Key Insights

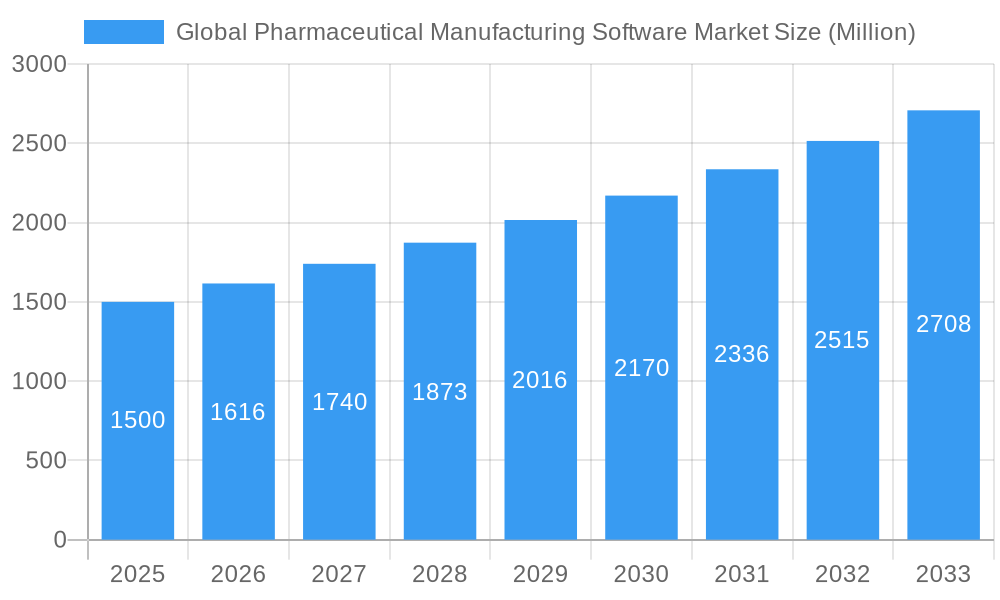

The Global Pharmaceutical Manufacturing Software Market is poised for substantial expansion, projected to reach a significant market size by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 7.70%. This growth is fueled by the increasing need for enhanced efficiency, stringent regulatory compliance, and the imperative to maintain product quality in the highly regulated pharmaceutical industry. The market is witnessing a clear shift towards on-cloud solutions, reflecting a broader industry trend of digitalization and the adoption of Software-as-a-Service (SaaS) models, offering scalability, flexibility, and cost-effectiveness. Concurrently, on-premise solutions continue to hold a steady position, particularly for large enterprises with specific security and integration requirements. The demand for advanced manufacturing software is paramount across all enterprise sizes, with both large corporations and Small and Medium-sized Enterprises (SMEs) recognizing its critical role in optimizing production processes, managing supply chains, and ensuring data integrity. This widespread adoption underscores the software's capacity to streamline operations, reduce errors, and ultimately accelerate the drug development and manufacturing lifecycle.

Global Pharmaceutical Manufacturing Software Market Market Size (In Billion)

Key trends shaping this dynamic market include the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, process optimization, and quality control, alongside the growing emphasis on serialization and track-and-trace capabilities to combat counterfeiting and ensure supply chain transparency. The rise of the Internet of Things (IoT) in manufacturing environments is also playing a crucial role, enabling real-time data collection and remote monitoring. However, the market faces certain restraints, such as the high initial investment costs associated with implementing sophisticated software systems and the potential complexity of integrating new solutions with existing legacy infrastructure. Cybersecurity concerns and the need for continuous training and upskilling of the workforce to adapt to evolving technologies also present challenges. Despite these hurdles, the overarching benefits of improved operational efficiency, enhanced compliance, and superior product quality are expected to propel the Global Pharmaceutical Manufacturing Software Market to new heights, with North America and Europe currently leading adoption, and the Asia Pacific region showing promising growth potential.

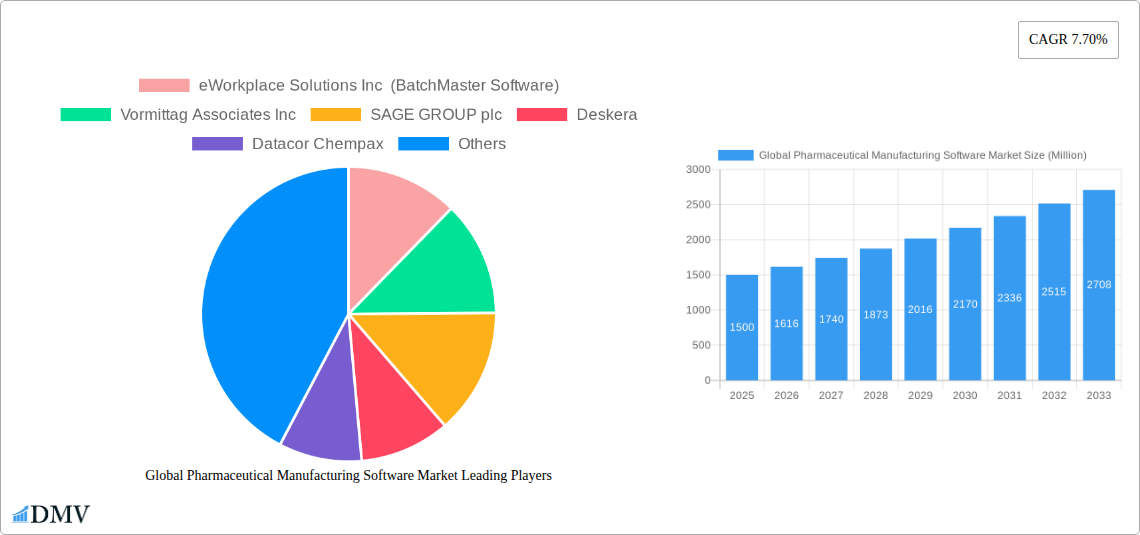

Global Pharmaceutical Manufacturing Software Market Company Market Share

Unlock critical insights into the evolving global pharmaceutical manufacturing software market with this in-depth report. Analyzing the period from 2019 to 2033, with a base year of 2025, this comprehensive study provides a deep dive into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Essential for pharmaceutical manufacturers, biotech companies, software providers, and investment firms, this report offers actionable intelligence on market trends, technological advancements, and competitive landscapes. Discover how On-Cloud and On-Premise solutions are shaping the industry, and understand the impact on Large Enterprises and Small and Medium-Sized Enterprises (SMEs).

Global Pharmaceutical Manufacturing Software Market Market Composition & Trends

The pharmaceutical manufacturing software market exhibits a dynamic composition characterized by increasing consolidation and strategic alliances aimed at enhancing operational efficiency and regulatory compliance. Market concentration is influenced by the presence of established players offering comprehensive suites of solutions, alongside agile innovators focusing on niche segments like AI-driven analytics and IoT integration for smart manufacturing. Key innovation catalysts include the relentless pursuit of Industry 4.0 adoption, the demand for electronic batch records (EBR), and the need for robust manufacturing execution systems (MES) and enterprise resource planning (ERP) solutions. The regulatory landscape, particularly stringent requirements from bodies like the FDA and EMA, significantly shapes software development and adoption, driving demand for GxP-compliant software. Substitute products are emerging in the form of more generalized manufacturing software adapted for pharma, but dedicated solutions maintain a competitive edge due to specialized functionalities. End-user profiles range from large, multinational pharmaceutical giants requiring scalable, integrated platforms to smaller biotech startups prioritizing cost-effective, cloud-based solutions. Mergers & Acquisitions (M&A) activities are on the rise, with deal values ranging from tens of millions to hundreds of millions of dollars, as larger entities acquire innovative startups to expand their product portfolios and market reach. For instance, the increasing M&A activity in the past year indicates a market valuation for key players and potential acquisition targets in the range of approximately $200 Million to $500 Million.

- Market Share Distribution: Dominated by a mix of large ERP vendors and specialized MES/QMS providers.

- M&A Deal Values: Averaging between $50 Million and $300 Million for significant acquisitions.

- Regulatory Impact: GxP compliance and data integrity are paramount, driving demand for validated software solutions.

- Technological Adoption: High adoption rates for cloud-based solutions and AI-powered analytics are observed.

Global Pharmaceutical Manufacturing Software Market Industry Evolution

The global pharmaceutical manufacturing software market has witnessed a significant evolution driven by technological advancements, increasing regulatory pressures, and a growing emphasis on operational efficiency and patient safety. From the foundational MES (Manufacturing Execution Systems) and ERP (Enterprise Resource Planning) solutions that digitized core manufacturing processes, the market has rapidly advanced towards more integrated and intelligent platforms. The historical period (2019-2024) saw a steady growth in the adoption of digital technologies, spurred by the need for better traceability, reduced errors, and improved compliance with evolving Good Manufacturing Practices (GMP). This era was characterized by the increasing demand for cloud-based pharmaceutical software due to its scalability, cost-effectiveness, and accessibility, particularly for SMEs.

The base year of 2025 marks a pivotal point, with the market poised for accelerated growth fueled by the widespread embrace of Industry 4.0 principles. This includes the integration of Internet of Things (IoT) devices for real-time data collection, Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and process optimization, and advanced data analytics for enhanced decision-making. The shift towards digital transformation is not merely about adopting new software; it's about fundamentally rethinking manufacturing processes to achieve greater agility, resilience, and speed in bringing life-saving drugs to market.

Consumer demands have also played a crucial role, with an increasing focus on personalized medicine, biologics, and complex therapeutics requiring highly flexible and adaptable manufacturing processes. This has driven the need for pharmaceutical quality management systems (QMS) that can seamlessly integrate with manufacturing operations, ensuring that every step adheres to the highest standards of quality and compliance. The growth trajectory of the market is projected to remain robust throughout the forecast period (2025–2033), with an estimated Compound Annual Growth Rate (CAGR) of approximately 12-15%. This growth is underpinned by continuous innovation in areas such as digital batch records, laboratory information management systems (LIMS), and supply chain visibility software. The increasing investment in R&D by pharmaceutical companies, coupled with government initiatives to promote advanced manufacturing, further solidifies the upward trend. Adoption metrics indicate that over 70% of large pharmaceutical enterprises are currently implementing or planning to implement integrated digital manufacturing solutions by 2026, with SMEs showing a comparable, albeit phased, adoption rate.

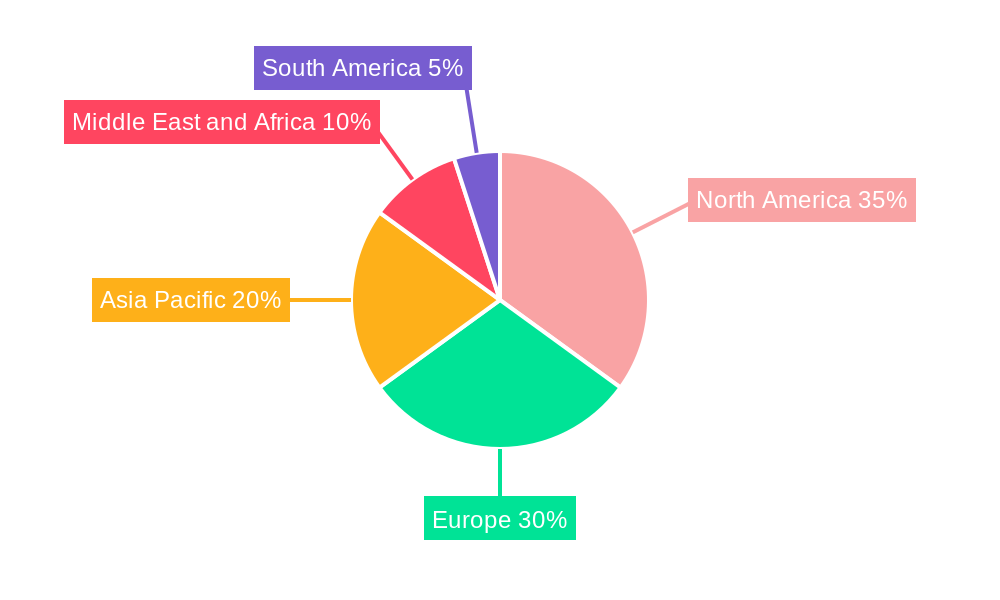

Leading Regions, Countries, or Segments in Global Pharmaceutical Manufacturing Software Market

The global pharmaceutical manufacturing software market is experiencing significant regional and segmental dominance, with North America and Europe leading the charge. These regions benefit from a well-established pharmaceutical industry, strong regulatory frameworks, and substantial investments in research and development. In North America, the United States, with its robust life sciences sector and proactive adoption of advanced technologies, stands out. Regulatory bodies like the FDA have been instrumental in driving the adoption of compliant software solutions, fostering a market ripe for e-batch records, quality management systems (QMS), and manufacturing execution systems (MES). The presence of numerous R&D-intensive pharmaceutical and biotechnology companies fuels the demand for sophisticated ERP solutions tailored for complex manufacturing processes.

Europe, driven by countries such as Germany, the UK, and Switzerland, also represents a highly influential market. The European Medicines Agency (EMA) and national regulatory bodies enforce stringent quality and safety standards, pushing manufacturers towards digital solutions that ensure compliance and data integrity. The region's strong pharmaceutical manufacturing base and its commitment to digitalization and Industry 4.0 further solidify its leadership position.

Segment-wise, the On-Cloud deployment model is rapidly gaining traction, projected to capture a significant share of the market by 2030. This growth is attributed to the scalability, flexibility, and cost-effectiveness of cloud solutions, making them attractive for both Large Enterprises and Small and Medium-Sized Enterprises (SMEs). While On-Premise solutions continue to be preferred by some larger organizations with specific data security concerns or existing infrastructure, the trend is clearly shifting towards cloud-based architectures.

Among enterprise types, Large Enterprises currently represent the largest market share due to their extensive manufacturing operations and higher budgets for sophisticated software investments. However, the growth rate for SMEs is notably higher. As cloud solutions become more accessible and affordable, SMEs are increasingly adopting these technologies to enhance their competitiveness, improve compliance, and streamline their operations. The demand for modular and scalable software that can grow with their business is a key driver for this segment. The investment trends in these leading regions and segments are characterized by substantial R&D spending and strategic partnerships, estimated to be in the range of $5 Billion to $7 Billion annually.

- North America: Driven by the US, strong regulatory support, and high R&D investment.

- Europe: Led by Germany, UK, and Switzerland, with stringent regulations and commitment to digitalization.

- Product Segment - On-Cloud: Experiencing rapid adoption due to scalability and cost-effectiveness.

- Enterprise Segment - Large Enterprises: Currently the largest market share, with significant investment in integrated solutions.

- Enterprise Segment - SMEs: Showing the highest growth rate due to increasing accessibility of cloud solutions.

Global Pharmaceutical Manufacturing Software Market Product Innovations

Product innovations in the pharmaceutical manufacturing software market are centered on enhancing efficiency, ensuring compliance, and enabling advanced data analytics. Key advancements include the development of AI-powered predictive maintenance modules for manufacturing equipment, reducing downtime and optimizing resource allocation. Furthermore, the evolution of digital batch records (DBR) is transforming traditional paper-based processes, offering real-time data capture, automated workflows, and enhanced data integrity. Innovative Quality Management Systems (QMS) now seamlessly integrate with manufacturing execution systems (MES), providing end-to-end visibility and control over quality processes. The development of modular, cloud-based solutions that can be easily scaled and integrated with existing enterprise systems is also a significant trend, catering to the diverse needs of pharmaceutical companies, from large enterprises to SMEs. These innovations are driven by the need for greater agility, reduced operational costs, and a faster time-to-market for life-saving therapies.

Propelling Factors for Global Pharmaceutical Manufacturing Software Market Growth

The global pharmaceutical manufacturing software market is propelled by a confluence of factors driving significant growth. The increasing stringency of regulatory requirements worldwide, such as FDA's 21 CFR Part 11 and EMA's Annex 11, mandates advanced data integrity and traceability, directly boosting demand for compliant software. The relentless pursuit of operational efficiency and cost reduction within pharmaceutical companies compels them to adopt advanced MES (Manufacturing Execution Systems) and ERP (Enterprise Resource Planning) solutions. Furthermore, the escalating complexity of drug development, including personalized medicine and biologics, necessitates agile and flexible manufacturing processes, achievable only through sophisticated software. The growing adoption of Industry 4.0 technologies, including AI, IoT, and Big Data analytics, is transforming manufacturing operations, leading to smarter, more connected facilities. Lastly, the expanding global pharmaceutical market, particularly in emerging economies, creates new opportunities for software providers. The market is projected to reach approximately $15 Billion by 2030.

Obstacles in the Global Pharmaceutical Manufacturing Software Market Market

Despite the robust growth, the global pharmaceutical manufacturing software market faces several obstacles. The high cost of implementation and validation for GxP-compliant software can be a significant barrier, especially for Small and Medium-Sized Enterprises (SMEs). The complex and ever-evolving regulatory landscape requires continuous updates and adherence, adding to the operational burden. Resistance to change and the need for extensive employee training to adopt new digital workflows can slow down implementation. Cybersecurity threats and concerns regarding data privacy and integrity in cloud-based solutions remain a critical challenge, demanding robust security measures. Furthermore, the integration of disparate legacy systems with new software solutions can be technically challenging and time-consuming.

Future Opportunities in Global Pharmaceutical Manufacturing Software Market

The global pharmaceutical manufacturing software market is ripe with future opportunities. The accelerating trend towards digital twins offers immense potential for virtual simulation and optimization of manufacturing processes before physical implementation, saving considerable time and cost. The burgeoning field of personalized medicine requires highly flexible and configurable manufacturing software capable of handling diverse batch sizes and complex formulations. The increasing adoption of AI and Machine Learning for predictive analytics, quality control, and supply chain optimization presents a significant growth avenue. Expansion into emerging markets with rapidly growing pharmaceutical sectors also offers substantial untapped potential. Furthermore, the demand for integrated solutions that bridge the gap between R&D, manufacturing, and supply chain management will continue to drive innovation and market growth. The market is expected to witness an approximate growth of $25 Billion by 2033.

Major Players in the Global Pharmaceutical Manufacturing Software Market Ecosystem

- eWorkplace Solutions Inc (BatchMaster Software)

- Vormittag Associates Inc

- SAGE GROUP plc

- Deskera

- Datacor Chempax

- Logic ERP Solutions Pvt Ltd

- MasterControl Inc

- Intellect

- Aquilon Software

- Fishbowl

- Oracle

- ABB

Key Developments in Global Pharmaceutical Manufacturing Software Market Industry

- March 2022: Aizon and Aggity established a partnership to accelerate digital transformation within manufacturing operations at the world's biggest pharmaceutical and biotech companies, focusing on enterprise AI software.

- March 2022: Triastek, Inc. and Siemens Ltd., China, agreed to collaborate on digital technologies for the worldwide pharmaceutical business, leveraging Triastek's 3D printing and digital pharmaceutical technologies with Siemens' automation and digitalization expertise.

Strategic Global Pharmaceutical Manufacturing Software Market Market Forecast

The global pharmaceutical manufacturing software market is set for robust expansion, driven by technological advancements and the imperative for enhanced efficiency and compliance. The forecast period (2025–2033) will witness a significant surge in the adoption of AI-driven analytics, IoT integration for smart manufacturing, and cloud-based platforms offering unparalleled scalability. Emerging trends such as digital twins and the software's role in enabling personalized medicine will create new avenues for growth. The increasing focus on data integrity and regulatory adherence, coupled with the expanding global pharmaceutical industry, will continue to fuel demand for advanced MES, ERP, and QMS solutions, positioning the market for sustained, high-value growth, with an estimated market size of $22 Billion in 2028.

Global Pharmaceutical Manufacturing Software Market Segmentation

-

1. Product

- 1.1. On-Cloud

- 1.2. On-Premise

-

2. Enterprise

- 2.1. Large Enterprises

- 2.2. Small and Medium-Sized Enterprises (SMEs)

Global Pharmaceutical Manufacturing Software Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Pharmaceutical Manufacturing Software Market Regional Market Share

Geographic Coverage of Global Pharmaceutical Manufacturing Software Market

Global Pharmaceutical Manufacturing Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Adoption of Pharmaceutical Manufacturing Software by Pharmaceutical Companies; Increasing Cost of Drugs Manufacturing

- 3.3. Market Restrains

- 3.3.1. High Cost of Pharamceutical Manufacturing Software; Security Concerns Pertaining to On-Cloud Deployment

- 3.4. Market Trends

- 3.4.1. On-Cloud Software is Expected to Hold a Significant Share in the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. On-Cloud

- 5.1.2. On-Premise

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Large Enterprises

- 5.2.2. Small and Medium-Sized Enterprises (SMEs)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. On-Cloud

- 6.1.2. On-Premise

- 6.2. Market Analysis, Insights and Forecast - by Enterprise

- 6.2.1. Large Enterprises

- 6.2.2. Small and Medium-Sized Enterprises (SMEs)

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. On-Cloud

- 7.1.2. On-Premise

- 7.2. Market Analysis, Insights and Forecast - by Enterprise

- 7.2.1. Large Enterprises

- 7.2.2. Small and Medium-Sized Enterprises (SMEs)

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. On-Cloud

- 8.1.2. On-Premise

- 8.2. Market Analysis, Insights and Forecast - by Enterprise

- 8.2.1. Large Enterprises

- 8.2.2. Small and Medium-Sized Enterprises (SMEs)

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. On-Cloud

- 9.1.2. On-Premise

- 9.2. Market Analysis, Insights and Forecast - by Enterprise

- 9.2.1. Large Enterprises

- 9.2.2. Small and Medium-Sized Enterprises (SMEs)

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. On-Cloud

- 10.1.2. On-Premise

- 10.2. Market Analysis, Insights and Forecast - by Enterprise

- 10.2.1. Large Enterprises

- 10.2.2. Small and Medium-Sized Enterprises (SMEs)

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 eWorkplace Solutions Inc (BatchMaster Software)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vormittag Associates Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SAGE GROUP plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Deskera

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Datacor Chempax

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Logic ERP Solutions Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MasterControl Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Intellect

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aquilon Software

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fishbowl

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Oracle

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ABB

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 eWorkplace Solutions Inc (BatchMaster Software)

List of Figures

- Figure 1: Global Global Pharmaceutical Manufacturing Software Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 3: North America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 5: North America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 6: North America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 9: Europe Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 11: Europe Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 12: Europe Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 15: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 17: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 18: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 21: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 23: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 24: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 27: South America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: South America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 29: South America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 30: South America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 3: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 6: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 11: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 12: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 20: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 21: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 29: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 30: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 35: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 36: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Pharmaceutical Manufacturing Software Market?

The projected CAGR is approximately 10.1%.

2. Which companies are prominent players in the Global Pharmaceutical Manufacturing Software Market?

Key companies in the market include eWorkplace Solutions Inc (BatchMaster Software), Vormittag Associates Inc, SAGE GROUP plc, Deskera, Datacor Chempax, Logic ERP Solutions Pvt Ltd, MasterControl Inc, Intellect, Aquilon Software, Fishbowl, Oracle, ABB.

3. What are the main segments of the Global Pharmaceutical Manufacturing Software Market?

The market segments include Product, Enterprise.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Adoption of Pharmaceutical Manufacturing Software by Pharmaceutical Companies; Increasing Cost of Drugs Manufacturing.

6. What are the notable trends driving market growth?

On-Cloud Software is Expected to Hold a Significant Share in the Market Studied.

7. Are there any restraints impacting market growth?

High Cost of Pharamceutical Manufacturing Software; Security Concerns Pertaining to On-Cloud Deployment.

8. Can you provide examples of recent developments in the market?

In March 2022, Aizon, a developer of enterprise AI software, and Aggity, a Spanish firm focused on business digital transformation, established a partnership to accelerate digital transformation within manufacturing operations at the world's biggest pharmaceutical and biotech companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Pharmaceutical Manufacturing Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Pharmaceutical Manufacturing Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Pharmaceutical Manufacturing Software Market?

To stay informed about further developments, trends, and reports in the Global Pharmaceutical Manufacturing Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence