Key Insights

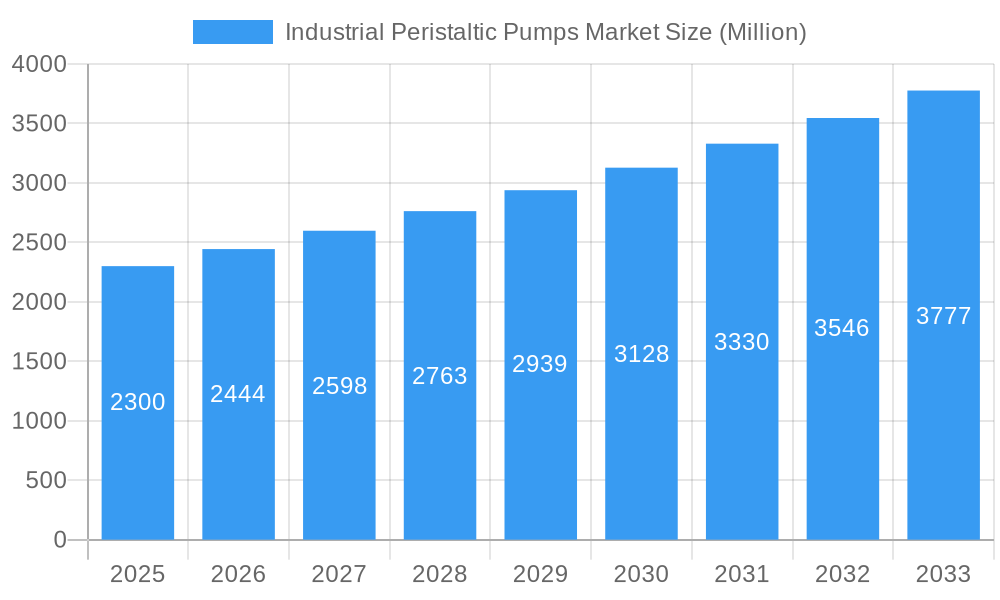

The global Industrial Peristaltic Pumps Market is projected to experience substantial growth, reaching an estimated $1403.8 million by 2025. This expansion is driven by a projected Compound Annual Growth Rate (CAGR) of 3.8% from 2025 to 2033. Key growth catalysts include heightened demand from the pharmaceutical and biotechnology sectors, necessitated by stringent regulatory standards for precise and sterile fluid handling, and advancements in drug discovery. Healthcare facilities also contribute significantly, utilizing these pumps for accurate medication dosing, chemotherapy, and sensitive fluid transfer. Peristaltic pumps offer distinct advantages, including the ability to handle abrasive, corrosive, and shear-sensitive fluids without contamination, along with low maintenance and gentle pumping action, making them critical in these applications. The market is segmented by type, encompassing Peristaltic Tube Pumps and Peristaltic Hose Pumps, with discharge capacities ranging from below 30 psi to above 200 psi, addressing diverse industrial requirements.

Industrial Peristaltic Pumps Market Market Size (In Billion)

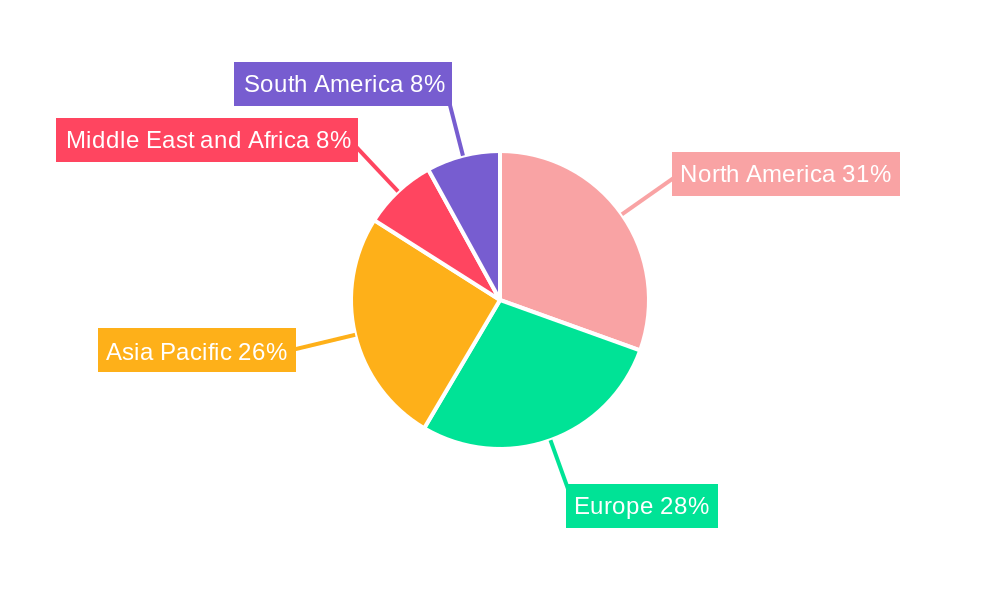

Primary drivers for this market's growth include the increasing adoption of automation in manufacturing, continuous technological innovation leading to enhanced efficiency and precision, and the rising focus on biopharmaceutical production. Emerging trends, such as the development of smart peristaltic pumps with integrated monitoring and control systems, and their expanding application in water treatment and food & beverage processing, are shaping the market. Potential restraints, such as the initial higher cost compared to alternative pump technologies and limitations in high-volume flow rates for certain applications, are being addressed through ongoing advancements. Leading companies are actively investing in research and development to secure market share. Geographically, North America and Europe dominate, supported by established pharmaceutical and biotech industries, while the Asia Pacific region presents significant growth potential.

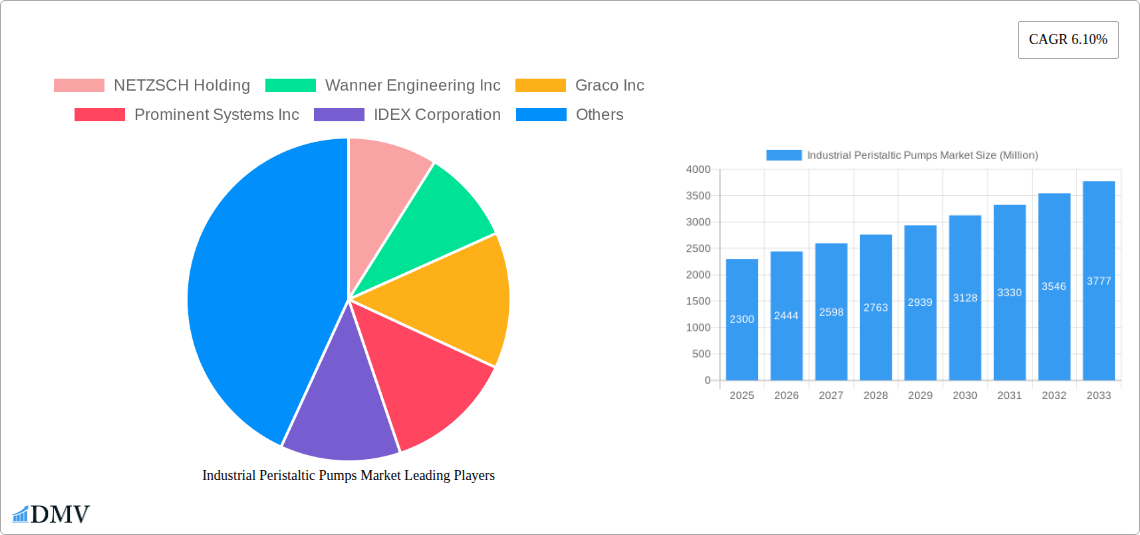

Industrial Peristaltic Pumps Market Company Market Share

This comprehensive report provides an in-depth analysis of the Industrial Peristaltic Pumps Market, examining its current state, evolving trends, and future outlook. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this study is vital for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate competitive landscapes within the peristaltic pump industry. The global Industrial Peristaltic Pumps Market size is expected to see significant expansion, driven by increasing demand from critical sectors such as pharmaceuticals and biotechnology.

Industrial Peristaltic Pumps Market Market Composition & Trends

The Industrial Peristaltic Pumps Market is characterized by moderate to high concentration, with key players like NETZSCH Holding, Wanner Engineering Inc., Graco Inc., Prominent Systems Inc., and IDEX Corporation holding substantial market share. Innovation is a critical catalyst, driven by the continuous need for enhanced precision, reliability, and chemical compatibility in fluid handling. Regulatory landscapes, particularly concerning hygiene and safety in pharmaceutical and biotechnological applications, significantly influence product development and market access. Substitute products, while present, often fall short in offering the precise, contamination-free fluid transfer that peristaltic pumps excel at, especially for sensitive materials. End-user profiles are diverse, with pharmaceutical and biotechnological companies and hospitals and other facilities being major consumers due to stringent requirements for sterile and accurate fluid delivery. Mergers and acquisitions (M&A) activities are a notable trend, with companies strategically consolidating to expand their product portfolios and geographical reach. For instance, the acquisition of smaller, specialized pump manufacturers by larger entities often aims to integrate advanced technologies and bolster market presence. The overall market value is estimated to be in the billions of US dollars, with M&A deal values ranging from tens to hundreds of millions of US dollars reflecting strategic consolidation and growth investments.

- Market Concentration: Dominated by a few key players, with strategic importance placed on technological leadership.

- Innovation Catalysts: Driven by demand for high-purity fluid transfer, process automation, and specialized applications.

- Regulatory Landscapes: Stringent regulations in healthcare and pharmaceuticals are key drivers for advanced, compliant peristaltic pump solutions.

- Substitute Products: While alternatives exist, peristaltic pumps offer unique advantages in sterility and precision for specific applications.

- End-User Profiles: Strong reliance from pharmaceutical and biotechnological companies and hospitals and other facilities due to sterile fluid handling needs.

- M&A Activities: Strategic acquisitions and partnerships aimed at expanding product lines and market penetration.

Industrial Peristaltic Pumps Market Industry Evolution

The Industrial Peristaltic Pumps Market has undergone a remarkable evolution, transitioning from niche applications to becoming an indispensable technology across a wide spectrum of industries. The market growth trajectory is robust, fueled by an escalating demand for precise and contamination-free fluid transfer solutions. Technological advancements have been pivotal, with manufacturers continuously innovating to enhance pump performance, efficiency, and durability. Early peristaltic pumps were primarily used for simple dosing and transfer tasks; however, modern peristaltic pumps are sophisticated instruments capable of handling highly aggressive chemicals, sensitive biological fluids, and abrasive slurries with exceptional accuracy. The development of advanced tubing materials, such as novel elastomers and silicones, has significantly broadened the application range and improved the lifespan of the pumping elements. Furthermore, the integration of smart technologies, including IoT connectivity and advanced control systems, has enabled real-time monitoring, predictive maintenance, and seamless integration into automated production lines. This shift towards intelligent pumping solutions is a direct response to evolving consumer demands for greater process control, reduced downtime, and optimized operational efficiency.

Adoption metrics showcase a steady increase in peristaltic pump installations across various sectors. The pharmaceutical and biotechnology industries, in particular, have witnessed a significant surge in adoption due to the inherent benefits of peristaltic pumps, such as their ability to prevent cross-contamination and maintain fluid sterility – critical for drug manufacturing and life science research. Similarly, the food and beverage sector is increasingly leveraging peristaltic pumps for hygienic fluid handling and accurate ingredient dispensing. The industrial peristaltic pumps market size is estimated to have grown at a Compound Annual Growth Rate (CAGR) of approximately XX% during the historical period (2019-2024), and this growth is projected to continue, with a forecast CAGR of around XX% from 2025 to 2033. This sustained growth is indicative of the expanding applications and the increasing recognition of the unique advantages offered by peristaltic pump technology. The market's evolution is a testament to its adaptability and its capacity to meet the ever-increasing demands of modern industrial processes, solidifying its position as a vital component in advanced fluid management systems.

Leading Regions, Countries, or Segments in Industrial Peristaltic Pumps Market

The dominance within the Industrial Peristaltic Pumps Market is demonstrably strong in regions and segments catering to high-value applications and possessing robust industrial infrastructure. North America and Europe currently lead the market, driven by the significant presence of pharmaceutical and biotechnological companies, advanced research institutions, and stringent regulatory frameworks that necessitate high-precision and sterile fluid handling. These regions exhibit substantial investment in R&D, leading to a higher adoption rate of cutting-edge peristaltic pump technologies.

Within the segment analysis, Peristaltic Tube Pumps generally hold a larger market share compared to Peristaltic Hose Pumps due to their wider applicability in laboratory settings, precise dosing, and biopharmaceutical processes where tube integrity and ease of replacement are paramount. The Discharge Capacity segment of Up to 30 psi and 30-50 psi represents a significant portion of the market, as these pressure ranges are sufficient for a vast array of common industrial and laboratory applications, including chemical dosing, sample transfer, and filtration. However, the growth in demand for higher discharge capacities, such as 50-100 psi and 100-200 psi, is accelerating, driven by specialized industrial processes and fluid transfer requirements in manufacturing. The Above 200 psi segment, while smaller, is experiencing rapid growth due to its critical role in high-pressure fluid injection and demanding industrial operations.

The end-user segment of Pharmaceutical and Biotechnological Companies is a dominant force in the Industrial Peristaltic Pumps Market. This dominance stems from the absolute necessity for sterile, contamination-free fluid handling, precise volumetric control for drug formulation and manufacturing, and the sensitive nature of biological materials. Regulatory compliance in these sectors, such as FDA and EMA guidelines, further mandates the use of pumps that minimize the risk of fluid degradation or contamination, a forte of peristaltic pump technology. Hospitals and Other Facilities also contribute significantly, particularly in areas like diagnostics, laboratory testing, and the dispensing of medical fluids. Investment trends in these leading regions are heavily skewed towards innovation and expansion within these critical end-user industries, supported by government initiatives and private sector investments in healthcare and life sciences. Regulatory support, such as the increasing focus on Good Manufacturing Practices (GMP) and Good Laboratory Practices (GLP), directly boosts the demand for compliant peristaltic pump solutions.

- Dominant Region: North America and Europe, owing to strong pharmaceutical & biotech sectors and advanced industrial infrastructure.

- Key Segment Driver (Type): Peristaltic Tube Pumps, favored for precision and sterility in critical applications.

- Key Segment Driver (Discharge Capacity): Up to 30 psi and 30-50 psi are dominant due to widespread application; higher pressure segments showing rapid growth.

- Dominant End User: Pharmaceutical and Biotechnological Companies, due to stringent requirements for contamination-free and precise fluid handling.

- Investment Trends: High investment in R&D and infrastructure for pharmaceutical, biotech, and advanced manufacturing sectors.

- Regulatory Support: Stringent regulations in healthcare and biopharma create a favorable market for compliant peristaltic pumps.

Industrial Peristaltic Pumps Market Product Innovations

Product innovations in the Industrial Peristaltic Pumps Market are consistently pushing the boundaries of fluid handling capabilities. Recent advancements include the development of pumps with enhanced chemical resistance, allowing them to handle a broader range of aggressive or corrosive fluids without degradation. Innovations in tubing materials, such as advanced thermoplastic elastomers and silicones, are leading to longer pump head life, reduced pulsation, and improved sterility for sensitive applications. Furthermore, intelligent pump designs are emerging, incorporating features like integrated sensors for real-time flow monitoring, pressure sensing, and predictive maintenance alerts, significantly improving process control and operational efficiency. These innovations are crucial for meeting the evolving demands of industries requiring high accuracy, reliability, and minimal downtime, thereby enhancing product performance and application versatility.

Propelling Factors for Industrial Peristaltic Pumps Market Growth

The Industrial Peristaltic Pumps Market is experiencing robust growth driven by several key factors. Technological advancements in tubing materials and pump head designs are enabling greater accuracy, longevity, and chemical compatibility, expanding their applicability. The increasing stringency of regulations in pharmaceutical, biotechnological, and food & beverage industries, mandating sterile and contamination-free fluid transfer, is a significant driver. Furthermore, the growing adoption of automation and process optimization across various manufacturing sectors necessitates reliable and precise fluid handling solutions, a role peristaltic pumps are well-suited to fulfill. The rising global demand for pharmaceuticals and biopharmaceuticals directly fuels the need for advanced peristaltic pumping systems.

- Technological Advancements: Improved tubing materials, enhanced pump head designs, and intelligent control systems.

- Regulatory Compliance: Growing demand for sterile, contamination-free fluid transfer in regulated industries.

- Automation & Process Optimization: Need for precise and reliable fluid handling in automated manufacturing.

- Sectoral Growth: Expansion of pharmaceutical, biotechnology, and food & beverage industries.

Obstacles in the Industrial Peristaltic Pumps Market Market

Despite its strong growth, the Industrial Peristaltic Pumps Market faces certain obstacles. High initial purchase costs compared to some alternative pump technologies can be a deterrent for smaller enterprises or those with budget constraints. The lifespan of the peristaltic tubing, while improving, remains a consumable component that requires periodic replacement, contributing to ongoing operational costs. Supply chain disruptions for specialized tubing materials can also impact production and availability, leading to potential delays and increased costs. Furthermore, the market experiences intense competition, with numerous players offering a wide range of products, which can sometimes lead to price pressures and challenges in market differentiation.

Future Opportunities in Industrial Peristaltic Pumps Market

The Industrial Peristaltic Pumps Market is poised for significant future opportunities. The growing demand for single-use technologies in biopharmaceutical manufacturing presents a substantial avenue for growth, as peristaltic pumps are ideally suited for sterile, disposable fluid pathways. Emerging markets in developing economies are increasingly adopting advanced manufacturing processes, creating new demand centers for these specialized pumps. Continued innovation in smart pump technology, including advanced IoT integration and AI-driven diagnostics, will open up opportunities for predictive maintenance and remote monitoring services. The expansion of niche applications in areas like advanced wastewater treatment and specialized chemical processing also holds considerable potential.

Major Players in the Industrial Peristaltic Pumps Market Ecosystem

- NETZSCH Holding

- Wanner Engineering Inc.

- Graco Inc.

- Prominent Systems Inc.

- IDEX Corporation

- VWR International (Masterflex)

- Spirax-Sarco Engineering (Watson-Marlow Fluid Technology Group)

- Randolph Austin Company

- Verder Group

- Cole-Parmer Instrument Company LLC

- Gilson Inc.

- Capillary Oy (Flowrox Oy)

Key Developments in Industrial Peristaltic Pumps Market Industry

- September 2022: Freudenberg Medical launched HelixFlex, a high-purity thermoplastic elastomer TPE tubing designed for use in biopharmaceutical fluid transfer applications, enhancing fluid integrity and application scope.

- February 2022: Watson-Marlow Fluid Technology Group extended its industrial Ethernet control offer by making PROFINET available on its 530, 630, and 730 series of cased peristaltic pumps, improving integration capabilities with industrial automation systems.

Strategic Industrial Peristaltic Pumps Market Market Forecast

The strategic Industrial Peristaltic Pumps Market forecast indicates sustained and robust growth, propelled by an insatiable demand from the pharmaceutical and biotechnology sectors, which consistently require sterile and precise fluid handling. The ongoing trend towards automation in manufacturing across diverse industries will further amplify the need for reliable peristaltic pumps. Emerging opportunities in single-use applications and developing economies present significant avenues for market expansion. Continued innovation in smart pump technologies, focusing on enhanced connectivity, predictive maintenance, and energy efficiency, will be crucial for capturing future market share and solidifying the position of peristaltic pumps as indispensable tools in advanced fluid management.

Industrial Peristaltic Pumps Market Segmentation

-

1. Type

- 1.1. Peristaltic Tube Pumps

- 1.2. Peristaltic Hose Pumps

-

2. Discharge Capacity

- 2.1. Up to 30 psi

- 2.2. 30-50 psi

- 2.3. 50-100 psi

- 2.4. 100-200 psi

- 2.5. Above 200 psi

-

3. End User

- 3.1. Pharmaceutical and Biotechnological Companies

- 3.2. Hospitals and Other Facilities

Industrial Peristaltic Pumps Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Industrial Peristaltic Pumps Market Regional Market Share

Geographic Coverage of Industrial Peristaltic Pumps Market

Industrial Peristaltic Pumps Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investments in the Expansion of Water and Wastewater Treatment Plants Worldwide; Increasing Investments in the Drug Development and Discovery

- 3.3. Market Restrains

- 3.3.1. Frequent Replacement of Hoses and Tubes

- 3.4. Market Trends

- 3.4.1. Peristaltic Tube Pumps Segment is Expected to Hold Significant Market Share of the Peristaltic Pumps Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Peristaltic Pumps Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Peristaltic Tube Pumps

- 5.1.2. Peristaltic Hose Pumps

- 5.2. Market Analysis, Insights and Forecast - by Discharge Capacity

- 5.2.1. Up to 30 psi

- 5.2.2. 30-50 psi

- 5.2.3. 50-100 psi

- 5.2.4. 100-200 psi

- 5.2.5. Above 200 psi

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical and Biotechnological Companies

- 5.3.2. Hospitals and Other Facilities

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Industrial Peristaltic Pumps Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Peristaltic Tube Pumps

- 6.1.2. Peristaltic Hose Pumps

- 6.2. Market Analysis, Insights and Forecast - by Discharge Capacity

- 6.2.1. Up to 30 psi

- 6.2.2. 30-50 psi

- 6.2.3. 50-100 psi

- 6.2.4. 100-200 psi

- 6.2.5. Above 200 psi

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceutical and Biotechnological Companies

- 6.3.2. Hospitals and Other Facilities

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Industrial Peristaltic Pumps Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Peristaltic Tube Pumps

- 7.1.2. Peristaltic Hose Pumps

- 7.2. Market Analysis, Insights and Forecast - by Discharge Capacity

- 7.2.1. Up to 30 psi

- 7.2.2. 30-50 psi

- 7.2.3. 50-100 psi

- 7.2.4. 100-200 psi

- 7.2.5. Above 200 psi

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceutical and Biotechnological Companies

- 7.3.2. Hospitals and Other Facilities

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Industrial Peristaltic Pumps Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Peristaltic Tube Pumps

- 8.1.2. Peristaltic Hose Pumps

- 8.2. Market Analysis, Insights and Forecast - by Discharge Capacity

- 8.2.1. Up to 30 psi

- 8.2.2. 30-50 psi

- 8.2.3. 50-100 psi

- 8.2.4. 100-200 psi

- 8.2.5. Above 200 psi

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceutical and Biotechnological Companies

- 8.3.2. Hospitals and Other Facilities

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Industrial Peristaltic Pumps Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Peristaltic Tube Pumps

- 9.1.2. Peristaltic Hose Pumps

- 9.2. Market Analysis, Insights and Forecast - by Discharge Capacity

- 9.2.1. Up to 30 psi

- 9.2.2. 30-50 psi

- 9.2.3. 50-100 psi

- 9.2.4. 100-200 psi

- 9.2.5. Above 200 psi

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceutical and Biotechnological Companies

- 9.3.2. Hospitals and Other Facilities

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Industrial Peristaltic Pumps Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Peristaltic Tube Pumps

- 10.1.2. Peristaltic Hose Pumps

- 10.2. Market Analysis, Insights and Forecast - by Discharge Capacity

- 10.2.1. Up to 30 psi

- 10.2.2. 30-50 psi

- 10.2.3. 50-100 psi

- 10.2.4. 100-200 psi

- 10.2.5. Above 200 psi

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pharmaceutical and Biotechnological Companies

- 10.3.2. Hospitals and Other Facilities

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NETZSCH Holding

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wanner Engineering Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Graco Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Prominent Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IDEX Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VWR International (Masterflex)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Spirax-Sarco Engineering (Watson-Marlow Fluid Technology Group)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Randolph Austin Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Verder Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cole-Parmer Instrument Company LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Gilson Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Capillary Oy (Flowrox Oy)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 NETZSCH Holding

List of Figures

- Figure 1: Global Industrial Peristaltic Pumps Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Industrial Peristaltic Pumps Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Industrial Peristaltic Pumps Market Revenue (million), by Type 2025 & 2033

- Figure 4: North America Industrial Peristaltic Pumps Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Industrial Peristaltic Pumps Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Industrial Peristaltic Pumps Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Industrial Peristaltic Pumps Market Revenue (million), by Discharge Capacity 2025 & 2033

- Figure 8: North America Industrial Peristaltic Pumps Market Volume (K Unit), by Discharge Capacity 2025 & 2033

- Figure 9: North America Industrial Peristaltic Pumps Market Revenue Share (%), by Discharge Capacity 2025 & 2033

- Figure 10: North America Industrial Peristaltic Pumps Market Volume Share (%), by Discharge Capacity 2025 & 2033

- Figure 11: North America Industrial Peristaltic Pumps Market Revenue (million), by End User 2025 & 2033

- Figure 12: North America Industrial Peristaltic Pumps Market Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Industrial Peristaltic Pumps Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Industrial Peristaltic Pumps Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Industrial Peristaltic Pumps Market Revenue (million), by Country 2025 & 2033

- Figure 16: North America Industrial Peristaltic Pumps Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Industrial Peristaltic Pumps Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Industrial Peristaltic Pumps Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Industrial Peristaltic Pumps Market Revenue (million), by Type 2025 & 2033

- Figure 20: Europe Industrial Peristaltic Pumps Market Volume (K Unit), by Type 2025 & 2033

- Figure 21: Europe Industrial Peristaltic Pumps Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Industrial Peristaltic Pumps Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Industrial Peristaltic Pumps Market Revenue (million), by Discharge Capacity 2025 & 2033

- Figure 24: Europe Industrial Peristaltic Pumps Market Volume (K Unit), by Discharge Capacity 2025 & 2033

- Figure 25: Europe Industrial Peristaltic Pumps Market Revenue Share (%), by Discharge Capacity 2025 & 2033

- Figure 26: Europe Industrial Peristaltic Pumps Market Volume Share (%), by Discharge Capacity 2025 & 2033

- Figure 27: Europe Industrial Peristaltic Pumps Market Revenue (million), by End User 2025 & 2033

- Figure 28: Europe Industrial Peristaltic Pumps Market Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Industrial Peristaltic Pumps Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Industrial Peristaltic Pumps Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Industrial Peristaltic Pumps Market Revenue (million), by Country 2025 & 2033

- Figure 32: Europe Industrial Peristaltic Pumps Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Industrial Peristaltic Pumps Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Industrial Peristaltic Pumps Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Industrial Peristaltic Pumps Market Revenue (million), by Type 2025 & 2033

- Figure 36: Asia Pacific Industrial Peristaltic Pumps Market Volume (K Unit), by Type 2025 & 2033

- Figure 37: Asia Pacific Industrial Peristaltic Pumps Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Industrial Peristaltic Pumps Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Industrial Peristaltic Pumps Market Revenue (million), by Discharge Capacity 2025 & 2033

- Figure 40: Asia Pacific Industrial Peristaltic Pumps Market Volume (K Unit), by Discharge Capacity 2025 & 2033

- Figure 41: Asia Pacific Industrial Peristaltic Pumps Market Revenue Share (%), by Discharge Capacity 2025 & 2033

- Figure 42: Asia Pacific Industrial Peristaltic Pumps Market Volume Share (%), by Discharge Capacity 2025 & 2033

- Figure 43: Asia Pacific Industrial Peristaltic Pumps Market Revenue (million), by End User 2025 & 2033

- Figure 44: Asia Pacific Industrial Peristaltic Pumps Market Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Industrial Peristaltic Pumps Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Industrial Peristaltic Pumps Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Industrial Peristaltic Pumps Market Revenue (million), by Country 2025 & 2033

- Figure 48: Asia Pacific Industrial Peristaltic Pumps Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Industrial Peristaltic Pumps Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Industrial Peristaltic Pumps Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Industrial Peristaltic Pumps Market Revenue (million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Industrial Peristaltic Pumps Market Volume (K Unit), by Type 2025 & 2033

- Figure 53: Middle East and Africa Industrial Peristaltic Pumps Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Industrial Peristaltic Pumps Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Industrial Peristaltic Pumps Market Revenue (million), by Discharge Capacity 2025 & 2033

- Figure 56: Middle East and Africa Industrial Peristaltic Pumps Market Volume (K Unit), by Discharge Capacity 2025 & 2033

- Figure 57: Middle East and Africa Industrial Peristaltic Pumps Market Revenue Share (%), by Discharge Capacity 2025 & 2033

- Figure 58: Middle East and Africa Industrial Peristaltic Pumps Market Volume Share (%), by Discharge Capacity 2025 & 2033

- Figure 59: Middle East and Africa Industrial Peristaltic Pumps Market Revenue (million), by End User 2025 & 2033

- Figure 60: Middle East and Africa Industrial Peristaltic Pumps Market Volume (K Unit), by End User 2025 & 2033

- Figure 61: Middle East and Africa Industrial Peristaltic Pumps Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa Industrial Peristaltic Pumps Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa Industrial Peristaltic Pumps Market Revenue (million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Industrial Peristaltic Pumps Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Industrial Peristaltic Pumps Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Industrial Peristaltic Pumps Market Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Industrial Peristaltic Pumps Market Revenue (million), by Type 2025 & 2033

- Figure 68: South America Industrial Peristaltic Pumps Market Volume (K Unit), by Type 2025 & 2033

- Figure 69: South America Industrial Peristaltic Pumps Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: South America Industrial Peristaltic Pumps Market Volume Share (%), by Type 2025 & 2033

- Figure 71: South America Industrial Peristaltic Pumps Market Revenue (million), by Discharge Capacity 2025 & 2033

- Figure 72: South America Industrial Peristaltic Pumps Market Volume (K Unit), by Discharge Capacity 2025 & 2033

- Figure 73: South America Industrial Peristaltic Pumps Market Revenue Share (%), by Discharge Capacity 2025 & 2033

- Figure 74: South America Industrial Peristaltic Pumps Market Volume Share (%), by Discharge Capacity 2025 & 2033

- Figure 75: South America Industrial Peristaltic Pumps Market Revenue (million), by End User 2025 & 2033

- Figure 76: South America Industrial Peristaltic Pumps Market Volume (K Unit), by End User 2025 & 2033

- Figure 77: South America Industrial Peristaltic Pumps Market Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Industrial Peristaltic Pumps Market Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Industrial Peristaltic Pumps Market Revenue (million), by Country 2025 & 2033

- Figure 80: South America Industrial Peristaltic Pumps Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Industrial Peristaltic Pumps Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Industrial Peristaltic Pumps Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Discharge Capacity 2020 & 2033

- Table 4: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Discharge Capacity 2020 & 2033

- Table 5: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by End User 2020 & 2033

- Table 6: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Discharge Capacity 2020 & 2033

- Table 12: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Discharge Capacity 2020 & 2033

- Table 13: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by End User 2020 & 2033

- Table 14: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: United States Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Canada Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Type 2020 & 2033

- Table 24: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 25: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Discharge Capacity 2020 & 2033

- Table 26: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Discharge Capacity 2020 & 2033

- Table 27: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by End User 2020 & 2033

- Table 28: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Country 2020 & 2033

- Table 30: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Germany Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: France Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Italy Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Spain Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Type 2020 & 2033

- Table 44: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 45: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Discharge Capacity 2020 & 2033

- Table 46: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Discharge Capacity 2020 & 2033

- Table 47: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by End User 2020 & 2033

- Table 48: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 49: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Country 2020 & 2033

- Table 50: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: China Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Japan Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 56: India Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 58: Australia Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Type 2020 & 2033

- Table 64: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 65: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Discharge Capacity 2020 & 2033

- Table 66: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Discharge Capacity 2020 & 2033

- Table 67: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by End User 2020 & 2033

- Table 68: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 69: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Country 2020 & 2033

- Table 70: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 72: GCC Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Type 2020 & 2033

- Table 78: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 79: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Discharge Capacity 2020 & 2033

- Table 80: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Discharge Capacity 2020 & 2033

- Table 81: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by End User 2020 & 2033

- Table 82: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 83: Global Industrial Peristaltic Pumps Market Revenue million Forecast, by Country 2020 & 2033

- Table 84: Global Industrial Peristaltic Pumps Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Industrial Peristaltic Pumps Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Industrial Peristaltic Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Peristaltic Pumps Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the Industrial Peristaltic Pumps Market?

Key companies in the market include NETZSCH Holding, Wanner Engineering Inc, Graco Inc, Prominent Systems Inc, IDEX Corporation, VWR International (Masterflex), Spirax-Sarco Engineering (Watson-Marlow Fluid Technology Group), Randolph Austin Company, Verder Group, Cole-Parmer Instrument Company LLC, Gilson Inc, Capillary Oy (Flowrox Oy).

3. What are the main segments of the Industrial Peristaltic Pumps Market?

The market segments include Type, Discharge Capacity, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1403.8 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Investments in the Expansion of Water and Wastewater Treatment Plants Worldwide; Increasing Investments in the Drug Development and Discovery.

6. What are the notable trends driving market growth?

Peristaltic Tube Pumps Segment is Expected to Hold Significant Market Share of the Peristaltic Pumps Market.

7. Are there any restraints impacting market growth?

Frequent Replacement of Hoses and Tubes.

8. Can you provide examples of recent developments in the market?

In September 2022, Freudenberg Medical launched HelixFlex, a high-purity thermoplastic elastomer TPE tubing designed for use in biopharmaceutical fluid transfer applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Peristaltic Pumps Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Peristaltic Pumps Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Peristaltic Pumps Market?

To stay informed about further developments, trends, and reports in the Industrial Peristaltic Pumps Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence