Key Insights

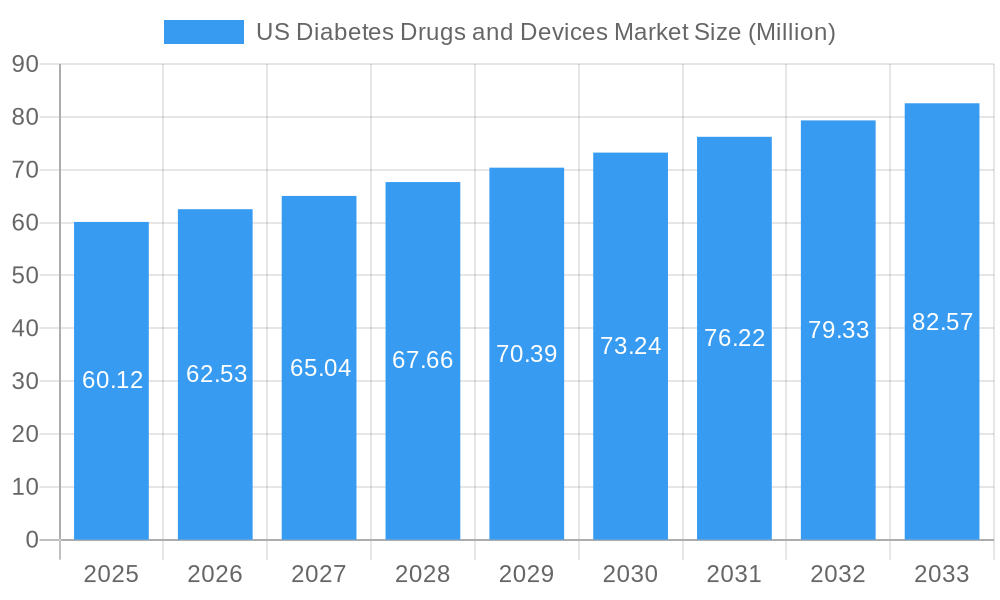

The US diabetes drugs and devices market is poised for significant expansion, projected to reach an estimated USD 60.12 million in 2025 with a robust Compound Annual Growth Rate (CAGR) exceeding 4.00%. This growth is primarily fueled by the escalating prevalence of diabetes, a growing awareness of its complications, and continuous advancements in therapeutic and monitoring technologies. The market is broadly segmented into devices, encompassing both self-monitoring and continuous glucose monitoring systems alongside insulin delivery devices like pumps, syringes, cartridges, and disposable pens, and drugs, which include oral anti-diabetic medications, insulins, combination therapies, and non-insulin injectable options. Key drivers for this expansion include the increasing incidence of type 1 and type 2 diabetes, a growing aging population who are more susceptible to the condition, and a heightened focus on proactive diabetes management through innovative solutions. Pharmaceutical giants and medical device manufacturers are heavily investing in research and development to introduce novel treatment paradigms and user-friendly devices, further stimulating market demand.

US Diabetes Drugs and Devices Market Market Size (In Million)

The market's trajectory is also shaped by emerging trends such as the rising adoption of connected diabetes management systems that integrate glucose monitoring with insulin delivery, facilitating a more personalized and efficient approach to care. The increasing demand for minimally invasive and user-friendly devices, coupled with the development of more effective and targeted drug therapies, are key growth catalysts. However, certain restraints, such as the high cost of advanced diabetes management devices and certain novel drug therapies, along with evolving reimbursement policies, could present challenges. Despite these hurdles, the overwhelming demand for better diabetes management solutions, driven by a large and growing patient pool in the US, ensures a promising outlook for the market, with significant opportunities for companies offering innovative and accessible solutions across both drug and device categories.

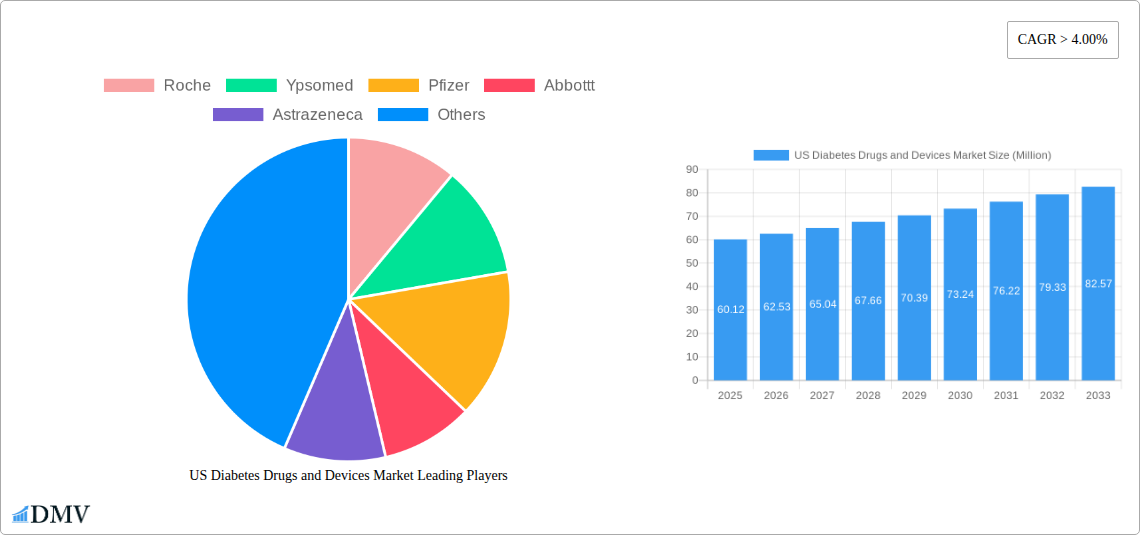

US Diabetes Drugs and Devices Market Company Market Share

This in-depth report provides an unparalleled analysis of the US Diabetes Drugs and Devices Market, a dynamic and rapidly evolving sector critical to public health. Spanning from 2019 to 2033, with a detailed base year of 2025 and a robust forecast period of 2025-2033, this study delves into the intricate interplay of innovative therapies, cutting-edge technologies, and shifting patient needs. We dissect the market's composition, identify key growth drivers and restraints, and illuminate the strategic initiatives of leading industry players. Whether you are a pharmaceutical giant, a medical device innovator, an investor, or a healthcare provider, this report offers the critical insights needed to navigate and capitalize on the future of diabetes management in the United States.

US Diabetes Drugs and Devices Market Market Composition & Trends

The US Diabetes Drugs and Devices Market exhibits a moderately consolidated landscape, characterized by intense competition and continuous innovation. Key trends include the increasing adoption of continuous glucose monitoring (CGM) systems, the growing demand for insulin pumps and advanced disposable pens, and the persistent development of novel oral anti-diabetes drugs and non-insulin injectable drugs. Regulatory approvals, particularly from the FDA, act as significant catalysts, shaping product pipelines and market entry strategies. The threat of substitute products, while present, is mitigated by the highly specialized nature of diabetes care and the long-term commitment required for effective disease management. End-user profiles are diversifying, encompassing individuals with Type 1, Type 2, and gestational diabetes, each with distinct treatment requirements. Merger and acquisition (M&A) activities remain a prominent feature, driven by the pursuit of market share expansion, technological integration, and portfolio diversification. For instance, strategic acquisitions of promising device manufacturers by larger pharmaceutical companies are common.

- Market Concentration: Moderate, with a few key players holding significant market share.

- Innovation Catalysts: FDA approvals, unmet patient needs, technological advancements.

- Regulatory Landscapes: Stringent yet supportive of innovation, impacting market access and product development.

- Substitute Products: Limited for advanced therapies and devices, but evolving in oral medications.

- End-User Profiles: Diverse, with increasing focus on personalized treatment approaches.

- M&A Activities: Active, driven by market consolidation and strategic partnerships. Estimated M&A deal values range from hundreds of millions to billions of dollars, reflecting the high stakes in this market.

US Diabetes Drugs and Devices Market Industry Evolution

The US Diabetes Drugs and Devices Market has witnessed a profound transformation, moving from reactive management to proactive, technology-driven solutions. Over the historical period of 2019-2024 and projected into the forecast period of 2025-2033, market growth has been consistently fueled by the escalating prevalence of diabetes, a direct consequence of aging demographics, sedentary lifestyles, and unhealthy dietary patterns. Technological advancements have been the primary engine of evolution. The shift from self-monitoring blood glucose (SMBG) devices to sophisticated continuous blood glucose monitoring (CGM) systems represents a paradigm shift, offering real-time data and enabling more precise insulin delivery. Similarly, insulin pump technology has advanced significantly, offering greater convenience, accuracy, and integration with CGM devices, leading to the development of hybrid closed-loop systems.

The pharmaceutical segment has seen the introduction of novel oral anti-diabetes drugs, particularly SGLT2 inhibitors and GLP-1 receptor agonists, which not only improve glycemic control but also offer cardiovascular and renal benefits, thereby expanding their utility beyond glucose management. Insulin drugs continue to evolve with the development of ultra-long-acting and rapid-acting insulins, enhancing treatment flexibility. The market has also seen a rise in combination drugs, offering the convenience of single-pill regimens for complex treatment protocols. Consumer demands have shifted towards less invasive, more user-friendly, and data-rich solutions. Patients are increasingly empowered and seek tools that facilitate active participation in their diabetes management. This demand has spurred greater investment in digital health platforms, artificial intelligence-driven insights, and connected devices. The overall growth trajectory of the market is robust, driven by a combination of increasing incidence, technological innovation, and a growing understanding of the multifactorial nature of diabetes complications. Adoption metrics for advanced devices like CGMs have seen year-on-year growth exceeding 20% in recent years.

Leading Regions, Countries, or Segments in US Diabetes Drugs and Devices Market

Within the US Diabetes Drugs and Devices Market, the United States itself stands as the preeminent region, driven by a confluence of factors that foster innovation, market penetration, and substantial patient demand. The dominance is not confined to a single segment but is remarkably distributed across both Devices and Drugs.

Devices:

Monitoring Devices: This segment, particularly Continuous Blood Glucose Monitoring (CGM), is witnessing explosive growth.

- Key Drivers:

- Technological Sophistication: Advanced sensor technology offering greater accuracy and fewer calibration requirements.

- Reimbursement Policies: Increased coverage by private insurers and Medicare for eligible patients.

- Patient Empowerment: Desire for real-time data and proactive management.

- Integration with Insulin Delivery Systems: Seamless connectivity with insulin pumps for closed-loop systems.

- Dominance Factors: The US market leads in the early adoption and widespread use of CGMs, driven by a higher disposable income and a proactive healthcare system. Companies like Dexcom have a significant presence, with their products becoming standard of care for many Type 1 diabetes patients. Self-monitoring Blood Glucose Devices (SMBG), while a more mature segment, still holds a substantial share due to cost-effectiveness and accessibility.

- Key Drivers:

Management Devices: Insulin Pumps are a cornerstone of advanced diabetes management in the US.

- Key Drivers:

- Improved Quality of Life: Offering greater flexibility and reduced burden compared to multiple daily injections.

- Advancements in Miniaturization and Connectivity: Leading to more discreet and user-friendly devices.

- Hybrid Closed-Loop Systems: The integration of pumps with CGMs has revolutionized glycemic control, making them highly desirable.

- Dominance Factors: Tandem Diabetes Care and Insulet are major players in this space, continually innovating with smart algorithms and connectivity features. Insulin Syringes, Insulin Cartridges, and Disposable Pens remain essential, with a steady demand, though the trend is shifting towards more advanced delivery systems.

- Key Drivers:

Drugs:

Oral Anti-Diabetes Drugs: The US market is a key battleground for the latest innovations in SGLT2 inhibitors and DPP-4 inhibitors, as well as emerging classes.

- Key Drivers:

- Cardiovascular and Renal Benefits: Beyond glycemic control, these drugs offer significant protective effects, expanding their prescription base.

- Growing Type 2 Diabetes Population: The sheer volume of patients with Type 2 diabetes in the US fuels demand.

- Aggressive Marketing and Physician Education: Pharmaceutical companies invest heavily in promoting these drugs.

- Dominance Factors: The US pharmaceutical market is characterized by its size and the rapid approval and adoption of new drug classes.

- Key Drivers:

Insulin Drugs: While evolving, insulin remains critical.

- Key Drivers:

- Type 1 Diabetes Management: Essential for survival and glycemic control.

- Progression of Type 2 Diabetes: Many patients eventually require insulin therapy.

- New Formulations: Development of ultra-long-acting insulins and rapid-acting analogs enhances treatment options.

- Dominance Factors: Major pharmaceutical players like Sanofi, Eli Lilly, and Novo Nordisk have a strong established presence and continue to innovate in insulin formulations.

- Key Drivers:

Combination Drugs: Offering convenience, these are gaining traction.

- Key Drivers:

- Improved Patient Adherence: Simplifies treatment regimens.

- Synergistic Efficacy: Combining multiple mechanisms of action for better glycemic control.

- Dominance Factors: Pharmaceutical companies are actively developing and promoting combination therapies.

- Key Drivers:

Non-Insulin Injectable Drugs: GLP-1 receptor agonists are particularly dominant.

- Key Drivers:

- Weight Loss Benefits: A significant advantage for many individuals with Type 2 diabetes.

- Cardiovascular Protective Effects: Further enhancing their therapeutic value.

- Increasing Awareness: Physicians and patients are increasingly recognizing their benefits.

- Dominance Factors: Companies like Novo Nordisk and Eli Lilly are leaders in this segment, with blockbuster drugs driving significant market value.

- Key Drivers:

The US market's size, advanced healthcare infrastructure, high disposable income, robust R&D environment, and strong regulatory framework for innovation make it the undisputed leader across most segments of the diabetes drugs and devices landscape.

US Diabetes Drugs and Devices Market Product Innovations

The US Diabetes Drugs and Devices Market is a hotbed of product innovation, with advancements focused on enhanced accuracy, user convenience, and personalized treatment. In devices, the evolution of Continuous Blood Glucose Monitoring (CGM) systems showcases this trend, with newer generations offering extended wear times, reduced sensor size, and improved connectivity for real-time data sharing with caregivers and healthcare providers. Insulin pumps have become smarter, integrating with CGMs to form sophisticated hybrid closed-loop systems that automatically adjust insulin delivery, significantly improving glycemic control and reducing the risk of hypoglycemia. On the drug front, innovations include the development of novel oral anti-diabetes drugs with pleiotropic effects beyond glycemic control, such as cardiovascular and renal protection. Pharmaceutical companies are also focusing on more convenient non-insulin injectable drugs, including GLP-1 receptor agonists with improved dosing schedules and efficacy for weight management.

Propelling Factors for US Diabetes Drugs and Devices Market Growth

The US Diabetes Drugs and Devices Market is propelled by a potent combination of technological, economic, and regulatory influences.

- Technological Advancements: The rapid development and adoption of continuous glucose monitoring (CGM) systems and insulin pumps, especially hybrid closed-loop systems, are transforming diabetes management by offering real-time data and automated insulin delivery.

- Rising Diabetes Prevalence: An increasing incidence of Type 1 and Type 2 diabetes, driven by lifestyle factors and an aging population, creates a perpetually expanding patient pool requiring therapeutic interventions and monitoring devices.

- Healthcare Policy and Reimbursement: Favorable reimbursement policies from government and private insurers for advanced diabetes technologies like CGMs and insulin pumps significantly enhance market accessibility and drive adoption.

- Government Initiatives and R&D Investments: Significant investments in diabetes research and development by both public and private sectors lead to the continuous pipeline of novel drugs and devices.

- Growing Health Awareness: Increased patient awareness regarding diabetes management, complications, and the benefits of early intervention encourages proactive engagement with available treatments and technologies.

Obstacles in the US Diabetes Drugs and Devices Market Market

Despite robust growth, the US Diabetes Drugs and Devices Market faces several significant obstacles.

- High Cost of Advanced Technologies: The substantial price tags associated with innovative devices like insulin pumps and advanced CGMs can be a barrier for many patients, particularly those with limited insurance coverage or high deductibles.

- Regulatory Hurdles and Approval Times: While supportive of innovation, the FDA's rigorous approval processes for new drugs and devices can lead to lengthy development timelines and increased R&D costs, impacting the speed of market entry.

- Interoperability Challenges: Ensuring seamless data exchange and integration between different devices and software platforms from various manufacturers remains a persistent technical challenge, hindering a truly connected diabetes management ecosystem.

- Physician and Patient Education Gaps: The complexity of some advanced treatment regimens necessitates continuous education for both healthcare providers and patients to ensure optimal utilization and adherence, which can be resource-intensive.

- Supply Chain Disruptions: Global supply chain vulnerabilities, as highlighted by recent events, can impact the availability and affordability of critical raw materials and finished products, leading to potential shortages.

Future Opportunities in US Diabetes Drugs and Devices Market

The US Diabetes Drugs and Devices Market presents numerous exciting future opportunities.

- AI and Machine Learning Integration: Leveraging AI for predictive analytics in glycemic control, personalized treatment recommendations, and early detection of complications.

- Expansion of Telehealth and Remote Patient Monitoring: Facilitating wider access to diabetes care, particularly for underserved populations, through virtual consultations and remote data monitoring.

- Development of "Artificial Pancreas" Systems: Continued refinement and wider adoption of fully automated closed-loop insulin delivery systems promising near-normal glucose levels.

- Preventive and Regenerative Therapies: Research into early intervention strategies, pre-diabetes management, and novel approaches to beta-cell regeneration or islet cell transplantation.

- Personalized Medicine: Tailoring treatment plans based on individual genetic profiles, lifestyle, and specific disease characteristics for enhanced efficacy and reduced side effects.

Major Players in the US Diabetes Drugs and Devices Market Ecosystem

- Roche

- Ypsomed

- Pfizer

- Abbott

- AstraZeneca

- Eli Lilly

- Sanofi

- Novartis

- Medtronic

- Tandem

- Insulet

- Novo Nordisk

- Dexcom

Key Developments in US Diabetes Drugs and Devices Market Industry

- June 2023: The U.S. Food and Drug Administration (FDA) sanctioned Lantidra, the initial allogeneic (donor) pancreatic islet cellular therapy made from deceased donor pancreatic cells. Lantidra is specifically authorized for adults with type 1 diabetes who are incapable of achieving target glycated hemoglobin due to recurrent episodes of severe hypoglycemia despite intensive diabetes management. This marks a significant advancement in cellular therapy for Type 1 diabetes.

- January 2023: Bexagliflozin (Brenzavvy, TheracosBio) received approval from the US Food and Drug Administration (FDA) for the management of type 2 diabetes in adults. This oral sodium-glucose cotransporter 2 (SGLT2) inhibitor, taken once daily at a dosage of 20 mg, is recommended as a supplementary treatment alongside diet and exercise to enhance glycemic control.

Strategic US Diabetes Drugs and Devices Market Market Forecast

The US Diabetes Drugs and Devices Market is poised for sustained and significant growth, driven by ongoing innovation and increasing healthcare expenditure. The forecast period, 2025-2033, will witness the continued dominance of advanced monitoring devices like CGMs and sophisticated management devices such as integrated insulin pump systems. Pharmaceutical advancements will focus on novel oral anti-diabetes drugs and non-insulin injectable drugs with expanded therapeutic benefits beyond glycemic control, including cardiovascular and weight management aspects. The market's trajectory is further bolstered by favorable reimbursement policies, a growing patient population, and a strong commitment to R&D. Strategic collaborations between device manufacturers and pharmaceutical companies are expected to accelerate the development of connected health solutions, enhancing patient outcomes and market penetration. The increasing emphasis on personalized medicine and preventative care will also shape the market, creating opportunities for tailored treatment approaches and early intervention strategies.

US Diabetes Drugs and Devices Market Segmentation

-

1. Devices

-

1.1. Monitoring Devices

- 1.1.1. Self-monitoring Blood Glucose Devices

- 1.1.2. Continuous Blood Glucose Monitoring

-

1.2. Management Devices

- 1.2.1. Insulin Pump

- 1.2.2. Insulin Syringes

- 1.2.3. Insulin Cartridges

- 1.2.4. Disposable Pens

-

1.1. Monitoring Devices

-

2. Drugs

- 2.1. Oral Anti-Diabetes Drugs

- 2.2. Insulin Drugs

- 2.3. Combination Drugs

- 2.4. Non-Insulin Injectable Drugs

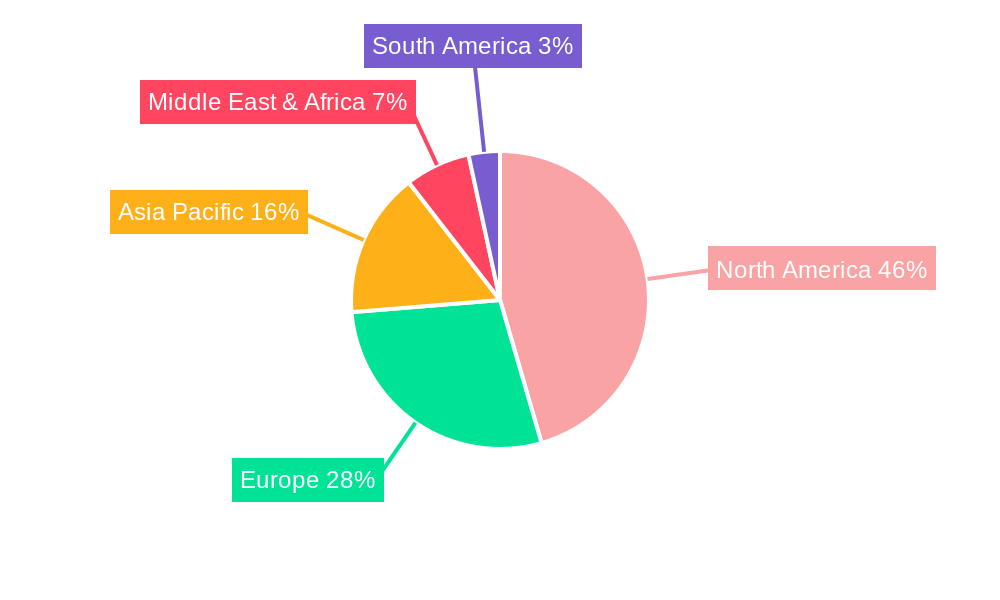

US Diabetes Drugs and Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Diabetes Drugs and Devices Market Regional Market Share

Geographic Coverage of US Diabetes Drugs and Devices Market

US Diabetes Drugs and Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Continuous Glucose Monitoring Segment is Expected to Witness Highest Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. US Diabetes Drugs and Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 5.1.1. Monitoring Devices

- 5.1.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.2. Continuous Blood Glucose Monitoring

- 5.1.2. Management Devices

- 5.1.2.1. Insulin Pump

- 5.1.2.2. Insulin Syringes

- 5.1.2.3. Insulin Cartridges

- 5.1.2.4. Disposable Pens

- 5.1.1. Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Drugs

- 5.2.1. Oral Anti-Diabetes Drugs

- 5.2.2. Insulin Drugs

- 5.2.3. Combination Drugs

- 5.2.4. Non-Insulin Injectable Drugs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 6. North America US Diabetes Drugs and Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Devices

- 6.1.1. Monitoring Devices

- 6.1.1.1. Self-monitoring Blood Glucose Devices

- 6.1.1.2. Continuous Blood Glucose Monitoring

- 6.1.2. Management Devices

- 6.1.2.1. Insulin Pump

- 6.1.2.2. Insulin Syringes

- 6.1.2.3. Insulin Cartridges

- 6.1.2.4. Disposable Pens

- 6.1.1. Monitoring Devices

- 6.2. Market Analysis, Insights and Forecast - by Drugs

- 6.2.1. Oral Anti-Diabetes Drugs

- 6.2.2. Insulin Drugs

- 6.2.3. Combination Drugs

- 6.2.4. Non-Insulin Injectable Drugs

- 6.1. Market Analysis, Insights and Forecast - by Devices

- 7. South America US Diabetes Drugs and Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Devices

- 7.1.1. Monitoring Devices

- 7.1.1.1. Self-monitoring Blood Glucose Devices

- 7.1.1.2. Continuous Blood Glucose Monitoring

- 7.1.2. Management Devices

- 7.1.2.1. Insulin Pump

- 7.1.2.2. Insulin Syringes

- 7.1.2.3. Insulin Cartridges

- 7.1.2.4. Disposable Pens

- 7.1.1. Monitoring Devices

- 7.2. Market Analysis, Insights and Forecast - by Drugs

- 7.2.1. Oral Anti-Diabetes Drugs

- 7.2.2. Insulin Drugs

- 7.2.3. Combination Drugs

- 7.2.4. Non-Insulin Injectable Drugs

- 7.1. Market Analysis, Insights and Forecast - by Devices

- 8. Europe US Diabetes Drugs and Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Devices

- 8.1.1. Monitoring Devices

- 8.1.1.1. Self-monitoring Blood Glucose Devices

- 8.1.1.2. Continuous Blood Glucose Monitoring

- 8.1.2. Management Devices

- 8.1.2.1. Insulin Pump

- 8.1.2.2. Insulin Syringes

- 8.1.2.3. Insulin Cartridges

- 8.1.2.4. Disposable Pens

- 8.1.1. Monitoring Devices

- 8.2. Market Analysis, Insights and Forecast - by Drugs

- 8.2.1. Oral Anti-Diabetes Drugs

- 8.2.2. Insulin Drugs

- 8.2.3. Combination Drugs

- 8.2.4. Non-Insulin Injectable Drugs

- 8.1. Market Analysis, Insights and Forecast - by Devices

- 9. Middle East & Africa US Diabetes Drugs and Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Devices

- 9.1.1. Monitoring Devices

- 9.1.1.1. Self-monitoring Blood Glucose Devices

- 9.1.1.2. Continuous Blood Glucose Monitoring

- 9.1.2. Management Devices

- 9.1.2.1. Insulin Pump

- 9.1.2.2. Insulin Syringes

- 9.1.2.3. Insulin Cartridges

- 9.1.2.4. Disposable Pens

- 9.1.1. Monitoring Devices

- 9.2. Market Analysis, Insights and Forecast - by Drugs

- 9.2.1. Oral Anti-Diabetes Drugs

- 9.2.2. Insulin Drugs

- 9.2.3. Combination Drugs

- 9.2.4. Non-Insulin Injectable Drugs

- 9.1. Market Analysis, Insights and Forecast - by Devices

- 10. Asia Pacific US Diabetes Drugs and Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Devices

- 10.1.1. Monitoring Devices

- 10.1.1.1. Self-monitoring Blood Glucose Devices

- 10.1.1.2. Continuous Blood Glucose Monitoring

- 10.1.2. Management Devices

- 10.1.2.1. Insulin Pump

- 10.1.2.2. Insulin Syringes

- 10.1.2.3. Insulin Cartridges

- 10.1.2.4. Disposable Pens

- 10.1.1. Monitoring Devices

- 10.2. Market Analysis, Insights and Forecast - by Drugs

- 10.2.1. Oral Anti-Diabetes Drugs

- 10.2.2. Insulin Drugs

- 10.2.3. Combination Drugs

- 10.2.4. Non-Insulin Injectable Drugs

- 10.1. Market Analysis, Insights and Forecast - by Devices

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Roche

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ypsomed

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pfizer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbottt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Astrazeneca

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eli Lilly

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sanofi

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Novartis

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Medtronic

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tandem

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Insulet

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Novo Nordisk

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Dexcom

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Roche

List of Figures

- Figure 1: US Diabetes Drugs and Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: US Diabetes Drugs and Devices Market Share (%) by Company 2025

List of Tables

- Table 1: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Devices 2020 & 2033

- Table 2: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 3: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 4: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 5: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Devices 2020 & 2033

- Table 8: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 9: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 10: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 11: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Devices 2020 & 2033

- Table 20: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 21: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 22: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 23: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Brazil US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Argentina US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Devices 2020 & 2033

- Table 32: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 33: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 34: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 35: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: United Kingdom US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Germany US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: France US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Italy US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Spain US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Russia US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Benelux US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Nordics US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Devices 2020 & 2033

- Table 56: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 57: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 58: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 59: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Turkey US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Israel US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: GCC US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: North Africa US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: South Africa US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Devices 2020 & 2033

- Table 74: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 75: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 76: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 77: US Diabetes Drugs and Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: US Diabetes Drugs and Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 79: China US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: India US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Japan US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 85: South Korea US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: ASEAN US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Oceania US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific US Diabetes Drugs and Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific US Diabetes Drugs and Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Diabetes Drugs and Devices Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the US Diabetes Drugs and Devices Market?

Key companies in the market include Roche, Ypsomed, Pfizer, Abbottt, Astrazeneca, Eli Lilly, Sanofi, Novartis, Medtronic, Tandem, Insulet, Novo Nordisk, Dexcom.

3. What are the main segments of the US Diabetes Drugs and Devices Market?

The market segments include Devices, Drugs.

4. Can you provide details about the market size?

The market size is estimated to be USD 60.12 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Continuous Glucose Monitoring Segment is Expected to Witness Highest Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

June 2023: The initial allogeneic (donor) pancreatic islet cellular therapy made from deceased donor pancreatic cells, Lantidra, has been sanctioned by the U.S. Food and Drug Administration for the management of type 1 diabetes. Lantidra is specifically authorized for adults with type 1 diabetes who are incapable of achieving target glycated hemoglobin (average blood glucose levels) due to recurrent episodes of severe hypoglycemia (low blood sugar) despite intensive diabetes management and education.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Diabetes Drugs and Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Diabetes Drugs and Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Diabetes Drugs and Devices Market?

To stay informed about further developments, trends, and reports in the US Diabetes Drugs and Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence