Key Insights

The Global Patient Derived Xenograft (PDX) Models Market is poised for significant expansion, projected to reach a market size of 319 million by 2025, with a Compound Annual Growth Rate (CAGR) of 17.01%. This robust growth is driven by the accelerating demand for personalized medicine and the indispensable role of PDX models in preclinical drug development. Pharmaceutical and biotechnology firms are leveraging PDX models for accurate prediction of drug responses, thereby expediting the discovery of novel cancer therapies. Research institutions also contribute significantly through advanced studies on tumor biology and therapeutic target identification. Market expansion is further bolstered by innovations in xenografting techniques, enhancing model reliability and predictive accuracy, and a growing recognition of their superior translational value over traditional cell line models. Addressing the limitations of conventional preclinical models and improving cancer drug development success rates are key growth drivers.

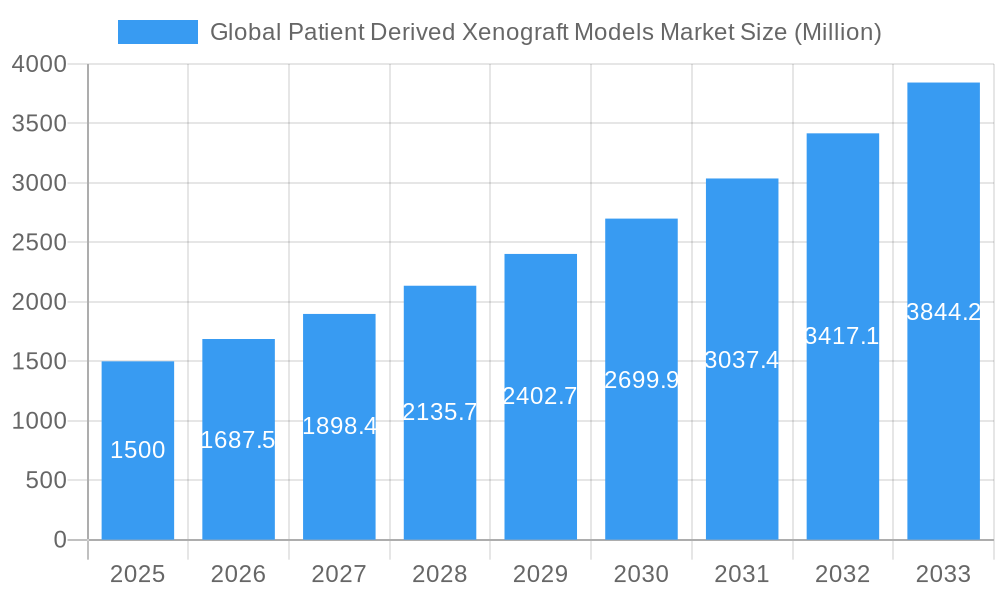

Global Patient Derived Xenograft Models Market Market Size (In Million)

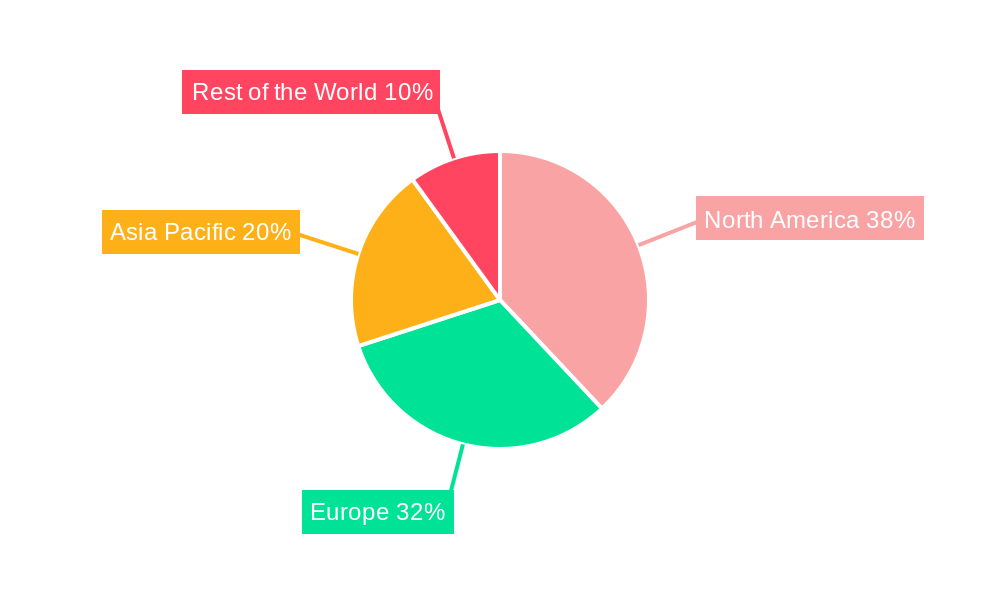

The market segmentation includes diverse tumor types, with Gastrointestinal, Gynecological, and Respiratory models holding prominence due to high prevalence and unmet medical needs. The increasing complexity of cancer and the development of targeted therapies necessitate precise preclinical models, a need effectively met by PDX models. Geographically, North America, led by the United States, and Europe, with strong markets in Germany and the UK, currently lead the PDX models market, supported by established research infrastructure and substantial R&D investments. The Asia Pacific region, particularly China and Japan, shows rapid growth fueled by expanding biotech industries and increased government support for life sciences research. Key challenges include the high cost and time investment in PDX model generation and maintenance, alongside ethical and regulatory considerations. However, continuous innovation and the proven clinical relevance of PDX models ensure sustained market growth.

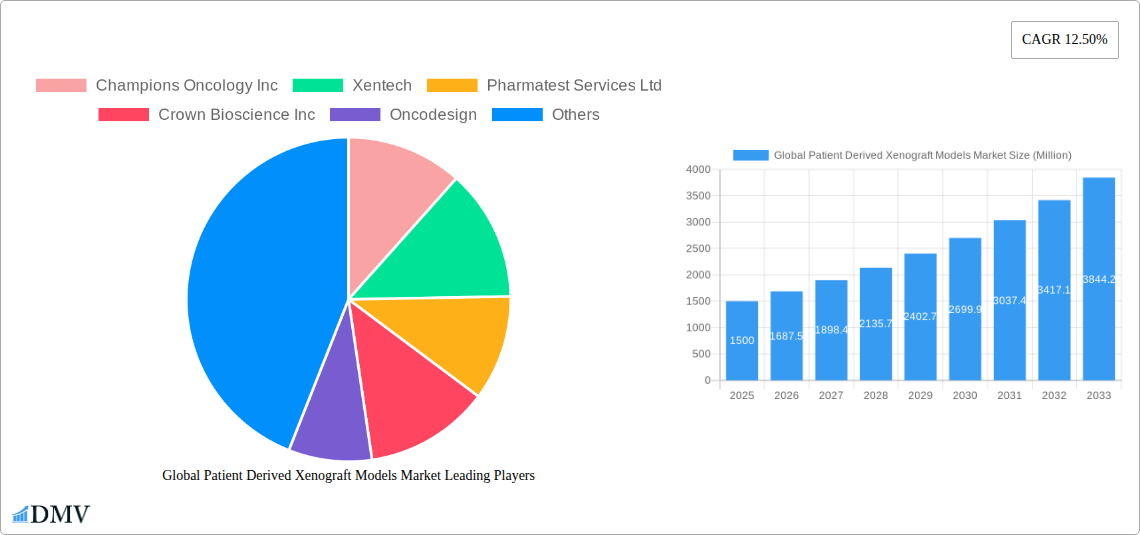

Global Patient Derived Xenograft Models Market Company Market Share

This comprehensive report offers a strategic overview of the Global Patient Derived Xenograft (PDX) Models Market, providing critical insights into market dynamics and future potential. Covering the base year 2025 and a forecast period from 2025 to 2033, this analysis is essential for stakeholders focused on preclinical cancer research models. The report details market composition, industry evolution, regional trends, product innovations, growth drivers, challenges, and future opportunities, facilitating informed strategic decision-making.

Global Patient Derived Xenograft Models Market Market Composition & Trends

The Global Patient Derived Xenograft Models Market is characterized by a moderate to high level of concentration, with key players like Champions Oncology Inc., Charles River Laboratories Inc., and Crown Bioscience Inc. dominating market share distribution, estimated to be around XX% collectively in 2025. Innovation catalysts are primarily driven by advancements in oncology research, the increasing demand for personalized medicine, and the need for more predictive preclinical models to accelerate drug discovery. Regulatory landscapes, while generally supportive of innovative research tools, can present hurdles related to ethical considerations and data standardization. Substitute products, such as genetically engineered mouse models (GEMMs) and in vitro 3D cell culture models, pose a competitive challenge, yet PDX models retain their advantage in recapitulating tumor heterogeneity and the tumor microenvironment. End-user profiles reveal a strong reliance by pharmaceutical & biotechnology companies (estimated XX% market share in 2025) and academic & research institutions (estimated XX% market share in 2025) for drug efficacy and toxicity testing. Mergers & Acquisitions (M&A) activities are a significant trend, with deal values anticipated to reach XXX Million by 2025, aimed at consolidating market presence and expanding service portfolios.

- Market Share Distribution: Leading players hold substantial portions, driven by established reputations and comprehensive service offerings.

- Innovation Catalysts: Focus on cancer drug development, biomarker discovery, and immuno-oncology research.

- Regulatory Landscapes: Navigating ethical approvals and quality control standards for xenograft research.

- Substitute Products: Competition from GEMMs and organoids; PDX models excel in in vivo recapitulation.

- End-User Profiles: Dominance of pharma/biotech and academic institutions for preclinical studies.

- M&A Activities: Strategic acquisitions to enhance capabilities and market reach, with M&A deal values projected at XXX Million by 2025.

Global Patient Derived Xenograft Models Market Industry Evolution

The Global Patient Derived Xenograft Models Market has undergone a significant industry evolution, driven by the relentless pursuit of more accurate and predictive preclinical models for cancer therapy development. From its inception, the market has witnessed a progressive shift from simpler xenograft techniques to more sophisticated and genetically defined PDX models. The historical period (2019–2024) saw steady growth, fueled by an increasing understanding of cancer complexity and the limitations of traditional cell line-based studies. The base year of 2025 represents a mature market with established players and a growing demand for specialized PDX models. The forecast period (2025–2033) is projected to witness robust expansion, with an estimated Compound Annual Growth Rate (CAGR) of XX% for the Global Patient Derived Xenograft Models Market. This growth trajectory is primarily propelled by technological advancements in genomic sequencing, CRISPR technology, and high-throughput screening platforms, which enable the creation and characterization of highly representative PDX models. Shifting consumer demands, particularly from pharmaceutical and biotechnology companies, are increasingly leaning towards PDX models that closely mirror patient tumor biology, including tumor microenvironment components and immune cell infiltration. This has led to a surge in the development of patient-derived organoids and co-clinical trial readiness of PDX models. Furthermore, the rising incidence of cancer globally and the subsequent increase in R&D investments by biopharmaceutical firms further underscore the growing importance of PDX models in oncology research and drug discovery. The adoption metrics for PDX models in preclinical pipelines are steadily increasing, displacing older, less predictive methodologies and solidifying their position as a cornerstone for novel therapeutic agent validation and precision medicine initiatives. The market is also seeing a trend towards the development of PDX models for rare cancers and specific genetic mutations, catering to niche but high-impact research areas.

Leading Regions, Countries, or Segments in Global Patient Derived Xenograft Models Market

The Global Patient Derived Xenograft Models Market is currently witnessing significant dominance by North America, driven by a confluence of factors that foster innovation and adoption. Within the Type segment, Mice Models (estimated XX% market share in 2025) continue to be the predominant choice due to their well-established utility, genetic manipulability, and the extensive availability of immunocompromised strains essential for xenograft engraftment. Rats Models are gaining traction for specific applications requiring larger subject sizes or different physiological characteristics. In terms of Tumor Type, Gastrointestinal Tumor Models and Gynecological Tumor Models represent significant segments (estimated XX% and XX% market share respectively in 2025), reflecting the high prevalence of these cancers and the substantial research efforts dedicated to finding effective treatments. Respiratory Tumor Models and Other Tumor Models also contribute to the market's diversity. For End User, Pharmaceutical & Biotechnology Companies are the largest consumers (estimated XX% market share in 2025), leveraging PDX models for critical stages of drug development, from target validation to lead optimization and efficacy studies. Academic & Research Institutions (estimated XX% market share in 2025) play a crucial role in fundamental research, exploring novel therapeutic avenues and understanding disease mechanisms.

Key Drivers for Dominance in North America:

- Robust R&D Investment: High levels of funding from both government agencies and private sector entities in cancer research and biopharmaceutical innovation.

- Presence of Leading Pharmaceutical Hubs: Concentration of major biotechnology and pharmaceutical companies driving demand for advanced preclinical models.

- Advanced Technological Infrastructure: Widespread adoption of cutting-edge technologies for xenograft model generation, characterization, and analysis.

- Supportive Regulatory Environment: Favorable policies and guidelines that encourage the development and application of innovative research tools for drug development.

- Academic Excellence: Leading universities and research institutions actively engaged in oncology research and the utilization of PDX models.

- Skilled Workforce: Availability of highly trained scientists and researchers proficient in xenograft model handling and study design.

In-depth analysis reveals that the established infrastructure, coupled with a strong pipeline of novel cancer therapies in development, solidifies North America's lead. The segment of Mice Models for Gastrointestinal Tumor Models within Pharmaceutical & Biotechnology Companies represents a particularly high-demand area, driven by the significant unmet medical needs and the substantial investment in developing targeted therapies and immunotherapies for these prevalent cancers.

Global Patient Derived Xenograft Models Market Product Innovations

The Global Patient Derived Xenograft Models Market is witnessing continuous product innovation aimed at enhancing the translational relevance and predictive power of these critical research tools. Advancements focus on creating PDX models that better mimic the human tumor microenvironment, including immune cell components and stromal interactions. Innovations such as the development of humanized PDX models (incorporating human immune cells) and the utilization of CRISPR technology for precise genetic manipulation are significantly improving their application in immuno-oncology and targeted therapy research. Furthermore, efforts are underway to develop PDX models for a wider range of cancer types, including rare and difficult-to-treat malignancies, expanding their utility in personalized medicine strategies. These innovations offer improved drug efficacy testing, pharmacodynamic profiling, and biomarker identification, leading to more efficient and successful drug development pipelines.

Propelling Factors for Global Patient Derived Xenograft Models Market Growth

Several key factors are propelling the growth of the Global Patient Derived Xenograft Models Market. The escalating global burden of cancer and the subsequent increase in R&D investments by pharmaceutical and biotechnology companies are paramount. Advancements in genomic sequencing and biotechnology are enabling the creation of more accurate and predictive PDX models that better recapitulate human tumor heterogeneity. The growing emphasis on personalized medicine and the need for preclinical validation of targeted therapies and immunotherapies are also significant drivers. Furthermore, the limitations of traditional cell-based assays in reflecting the complex in vivo tumor microenvironment are driving the adoption of PDX models. Regulatory bodies are also increasingly recognizing the value of PDX models in supporting drug approval processes.

Obstacles in the Global Patient Derived Xenograft Models Market Market

Despite its robust growth, the Global Patient Derived Xenograft Models Market faces several obstacles. The ethical considerations surrounding animal research and the need for rigorous animal welfare protocols can pose challenges. The cost and time investment required for generating and maintaining high-quality PDX models can be substantial, limiting accessibility for some research groups. Variability in engraftment rates and the potential for tumor evolution over serial passages can also impact reproducibility and complicate data interpretation. Furthermore, the standardization of methodologies across different research institutions and the development of robust data sharing platforms are ongoing challenges. Supply chain disruptions for specialized reagents and animal husbandry resources can also impact market operations.

Future Opportunities in Global Patient Derived Xenograft Models Market

The Global Patient Derived Xenograft Models Market is ripe with future opportunities. The increasing focus on immuno-oncology is driving the demand for advanced PDX models that incorporate functional immune components, leading to the development of syngeneic and humanized PDX models. The growing interest in combination therapies will necessitate PDX models capable of evaluating the efficacy of multiple drug agents simultaneously. Expansion into emerging markets with increasing healthcare expenditure and R&D investments presents a significant growth avenue. The development of next-generation PDX models incorporating advanced imaging techniques, real-time monitoring, and sophisticated bioinformatics analysis will further enhance their value proposition. The integration of PDX models with digital pathology and AI-driven data analysis offers immense potential for accelerating drug discovery and understanding treatment responses.

Major Players in the Global Patient Derived Xenograft Models Market Ecosystem

- Champions Oncology Inc.

- Xentech

- Pharmatest Services Ltd

- Crown Bioscience Inc.

- Oncodesign

- EPO Berlin-Buch GmbH

- Charles River Laboratories Inc.

- Urolead

- Hera BioLabs

Key Developments in Global Patient Derived Xenograft Models Market Industry

- July 2022: GemPharmatech (GemPharmatech Co., Ltd.) announced that it has entered into a strategic license agreement with Charles River Laboratories, Inc. for exclusive distribution of its next-generation NOD CRISPR Prkdc Il2r gamma (NCG) mouse lines in North America. Charles River will establish foundation colonies with models to be commercially available beginning in 2023.

- April 2022: The research group of Professor Kamimura at Niigata University established a novel pancreatic carcinogenesis model in wild-type rats utilizing the pancreas-targeted selective hydrodynamic gene delivery method.

Strategic Global Patient Derived Xenograft Models Market Market Forecast

The strategic forecast for the Global Patient Derived Xenograft Models Market indicates sustained and robust growth in the coming years. This expansion will be driven by the continuous need for more predictive and translatable preclinical models in oncology drug development. The increasing investment in immuno-oncology research and the growing demand for personalized medicine solutions will further fuel the market. Advancements in genomic technologies and the development of novel xenograft model platforms, such as humanized and syngeneic models, will broaden their application spectrum. The market's potential is further amplified by the global rise in cancer incidence, necessitating innovative approaches to therapy development and validation. The strategic focus on enhancing model accuracy and efficiency will ensure PDX models remain a cornerstone for advancing cancer therapeutics.

Global Patient Derived Xenograft Models Market Segmentation

-

1. Type

- 1.1. Mice Model

- 1.2. Rats Model

-

2. Tumor Type

- 2.1. Gastrointestinal Tumor Model

- 2.2. Gynecological Tumor Model

- 2.3. Respiratory Tumor Model

- 2.4. Other Tumor Model

-

3. End User

- 3.1. Pharmaceutical & Biotechnology Companies

- 3.2. Academic & Research Institutions

- 3.3. Others

Global Patient Derived Xenograft Models Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Global Patient Derived Xenograft Models Market Regional Market Share

Geographic Coverage of Global Patient Derived Xenograft Models Market

Global Patient Derived Xenograft Models Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Cases of Cancer; Rising R&D Activities in the Pharmaceutical Industry; Continuous Support for Cancer Research From Public as Well as Private Sector

- 3.3. Market Restrains

- 3.3.1. High Cost of Personalized Patient Derived Xenograft Models; Stringent Regulations Towards Use of Animals Models

- 3.4. Market Trends

- 3.4.1. Mice Model Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Patient Derived Xenograft Models Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mice Model

- 5.1.2. Rats Model

- 5.2. Market Analysis, Insights and Forecast - by Tumor Type

- 5.2.1. Gastrointestinal Tumor Model

- 5.2.2. Gynecological Tumor Model

- 5.2.3. Respiratory Tumor Model

- 5.2.4. Other Tumor Model

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical & Biotechnology Companies

- 5.3.2. Academic & Research Institutions

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Patient Derived Xenograft Models Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mice Model

- 6.1.2. Rats Model

- 6.2. Market Analysis, Insights and Forecast - by Tumor Type

- 6.2.1. Gastrointestinal Tumor Model

- 6.2.2. Gynecological Tumor Model

- 6.2.3. Respiratory Tumor Model

- 6.2.4. Other Tumor Model

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceutical & Biotechnology Companies

- 6.3.2. Academic & Research Institutions

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Patient Derived Xenograft Models Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mice Model

- 7.1.2. Rats Model

- 7.2. Market Analysis, Insights and Forecast - by Tumor Type

- 7.2.1. Gastrointestinal Tumor Model

- 7.2.2. Gynecological Tumor Model

- 7.2.3. Respiratory Tumor Model

- 7.2.4. Other Tumor Model

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceutical & Biotechnology Companies

- 7.3.2. Academic & Research Institutions

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Patient Derived Xenograft Models Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mice Model

- 8.1.2. Rats Model

- 8.2. Market Analysis, Insights and Forecast - by Tumor Type

- 8.2.1. Gastrointestinal Tumor Model

- 8.2.2. Gynecological Tumor Model

- 8.2.3. Respiratory Tumor Model

- 8.2.4. Other Tumor Model

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceutical & Biotechnology Companies

- 8.3.2. Academic & Research Institutions

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Global Patient Derived Xenograft Models Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mice Model

- 9.1.2. Rats Model

- 9.2. Market Analysis, Insights and Forecast - by Tumor Type

- 9.2.1. Gastrointestinal Tumor Model

- 9.2.2. Gynecological Tumor Model

- 9.2.3. Respiratory Tumor Model

- 9.2.4. Other Tumor Model

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceutical & Biotechnology Companies

- 9.3.2. Academic & Research Institutions

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Champions Oncology Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Xentech

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Pharmatest Services Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Crown Bioscience Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Oncodesign

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 EPO Berlin-Buch GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Charles River Laboratories Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Urolead

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hera BioLabs

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Champions Oncology Inc

List of Figures

- Figure 1: Global Global Patient Derived Xenograft Models Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Global Patient Derived Xenograft Models Market Revenue (million), by Type 2025 & 2033

- Figure 3: North America Global Patient Derived Xenograft Models Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Global Patient Derived Xenograft Models Market Revenue (million), by Tumor Type 2025 & 2033

- Figure 5: North America Global Patient Derived Xenograft Models Market Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 6: North America Global Patient Derived Xenograft Models Market Revenue (million), by End User 2025 & 2033

- Figure 7: North America Global Patient Derived Xenograft Models Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Global Patient Derived Xenograft Models Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Global Patient Derived Xenograft Models Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Patient Derived Xenograft Models Market Revenue (million), by Type 2025 & 2033

- Figure 11: Europe Global Patient Derived Xenograft Models Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Global Patient Derived Xenograft Models Market Revenue (million), by Tumor Type 2025 & 2033

- Figure 13: Europe Global Patient Derived Xenograft Models Market Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 14: Europe Global Patient Derived Xenograft Models Market Revenue (million), by End User 2025 & 2033

- Figure 15: Europe Global Patient Derived Xenograft Models Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Global Patient Derived Xenograft Models Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Global Patient Derived Xenograft Models Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Patient Derived Xenograft Models Market Revenue (million), by Type 2025 & 2033

- Figure 19: Asia Pacific Global Patient Derived Xenograft Models Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Global Patient Derived Xenograft Models Market Revenue (million), by Tumor Type 2025 & 2033

- Figure 21: Asia Pacific Global Patient Derived Xenograft Models Market Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 22: Asia Pacific Global Patient Derived Xenograft Models Market Revenue (million), by End User 2025 & 2033

- Figure 23: Asia Pacific Global Patient Derived Xenograft Models Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Global Patient Derived Xenograft Models Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Patient Derived Xenograft Models Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Global Patient Derived Xenograft Models Market Revenue (million), by Type 2025 & 2033

- Figure 27: Rest of the World Global Patient Derived Xenograft Models Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Global Patient Derived Xenograft Models Market Revenue (million), by Tumor Type 2025 & 2033

- Figure 29: Rest of the World Global Patient Derived Xenograft Models Market Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 30: Rest of the World Global Patient Derived Xenograft Models Market Revenue (million), by End User 2025 & 2033

- Figure 31: Rest of the World Global Patient Derived Xenograft Models Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Rest of the World Global Patient Derived Xenograft Models Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the World Global Patient Derived Xenograft Models Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Tumor Type 2020 & 2033

- Table 3: Global Patient Derived Xenograft Models Market Revenue million Forecast, by End User 2020 & 2033

- Table 4: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Tumor Type 2020 & 2033

- Table 7: Global Patient Derived Xenograft Models Market Revenue million Forecast, by End User 2020 & 2033

- Table 8: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Type 2020 & 2033

- Table 13: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Tumor Type 2020 & 2033

- Table 14: Global Patient Derived Xenograft Models Market Revenue million Forecast, by End User 2020 & 2033

- Table 15: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Spain Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Type 2020 & 2033

- Table 23: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Tumor Type 2020 & 2033

- Table 24: Global Patient Derived Xenograft Models Market Revenue million Forecast, by End User 2020 & 2033

- Table 25: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: China Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Japan Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: India Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Australia Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Global Patient Derived Xenograft Models Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Type 2020 & 2033

- Table 33: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Tumor Type 2020 & 2033

- Table 34: Global Patient Derived Xenograft Models Market Revenue million Forecast, by End User 2020 & 2033

- Table 35: Global Patient Derived Xenograft Models Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Patient Derived Xenograft Models Market?

The projected CAGR is approximately 17.01%.

2. Which companies are prominent players in the Global Patient Derived Xenograft Models Market?

Key companies in the market include Champions Oncology Inc, Xentech, Pharmatest Services Ltd, Crown Bioscience Inc, Oncodesign, EPO Berlin-Buch GmbH, Charles River Laboratories Inc, Urolead, Hera BioLabs.

3. What are the main segments of the Global Patient Derived Xenograft Models Market?

The market segments include Type, Tumor Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 319 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Cases of Cancer; Rising R&D Activities in the Pharmaceutical Industry; Continuous Support for Cancer Research From Public as Well as Private Sector.

6. What are the notable trends driving market growth?

Mice Model Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Personalized Patient Derived Xenograft Models; Stringent Regulations Towards Use of Animals Models.

8. Can you provide examples of recent developments in the market?

July 2022: GemPharmatech (GemPharmatech Co., Ltd.) announced that it has entered into a strategic license agreement with Charles River Laboratories, Inc. for exclusive distribution of its next-generation NOD CRISPR Prkdc Il2r gamma (NCG) mouse lines in North America. Charles River will establish foundation colonies with models to be commercially available beginning in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Patient Derived Xenograft Models Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Patient Derived Xenograft Models Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Patient Derived Xenograft Models Market?

To stay informed about further developments, trends, and reports in the Global Patient Derived Xenograft Models Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence