Key Insights

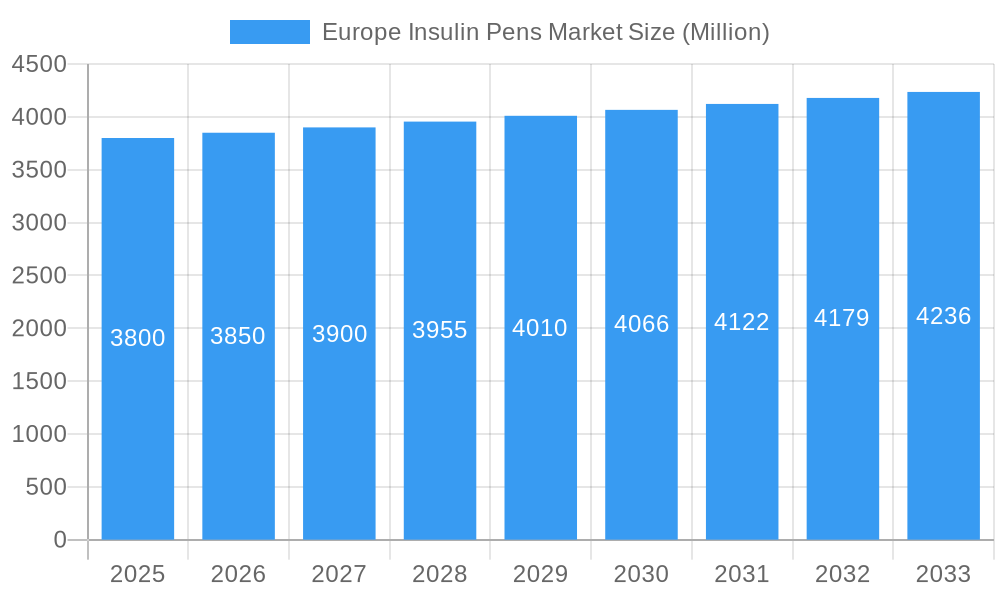

The Europe Insulin Pens Market is projected for robust growth, expected to reach a significant valuation by 2033. This expansion is driven by the increasing prevalence of diabetes and a growing patient preference for convenient, discreet insulin delivery. The adoption of smart, reusable insulin pens is a key trend, enhancing patient engagement and treatment adherence. Disposable pens remain popular due to their simplicity and affordability. Leading companies are investing in R&D to introduce innovative devices, supported by favorable reimbursement policies and awareness campaigns promoting advanced insulin delivery systems.

Europe Insulin Pens Market Market Size (In Billion)

Challenges include the high cost of advanced pens and cartridges, and potential reimbursement limitations in some regions. Intense competition necessitates continuous innovation and cost-effective solutions. Western Europe is anticipated to lead market revenue due to higher diabetes incidence and disposable income, while Eastern Europe shows substantial growth potential. The market's future will be shaped by connected pen technology, digital health integration, and a focus on patient-centric diabetes care.

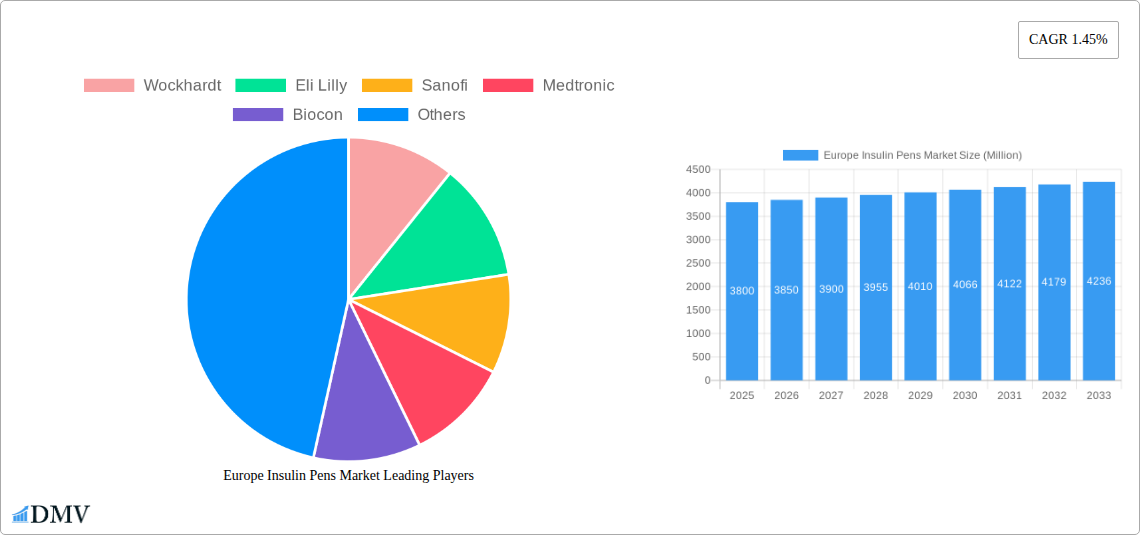

Europe Insulin Pens Market Company Market Share

This report offers an in-depth analysis of the Europe Insulin Pens Market, detailing its current landscape and forecasting its trajectory through 2033. Covering the base year 2025 and a forecast period of 2025-2033, this study provides critical insights into market dynamics, technological advancements, and growth drivers. With an estimated market size of 39.6 billion by 2025, the Europe Insulin Pens Market is a pivotal segment within the diabetes care industry, fueled by rising diabetes prevalence and demand for user-friendly insulin delivery systems.

Europe Insulin Pens Market Market Composition & Trends

The Europe Insulin Pens Market exhibits a moderate concentration, with key players like Novo Nordisk, Eli Lilly, and Sanofi holding significant market share. Innovation remains a crucial catalyst, primarily driven by the pursuit of enhanced patient convenience and improved glycemic control. The regulatory landscape, while stringent, has seen adaptations to accommodate novel diabetes management technologies. Substitute products, such as vials and syringes, are gradually being displaced by the superior usability of insulin pens. End-user profiles are diverse, ranging from Type 1 and Type 2 diabetes patients requiring daily insulin injections to healthcare providers seeking efficient treatment solutions. Merger and acquisition (M&A) activities are anticipated to shape the market further, consolidating expertise and expanding product portfolios. The Europe Insulin Pens Market is characterized by:

- Market Share Distribution: Leading players command substantial portions, with innovative smaller companies carving out niche segments.

- Innovation Focus: Development of smart insulin pens with connectivity features, enhanced ease of use, and reduced injection pain.

- Regulatory Approvals: CE marking certification plays a critical role in market access for new devices.

- End-User Demographics: Growing patient populations with diabetes, particularly in aging demographics and those adopting healthier lifestyles.

- M&A Trends: Strategic acquisitions aimed at acquiring advanced technologies and expanding geographical reach.

Europe Insulin Pens Market Industry Evolution

The Europe Insulin Pens Market has witnessed a remarkable evolution, driven by a confluence of factors that have reshaped diabetes management. The historical period (2019-2024) laid the groundwork for the current growth trajectory, characterized by a steady increase in the adoption of insulin pens as a preferred mode of insulin delivery. This shift is primarily attributable to their inherent advantages over traditional methods like vials and syringes, offering greater convenience, portability, and precision in dosing. The rising global incidence of diabetes, fueled by sedentary lifestyles, increasing obesity rates, and an aging population, has created a robust and ever-expanding patient pool requiring consistent insulin therapy.

Technological advancements have been at the forefront of this evolution. Early insulin pens, while a significant improvement, have been continuously refined to incorporate user-centric features. The introduction of disposable insulin pens offered unparalleled simplicity, eliminating the need for separate cartridges and simplifying the injection process for many patients. Simultaneously, the development of reusable insulin pen systems with interchangeable cartridges provided a more sustainable and potentially cost-effective option for long-term users. These innovations have directly addressed patient needs, simplifying the complex task of managing chronic diabetes and improving adherence to prescribed treatment regimens.

Consumer demand has been a potent force in shaping the Europe Insulin Pens Market. Patients are increasingly seeking solutions that integrate seamlessly into their daily lives, minimizing the burden of their condition. This has spurred the development of insulin pens with improved ergonomics, reduced injection force, and discreet designs. Furthermore, the burgeoning interest in digital health and connected devices has paved the way for the emergence of "smart" insulin pens. These advanced devices offer features such as dose tracking, injection reminders, and data logging, which can be synchronized with smartphone applications. This connectivity empowers patients with greater control over their diabetes management and provides valuable data for healthcare professionals to monitor treatment effectiveness. The market growth rate has been consistently positive, with an estimated compound annual growth rate (CAGR) of XX% during the historical period, a trend projected to continue into the forecast period, driven by continuous product innovation and increasing market penetration across various European nations. The adoption metrics for insulin pens, relative to traditional methods, have seen a significant upward trend, indicating a clear preference shift towards these advanced delivery systems.

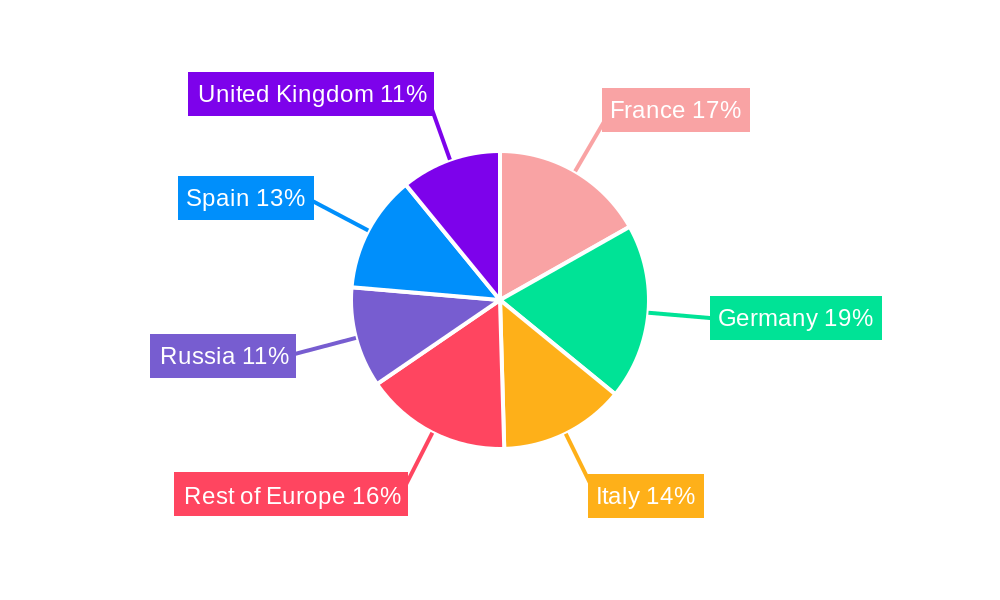

Leading Regions, Countries, or Segments in Europe Insulin Pens Market

The Europe Insulin Pens Market is characterized by significant regional variations in adoption and growth, with certain segments demonstrating particular dominance. Among the product segments, Disposable Insulin Pens have emerged as a leading force, outperforming Cartridges in Reusable Pens due to their inherent simplicity and ease of use, particularly for newly diagnosed patients or those who prioritize convenience. The Germany Insulin Pens Market and the France Insulin Pens Market stand out as key contributors to the overall European market, driven by a confluence of factors including high diabetes prevalence, robust healthcare infrastructure, and strong reimbursement policies for diabetes management devices.

Key Drivers for Disposable Insulin Pens Dominance:

- Patient Convenience: Eliminates the need to manage separate cartridges, simplifying the injection process and reducing the risk of errors.

- Portability: Lightweight and pre-filled, making them ideal for on-the-go lifestyle and travel.

- Lower Barrier to Entry: Often perceived as more accessible for individuals new to insulin therapy.

- Reduced Cost of Ownership (for initial adoption): Eliminates the upfront cost of a reusable pen device.

The dominance of Disposable Insulin Pens is further bolstered by the increasing number of individuals diagnosed with diabetes across Europe, a significant portion of whom are seeking straightforward and reliable insulin delivery solutions. Investment trends in this segment are consistently strong, with manufacturers focusing on expanding production capacities and enhancing the quality and variety of disposable pen offerings. Regulatory support in countries like Germany has been instrumental, with favorable guidelines encouraging the uptake of advanced diabetes care products.

In terms of geographical leadership, Germany consistently ranks as a frontrunner in the Europe Insulin Pens Market. This is attributed to several factors:

- High Diabetes Prevalence: Germany has one of the highest rates of diabetes in Europe, creating a substantial patient base requiring insulin therapy.

- Advanced Healthcare System: A well-established healthcare system with a strong focus on chronic disease management ensures timely access to treatments and devices.

- Reimbursement Policies: Favorable reimbursement schemes for insulin pens and associated consumables encourage widespread adoption by both patients and healthcare providers.

- Patient Awareness and Education: High levels of patient awareness regarding diabetes management options and the benefits of insulin pens contribute to their demand.

- Technological Adoption: German consumers and healthcare professionals are generally receptive to adopting new technologies that improve healthcare outcomes.

Consequently, the demand for both disposable and cartridge-based insulin pens remains robust in Germany, with a continuous push towards even more innovative and connected devices to further enhance patient care and adherence.

Europe Insulin Pens Market Product Innovations

The Europe Insulin Pens Market is being continuously shaped by groundbreaking product innovations focused on enhancing user experience and therapeutic outcomes. Manufacturers are actively developing smart insulin pens that integrate Bluetooth connectivity, allowing for seamless data transfer to mobile applications. These devices offer features such as automated dose logging, injection timing reminders, and glucose level tracking, empowering patients with greater control and providing valuable insights to healthcare professionals. Furthermore, advancements in materials science and pen design are leading to pens with reduced injection force, minimizing patient discomfort and improving adherence. The pursuit of miniaturization and enhanced ergonomics ensures that insulin pens remain discreet and easy to use, further solidifying their position as the preferred insulin delivery method.

Propelling Factors for Europe Insulin Pens Market Growth

The Europe Insulin Pens Market is experiencing robust growth fueled by several interconnected factors. The escalating global prevalence of diabetes, exacerbated by lifestyle changes and an aging population, directly translates to a larger patient pool requiring consistent insulin therapy. Technological advancements are a significant growth engine, with the continuous development of user-friendly, precise, and increasingly "smart" insulin pens that offer enhanced convenience and data tracking capabilities. Regulatory bodies in Europe are also playing a crucial role by approving innovative devices and often implementing supportive reimbursement policies that encourage the adoption of advanced insulin delivery systems. Economic stability and rising healthcare expenditure across European nations ensure that patients have access to these essential medical devices, further propelling market expansion.

Obstacles in the Europe Insulin Pens Market Market

Despite the promising growth, the Europe Insulin Pens Market faces certain obstacles. Stringent regulatory approval processes, while ensuring safety and efficacy, can sometimes delay the market entry of innovative products, leading to increased development costs and timelines. Supply chain disruptions, as witnessed in recent global events, can impact the availability and affordability of essential components and finished products, potentially hindering market growth. Moreover, intense competition among established players and emerging innovators can lead to price pressures, impacting profit margins. The higher initial cost of some advanced insulin pens compared to traditional methods can also present a barrier for certain patient segments with limited financial resources, particularly in countries with less comprehensive reimbursement schemes.

Future Opportunities in Europe Insulin Pens Market

The Europe Insulin Pens Market is poised for significant future growth, driven by emerging opportunities. The increasing demand for connected and smart insulin pens presents a substantial avenue for innovation, with potential for greater integration with continuous glucose monitoring (CGM) systems and broader digital health ecosystems. Expanding into less penetrated markets within Europe, offering tailored solutions for specific patient demographics, also represents a key opportunity. Furthermore, advancements in drug delivery technology, such as longer-acting insulin formulations, could lead to new pen designs and functionalities, further enhancing patient convenience and treatment adherence. The growing focus on personalized medicine will also create opportunities for specialized insulin pen solutions catering to individual patient needs and genetic predispositions.

Major Players in the Europe Insulin Pens Market Ecosystem

- Wockhardt

- Eli Lilly

- Sanofi

- Medtronic

- Biocon

- Novo Nordisk

Key Developments in Europe Insulin Pens Market Industry

- August 2022: Lilly received CE (Conformité Européenne or European Conformity) marking certification for the Tempo Smart Button and plans to begin small-scale pilots in selected countries through partnerships with existing diabetes management ecosystems.

- June 2022: Cequr, the leader in wearable diabetes technology, released its newest and most innovative insulin delivery device yet, the Insulin Pen 2.0TM. The pen is small enough to be always worn on the user's body, and it also features a built-in blood glucose meter so that users can track their blood sugar throughout the day. The insulin pen also has an integrated injection system that doesn't require any manual pumping or priming to inject insulin into the body, making it much easier and faster to administer than other types of insulin pumps currently on the market.

Strategic Europe Insulin Pens Market Market Forecast

The Europe Insulin Pens Market is projected to witness sustained growth, driven by an aging population and the escalating incidence of diabetes. The continued innovation in smart insulin pens, offering enhanced connectivity and data management, will be a significant catalyst for market expansion. Favorable reimbursement policies in key European countries, coupled with increasing patient awareness of the benefits of user-friendly insulin delivery systems, will further bolster adoption rates. The market's future is characterized by a strategic focus on developing more personalized and integrated diabetes management solutions, creating substantial opportunities for manufacturers to enhance patient outcomes and capture market share.

Europe Insulin Pens Market Segmentation

-

1. Product

- 1.1. Disposable Insulin Pens

- 1.2. Cartridges in Reusable Pens

Europe Insulin Pens Market Segmentation By Geography

- 1. France

- 2. Germany

- 3. Italy

- 4. Rest of Europe

- 5. Russia

- 6. Spain

- 7. United Kingdom

Europe Insulin Pens Market Regional Market Share

Geographic Coverage of Europe Insulin Pens Market

Europe Insulin Pens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Increasing diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Disposable Insulin Pens

- 5.1.2. Cartridges in Reusable Pens

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.2.2. Germany

- 5.2.3. Italy

- 5.2.4. Rest of Europe

- 5.2.5. Russia

- 5.2.6. Spain

- 5.2.7. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. France Europe Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Disposable Insulin Pens

- 6.1.2. Cartridges in Reusable Pens

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Germany Europe Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Disposable Insulin Pens

- 7.1.2. Cartridges in Reusable Pens

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Italy Europe Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Disposable Insulin Pens

- 8.1.2. Cartridges in Reusable Pens

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of Europe Europe Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Disposable Insulin Pens

- 9.1.2. Cartridges in Reusable Pens

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Russia Europe Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Disposable Insulin Pens

- 10.1.2. Cartridges in Reusable Pens

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Spain Europe Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Disposable Insulin Pens

- 11.1.2. Cartridges in Reusable Pens

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. United Kingdom Europe Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product

- 12.1.1. Disposable Insulin Pens

- 12.1.2. Cartridges in Reusable Pens

- 12.1. Market Analysis, Insights and Forecast - by Product

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Wockhardt

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Eli Lilly

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sanofi

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Medtronic

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Biocon

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Novo Nordisk

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Eli Lill

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 Wockhardt

List of Figures

- Figure 1: Europe Insulin Pens Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Insulin Pens Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Insulin Pens Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Europe Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Europe Insulin Pens Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Insulin Pens Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Europe Insulin Pens Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: Europe Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 7: Europe Insulin Pens Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Europe Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Europe Insulin Pens Market Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Europe Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: Europe Insulin Pens Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Europe Insulin Pens Market Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Europe Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 15: Europe Insulin Pens Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Europe Insulin Pens Market Revenue billion Forecast, by Product 2020 & 2033

- Table 18: Europe Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 19: Europe Insulin Pens Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Europe Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Europe Insulin Pens Market Revenue billion Forecast, by Product 2020 & 2033

- Table 22: Europe Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 23: Europe Insulin Pens Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Insulin Pens Market Revenue billion Forecast, by Product 2020 & 2033

- Table 26: Europe Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 27: Europe Insulin Pens Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Europe Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: Europe Insulin Pens Market Revenue billion Forecast, by Product 2020 & 2033

- Table 30: Europe Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 31: Europe Insulin Pens Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Europe Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Insulin Pens Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Europe Insulin Pens Market?

Key companies in the market include Wockhardt, Eli Lilly, Sanofi, Medtronic, Biocon, Novo Nordisk, Eli Lill.

3. What are the main segments of the Europe Insulin Pens Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.6 billion as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Increasing diabetes prevalence.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

August 2022: Lilly received CE (Conformité Européenne or European Conformity) marking certification for the Tempo Smart Button and plans to begin small-scale pilots in selected countries through partnerships with existing diabetes management ecosystems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Insulin Pens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Insulin Pens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Insulin Pens Market?

To stay informed about further developments, trends, and reports in the Europe Insulin Pens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence