Key Insights

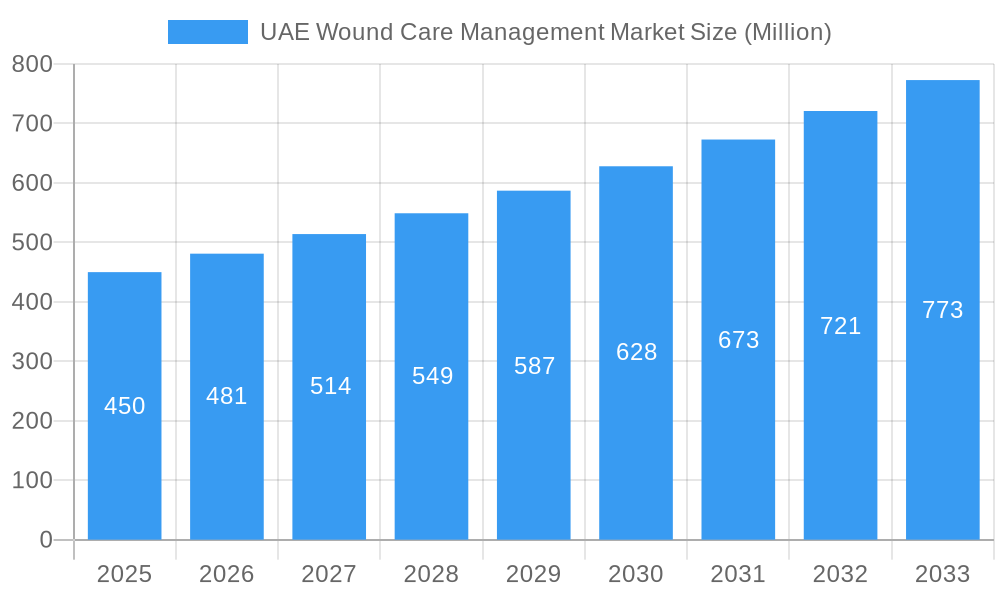

The UAE wound care management market is poised for significant expansion, projected to reach a substantial market size of approximately USD 450 million by 2025, and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.89% through 2033. This robust growth is primarily fueled by an increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions, which are leading causes of complex wounds, alongside an aging population that requires more specialized care. The rising adoption of advanced wound care products, including innovative dressings and therapeutic devices like Negative Pressure Wound Therapy (NPWT) systems, is a key driver, offering enhanced healing outcomes and reduced patient discomfort. Furthermore, a growing awareness among healthcare professionals and patients regarding the benefits of modern wound management techniques contributes to market dynamism. Investments in healthcare infrastructure and the increasing focus on home healthcare services are also expected to bolster market penetration for these essential products and technologies.

UAE Wound Care Management Market Market Size (In Million)

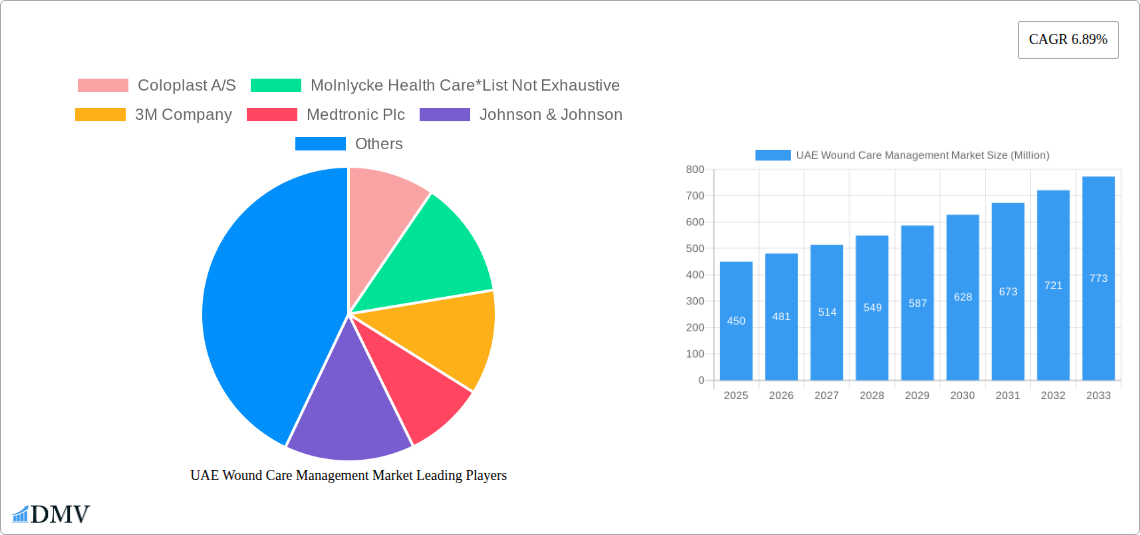

The market's trajectory is further shaped by distinct trends such as the increasing demand for technologically advanced wound therapy devices, including disposable NPWT systems and electrical stimulation devices, which offer greater convenience and efficacy. The expansion of hospital and specialty wound clinics, equipped to handle complex wound cases, is a significant end-user segment. Concurrently, the growing emphasis on reducing hospital stays and managing wounds in long-term care facilities presents another avenue for market development. Key players like Coloplast A/S, Molnlycke Health Care, 3M Company, Medtronic Plc, and Johnson & Johnson are actively innovating and expanding their product portfolios to cater to the evolving needs of the UAE's healthcare landscape. While the market benefits from these drivers and trends, challenges such as the high cost of certain advanced wound care products and the need for specialized training for healthcare professionals may present some restraint, though these are expected to be overcome with continued market maturity and increased accessibility.

UAE Wound Care Management Market Company Market Share

Dive deep into the burgeoning UAE Wound Care Management Market with our in-depth report, meticulously crafted to provide stakeholders with actionable intelligence for strategic decision-making. This comprehensive analysis spans from 2019–2033, with a focused deep-dive into the base year of 2025 and a robust forecast period of 2025–2033. We dissect the market's intricate composition, evolving trends, and future trajectory, equipping you with unparalleled insights into this dynamic sector.

UAE Wound Care Management Market Market Composition & Trends

The UAE wound care management market exhibits a moderate concentration, driven by innovation in advanced wound care products and increasing adoption of sophisticated therapeutic devices. Key innovation catalysts include significant investments in healthcare infrastructure and a growing awareness of advanced wound healing techniques among healthcare professionals. The regulatory landscape is supportive, with government initiatives aimed at enhancing patient outcomes and quality of care. While substitute products exist, the superior efficacy and specialized applications of advanced wound dressings and therapy devices create a strong market differentiation. End-user profiles are diverse, with hospitals and specialty wound clinics representing the largest segment due to the prevalence of chronic wounds and post-surgical care requirements. Long-term care facilities are also a significant contributor, driven by an aging population and the need for ongoing wound management. Mergers and acquisitions (M&A) activity, while not extensive, is expected to shape market consolidation, with potential deal values in the tens of millions of USD. The market share distribution is currently led by established players offering comprehensive portfolios, but emerging innovators are steadily gaining traction.

UAE Wound Care Management Market Industry Evolution

The UAE Wound Care Management Market has witnessed a transformative evolution, marked by substantial growth trajectories and a rapid embrace of technological advancements. From its historical period of 2019–2024, the market has demonstrated consistent upward momentum, fueled by an increasing incidence of chronic diseases such as diabetes and vascular ailments, which are primary contributors to complex wound development. The adoption of advanced wound care solutions has seen a significant surge, with growth rates consistently in the xx% range year-on-year. This shift is underpinned by a growing understanding among healthcare providers and patients about the benefits of these sophisticated products, including faster healing times, reduced infection rates, and improved patient comfort, ultimately leading to lower overall healthcare costs.

Technological advancements have been a cornerstone of this evolution. The introduction and widespread acceptance of Negative Pressure Wound Therapy (NPWT) systems, both conventional and disposable, have revolutionized the management of difficult-to-heal wounds. Similarly, the proliferation of advanced wound dressings, encompassing foam, hydrocolloid, film, alginate, and hydrogel variants, has provided clinicians with a wider array of targeted treatment options. The market has also seen a rise in the utilization of wound therapy devices such as pressure relief devices and electrical stimulation devices, further enhancing therapeutic efficacy.

Shifting consumer demands, driven by an increasing health consciousness and a desire for less invasive and more effective treatment modalities, have also played a pivotal role. Patients are actively seeking solutions that minimize pain, reduce scarring, and promote quicker return to daily activities. This patient-centric approach has compelled manufacturers and healthcare providers to prioritize products and services that align with these evolving expectations. The ongoing focus on preventative care and early intervention strategies further bolsters the market's growth prospects, as it encourages proactive wound management and reduces the burden of advanced wound care. The projected growth for the forecast period (2025–2033) is estimated to be between xx% and xx%, reflecting the sustained demand for innovative and effective wound care solutions in the UAE.

Leading Regions, Countries, or Segments in UAE Wound Care Management Market

The UAE Wound Care Management Market is characterized by a strong dominance within specific segments and end-user categories, reflecting the nation's advanced healthcare infrastructure and proactive approach to patient care.

Dominant Segment: Advanced Wound Management Products Advanced Wound Management Products represent the vanguard of the UAE wound care market, driven by innovation and superior clinical outcomes.

- Advanced Wound Dressings: This sub-segment is particularly robust, with

- Foam Dressings: Widely adopted for their absorbency and cushioning properties, ideal for moderate to heavily exuding wounds.

- Hydrocolloid Dressings: Valued for their ability to maintain a moist wound environment and offer protection, particularly for partial-thickness wounds.

- Film Dressings: Preferred for superficial wounds and as secondary dressings, offering breathability and barrier protection.

- Alginate Dressings: Essential for managing highly exuding wounds, providing hemostatic properties and gel formation.

- Hydrogel Dressings: Crucial for debriding dry wounds and providing a soothing effect, beneficial for burns and radiation wounds.

- Wound Therapy Devices: This sub-segment is experiencing significant growth due to its role in accelerating healing and managing complex wounds.

- Negative Pressure Wound Therapy (NPWT) Systems: Both Conventional NPWT Systems and Disposable NPWT Systems are instrumental in treating chronic and acute wounds, demonstrating significant adoption rates in hospitals and specialty clinics. The ease of use and portability of disposable systems are increasingly driving their market share.

- Pressure Relief Devices: Essential in preventing pressure ulcers, especially in long-term care facilities and hospitals.

- Oxygen and Hyperbaric Oxygen Equipment: Critical for treating challenging wounds like diabetic foot ulcers and radiation-induced injuries.

- Electrical Stimulation Devices: Gaining traction for their role in promoting cell proliferation and tissue regeneration.

Dominant End-User: Hospitals and Specialty Wound Clinics Hospitals and Specialty Wound Clinics are the primary consumers of wound care management products and services in the UAE.

- High Patient Volume: These facilities handle a large influx of patients with diverse wound etiologies, including surgical site infections, chronic ulcers (diabetic foot ulcers, venous leg ulcers, pressure ulcers), and burns.

- Access to Advanced Technology: They are equipped with the latest medical technology and staffed by highly trained professionals specializing in wound care, enabling the effective use of advanced wound products and therapies.

- Reimbursement Policies: Favorable reimbursement structures for advanced wound care treatments within these settings further drive their utilization.

- Focus on Patient-Centric Care: The increasing emphasis on patient outcomes and reducing hospital stays encourages the adoption of more effective and faster-healing wound care solutions.

Investment Trends and Regulatory Support: Significant government and private sector investments in healthcare infrastructure, coupled with supportive regulatory frameworks that encourage the adoption of innovative medical technologies, are key drivers for the dominance of these segments. The UAE's commitment to becoming a global hub for medical tourism also fuels demand for high-quality wound care services.

UAE Wound Care Management Market Product Innovations

Product innovations in the UAE wound care management market are primarily centered on developing next-generation advanced wound dressings and sophisticated wound therapy devices. These innovations focus on enhancing biodegradability, improving patient comfort, and accelerating healing through advanced material science and bio-engineering. For instance, the development of self-sanitizing wound dressings incorporating antimicrobial agents and novel drug delivery systems for sustained release of therapeutic compounds are key areas of research and development. Furthermore, smart wound dressings that can monitor wound status, such as pH levels and exudate, and transmit data wirelessly are emerging as significant technological advancements, offering real-time insights for clinicians and improving personalized patient care. The performance metrics of these innovative products often demonstrate faster epithelialization, reduced pain scores, and a significant decrease in infection rates compared to traditional wound care methods.

Propelling Factors for UAE Wound Care Management Market Growth

Several pivotal factors are propelling the growth of the UAE Wound Care Management Market. The escalating prevalence of chronic diseases like diabetes and peripheral vascular disease, which significantly contribute to the incidence of complex and hard-to-heal wounds, is a primary driver. Advancements in medical technology have introduced sophisticated wound care products and therapies, such as negative pressure wound therapy (NPNT) systems and advanced wound dressings, leading to improved patient outcomes and reduced treatment costs. Furthermore, a growing awareness among the population and healthcare professionals about the importance of timely and effective wound management, coupled with a rising elderly population who are more susceptible to chronic wounds, are also contributing factors. Government initiatives focused on enhancing healthcare infrastructure and promoting advanced medical treatments further bolster market expansion.

Obstacles in the UAE Wound Care Management Market Market

Despite its promising growth, the UAE Wound Care Management Market faces certain obstacles. The high cost of advanced wound care products and therapies can be a significant barrier to accessibility, particularly for patients with limited insurance coverage or in lower-income demographics. While the regulatory landscape is generally supportive, the process for approving new medical devices and treatments can be lengthy, potentially delaying market entry for innovative products. Furthermore, a shortage of highly specialized wound care nurses and clinicians in certain regions can hinder the effective implementation of advanced treatment protocols. Supply chain disruptions, as seen during global health crises, can also impact the availability of essential wound care supplies. Intense competition among established players and emerging innovators can also exert pricing pressures.

Future Opportunities in UAE Wound Care Management Market

The UAE Wound Care Management Market presents a wealth of future opportunities. The growing demand for home-based wound care services, driven by an aging population and the desire for convenience, opens avenues for specialized service providers and telehealth solutions. The increasing focus on preventative wound care strategies, particularly for diabetic patients, presents a significant market for diagnostic tools and educational programs. The burgeoning medical tourism sector in the UAE also offers substantial opportunities for providers offering high-quality, specialized wound care services. Furthermore, the development of smart wound dressings with integrated sensors for remote monitoring and AI-powered wound analysis platforms represents a frontier of innovation with immense market potential. Continued investment in research and development for novel biomaterials and regenerative medicine approaches to wound healing will also unlock new market segments.

Major Players in the UAE Wound Care Management Market Ecosystem

- Coloplast A/S

- Molnlycke Health Care

- 3M Company

- Medtronic Plc

- Johnson & Johnson

- Beiersdorf AG

- Smith & Nephew Plc

- ConvaTec Inc

Key Developments in UAE Wound Care Management Market Industry

- March 2022: Abu Dhabi Health Services Company (SEHA) successfully concluded the 6th World Union of Wound Healing Societies (WUWHS) congress, aiming to improve patient-centered wound care and foster knowledge exchange among global experts.

- January 2022: PolyNovo launched their revolutionary NovoSorb BTM synthetic wound matrix technology at Arab Health 2022. This launch highlighted the company's patented NovoSorb polymer technology, developed to address the need for a safe, synthetic, and biodegradable product for medical devices.

Strategic UAE Wound Care Management Market Market Forecast

The strategic forecast for the UAE Wound Care Management Market is exceptionally positive, driven by a confluence of robust growth catalysts. The increasing incidence of chronic diseases, coupled with the nation's commitment to advancing healthcare infrastructure and adopting cutting-edge medical technologies, will continue to fuel demand for advanced wound care solutions. The market's trajectory is further bolstered by favorable demographic trends, including an aging population, and the burgeoning medical tourism sector. Innovations in biomaterials, smart wound care devices, and a growing emphasis on preventative strategies will unlock new avenues for growth, ensuring a sustained expansion throughout the forecast period. The market is poised for significant gains, with projected values reaching xx Million by 2033.

UAE Wound Care Management Market Segmentation

-

1. Product

-

1.1. Advanced Wound Management Product

-

1.1.1. Advanced Wound Dressing

- 1.1.1.1. Foam Dressing

- 1.1.1.2. Hydrocolloid Dressing

- 1.1.1.3. Film Dressing

- 1.1.1.4. Alginate Dressing

- 1.1.1.5. Hydrogel Dressing

- 1.1.1.6. Other Advanced Dressings

-

1.1.2. Wound Therapy Device

- 1.1.2.1. Pressure Relief Device

-

1.1.2.2. Negative Pressure Wound Therapy (NPWT) System

- 1.1.2.2.1. Conventional NPWT System

- 1.1.2.2.2. Disposable NPWT System

- 1.1.2.3. Oxygen and Hyperbaric Oxygen Equipment

- 1.1.2.4. Electrical Stimulation Device

- 1.1.2.5. Other Therapy Devices

-

1.1.1. Advanced Wound Dressing

-

1.2. Surgical Wound Care Product

- 1.2.1. Suture and Staple

- 1.2.2. Tissue Adhesive, Sealant, and Glue

-

1.1. Advanced Wound Management Product

-

2. End-User

- 2.1. Hospital and Specialty Wound Clinics

- 2.2. Long-term Care Facility

UAE Wound Care Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

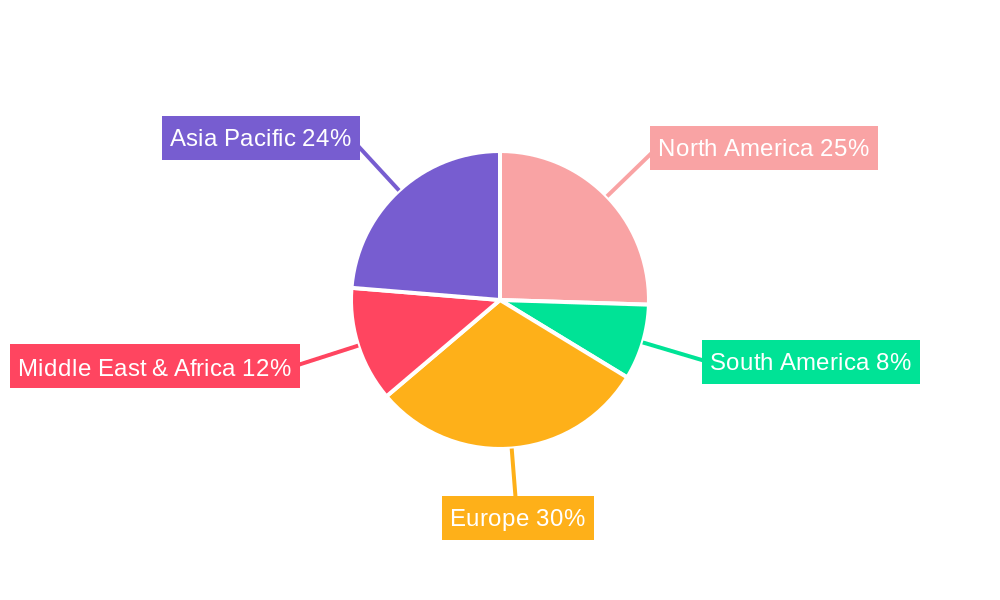

UAE Wound Care Management Market Regional Market Share

Geographic Coverage of UAE Wound Care Management Market

UAE Wound Care Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of Chronic Wounds; Increase in the Number of Surgeries

- 3.3. Market Restrains

- 3.3.1. High-cost Procedures; Reluctance Toward the Acceptance of New Technologies

- 3.4. Market Trends

- 3.4.1. Foam Dressing is is Expected to Have a High Growth Rate in the UAE Wound Care Management Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Wound Care Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Advanced Wound Management Product

- 5.1.1.1. Advanced Wound Dressing

- 5.1.1.1.1. Foam Dressing

- 5.1.1.1.2. Hydrocolloid Dressing

- 5.1.1.1.3. Film Dressing

- 5.1.1.1.4. Alginate Dressing

- 5.1.1.1.5. Hydrogel Dressing

- 5.1.1.1.6. Other Advanced Dressings

- 5.1.1.2. Wound Therapy Device

- 5.1.1.2.1. Pressure Relief Device

- 5.1.1.2.2. Negative Pressure Wound Therapy (NPWT) System

- 5.1.1.2.2.1. Conventional NPWT System

- 5.1.1.2.2.2. Disposable NPWT System

- 5.1.1.2.3. Oxygen and Hyperbaric Oxygen Equipment

- 5.1.1.2.4. Electrical Stimulation Device

- 5.1.1.2.5. Other Therapy Devices

- 5.1.1.1. Advanced Wound Dressing

- 5.1.2. Surgical Wound Care Product

- 5.1.2.1. Suture and Staple

- 5.1.2.2. Tissue Adhesive, Sealant, and Glue

- 5.1.1. Advanced Wound Management Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Hospital and Specialty Wound Clinics

- 5.2.2. Long-term Care Facility

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America UAE Wound Care Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Advanced Wound Management Product

- 6.1.1.1. Advanced Wound Dressing

- 6.1.1.1.1. Foam Dressing

- 6.1.1.1.2. Hydrocolloid Dressing

- 6.1.1.1.3. Film Dressing

- 6.1.1.1.4. Alginate Dressing

- 6.1.1.1.5. Hydrogel Dressing

- 6.1.1.1.6. Other Advanced Dressings

- 6.1.1.2. Wound Therapy Device

- 6.1.1.2.1. Pressure Relief Device

- 6.1.1.2.2. Negative Pressure Wound Therapy (NPWT) System

- 6.1.1.2.2.1. Conventional NPWT System

- 6.1.1.2.2.2. Disposable NPWT System

- 6.1.1.2.3. Oxygen and Hyperbaric Oxygen Equipment

- 6.1.1.2.4. Electrical Stimulation Device

- 6.1.1.2.5. Other Therapy Devices

- 6.1.1.1. Advanced Wound Dressing

- 6.1.2. Surgical Wound Care Product

- 6.1.2.1. Suture and Staple

- 6.1.2.2. Tissue Adhesive, Sealant, and Glue

- 6.1.1. Advanced Wound Management Product

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Hospital and Specialty Wound Clinics

- 6.2.2. Long-term Care Facility

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America UAE Wound Care Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Advanced Wound Management Product

- 7.1.1.1. Advanced Wound Dressing

- 7.1.1.1.1. Foam Dressing

- 7.1.1.1.2. Hydrocolloid Dressing

- 7.1.1.1.3. Film Dressing

- 7.1.1.1.4. Alginate Dressing

- 7.1.1.1.5. Hydrogel Dressing

- 7.1.1.1.6. Other Advanced Dressings

- 7.1.1.2. Wound Therapy Device

- 7.1.1.2.1. Pressure Relief Device

- 7.1.1.2.2. Negative Pressure Wound Therapy (NPWT) System

- 7.1.1.2.2.1. Conventional NPWT System

- 7.1.1.2.2.2. Disposable NPWT System

- 7.1.1.2.3. Oxygen and Hyperbaric Oxygen Equipment

- 7.1.1.2.4. Electrical Stimulation Device

- 7.1.1.2.5. Other Therapy Devices

- 7.1.1.1. Advanced Wound Dressing

- 7.1.2. Surgical Wound Care Product

- 7.1.2.1. Suture and Staple

- 7.1.2.2. Tissue Adhesive, Sealant, and Glue

- 7.1.1. Advanced Wound Management Product

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Hospital and Specialty Wound Clinics

- 7.2.2. Long-term Care Facility

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe UAE Wound Care Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Advanced Wound Management Product

- 8.1.1.1. Advanced Wound Dressing

- 8.1.1.1.1. Foam Dressing

- 8.1.1.1.2. Hydrocolloid Dressing

- 8.1.1.1.3. Film Dressing

- 8.1.1.1.4. Alginate Dressing

- 8.1.1.1.5. Hydrogel Dressing

- 8.1.1.1.6. Other Advanced Dressings

- 8.1.1.2. Wound Therapy Device

- 8.1.1.2.1. Pressure Relief Device

- 8.1.1.2.2. Negative Pressure Wound Therapy (NPWT) System

- 8.1.1.2.2.1. Conventional NPWT System

- 8.1.1.2.2.2. Disposable NPWT System

- 8.1.1.2.3. Oxygen and Hyperbaric Oxygen Equipment

- 8.1.1.2.4. Electrical Stimulation Device

- 8.1.1.2.5. Other Therapy Devices

- 8.1.1.1. Advanced Wound Dressing

- 8.1.2. Surgical Wound Care Product

- 8.1.2.1. Suture and Staple

- 8.1.2.2. Tissue Adhesive, Sealant, and Glue

- 8.1.1. Advanced Wound Management Product

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Hospital and Specialty Wound Clinics

- 8.2.2. Long-term Care Facility

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa UAE Wound Care Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Advanced Wound Management Product

- 9.1.1.1. Advanced Wound Dressing

- 9.1.1.1.1. Foam Dressing

- 9.1.1.1.2. Hydrocolloid Dressing

- 9.1.1.1.3. Film Dressing

- 9.1.1.1.4. Alginate Dressing

- 9.1.1.1.5. Hydrogel Dressing

- 9.1.1.1.6. Other Advanced Dressings

- 9.1.1.2. Wound Therapy Device

- 9.1.1.2.1. Pressure Relief Device

- 9.1.1.2.2. Negative Pressure Wound Therapy (NPWT) System

- 9.1.1.2.2.1. Conventional NPWT System

- 9.1.1.2.2.2. Disposable NPWT System

- 9.1.1.2.3. Oxygen and Hyperbaric Oxygen Equipment

- 9.1.1.2.4. Electrical Stimulation Device

- 9.1.1.2.5. Other Therapy Devices

- 9.1.1.1. Advanced Wound Dressing

- 9.1.2. Surgical Wound Care Product

- 9.1.2.1. Suture and Staple

- 9.1.2.2. Tissue Adhesive, Sealant, and Glue

- 9.1.1. Advanced Wound Management Product

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Hospital and Specialty Wound Clinics

- 9.2.2. Long-term Care Facility

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific UAE Wound Care Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Advanced Wound Management Product

- 10.1.1.1. Advanced Wound Dressing

- 10.1.1.1.1. Foam Dressing

- 10.1.1.1.2. Hydrocolloid Dressing

- 10.1.1.1.3. Film Dressing

- 10.1.1.1.4. Alginate Dressing

- 10.1.1.1.5. Hydrogel Dressing

- 10.1.1.1.6. Other Advanced Dressings

- 10.1.1.2. Wound Therapy Device

- 10.1.1.2.1. Pressure Relief Device

- 10.1.1.2.2. Negative Pressure Wound Therapy (NPWT) System

- 10.1.1.2.2.1. Conventional NPWT System

- 10.1.1.2.2.2. Disposable NPWT System

- 10.1.1.2.3. Oxygen and Hyperbaric Oxygen Equipment

- 10.1.1.2.4. Electrical Stimulation Device

- 10.1.1.2.5. Other Therapy Devices

- 10.1.1.1. Advanced Wound Dressing

- 10.1.2. Surgical Wound Care Product

- 10.1.2.1. Suture and Staple

- 10.1.2.2. Tissue Adhesive, Sealant, and Glue

- 10.1.1. Advanced Wound Management Product

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Hospital and Specialty Wound Clinics

- 10.2.2. Long-term Care Facility

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Coloplast A/S

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Molnlycke Health Care*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 3M Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Medtronic Plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson & Johnson

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Beiersdorf AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Smith & Nephew Plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ConvaTec Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Coloplast A/S

List of Figures

- Figure 1: Global UAE Wound Care Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UAE Wound Care Management Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America UAE Wound Care Management Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America UAE Wound Care Management Market Revenue (Million), by End-User 2025 & 2033

- Figure 5: North America UAE Wound Care Management Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America UAE Wound Care Management Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UAE Wound Care Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UAE Wound Care Management Market Revenue (Million), by Product 2025 & 2033

- Figure 9: South America UAE Wound Care Management Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America UAE Wound Care Management Market Revenue (Million), by End-User 2025 & 2033

- Figure 11: South America UAE Wound Care Management Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: South America UAE Wound Care Management Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America UAE Wound Care Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UAE Wound Care Management Market Revenue (Million), by Product 2025 & 2033

- Figure 15: Europe UAE Wound Care Management Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe UAE Wound Care Management Market Revenue (Million), by End-User 2025 & 2033

- Figure 17: Europe UAE Wound Care Management Market Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Europe UAE Wound Care Management Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe UAE Wound Care Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UAE Wound Care Management Market Revenue (Million), by Product 2025 & 2033

- Figure 21: Middle East & Africa UAE Wound Care Management Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa UAE Wound Care Management Market Revenue (Million), by End-User 2025 & 2033

- Figure 23: Middle East & Africa UAE Wound Care Management Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Middle East & Africa UAE Wound Care Management Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UAE Wound Care Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UAE Wound Care Management Market Revenue (Million), by Product 2025 & 2033

- Figure 27: Asia Pacific UAE Wound Care Management Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific UAE Wound Care Management Market Revenue (Million), by End-User 2025 & 2033

- Figure 29: Asia Pacific UAE Wound Care Management Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Asia Pacific UAE Wound Care Management Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific UAE Wound Care Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Wound Care Management Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global UAE Wound Care Management Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Global UAE Wound Care Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UAE Wound Care Management Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global UAE Wound Care Management Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global UAE Wound Care Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global UAE Wound Care Management Market Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global UAE Wound Care Management Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global UAE Wound Care Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global UAE Wound Care Management Market Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global UAE Wound Care Management Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: Global UAE Wound Care Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global UAE Wound Care Management Market Revenue Million Forecast, by Product 2020 & 2033

- Table 29: Global UAE Wound Care Management Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 30: Global UAE Wound Care Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UAE Wound Care Management Market Revenue Million Forecast, by Product 2020 & 2033

- Table 38: Global UAE Wound Care Management Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 39: Global UAE Wound Care Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UAE Wound Care Management Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Wound Care Management Market?

The projected CAGR is approximately 6.89%.

2. Which companies are prominent players in the UAE Wound Care Management Market?

Key companies in the market include Coloplast A/S, Molnlycke Health Care*List Not Exhaustive, 3M Company, Medtronic Plc, Johnson & Johnson, Beiersdorf AG, Smith & Nephew Plc, ConvaTec Inc.

3. What are the main segments of the UAE Wound Care Management Market?

The market segments include Product, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of Chronic Wounds; Increase in the Number of Surgeries.

6. What are the notable trends driving market growth?

Foam Dressing is is Expected to Have a High Growth Rate in the UAE Wound Care Management Market.

7. Are there any restraints impacting market growth?

High-cost Procedures; Reluctance Toward the Acceptance of New Technologies.

8. Can you provide examples of recent developments in the market?

In March 2022, Abu Dhabi Health Services Company (SEHA) successfully concluded the 6th World Union of Wound Healing Societies (WUWHS) congress, which aimed at improving patient-centered wound care.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Wound Care Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Wound Care Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Wound Care Management Market?

To stay informed about further developments, trends, and reports in the UAE Wound Care Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence