Key Insights

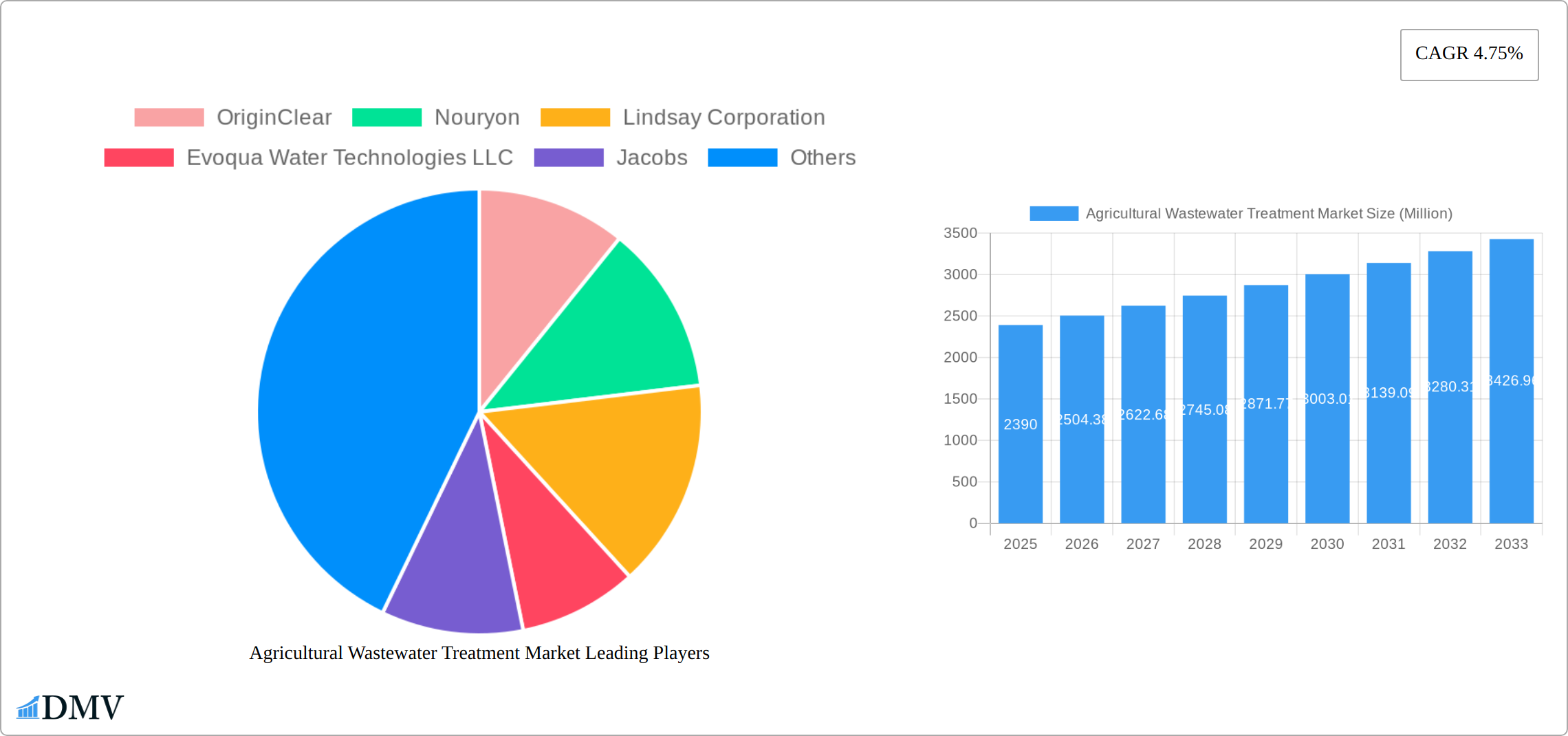

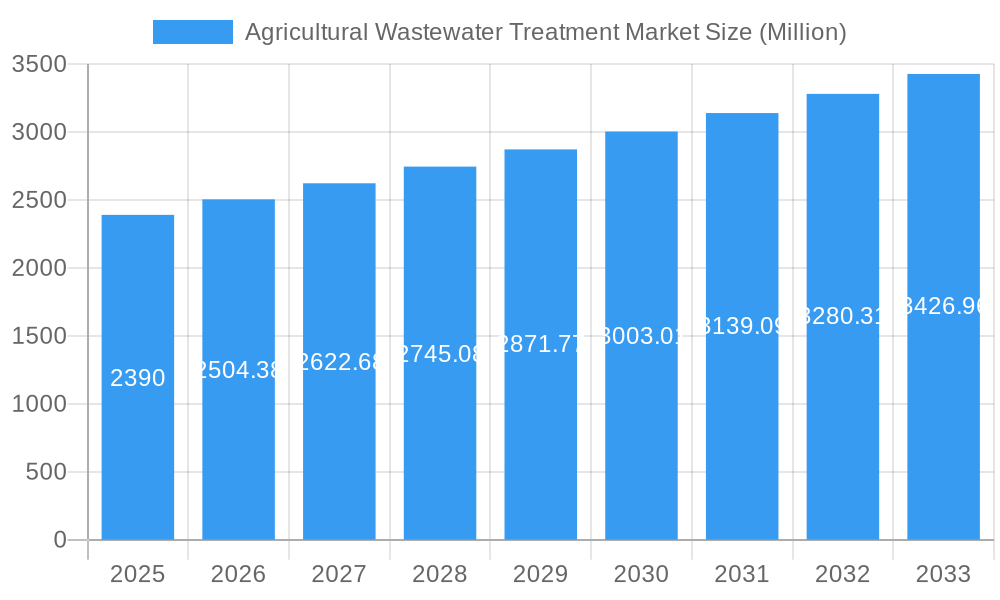

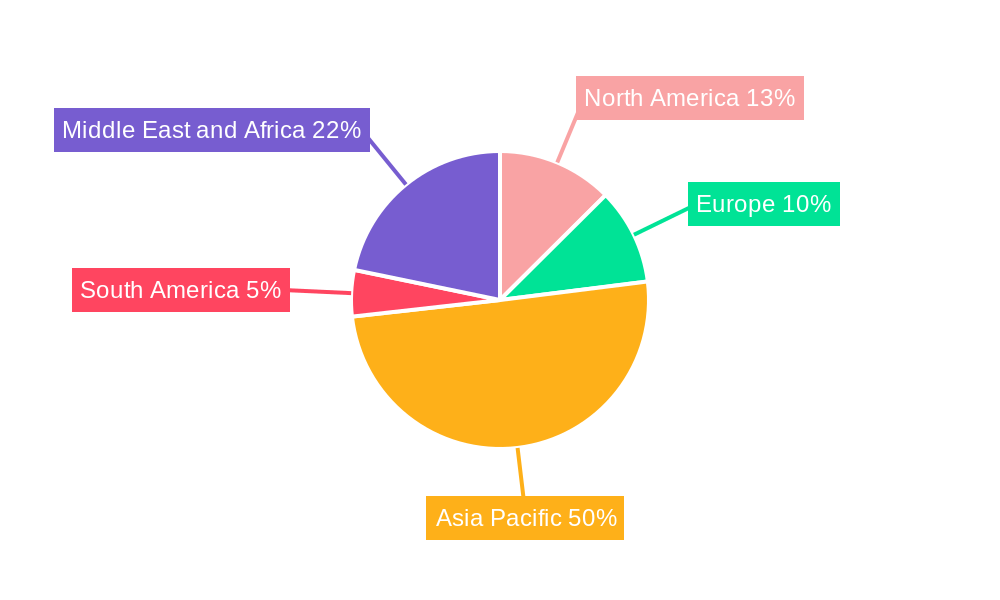

The global agricultural wastewater treatment market is poised for significant growth, projected to reach \$2.39 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 4.75% from 2025 to 2033. This expansion is driven by several key factors. Stringent government regulations aimed at reducing water pollution from agricultural runoff are compelling farmers and agricultural businesses to adopt advanced wastewater treatment technologies. The increasing awareness of environmental sustainability and the need to preserve water resources are further fueling market demand. Technological advancements in wastewater treatment, such as the development of more efficient and cost-effective biological and chemical solutions, are also contributing to market growth. The market is segmented by technology (physical, chemical, and biological solutions), pollutant source (point and non-point sources), and application (crop and non-crop). The Asia-Pacific region, particularly China and India, is expected to witness substantial growth due to the region's large agricultural sector and increasing emphasis on environmental protection. North America and Europe also represent significant market segments, driven by established environmental regulations and a strong focus on sustainable agricultural practices. Competition in the market is intense, with established players like OriginClear, Nouryon, and Evoqua Water Technologies competing alongside smaller, specialized firms. The market's future growth will depend on factors such as continued regulatory pressure, technological innovation, and the increasing adoption of sustainable agricultural practices globally.

Agricultural Wastewater Treatment Market Market Size (In Billion)

The projected growth trajectory is influenced by several factors. While the base year of 2025 presents a strong starting point, the subsequent years will see a steady increase in market size, largely due to the continuous adoption of advanced treatment technologies and increased government investments in water infrastructure improvements. The market segmentation highlights opportunities for specialized solutions targeted at specific pollutant types and agricultural applications. Furthermore, the geographical distribution of market share indicates significant regional variations, with developing economies expected to drive much of the growth due to their rapidly expanding agricultural sectors and increasing needs for water resource management. The presence of numerous players suggests a competitive landscape, with companies vying for market share through innovation and competitive pricing. Understanding these dynamics is key to successfully navigating and capitalizing on the opportunities presented within the agricultural wastewater treatment market.

Agricultural Wastewater Treatment Market Company Market Share

Agricultural Wastewater Treatment Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Agricultural Wastewater Treatment Market, offering a comprehensive overview of market trends, key players, technological advancements, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for stakeholders seeking to understand the dynamics of this crucial sector and make informed strategic decisions. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Agricultural Wastewater Treatment Market Market Composition & Trends

This section delves into the intricate composition of the Agricultural Wastewater Treatment Market, examining market concentration, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. The market exhibits a moderately fragmented landscape, with no single entity dominating. However, several key players like OriginClear, Nouryon, and Evoqua Water Technologies hold significant market shares.

Market Share Distribution (Estimated 2025):

- OriginClear: xx%

- Nouryon: xx%

- Evoqua Water Technologies LLC: xx%

- Others: xx%

Innovation Catalysts: Stringent environmental regulations globally are driving innovation in treatment technologies, pushing the adoption of more efficient and sustainable solutions. The increasing awareness of water scarcity and its impact on agricultural productivity is another major catalyst.

Regulatory Landscape: Varying regulations across different regions significantly impact market dynamics. Compliance costs and the need for advanced treatment solutions differ based on local environmental standards.

Substitute Products: While alternative wastewater management practices exist, they often lack the efficiency and scalability of dedicated treatment solutions.

End-User Profiles: The market encompasses a diverse range of end-users, including large-scale farms, smaller agricultural operations, and food processing facilities.

M&A Activities: The market has witnessed several M&A activities in recent years, driven by the need for expansion and technological integration. Deal values vary significantly, with some transactions exceeding USD xx Million.

Agricultural Wastewater Treatment Market Industry Evolution

The Agricultural Wastewater Treatment Market has witnessed substantial growth throughout the historical period (2019-2024). Driven by factors such as increasing environmental concerns, stricter regulations, and technological advancements, the market is expected to continue its upward trajectory. The adoption of advanced technologies such as membrane bioreactors and anaerobic digestion systems is accelerating, improving treatment efficiency and reducing environmental impact. The market is witnessing a shift toward more sustainable and cost-effective solutions, catering to the evolving needs of diverse agricultural operations. Technological advancements are leading to reduced operational costs and improved resource recovery, making wastewater treatment a more attractive investment for agricultural businesses. The market growth rate is projected to be xx% in 2026.

Leading Regions, Countries, or Segments in Agricultural Wastewater Treatment Market

North America currently dominates the global Agricultural Wastewater Treatment Market, driven by stringent environmental regulations, substantial investments in infrastructure development, and a growing awareness of sustainable agriculture practices.

Key Drivers:

- Technology:

- Physical Solutions: High adoption rates in developed regions due to established infrastructure and higher initial investment capacity.

- Chemical Solutions: Wide application across various segments, driven by cost-effectiveness and efficacy in certain applications.

- Biological Solutions: Growing popularity due to environmental benefits and potential for resource recovery.

- Pollutant Source:

- Point Source: Higher focus due to easier monitoring and regulation compared to non-point sources.

- Non-point Source: Challenges in management and treatment drive innovation in decentralized solutions.

- Application:

- Crop: Largest segment due to the significant volume of wastewater generated in crop production.

- Non-Crop: Growing segment with increasing adoption in livestock farming and aquaculture.

The dominance of North America stems from several factors:

- Stringent Environmental Regulations: The region has implemented strict regulations regarding wastewater discharge, forcing agricultural businesses to adopt advanced treatment technologies.

- High Investment in Infrastructure: Significant investments in research and development, coupled with government funding initiatives, have fueled market growth.

- Increased Awareness of Sustainable Practices: Growing environmental consciousness among agricultural businesses is promoting the adoption of sustainable wastewater management practices.

Agricultural Wastewater Treatment Market Product Innovations

Recent innovations in agricultural wastewater treatment focus on enhancing efficiency, reducing energy consumption, and maximizing resource recovery. Advanced oxidation processes, membrane filtration technologies, and integrated systems combining various treatment methods are gaining traction. These innovations offer unique selling propositions, including reduced footprint, improved treatment efficiency, and the potential for resource recovery (e.g., biogas production, nutrient recovery).

Propelling Factors for Agricultural Wastewater Treatment Market Growth

Several factors are propelling the growth of the Agricultural Wastewater Treatment Market. Increasing environmental concerns and stricter government regulations are major drivers. Technological advancements, such as the development of more efficient and cost-effective treatment technologies, are also contributing to market expansion. Furthermore, rising agricultural production and the growing demand for food are increasing the volume of wastewater generated, further driving market growth. The increasing focus on sustainable agricultural practices is also contributing to market expansion.

Obstacles in the Agricultural Wastewater Treatment Market Market

The Agricultural Wastewater Treatment Market faces several challenges, including high initial investment costs associated with advanced treatment technologies. Supply chain disruptions, particularly concerning specialized components and chemicals, can impact project timelines and costs. Furthermore, the complexity of wastewater treatment and the need for skilled labor pose operational hurdles. The fragmented nature of the market also contributes to competitive pressures, affecting pricing and profitability.

Future Opportunities in Agricultural Wastewater Treatment Market

The future landscape of the Agricultural Wastewater Treatment Market is rich with opportunity, largely driven by the development and widespread adoption of cutting-edge technologies. The integration of artificial intelligence (AI) and machine learning (ML) is set to revolutionize process optimization, leading to enhanced efficiency and cost-effectiveness. Significant growth potential exists in emerging markets that are experiencing a rapid expansion of their agricultural sectors, creating a heightened demand for effective wastewater management solutions. A particularly promising avenue lies in the integration of wastewater treatment with comprehensive resource recovery strategies, such as the extraction of valuable nutrients for fertilizer and the generation of biogas for energy, unlocking new revenue streams and promoting circular economy principles. Moreover, the increasing focus on decentralized treatment solutions presents a substantial opportunity to tap into previously underserved market segments and cater to the diverse needs of agricultural enterprises.

Major Players in the Agricultural Wastewater Treatment Market Ecosystem

- OriginClear

- Nouryon

- Lindsay Corporation

- Evoqua Water Technologies LLC

- Jacobs

- Aquatech International LLC

- BASF SE

- IDE Technologies

- SUEZ

- DuPont

- Organo Corporation

- Veolia

- AECOM

- Louis Berger International

Key Developments in Agricultural Wastewater Treatment Market Industry

- September 2022: Lanxess made a significant investment of USD 12.65 Million to commission a new, advanced wastewater treatment plant in Belgium. With a substantial capacity of 260,000 liters per hour, this development underscores the industry's commitment to adopting and scaling up sophisticated treatment solutions.

- June 2022: AECOM successfully completed the design phase for a new North Shore wastewater treatment plant. This milestone highlights the escalating demand for expert engineering and design services crucial for the planning and implementation of essential wastewater infrastructure projects in the agricultural sector.

Strategic Agricultural Wastewater Treatment Market Market Forecast

The Agricultural Wastewater Treatment Market is poised for robust growth, driven by increasing environmental awareness, stringent regulations, and technological advancements. The market's potential is substantial, with opportunities across various regions and applications. Continued innovation in treatment technologies and a focus on resource recovery will further propel market expansion. The market is expected to witness considerable investment in sustainable solutions in the coming years, leading to a substantial increase in market size.

Agricultural Wastewater Treatment Market Segmentation

-

1. Technology

- 1.1. Physical Solutions

- 1.2. Chemical Solutions

- 1.3. Biological Solutions

-

2. Pollutant Source

- 2.1. Point Source

- 2.2. Nonpoint Source

-

3. Application

- 3.1. Crop

- 3.2. Non-Crop

Agricultural Wastewater Treatment Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Agricultural Wastewater Treatment Market Regional Market Share

Geographic Coverage of Agricultural Wastewater Treatment Market

Agricultural Wastewater Treatment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Diminishing Fresh Water Resources; Rising Agricultural Water Demand; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Dearth of Awareness regarding Agriculture Wastewater Treatment; Other Restraints

- 3.4. Market Trends

- 3.4.1. Non-Crop Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agricultural Wastewater Treatment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Physical Solutions

- 5.1.2. Chemical Solutions

- 5.1.3. Biological Solutions

- 5.2. Market Analysis, Insights and Forecast - by Pollutant Source

- 5.2.1. Point Source

- 5.2.2. Nonpoint Source

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Crop

- 5.3.2. Non-Crop

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Asia Pacific Agricultural Wastewater Treatment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Physical Solutions

- 6.1.2. Chemical Solutions

- 6.1.3. Biological Solutions

- 6.2. Market Analysis, Insights and Forecast - by Pollutant Source

- 6.2.1. Point Source

- 6.2.2. Nonpoint Source

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Crop

- 6.3.2. Non-Crop

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. North America Agricultural Wastewater Treatment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Physical Solutions

- 7.1.2. Chemical Solutions

- 7.1.3. Biological Solutions

- 7.2. Market Analysis, Insights and Forecast - by Pollutant Source

- 7.2.1. Point Source

- 7.2.2. Nonpoint Source

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Crop

- 7.3.2. Non-Crop

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Europe Agricultural Wastewater Treatment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Physical Solutions

- 8.1.2. Chemical Solutions

- 8.1.3. Biological Solutions

- 8.2. Market Analysis, Insights and Forecast - by Pollutant Source

- 8.2.1. Point Source

- 8.2.2. Nonpoint Source

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Crop

- 8.3.2. Non-Crop

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Agricultural Wastewater Treatment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Physical Solutions

- 9.1.2. Chemical Solutions

- 9.1.3. Biological Solutions

- 9.2. Market Analysis, Insights and Forecast - by Pollutant Source

- 9.2.1. Point Source

- 9.2.2. Nonpoint Source

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Crop

- 9.3.2. Non-Crop

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Agricultural Wastewater Treatment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Physical Solutions

- 10.1.2. Chemical Solutions

- 10.1.3. Biological Solutions

- 10.2. Market Analysis, Insights and Forecast - by Pollutant Source

- 10.2.1. Point Source

- 10.2.2. Nonpoint Source

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Crop

- 10.3.2. Non-Crop

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 OriginClear

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nouryon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lindsay Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Evoqua Water Technologies LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jacobs

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aquatech International LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BASF SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IDE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SUEZ

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DuPont

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Organo Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Veolia*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AECOM

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Louis Berger International

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 OriginClear

List of Figures

- Figure 1: Global Agricultural Wastewater Treatment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Agricultural Wastewater Treatment Market Revenue (Million), by Technology 2025 & 2033

- Figure 3: Asia Pacific Agricultural Wastewater Treatment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: Asia Pacific Agricultural Wastewater Treatment Market Revenue (Million), by Pollutant Source 2025 & 2033

- Figure 5: Asia Pacific Agricultural Wastewater Treatment Market Revenue Share (%), by Pollutant Source 2025 & 2033

- Figure 6: Asia Pacific Agricultural Wastewater Treatment Market Revenue (Million), by Application 2025 & 2033

- Figure 7: Asia Pacific Agricultural Wastewater Treatment Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Agricultural Wastewater Treatment Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Agricultural Wastewater Treatment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Agricultural Wastewater Treatment Market Revenue (Million), by Technology 2025 & 2033

- Figure 11: North America Agricultural Wastewater Treatment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: North America Agricultural Wastewater Treatment Market Revenue (Million), by Pollutant Source 2025 & 2033

- Figure 13: North America Agricultural Wastewater Treatment Market Revenue Share (%), by Pollutant Source 2025 & 2033

- Figure 14: North America Agricultural Wastewater Treatment Market Revenue (Million), by Application 2025 & 2033

- Figure 15: North America Agricultural Wastewater Treatment Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Agricultural Wastewater Treatment Market Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Agricultural Wastewater Treatment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Agricultural Wastewater Treatment Market Revenue (Million), by Technology 2025 & 2033

- Figure 19: Europe Agricultural Wastewater Treatment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Europe Agricultural Wastewater Treatment Market Revenue (Million), by Pollutant Source 2025 & 2033

- Figure 21: Europe Agricultural Wastewater Treatment Market Revenue Share (%), by Pollutant Source 2025 & 2033

- Figure 22: Europe Agricultural Wastewater Treatment Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Agricultural Wastewater Treatment Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Agricultural Wastewater Treatment Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Agricultural Wastewater Treatment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Agricultural Wastewater Treatment Market Revenue (Million), by Technology 2025 & 2033

- Figure 27: South America Agricultural Wastewater Treatment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: South America Agricultural Wastewater Treatment Market Revenue (Million), by Pollutant Source 2025 & 2033

- Figure 29: South America Agricultural Wastewater Treatment Market Revenue Share (%), by Pollutant Source 2025 & 2033

- Figure 30: South America Agricultural Wastewater Treatment Market Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Agricultural Wastewater Treatment Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Agricultural Wastewater Treatment Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Agricultural Wastewater Treatment Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Agricultural Wastewater Treatment Market Revenue (Million), by Technology 2025 & 2033

- Figure 35: Middle East and Africa Agricultural Wastewater Treatment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 36: Middle East and Africa Agricultural Wastewater Treatment Market Revenue (Million), by Pollutant Source 2025 & 2033

- Figure 37: Middle East and Africa Agricultural Wastewater Treatment Market Revenue Share (%), by Pollutant Source 2025 & 2033

- Figure 38: Middle East and Africa Agricultural Wastewater Treatment Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Agricultural Wastewater Treatment Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Agricultural Wastewater Treatment Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Agricultural Wastewater Treatment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Pollutant Source 2020 & 2033

- Table 3: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Pollutant Source 2020 & 2033

- Table 7: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 15: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Pollutant Source 2020 & 2033

- Table 16: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 22: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Pollutant Source 2020 & 2033

- Table 23: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: France Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 31: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Pollutant Source 2020 & 2033

- Table 32: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 38: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Pollutant Source 2020 & 2033

- Table 39: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Agricultural Wastewater Treatment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Agricultural Wastewater Treatment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural Wastewater Treatment Market?

The projected CAGR is approximately 4.75%.

2. Which companies are prominent players in the Agricultural Wastewater Treatment Market?

Key companies in the market include OriginClear, Nouryon, Lindsay Corporation, Evoqua Water Technologies LLC, Jacobs, Aquatech International LLC, BASF SE, IDE, SUEZ, DuPont, Organo Corporation, Veolia*List Not Exhaustive, AECOM, Louis Berger International.

3. What are the main segments of the Agricultural Wastewater Treatment Market?

The market segments include Technology, Pollutant Source, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Diminishing Fresh Water Resources; Rising Agricultural Water Demand; Other Drivers.

6. What are the notable trends driving market growth?

Non-Crop Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Dearth of Awareness regarding Agriculture Wastewater Treatment; Other Restraints.

8. Can you provide examples of recent developments in the market?

September 2022: Lanxess commissioned a new wastewater treatment plant at its Belgium Kallo/Antwerp site. The company invested around EUR 12 million (USD 12.65 million) in the plant, having a treatment capacity of around 260,000 liters of wastewater per hour.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agricultural Wastewater Treatment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agricultural Wastewater Treatment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agricultural Wastewater Treatment Market?

To stay informed about further developments, trends, and reports in the Agricultural Wastewater Treatment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence