Key Insights

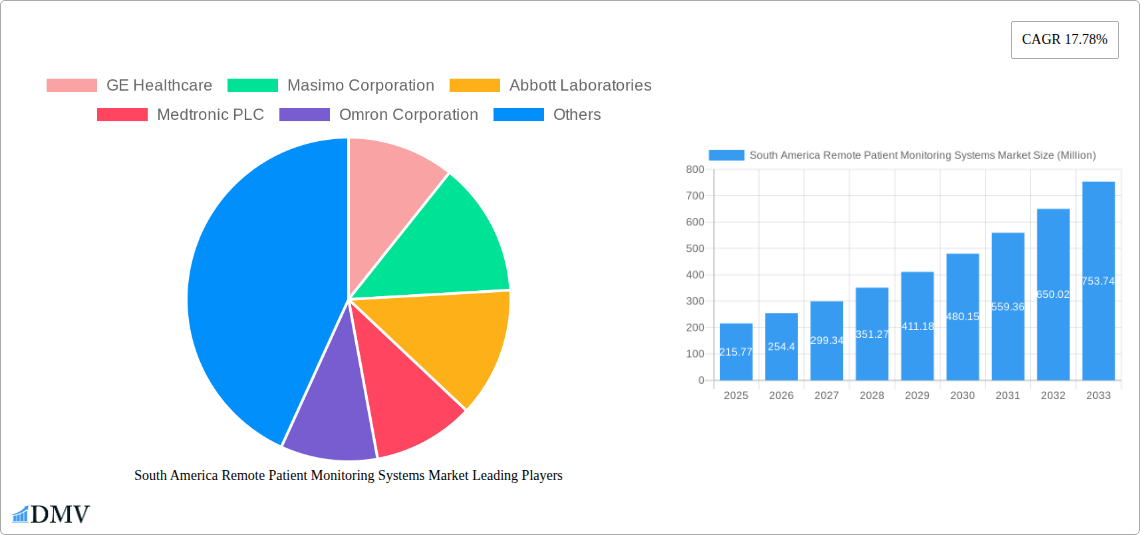

The South America Remote Patient Monitoring Systems Market is poised for substantial expansion, projected to reach a market size of USD 215.77 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 17.78% during the forecast period of 2025-2033. This robust growth is fueled by several key drivers. Increasing prevalence of chronic diseases such as cardiovascular conditions, diabetes, and cancer across the region necessitates continuous patient oversight, making remote monitoring an indispensable tool for managing these conditions effectively. Furthermore, the growing adoption of home healthcare services, driven by an aging population and the desire for convenient and personalized care, is significantly propelling market demand. Technological advancements in connected medical devices, including sophisticated heart and breath monitors, alongside the widespread availability of smartphones and improved internet infrastructure, are creating a fertile ground for the expansion of remote patient monitoring solutions.

South America Remote Patient Monitoring Systems Market Market Size (In Million)

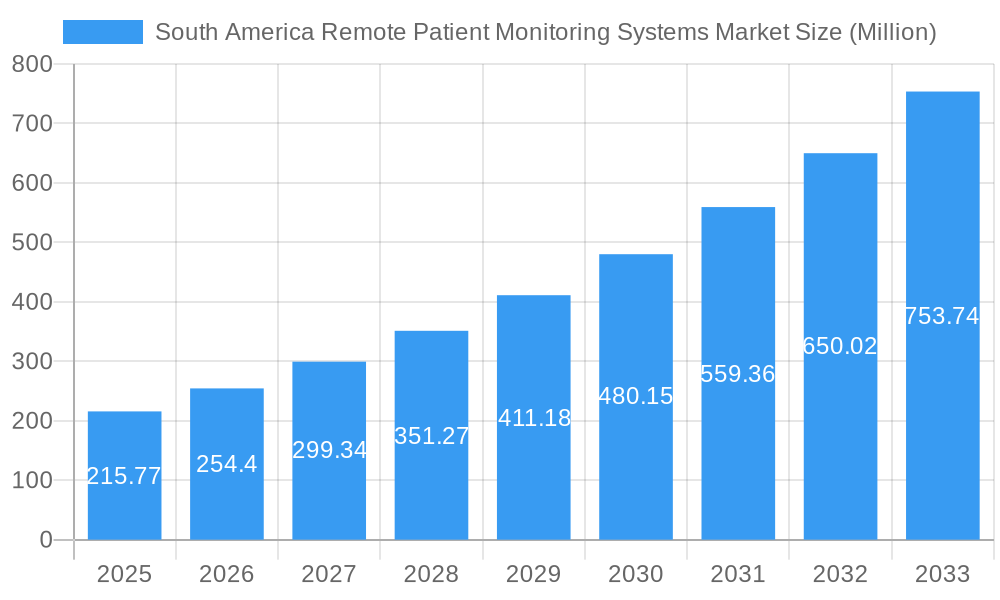

The market is segmented across various device types, with Heart Monitors and Breath Monitors anticipated to witness considerable adoption due to the high burden of cardiovascular and respiratory ailments. In terms of applications, Cancer Treatment and Cardiovascular Diseases are expected to be the dominant segments, reflecting the critical need for ongoing monitoring in these critical health areas. Home Care Settings are emerging as a primary end-user segment, highlighting the shift towards decentralized healthcare models. Geographically, while Brazil is expected to lead the market in terms of size and growth, Argentina and the Rest of South America are also projected to exhibit strong upward trends. Leading companies such as GE Healthcare, Masimo Corporation, and Medtronic PLC are actively investing in research and development, introducing innovative solutions to cater to the evolving needs of the South American healthcare landscape and capitalize on the burgeoning market opportunities.

South America Remote Patient Monitoring Systems Market Company Market Share

Gain a strategic advantage with this in-depth market analysis of South America's burgeoning remote patient monitoring (RPM) systems market. This report offers a definitive roadmap for stakeholders, providing critical insights into market dynamics, growth trajectories, and competitive landscapes from 2019–2033, with a base and estimated year of 2025. Explore the expansive opportunities within this vital healthcare segment, driven by increasing chronic disease prevalence, technological advancements, and a growing demand for accessible, cost-effective healthcare solutions.

South America Remote Patient Monitoring Systems Market Market Composition & Trends

The South America remote patient monitoring systems market is characterized by a moderately concentrated landscape, with key players like GE Healthcare, Masimo Corporation, Abbott Laboratories, Medtronic PLC, and Omron Corporation actively shaping innovation and market share. Innovation is significantly driven by advancements in wearable technology, AI-powered analytics for early disease detection, and the increasing adoption of telehealth platforms. The regulatory environment is evolving, with governments increasingly recognizing the potential of RPM to improve population health outcomes and reduce healthcare expenditures. Substitute products, while present in the form of traditional in-person consultations, are gradually being overshadowed by the convenience and efficiency of RPM. End-user profiles are diverse, encompassing individuals managing chronic conditions at home, elderly populations requiring continuous health oversight, and healthcare providers seeking to optimize patient care. Mergers and acquisitions (M&A) are a notable trend, indicating strategic consolidation and expansion efforts. For instance, recent M&A activities have focused on acquiring innovative startups in the RPM space, bolstering portfolios with cutting-edge technologies. The overall market share distribution sees a significant portion held by companies specializing in cardiovascular and diabetes management devices.

South America Remote Patient Monitoring Systems Market Industry Evolution

The South America remote patient monitoring systems market has undergone a significant transformation over the historical period (2019–2024) and is poised for robust growth in the forecast period (2025–2033). Early adoption was primarily driven by advanced healthcare systems in select countries, with a focus on managing chronic conditions like cardiovascular diseases and diabetes treatment. The study period (2019–2033) has witnessed a substantial shift from episodic care to continuous patient oversight, propelled by increasing awareness of the benefits of proactive health management.

Technological advancements have been a cornerstone of this evolution. The integration of sophisticated sensors, miniaturization of devices, and enhancement of data analytics capabilities have made RPM systems more accurate, user-friendly, and cost-effective. The rise of the Internet of Medical Things (IoMT) has further accelerated this trend, enabling seamless data transmission between devices, patients, and healthcare providers. Growth rates during the historical period averaged approximately 15-20% annually, with projections indicating a sustained CAGR of 22-25% through 2033. Adoption metrics are steadily increasing, with a significant portion of the target population now being reached through various RPM solutions, particularly in home care settings.

Shifting consumer demands play a crucial role. Patients are increasingly seeking greater control over their health and prefer the convenience of monitoring their conditions from the comfort of their homes. This preference, coupled with the rising burden of chronic diseases across the region, has created a fertile ground for RPM market expansion. Furthermore, the COVID-19 pandemic acted as a significant catalyst, accelerating the adoption of telemedicine and remote monitoring solutions to ensure continuity of care while minimizing exposure risks. This has led to a surge in demand for devices catering to various applications, including cancer treatment monitoring, diabetes treatment, and general well-being. The market is also witnessing a growing demand for integrated RPM platforms that offer comprehensive data management and communication tools, enhancing the efficiency of healthcare delivery and improving patient outcomes.

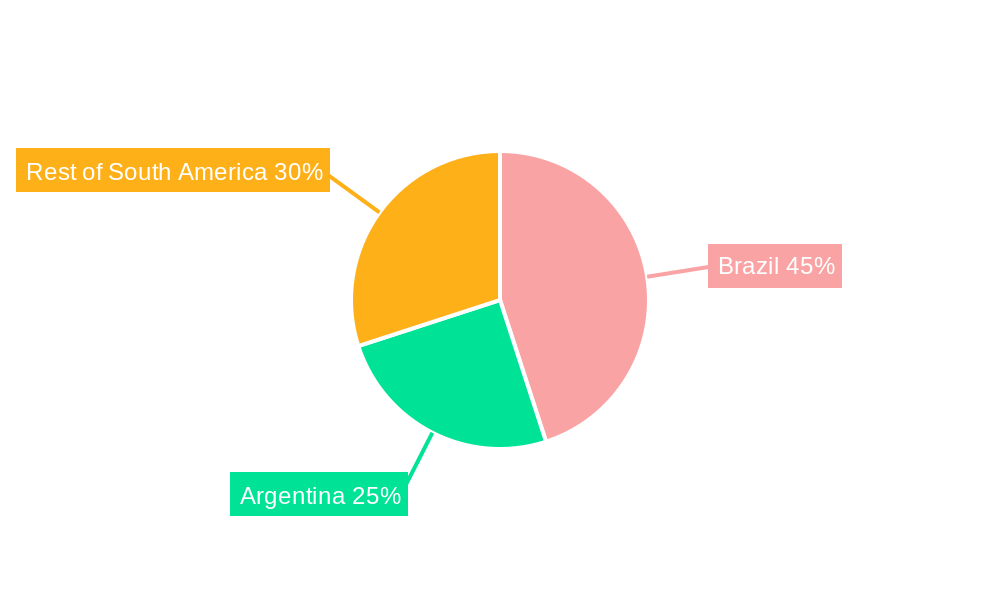

Leading Regions, Countries, or Segments in South America Remote Patient Monitoring Systems Market

The South America remote patient monitoring systems market is experiencing dynamic growth across its various segments and geographies. Among the geographical regions, Brazil stands out as the dominant market, driven by its large population, relatively developed healthcare infrastructure, and increasing government initiatives to promote digital health solutions. Argentina also represents a significant market, with a growing awareness of RPM benefits, particularly for chronic disease management. The "Rest of South America" segment, encompassing countries like Colombia, Chile, and Peru, is showing substantial promise with increasing investment in healthcare technology and a rising need for accessible healthcare services in remote areas.

In terms of Type of Device, Heart Monitors command the largest market share, reflecting the high prevalence of cardiovascular diseases across South America. These devices, including ECG monitors, blood pressure monitors, and pulse oximeters, are essential for managing conditions like hypertension, arrhythmias, and heart failure. Breath Monitors, such as spirometers and respiratory rate monitors, are gaining traction, particularly with the increasing incidence of respiratory illnesses. Hematology Monitors are also crucial for managing conditions like anemia and monitoring treatment efficacy in certain cancers. The "Others" category, encompassing devices for glucose monitoring, temperature monitoring, and neurological monitoring, is also expanding as RPM finds applications in a wider range of health conditions.

Analyzing by Application, Cardiovascular Diseases represent the largest segment, aligning with the dominance of heart monitors. The ability to remotely track vital signs associated with cardiac health significantly contributes to early detection of complications and improved patient management. Diabetes Treatment is the second-largest application, with continuous glucose monitoring systems playing a pivotal role in helping patients manage their blood sugar levels effectively. Cancer Treatment monitoring is an emerging area, with RPM systems being utilized for pain management, symptom tracking, and post-treatment recovery. The "Other Application" segment is diverse, encompassing remote monitoring for infectious diseases, neurological disorders, and post-operative care.

From an End User perspective, Home Care Settings are emerging as the fastest-growing segment. The convenience, cost-effectiveness, and patient preference for home-based care are driving this trend. Patients with chronic conditions can now receive continuous monitoring and timely interventions without frequent hospital visits. Hospital/Clinics remain significant end-users, leveraging RPM to manage patients with complex conditions, reduce hospital readmissions, and optimize resource allocation. The "Other End Users" category includes long-term care facilities and rehabilitation centers, which are increasingly adopting RPM to enhance the quality of care provided to their residents. Key drivers for this segment's dominance include favorable reimbursement policies, increasing penetration of connected devices, and the growing need to alleviate pressure on hospital infrastructure.

South America Remote Patient Monitoring Systems Market Product Innovations

Product innovations in the South America remote patient monitoring systems market are centered around enhanced accuracy, miniaturization, and seamless connectivity. Companies are developing sophisticated wearable sensors capable of continuous, non-invasive monitoring of vital signs such as ECG, SpO2, blood pressure, and temperature with medical-grade precision. AI-powered algorithms are being integrated to provide predictive analytics, alerting healthcare providers to potential health deteriorations before they become critical. For instance, smart wearable patches offer continuous cardiac monitoring with advanced arrhythmia detection capabilities, demonstrating improved patient outcomes in managing atrial fibrillation. Furthermore, the development of integrated RPM platforms streamlines data aggregation, analysis, and communication between patients and clinicians, fostering a more proactive and personalized approach to healthcare delivery. These innovations are crucial for expanding the reach of RPM to underserved populations and diverse chronic conditions.

Propelling Factors for South America Remote Patient Monitoring Systems Market Growth

The South America remote patient monitoring systems market is propelled by several key factors. A primary driver is the escalating prevalence of chronic diseases such as cardiovascular diseases, diabetes, and respiratory illnesses, necessitating continuous patient oversight. Technological advancements, including the development of sophisticated wearable sensors, AI-driven analytics, and robust connectivity solutions, are making RPM systems more accessible and effective. Government initiatives and supportive regulatory frameworks promoting digital health adoption and telehealth services are also significantly contributing to market expansion. The increasing demand for personalized and convenient healthcare solutions from an aging population and tech-savvy individuals further fuels market growth. Economic factors, such as the potential for cost savings in healthcare delivery through reduced hospitalizations and emergency room visits, are also a strong impetus for RPM adoption.

Obstacles in the South America Remote Patient Monitoring Systems Market Market

Despite robust growth, the South America remote patient monitoring systems market faces several obstacles. Regulatory challenges and the lack of standardized reimbursement policies across different countries can hinder widespread adoption. Data security and privacy concerns remain paramount, requiring robust cybersecurity measures to protect sensitive patient information. Interoperability issues between different RPM devices and existing healthcare IT systems can also pose integration challenges. Limited digital literacy and access to reliable internet connectivity in certain rural or low-income areas can restrict the reach of RPM solutions. Furthermore, initial investment costs for implementing comprehensive RPM programs can be a barrier for smaller healthcare providers. Competitive pressures from established players and new entrants also necessitate continuous innovation and cost optimization.

Future Opportunities in South America Remote Patient Monitoring Systems Market

The future of the South America remote patient monitoring systems market is ripe with opportunities. The expanding adoption of telehealth platforms presents a synergistic growth avenue for RPM. Increased focus on preventative healthcare and wellness management will drive demand for RPM solutions beyond chronic disease monitoring. The development of specialized RPM devices for niche applications, such as pediatric care and mental health monitoring, offers untapped potential. As governments continue to invest in digital health infrastructure, there will be greater opportunities for market penetration in underserved regions. The integration of advanced AI and machine learning for predictive diagnostics and personalized treatment plans will unlock new capabilities. Moreover, partnerships between technology providers, healthcare institutions, and insurance companies will pave the way for innovative service models and expanded market reach.

Major Players in the South America Remote Patient Monitoring Systems Market Ecosystem

- GE Healthcare

- Masimo Corporation

- Abbott Laboratories

- Medtronic PLC

- Omron Corporation

- NIHON KOHDEN CORPORATION

- Boston Scientific Corporation

- Baxter International Inc

Key Developments in South America Remote Patient Monitoring Systems Market Industry

- January 2023: The Pan American Health Organization (PAHO) developed a digital platform for providing health monitoring to remote populations in Latin American and Caribbean countries, enhancing access to care.

- October 2021: OMRON Healthcare Co., Ltd. made a foreign capital investment in Micromed, a leader in electrocardiography and telemedicine in Brazil. This collaboration aims to accelerate the development of solutions for cardiovascular disease management and remote patient monitoring utilizing ECG technology.

Strategic South America Remote Patient Monitoring Systems Market Market Forecast

The strategic outlook for the South America remote patient monitoring systems market is exceptionally positive, driven by a confluence of factors. The increasing adoption of advanced healthcare technologies, coupled with a growing emphasis on value-based care and preventative health strategies, will fuel substantial market expansion. The ongoing development of more sophisticated and user-friendly RPM devices, alongside robust connectivity infrastructure, will further accelerate market penetration across diverse patient populations. Projections indicate a sustained high growth trajectory, with significant opportunities arising from the expanding elderly demographic and the rising burden of chronic diseases. Strategic collaborations, innovative product launches, and supportive government policies will continue to shape this dynamic market, positioning it for significant growth and impact on healthcare delivery throughout the region.

South America Remote Patient Monitoring Systems Market Segmentation

-

1. Type of Device

- 1.1. Heart Monitors

- 1.2. Breath Monitors

- 1.3. Hematology Monitors

- 1.4. Others

-

2. Application

- 2.1. Cancer Treatment

- 2.2. Cardiovascular Diseases

- 2.3. Diabetes Treatment

- 2.4. Other Application

-

3. End User

- 3.1. Home Care Settings

- 3.2. Hospital/Clinics

- 3.3. Other End Users

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Remote Patient Monitoring Systems Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Remote Patient Monitoring Systems Market Regional Market Share

Geographic Coverage of South America Remote Patient Monitoring Systems Market

South America Remote Patient Monitoring Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Diseases and Growing Geriatric population; Growing Demand for Home-based Monitoring Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework Coupled with Lack of Proper Reimbursement

- 3.4. Market Trends

- 3.4.1. Heart Monitors Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Remote Patient Monitoring Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Heart Monitors

- 5.1.2. Breath Monitors

- 5.1.3. Hematology Monitors

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cancer Treatment

- 5.2.2. Cardiovascular Diseases

- 5.2.3. Diabetes Treatment

- 5.2.4. Other Application

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Home Care Settings

- 5.3.2. Hospital/Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Brazil South America Remote Patient Monitoring Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 6.1.1. Heart Monitors

- 6.1.2. Breath Monitors

- 6.1.3. Hematology Monitors

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cancer Treatment

- 6.2.2. Cardiovascular Diseases

- 6.2.3. Diabetes Treatment

- 6.2.4. Other Application

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Home Care Settings

- 6.3.2. Hospital/Clinics

- 6.3.3. Other End Users

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 7. Argentina South America Remote Patient Monitoring Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 7.1.1. Heart Monitors

- 7.1.2. Breath Monitors

- 7.1.3. Hematology Monitors

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cancer Treatment

- 7.2.2. Cardiovascular Diseases

- 7.2.3. Diabetes Treatment

- 7.2.4. Other Application

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Home Care Settings

- 7.3.2. Hospital/Clinics

- 7.3.3. Other End Users

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 8. Rest of South America South America Remote Patient Monitoring Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 8.1.1. Heart Monitors

- 8.1.2. Breath Monitors

- 8.1.3. Hematology Monitors

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cancer Treatment

- 8.2.2. Cardiovascular Diseases

- 8.2.3. Diabetes Treatment

- 8.2.4. Other Application

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Home Care Settings

- 8.3.2. Hospital/Clinics

- 8.3.3. Other End Users

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 GE Healthcare

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Masimo Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Abbott Laboratories

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Medtronic PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Omron Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 NIHON KOHDEN CORPORATION

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Boston Scientific Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Baxter International Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 GE Healthcare

List of Figures

- Figure 1: South America Remote Patient Monitoring Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Remote Patient Monitoring Systems Market Share (%) by Company 2025

List of Tables

- Table 1: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 2: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 3: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 12: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 13: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by End User 2020 & 2033

- Table 16: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 17: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 22: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 23: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 25: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by End User 2020 & 2033

- Table 26: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 32: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 33: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by End User 2020 & 2033

- Table 36: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 37: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: South America Remote Patient Monitoring Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: South America Remote Patient Monitoring Systems Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Remote Patient Monitoring Systems Market?

The projected CAGR is approximately 17.78%.

2. Which companies are prominent players in the South America Remote Patient Monitoring Systems Market?

Key companies in the market include GE Healthcare, Masimo Corporation, Abbott Laboratories, Medtronic PLC, Omron Corporation, NIHON KOHDEN CORPORATION, Boston Scientific Corporation, Baxter International Inc.

3. What are the main segments of the South America Remote Patient Monitoring Systems Market?

The market segments include Type of Device, Application, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 215.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Diseases and Growing Geriatric population; Growing Demand for Home-based Monitoring Devices.

6. What are the notable trends driving market growth?

Heart Monitors Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework Coupled with Lack of Proper Reimbursement.

8. Can you provide examples of recent developments in the market?

January 2023: The Pan American Health Organization (PAHO) developed a digital platform for providing health monitoring to remote populations in Latin American and Caribbean countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Remote Patient Monitoring Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Remote Patient Monitoring Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Remote Patient Monitoring Systems Market?

To stay informed about further developments, trends, and reports in the South America Remote Patient Monitoring Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence