Key Insights

The Asia-Pacific dry mix mortar market is poised for substantial expansion, fueled by dynamic construction activities across the region. With a projected Compound Annual Growth Rate (CAGR) of 6.1%, the market is expected to reach approximately 15.54 billion by 2024. Key drivers include burgeoning infrastructure and residential development, alongside increasing adoption of pre-mixed solutions for enhanced quality and efficiency. Growth is particularly pronounced in rapidly urbanizing economies such as China and India, supported by government initiatives promoting sustainable construction. While raw material price volatility and competitive pressures exist, the shift towards advanced, eco-friendly dry mix mortars presents significant opportunities.

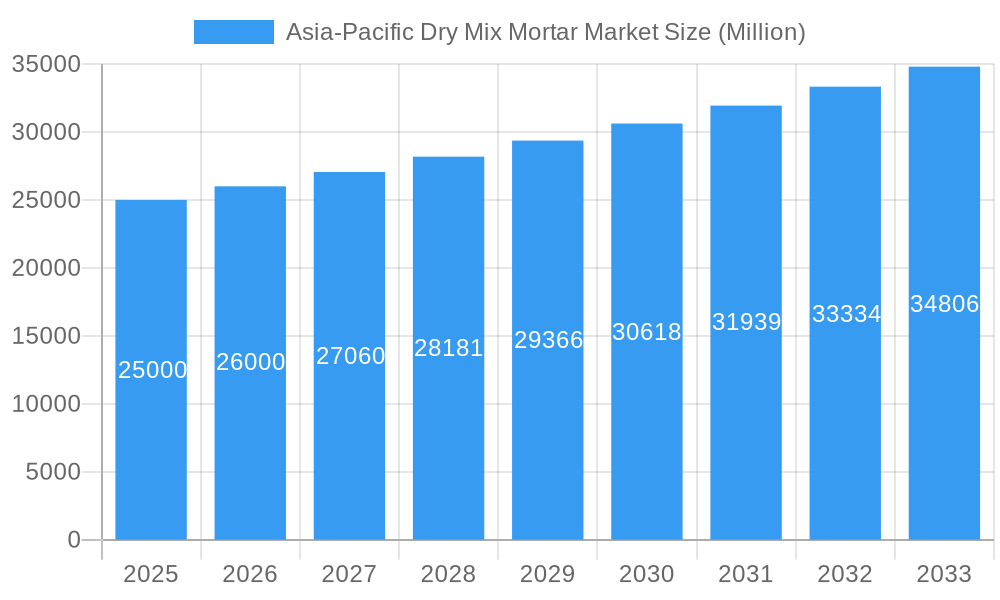

Asia-Pacific Dry Mix Mortar Market Market Size (In Billion)

Geographic growth varies, with China, India, and Southeast Asian nations exhibiting the fastest expansion. Leading players like HANIL HOLDINGS CO LTD, UltraTech Cement Ltd, Saint-Gobain, and Sika AG are strategically expanding their presence through technological innovation and robust distribution channels. The market's segmentation across diverse applications, including concrete protection, renovation, grouts, and tile adhesives, underscores its multifaceted growth trajectory. The increasing integration of advanced technologies and sustainable practices in construction will continue to shape this evolving market landscape.

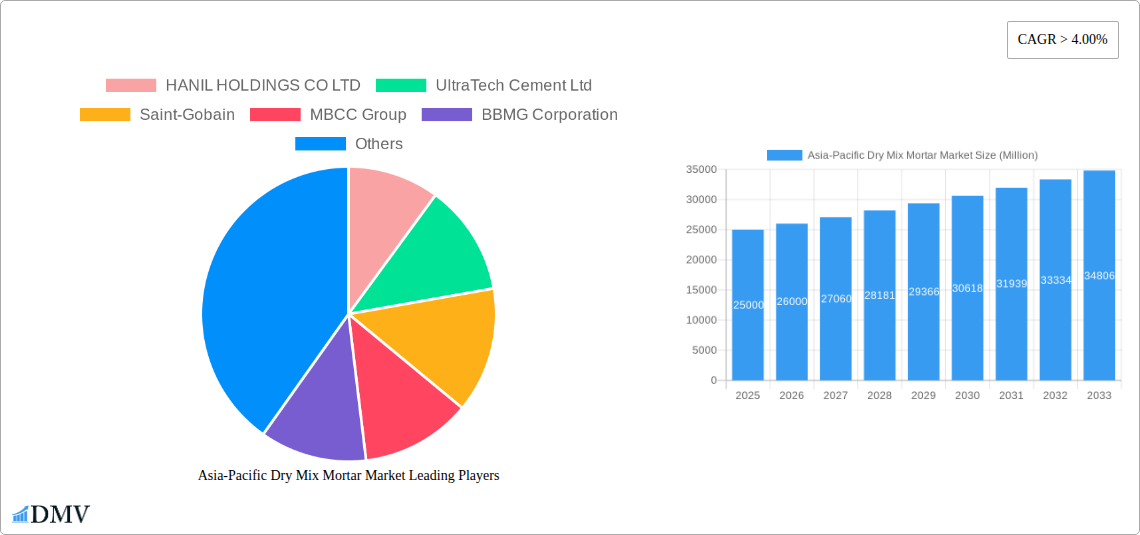

Asia-Pacific Dry Mix Mortar Market Company Market Share

Asia-Pacific Dry Mix Mortar Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Asia-Pacific dry mix mortar market, offering a detailed overview of market dynamics, trends, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust CAGR.

Asia-Pacific Dry Mix Mortar Market Composition & Trends

The Asia-Pacific dry mix mortar market is characterized by a moderately consolidated structure, with key players such as HANIL HOLDINGS CO LTD, UltraTech Cement Ltd, Saint-Gobain, MBCC Group, and Sika AG holding significant market share. Innovation is driven by the increasing demand for high-performance, sustainable, and specialized mortars. Stringent environmental regulations across several Asia-Pacific countries are shaping product development, pushing manufacturers towards eco-friendly formulations. Substitute products, such as traditional cement-based mortars, continue to compete, but the advantages of dry mix mortars in terms of convenience, consistency, and performance are driving market growth. End-users primarily comprise the residential, commercial, industrial, and infrastructure sectors.

The market has witnessed significant M&A activity, as highlighted by recent deals:

- October 2023: Beijing BBMG Mortar Co. Ltd acquired 30% of equities in Tianjin Jinyu Treasure Bright Mortar Co. Ltd for around USD 2430 Million, signifying consolidation within the Chinese market.

- May 2023: MBCC Group's divestment of its construction systems business to Sika AG reshaped the competitive landscape, impacting market share distribution significantly. The exact impact on market share is still being assessed, but it is expected to be significant.

Market share distribution among the major players is estimated as follows (2025):

- UltraTech Cement Ltd: xx%

- Saint-Gobain: xx%

- MBCC Group: xx%

- Sika AG: xx%

- Others: xx%

Asia-Pacific Dry Mix Mortar Market Industry Evolution

The Asia-Pacific dry mix mortar market has experienced consistent growth over the historical period (2019-2024), driven by robust construction activity across the region, particularly in rapidly developing economies like India, China, and Indonesia. The market witnessed a growth rate of xx% during the historical period. This growth is attributed to several factors, including increasing urbanization, rising infrastructure investments, and the growing preference for pre-mixed mortars due to their convenience and consistent quality. Technological advancements, such as the introduction of self-leveling mortars and high-performance admixtures, are further enhancing product functionality and broadening application areas. Consumer demand is shifting towards eco-friendly and high-performance mortars, pushing innovation in product formulation and manufacturing processes. The adoption rate of innovative dry mix mortar solutions is increasing, with a significant uptake observed in the residential and infrastructure sectors. The forecast period (2025-2033) projects continued growth, driven by sustained infrastructure development projects across the region and increasing demand from the commercial and industrial sectors. The market is expected to achieve a CAGR of xx% during this period.

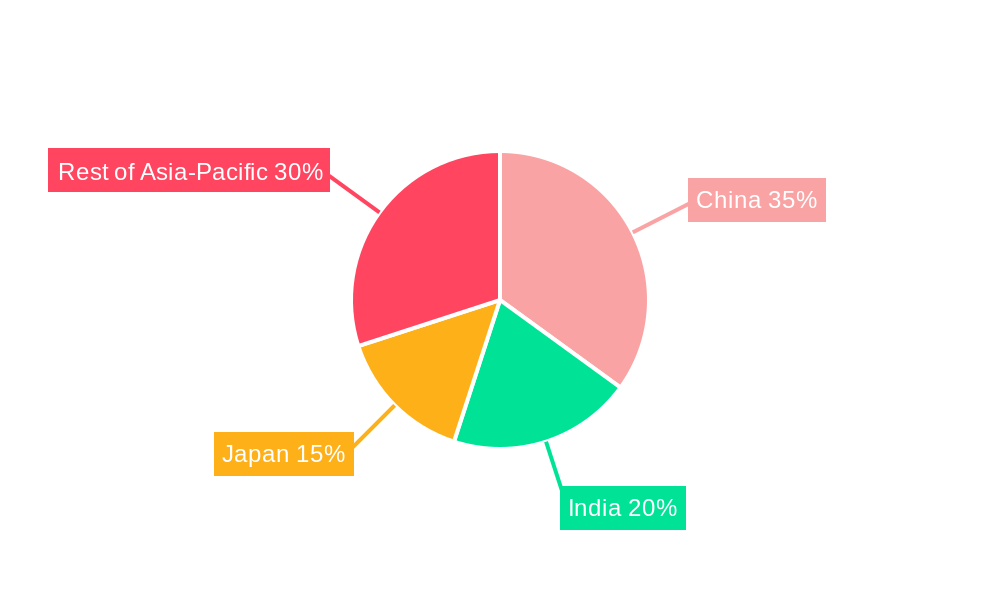

Leading Regions, Countries, or Segments in Asia-Pacific Dry Mix Mortar Market

China and India are currently the dominant markets in the Asia-Pacific dry mix mortar sector, driven by extensive infrastructure development and rapid urbanization.

Key Drivers:

- China: Massive government investments in infrastructure projects, including high-speed rail, roads, and buildings, are fueling demand. Stringent environmental regulations are also driving the adoption of eco-friendly mortars.

- India: Rapid urbanization, expanding middle class, and government initiatives promoting affordable housing are key drivers of market growth.

- Other Countries: Significant growth potential exists in Southeast Asian countries like Indonesia, Vietnam, and Thailand, driven by rising construction activities and increasing disposable incomes.

Dominance Factors:

- High Construction Activity: The booming construction sector in these countries is the primary driver of market growth, creating a high demand for dry mix mortars.

- Government Support: Government initiatives promoting infrastructure development and affordable housing significantly impact market growth.

- Favorable Economic Conditions: Rising disposable incomes and increased foreign direct investment contribute to market expansion.

Among application segments, Tile Adhesive and Concrete Protection and Renovation currently hold the largest market shares, driven by widespread use in residential and commercial construction.

Asia-Pacific Dry Mix Mortar Market Product Innovations

Recent innovations focus on enhancing performance characteristics like strength, durability, and workability. The introduction of self-leveling mortars, high-performance admixtures, and specialized mortars for specific applications (e.g., waterproofing, insulation) has significantly improved efficiency and quality in construction projects. Products featuring improved setting times and enhanced sustainability (reduced carbon footprint) are gaining traction, aligning with global environmental concerns and regulatory pressures. For instance, PCI Novoment Flow, a ready-mixed flowable screed mortar launched by PCI (MBCC Group), showcases these advancements.

Propelling Factors for Asia-Pacific Dry Mix Mortar Market Growth

The Asia-Pacific dry mix mortar market is propelled by several factors: Firstly, robust infrastructure development across the region, fueled by government investments and private sector participation, creates significant demand. Secondly, the increasing urbanization and rising disposable incomes are driving the construction of residential and commercial buildings, further boosting market growth. Thirdly, technological advancements leading to improved product quality, performance, and ease of use are enhancing market appeal. Finally, favorable government policies supporting sustainable construction practices are encouraging the adoption of eco-friendly dry mix mortar solutions.

Obstacles in the Asia-Pacific Dry Mix Mortar Market

The market faces challenges including fluctuating raw material prices, impacting production costs and profitability. Supply chain disruptions, particularly concerning key raw materials like cement and admixtures, can cause production delays and price volatility. Intense competition among established players and new entrants also creates pricing pressure. Furthermore, variations in regulatory frameworks and building codes across different countries can complicate market entry and expansion strategies. These factors can potentially constrain market growth if not properly addressed.

Future Opportunities in Asia-Pacific Dry Mix Mortar Market

Future opportunities lie in the growing demand for specialized mortars catering to specific construction needs, such as high-performance mortars for infrastructure projects and eco-friendly mortars aligned with sustainable construction practices. Expansion into less-penetrated markets within the Asia-Pacific region also presents significant growth potential. Technological advancements, such as the development of smart mortars with enhanced functionalities, are expected to drive future innovation and market growth. Furthermore, focusing on customized solutions for specific end-use sectors could create niche market opportunities.

Major Players in the Asia-Pacific Dry Mix Mortar Market Ecosystem

- HANIL HOLDINGS CO LTD

- UltraTech Cement Ltd

- Saint-Gobain

- MBCC Group

- BBMG Corporation

- Asia Cement Co Ltd

- Sika AG

- Oriental Yuhong

- SCG

- SAMPYO GROUP

Key Developments in Asia-Pacific Dry Mix Mortar Market Industry

- October 2023: Beijing BBMG Mortar Co. Ltd acquired 30% of equities in Tianjin Jinyu Treasure Bright Mortar Co. Ltd for around USD 2430 Million, significantly increasing its market presence in China.

- May 2023: PCI (MBCC Group) launched PCI Novoment Flow, a ready-mixed flowable screed mortar, enhancing its product portfolio and competitiveness.

- May 2023: MBCC Group divested its construction systems business to Sika AG, altering the competitive landscape and potentially impacting market share distribution in the long term.

Strategic Asia-Pacific Dry Mix Mortar Market Forecast

The Asia-Pacific dry mix mortar market is poised for sustained growth over the forecast period (2025-2033), driven by the ongoing expansion of the construction sector, rising urbanization, and increasing demand for high-performance and sustainable building materials. The market's future success hinges on technological innovation, strategic partnerships, and adaptation to evolving regulatory landscapes. Companies focusing on sustainable solutions and customized products will be better positioned to capitalize on emerging opportunities.

Asia-Pacific Dry Mix Mortar Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Application

- 2.1. Concrete Protection and Renovation

- 2.2. Grouts

- 2.3. Insulation and Finishing Systems

- 2.4. Plaster

- 2.5. Render

- 2.6. Tile Adhesive

- 2.7. Water Proofing Slurries

- 2.8. Other Applications

Asia-Pacific Dry Mix Mortar Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. Southeast Asia

- 1.7. Rest of Asia Pacific

Asia-Pacific Dry Mix Mortar Market Regional Market Share

Geographic Coverage of Asia-Pacific Dry Mix Mortar Market

Asia-Pacific Dry Mix Mortar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Construction Industry; Government Policies to Promote the Usage of Fly Ash

- 3.3. Market Restrains

- 3.3.1. Harmful Properties of Fly Ash; Non-suitability in Cold Weather Conditions

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Dry Mix Mortar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Concrete Protection and Renovation

- 5.2.2. Grouts

- 5.2.3. Insulation and Finishing Systems

- 5.2.4. Plaster

- 5.2.5. Render

- 5.2.6. Tile Adhesive

- 5.2.7. Water Proofing Slurries

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HANIL HOLDINGS CO LTD

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UltraTech Cement Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saint-Gobain

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MBCC Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BBMG Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Asia Cement Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sika AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oriental Yuhong

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SCG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SAMPYO GROUP

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 HANIL HOLDINGS CO LTD

List of Figures

- Figure 1: Asia-Pacific Dry Mix Mortar Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Dry Mix Mortar Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Dry Mix Mortar Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 2: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: Asia-Pacific Dry Mix Mortar Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Dry Mix Mortar Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Dry Mix Mortar Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 8: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: Asia-Pacific Dry Mix Mortar Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Dry Mix Mortar Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Dry Mix Mortar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Dry Mix Mortar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Dry Mix Mortar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Dry Mix Mortar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Dry Mix Mortar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Southeast Asia Asia-Pacific Dry Mix Mortar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Southeast Asia Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Asia-Pacific Dry Mix Mortar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Dry Mix Mortar Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Asia-Pacific Dry Mix Mortar Market?

Key companies in the market include HANIL HOLDINGS CO LTD, UltraTech Cement Ltd, Saint-Gobain, MBCC Group, BBMG Corporation, Asia Cement Co Ltd, Sika AG, Oriental Yuhong, SCG, SAMPYO GROUP.

3. What are the main segments of the Asia-Pacific Dry Mix Mortar Market?

The market segments include End Use Sector, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Construction Industry; Government Policies to Promote the Usage of Fly Ash.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Harmful Properties of Fly Ash; Non-suitability in Cold Weather Conditions.

8. Can you provide examples of recent developments in the market?

October 2023: Beijing BBMG Mortar Co. Ltd acquired 30% of equities in Tianjin Jinyu Treasure Bright Mortar Co. Ltd for around USD 2430 million.May 2023: PCI, an affiliate of MBCC Group, formulated a ready-mixed flowable screed mortar, PCI Novoment Flow, offering multiple benefits like quick setting and curing.May 2023: MBCC group divested its construction systems business, including its subsidiaries, product portfolio, and advanced technologies, to Sika AG.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Dry Mix Mortar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Dry Mix Mortar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Dry Mix Mortar Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Dry Mix Mortar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence