Key Insights

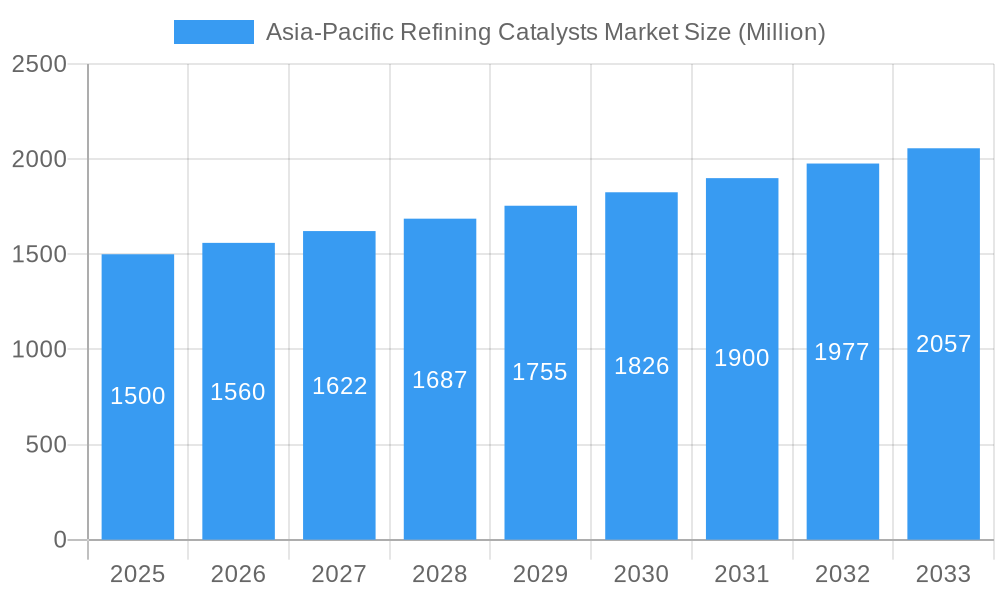

The Asia-Pacific refining catalysts market is poised for substantial growth, projected to reach $10096.57 million by 2033, with a Compound Annual Growth Rate (CAGR) of 4.3% from the base year 2025. This expansion is propelled by the burgeoning petrochemical and refining sectors across China, India, and South Korea, driving demand for high-performance catalysts. Additionally, escalating environmental regulations are compelling refiners to adopt cleaner technologies, necessitating advanced catalysts for improved fuel efficiency and reduced emissions. Investments in refinery upgrades and new constructions further stimulate catalyst demand. Technological innovations in catalyst design and manufacturing are yielding enhanced activity, selectivity, and longevity, offering greater cost-effectiveness. The market is segmented by ingredient (zeolite, metal, chemical compounds) and catalyst type (fluid catalytic cracking, reforming, hydrotreating, hydrocracking, isomerization, and alkylation catalysts). Key market participants, including Haldor Topsoe, Axens, Honeywell, and Clariant, are actively engaged in innovation and strategic alliances.

Asia-Pacific Refining Catalysts Market Market Size (In Billion)

Despite a positive outlook, market dynamics are influenced by crude oil price volatility and the long-term implications of alternative energy adoption. Continuous investment in R&D for catalyst efficiency and sustainability is crucial for mitigating these challenges. The robust economic development and infrastructure expansion in the Asia-Pacific region are anticipated to sustain market growth throughout the forecast period. Sub-segment growth will be contingent upon regional refinery projects and evolving emissions standards.

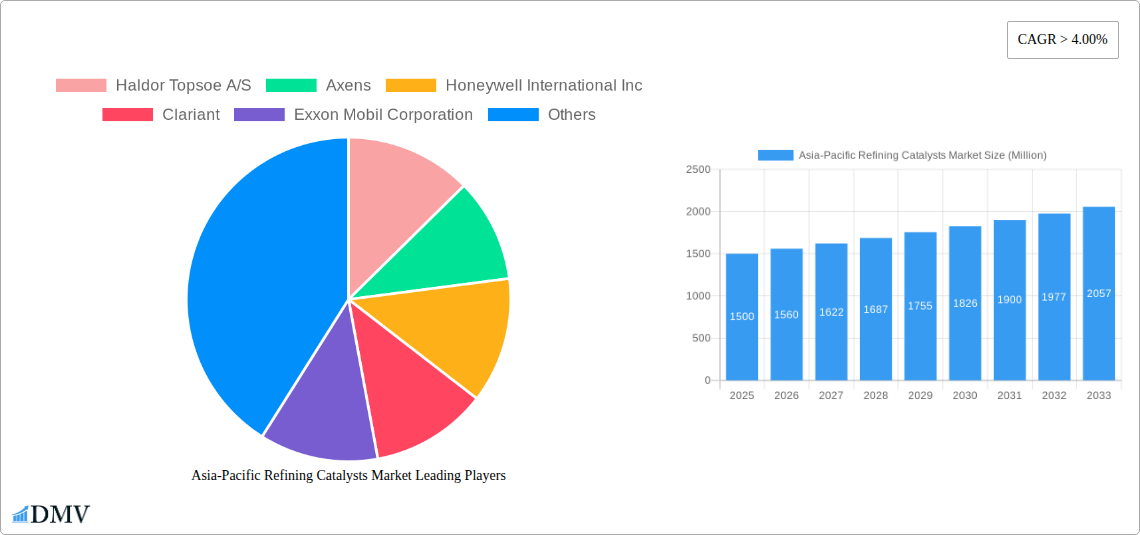

Asia-Pacific Refining Catalysts Market Company Market Share

Asia-Pacific Refining Catalysts Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Asia-Pacific Refining Catalysts market, offering crucial insights for stakeholders seeking to navigate this dynamic landscape. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report delves into market size, segmentation, leading players, technological advancements, and future growth prospects, equipping you with the knowledge necessary to make informed strategic decisions. The market is segmented by ingredient (Zeolite, Metal, Chemical Compounds) and type (Fluid Catalytic Cracking Catalysts, Reforming Catalysts, Hydrotreating Catalysts, Hydrocracking Catalysts, Isomerization Catalysts, Alkylation Catalysts). Key players include Haldor Topsoe A/S, Axens, Honeywell International Inc, Clariant, Exxon Mobil Corporation, Evonik Industries AG, W R Grace & Co -Conn, BASF SE, Sinopec (China Petroleum & Chemical Corporation), Chevron Corporation, DuPont, JGC C & C, Johnson Matthey, and Albemarle Corporation. The total market value in 2025 is estimated at XXX Million.

Asia-Pacific Refining Catalysts Market Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics of the Asia-Pacific Refining Catalysts market. We examine the market share distribution amongst key players, revealing the level of market concentration. The report also explores the influence of mergers and acquisitions (M&A) activities, detailing significant deals and their impact on market structure. Furthermore, we identify substitute products and their potential to disrupt the market, alongside a detailed profile of end-users and their evolving needs.

- Market Concentration: The market exhibits a [High/Medium/Low] level of concentration, with the top 5 players holding approximately XX% of the market share in 2025.

- Innovation Catalysts: Government incentives for clean energy technologies and increasing demand for higher-quality fuels are driving innovation in catalyst technology.

- Regulatory Landscape: Stringent emission regulations in several Asian countries are pushing the adoption of more efficient and environmentally friendly catalysts.

- Substitute Products: The emergence of [mention specific substitute products or technologies] poses a potential threat to traditional refining catalysts.

- End-User Profiles: Major end-users include large-scale refineries, petrochemical plants, and independent oil companies across the Asia-Pacific region.

- M&A Activities: The past five years have witnessed [Number] significant M&A deals, totaling approximately XXX Million in value, shaping the competitive landscape. Examples include [mention specific deals if data available, otherwise use "strategic acquisitions to enhance product portfolios and expand market reach"].

Asia-Pacific Refining Catalysts Market Industry Evolution

This section details the historical and projected growth trajectories of the Asia-Pacific Refining Catalysts market. We analyze the key factors influencing market expansion, such as technological advancements, shifting consumer preferences (demand for cleaner fuels), and evolving refinery operations. Data points include historical growth rates (2019-2024) and projected growth rates (2025-2033) for the overall market and key segments. We also assess the adoption rate of new catalyst technologies and their impact on market dynamics. The market is expected to experience a CAGR of XX% during the forecast period, driven by [mention key drivers such as increased refining capacity, stricter emission norms, and technological advancements]. Specific examples of technological advancements include [mention specific advancements and their impact on market growth].

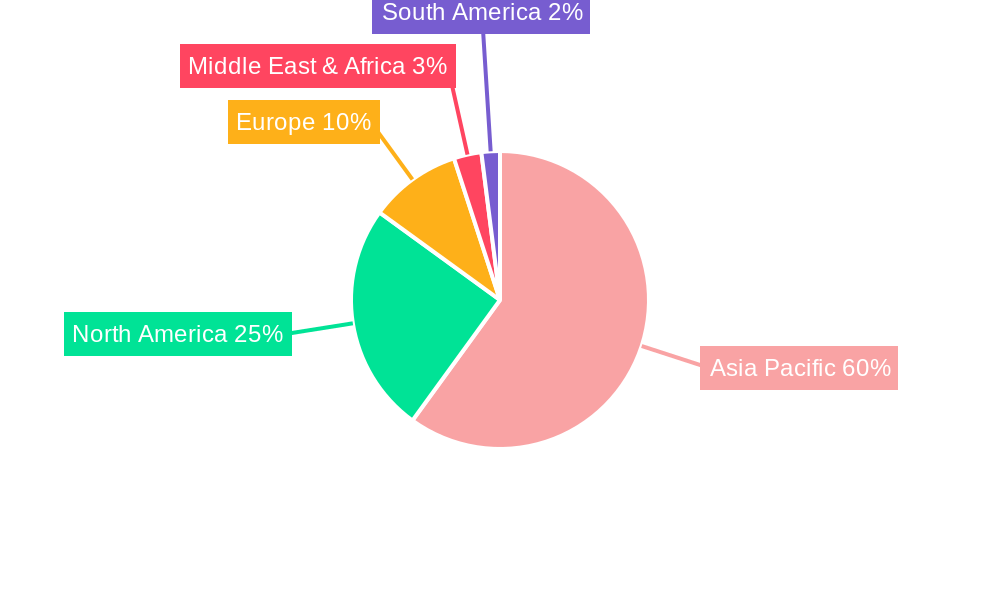

Leading Regions, Countries, or Segments in Asia-Pacific Refining Catalysts Market

This section identifies the dominant regions, countries, and segments within the Asia-Pacific Refining Catalysts market. We analyze the factors contributing to their leadership, providing a granular understanding of market dynamics within these key areas.

- Dominant Region: [Specify dominant region, e.g., China] accounts for the largest market share due to [Reasons: e.g., high refining capacity, strong economic growth, government support for the petrochemical industry].

- Dominant Country: [Specify dominant country, e.g., China] holds the largest market share within the region because of [Reasons: e.g., its massive refining industry, significant investments in upgrading refineries, and supportive government policies].

- Dominant Ingredient Segment: [Specify dominant ingredient segment, e.g., Zeolite] dominates due to its [Reasons: e.g., cost-effectiveness, high activity, and versatility].

- Dominant Catalyst Type Segment: [Specify dominant catalyst type segment, e.g., Fluid Catalytic Cracking Catalysts] holds the largest market share due to [Reasons: e.g., its widespread use in refineries, high demand for gasoline and diesel production].

Key Drivers:

- Significant investments in refinery expansion and modernization projects across the region.

- Stringent environmental regulations promoting the adoption of advanced catalyst technologies.

- Growing demand for cleaner fuels due to increasing environmental concerns.

Asia-Pacific Refining Catalysts Market Product Innovations

Recent innovations in refining catalysts focus on improving efficiency, selectivity, and environmental performance. New catalyst formulations boast enhanced activity, longer lifespan, and reduced emissions, leading to cost savings and improved sustainability for refineries. For instance, advancements in [Mention specific catalyst type, e.g., hydrocracking catalysts] have resulted in higher yields of valuable products and reduced energy consumption. These innovations are driven by the increasing demand for cleaner fuels and stricter emission regulations across the Asia-Pacific region.

Propelling Factors for Asia-Pacific Refining Catalysts Market Growth

The Asia-Pacific Refining Catalysts market's growth is propelled by several factors: Firstly, the region's expanding refining capacity fuels higher demand for catalysts. Secondly, stringent environmental regulations mandate the adoption of more efficient and eco-friendly catalyst technologies. Thirdly, technological advancements constantly improve catalyst performance, driving adoption. Finally, increasing investments in refinery upgrades and modernization projects further stimulate market growth.

Obstacles in the Asia-Pacific Refining Catalysts Market Market

Several challenges hinder the Asia-Pacific Refining Catalysts market. Fluctuations in crude oil prices can impact refinery profitability and catalyst demand. Supply chain disruptions, particularly related to raw material sourcing, can impact catalyst availability and cost. Intense competition among catalyst manufacturers exerts downward pressure on prices and margins. Moreover, navigating complex regulatory landscapes and complying with stringent environmental norms add to operational costs.

Future Opportunities in Asia-Pacific Refining Catalysts Market

Future opportunities abound. The growing demand for cleaner fuels, such as low-sulfur diesel and gasoline, will drive demand for advanced catalyst technologies. Emerging markets in Southeast Asia offer significant growth potential. The development of more sustainable and cost-effective catalyst formulations will unlock new market segments. Furthermore, collaborative efforts between catalyst manufacturers and refineries can lead to customized solutions and optimized refinery operations.

Major Players in the Asia-Pacific Refining Catalysts Market Ecosystem

Key Developments in Asia-Pacific Refining Catalysts Market Industry

- 2023-Q1: [Company Name] launched a new generation of [Catalyst Type] catalyst, improving efficiency by XX%.

- 2022-Q4: [Company A] and [Company B] announced a strategic partnership to develop advanced catalyst technologies for cleaner fuel production.

- 2021-Q3: [Government agency] implemented stricter emission regulations, driving demand for advanced catalyst technologies. (Add more bullet points as data becomes available)

Strategic Asia-Pacific Refining Catalysts Market Market Forecast

The Asia-Pacific Refining Catalysts market is poised for robust growth over the forecast period, driven by a combination of factors including expanding refining capacity, stringent emission regulations, and ongoing technological advancements in catalyst formulations. The market's future hinges on sustained investments in refinery upgrades, the adoption of cleaner fuel technologies, and the development of innovative and cost-effective catalyst solutions. This presents significant opportunities for established players and new entrants alike.

Asia-Pacific Refining Catalysts Market Segmentation

-

1. Ingredient

- 1.1. Zeolite

- 1.2. Metal

- 1.3. Chemical Compounds

-

2. Type

- 2.1. Fluid Catalytic Cracking Catalysts

- 2.2. Reforming Catalysts

- 2.3. Hydrotreating Catalysts

- 2.4. Hydrocracking Catalysts

- 2.5. Isomerization Catalysts

- 2.6. Alkylation Catalysts

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ASEAN Countries

- 3.6. Rest of Asia-Pacific

Asia-Pacific Refining Catalysts Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia-Pacific Refining Catalysts Market Regional Market Share

Geographic Coverage of Asia-Pacific Refining Catalysts Market

Asia-Pacific Refining Catalysts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Investment in Refineries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Volatility in Precious Metal Prices

- 3.4. Market Trends

- 3.4.1. Fluid Catalytic Cracking (FCC) Catalysts to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Refining Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient

- 5.1.1. Zeolite

- 5.1.2. Metal

- 5.1.3. Chemical Compounds

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fluid Catalytic Cracking Catalysts

- 5.2.2. Reforming Catalysts

- 5.2.3. Hydrotreating Catalysts

- 5.2.4. Hydrocracking Catalysts

- 5.2.5. Isomerization Catalysts

- 5.2.6. Alkylation Catalysts

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. ASEAN Countries

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Ingredient

- 6. China Asia-Pacific Refining Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient

- 6.1.1. Zeolite

- 6.1.2. Metal

- 6.1.3. Chemical Compounds

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fluid Catalytic Cracking Catalysts

- 6.2.2. Reforming Catalysts

- 6.2.3. Hydrotreating Catalysts

- 6.2.4. Hydrocracking Catalysts

- 6.2.5. Isomerization Catalysts

- 6.2.6. Alkylation Catalysts

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. ASEAN Countries

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Ingredient

- 7. India Asia-Pacific Refining Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient

- 7.1.1. Zeolite

- 7.1.2. Metal

- 7.1.3. Chemical Compounds

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fluid Catalytic Cracking Catalysts

- 7.2.2. Reforming Catalysts

- 7.2.3. Hydrotreating Catalysts

- 7.2.4. Hydrocracking Catalysts

- 7.2.5. Isomerization Catalysts

- 7.2.6. Alkylation Catalysts

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. ASEAN Countries

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Ingredient

- 8. Japan Asia-Pacific Refining Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient

- 8.1.1. Zeolite

- 8.1.2. Metal

- 8.1.3. Chemical Compounds

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fluid Catalytic Cracking Catalysts

- 8.2.2. Reforming Catalysts

- 8.2.3. Hydrotreating Catalysts

- 8.2.4. Hydrocracking Catalysts

- 8.2.5. Isomerization Catalysts

- 8.2.6. Alkylation Catalysts

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. ASEAN Countries

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Ingredient

- 9. South Korea Asia-Pacific Refining Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient

- 9.1.1. Zeolite

- 9.1.2. Metal

- 9.1.3. Chemical Compounds

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fluid Catalytic Cracking Catalysts

- 9.2.2. Reforming Catalysts

- 9.2.3. Hydrotreating Catalysts

- 9.2.4. Hydrocracking Catalysts

- 9.2.5. Isomerization Catalysts

- 9.2.6. Alkylation Catalysts

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. ASEAN Countries

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Ingredient

- 10. ASEAN Countries Asia-Pacific Refining Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredient

- 10.1.1. Zeolite

- 10.1.2. Metal

- 10.1.3. Chemical Compounds

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fluid Catalytic Cracking Catalysts

- 10.2.2. Reforming Catalysts

- 10.2.3. Hydrotreating Catalysts

- 10.2.4. Hydrocracking Catalysts

- 10.2.5. Isomerization Catalysts

- 10.2.6. Alkylation Catalysts

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. ASEAN Countries

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Ingredient

- 11. Rest of Asia Pacific Asia-Pacific Refining Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Ingredient

- 11.1.1. Zeolite

- 11.1.2. Metal

- 11.1.3. Chemical Compounds

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Fluid Catalytic Cracking Catalysts

- 11.2.2. Reforming Catalysts

- 11.2.3. Hydrotreating Catalysts

- 11.2.4. Hydrocracking Catalysts

- 11.2.5. Isomerization Catalysts

- 11.2.6. Alkylation Catalysts

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. ASEAN Countries

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Ingredient

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Haldor Topsoe A/S

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Axens

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Honeywell International Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Clariant

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Exxon Mobil Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Evonik Industries AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 W R Grace & Co -Conn

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 BASF SE

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sinopec (China Petroleum & Chemical Corporation)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Chevron Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 DuPont

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 JGC C & C

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Johnson Matthey

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Albemarle Corporation

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Haldor Topsoe A/S

List of Figures

- Figure 1: Asia-Pacific Refining Catalysts Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Refining Catalysts Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Ingredient 2020 & 2033

- Table 2: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 3: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Type 2020 & 2033

- Table 4: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 5: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Ingredient 2020 & 2033

- Table 10: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 11: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Type 2020 & 2033

- Table 12: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 13: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Ingredient 2020 & 2033

- Table 18: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 19: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Type 2020 & 2033

- Table 20: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 21: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Ingredient 2020 & 2033

- Table 26: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 27: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Type 2020 & 2033

- Table 28: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 29: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Ingredient 2020 & 2033

- Table 34: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 35: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Type 2020 & 2033

- Table 36: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 37: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Ingredient 2020 & 2033

- Table 42: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 43: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Type 2020 & 2033

- Table 44: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 45: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Ingredient 2020 & 2033

- Table 50: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Ingredient 2020 & 2033

- Table 51: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Type 2020 & 2033

- Table 52: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 53: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Geography 2020 & 2033

- Table 54: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 55: Asia-Pacific Refining Catalysts Market Revenue million Forecast, by Country 2020 & 2033

- Table 56: Asia-Pacific Refining Catalysts Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Refining Catalysts Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Asia-Pacific Refining Catalysts Market?

Key companies in the market include Haldor Topsoe A/S, Axens, Honeywell International Inc, Clariant, Exxon Mobil Corporation, Evonik Industries AG, W R Grace & Co -Conn, BASF SE, Sinopec (China Petroleum & Chemical Corporation), Chevron Corporation, DuPont, JGC C & C, Johnson Matthey, Albemarle Corporation.

3. What are the main segments of the Asia-Pacific Refining Catalysts Market?

The market segments include Ingredient, Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 10096.57 million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Investment in Refineries; Other Drivers.

6. What are the notable trends driving market growth?

Fluid Catalytic Cracking (FCC) Catalysts to Dominate the Market.

7. Are there any restraints impacting market growth?

; Volatility in Precious Metal Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Refining Catalysts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Refining Catalysts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Refining Catalysts Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Refining Catalysts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence