Key Insights

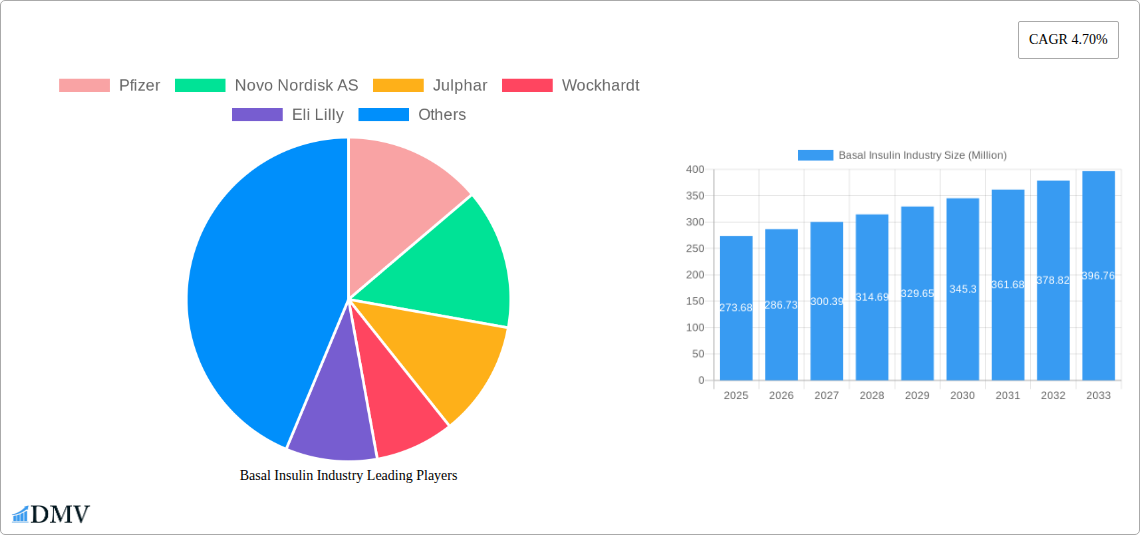

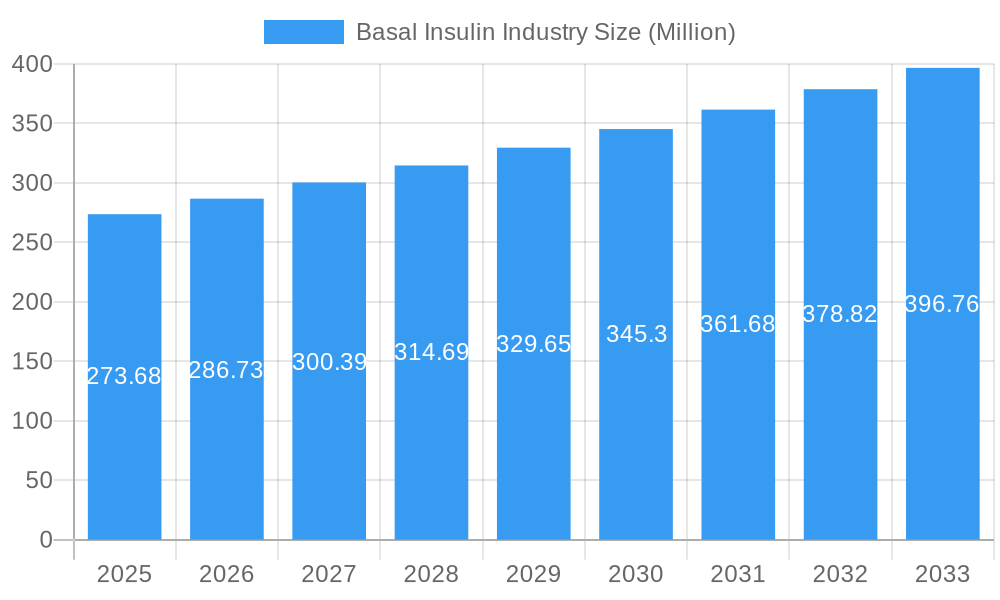

The global Basal Insulin market is poised for significant expansion, projected to reach an estimated $273.68 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.70% anticipated throughout the forecast period of 2025-2033. This growth is fundamentally driven by the escalating prevalence of diabetes, particularly Type 2 Diabetes, which is becoming a global health concern. An aging population worldwide also contributes to the increasing demand for long-acting insulin therapies, as older individuals are more susceptible to chronic conditions like diabetes. Furthermore, advancements in insulin formulations, leading to improved efficacy, safety profiles, and patient convenience, are key catalysts for market penetration. The development of biosimilar basal insulins, offering cost-effective alternatives to originator products, is also expected to broaden access and fuel market expansion, especially in emerging economies.

Basal Insulin Industry Market Size (In Million)

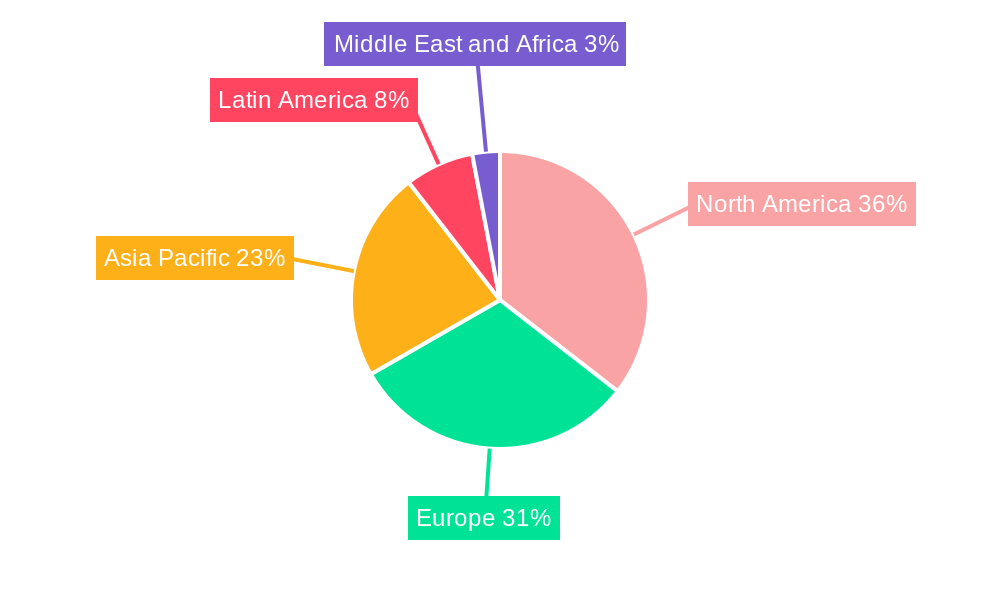

The market landscape is characterized by intense competition among established pharmaceutical giants and emerging biosimilar manufacturers. Key players like Novo Nordisk AS, Sanofi Aventis, and Eli Lilly are at the forefront, investing heavily in research and development to innovate and expand their product portfolios. The market is segmented into various products, including Lantus, Levemir, Toujeo, Tresiba, and Basaglar, catering to diverse patient needs and therapeutic preferences. The application of these basal insulins primarily spans Type 1 and Type 2 Diabetes management, highlighting the critical role they play in glycemic control. Geographically, North America and Europe currently hold substantial market shares due to advanced healthcare infrastructure and high diabetes incidence. However, the Asia Pacific region is expected to witness the fastest growth, driven by increasing healthcare expenditure, rising diabetes rates, and growing awareness. While market growth is promising, factors such as the high cost of some advanced insulin formulations and the potential for adverse events, though minimized by newer products, remain considerations for sustained expansion.

Basal Insulin Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global Basal Insulin Industry, providing critical insights for stakeholders navigating this dynamic market. With a study period spanning 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report delves into historical trends, current market composition, and future growth trajectories. Covering key products like Lantus, Levemir, Toujeo, Tresiba, and Basaglar, and applications in Type 1 Diabetes and Type 2 Diabetes management, this report is an indispensable resource for understanding market dynamics, competitive landscapes, and emerging opportunities in the basal insulin market.

Basal Insulin Industry Market Composition & Trends

The Basal Insulin Industry exhibits a moderately concentrated market structure, driven by significant innovation and a complex regulatory environment. Key players, including Pfizer, Novo Nordisk AS, Julphar, Wockhardt, Eli Lilly, Sanofi Aventis, and Biocon, hold substantial market share, with Novo Nordisk AS and Eli Lilly often leading in product development and commercialization. Innovation catalysts are primarily focused on developing longer-acting, more convenient, and cost-effective basal insulin formulations, alongside advancements in delivery devices and digital health integration for diabetes management. The regulatory landscape is characterized by stringent approval processes for new insulin products, emphasizing safety and efficacy. Substitute products, while not directly competing with basal insulin's core function, include other diabetes medications like GLP-1 receptor agonists and SGLT2 inhibitors, which are increasingly being used in combination therapies. End-user profiles span a broad spectrum, from children with Type 1 Diabetes to adults with Type 2 Diabetes, with varying needs for treatment efficacy, convenience, and affordability. Mergers and acquisitions (M&A) activities, while not as prevalent as in some other pharmaceutical sectors, do occur to consolidate market presence or acquire novel technologies. For instance, strategic acquisitions of smaller biotech firms with innovative insulin delivery systems can significantly impact market share distribution, which is estimated to see the top 5 players holding over 70% of the global basal insulin market by 2025. M&A deal values in this space, when they occur, can range from tens to hundreds of millions of dollars, depending on the strategic significance of the target company's intellectual property or market access.

Basal Insulin Industry Industry Evolution

The Basal Insulin Industry has witnessed a remarkable evolution, driven by persistent advancements in diabetes care and a growing global prevalence of diabetes. The historical period from 2019 to 2024 saw steady growth, fueled by increased diagnoses of both Type 1 and Type 2 Diabetes and the introduction of improved long-acting insulin analogues offering better glycemic control and reduced dosing frequency. This period was characterized by the growing adoption of products like insulin glargine and insulin detemir, with market penetration rates increasing by approximately 5-7% annually. Technological advancements played a pivotal role, with the development of pre-filled pens and pen needles enhancing patient convenience and adherence to treatment regimens. Consumer demand has shifted towards basal insulin formulations that minimize the risk of hypoglycemia, provide a flatter pharmacokinetic profile, and allow for greater flexibility in dosing. The market growth trajectory has been significantly influenced by global health initiatives and increased awareness surrounding diabetes management.

The base year of 2025 represents a crucial point, with established products solidifying their market positions and new innovations poised for further expansion. The forecast period from 2025 to 2033 is projected to witness accelerated growth, driven by the introduction of next-generation basal insulins, including ultra-long-acting formulations and biosimilars. We anticipate an average annual growth rate of 6-8% during this forecast period. Key drivers include the expanding aging population, increasing sedentary lifestyles contributing to higher diabetes rates, and a growing demand for personalized diabetes solutions. Furthermore, the integration of digital health technologies, such as connected insulin pens and diabetes management apps, will empower patients and healthcare providers with real-time data, leading to more effective treatment outcomes and increased adoption of advanced basal insulin therapies. The industry's evolution is also marked by a continuous push for cost-effectiveness, with the development of biosimilars playing a crucial role in expanding access to basal insulin treatments, particularly in emerging economies.

Leading Regions, Countries, or Segments in Basal Insulin Industry

The Basal Insulin Industry is experiencing robust growth across multiple regions, with North America and Europe consistently leading in market share due to high diabetes prevalence, advanced healthcare infrastructure, and significant R&D investments. However, the Asia-Pacific region is emerging as a rapidly growing market, driven by increasing healthcare expenditure, rising diabetes rates, and expanding access to insulin therapies.

Dominant Segments:

Products:

- Lantus (insulin glargine): Remains a cornerstone of basal insulin therapy, widely prescribed for its efficacy and established safety profile. Its market dominance is attributed to its long history of clinical use and broad physician familiarity.

- Levemir (insulin detemir): Another key player, offering a different pharmacokinetic profile that some patients find beneficial, particularly in managing nighttime glycemia.

- Toujeo (insulin glargine U300): A concentrated formulation of insulin glargine, providing a longer duration of action and potentially reduced injection site variability, appealing to patients requiring more consistent glycemic control.

- Tresiba (insulin degludec): Known for its ultra-long duration of action and flexible dosing, Tresiba has gained significant traction, offering enhanced convenience and reduced risk of hypoglycemia.

- Basaglar (biosimilar insulin glargine): The emergence and widespread adoption of biosimilars like Basaglar are revolutionizing market access, offering a more affordable alternative to branded insulin glargine and driving increased patient volumes, especially in cost-sensitive markets.

Application:

- Type 2 Diabetes: This segment represents the largest application for basal insulin due to the significantly higher prevalence of Type 2 Diabetes globally. The increasing incidence of obesity and lifestyle-related factors contribute to its sustained dominance.

- Type 1 Diabetes: While a smaller segment in terms of patient numbers, Type 1 Diabetes patients rely critically on basal insulin as a fundamental component of their lifelong treatment regimen. Innovations targeting improved basal insulin profiles are particularly impactful for this patient group.

Key Drivers of Dominance:

- Investment Trends: Significant investments in R&D by major pharmaceutical companies like Novo Nordisk, Eli Lilly, and Sanofi Aventis in developing novel basal insulin formulations and delivery systems directly correlate with market leadership.

- Regulatory Support: Favorable regulatory pathways and approvals for new and improved basal insulin products in developed markets accelerate market penetration and revenue generation.

- Healthcare Expenditure: Higher per capita healthcare spending in regions like North America and Europe allows for greater access to advanced basal insulin therapies and related medical devices.

- Diabetes Awareness and Diagnosis Rates: Increased public awareness campaigns and improved diagnostic capabilities lead to higher detection rates of diabetes, thereby expanding the patient pool requiring basal insulin treatment.

- Technological Advancements: The introduction of advanced delivery devices, such as smart pens and connected injection systems, enhances patient convenience and adherence, driving the uptake of specific basal insulin products.

- Presence of Key Manufacturers: Established manufacturing capabilities and robust supply chains of companies like Novo Nordisk AS and Eli Lilly in specific regions solidify their dominance.

The interplay of these factors ensures that regions and product segments with strong innovation pipelines, favorable reimbursement policies, and high disease burden continue to lead the Basal Insulin Industry.

Basal Insulin Industry Product Innovations

Product innovation in the Basal Insulin Industry is intensely focused on enhancing patient outcomes and convenience. Recent advancements include the development of ultra-long-acting basal insulins, such as insulin degludec (Tresiba), offering a duration of action exceeding 42 hours, which significantly improves glycemic control and reduces the burden of daily injections. Innovations in delivery devices are also paramount, with the introduction of smart insulin pens that track doses and connect to smartphone apps for better data management and adherence. Furthermore, the development of more concentrated formulations, like Toujeo, allows for smaller injection volumes, improving patient comfort. The performance metrics of these innovations are measured by improved HbA1c levels, reduced incidence of hypoglycemia, and enhanced patient-reported quality of life. Unique selling propositions often revolve around flexibility in dosing, predictable action profiles, and minimized pharmacokinetic variability.

Propelling Factors for Basal Insulin Industry Growth

Several key factors are propelling the growth of the Basal Insulin Industry.

- Rising Global Diabetes Prevalence: The escalating incidence of both Type 1 and Type 2 Diabetes worldwide, driven by aging populations, urbanization, and lifestyle changes, creates a continuously expanding patient pool requiring basal insulin therapy.

- Technological Advancements in Delivery Systems: Innovations like pre-filled pens, smart insulin pens, and continuous glucose monitoring (CGM) systems enhance patient convenience, adherence, and treatment efficacy, driving the adoption of advanced basal insulin products. For example, the integration of basal insulin delivery with CGM systems allows for more personalized and adaptive treatment adjustments.

- Development of Novel Insulin Formulations: Pharmaceutical companies are investing heavily in research and development to create longer-acting, more predictable, and safer basal insulins, such as ultra-long-acting analogues and biosimilars, which improve patient outcomes and market accessibility.

- Increasing Healthcare Expenditure and Access: Growing investments in healthcare infrastructure and expanding health insurance coverage, particularly in emerging economies, are improving access to essential diabetes medications, including basal insulins.

Obstacles in the Basal Insulin Industry Market

Despite robust growth, the Basal Insulin Industry faces several significant obstacles.

- High Cost of Insulin and Reimbursement Challenges: The substantial cost of branded basal insulins remains a major barrier for many patients and healthcare systems globally, leading to access issues and the need for more affordable alternatives like biosimilars. Reimbursement policies can also be complex and vary significantly by region, impacting market penetration.

- Regulatory Hurdles and Approval Timelines: The stringent regulatory approval process for new insulin products, requiring extensive clinical trials to demonstrate safety and efficacy, can lead to prolonged development timelines and significant investment.

- Competition from Biosimilars and Generic Alternatives: The increasing availability of biosimilar and generic basal insulins, while beneficial for affordability, intensifies price competition and can erode the market share of innovator products.

- Patient Adherence and Injection Site Issues: Despite advancements, some patients still struggle with consistent adherence to daily injections, and issues like lipohypertrophy can impact insulin absorption and treatment effectiveness.

Future Opportunities in Basal Insulin Industry

The Basal Insulin Industry is poised to capitalize on several emerging opportunities.

- Expansion in Emerging Markets: Significant growth potential exists in emerging economies in Asia, Africa, and Latin America, where diabetes rates are rising rapidly, and access to advanced diabetes care is improving.

- Advancements in Personalized Medicine: The integration of genomics, AI, and real-time glucose data will enable highly personalized basal insulin regimens tailored to individual patient needs, optimizing glycemic control and minimizing side effects.

- Development of Novel Insulin Delivery Technologies: Innovations in non-injectable insulin delivery methods, such as oral insulins or advanced transdermal patches, if proven effective and scalable, could revolutionize basal insulin administration.

- Combination Therapies and Device Integration: Further research into combination therapies that synergize basal insulin with other anti-diabetic medications, coupled with seamless integration of insulin delivery devices with continuous glucose monitoring systems and digital health platforms, will unlock new avenues for improved diabetes management.

Major Players in the Basal Insulin Industry Ecosystem

- Pfizer

- Novo Nordisk AS

- Julphar

- Wockhardt

- Eli Lilly

- Sanofi Aventis

- Biocon

Key Developments in Basal Insulin Industry Industry

- March 2023: Novo Nordisk announced that the company will drop prices for vials and pens of NovoLog and other insulin brands by 75 percent beginning January 1, 2024, in the United States. The price for some other Novo Nordisk insulin brands will be lowered by 65 percent.

- October 2022: Novo Nordisk announced headline results from the ONWARDS 5 phase 3a trial with once-weekly insulin icodec in people with type 2 diabetes. The ONWARDS 5 trial was a 52-week, open-label efficacy and safety treat-to-target trial investigating once-weekly insulin versus once-daily basal insulin (insulin degludec or insulin glargine U100/U300).

Strategic Basal Insulin Industry Market Forecast

The Basal Insulin Industry is projected for sustained and robust growth through 2033, driven by a confluence of factors. The increasing global prevalence of diabetes, coupled with advancements in therapeutic innovation, will continue to fuel demand. The forecast period anticipates significant market expansion, underpinned by the introduction of ultra-long-acting basal insulins offering unparalleled convenience and improved glycemic control. Furthermore, the growing emphasis on personalized medicine, integrated with digital health technologies and continuous glucose monitoring, will unlock new opportunities for optimized treatment strategies. The increasing affordability and accessibility of biosimilar insulins are also expected to broaden market reach, particularly in emerging economies. Strategic investments in R&D for novel delivery systems and combination therapies will further solidify the market's trajectory, presenting a promising outlook for stakeholders in the basal insulin market.

Basal Insulin Industry Segmentation

-

1. Products

- 1.1. Lantus

- 1.2. Levemir

- 1.3. Toujeo

- 1.4. Tresiba

- 1.5. Basaglar

-

2. Application

- 2.1. Type 1 Diabetes

- 2.2. Type 2 Diabetes

Basal Insulin Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. Spain

- 2.3. Italy

- 2.4. France

- 2.5. United Kingdom

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. Japan

- 3.2. China

- 3.3. Australia

- 3.4. India

- 3.5. South Korea

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. Thailand

- 3.9. Philippines

- 3.10. Vietnam

- 3.11. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Oman

- 5.4. Egypt

- 5.5. Iran

- 5.6. Rest of Middle East and Africa

Basal Insulin Industry Regional Market Share

Geographic Coverage of Basal Insulin Industry

Basal Insulin Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Increasing diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Basal Insulin Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Lantus

- 5.1.2. Levemir

- 5.1.3. Toujeo

- 5.1.4. Tresiba

- 5.1.5. Basaglar

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Type 1 Diabetes

- 5.2.2. Type 2 Diabetes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. North America Basal Insulin Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Products

- 6.1.1. Lantus

- 6.1.2. Levemir

- 6.1.3. Toujeo

- 6.1.4. Tresiba

- 6.1.5. Basaglar

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Type 1 Diabetes

- 6.2.2. Type 2 Diabetes

- 6.1. Market Analysis, Insights and Forecast - by Products

- 7. Europe Basal Insulin Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Products

- 7.1.1. Lantus

- 7.1.2. Levemir

- 7.1.3. Toujeo

- 7.1.4. Tresiba

- 7.1.5. Basaglar

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Type 1 Diabetes

- 7.2.2. Type 2 Diabetes

- 7.1. Market Analysis, Insights and Forecast - by Products

- 8. Asia Pacific Basal Insulin Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Products

- 8.1.1. Lantus

- 8.1.2. Levemir

- 8.1.3. Toujeo

- 8.1.4. Tresiba

- 8.1.5. Basaglar

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Type 1 Diabetes

- 8.2.2. Type 2 Diabetes

- 8.1. Market Analysis, Insights and Forecast - by Products

- 9. Latin America Basal Insulin Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Products

- 9.1.1. Lantus

- 9.1.2. Levemir

- 9.1.3. Toujeo

- 9.1.4. Tresiba

- 9.1.5. Basaglar

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Type 1 Diabetes

- 9.2.2. Type 2 Diabetes

- 9.1. Market Analysis, Insights and Forecast - by Products

- 10. Middle East and Africa Basal Insulin Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Products

- 10.1.1. Lantus

- 10.1.2. Levemir

- 10.1.3. Toujeo

- 10.1.4. Tresiba

- 10.1.5. Basaglar

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Type 1 Diabetes

- 10.2.2. Type 2 Diabetes

- 10.1. Market Analysis, Insights and Forecast - by Products

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pfizer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Novo Nordisk AS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Julphar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wockhardt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eli Lilly

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sanofi Aventis

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Biocon

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eli Lill

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Pfizer

List of Figures

- Figure 1: Global Basal Insulin Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Basal Insulin Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Basal Insulin Industry Revenue (Million), by Products 2025 & 2033

- Figure 4: North America Basal Insulin Industry Volume (K Unit), by Products 2025 & 2033

- Figure 5: North America Basal Insulin Industry Revenue Share (%), by Products 2025 & 2033

- Figure 6: North America Basal Insulin Industry Volume Share (%), by Products 2025 & 2033

- Figure 7: North America Basal Insulin Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Basal Insulin Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Basal Insulin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Basal Insulin Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Basal Insulin Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Basal Insulin Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Basal Insulin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Basal Insulin Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Basal Insulin Industry Revenue (Million), by Products 2025 & 2033

- Figure 16: Europe Basal Insulin Industry Volume (K Unit), by Products 2025 & 2033

- Figure 17: Europe Basal Insulin Industry Revenue Share (%), by Products 2025 & 2033

- Figure 18: Europe Basal Insulin Industry Volume Share (%), by Products 2025 & 2033

- Figure 19: Europe Basal Insulin Industry Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe Basal Insulin Industry Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Basal Insulin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Basal Insulin Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Basal Insulin Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Basal Insulin Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Basal Insulin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Basal Insulin Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Basal Insulin Industry Revenue (Million), by Products 2025 & 2033

- Figure 28: Asia Pacific Basal Insulin Industry Volume (K Unit), by Products 2025 & 2033

- Figure 29: Asia Pacific Basal Insulin Industry Revenue Share (%), by Products 2025 & 2033

- Figure 30: Asia Pacific Basal Insulin Industry Volume Share (%), by Products 2025 & 2033

- Figure 31: Asia Pacific Basal Insulin Industry Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Pacific Basal Insulin Industry Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Basal Insulin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Basal Insulin Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Basal Insulin Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Basal Insulin Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Basal Insulin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Basal Insulin Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Basal Insulin Industry Revenue (Million), by Products 2025 & 2033

- Figure 40: Latin America Basal Insulin Industry Volume (K Unit), by Products 2025 & 2033

- Figure 41: Latin America Basal Insulin Industry Revenue Share (%), by Products 2025 & 2033

- Figure 42: Latin America Basal Insulin Industry Volume Share (%), by Products 2025 & 2033

- Figure 43: Latin America Basal Insulin Industry Revenue (Million), by Application 2025 & 2033

- Figure 44: Latin America Basal Insulin Industry Volume (K Unit), by Application 2025 & 2033

- Figure 45: Latin America Basal Insulin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Latin America Basal Insulin Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Latin America Basal Insulin Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Basal Insulin Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Latin America Basal Insulin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Basal Insulin Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Basal Insulin Industry Revenue (Million), by Products 2025 & 2033

- Figure 52: Middle East and Africa Basal Insulin Industry Volume (K Unit), by Products 2025 & 2033

- Figure 53: Middle East and Africa Basal Insulin Industry Revenue Share (%), by Products 2025 & 2033

- Figure 54: Middle East and Africa Basal Insulin Industry Volume Share (%), by Products 2025 & 2033

- Figure 55: Middle East and Africa Basal Insulin Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Basal Insulin Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: Middle East and Africa Basal Insulin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Basal Insulin Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Basal Insulin Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Basal Insulin Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East and Africa Basal Insulin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Basal Insulin Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Basal Insulin Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 2: Global Basal Insulin Industry Volume K Unit Forecast, by Products 2020 & 2033

- Table 3: Global Basal Insulin Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Basal Insulin Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Basal Insulin Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Basal Insulin Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Basal Insulin Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 8: Global Basal Insulin Industry Volume K Unit Forecast, by Products 2020 & 2033

- Table 9: Global Basal Insulin Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Basal Insulin Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Basal Insulin Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Rest of North America Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of North America Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Basal Insulin Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 20: Global Basal Insulin Industry Volume K Unit Forecast, by Products 2020 & 2033

- Table 21: Global Basal Insulin Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Basal Insulin Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Basal Insulin Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Spain Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Spain Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Italy Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: France Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: France Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Russia Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Rest of Europe Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Europe Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Global Basal Insulin Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 40: Global Basal Insulin Industry Volume K Unit Forecast, by Products 2020 & 2033

- Table 41: Global Basal Insulin Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 42: Global Basal Insulin Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 43: Global Basal Insulin Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: Japan Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: China Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: China Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Australia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: India Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: India Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: South Korea Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: South Korea Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Malaysia Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Malaysia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Indonesia Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Indonesia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Thailand Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Thailand Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Philippines Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Philippines Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Vietnam Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Vietnam Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Asia Pacific Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Asia Pacific Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Basal Insulin Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 68: Global Basal Insulin Industry Volume K Unit Forecast, by Products 2020 & 2033

- Table 69: Global Basal Insulin Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 70: Global Basal Insulin Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 71: Global Basal Insulin Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Mexico Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Mexico Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of Latin America Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of Latin America Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: Global Basal Insulin Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 80: Global Basal Insulin Industry Volume K Unit Forecast, by Products 2020 & 2033

- Table 81: Global Basal Insulin Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 82: Global Basal Insulin Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 83: Global Basal Insulin Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: South Africa Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Africa Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Saudi Arabia Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Saudi Arabia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Oman Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oman Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 91: Egypt Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Egypt Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: Iran Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: Iran Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 95: Rest of Middle East and Africa Basal Insulin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Rest of Middle East and Africa Basal Insulin Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Basal Insulin Industry?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Basal Insulin Industry?

Key companies in the market include Pfizer, Novo Nordisk AS, Julphar, Wockhardt, Eli Lilly, Sanofi Aventis, Biocon, Eli Lill.

3. What are the main segments of the Basal Insulin Industry?

The market segments include Products, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 273.68 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Increasing diabetes prevalence.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

March 2023: Novo Nordisk announced that the company will drop prices for vials and pens of NovoLog and other insulin brands by 75 percent beginning January 1, 2024, in the United States. The price for some other Novo Nordisk insulin brands will be lowered by 65 percent.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Basal Insulin Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Basal Insulin Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Basal Insulin Industry?

To stay informed about further developments, trends, and reports in the Basal Insulin Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence