Key Insights

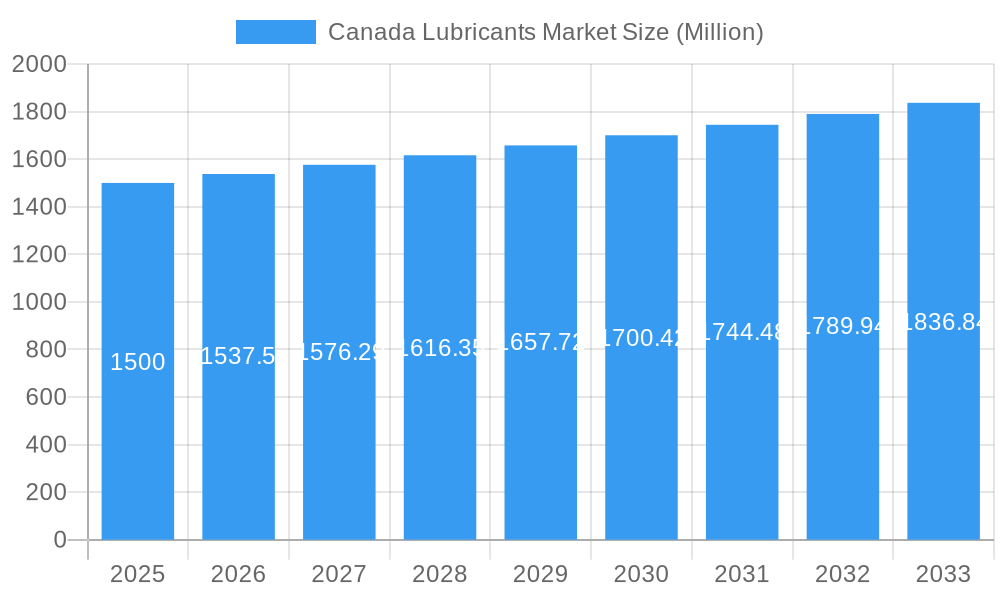

The Canadian lubricants market is projected for stable growth, with a Compound Annual Growth Rate (CAGR) of 2.9%. The market size was estimated at 182900.4 million in the 2025 base year. Key growth drivers include the robust automotive sector, particularly demand for high-performance lubricants in commercial and passenger vehicles, and the expanding industrial sector's need for specialized lubricants in mining, manufacturing, and construction. Emerging trends such as the increased adoption of fuel-efficient and environmentally conscious synthetic lubricants, alongside a growing emphasis on sustainable and biodegradable products, are shaping market dynamics. Regulatory initiatives promoting eco-friendly lubricants are also spurring innovation.

Canada Lubricants Market Market Size (In Billion)

Despite challenges like volatile crude oil prices, economic uncertainties, and competitive pressures, the Canadian lubricants market demonstrates resilience. Sustained demand from core sectors and continuous technological advancements are anticipated to fuel market expansion throughout the forecast period. Leading companies like BP PLC (Castrol), Chevron Corporation, Exxon Mobil Corporation, and Shell plc are actively participating, fostering innovation and broadening product offerings. Market concentration is expected to remain within populous urban centers and industrial regions across Canada. The forecast indicates consistent market growth, driven by enduring demand and the projected positive trajectory of the Canadian economy and its primary industrial sectors, presenting an attractive landscape for market participants.

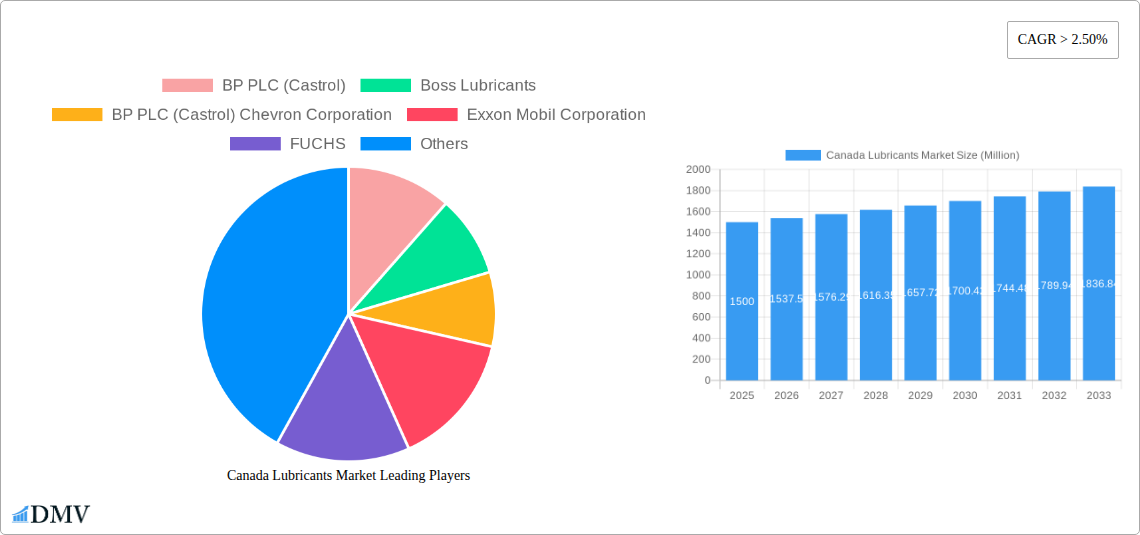

Canada Lubricants Market Company Market Share

Canada Lubricants Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Canada lubricants market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, demonstrating significant growth potential.

Canada Lubricants Market Composition & Trends

This section delves into the competitive landscape of the Canadian lubricants market, examining market concentration, innovation drivers, regulatory influences, substitute product analysis, end-user profiles, and mergers & acquisitions (M&A) activities. We analyze market share distribution amongst key players, including BP PLC (Castrol), Boss Lubricants, Chevron Corporation, Exxon Mobil Corporation, FUCHS, HF Sinclair Corporation (PetroCanada lubricants), Phillips 66 Company, Shell plc, TotalEnergies SE, and Valvoline Inc (Saudi Arabian Oil Co), to understand the level of competition and market consolidation. The report also quantifies M&A deal values and their impact on market dynamics. Further, we assess the impact of evolving regulations, the presence of substitute products, and the changing needs of various end-user segments on the market's trajectory.

- Market Concentration: Analysis of market share held by top players. XX% of the market is controlled by the top 5 players.

- Innovation Catalysts: Examination of technological advancements driving innovation in lubricant formulations and application methods.

- Regulatory Landscape: Assessment of current and upcoming regulations impacting the industry, including environmental regulations and safety standards.

- Substitute Products: Evaluation of substitute products and their potential impact on market share.

- End-User Profiles: Detailed analysis of the end-user segments (automotive, industrial, etc.) and their lubricant needs.

- M&A Activities: Review of recent mergers and acquisitions, including deal values and their implications for the market structure. For example, the USD 2,650 Million acquisition of Valvoline Global Products by Saudi Aramco is analyzed in detail.

Canada Lubricants Market Industry Evolution

This section offers a comprehensive examination of the Canada lubricants market's historical trajectory and future outlook. We delve into the market's evolution from 2019 to 2024, identifying key growth drivers, significant technological innovations, and the dynamic shifts in consumer preferences. Our analysis projects market trends from 2025 to 2033, providing calculated growth rates across crucial market segments and sub-segments. We highlight the transformative impact of advancements such as the development and adoption of high-performance synthetic lubricants and sophisticated additive technologies. Furthermore, we scrutinize the increasing consumer demand for sustainable, eco-friendly, and high-performance lubricant solutions. Detailed data illustrates the adoption rates of emerging technologies and the evolving landscape of consumer choices within the Canadian market.

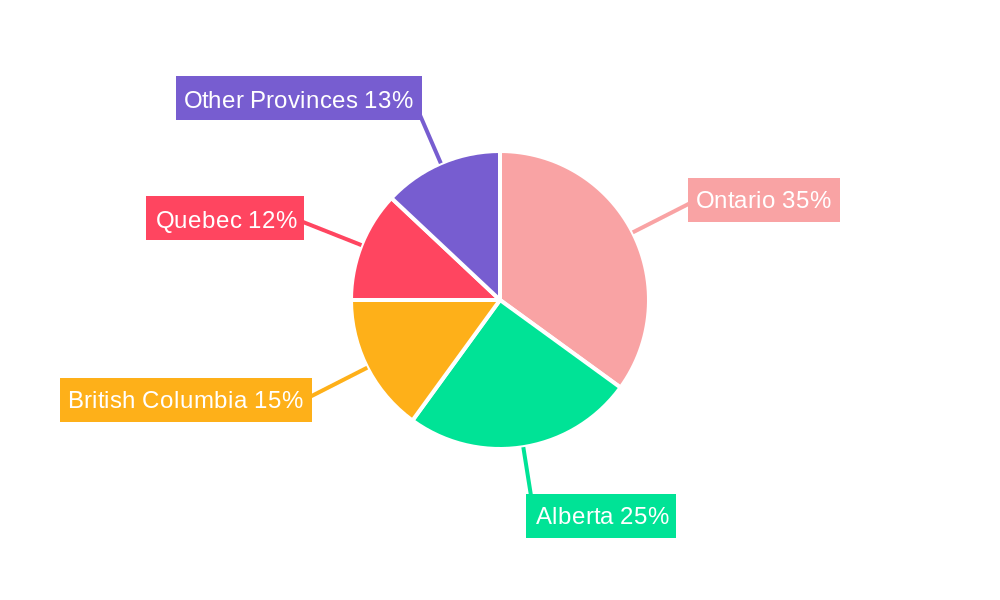

Leading Regions, Countries, or Segments in Canada Lubricants Market

This section identifies and analyzes the leading regions, countries, or specific market segments that hold significant influence and market share within the Canadian lubricants industry. We conduct a granular examination to pinpoint the underlying factors that contribute to their dominance and sustained growth.

-

Key Drivers of Leadership:

- Substantial and ongoing investments in critical infrastructure development, driving demand for industrial and automotive lubricants.

- Supportive government regulations, tax incentives, and strategic policies designed to foster industrial growth and innovation within the sector.

- Robust economic expansion and diversification in specific geographical areas, leading to increased industrial output and consumer spending.

- Persistent and high demand from cornerstone end-user industries, including automotive, manufacturing, mining, and energy sectors.

-

Factors Contributing to Dominance: An in-depth analysis will explore the specific elements that elevate certain regions or segments to a leadership position. This includes a detailed look at advanced infrastructure networks, the concentration of industrial and manufacturing activities, the level of technological adoption, and nuanced consumer behavior patterns specific to those areas.

Canada Lubricants Market Product Innovations

This section highlights recent product innovations, applications, and performance metrics within the Canadian lubricants market. We focus on unique selling propositions and the integration of advanced technologies. Examples include the development of high-performance lubricants for specific applications, such as those with enhanced fuel efficiency or improved wear resistance.

Propelling Factors for Canada Lubricants Market Growth

The growth of the Canada lubricants market is driven by several key factors:

- Technological advancements in lubricant formulations resulting in improved efficiency and performance.

- Strong economic growth and associated industrial activity boosting lubricant demand across diverse sectors.

- Government regulations promoting the use of environmentally friendly lubricants.

Obstacles in the Canada Lubricants Market

The Canada lubricants market faces several challenges that can impede its growth and development. These include:

- Significant volatility in global crude oil prices, directly impacting the cost of raw materials and overall production expenses for lubricants.

- Increasing susceptibility to supply chain disruptions, which can affect the availability of essential components, raw materials, and the timely delivery of finished products to market.

- Intensified competition from well-established market players and the persistent emergence of agile new entrants, leading to pricing pressures and market fragmentation.

- The growing demand for specialized, high-performance, and environmentally sustainable lubricants, requiring substantial investment in research and development to meet evolving industry standards and consumer expectations.

- Stringent environmental regulations and the need for compliance with evolving sustainability mandates, necessitating product reformulation and process adjustments.

Future Opportunities in Canada Lubricants Market

Future opportunities include:

- Expansion into new market segments such as renewable energy sectors.

- Development of specialized lubricants for emerging technologies (e.g., electric vehicles).

- Growing demand for sustainable and environmentally friendly lubricant solutions.

Major Players in the Canada Lubricants Market Ecosystem

- BP PLC (Castrol)

- Boss Lubricants

- Chevron Corporation

- Exxon Mobil Corporation

- FUCHS

- HF Sinclair Corporation (PetroCanada lubricants)

- Phillips 66 Company

- Shell plc

- TotalEnergies SE

- Valvoline Inc (Saudi Arabian Oil Co)

- List Not Exhaustive

Key Developments in Canada Lubricants Market Industry

- September 2022: TotalEnergies Marketing Canada Inc. strategically launched its innovative digital platform, LubConsult Recommendation, significantly enhancing its client advisory services and providing personalized lubrication solutions.

- August 2022: Saudi Aramco's landmark acquisition of Valvoline Global Products marked a substantial move towards market consolidation, signaling potential shifts in product portfolios, distribution networks, and competitive dynamics within the broader lubricants industry.

- Early 2023: Several major lubricant manufacturers introduced new lines of biodegradable and low-VOC (Volatile Organic Compound) lubricants, responding to increasing environmental awareness and regulatory pressures.

- Late 2023: The Canadian automotive sector saw a notable increase in the adoption of electric vehicles (EVs), prompting lubricant manufacturers to develop specialized EV fluids for thermal management, gear lubrication, and other critical functions.

Strategic Canada Lubricants Market Forecast

The Canadian lubricants market is poised for continued growth driven by technological advancements, increasing industrial activity, and the adoption of sustainable solutions. Opportunities exist in specialized lubricant segments and the development of environmentally friendly products. The market is expected to witness strong growth over the forecast period (2025-2033), with significant potential for expansion into new applications and geographical areas.

Canada Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oil

- 1.5. Metalworking Fluids

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Heavy Equipment

- 2.3. Metallurgy and Metalworking

- 2.4. Power Generation

- 2.5. Other End-user Industries

Canada Lubricants Market Segmentation By Geography

- 1. Canada

Canada Lubricants Market Regional Market Share

Geographic Coverage of Canada Lubricants Market

Canada Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Sales of Motor Vehicles; Increasing Demand from Manufacturing Industry

- 3.3. Market Restrains

- 3.3.1. Growing Sales of Motor Vehicles; Increasing Demand from Manufacturing Industry

- 3.4. Market Trends

- 3.4.1. Engine Oil to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oil

- 5.1.5. Metalworking Fluids

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Heavy Equipment

- 5.2.3. Metallurgy and Metalworking

- 5.2.4. Power Generation

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BP PLC (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Boss Lubricants

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BP PLC (Castrol) Chevron Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Exxon Mobil Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FUCHS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HF Sinclair Corporation (PetroCanada lubricants)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Phillips 66 Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shell plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TotalEnergies SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Valvoline Inc (Saudi Arabian Oil Co )*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BP PLC (Castrol)

List of Figures

- Figure 1: Canada Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Canada Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Canada Lubricants Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 3: Canada Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Canada Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Canada Lubricants Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: Canada Lubricants Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Lubricants Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the Canada Lubricants Market?

Key companies in the market include BP PLC (Castrol), Boss Lubricants, BP PLC (Castrol) Chevron Corporation, Exxon Mobil Corporation, FUCHS, HF Sinclair Corporation (PetroCanada lubricants), Phillips 66 Company, Shell plc, TotalEnergies SE, Valvoline Inc (Saudi Arabian Oil Co )*List Not Exhaustive.

3. What are the main segments of the Canada Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 182900.4 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Sales of Motor Vehicles; Increasing Demand from Manufacturing Industry.

6. What are the notable trends driving market growth?

Engine Oil to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Sales of Motor Vehicles; Increasing Demand from Manufacturing Industry.

8. Can you provide examples of recent developments in the market?

September 2022: TotalEnergies Marketing Canada Inc. launched its new digital platform, LubConsult Recommendation, which will enable it to better advise its clients and their clients' clients on the selection of lubricants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Lubricants Market?

To stay informed about further developments, trends, and reports in the Canada Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence