Key Insights

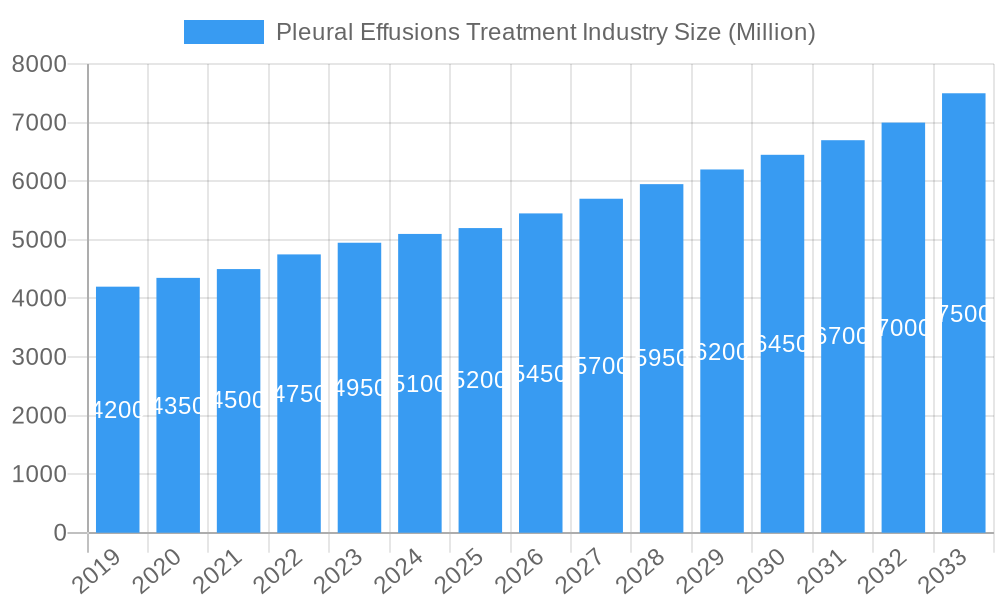

The global Pleural Effusions Treatment market is poised for significant growth, projected to reach an estimated USD 5,200 million in 2025. With a Compound Annual Growth Rate (CAGR) of 4.70%, the market is expected to expand steadily to approximately USD 7,500 million by 2033. This upward trajectory is primarily driven by the increasing prevalence of underlying conditions leading to pleural effusions, such as heart failure, pneumonia, and cancer. Advancements in diagnostic tools and therapeutic interventions, including minimally invasive procedures and targeted drug therapies, are further propelling market expansion. The growing awareness among healthcare professionals and patients regarding early diagnosis and effective management of pleural effusions is also a key contributor to this positive market outlook.

Pleural Effusions Treatment Industry Market Size (In Billion)

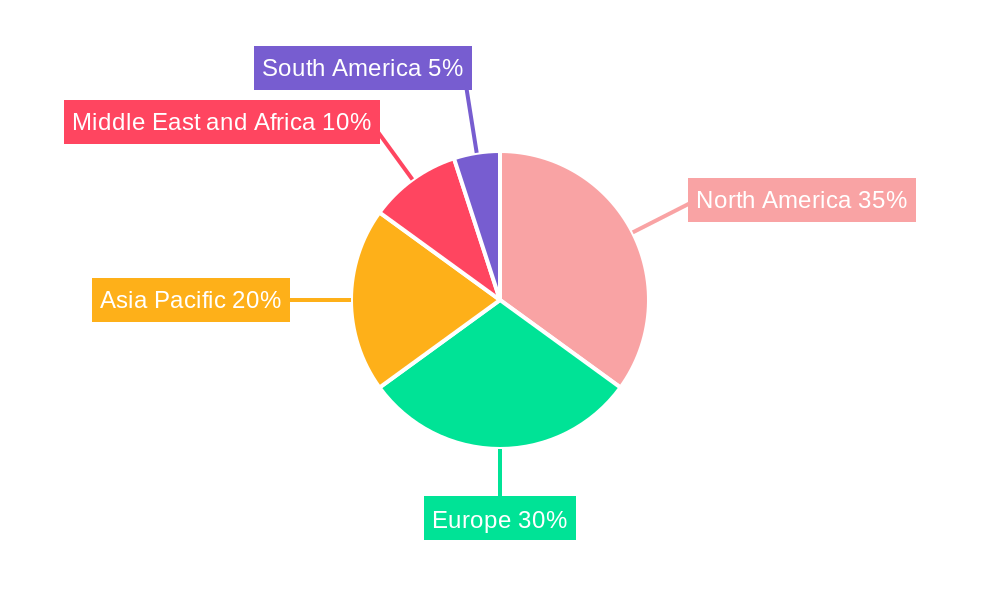

The market is segmented based on disease type, with Exudative effusions constituting a larger share due to their association with more complex underlying pathologies like malignancies and infections, demanding more intricate treatment approaches. Transudative effusions, often linked to systemic diseases like heart failure and kidney disease, also represent a substantial segment. In terms of end-users, Hospitals are the dominant segment, owing to their comprehensive infrastructure, specialized equipment, and the concentration of critical care patients requiring pleural effusion management. Ambulatory clinics are also witnessing steady growth as outpatient procedures and diagnostics become more prevalent. The market is characterized by a competitive landscape with established players and emerging innovators, focusing on developing advanced medical devices, diagnostic solutions, and novel therapeutic agents to address unmet clinical needs. Key regions like North America and Europe are leading the market, driven by robust healthcare systems and high healthcare expenditure, while the Asia Pacific region shows immense growth potential due to increasing healthcare investments and a rising burden of chronic diseases.

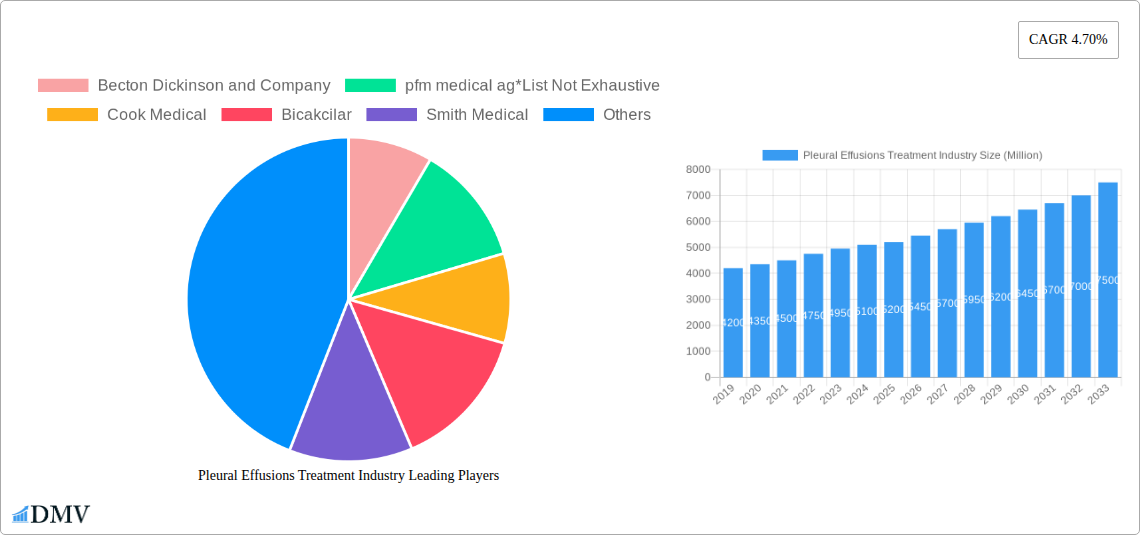

Pleural Effusions Treatment Industry Company Market Share

Pleural Effusions Treatment Industry Market Analysis: A Comprehensive Report (2019–2033)

This in-depth report provides an unparalleled analysis of the global Pleural Effusions Treatment Industry, offering critical insights for stakeholders seeking to understand market dynamics, capitalize on emerging trends, and navigate future opportunities. Covering the historical period from 2019 to 2024 and projecting growth through 2033, this study offers a detailed outlook on treatment modalities, key market players, and technological advancements shaping the pleural effusion management market. With a base year of 2025 and a comprehensive forecast period, this report is your essential guide to the evolving lung effusion treatment market, thoracentesis market, and pleurodesis market.

Pleural Effusions Treatment Industry Market Composition & Trends

The Pleural Effusions Treatment Industry exhibits a moderate market concentration, with a blend of established medical device manufacturers and emerging biopharmaceutical companies vying for market share. Innovation catalysts are primarily driven by advancements in minimally invasive procedures, improved diagnostic tools for pleural effusion diagnosis, and the development of targeted therapies for malignant pleural effusions. The regulatory landscape, overseen by agencies like the FDA and EMA, influences product approvals and market access for new pleural effusion therapies. Substitute products, while present in the form of less invasive symptom management, are increasingly being outpaced by definitive treatment solutions. End-user profiles are dominated by hospitals, followed by ambulatory clinics, with a growing segment of specialized respiratory care centers. Mergers and acquisitions (M&A) activities are a significant trend, with several deals valued in the tens of millions of dollars, consolidating market power and expanding product portfolios within the pleural effusion drainage market. Key M&A deal values are estimated to reach XX Million by 2025. Market share distribution for major players is dynamic, with leading entities holding approximately 15-20% of the market, while smaller players collectively contribute to the remaining share.

Pleural Effusions Treatment Industry Industry Evolution

The pleural effusions treatment market has witnessed significant evolution driven by a confluence of factors including rising prevalence of underlying conditions like lung cancer, heart failure, and infections, which are primary causes of pleural effusion. Technological advancements have been paramount in shaping this evolution. Historically, the market relied heavily on traditional methods for fluid removal and management. However, the past decade has seen a dramatic shift towards minimally invasive techniques and interventional pulmonology. The introduction of improved diagnostic imaging, such as ultrasound-guided thoracentesis, has enhanced precision and reduced complications, thereby boosting adoption rates of these procedures. Furthermore, the development of advanced medical devices for continuous drainage, like indwelling pleural catheters (IPCs), has transformed patient care, allowing for outpatient management and improved quality of life for individuals with recurrent malignant pleural effusions. The growth trajectory of the market has been steadily upward, with a compound annual growth rate (CAGR) of approximately 6.5% from 2019 to 2024, projected to continue at a robust pace. Shifting consumer demands, influenced by patient preference for less invasive interventions and faster recovery times, have further propelled innovation and market expansion in pleural effusion therapy. The increasing demand for effective and durable pleural effusion solutions has also spurred research into novel pharmacological agents and biological treatments for malignant effusions. The market size for pleural effusions treatment is estimated to grow from XX Million in 2019 to XX Million by 2025, and is projected to reach XX Million by 2033.

Leading Regions, Countries, or Segments in Pleural Effusions Treatment Industry

North America currently dominates the pleural effusion treatment landscape, driven by a sophisticated healthcare infrastructure, high patient awareness, and significant investment in medical research and development. The United States, in particular, leads due to its advanced hospital systems and the early adoption of innovative pleural effusion management devices and pleural effusion treatments. The region’s robust reimbursement policies for interventional procedures also contribute to its market leadership.

- Disease Type Dominance: Within the pleural effusion disease types, Exudative pleural effusions, often linked to more severe underlying conditions like cancer and infections, represent a larger segment of the treatment market. This is due to the complexity of management and the frequent need for recurrent interventions. Transudative effusions, typically associated with systemic conditions like heart failure and kidney disease, also contribute significantly, but often have more straightforward management pathways.

- End User Dominance: Hospitals are the principal end-users in the pleural effusion industry, accounting for the largest share of treatment procedures and device utilization. Their comprehensive facilities, availability of specialized medical personnel, and capacity for complex interventions make them the primary centers for pleural effusion management. Ambulatory clinics are emerging as significant players, particularly for post-procedure follow-up and management of patients with indwelling catheters.

- Key Drivers in North America:

- Investment Trends: Substantial private and public investments in respiratory health research and the development of novel pleural effusion diagnostics and pleural effusion therapies.

- Regulatory Support: Favorable regulatory pathways for medical devices and pharmaceutical products, facilitating faster market entry.

- Technological Adoption: High rates of adoption for advanced technologies such as ultrasound-guided thoracentesis, CT-guided drainage, and indwelling pleural catheters.

- Physician Expertise: A well-established network of pulmonologists, thoracic surgeons, and interventional radiologists skilled in pleural procedures.

The Exudative segment within Disease Type and Hospitals within End User are expected to continue their dominance throughout the forecast period, driven by the increasing incidence of cancers and chronic diseases leading to complex pleural effusions. The global market size for pleural effusions treatment is segmented by disease type (Transudative, Exudative) and end-user (Hospitals, Ambulatory Clinics, Other End Users). The Exudative segment is projected to hold a market share of XX% by 2025, while Hospitals will continue to dominate end-user segments with an estimated XX% share in the same year.

Pleural Effusions Treatment Industry Product Innovations

Product innovation in the pleural effusions treatment industry centers on enhancing efficiency, patient comfort, and treatment efficacy. Advancements include the development of novel, biocompatible materials for indwelling pleural catheters that reduce infection rates and improve long-term patency, such as those offered by companies like Cook Medical and B Braun SE. Improved drainage systems offer better fluid management and reduced risk of pneumothorax. Furthermore, the exploration of targeted therapies for malignant pleural effusions, including immunotherapies and intrapleural chemotherapy, represents a significant area of innovation, with companies like Taiho Pharmaceutical Co Ltd and Lung Therapeutics Inc actively engaged in research. Performance metrics such as reduced hospital stay, improved quality of life scores, and decreased recurrence rates are key indicators of successful innovation.

Propelling Factors for Pleural Effusions Treatment Industry Growth

Several factors are propelling the growth of the pleural effusions treatment industry. The increasing global incidence of diseases like lung cancer, tuberculosis, and heart failure, which are primary causes of pleural effusion, directly expands the patient pool requiring treatment. Technological advancements in minimally invasive procedures, such as ultrasound-guided thoracentesis and the development of improved indwelling pleural catheters, enhance treatment outcomes and patient compliance, driving adoption. Growing awareness among healthcare professionals and patients regarding the benefits of early and effective management of pleural effusions also contributes to market expansion. Furthermore, favorable reimbursement policies in many developed nations for interventional pulmonology procedures and medical devices support increased utilization. The aging global population, with its higher susceptibility to chronic diseases, further fuels sustained demand for pleural effusion management solutions.

Obstacles in the Pleural Effusions Treatment Industry Market

Despite robust growth, the pleural effusions treatment market faces certain obstacles. High initial costs associated with advanced medical devices and interventional procedures can pose a barrier to adoption, particularly in resource-limited settings. Stringent regulatory approval processes for new drugs and devices, although essential for patient safety, can prolong market entry timelines. Complications associated with certain procedures, such as infection, pneumothorax, and pain, can lead to patient apprehension and impact treatment choices. The availability of less invasive, but often temporary, palliative measures as substitutes for definitive treatment can also slow market penetration. Moreover, a shortage of trained interventional pulmonologists and thoracic surgeons in some regions can limit access to advanced pleural effusion therapies. Supply chain disruptions for specialized medical devices can also pose challenges.

Future Opportunities in Pleural Effusions Treatment Industry

The pleural effusions treatment industry presents numerous future opportunities. The growing demand for home-based care solutions, facilitated by advanced indwelling pleural catheters and remote monitoring technologies, opens up new market segments. Advancements in targeted therapies, particularly for malignant pleural effusions, including novel drug delivery systems and personalized medicine approaches, represent a significant growth avenue. The expansion of healthcare infrastructure in emerging economies will create new markets for pleural effusion treatment devices and services. Furthermore, increasing research into non-invasive diagnostic techniques and biomarkers for early detection of pleural effusions could streamline diagnosis and treatment pathways. The development of innovative solutions for managing complex, recurrent effusions will also drive market expansion. The estimated market size for advanced pleural effusion solutions is projected to reach XX Million by 2033.

Major Players in the Pleural Effusions Treatment Industry Ecosystem

- Becton Dickinson and Company

- pfm medical ag

- Cook Medical

- Bicakcilar

- Smith Medical

- Grena

- Lung Therapeutics Inc

- Redax

- Taiho Pharmaceutical Co Ltd

- Biometrix

- Rocket Medical

- B Braun SE

Key Developments in Pleural Effusions Treatment Industry Industry

- April 2022: The study titled 'IFN-γ Combined With T Cells in the Treatment of Refractory Malignant Pleural Effusion and Ascites' was registered in ClinicalTrials.gov for Malignant Pleural Effusion, signaling advancements in immunotherapy for complex effusions.

- September 2021: Bristol Mayer Squibb declared three-year data from the CheckMate -743 trial. As per the clinical trial data, serious adverse reactions occurred in 54% of patients receiving OPDIVO plus YERVOY. The most frequent serious adverse reactions reported in 2% of patients were pneumonia, pyrexia, diarrhea, pneumonitis, pleural effusion, dyspnea, acute kidney injury, infusion-related reaction, musculoskeletal pain, and pulmonary embolism. This highlights the importance of comprehensive management and monitoring for patients undergoing advanced cancer therapies that can impact pleural health.

Strategic Pleural Effusions Treatment Industry Market Forecast

The pleural effusions treatment market is poised for sustained growth, driven by an aging global population, rising incidence of chronic diseases, and continuous technological innovation. Key growth catalysts include the increasing adoption of minimally invasive procedures and the development of novel therapeutic agents for malignant pleural effusions. The forecast period, 2025–2033, is expected to witness significant expansion, with market size projected to reach XX Million by 2033. Strategic investments in research and development, coupled with expanding healthcare access in emerging economies, will further bolster market potential. The focus on improving patient quality of life and reducing healthcare costs associated with recurrent effusions will continue to shape market strategies and product development.

Pleural Effusions Treatment Industry Segmentation

-

1. Disease Type

- 1.1. Transudative

- 1.2. Exudative

-

2. End User

- 2.1. Hospitals

- 2.2. Ambulatory Clinics

- 2.3. Other End Users

Pleural Effusions Treatment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pleural Effusions Treatment Industry Regional Market Share

Geographic Coverage of Pleural Effusions Treatment Industry

Pleural Effusions Treatment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Pleural Effusions; Significant Progress in the Management of Pleural Effusions

- 3.3. Market Restrains

- 3.3.1. Partial Success Rate of Treatment

- 3.4. Market Trends

- 3.4.1. Transudative Pleural Effusions Segment Shows Lucrative Opportunity in the Pleural Effusions Treatment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pleural Effusions Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 5.1.1. Transudative

- 5.1.2. Exudative

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Ambulatory Clinics

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 6. North America Pleural Effusions Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 6.1.1. Transudative

- 6.1.2. Exudative

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Ambulatory Clinics

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 7. Europe Pleural Effusions Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 7.1.1. Transudative

- 7.1.2. Exudative

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Ambulatory Clinics

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 8. Asia Pacific Pleural Effusions Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 8.1.1. Transudative

- 8.1.2. Exudative

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Ambulatory Clinics

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 9. Middle East and Africa Pleural Effusions Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Disease Type

- 9.1.1. Transudative

- 9.1.2. Exudative

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Ambulatory Clinics

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Disease Type

- 10. South America Pleural Effusions Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Disease Type

- 10.1.1. Transudative

- 10.1.2. Exudative

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Ambulatory Clinics

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Disease Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 pfm medical ag*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cook Medical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bicakcilar

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Smith Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Grena

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lung Therapeutics Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Redax

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Taiho Pharmaceutical Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Biometrix

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rocket Medical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 B Braun SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Pleural Effusions Treatment Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Pleural Effusions Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 3: North America Pleural Effusions Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 4: North America Pleural Effusions Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Pleural Effusions Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Pleural Effusions Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Pleural Effusions Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pleural Effusions Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 9: Europe Pleural Effusions Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 10: Europe Pleural Effusions Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Pleural Effusions Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Pleural Effusions Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Pleural Effusions Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Pleural Effusions Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 15: Asia Pacific Pleural Effusions Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 16: Asia Pacific Pleural Effusions Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Pleural Effusions Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Pleural Effusions Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Pleural Effusions Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Pleural Effusions Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 21: Middle East and Africa Pleural Effusions Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 22: Middle East and Africa Pleural Effusions Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Middle East and Africa Pleural Effusions Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East and Africa Pleural Effusions Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Pleural Effusions Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Pleural Effusions Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 27: South America Pleural Effusions Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 28: South America Pleural Effusions Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 29: South America Pleural Effusions Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Pleural Effusions Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Pleural Effusions Treatment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 2: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 5: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 11: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 20: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 21: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 29: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 30: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 35: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 36: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pleural Effusions Treatment Industry?

The projected CAGR is approximately 7.23%.

2. Which companies are prominent players in the Pleural Effusions Treatment Industry?

Key companies in the market include Becton Dickinson and Company, pfm medical ag*List Not Exhaustive, Cook Medical, Bicakcilar, Smith Medical, Grena, Lung Therapeutics Inc, Redax, Taiho Pharmaceutical Co Ltd, Biometrix, Rocket Medical, B Braun SE.

3. What are the main segments of the Pleural Effusions Treatment Industry?

The market segments include Disease Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Pleural Effusions; Significant Progress in the Management of Pleural Effusions.

6. What are the notable trends driving market growth?

Transudative Pleural Effusions Segment Shows Lucrative Opportunity in the Pleural Effusions Treatment Market.

7. Are there any restraints impacting market growth?

Partial Success Rate of Treatment.

8. Can you provide examples of recent developments in the market?

In April 2022, the study titled 'IFN-γ Combined With T Cells in the Treatment of Refractory Malignant Pleural Effusion and Ascites' was registered in ClinicalTrials.gov for Malignant Pleural Effusion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pleural Effusions Treatment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pleural Effusions Treatment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pleural Effusions Treatment Industry?

To stay informed about further developments, trends, and reports in the Pleural Effusions Treatment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence