Key Insights

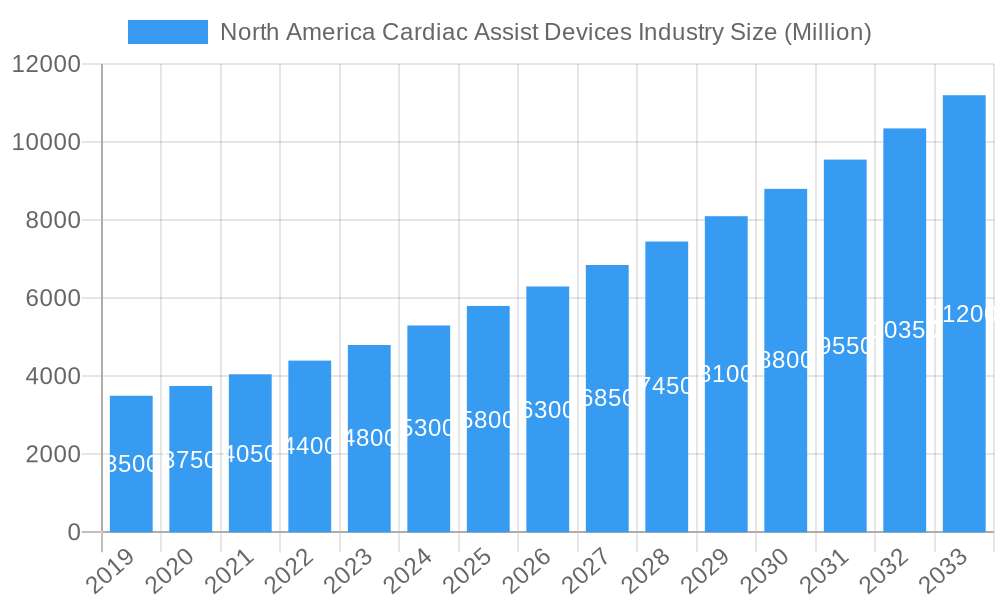

The North America Cardiac Assist Devices market is projected for significant growth, with an estimated market size of $1.4 billion in 2025. This expansion is driven by a projected Compound Annual Growth Rate (CAGR) of 5.8% from 2025 to 2033. Key growth factors include the rising prevalence of cardiovascular diseases, an aging global population, and technological advancements leading to more effective and less invasive devices. Increased awareness of cardiac assist devices' benefits in improving patient outcomes and extending survival rates also fuels market penetration.

North America Cardiac Assist Devices Industry Market Size (In Billion)

The market is segmented by device type, with Ventricular Assist Devices (VADs), particularly Left Ventricular Assist Devices (LVADs), expected to dominate. Intra-aortic Balloon Pumps (IABPs) will remain vital for acute care, while Total Artificial Hearts (TAHs) cater to end-stage heart failure patients. North America leads the market, supported by high healthcare spending, robust reimbursement policies, and a strong presence of leading manufacturers. Challenges include high device costs and the need for specialized surgical expertise, though ongoing R&D efforts to reduce costs and enhance device performance are expected to mitigate these restraints.

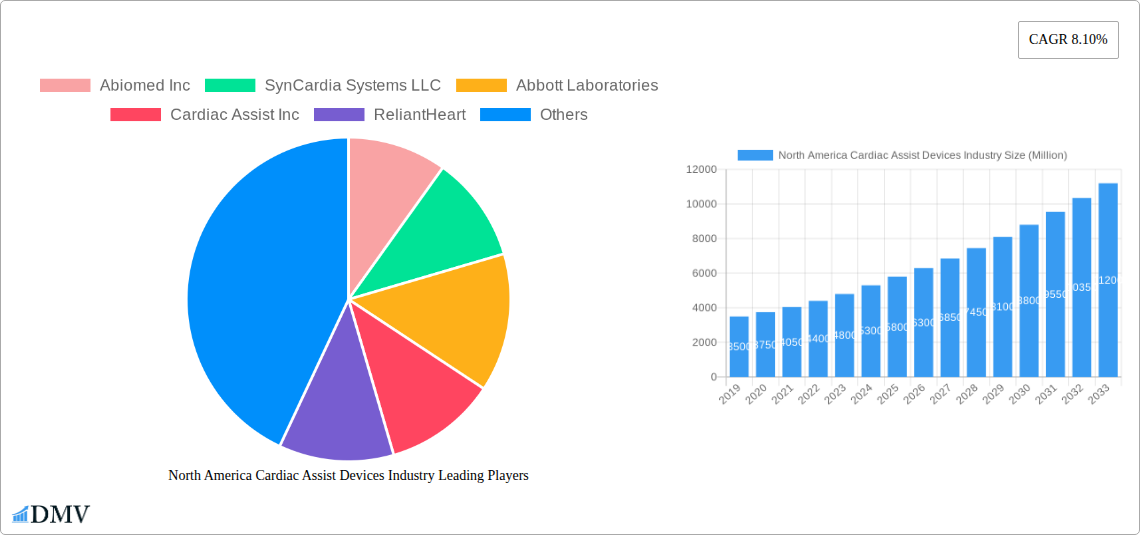

North America Cardiac Assist Devices Industry Company Market Share

North America Cardiac Assist Devices Industry Market Composition & Trends

The North America Cardiac Assist Devices market is characterized by a dynamic competitive landscape, with key players like Abiomed Inc, SynCardia Systems LLC, Abbott Laboratories, Cardiac Assist Inc, ReliantHeart, Calon Cardio-Technology Ltd, Bioheart Inc, Medtronic Plc, Cardiokinetix Inc, and Liva Nova PLC (Cardiac Assist Inc) vying for significant market share. Abiomed Inc is a dominant force, holding an estimated xx% market share in the Ventricular Assist Devices (VADs) segment. Market concentration is moderate, with a few large entities and several innovative smaller companies driving advancements. Innovation catalysts include the increasing prevalence of heart failure, advancements in miniaturization and wireless technology for VADs, and a growing demand for less invasive treatment options. The regulatory landscape, primarily governed by the FDA in the United States and Health Canada, remains stringent, impacting product approval timelines and market entry strategies. Substitute products, such as advanced heart failure medications and heart transplantation, continue to pose a competitive threat, but the efficacy and growing accessibility of cardiac assist devices are steadily eroding their market share. End-user profiles range from acute care hospitals performing transplant surgeries to chronic heart failure patients requiring long-term support. Mergers and acquisitions (M&A) activity has been a significant trend, with notable deals in the historical period of 2019-2024, including Medtronic's acquisition of a smaller VAD technology company for an estimated USD XXX Million, aimed at expanding its product portfolio and market reach. The market share distribution clearly favors VADs, especially Left Ventricular Assist Devices (LVADs), which are projected to capture xx% of the market by 2025.

North America Cardiac Assist Devices Industry Industry Evolution

The North America Cardiac Assist Devices industry has witnessed a remarkable evolution from 2019 to 2033, driven by a confluence of technological breakthroughs, increasing incidences of cardiovascular diseases, and a growing patient preference for advanced therapeutic solutions. Throughout the historical period of 2019-2024, the market experienced a robust Compound Annual Growth Rate (CAGR) of approximately XX%, fueled by significant investments in research and development by leading companies and a rising awareness of the benefits offered by cardiac assist devices over traditional treatment modalities. The base year of 2025 stands as a pivotal point, with the market projected to reach a valuation of over USD XXXX Million.

Technological advancements have been at the forefront of this evolution. The development of smaller, more efficient, and less invasive ventricular assist devices (VADs) has revolutionized the treatment of advanced heart failure. Innovations in pump design, including centrifugal and axial flow pumps, have improved patient mobility and quality of life. Furthermore, advancements in battery technology have extended device longevity and reduced the need for frequent recharging, enhancing patient independence. The miniaturization of components has led to the development of implantable VADs with a significantly lower risk of infection and complications.

Shifting consumer demands and patient profiles have also played a crucial role. As the aging population in North America grows, so does the prevalence of heart failure, creating a larger addressable market for cardiac assist devices. Patients are increasingly seeking proactive and effective solutions to manage their chronic conditions, and cardiac assist devices offer a viable alternative to heart transplantation, which remains limited by donor availability. The shift towards home-based care and remote patient monitoring has also spurred the development of devices with enhanced connectivity and user-friendly interfaces.

The market has seen a steady increase in adoption metrics, with the number of VAD implants growing by an estimated XX% annually in the historical period. Intra-aortic Balloon Pumps (IABPs), while an older technology, continue to hold a significant market share in the acute care setting due to their cost-effectiveness and established efficacy in temporary hemodynamic support. However, the long-term ventricular assist devices, particularly Left Ventricular Assist Devices (LVADs), are experiencing accelerated growth, driven by their ability to provide durable support for end-stage heart failure patients, thereby improving survival rates and functional capacity. The market's trajectory is strongly influenced by supportive reimbursement policies and an increasing focus on patient outcomes.

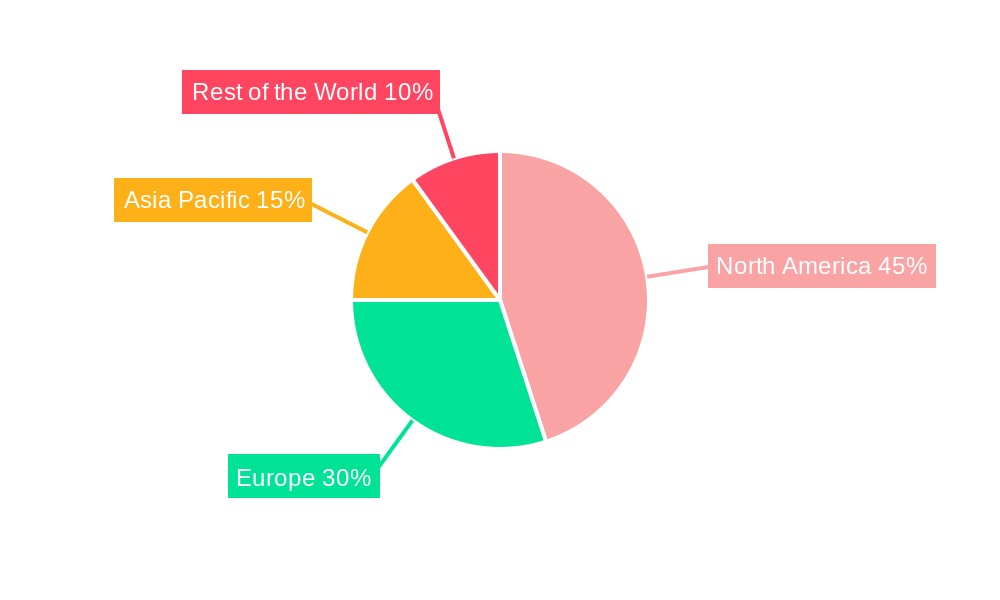

Leading Regions, Countries, or Segments in North America Cardiac Assist Devices Industry

The North America Cardiac Assist Devices industry is dominated by the United States, a powerhouse of innovation and patient demand, consistently driving market growth and technological adoption. Within the broader North American landscape, encompassing Canada and Mexico, the U.S. market accounts for an estimated xx% of the total regional revenue. This dominance is attributable to several interconnected factors, including a large and aging population with a high prevalence of cardiovascular diseases, substantial healthcare expenditure, and a well-established ecosystem of leading medical device manufacturers and research institutions.

Dominant Segment: Ventricular Assist Devices (VADs) Within the product segments, Ventricular Assist Devices (VADs) are the undisputed leaders, with Left Ventricular Assist Devices (LVADs) spearheading this category.

- Key Drivers for VAD Dominance:

- Rising Incidence of Heart Failure: The escalating number of patients diagnosed with advanced heart failure in North America creates a substantial demand for VADs as life-saving or life-sustaining therapy.

- Technological Advancements: Continuous innovation in VAD technology, including miniaturization, improved pump efficiency, wireless power transmission, and reduced thrombogenicity, has enhanced patient outcomes and broadened their applicability.

- Improved Patient Outcomes and Quality of Life: VADs have demonstrated significant improvements in survival rates and functional capacity for patients with end-stage heart failure, enabling them to lead more active lives.

- Limited Donor Availability for Heart Transplants: The persistent shortage of donor hearts makes VADs a critical bridge-to-transplant therapy and a viable destination therapy option.

- Favorable Reimbursement Policies: Government and private payers in the United States, in particular, offer robust reimbursement frameworks for VAD implantation and ongoing management, incentivizing healthcare providers to adopt these devices.

The United States' leadership in VAD adoption is further bolstered by its advanced healthcare infrastructure, a high concentration of specialized cardiac surgery centers, and significant investments in clinical trials that validate the efficacy and safety of new VAD technologies. Abbott Laboratories and Abiomed Inc, prominent players in this segment, consistently invest heavily in research and development, driving innovation and expanding the market.

While Intra-aortic Balloon Pumps (IABPs) and Total Artificial Hearts (TAHs) hold crucial roles in specific clinical scenarios, their market penetration and growth trajectory are less pronounced compared to VADs. IABPs primarily serve as temporary mechanical circulatory support in acute cardiac conditions, while TAHs are reserved for specific complex cases where both ventricles require replacement. Mexico and Canada, while experiencing steady growth in cardiac assist device adoption, are still playing catch-up to the sheer scale and pace of innovation seen in the United States. Investment trends in these countries are gradually increasing, driven by a growing awareness and the desire to provide advanced cardiac care.

North America Cardiac Assist Devices Industry Product Innovations

Product innovations in the North America Cardiac Assist Devices market are continuously enhancing patient care and expanding therapeutic possibilities. Leading companies are focused on developing next-generation Ventricular Assist Devices (VADs) that are smaller, more efficient, and less invasive. Innovations include advancements in wireless power transfer systems, reducing the risk of driveline infections and improving patient mobility. Furthermore, novel pump designs incorporating advanced materials are aimed at minimizing hemolysis and thrombosis, thereby improving device longevity and patient safety. The integration of sophisticated monitoring systems allows for real-time data collection and remote patient management, empowering both patients and clinicians with crucial insights into device performance and patient health. These advancements are crucial for improving the quality of life for patients suffering from heart failure.

Propelling Factors for North America Cardiac Assist Devices Industry Growth

The growth of the North America Cardiac Assist Devices industry is propelled by a multifaceted set of factors. A primary driver is the increasing prevalence of heart failure due to an aging population and rising rates of conditions like hypertension and diabetes. Technological advancements, including miniaturization and wireless power solutions for Ventricular Assist Devices (VADs), are making these devices safer, more efficient, and user-friendly, expanding their adoption. Favorable reimbursement policies in the United States, particularly for VADs as both bridge-to-transplant and destination therapy, are critical economic enablers. Furthermore, growing patient awareness and a desire for improved quality of life are pushing demand for advanced cardiac support solutions. The limited availability of donor organs for heart transplantation also redirects patients towards VADs.

Obstacles in the North America Cardiac Assist Devices Industry Market

Despite robust growth, the North America Cardiac Assist Devices industry faces significant obstacles. Stringent regulatory approval processes, particularly from the FDA, can lead to lengthy timelines and high development costs for new devices. High device costs and associated long-term care expenses pose a significant financial burden for healthcare systems and patients, potentially limiting access. The risk of device-related complications, such as infection, bleeding, and stroke, remains a concern for patients and clinicians. Supply chain disruptions, amplified by geopolitical events and global manufacturing challenges, can impact the availability of critical components. Additionally, competition from alternative therapies, including pharmacological treatments and heart transplantation (where available), presents an ongoing challenge.

Future Opportunities in North America Cardiac Assist Devices Industry

The North America Cardiac Assist Devices industry is poised for significant future opportunities. The development of smaller, fully implantable VADs with extended battery life and wireless charging capabilities will further enhance patient convenience and reduce infection risks. Advancements in artificial intelligence (AI) for predictive analytics and personalized patient management will optimize device performance and early detection of complications. Exploring new market segments, such as pediatric cardiac assist devices and less invasive support options for earlier stages of heart failure, presents substantial growth potential. The increasing focus on remote patient monitoring and telehealth creates opportunities for integrated solutions that improve patient outcomes and reduce hospital readmissions. Expansion into emerging applications for mechanical circulatory support beyond end-stage heart failure is also anticipated.

Major Players in the North America Cardiac Assist Devices Industry Ecosystem

- Abiomed Inc

- SynCardia Systems LLC

- Abbott Laboratories

- Cardiac Assist Inc

- ReliantHeart

- Calon Cardio-Technology Ltd

- Bioheart Inc

- Medtronic Plc

- Cardiokinetix Inc

- Liva Nova PLC

Key Developments in North America Cardiac Assist Devices Industry Industry

- 2023: Abiomed Inc receives FDA approval for an expanded indication for its Impella heart pump to include certain patients with cardiogenic shock.

- 2023: Medtronic Plc announces positive long-term outcomes from clinical studies of its HVAD system, reinforcing its position in the VAD market.

- 2022: Abbott Laboratories expands its cardiac assist device portfolio with the launch of a new generation of HeartMate VADs featuring enhanced durability and patient comfort.

- 2022: SynCardia Systems LLC continues to focus on its Total Artificial Heart solutions, reporting strong adoption for patients with biventricular failure.

- 2021: The FDA grants breakthrough device designation for novel VAD technologies focused on reducing thrombogenicity and improving patient anticoagulation management.

Strategic North America Cardiac Assist Devices Industry Market Forecast

The North America Cardiac Assist Devices market is projected for substantial expansion, driven by escalating heart failure incidence and continuous technological innovation. The forecast period (2025–2033) anticipates accelerated adoption of Ventricular Assist Devices (VADs), particularly Left Ventricular Assist Devices (LVADs), due to their proven efficacy in improving patient survival and quality of life. Key growth catalysts include the development of more compact, wirelessly powered, and user-friendly devices, coupled with advancements in AI-driven patient monitoring and personalized therapy. Favorable reimbursement policies in the United States and increasing healthcare investments across North America will further fuel market penetration. The market holds immense potential as researchers and manufacturers focus on addressing unmet needs and expanding the applicability of mechanical circulatory support.

North America Cardiac Assist Devices Industry Segmentation

-

1. Product

- 1.1. Intra-aortic Balloon Pumps

- 1.2. Total Artificial Heart

-

1.3. Ventricular Assist Devices

- 1.3.1. Left Ventricular Assist Device

- 1.3.2. Right Ventricular Assist Device

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

- 2.1.3. Mexico

-

2.1. North America

North America Cardiac Assist Devices Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cardiac Assist Devices Industry Regional Market Share

Geographic Coverage of North America Cardiac Assist Devices Industry

North America Cardiac Assist Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Heart Diseases; Advancements in Technology; Shortage of Heart Donors in Transplantation

- 3.3. Market Restrains

- 3.3.1. Risk Associated with Device Implantation

- 3.4. Market Trends

- 3.4.1. Total Artificial Hearts Segment Dominates the North American Cardiac Assist Devices Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cardiac Assist Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Intra-aortic Balloon Pumps

- 5.1.2. Total Artificial Heart

- 5.1.3. Ventricular Assist Devices

- 5.1.3.1. Left Ventricular Assist Device

- 5.1.3.2. Right Ventricular Assist Device

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1.3. Mexico

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Abiomed Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SynCardia Systems LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abbott Laboratories

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cardiac Assist Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ReliantHeart

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Calon Cardio-Technology Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bioheart Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Medtronic Plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cardiokinetix Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LivaNova PLC (Cardiac Assist Inc )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Abiomed Inc

List of Figures

- Figure 1: North America Cardiac Assist Devices Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Cardiac Assist Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Cardiac Assist Devices Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: North America Cardiac Assist Devices Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: North America Cardiac Assist Devices Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Cardiac Assist Devices Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 5: North America Cardiac Assist Devices Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Cardiac Assist Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Cardiac Assist Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Cardiac Assist Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Cardiac Assist Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cardiac Assist Devices Industry?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the North America Cardiac Assist Devices Industry?

Key companies in the market include Abiomed Inc, SynCardia Systems LLC, Abbott Laboratories, Cardiac Assist Inc, ReliantHeart, Calon Cardio-Technology Ltd, Bioheart Inc, Medtronic Plc, Cardiokinetix Inc, LivaNova PLC (Cardiac Assist Inc ).

3. What are the main segments of the North America Cardiac Assist Devices Industry?

The market segments include Product, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Heart Diseases; Advancements in Technology; Shortage of Heart Donors in Transplantation.

6. What are the notable trends driving market growth?

Total Artificial Hearts Segment Dominates the North American Cardiac Assist Devices Market.

7. Are there any restraints impacting market growth?

Risk Associated with Device Implantation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cardiac Assist Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cardiac Assist Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cardiac Assist Devices Industry?

To stay informed about further developments, trends, and reports in the North America Cardiac Assist Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence