Key Insights

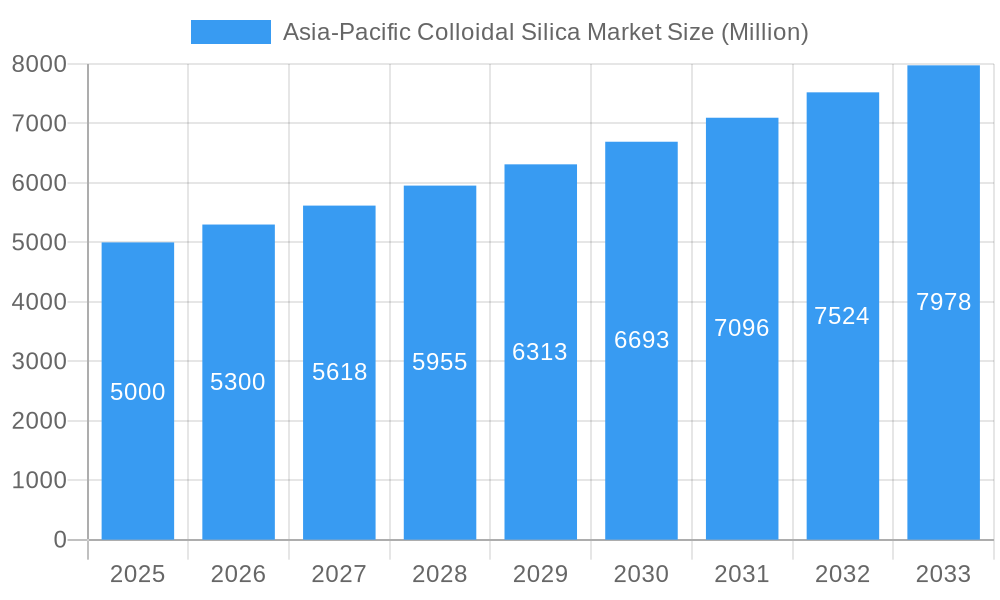

The Asia-Pacific colloidal silica market is poised for substantial expansion, driven by escalating demand from critical sectors including construction, coatings, and personal care. Projections indicate a robust Compound Annual Growth Rate (CAGR) of 9.3% between 2025 and 2033. This growth trajectory is underpinned by several key drivers: accelerated construction initiatives across the region, especially within rapidly developing economies; the growing preference for advanced coatings leveraging colloidal silica for superior performance; and the expanding personal care industry's utilization of colloidal silica in formulations such as lotions and creams. Technological innovations in colloidal silica production are also enhancing product quality and cost-efficiency, further stimulating market penetration. Despite potential challenges like raw material price volatility and evolving environmental regulations, the market outlook remains highly favorable, with continued growth anticipated throughout the forecast period. The established presence of leading entities such as Cabot Corporation, Ecolab, and Evonik Industries AG highlights the market's maturity and appeal to major global enterprises. Regional growth differentials are expected, with faster expansion anticipated in economies characterized by rapid industrialization and infrastructure development.

Asia-Pacific Colloidal Silica Market Market Size (In Billion)

Market segmentation within the Asia-Pacific region reveals diverse applications for colloidal silica. While granular segmental market share data is not publicly disclosed, industry trends suggest a significant allocation towards the construction sector, driven by ongoing infrastructure development. The coatings and personal care segments are also anticipated to command substantial shares, reflecting their increasing reliance on the unique properties of colloidal silica. The competitive environment is shaped by a blend of multinational corporations and regional manufacturers, fostering both price competition and product innovation. Future market expansion will be contingent upon sustained economic prosperity across the Asia-Pacific, continued advancements in colloidal silica technology, and effective navigation of regulatory landscapes. Companies are likely to prioritize product diversification and strategic alliances to secure a competitive advantage in this dynamic market.

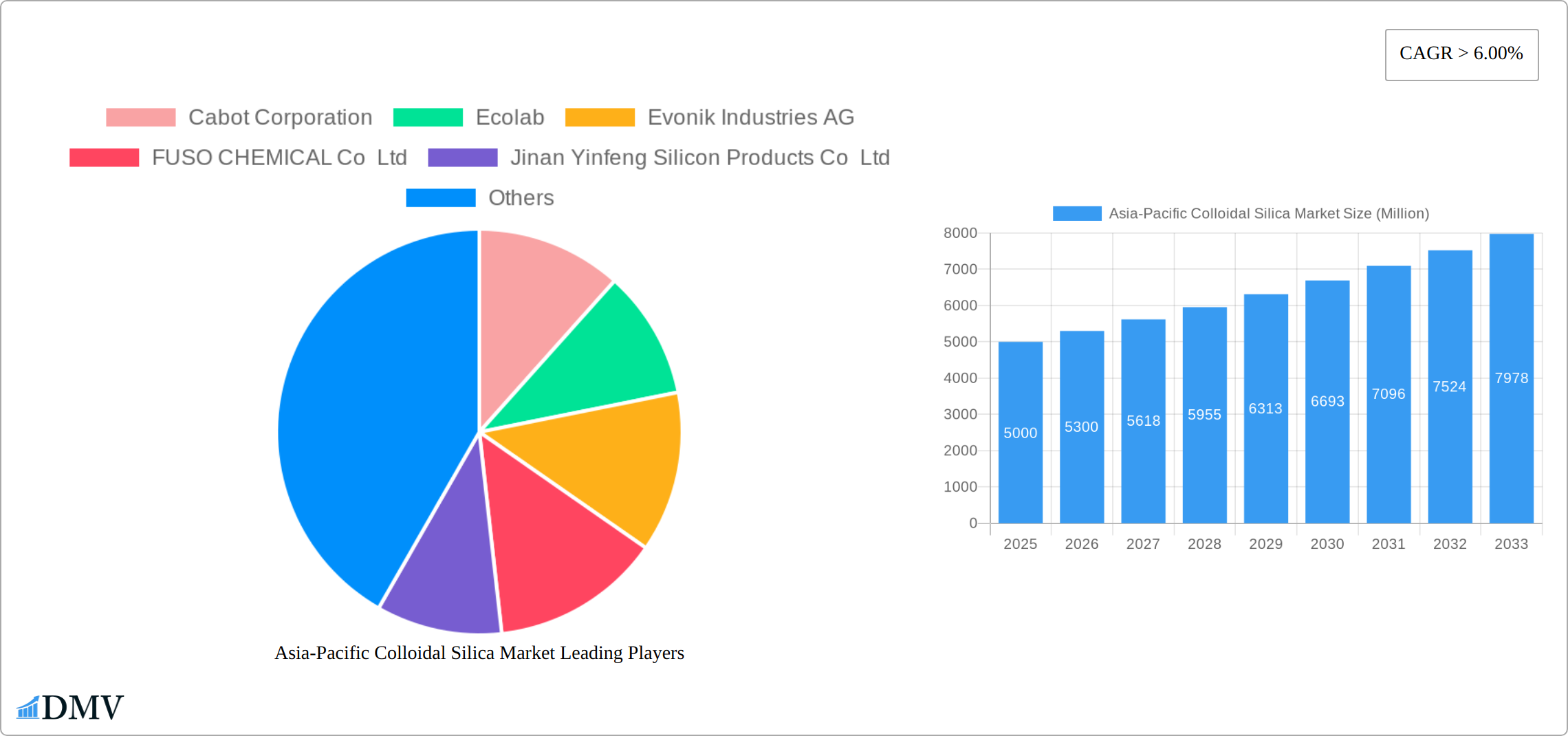

Asia-Pacific Colloidal Silica Market Company Market Share

Asia-Pacific Colloidal Silica Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific colloidal silica market, offering a comprehensive overview of its current state, future trends, and key players. From market size and segmentation to growth drivers and challenges, this study equips stakeholders with the critical intelligence needed to navigate this dynamic landscape and capitalize on emerging opportunities. The report covers the period 2019-2033, with 2025 as the base and estimated year.

Asia-Pacific Colloidal Silica Market Market Composition & Trends

The Asia-Pacific colloidal silica market is characterized by a moderately concentrated competitive landscape. A blend of established multinational corporations and agile regional players actively compete for market share. The market concentration is estimated at around 65-75%, with the top five key players collectively holding approximately 50-60% of the total market share as of 2023. This concentration is influenced by the specialized nature of colloidal silica production and its diverse, yet often demanding, applications. Market dynamics are significantly propelled by relentless innovation, particularly advancements in nanotechnology and material science. These innovations are instrumental in the development of highly specialized colloidal silica products tailored for specific performance requirements across a multitude of industries. The regulatory environment across the Asia-Pacific region is dynamic and varies considerably from country to country. Certain nations are implementing increasingly stringent environmental regulations, which can impact both the production processes and the permissible usage of colloidal silica. While substitute products like alternative binders and thickening agents are available, they often struggle to fully replicate the unique rheological, binding, and surface modification properties that colloidal silica offers. The end-user base is exceptionally diverse, encompassing critical sectors such as construction, paints and coatings, personal care products, and the food and beverage industry. The varying demand patterns and growth trajectories within these sectors directly influence the overall market dynamics. Mergers and acquisitions (M&A) have played a moderate role in shaping the market in recent years, with reported aggregate deal values totaling approximately $300-500 Million over the past five years (2019-2024), indicating strategic consolidations and expansions.

- Market Concentration: Estimated at 65-75% (as of 2023)

- Top 5 Players Market Share: Approximately 50-60% (as of 2023)

- M&A Deal Value (2019-2024): Approximately $300-500 Million

Asia-Pacific Colloidal Silica Market Industry Evolution

The Asia-Pacific colloidal silica market has witnessed robust growth over the historical period (2019-2024), expanding at a CAGR of xx%. This growth is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, with an estimated CAGR of xx%. This trajectory is fueled by the increasing demand from key end-use sectors, particularly construction and coatings, driven by robust infrastructure development across the region. Technological advancements, such as the development of high-purity colloidal silica with enhanced performance characteristics, are also contributing to market expansion. Consumer demand is shifting towards more sustainable and environmentally friendly products, leading to the development of colloidal silica solutions with reduced environmental impact. Adoption of advanced technologies like nanotechnology is increasing at a rate of xx% annually, resulting in improved product efficiency and performance.

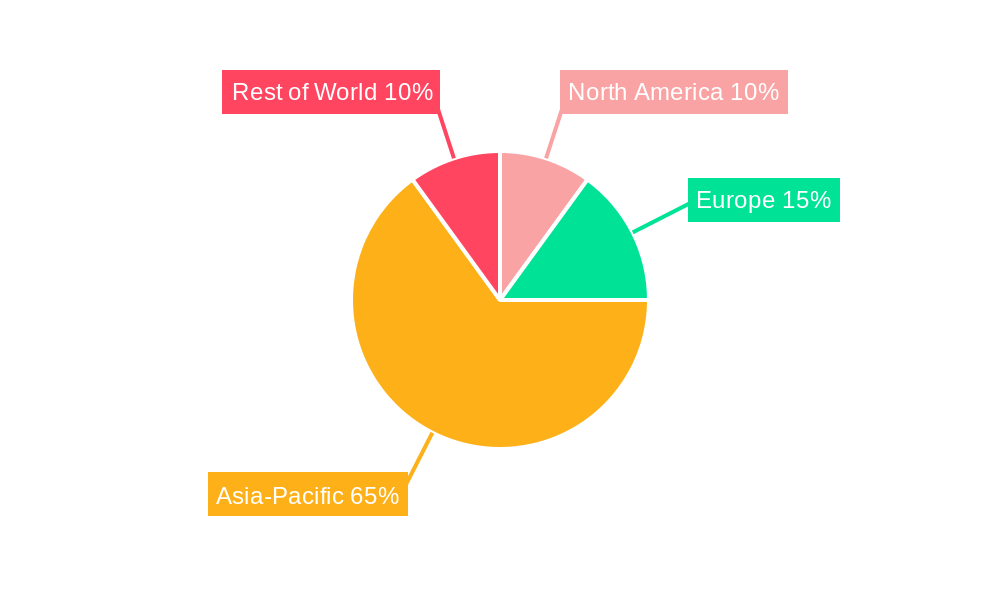

Leading Regions, Countries, or Segments in Asia-Pacific Colloidal Silica Market

China stands as the dominant region in the Asia-Pacific colloidal silica market, accounting for an estimated xx% of the total market share in 2025. This dominance is attributed to several key factors:

- Robust Infrastructure Development: Significant investments in infrastructure projects are driving demand for colloidal silica in construction and related industries.

- Growing Industrialization: Rapid industrialization and urbanization are fueling the demand for colloidal silica across various applications.

- Government Support: Favorable government policies and initiatives promoting industrial growth further boost market expansion.

- Favorable Cost Structure: Relatively lower production costs compared to other regions contribute to China's dominance.

Beyond China, India and other Southeast Asian nations are exhibiting strong growth potential, driven by increasing industrial activity and rising disposable incomes.

Asia-Pacific Colloidal Silica Market Product Innovations

Recent product innovations focus on enhancing the performance characteristics of colloidal silica, such as improved dispersion, rheological properties, and stability. New applications are emerging in specialized fields, including advanced ceramics, electronics, and biomedicine. Key innovations involve utilizing nanotechnology to tailor the particle size and surface properties of colloidal silica, resulting in enhanced performance and unique selling propositions. These advancements are driving market expansion and creating new opportunities for manufacturers.

Propelling Factors for Asia-Pacific Colloidal Silica Market Growth

Several factors are driving the growth of the Asia-Pacific colloidal silica market. These include:

- Expanding Construction and Infrastructure: The continuous development of infrastructure projects across the region fuels strong demand for colloidal silica in construction materials.

- Rising Disposable Incomes: Increased disposable income in many Asian countries is boosting consumer spending, increasing the demand for colloidal silica in diverse sectors such as personal care and food.

- Technological Advancements: Continued innovation in nanotechnology leads to enhanced colloidal silica performance and new applications.

Obstacles in the Asia-Pacific Colloidal Silica Market Market

Several factors pose challenges to the Asia-Pacific colloidal silica market's growth:

- Fluctuating Raw Material Prices: Price volatility of raw materials, such as silica, impacts production costs and profitability.

- Stringent Environmental Regulations: Increasingly strict environmental regulations necessitate investments in cleaner production technologies.

- Intense Competition: The presence of numerous players, both domestic and international, creates a competitive environment.

Future Opportunities in Asia-Pacific Colloidal Silica Market

The Asia-Pacific colloidal silica market is ripe with emerging opportunities, driven by evolving technological capabilities and growing market demands:

- Expansion into High-Value Niche Applications: Significant growth potential lies in the exploration and penetration of niche applications within advanced materials, sophisticated biomedical devices and drug delivery systems, and cutting-edge electronics manufacturing, where the unique properties of colloidal silica are highly sought after.

- Development of Sustainable and Eco-Friendly Products: A strong emphasis on developing and promoting eco-friendly colloidal silica solutions, including those with reduced environmental impact during production and enhanced biodegradability, directly aligns with the region's increasing focus on sustainability and growing environmental consciousness among consumers and industries.

- Technological Advancements and Customization: Continuous research and development efforts in nanotechnology will not only lead to incremental improvements in product performance but also unlock entirely new applications. The ability to tailor particle size, surface chemistry, and dispersion characteristics of colloidal silica to meet highly specific customer requirements will be a key differentiator.

- Leveraging Digitalization and Automation: Implementing advanced digital technologies and automation in manufacturing and supply chain management can enhance efficiency, reduce costs, and improve product consistency, providing a competitive edge.

- Growth in Emerging Economies: Untapped potential exists in rapidly developing economies within the Asia-Pacific region, where industrialization and infrastructure development are accelerating, creating new demand centers for colloidal silica.

Major Players in the Asia-Pacific Colloidal Silica Market Ecosystem

- Cabot Corporation

- Ecolab

- Evonik Industries AG

- FUSO CHEMICAL Co Ltd

- Jinan Yinfeng Silicon Products Co Ltd

- Linyi Kehan Silicon Products Co LTD

- Nissan Chemical Corporation

- Nouryon

- Nyacol Nano Technologies Inc

- Qingdao Haiwan Group Co Ltd

- W R Grace & Co

- YOUNG IL CHEMICAL Co Ltd

- Zhejiang Yuda Chemical Co Ltd

- *This list is not exhaustive and represents prominent entities in the market.

Key Developments in Asia-Pacific Colloidal Silica Market Industry

- July 2022: Cabot Corporation implemented a pricing adjustment for its CAB-O-SIL™ hydrophobic and colloidal silica product lines, with increases of up to 15%. This strategic move was attributed to rising raw material costs and escalating operational expenditures, signaling a market trend towards premium pricing for high-performance silica products.

- December 2021: Nouryon significantly bolstered its regional presence with the expansion of its office and research center in Mumbai, India. This strategic investment underscores the growing importance of the Asia-Pacific region as a key market and innovation hub for major global players in the colloidal silica sector.

- Recent (Late 2023/Early 2024): Several players have announced investments in R&D for specialized grades of colloidal silica, particularly for applications in battery materials and advanced coatings, highlighting the sector's focus on future-oriented growth areas.

- Ongoing: Strategic partnerships are being formed between colloidal silica manufacturers and end-users in sectors like electronics and renewable energy to co-develop tailored solutions, driving innovation and market penetration.

Strategic Asia-Pacific Colloidal Silica Market Market Forecast

The Asia-Pacific colloidal silica market is poised for robust and sustained growth in the coming years, propelled by a confluence of powerful market drivers. Significant infrastructure development initiatives across the region, coupled with accelerating industrialization and continuous technological advancements, are creating a burgeoning demand for high-performance materials like colloidal silica. The expanding applications across diverse and critical end-use sectors, ranging from advanced manufacturing to consumer goods, are a primary catalyst for this growth. Furthermore, ongoing product innovations, leading to the development of specialized and enhanced colloidal silica grades, alongside increasing market penetration in emerging economies, present substantial opportunities for both established and new market participants. The future trajectory of the market will be intrinsically linked to evolving factors such as the volatility of raw material prices, the dynamic and often varying regulatory landscapes across different countries, and the growing imperative to adopt sustainable manufacturing practices. Overall, the Asia-Pacific colloidal silica market exhibits strong intrinsic growth potential, characterized by significant opportunities for strategic expansion, pioneering innovation, and increased market share capture in the foreseeable future.

Asia-Pacific Colloidal Silica Market Segmentation

-

1. Application

- 1.1. Pulp and Paper

- 1.2. Paints and Coatings

- 1.3. Chemicals

- 1.4. Construction

- 1.5. Metals and Metallurgy

- 1.6. Electronics and Semiconductors

- 1.7. Other Applications

-

2. Geography

- 2.1. China (including Taiwan)

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of Asia-Pacific

Asia-Pacific Colloidal Silica Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Colloidal Silica Market Regional Market Share

Geographic Coverage of Asia-Pacific Colloidal Silica Market

Asia-Pacific Colloidal Silica Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Concrete and Cement in the Construction Industry; Increasing Demand for Silicon Wafers for the Production of Integrated Circuits in Electronic Devices

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Concrete and Cement in the Construction Industry; Increasing Demand for Silicon Wafers for the Production of Integrated Circuits in Electronic Devices

- 3.4. Market Trends

- 3.4.1. Construction Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Colloidal Silica Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pulp and Paper

- 5.1.2. Paints and Coatings

- 5.1.3. Chemicals

- 5.1.4. Construction

- 5.1.5. Metals and Metallurgy

- 5.1.6. Electronics and Semiconductors

- 5.1.7. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China (including Taiwan)

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. China Asia-Pacific Colloidal Silica Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pulp and Paper

- 6.1.2. Paints and Coatings

- 6.1.3. Chemicals

- 6.1.4. Construction

- 6.1.5. Metals and Metallurgy

- 6.1.6. Electronics and Semiconductors

- 6.1.7. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China (including Taiwan)

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. India Asia-Pacific Colloidal Silica Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pulp and Paper

- 7.1.2. Paints and Coatings

- 7.1.3. Chemicals

- 7.1.4. Construction

- 7.1.5. Metals and Metallurgy

- 7.1.6. Electronics and Semiconductors

- 7.1.7. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China (including Taiwan)

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Japan Asia-Pacific Colloidal Silica Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pulp and Paper

- 8.1.2. Paints and Coatings

- 8.1.3. Chemicals

- 8.1.4. Construction

- 8.1.5. Metals and Metallurgy

- 8.1.6. Electronics and Semiconductors

- 8.1.7. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China (including Taiwan)

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South Korea Asia-Pacific Colloidal Silica Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pulp and Paper

- 9.1.2. Paints and Coatings

- 9.1.3. Chemicals

- 9.1.4. Construction

- 9.1.5. Metals and Metallurgy

- 9.1.6. Electronics and Semiconductors

- 9.1.7. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China (including Taiwan)

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Rest of Asia Pacific Asia-Pacific Colloidal Silica Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pulp and Paper

- 10.1.2. Paints and Coatings

- 10.1.3. Chemicals

- 10.1.4. Construction

- 10.1.5. Metals and Metallurgy

- 10.1.6. Electronics and Semiconductors

- 10.1.7. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China (including Taiwan)

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cabot Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ecolab

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Evonik Industries AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FUSO CHEMICAL Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jinan Yinfeng Silicon Products Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Linyi Kehan Silicon Products Co LTD

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nissan Chemical Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nouryon

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nyacol Nano Technologies Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qingdao Haiwan Group Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 W R Grace & Co

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 YOUNG IL CHEMICAL Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Zhejiang Yuda Chemical Co Ltd*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Cabot Corporation

List of Figures

- Figure 1: Global Asia-Pacific Colloidal Silica Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Colloidal Silica Market Revenue (billion), by Application 2025 & 2033

- Figure 3: China Asia-Pacific Colloidal Silica Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: China Asia-Pacific Colloidal Silica Market Revenue (billion), by Geography 2025 & 2033

- Figure 5: China Asia-Pacific Colloidal Silica Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: China Asia-Pacific Colloidal Silica Market Revenue (billion), by Country 2025 & 2033

- Figure 7: China Asia-Pacific Colloidal Silica Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: India Asia-Pacific Colloidal Silica Market Revenue (billion), by Application 2025 & 2033

- Figure 9: India Asia-Pacific Colloidal Silica Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: India Asia-Pacific Colloidal Silica Market Revenue (billion), by Geography 2025 & 2033

- Figure 11: India Asia-Pacific Colloidal Silica Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: India Asia-Pacific Colloidal Silica Market Revenue (billion), by Country 2025 & 2033

- Figure 13: India Asia-Pacific Colloidal Silica Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Japan Asia-Pacific Colloidal Silica Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Japan Asia-Pacific Colloidal Silica Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Japan Asia-Pacific Colloidal Silica Market Revenue (billion), by Geography 2025 & 2033

- Figure 17: Japan Asia-Pacific Colloidal Silica Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Japan Asia-Pacific Colloidal Silica Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Japan Asia-Pacific Colloidal Silica Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South Korea Asia-Pacific Colloidal Silica Market Revenue (billion), by Application 2025 & 2033

- Figure 21: South Korea Asia-Pacific Colloidal Silica Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: South Korea Asia-Pacific Colloidal Silica Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: South Korea Asia-Pacific Colloidal Silica Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: South Korea Asia-Pacific Colloidal Silica Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South Korea Asia-Pacific Colloidal Silica Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Asia Pacific Asia-Pacific Colloidal Silica Market Revenue (billion), by Application 2025 & 2033

- Figure 27: Rest of Asia Pacific Asia-Pacific Colloidal Silica Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Rest of Asia Pacific Asia-Pacific Colloidal Silica Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Rest of Asia Pacific Asia-Pacific Colloidal Silica Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Rest of Asia Pacific Asia-Pacific Colloidal Silica Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Rest of Asia Pacific Asia-Pacific Colloidal Silica Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Global Asia-Pacific Colloidal Silica Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Colloidal Silica Market?

The projected CAGR is approximately 9.3%.

2. Which companies are prominent players in the Asia-Pacific Colloidal Silica Market?

Key companies in the market include Cabot Corporation, Ecolab, Evonik Industries AG, FUSO CHEMICAL Co Ltd, Jinan Yinfeng Silicon Products Co Ltd, Linyi Kehan Silicon Products Co LTD, Nissan Chemical Corporation, Nouryon, Nyacol Nano Technologies Inc, Qingdao Haiwan Group Co Ltd, W R Grace & Co, YOUNG IL CHEMICAL Co Ltd, Zhejiang Yuda Chemical Co Ltd*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Colloidal Silica Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Concrete and Cement in the Construction Industry; Increasing Demand for Silicon Wafers for the Production of Integrated Circuits in Electronic Devices.

6. What are the notable trends driving market growth?

Construction Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Rising Demand for Concrete and Cement in the Construction Industry; Increasing Demand for Silicon Wafers for the Production of Integrated Circuits in Electronic Devices.

8. Can you provide examples of recent developments in the market?

July 2022: Cabot Corporation raised pricing for all CAB-O-SILTM hydrophobic and colloidal silica products by up to 15%. The price rise is required due to increasing prices for treatment agents and shipping and greater facility running costs. This boost will assist Cabot in becoming a dependable, long-term provider of high-quality products and services. It will also allow Cabot to continue investing in developing new products and applications to serve its customers better.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Colloidal Silica Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Colloidal Silica Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Colloidal Silica Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Colloidal Silica Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence