Key Insights

The Brazilian cardiovascular devices market is projected for robust expansion, with an estimated market size of $304.36 million by 2025, driven by a compound annual growth rate (CAGR) of 4.04% through 2033. This growth is primarily attributed to the rising incidence of cardiovascular diseases (CVDs) influenced by lifestyle shifts, an aging demographic, and increased awareness of early diagnosis and treatment. The demand for advanced diagnostic and monitoring solutions, including ECG and remote cardiac monitoring, is escalating, facilitating proactive patient management. Concurrently, therapeutic and surgical devices, encompassing cardiac assist devices, rhythm management solutions, catheters, grafts, heart valves, and stents, are experiencing significant adoption as healthcare providers increasingly favor minimally invasive procedures and advanced implantable technologies to enhance patient outcomes.

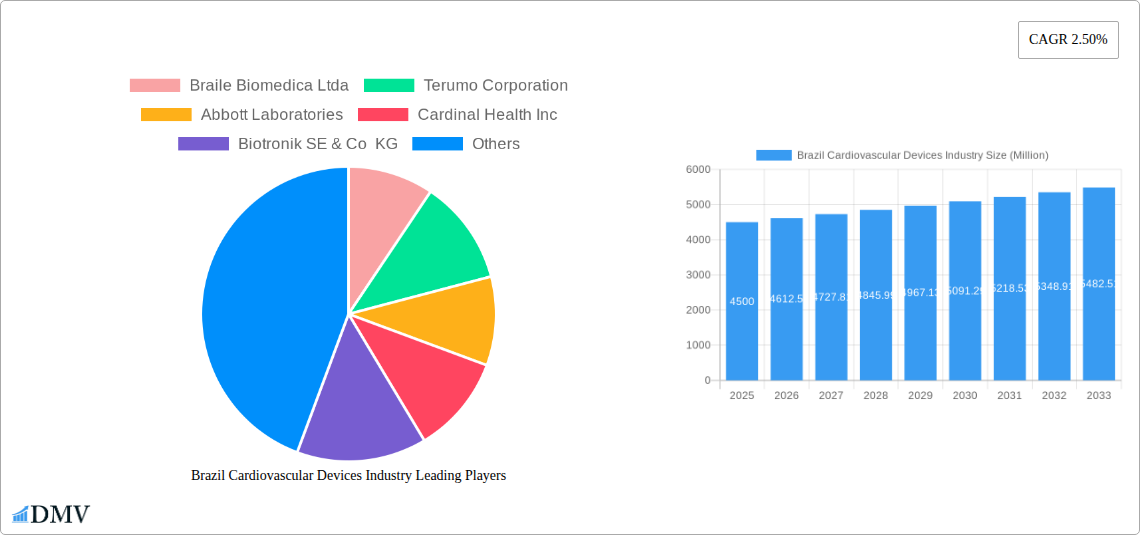

Brazil Cardiovascular Devices Industry Market Size (In Million)

Market growth is further bolstered by substantial investments in healthcare infrastructure and a focus on preventative care initiatives in Brazil. Key growth drivers include expanding healthcare expenditure, supportive government policies for medical device adoption, and continuous innovation from leading manufacturers such as Abbott Laboratories, Medtronic Inc., and Boston Scientific Corporation. However, challenges such as the high cost of advanced medical devices, the requirement for specialized professional training, and potential regulatory complexities exist. Despite these factors, ongoing technological advancements and collaborative efforts from public and private sectors to mitigate the burden of cardiovascular disease are expected to ensure a resilient and dynamic Brazilian cardiovascular devices sector.

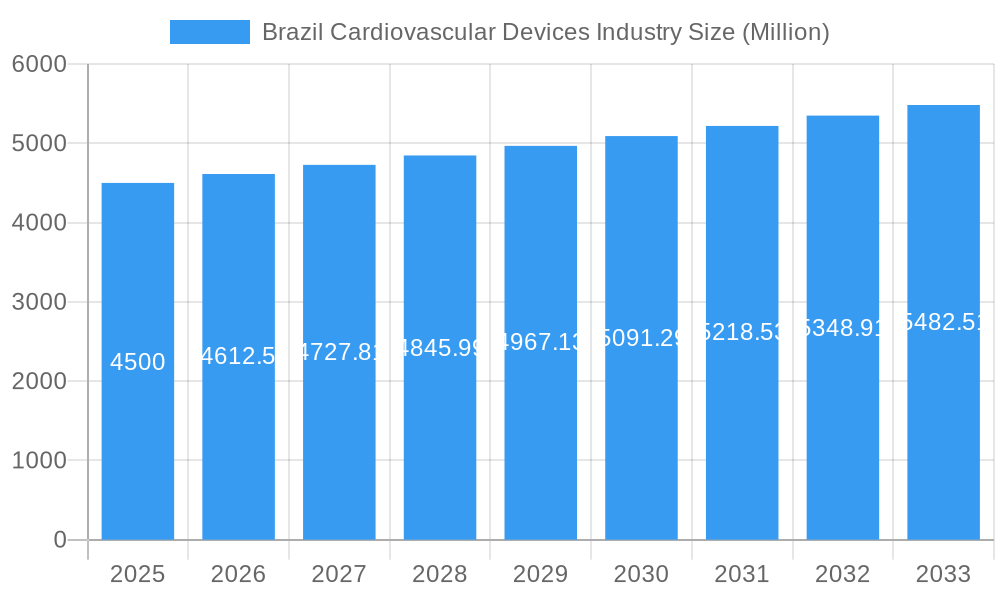

Brazil Cardiovascular Devices Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Brazil cardiovascular devices market, offering critical insights for stakeholders, investors, and industry professionals. The study covers market segmentation, trends, evolution, regional analysis, product innovations, growth drivers, challenges, and future opportunities. Utilizing a robust methodology that spans the historical period (2019–2024), base year (2025), estimated year (2025), and an extensive forecast period (2025–2033), this report serves as a definitive guide to understanding and capitalizing on the burgeoning Brazilian market for cardiovascular solutions.

Brazil Cardiovascular Devices Industry Market Composition & Trends

The Brazil cardiovascular devices market exhibits a moderate level of concentration, with key players like Medtronic Inc (Covidien Plc), Abbott Laboratories, and Edwards Lifesciences holding significant market share. Innovation in this sector is primarily driven by advancements in minimally invasive procedures and personalized treatment approaches. Regulatory frameworks, while evolving, are becoming more streamlined, fostering market entry and growth. Substitute products, such as less invasive pharmaceutical treatments, present a challenge but are often complemented by device-based interventions. End-user profiles vary, encompassing leading hospitals, specialized cardiac centers, and a growing outpatient segment. Mergers and acquisitions are a significant trend, with estimated deal values in the multi-million dollar range, aimed at consolidating market presence and expanding product portfolios. For instance, strategic acquisitions could see companies expanding their reach in areas like cardiac rhythm management devices or heart valves. Key segments such as therapeutic and surgical devices are anticipated to dominate the market share, driven by increasing prevalence of cardiovascular diseases and demand for advanced treatment options.

Brazil Cardiovascular Devices Industry Industry Evolution

The Brazil cardiovascular devices industry has undergone significant evolution, characterized by a consistent upward trajectory in market growth. The historical period from 2019 to 2024 witnessed a steady expansion, fueled by increasing healthcare expenditure and a growing awareness of cardiovascular health. This growth momentum is projected to continue into the forecast period of 2025–2033, with anticipated compound annual growth rates (CAGRs) in the high single digits, reflecting strong market potential. Technological advancements have been a primary catalyst for this evolution. Innovations in areas such as remote cardiac monitoring and advanced catheter technologies have not only improved patient outcomes but also expanded the accessibility of cardiovascular care. The adoption of these advanced devices has been accelerated by a rising prevalence of lifestyle-related diseases like obesity and diabetes, which are significant risk factors for cardiovascular ailments. Shifting consumer demands, influenced by a desire for less invasive procedures and quicker recovery times, further propel the adoption of cutting-edge cardiovascular solutions. The increasing focus on preventative healthcare and early diagnosis is also a key factor, driving demand for electrocardiogram (ECG) devices and other diagnostic tools. The market's evolution is a testament to the successful integration of technological innovation with evolving healthcare needs and patient preferences, solidifying its position as a critical segment within the broader Brazilian healthcare landscape.

Leading Regions, Countries, or Segments in Brazil Cardiovascular Devices Industry

Within the Brazil cardiovascular devices industry, the therapeutic and surgical devices segment emerges as the dominant force, consistently outperforming other categories. This dominance is particularly pronounced within the São Paulo metropolitan region, which serves as a central hub for healthcare innovation and patient volume in Brazil. Key drivers for the prominence of therapeutic and surgical devices include substantial investments in advanced medical infrastructure, a high concentration of specialized cardiac surgeons and interventional cardiologists, and a robust demand for complex interventions. Regulatory support in this segment, while stringent, is geared towards ensuring the safety and efficacy of life-saving technologies, fostering responsible innovation.

Within the therapeutic and surgical devices category, several sub-segments exhibit significant growth and market share:

- Heart Valves: The increasing incidence of valvular heart disease, coupled with the growing preference for transcatheter aortic valve implantation (TAVI) procedures, has propelled this sub-segment. Investments in R&D for bio-prosthetic and mechanical valves continue to drive innovation and market expansion.

- Stents: The demand for both drug-eluting stents (DES) and biodegradable stents is high, driven by advancements in stent design and drug delivery mechanisms that improve long-term patient outcomes and reduce restenosis rates.

- Catheters: A wide array of catheters, including angioplasty, diagnostic, and electrophysiology catheters, are essential for various interventional procedures. Their widespread use in minimally invasive treatments contributes significantly to the overall market share.

- Cardiac Rhythm Management Devices (CRMDs): Pacemakers, implantable cardioverter-defibrillators (ICDs), and cardiac resynchronization therapy (CRT) devices are crucial for managing arrhythmias and heart failure. The aging population and the rising prevalence of heart conditions are key growth factors.

- Cardiac Assist Devices: While a more niche segment, ventricular assist devices (VADs) and artificial hearts are critical for patients with end-stage heart failure, with ongoing technological advancements enhancing their efficacy and patient quality of life.

- Grafts: Vascular grafts play a vital role in bypass surgeries and reconstructions, with ongoing research focusing on biocompatible and antimicrobial materials.

The dominance of therapeutic and surgical devices is further amplified by the concentration of leading healthcare institutions and a patient demographic that can access and afford these advanced treatments.

Brazil Cardiovascular Devices Industry Product Innovations

The Brazil cardiovascular devices industry is witnessing remarkable product innovations aimed at enhancing patient care and procedural efficiency. Companies are focusing on developing next-generation stents with superior drug-eluting properties and bio-absorbable designs, minimizing long-term complications. Advances in heart valve technology, particularly in transcatheter solutions, are enabling less invasive replacements with improved durability and patient comfort. Furthermore, the integration of artificial intelligence and machine learning into diagnostic and monitoring devices, such as advanced electrocardiogram (ECG) and remote cardiac monitoring systems, is revolutionizing early detection and personalized risk stratification. These innovations promise to transform cardiovascular care by offering greater precision, reduced invasiveness, and improved patient outcomes.

Propelling Factors for Brazil Cardiovascular Devices Industry Growth

The Brazil cardiovascular devices industry is propelled by several key factors. A significant growth driver is the increasing prevalence of cardiovascular diseases (CVDs) attributed to lifestyle changes, an aging population, and rising rates of diabetes and hypertension. Technological advancements, including the development of minimally invasive devices, robotic-assisted surgery, and sophisticated diagnostic tools like advanced electrocardiogram (ECG), are expanding treatment options and improving patient outcomes. Furthermore, the Brazilian government's initiatives to expand healthcare access and promote medical device innovation, coupled with substantial investments in healthcare infrastructure, are creating a conducive environment for market expansion. Favorable reimbursement policies for advanced cardiovascular procedures also play a crucial role in driving adoption and growth.

Obstacles in the Brazil Cardiovascular Devices Industry Market

Despite robust growth, the Brazil cardiovascular devices industry faces several obstacles. Stringent and evolving regulatory pathways can lead to delays in product approvals and market entry, increasing costs for manufacturers. Economic volatility and currency fluctuations can impact the affordability of imported high-tech devices. Supply chain disruptions, exacerbated by global events, pose a persistent challenge in ensuring the consistent availability of critical components and finished products. Intense competition from both domestic and international players, coupled with pricing pressures, can affect profit margins. High initial investment costs for advanced device adoption by healthcare providers can also limit market penetration in certain regions.

Future Opportunities in Brazil Cardiovascular Devices Industry

The Brazil cardiovascular devices industry is poised for significant future opportunities. The growing adoption of telehealth and remote cardiac monitoring solutions presents a substantial avenue for market expansion, particularly in remote and underserved areas. Advancements in personalized medicine and smart cardiovascular devices, including wearable sensors and AI-powered diagnostics, offer new avenues for early intervention and proactive health management. The increasing demand for minimally invasive procedures will continue to fuel innovation in devices like transcatheter heart valves and advanced catheter systems. Furthermore, untapped potential exists in expanding the reach of advanced cardiovascular care to a broader segment of the population through innovative financing models and public-private partnerships.

Major Players in the Brazil Cardiovascular Devices Industry Ecosystem

- Braile Biomedica Ltda

- Terumo Corporation

- Abbott Laboratories

- Cardinal Health Inc

- Biotronik SE & Co KG

- Edwards Lifesciences

- Medtronic Inc (Covidien Plc)

- C R Bard Inc

- Boston Scientific Corporation

Key Developments in Brazil Cardiovascular Devices Industry Industry

- 2024: Launch of a new generation of drug-eluting stents with enhanced deliverability and long-term efficacy.

- 2024: Significant investment by a leading multinational company in expanding its manufacturing capabilities for cardiac rhythm management devices in Brazil.

- 2023: Approval of a novel transcatheter mitral valve replacement system, broadening treatment options for valvular heart disease.

- 2023: Strategic partnership established between a Brazilian device manufacturer and a global technology firm to develop AI-powered diagnostic tools.

- 2022: Increased adoption of remote patient monitoring platforms for cardiovascular care, driven by post-pandemic healthcare trends.

- 2022: Major acquisition of a Brazilian medical device distributor by a global player to strengthen its market presence.

- 2021: Introduction of advanced catheter-based systems for complex ablation procedures.

- 2021: Regulatory body streamlines approval processes for innovative cardiovascular devices.

- 2020: Focus on innovative solutions for managing chronic cardiovascular conditions amidst healthcare system strains.

- 2019: Increased R&D investment in biodegradable scaffold technology for cardiovascular applications.

Strategic Brazil Cardiovascular Devices Industry Market Forecast

The Brazil cardiovascular devices industry forecast indicates continued robust growth driven by a convergence of factors. The rising burden of cardiovascular diseases, coupled with an expanding and aging population, creates sustained demand for advanced treatments. Ongoing technological innovation, particularly in minimally invasive devices, remote monitoring, and AI integration, will further propel market expansion. Government initiatives to improve healthcare access and infrastructure, alongside increasing healthcare expenditure, will create a favorable ecosystem. Strategic partnerships and a focus on unmet clinical needs are expected to drive further penetration of high-value cardiovascular solutions, positioning Brazil as a key market in Latin America.

Brazil Cardiovascular Devices Industry Segmentation

-

1. Device Type

-

1.1. Diagnostic and Monitoring Devices

- 1.1.1. Electrocardiogram (ECG)

- 1.1.2. Remote Cardiac Monitoring

- 1.1.3. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic and Surgical Devices

- 1.2.1. Cardiac Assist Devices

- 1.2.2. Cardiac Rhythm Management Device

- 1.2.3. Catheter

- 1.2.4. Grafts

- 1.2.5. Heart Valves

- 1.2.6. Stents

- 1.2.7. Other Therapeutic and Surgical Devices

-

1.1. Diagnostic and Monitoring Devices

Brazil Cardiovascular Devices Industry Segmentation By Geography

- 1. Brazil

Brazil Cardiovascular Devices Industry Regional Market Share

Geographic Coverage of Brazil Cardiovascular Devices Industry

Brazil Cardiovascular Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Burden of Cardiovascular Diseases; Increased Preference of Minimally Invasive Procedures

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Policies; High Cost of Instruments and Procedures

- 3.4. Market Trends

- 3.4.1. Electrocardiogram (ECG) is Expected to Dominate the Diagnostic And Monitoring Segment Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Cardiovascular Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.1.1. Electrocardiogram (ECG)

- 5.1.1.2. Remote Cardiac Monitoring

- 5.1.1.3. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic and Surgical Devices

- 5.1.2.1. Cardiac Assist Devices

- 5.1.2.2. Cardiac Rhythm Management Device

- 5.1.2.3. Catheter

- 5.1.2.4. Grafts

- 5.1.2.5. Heart Valves

- 5.1.2.6. Stents

- 5.1.2.7. Other Therapeutic and Surgical Devices

- 5.1.1. Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Braile Biomedica Ltda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Terumo Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abbott Laboratories

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cardinal Health Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Biotronik SE & Co KG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Edwards Lifesciences

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medtronic Inc (Covidien Plc)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 C R Bard Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Boston Scientific Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Braile Biomedica Ltda

List of Figures

- Figure 1: Brazil Cardiovascular Devices Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Brazil Cardiovascular Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Cardiovascular Devices Industry Revenue million Forecast, by Device Type 2020 & 2033

- Table 2: Brazil Cardiovascular Devices Industry Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 3: Brazil Cardiovascular Devices Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Brazil Cardiovascular Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Brazil Cardiovascular Devices Industry Revenue million Forecast, by Device Type 2020 & 2033

- Table 6: Brazil Cardiovascular Devices Industry Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 7: Brazil Cardiovascular Devices Industry Revenue million Forecast, by Country 2020 & 2033

- Table 8: Brazil Cardiovascular Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Cardiovascular Devices Industry?

The projected CAGR is approximately 4.04%.

2. Which companies are prominent players in the Brazil Cardiovascular Devices Industry?

Key companies in the market include Braile Biomedica Ltda, Terumo Corporation, Abbott Laboratories, Cardinal Health Inc, Biotronik SE & Co KG, Edwards Lifesciences, Medtronic Inc (Covidien Plc), C R Bard Inc, Boston Scientific Corporation.

3. What are the main segments of the Brazil Cardiovascular Devices Industry?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 304.36 million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Burden of Cardiovascular Diseases; Increased Preference of Minimally Invasive Procedures.

6. What are the notable trends driving market growth?

Electrocardiogram (ECG) is Expected to Dominate the Diagnostic And Monitoring Segment Over the Forecast Period.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Policies; High Cost of Instruments and Procedures.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Cardiovascular Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Cardiovascular Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Cardiovascular Devices Industry?

To stay informed about further developments, trends, and reports in the Brazil Cardiovascular Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence