Key Insights

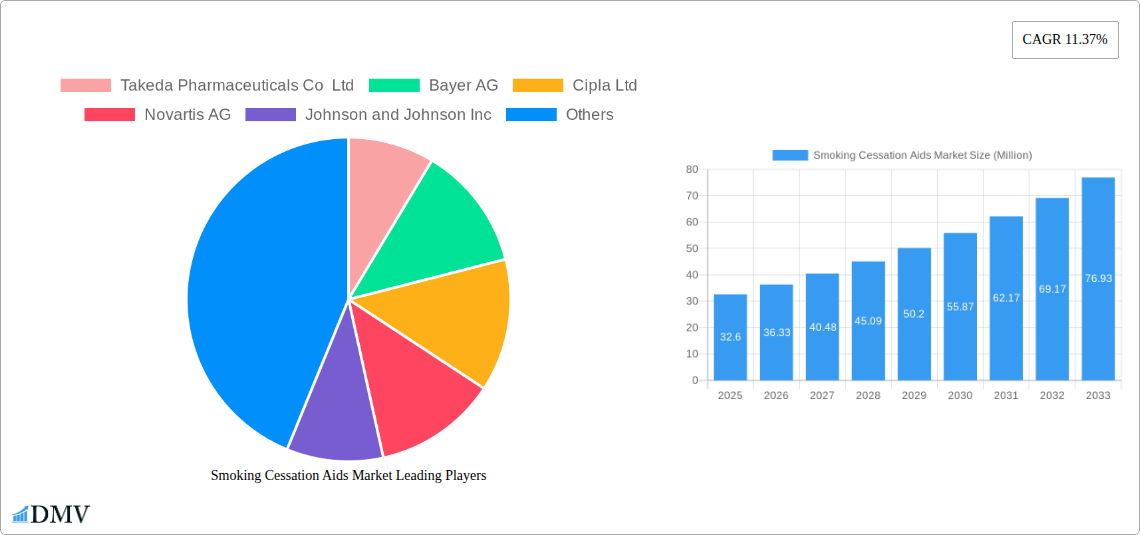

The global Smoking Cessation Aids Market is poised for robust expansion, projected to reach a substantial USD 32.60 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 11.37% throughout the forecast period of 2025-2033. This significant growth is primarily propelled by an increasing global awareness of the detrimental health impacts of smoking and a growing demand for effective methods to quit. Governments worldwide are implementing stringent anti-smoking policies and public health campaigns, further catalyzing the adoption of cessation aids. Furthermore, advancements in product development, leading to more effective and user-friendly cessation solutions like advanced nicotine replacement therapies (NRTs) and innovative electronic cigarettes designed for harm reduction, are contributing significantly to market expansion. The rising prevalence of chronic respiratory diseases and cardiovascular conditions directly linked to smoking is also a critical driver, compelling individuals to seek professional and over-the-counter cessation support.

Smoking Cessation Aids Market Market Size (In Million)

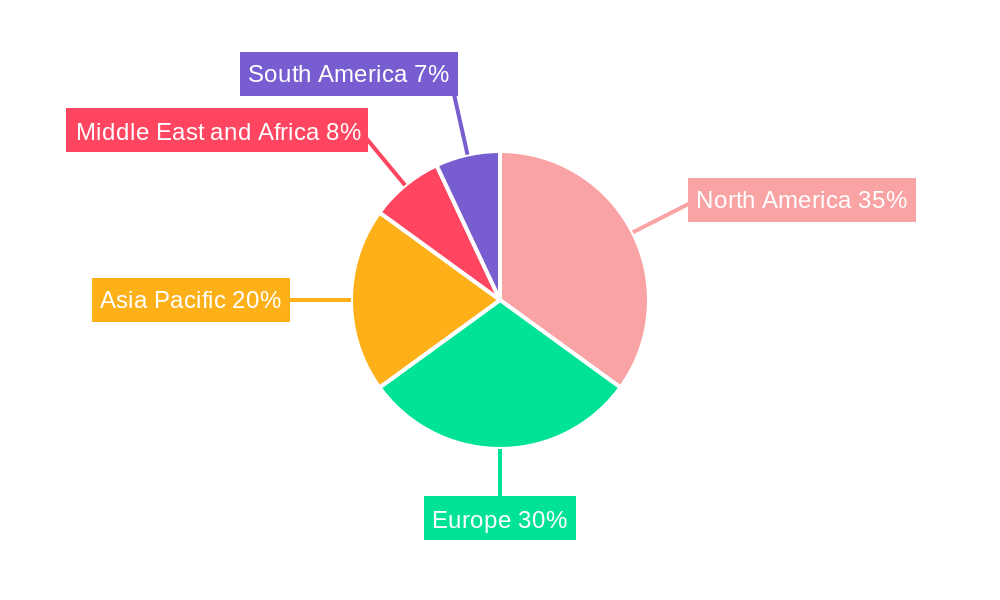

The market is segmented across various product types, including Nicotine Replacement Therapy (NRT), pharmaceutical drugs, electronic cigarettes, and other innovative products. NRTs, such as patches, gums, and lozenges, continue to be a cornerstone of smoking cessation strategies due to their established efficacy and accessibility. Electronic cigarettes, while a subject of ongoing debate, are increasingly being recognized as a potential harm reduction tool and a stepping stone for some smokers transitioning away from combustible cigarettes. The distribution channels are equally diverse, with hospital pharmacies and retail pharmacies playing a crucial role in providing direct access to these aids, complemented by the burgeoning online channels that offer convenience and a wider selection. Key players like Takeda Pharmaceuticals, Bayer AG, GlaxoSmithKline PLC, and Johnson & Johnson are investing heavily in research and development to introduce novel therapies and expand their product portfolios, further fueling market dynamics. North America and Europe currently dominate the market, owing to high smoking cessation rates and well-established healthcare infrastructures, but the Asia Pacific region is expected to witness substantial growth driven by increasing disposable incomes and rising health consciousness.

Smoking Cessation Aids Market Company Market Share

Unlock critical insights into the global smoking cessation aids market, a rapidly evolving sector driven by increasing health awareness and supportive government initiatives. This in-depth report, spanning 2019 to 2033 with a base year of 2025, provides a granular analysis of market dynamics, product innovations, regional leadership, and strategic outlook. Dive into detailed market segmentation by Nicotine Replacement Therapy (NRT), Drugs, Electronic Cigarettes, and Other Products, and understand end-user penetration across Hospital Pharmacies, Online Channels, Retail Pharmacies, and Other End Users. With projections from 2025 to 2033 and historical data from 2019-2024, this report is your definitive guide to understanding the present and future of smoking cessation solutions.

Smoking Cessation Aids Market Market Composition & Trends

The smoking cessation aids market is characterized by a dynamic interplay of established pharmaceutical giants and agile new entrants, driving innovation and market concentration. Key trends include a growing emphasis on nicotine replacement therapy (NRT), the rise of innovative drugs for addiction management, and the persistent evolution of electronic cigarettes as a harm-reduction tool. Regulatory landscapes continue to shape market access and product development, with governments worldwide implementing stricter tobacco control policies and offering incentives for smoking cessation. Substitute products, while present, are increasingly being outcompeted by scientifically validated and government-approved cessation aids. End-user profiles reveal a growing demand from health-conscious individuals seeking effective, accessible solutions, with a significant shift towards online channels for convenience and discreet purchasing. Mergers and acquisitions (M&A) activities remain a critical factor in market consolidation and the expansion of product portfolios, with recent deal values expected to drive further integration. Understanding the precise market share distribution and the strategic rationale behind M&A transactions is crucial for navigating this competitive ecosystem.

- Market Concentration: Dominated by a mix of large pharmaceutical companies and specialized NRT/e-cigarette manufacturers.

- Innovation Catalysts: Growing public health concerns, government anti-smoking campaigns, and advancements in pharmaceutical research.

- Regulatory Landscapes: Stringent regulations on tobacco products, coupled with supportive policies for smoking cessation interventions.

- Substitute Products: Limited efficacy of traditional methods compared to NRT, prescription drugs, and newer electronic alternatives.

- End-User Profiles: Increasing demand from individuals motivated by health benefits, cost savings, and social pressures to quit.

- M&A Activities: Strategic acquisitions aimed at expanding product portfolios, geographical reach, and technological capabilities.

Smoking Cessation Aids Market Industry Evolution

The smoking cessation aids market has witnessed a remarkable evolution over the past decade, propelled by a confluence of factors including escalating public health awareness, robust governmental support, and continuous technological innovation. The historical period from 2019 to 2024 saw steady growth, driven by increasing prevalence of smoking-related diseases and a corresponding surge in demand for effective quitting solutions. Market growth trajectories have been significantly influenced by advancements in pharmaceutical research, leading to the development of novel pharmacotherapies that offer improved efficacy and reduced side effects compared to older alternatives. For instance, the introduction of varenicline and bupropion has revolutionized the pharmacological approach to nicotine addiction, providing millions with a scientifically backed pathway to quit.

Technological advancements have been particularly disruptive, with the emergence and refinement of electronic cigarettes and heat-not-burn (HNB) devices. While initially met with skepticism, these products have gained traction as potentially less harmful alternatives for adult smokers unable to quit through conventional means. The global smoking cessation aids market size has seen a substantial uplift due to the increasing adoption of these new-generation products, alongside continued strength in traditional nicotine replacement therapy (NRT) products such as patches, gums, and lozenges. NRT continues to be a cornerstone, offering a gradual reduction in nicotine intake, thus mitigating withdrawal symptoms. The market's growth rate has been consistently positive, with an estimated CAGR of around 8.5% during the historical period, reflecting sustained demand.

Shifting consumer demands are also playing a pivotal role. Smokers are increasingly seeking personalized and convenient cessation solutions. This has led to the expansion of online channels for product distribution, allowing for greater accessibility and discretion. Furthermore, the growing understanding of the psychological and behavioral aspects of addiction has spurred the development of integrated cessation programs that combine pharmacotherapy with counseling and digital support tools. The smoking cessation aids market forecast indicates a continued upward trend, with projected market value to reach over USD 40,000 million by 2033. This expansion will be fueled by ongoing research into novel drug delivery systems, the increasing affordability and accessibility of cessation aids in emerging economies, and a persistent societal push towards a smoke-free future. The adoption of electronic cigarettes is expected to remain a significant factor, albeit with evolving regulatory frameworks influencing their market penetration.

Leading Regions, Countries, or Segments in Smoking Cessation Aids Market

The global smoking cessation aids market exhibits distinct regional dominance and segment leadership, driven by varied public health policies, economic conditions, and consumer behaviors. North America and Europe currently lead the market, primarily due to their well-established healthcare infrastructures, high per capita income, and proactive government initiatives aimed at tobacco control and smoking cessation. The strong presence of major pharmaceutical companies and a high level of health consciousness among the populace contribute to the significant market share in these regions.

Within the product segmentation, Nicotine Replacement Therapy (NRT) remains a dominant segment. NRT products, including patches, gums, lozenges, and inhalers, are widely recognized and accessible, offering a gradual method for nicotine withdrawal. The continuous innovation in NRT formulations and delivery systems further bolsters its market position. Following closely is the Drugs segment, which includes prescription medications like varenicline and bupropion. These drugs have demonstrated high efficacy in clinical trials and are often recommended by healthcare professionals, contributing to their substantial market penetration.

The Electronic Cigarettes segment, while experiencing rapid growth and innovation, operates within a more complex regulatory environment in many countries. Despite this, its role as a harm-reduction tool for adult smokers unable to quit traditional cigarettes continues to drive adoption, particularly in regions with less stringent regulations on e-cigarettes. "Other Products" encompass a range of emerging aids and support systems, showing potential for future growth.

In terms of end-user segmentation, Online Channels are rapidly emerging as a key distribution platform. The convenience, anonymity, and wider product selection offered by online retailers have led to a significant shift in consumer purchasing habits. Retail Pharmacies also maintain a strong presence, providing direct access to over-the-counter NRT products and enabling pharmacist consultations. Hospital Pharmacies cater to patients requiring medical supervision for their cessation journey, particularly for prescription drugs.

- Dominant Region: North America

- Key Drivers: Extensive public health campaigns, strong regulatory support for smoking cessation programs, high disposable incomes, and a significant prevalence of smoking-related diseases driving demand for aids.

- Analysis: The U.S. market, in particular, benefits from widespread availability of both OTC and prescription cessation options, coupled with insurance coverage for smoking cessation treatments.

- Dominant Segment: Nicotine Replacement Therapy (NRT)

- Key Drivers: High awareness and acceptance of NRT products, diverse product offerings (patches, gums, lozenges), and their classification as over-the-counter medications in many markets.

- Analysis: NRT's gradual nicotine delivery mechanism is perceived as a less intimidating starting point for many smokers looking to quit, making it a consistently high-performing segment.

- Emerging Segment: Electronic Cigarettes

- Key Drivers: Perceived harm reduction benefits compared to combustible cigarettes, technological advancements in device design and e-liquid formulations, and a growing user base seeking alternatives.

- Analysis: While regulatory scrutiny remains, the segment's innovation and appeal to a specific demographic of smokers continue to drive its market expansion, particularly in specific geographical pockets.

- Key End User: Online Channels

- Key Drivers: Growing e-commerce penetration, consumer demand for convenience and discretion, and competitive pricing offered by online retailers.

- Analysis: The ability to access a broad range of cessation aids without immediate in-person interaction has made online platforms a preferred choice for a growing segment of consumers.

Smoking Cessation Aids Market Product Innovations

The smoking cessation aids market is continuously shaped by groundbreaking product innovations designed to enhance efficacy, improve user experience, and cater to diverse quitting preferences. Significant advancements are being made in Nicotine Replacement Therapy (NRT), with the development of faster-acting formulations and more discreet delivery systems like sublingual tablets and nasal sprays, offering rapid relief from cravings. In the Drugs segment, research is focused on developing next-generation medications with improved safety profiles and personalized treatment approaches, potentially targeting specific genetic predispositions to nicotine addiction. The Electronic Cigarette landscape is witnessing rapid innovation in device technology, battery life, and e-liquid flavors, with a growing emphasis on product safety and reduced exposure to harmful byproducts. Furthermore, "Other Products" are emerging, including advanced wearable devices that monitor physiological cues and provide real-time cessation support, alongside AI-powered mobile applications offering personalized coaching and behavioral therapy.

Propelling Factors for Smoking Cessation Aids Market Growth

Several key factors are propelling the growth of the smoking cessation aids market. Heightened global health awareness and the increasing burden of smoking-related diseases are primary drivers, motivating individuals to seek effective quitting solutions. Supportive government policies, including smoking bans in public places, increased taxation on tobacco products, and public funding for cessation programs, create a favorable environment for market expansion. Technological advancements in pharmaceuticals and device development have led to more efficacious and user-friendly cessation aids, including novel drugs and improved Nicotine Replacement Therapies (NRTs). The growing acceptance of electronic cigarettes as a harm-reduction strategy also contributes to market growth.

Obstacles in the Smoking Cessation Aids Market Market

Despite robust growth, the smoking cessation aids market faces several obstacles. Stringent and evolving regulatory landscapes, particularly for electronic cigarettes, can create market uncertainty and hinder product development and marketing. The high cost of some prescription cessation drugs and limited insurance coverage in certain regions can act as a barrier to accessibility for a significant portion of the population. The persistent social acceptance of smoking in some cultures and the addictive nature of nicotine present psychological hurdles for individuals attempting to quit. Additionally, supply chain disruptions and the competitive pressure from illicit or unregulated products can impact market stability and consumer trust.

Future Opportunities in Smoking Cessation Aids Market

The smoking cessation aids market is ripe with future opportunities. The untapped potential in emerging economies, where smoking prevalence is high but access to cessation aids is limited, presents a significant growth avenue. Technological innovations in digital health and AI-powered platforms offer opportunities for personalized cessation support, remote monitoring, and behavioral interventions. The ongoing development of novel pharmacotherapies with enhanced efficacy and fewer side effects will continue to expand the treatment landscape. Furthermore, a greater focus on harm reduction strategies and the development of safer alternatives to combustible cigarettes, alongside a push for comprehensive public health campaigns and integrated cessation services, will drive future market expansion.

Major Players in the Smoking Cessation Aids Market Ecosystem

- Takeda Pharmaceuticals Co Ltd

- Bayer AG

- Cipla Ltd

- Novartis AG

- Johnson and Johnson Inc

- British American Tobacco PLC

- Perrigo Company plc

- F Hoffmann-La Roche AG

- NJOY

- Dr Reddy's Laboratories Ltd

- GlaxoSmithKline PLC

- Imperial Brands plc

- 22nd Century group Inc

- Pfizer Inc

Key Developments in Smoking Cessation Aids Market Industry

- November 2022: Philip Morris International Inc. launched the latest heat-not-burn tobacco heating system, BONDS, by IQOS with specially designed tobacco sticks, BLENDS. It provides adults who would otherwise continue to smoke access to a portable, low-maintenance, and hassle-free smoke-free solution, as a better alternative to cigarettes, to hasten the transition to a smoke-free future.

- September 2022: Qnovia raised USD 17 million in a series A funding round led by Blue Ledge Capital. The company used this fund to develop and launch an innovative inhaler, RespiRx, a portable handheld device. It helps users manage better their nicotine withdrawals.

Strategic Smoking Cessation Aids Market Market Forecast

The strategic outlook for the smoking cessation aids market is overwhelmingly positive, driven by an intensifying global focus on public health and disease prevention. The forecast period of 2025–2033 anticipates sustained growth, fueled by ongoing innovation in pharmaceutical treatments and the expanding acceptance of harm-reduction alternatives. Increasing government interventions and public awareness campaigns will continue to drive demand for effective quitting solutions. Furthermore, the growing penetration of online channels and the development of integrated digital cessation support systems are poised to enhance accessibility and patient engagement, promising significant market potential. The strategic push towards creating a smoke-free future remains a powerful catalyst for market expansion.

Smoking Cessation Aids Market Segmentation

-

1. Product

- 1.1. Nicotine Replacement Therapy

- 1.2. Drugs

- 1.3. Electronic Cigarettes

- 1.4. Other Products

-

2. End User

- 2.1. Hospital Pharmacies

- 2.2. Online Channels

- 2.3. Retail Pharmacies

- 2.4. Other End Users

Smoking Cessation Aids Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Smoking Cessation Aids Market Regional Market Share

Geographic Coverage of Smoking Cessation Aids Market

Smoking Cessation Aids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Large Population Addicted to Smoking; Awareness of the Hazards of Smoking; Banning Advertisements of Tobacco Products

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Drugs

- 3.4. Market Trends

- 3.4.1. Electronic Cigarettes Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smoking Cessation Aids Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Nicotine Replacement Therapy

- 5.1.2. Drugs

- 5.1.3. Electronic Cigarettes

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospital Pharmacies

- 5.2.2. Online Channels

- 5.2.3. Retail Pharmacies

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Smoking Cessation Aids Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Nicotine Replacement Therapy

- 6.1.2. Drugs

- 6.1.3. Electronic Cigarettes

- 6.1.4. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospital Pharmacies

- 6.2.2. Online Channels

- 6.2.3. Retail Pharmacies

- 6.2.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Smoking Cessation Aids Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Nicotine Replacement Therapy

- 7.1.2. Drugs

- 7.1.3. Electronic Cigarettes

- 7.1.4. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospital Pharmacies

- 7.2.2. Online Channels

- 7.2.3. Retail Pharmacies

- 7.2.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Smoking Cessation Aids Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Nicotine Replacement Therapy

- 8.1.2. Drugs

- 8.1.3. Electronic Cigarettes

- 8.1.4. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospital Pharmacies

- 8.2.2. Online Channels

- 8.2.3. Retail Pharmacies

- 8.2.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Smoking Cessation Aids Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Nicotine Replacement Therapy

- 9.1.2. Drugs

- 9.1.3. Electronic Cigarettes

- 9.1.4. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospital Pharmacies

- 9.2.2. Online Channels

- 9.2.3. Retail Pharmacies

- 9.2.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Smoking Cessation Aids Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Nicotine Replacement Therapy

- 10.1.2. Drugs

- 10.1.3. Electronic Cigarettes

- 10.1.4. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospital Pharmacies

- 10.2.2. Online Channels

- 10.2.3. Retail Pharmacies

- 10.2.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Takeda Pharmaceuticals Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cipla Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Novartis AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson and Johnson Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 British American Tobacco PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Perrigo Company plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 F Hoffmann-La Roche AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NJOY

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dr Reddy's Laboratories Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GlaxoSmithKline PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Imperial Brands plc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 22nd Century group Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Pfizer Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Takeda Pharmaceuticals Co Ltd

List of Figures

- Figure 1: Global Smoking Cessation Aids Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Smoking Cessation Aids Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Smoking Cessation Aids Market Revenue (Million), by Product 2025 & 2033

- Figure 4: North America Smoking Cessation Aids Market Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Smoking Cessation Aids Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Smoking Cessation Aids Market Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Smoking Cessation Aids Market Revenue (Million), by End User 2025 & 2033

- Figure 8: North America Smoking Cessation Aids Market Volume (K Unit), by End User 2025 & 2033

- Figure 9: North America Smoking Cessation Aids Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Smoking Cessation Aids Market Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Smoking Cessation Aids Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Smoking Cessation Aids Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Smoking Cessation Aids Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Smoking Cessation Aids Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Smoking Cessation Aids Market Revenue (Million), by Product 2025 & 2033

- Figure 16: Europe Smoking Cessation Aids Market Volume (K Unit), by Product 2025 & 2033

- Figure 17: Europe Smoking Cessation Aids Market Revenue Share (%), by Product 2025 & 2033

- Figure 18: Europe Smoking Cessation Aids Market Volume Share (%), by Product 2025 & 2033

- Figure 19: Europe Smoking Cessation Aids Market Revenue (Million), by End User 2025 & 2033

- Figure 20: Europe Smoking Cessation Aids Market Volume (K Unit), by End User 2025 & 2033

- Figure 21: Europe Smoking Cessation Aids Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Smoking Cessation Aids Market Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Smoking Cessation Aids Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Smoking Cessation Aids Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Smoking Cessation Aids Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Smoking Cessation Aids Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Smoking Cessation Aids Market Revenue (Million), by Product 2025 & 2033

- Figure 28: Asia Pacific Smoking Cessation Aids Market Volume (K Unit), by Product 2025 & 2033

- Figure 29: Asia Pacific Smoking Cessation Aids Market Revenue Share (%), by Product 2025 & 2033

- Figure 30: Asia Pacific Smoking Cessation Aids Market Volume Share (%), by Product 2025 & 2033

- Figure 31: Asia Pacific Smoking Cessation Aids Market Revenue (Million), by End User 2025 & 2033

- Figure 32: Asia Pacific Smoking Cessation Aids Market Volume (K Unit), by End User 2025 & 2033

- Figure 33: Asia Pacific Smoking Cessation Aids Market Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Pacific Smoking Cessation Aids Market Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia Pacific Smoking Cessation Aids Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Smoking Cessation Aids Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Smoking Cessation Aids Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Smoking Cessation Aids Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Smoking Cessation Aids Market Revenue (Million), by Product 2025 & 2033

- Figure 40: Middle East and Africa Smoking Cessation Aids Market Volume (K Unit), by Product 2025 & 2033

- Figure 41: Middle East and Africa Smoking Cessation Aids Market Revenue Share (%), by Product 2025 & 2033

- Figure 42: Middle East and Africa Smoking Cessation Aids Market Volume Share (%), by Product 2025 & 2033

- Figure 43: Middle East and Africa Smoking Cessation Aids Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Middle East and Africa Smoking Cessation Aids Market Volume (K Unit), by End User 2025 & 2033

- Figure 45: Middle East and Africa Smoking Cessation Aids Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Middle East and Africa Smoking Cessation Aids Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Middle East and Africa Smoking Cessation Aids Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Smoking Cessation Aids Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Smoking Cessation Aids Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Smoking Cessation Aids Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Smoking Cessation Aids Market Revenue (Million), by Product 2025 & 2033

- Figure 52: South America Smoking Cessation Aids Market Volume (K Unit), by Product 2025 & 2033

- Figure 53: South America Smoking Cessation Aids Market Revenue Share (%), by Product 2025 & 2033

- Figure 54: South America Smoking Cessation Aids Market Volume Share (%), by Product 2025 & 2033

- Figure 55: South America Smoking Cessation Aids Market Revenue (Million), by End User 2025 & 2033

- Figure 56: South America Smoking Cessation Aids Market Volume (K Unit), by End User 2025 & 2033

- Figure 57: South America Smoking Cessation Aids Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: South America Smoking Cessation Aids Market Volume Share (%), by End User 2025 & 2033

- Figure 59: South America Smoking Cessation Aids Market Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Smoking Cessation Aids Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Smoking Cessation Aids Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Smoking Cessation Aids Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smoking Cessation Aids Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Smoking Cessation Aids Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Smoking Cessation Aids Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Smoking Cessation Aids Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Global Smoking Cessation Aids Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Smoking Cessation Aids Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Smoking Cessation Aids Market Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Global Smoking Cessation Aids Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Global Smoking Cessation Aids Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Smoking Cessation Aids Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Global Smoking Cessation Aids Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Smoking Cessation Aids Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Smoking Cessation Aids Market Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Global Smoking Cessation Aids Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 21: Global Smoking Cessation Aids Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Smoking Cessation Aids Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global Smoking Cessation Aids Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Smoking Cessation Aids Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Smoking Cessation Aids Market Revenue Million Forecast, by Product 2020 & 2033

- Table 38: Global Smoking Cessation Aids Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 39: Global Smoking Cessation Aids Market Revenue Million Forecast, by End User 2020 & 2033

- Table 40: Global Smoking Cessation Aids Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 41: Global Smoking Cessation Aids Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Smoking Cessation Aids Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Australia Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Smoking Cessation Aids Market Revenue Million Forecast, by Product 2020 & 2033

- Table 56: Global Smoking Cessation Aids Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 57: Global Smoking Cessation Aids Market Revenue Million Forecast, by End User 2020 & 2033

- Table 58: Global Smoking Cessation Aids Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 59: Global Smoking Cessation Aids Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Smoking Cessation Aids Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: GCC Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Smoking Cessation Aids Market Revenue Million Forecast, by Product 2020 & 2033

- Table 68: Global Smoking Cessation Aids Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 69: Global Smoking Cessation Aids Market Revenue Million Forecast, by End User 2020 & 2033

- Table 70: Global Smoking Cessation Aids Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 71: Global Smoking Cessation Aids Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Smoking Cessation Aids Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Smoking Cessation Aids Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Smoking Cessation Aids Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smoking Cessation Aids Market?

The projected CAGR is approximately 11.37%.

2. Which companies are prominent players in the Smoking Cessation Aids Market?

Key companies in the market include Takeda Pharmaceuticals Co Ltd, Bayer AG, Cipla Ltd, Novartis AG, Johnson and Johnson Inc, British American Tobacco PLC, Perrigo Company plc, F Hoffmann-La Roche AG, NJOY, Dr Reddy's Laboratories Ltd, GlaxoSmithKline PLC, Imperial Brands plc, 22nd Century group Inc, Pfizer Inc.

3. What are the main segments of the Smoking Cessation Aids Market?

The market segments include Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Large Population Addicted to Smoking; Awareness of the Hazards of Smoking; Banning Advertisements of Tobacco Products.

6. What are the notable trends driving market growth?

Electronic Cigarettes Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Adverse Effects of Drugs.

8. Can you provide examples of recent developments in the market?

November 2022: Philip Morris International Inc. launched the latest heat-not-burn tobacco heating system, BONDS, by IQOS with specially designed tobacco sticks, BLENDS. It provides adults who would otherwise continue to smoke access to a portable, low-maintenance, and hassle-free smoke-free solution, as a better alternative to cigarettes, to hasten the transition to a smoke-free future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smoking Cessation Aids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smoking Cessation Aids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smoking Cessation Aids Market?

To stay informed about further developments, trends, and reports in the Smoking Cessation Aids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence