Key Insights

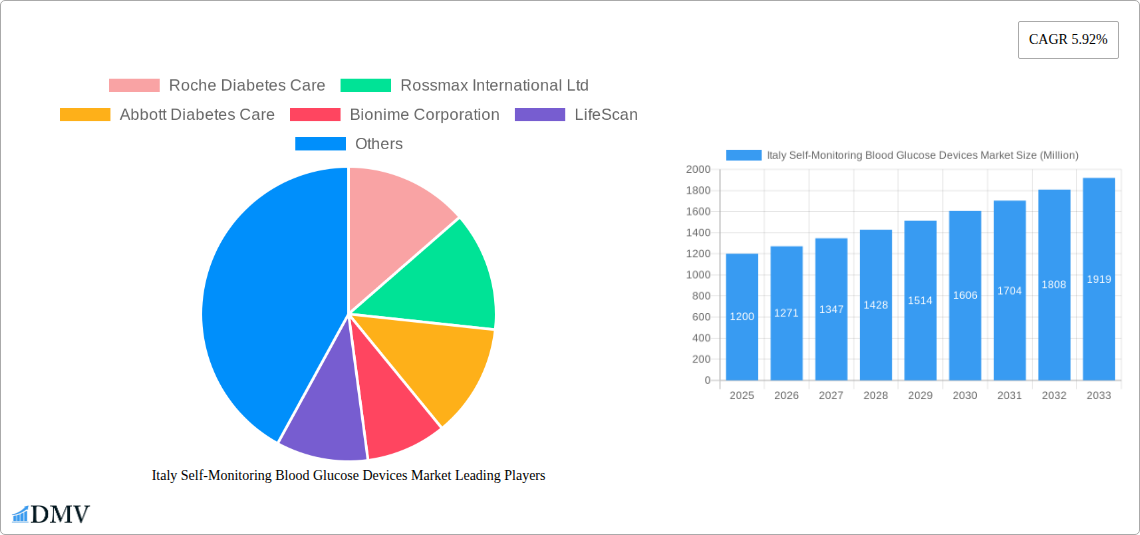

The Italian market for Self-Monitoring Blood Glucose (SMBG) devices is poised for substantial growth, driven by an increasing prevalence of diabetes and a growing awareness of proactive health management. With a current market size estimated at €1.20 billion, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.92% through 2033. This robust growth is underpinned by several key factors. The rising incidence of type 1 and type 2 diabetes, particularly among an aging population, necessitates regular blood glucose monitoring. Furthermore, advancements in technology are leading to the development of more user-friendly, accurate, and connected SMBG devices, encouraging greater adoption among patients. Government initiatives promoting diabetes awareness and management, alongside increasing healthcare expenditure, also contribute significantly to market expansion. The market is segmented into key components: glucometer devices, test strips, and lancets, with each segment experiencing steady demand.

Italy Self-Monitoring Blood Glucose Devices Market Market Size (In Billion)

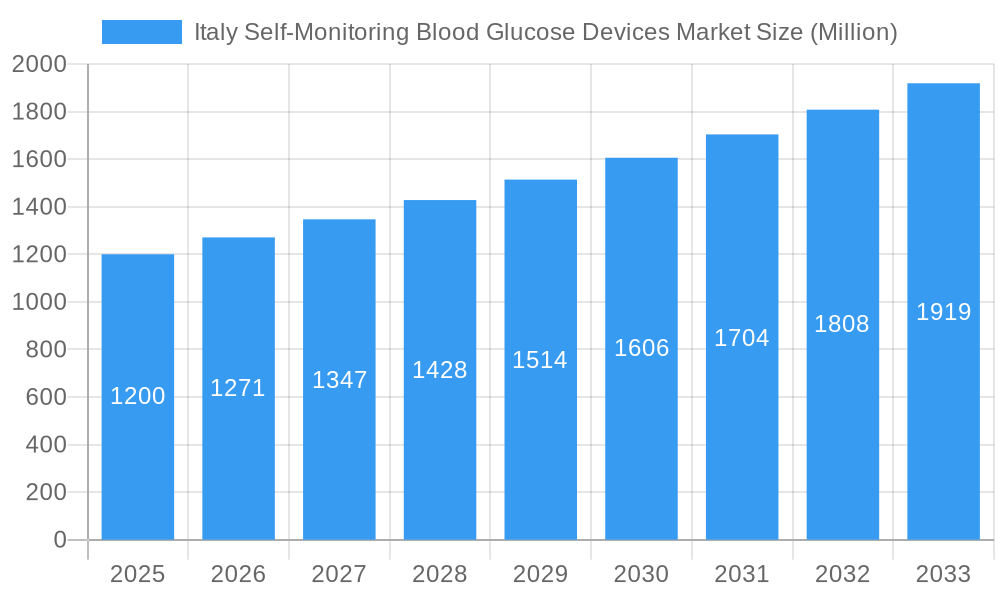

Key players like Roche Diabetes Care, Abbott Diabetes Care, and LifeScan are actively competing within the Italian SMBG landscape, focusing on innovation and expanding their product portfolios. The competitive intensity is high, with companies continually investing in research and development to introduce next-generation devices, including continuous glucose monitoring (CGM) systems, which are gaining traction. While the market is driven by the need for effective diabetes management, certain restraints exist, such as the cost of devices and consumables for some patient segments, and the ongoing transition towards more advanced CGM technologies for certain user groups. However, the overall outlook for the Italian SMBG market remains exceptionally positive, with opportunities for continued innovation and increased patient access to essential monitoring tools.

Italy Self-Monitoring Blood Glucose Devices Market Company Market Share

This in-depth report delivers a strategic analysis of the Italy Self-Monitoring Blood Glucose Devices Market, providing critical insights into market dynamics, growth drivers, and future projections. With a study period spanning 2019–2033, a base year of 2025, and a forecast period from 2025–2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning opportunities within the Italian diabetes management sector. We meticulously examine key segments including Glucometer Devices, Test Strips, and Lancets, offering a granular view of their individual performance and contribution to the overall market.

Italy Self-Monitoring Blood Glucose Devices Market Market Composition & Trends

The Italy Self-Monitoring Blood Glucose Devices Market is characterized by a dynamic interplay of established players and emerging innovators, driven by an increasing prevalence of diabetes and a growing awareness of proactive health management. Market concentration is moderate, with key companies holding significant shares, yet innovation remains a critical catalyst for competitive advantage. Regulatory landscapes, influenced by EU directives and national health policies, shape product approvals and market access. Substitute products, while present, are largely superseded by the accuracy and convenience of modern SMBG devices. End-user profiles range from newly diagnosed individuals requiring basic monitoring to long-term patients seeking advanced data integration. Mergers and acquisitions (M&A) activities are pivotal in consolidating market share and expanding product portfolios; for example, recent M&A deals are valued in the range of xx Million. The overall market share distribution indicates a steady growth trajectory, with significant revenue generated from both device sales and recurring consumables.

Italy Self-Monitoring Blood Glucose Devices Market Industry Evolution

The evolution of the Italy Self-Monitoring Blood Glucose Devices Market is a testament to technological innovation and a deepening understanding of diabetes care needs. Over the historical period (2019–2024) and into the estimated year (2025), this market has witnessed a consistent upward trend in growth trajectories, fueled by an increasing prevalence of diabetes and a growing emphasis on personalized health management. Technological advancements have been the cornerstone of this evolution, moving from basic glucose meters to sophisticated, connected devices that offer seamless data synchronization with smartphones and cloud platforms. This shift has been driven by evolving consumer demands for convenience, accuracy, and comprehensive diabetes management solutions. The adoption metrics for advanced SMBG devices, particularly those with Bluetooth connectivity, have seen substantial growth, indicating a preference for integrated digital health ecosystems. For instance, the average annual growth rate for the overall market has been approximately xx%, with segments like connected glucometers exhibiting even higher expansion. The increasing availability of innovative test strips with improved accuracy and faster results, alongside user-friendly lancets, further contributes to the positive market outlook. This sustained industry evolution, marked by continuous product refinement and a focus on user experience, positions the Italy Self-Monitoring Blood Glucose Devices Market for robust future expansion.

Leading Regions, Countries, or Segments in Italy Self-Monitoring Blood Glucose Devices Market

Within the Italy Self-Monitoring Blood Glucose Devices Market, the Glucometer Devices segment stands out as the dominant force, representing the core of self-monitoring capabilities. This dominance is underscored by several key drivers, including a substantial installed base of users and continuous technological advancements that enhance device functionality and user-friendliness.

Glucometer Devices: This segment commands the largest market share due to its foundational role in diabetes management. Investment trends are heavily skewed towards research and development in areas such as faster blood glucose reading times, smaller sample volume requirements, and improved connectivity features. Regulatory support, while overarching for all medical devices, specifically prioritizes the accuracy and reliability of glucometer devices to ensure effective patient care.

Test Strips: As a critical consumable for glucometers, test strips represent a significant and consistent revenue stream. The market for test strips is driven by the sheer volume of tests performed daily by individuals managing diabetes. Innovation in this sub-segment focuses on reducing the cost per strip, enhancing accuracy across varying environmental conditions, and developing strips compatible with the latest generations of glucometers.

Lancets: While a smaller segment in terms of overall market value compared to glucometers and test strips, lancets remain essential for sample collection. The market is characterized by a demand for pain-free and easy-to-use lancing devices. Trends include the development of adjustable depth lancets for personalized comfort and safety, as well as integrated lancing solutions that streamline the testing process.

The dominance of Glucometer Devices is further amplified by an aging population increasingly susceptible to diabetes and a growing awareness among healthcare professionals about the benefits of regular self-monitoring for better glycemic control. The Italian healthcare system's gradual embrace of digital health solutions also bolsters the demand for connected glucometers, further solidifying this segment's leading position.

Italy Self-Monitoring Blood Glucose Devices Market Product Innovations

Product innovation in the Italy Self-Monitoring Blood Glucose Devices Market is rapidly transforming diabetes care. Recent advancements focus on enhancing user experience and data integration. For instance, newer glucometer devices offer faster test times, require smaller blood samples, and boast improved accuracy. Many now feature Bluetooth connectivity, enabling seamless data transfer to smartphone applications. These connected devices provide users with historical data, trend analysis, and personalized insights, fostering better adherence to treatment plans. The unique selling proposition of these innovations lies in their ability to empower patients with actionable information, thereby improving overall glycemic control and reducing the risk of long-term complications. Performance metrics consistently show improved patient engagement and a reduction in A1C levels among users of these advanced systems.

Propelling Factors for Italy Self-Monitoring Blood Glucose Devices Market Growth

Several factors are propelling the Italy Self-Monitoring Blood Glucose Devices Market. The increasing global and national prevalence of diabetes, driven by lifestyle changes and an aging population, creates a growing demand for effective management tools. Technological advancements, such as the development of connected glucometers and continuous glucose monitoring (CGM) systems, offer enhanced accuracy, convenience, and data integration, appealing to tech-savvy consumers. Supportive government initiatives and healthcare policies aimed at promoting proactive diabetes management further fuel market expansion. Economic factors, including rising disposable incomes and increasing health expenditure, enable greater investment in personal health devices.

Obstacles in the Italy Self-Monitoring Blood Glucose Devices Market Market

Despite its promising growth, the Italy Self-Monitoring Blood Glucose Devices Market faces certain obstacles. Regulatory hurdles and stringent approval processes for new medical devices can delay market entry and increase development costs. Supply chain disruptions, as evidenced by recent global events, can impact the availability and pricing of essential components like test strips. Intense competition among numerous market players can lead to price wars and squeeze profit margins. Furthermore, the high cost of advanced SMBG devices and consumables can be a barrier for some segments of the population, particularly those with limited financial resources. Patient adherence to regular testing can also be a challenge, influenced by factors such as user fatigue and lack of perceived immediate benefit.

Future Opportunities in Italy Self-Monitoring Blood Glucose Devices Market

The Italy Self-Monitoring Blood Glucose Devices Market presents significant future opportunities. The growing trend towards personalized medicine and digital health integration opens avenues for advanced analytics and AI-driven insights derived from SMBG data. Expansion into rural or underserved areas with tailored and affordable solutions can unlock new customer bases. The development of non-invasive or minimally invasive glucose monitoring technologies represents a long-term, disruptive opportunity. Furthermore, strategic partnerships between device manufacturers, pharmaceutical companies, and healthcare providers can create comprehensive diabetes management ecosystems, enhancing patient outcomes and driving market growth. The increasing focus on preventative healthcare also creates opportunities for devices that can identify early signs of glucose intolerance.

Major Players in the Italy Self-Monitoring Blood Glucose Devices Market Ecosystem

- Roche Diabetes Care

- Rossmax International Ltd

- Abbott Diabetes Care

- Bionime Corporation

- LifeScan

- Menarini

- Ascensia Diabetes Care

- Arkray Inc

Key Developments in Italy Self-Monitoring Blood Glucose Devices Market Industry

January 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published "Improved Glycemic Control Using a Bluetooth Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence From Over 144,000 People With Diabetes," detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes - one of the largest combined blood glucose meter and mobile diabetes app datasets ever published. This development highlights the growing evidence base for connected devices and their impact on patient outcomes.

January 2022: Roche launched its new point-of-care blood glucose monitor designed for hospital professionals, with a companion device shaped like a touchscreen smartphone that will run its own apps. The hand-held Cobas Pulse included an automated glucose test strip reader as well as a camera and touchscreen for logging other diagnostic results. It was designed to be used with patients of all ages, including neonates and people in intensive care. This launch signifies advancements in professional diabetes management solutions and catering to diverse patient needs within clinical settings.

Strategic Italy Self-Monitoring Blood Glucose Devices Market Market Forecast

The strategic outlook for the Italy Self-Monitoring Blood Glucose Devices Market is exceptionally positive, driven by a confluence of sustained diabetes prevalence, rapid technological innovation, and increasing consumer demand for proactive health management. The forecast period (2025–2033) is expected to witness robust growth, with connected devices and integrated digital health platforms becoming the industry standard. Key growth catalysts include the ongoing development of more accurate, user-friendly, and affordable SMBG devices, coupled with supportive regulatory frameworks that encourage market adoption. Opportunities for market expansion lie in leveraging data analytics for personalized treatment recommendations and exploring new service models that bundle devices with digital health support. The overall market potential remains substantial, positioning Italy as a significant market for diabetes care solutions.

Italy Self-Monitoring Blood Glucose Devices Market Segmentation

-

1. Component

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

Italy Self-Monitoring Blood Glucose Devices Market Segmentation By Geography

- 1. Italy

Italy Self-Monitoring Blood Glucose Devices Market Regional Market Share

Geographic Coverage of Italy Self-Monitoring Blood Glucose Devices Market

Italy Self-Monitoring Blood Glucose Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Italy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roche Diabetes Care

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rossmax International Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abbott Diabetes Care

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bionime Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LifeScan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Other Company Share Analyse

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Menarini

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 7 COMPETITIVE LANDSCAPE7 1 COMPANY PROFILES

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ascensia Diabetes Care

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Arkray Inc *List Not Exhaustive 7 2 COMPANY SHARE ANALYSIS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Roche Diabetes Care

List of Figures

- Figure 1: Italy Self-Monitoring Blood Glucose Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy Self-Monitoring Blood Glucose Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Italy Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Italy Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Component 2020 & 2033

- Table 4: Italy Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Self-Monitoring Blood Glucose Devices Market?

The projected CAGR is approximately 5.92%.

2. Which companies are prominent players in the Italy Self-Monitoring Blood Glucose Devices Market?

Key companies in the market include Roche Diabetes Care, Rossmax International Ltd, Abbott Diabetes Care, Bionime Corporation, LifeScan, Other Company Share Analyse, Menarini, 7 COMPETITIVE LANDSCAPE7 1 COMPANY PROFILES, Ascensia Diabetes Care, Arkray Inc *List Not Exhaustive 7 2 COMPANY SHARE ANALYSIS.

3. What are the main segments of the Italy Self-Monitoring Blood Glucose Devices Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Italy.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

January 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published Improved Glycemic Control Using a Bluetooth Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence From Over 144,000 People With Diabetes, detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes - one of the largest combined blood glucose meter and mobile diabetes app datasets ever published.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Self-Monitoring Blood Glucose Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Self-Monitoring Blood Glucose Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Self-Monitoring Blood Glucose Devices Market?

To stay informed about further developments, trends, and reports in the Italy Self-Monitoring Blood Glucose Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence