Key Insights

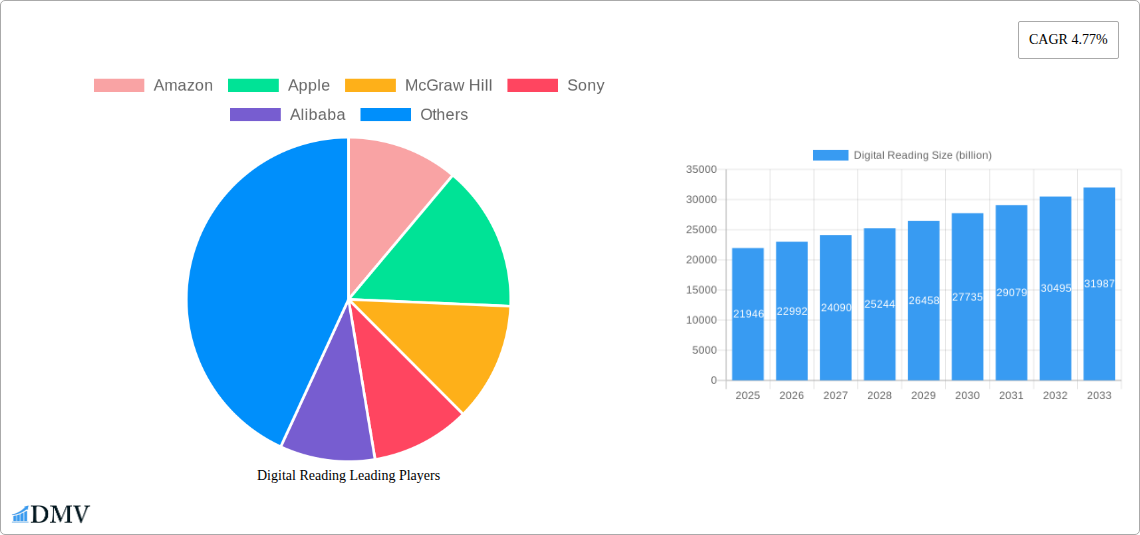

The global Digital Reading market is poised for significant expansion, projected to reach USD 21.946 billion in 2025. This growth is underpinned by a robust compound annual growth rate (CAGR) of 4.77%, indicating a steady upward trajectory for the foreseeable future. The market's dynamism is fueled by several key drivers, including the increasing penetration of smartphones and tablets, the growing demand for convenient and accessible content, and the continuous innovation in e-reading platforms and devices. The shift towards digital formats is evident across various applications, with cell phones and computers serving as primary access points for digital content consumption. Furthermore, the evolving consumer preferences, favoring both paid and free reading models, contribute to the market's broad appeal and adaptability. Emerging economies, particularly in the Asia Pacific region, are expected to be significant contributors to this growth, driven by rising literacy rates and increasing internet accessibility.

Digital Reading Market Size (In Billion)

The digital reading landscape is characterized by a clear segmentation into distinct types of reading experiences. Paid reading services, offering premium content and curated collections, are a vital component, alongside the rapidly expanding realm of free reading platforms that democratize access to information and entertainment. This dual approach caters to a diverse user base with varying budget sensitivities and content expectations. Key companies such as Amazon, Apple, and Google are at the forefront, investing heavily in content acquisition, platform development, and user experience enhancement. Meanwhile, a strong contingent of regional players, particularly from China, including Alibaba, CITIC Press Group, and China Literature, are actively shaping the market with localized content and innovative business models. Despite the overall positive outlook, certain restraints, such as content piracy and the cost of digital devices in developing regions, warrant strategic attention from industry stakeholders to ensure sustained and inclusive market development.

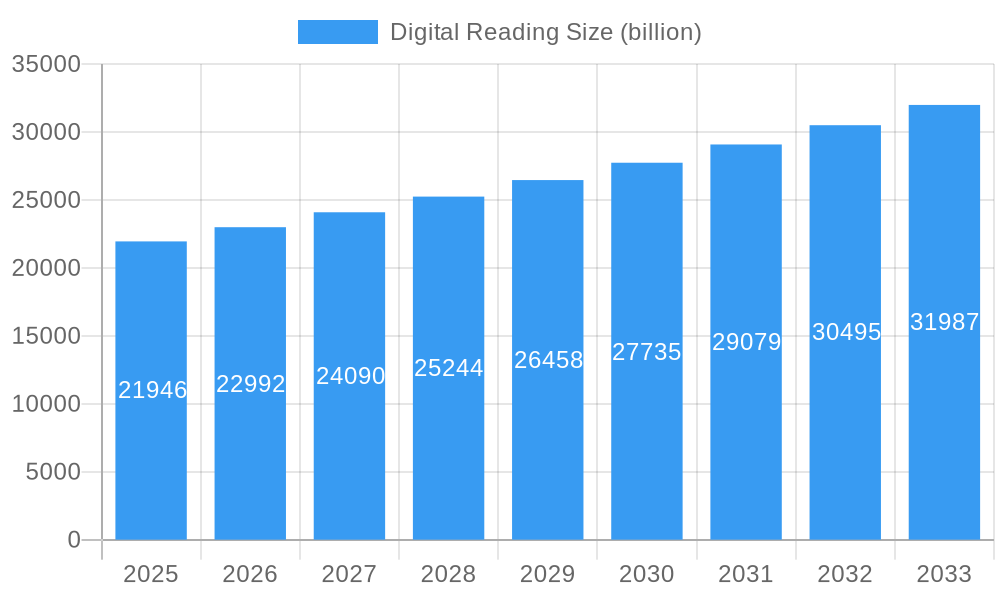

Digital Reading Company Market Share

This in-depth report delves into the dynamic and rapidly evolving digital reading market, providing a comprehensive analysis of its current landscape and future trajectory. Covering the study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this report offers invaluable insights for stakeholders seeking to navigate this lucrative sector. We meticulously examine paid reading, free reading, and the diverse applications across cell phones, e-readers, and computers. Discover key trends, understand market drivers, and anticipate future growth in the global digital publishing and e-book market.

Digital Reading Market Composition & Trends

The digital reading market exhibits a moderate to high level of concentration, with key players like Amazon, Apple, and a growing contingent of Chinese giants such as Alibaba, CITIC Press Group, Thinkingdom, and Zhangyue Technology, alongside established publishers like McGraw Hill and Sony, shaping its contours. Innovation catalysts are predominantly driven by advancements in e-reader technology, the proliferation of smartphones with enhanced reading capabilities, and sophisticated digital publishing platforms. The regulatory landscape varies significantly across regions, with some actively promoting digital content accessibility and others imposing stricter content controls. Substitute products, including audiobooks and other forms of digital entertainment, present a constant competitive pressure. End-user profiles are increasingly diverse, spanning students, professionals, and casual readers, all seeking convenient and accessible content. Mergers and acquisitions (M&A) activity, though currently valued in the hundreds of billions, is anticipated to accelerate as companies seek to consolidate market share and expand their digital content libraries.

- Market Share Distribution: Leading global players command significant shares, with Amazon holding approximately 40-50% of the e-book market. Chinese players, particularly Zhangyue Technology and China Literature, are rapidly gaining ground within their domestic market, collectively holding over 60% of China's digital reading revenue.

- M&A Deal Values: Recent significant M&A activities in the digital publishing industry have collectively surpassed XXX billion, with further consolidation expected.

- Innovation Hotspots: Focus areas include AI-powered content personalization, enhanced e-reader display technologies, and integrated multimedia reading experiences.

Digital Reading Industry Evolution

The digital reading industry has witnessed a transformative evolution, characterized by robust market growth trajectories fueled by increasing internet penetration, a surge in smartphone adoption, and a growing preference for digital content consumption. Technological advancements have been pivotal, with the development of more sophisticated e-reader devices offering enhanced portability and readability, and the widespread availability of dedicated reading applications on mobile platforms. This shift has fundamentally altered consumer demands, moving from physical books to readily accessible digital formats. The transition from traditional publishing models to digital-first strategies has accelerated, enabling publishers to reach wider audiences and reduce distribution costs. The e-book market has experienced a compound annual growth rate (CAGR) of approximately 10-15% over the historical period, with a projected CAGR of 8-12% during the forecast period. The adoption of digital reading across various demographics has climbed significantly, with over 60% of readers now engaging with digital content regularly. The rise of subscription-based reading services, similar to Netflix for books, has also democratized access and fostered continuous engagement. The integration of AI for personalized recommendations and enhanced reading experiences further solidifies its position.

Leading Regions, Countries, or Segments in Digital Reading

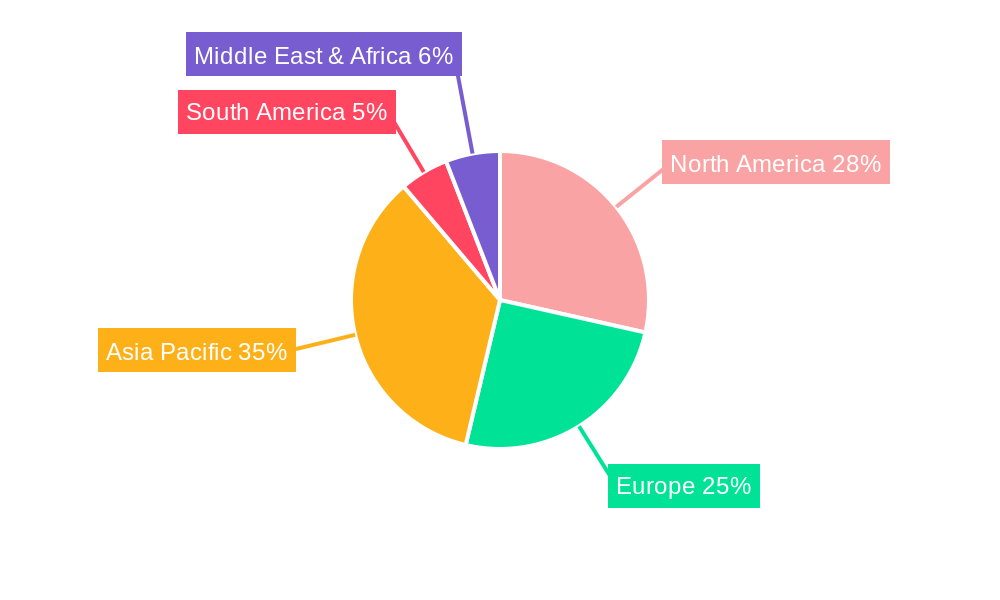

The digital reading market is experiencing dominant growth and adoption driven by specific regions and applications, with cell phones emerging as the leading application platform globally. The Asia-Pacific region, particularly China, is a powerhouse in digital reading, propelled by its vast population, rapid technological adoption, and a strong ecosystem of local digital publishing companies like Alibaba, CITIC Press Group, Thinkingdom, Zhangyue Technology, China Literature, COL Digital Publishing Group Co Ltd, China Media Inc, Hangzhou Anysoft, Winshare, Jiangsu Phoenix, and Central Plains Media. Paid reading constitutes the larger segment of the market, contributing over 70% of the global revenue, though free reading platforms also play a crucial role in user acquisition and content discovery. The convenience and omnipresence of smartphones make them the primary device for accessing digital content, accounting for an estimated 70% of all digital reading sessions.

- Dominant Application: Cell Phone usage in digital reading is projected to reach over 80% of total digital reading time by 2033, driven by the increasing power and screen size of smartphones.

- Key Market Segment: Paid Reading continues to be the most lucrative segment, with a projected market value of over XXX billion by 2033, fueled by premium content and subscription models.

- Regional Leadership: China's digital publishing market is expected to continue its rapid expansion, accounting for over 40% of the global digital reading revenue by 2033, driven by innovation from companies like Zhangyue Technology and CITIC Press Group.

- Investment Trends: Significant investment is flowing into AI-driven content curation and personalized reading experiences within the e-book market.

- Regulatory Support: Favorable government policies in key Asian markets are fostering the growth of domestic digital content platforms.

Digital Reading Product Innovations

Product innovations in the digital reading space are revolutionizing user experience. Advanced e-readers now boast color e-ink displays, faster page turns, and integrated stylus support for note-taking, blurring the lines between physical and digital notebooks. Mobile reading applications are enhancing functionality with AI-powered personalized recommendations, real-time translation, and adaptive font sizing. The integration of multimedia elements, such as embedded videos and interactive graphics within e-books, offers a more immersive reading experience. Performance metrics show a significant reduction in eye strain with newer display technologies and a dramatic increase in user engagement with interactive content. These advancements are critical for the continued growth of the digital publishing industry.

Propelling Factors for Digital Reading Growth

Several key factors are propelling the digital reading market forward. The widespread availability of affordable smartphones and tablets, coupled with ubiquitous internet access, makes digital content readily accessible to a global audience. Technological advancements in e-reader technology, including improved screen quality and battery life, enhance the reading experience. The convenience and portability of digital books cater to the busy lifestyles of modern consumers. Furthermore, the growth of subscription services and the increasing willingness of consumers to pay for premium digital content are significant economic drivers. Government initiatives promoting digital literacy and online education also contribute to market expansion.

Obstacles in the Digital Reading Market

Despite its growth, the digital reading market faces several obstacles. Piracy and copyright infringement remain a persistent challenge, impacting revenue streams for publishers and authors. The sheer volume of digital content can lead to reader fatigue and difficulty in discovering high-quality material. Device fragmentation and compatibility issues across different platforms can create user friction. Intense competition from free content platforms and other forms of digital entertainment also exerts pressure on paid reading models. Furthermore, some readers still prefer the tactile experience of physical books, representing a segment that remains resistant to full digital adoption. The estimated annual revenue loss due to piracy is in the hundreds of billions.

Future Opportunities in Digital Reading

Emerging opportunities in the digital reading market are abundant. The expansion of AI for personalized content creation and curation promises to deliver highly tailored reading experiences. The integration of augmented reality (AR) and virtual reality (VR) technologies could unlock new dimensions of immersive storytelling. Emerging markets in Africa and Southeast Asia present vast untapped potential for digital content consumption. The growth of the audiobook market and the increasing demand for niche and specialized content also offer significant avenues for expansion. Furthermore, the increasing focus on educational technology and remote learning creates a fertile ground for digital textbooks and learning materials.

Major Players in the Digital Reading Ecosystem

- Amazon

- Apple

- McGraw Hill

- Sony

- Alibaba

- CITIC Press Group

- Thinkingdom

- Zhangyue Technology

- China Literature

- COL Digital Publishing Group Co Ltd

- China Media Inc

- Hangzhou Anysoft

- Winshare

- Jiangsu Phoenix

- Central Plains Media

Key Developments in Digital Reading Industry

- 2023 May: Amazon launches a new generation of Kindle e-readers with enhanced color displays and faster processors, boosting e-book market appeal.

- 2023 August: Apple introduces advanced reading features in iOS 17, further integrating digital reading into its ecosystem and impacting cell phone reading.

- 2023 October: Zhangyue Technology announces substantial investment in AI-powered personalized content algorithms, aiming to revolutionize free reading discovery.

- 2024 January: China Literature secures major publishing rights for popular web novels, further solidifying its dominance in the digital publishing landscape.

- 2024 March: McGraw Hill expands its digital textbook offerings with interactive simulations, enhancing the paid reading experience for students.

- 2024 June: Alibaba launches a new platform for independent authors, fostering the growth of self-published e-books.

- 2024 September: Thinkingdom partners with leading universities to develop specialized digital learning modules, tapping into the paid reading education segment.

- 2025 February: Sony unveils a new e-reader designed for professional use, featuring advanced annotation and collaboration tools.

- 2025 April: CITIC Press Group announces plans to enter the global digital publishing market with a curated selection of Chinese literature.

- 2025 July: COL Digital Publishing Group Co Ltd focuses on expanding its audiobook library, catering to the growing demand for audio content.

Strategic Digital Reading Market Forecast

The digital reading market is poised for sustained and robust growth, driven by a confluence of technological innovation, shifting consumer preferences, and expanding market access. The increasing sophistication of e-reader devices, coupled with the ever-present nature of cell phones, will continue to fuel adoption. The growing acceptance of paid reading models, particularly subscription services, indicates a strong willingness among consumers to invest in digital content. Emerging markets represent significant untapped potential, promising to broaden the global reach of digital literature. Strategic investments in AI-driven personalization and immersive technologies will further enhance user engagement and create new avenues for monetization, ensuring a dynamic and evolving future for the digital publishing industry.

Digital Reading Segmentation

-

1. Application

- 1.1. Cell Phone

- 1.2. E-reader

- 1.3. Computer

-

2. Types

- 2.1. Paid Reading

- 2.2. Free Reading

Digital Reading Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Digital Reading Regional Market Share

Geographic Coverage of Digital Reading

Digital Reading REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Reading Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cell Phone

- 5.1.2. E-reader

- 5.1.3. Computer

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Paid Reading

- 5.2.2. Free Reading

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Digital Reading Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cell Phone

- 6.1.2. E-reader

- 6.1.3. Computer

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Paid Reading

- 6.2.2. Free Reading

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Digital Reading Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cell Phone

- 7.1.2. E-reader

- 7.1.3. Computer

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Paid Reading

- 7.2.2. Free Reading

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Digital Reading Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cell Phone

- 8.1.2. E-reader

- 8.1.3. Computer

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Paid Reading

- 8.2.2. Free Reading

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Digital Reading Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cell Phone

- 9.1.2. E-reader

- 9.1.3. Computer

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Paid Reading

- 9.2.2. Free Reading

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Digital Reading Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cell Phone

- 10.1.2. E-reader

- 10.1.3. Computer

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Paid Reading

- 10.2.2. Free Reading

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Amazon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Apple

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 McGraw Hill

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sony

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alibaba

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CITIC Press Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thinkingdom

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zhangyue Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 China Literature

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 COL Digital Publishing Group Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 China Media Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hangzhou Anysoft

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Winshare

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Jiangsu Phoenix

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Central Plains Media

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Amazon

List of Figures

- Figure 1: Global Digital Reading Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Digital Reading Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Digital Reading Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Digital Reading Revenue (billion), by Types 2025 & 2033

- Figure 5: North America Digital Reading Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Digital Reading Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Digital Reading Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Digital Reading Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Digital Reading Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Digital Reading Revenue (billion), by Types 2025 & 2033

- Figure 11: South America Digital Reading Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Digital Reading Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Digital Reading Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Digital Reading Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Digital Reading Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Digital Reading Revenue (billion), by Types 2025 & 2033

- Figure 17: Europe Digital Reading Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Digital Reading Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Digital Reading Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Digital Reading Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Digital Reading Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Digital Reading Revenue (billion), by Types 2025 & 2033

- Figure 23: Middle East & Africa Digital Reading Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Digital Reading Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Digital Reading Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Digital Reading Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Digital Reading Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Digital Reading Revenue (billion), by Types 2025 & 2033

- Figure 29: Asia Pacific Digital Reading Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Digital Reading Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Digital Reading Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Reading Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Digital Reading Revenue billion Forecast, by Types 2020 & 2033

- Table 3: Global Digital Reading Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Digital Reading Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Digital Reading Revenue billion Forecast, by Types 2020 & 2033

- Table 6: Global Digital Reading Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Digital Reading Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Digital Reading Revenue billion Forecast, by Types 2020 & 2033

- Table 12: Global Digital Reading Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Digital Reading Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Digital Reading Revenue billion Forecast, by Types 2020 & 2033

- Table 18: Global Digital Reading Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Digital Reading Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Digital Reading Revenue billion Forecast, by Types 2020 & 2033

- Table 30: Global Digital Reading Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Digital Reading Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Digital Reading Revenue billion Forecast, by Types 2020 & 2033

- Table 39: Global Digital Reading Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Digital Reading Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Reading?

The projected CAGR is approximately 4.77%.

2. Which companies are prominent players in the Digital Reading?

Key companies in the market include Amazon, Apple, McGraw Hill, Sony, Alibaba, CITIC Press Group, Thinkingdom, Zhangyue Technology, China Literature, COL Digital Publishing Group Co Ltd, China Media Inc, Hangzhou Anysoft, Winshare, Jiangsu Phoenix, Central Plains Media.

3. What are the main segments of the Digital Reading?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.946 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Reading," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Reading report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Reading?

To stay informed about further developments, trends, and reports in the Digital Reading, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence