Proservice For Engineering Consultation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Alkan CIT

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Encorp International Engineers and Contractors

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Jones Lang Lasalle Ip Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Enova Facilities Management Services LLC

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 G4S Limited (The Allied Universal Company)

List of Figures

- Figure 1: Egyptian Facility Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Egyptian Facility Management Market Share (%) by Company 2025

List of Tables

- Table 1: Egyptian Facility Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Egyptian Facility Management Market Revenue Million Forecast, by Offering Type 2020 & 2033

- Table 3: Egyptian Facility Management Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 4: Egyptian Facility Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Egyptian Facility Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Egyptian Facility Management Market Revenue Million Forecast, by Offering Type 2020 & 2033

- Table 7: Egyptian Facility Management Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 8: Egyptian Facility Management Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egyptian Facility Management Market?

The projected CAGR is approximately 6.33%.

2. Which companies are prominent players in the Egyptian Facility Management Market?

Key companies in the market include G4S Limited (The Allied Universal Company), EFS Facilities Services Group, Contrack FM (Orascom Construction PLC), Apleona IFMC (Apleona GMBH), CBRE Group Inc, Eden Facility Management, Energy & Contracting Solutions Company, Savills PLC, Egypro FME Joint Stock Company, Kharafi National, Proservice For Engineering Consultation, Alkan CIT, Encorp International Engineers and Contractors, Jones Lang Lasalle Ip Inc, Enova Facilities Management Services LLC.

3. What are the main segments of the Egyptian Facility Management Market?

The market segments include Type, Offering Type, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand For FM Services In Retail Outlets; Growing Construction Sector.

6. What are the notable trends driving market growth?

Growing Construction Sector in Egypt Driving the Market Growth.

7. Are there any restraints impacting market growth?

Diminishing Profit Margins and Ongoing Changes in Macro-environment.

8. Can you provide examples of recent developments in the market?

November 2022: The Egyptian developer Naia Real Estate Development Company announced its plans to invest EGP 30 billion (USD 1.21 billion) in real estate developments over the next three years. The company intends to begin construction on Naia West, a 140-acre development in New Sheikh Zayed, in the first quarter of 2023. The project would cost EGP 11 billion (USD 0.45 billion). This investment in real estate in the country would create a demand for FM services in Egypt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egyptian Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egyptian Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egyptian Facility Management Market?

To stay informed about further developments, trends, and reports in the Egyptian Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence