Key Insights

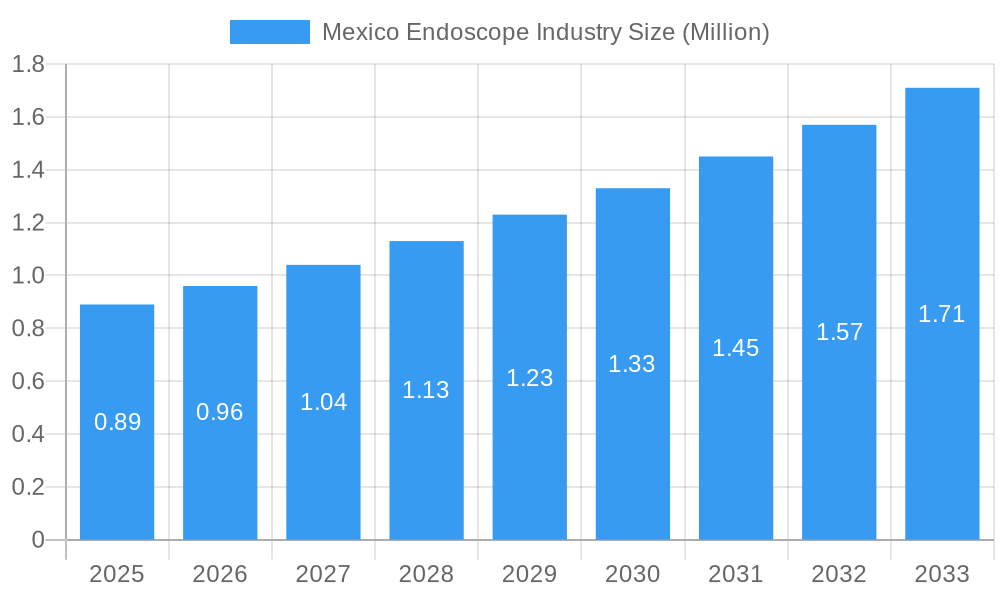

The Mexico endoscope market is poised for significant expansion, projected to reach an estimated market size of USD 0.89 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 8.42% throughout the forecast period of 2025-2033. This upward trajectory is primarily fueled by increasing healthcare expenditures and a growing prevalence of gastrointestinal, pulmonary, and urological conditions requiring endoscopic intervention. Advancements in minimally invasive surgical techniques and the development of more sophisticated, high-definition endoscopy devices are further driving market adoption. The rising demand for improved diagnostic accuracy and patient comfort is also a key factor, pushing healthcare providers in Mexico to invest in cutting-edge endoscopic technology. Furthermore, the expanding healthcare infrastructure, coupled with government initiatives aimed at enhancing access to quality medical care, are creating a favorable environment for market players.

Mexico Endoscope Industry Market Size (In Million)

The market is segmented across various device types, including rigid, flexible, and capsule endoscopes, alongside endoscopic operative and visualization devices. Gastroenterology and pulmonology applications are expected to dominate, reflecting the high incidence of related diseases in the region. Leading companies such as Olympus Corporation, Medtronic plc, and Boston Scientific Corporation are actively participating in the Mexican market, introducing innovative products and expanding their distribution networks. The increasing adoption of these advanced endoscopic solutions by Mexican hospitals and clinics, driven by the need for earlier disease detection and more effective treatment outcomes, will continue to shape the market dynamics. While the market presents substantial growth opportunities, factors such as the initial cost of advanced endoscopic equipment and the need for specialized training for healthcare professionals may present some moderate challenges. However, the overall outlook for the Mexico endoscope market remains exceptionally positive, driven by both technological advancements and the evolving healthcare landscape.

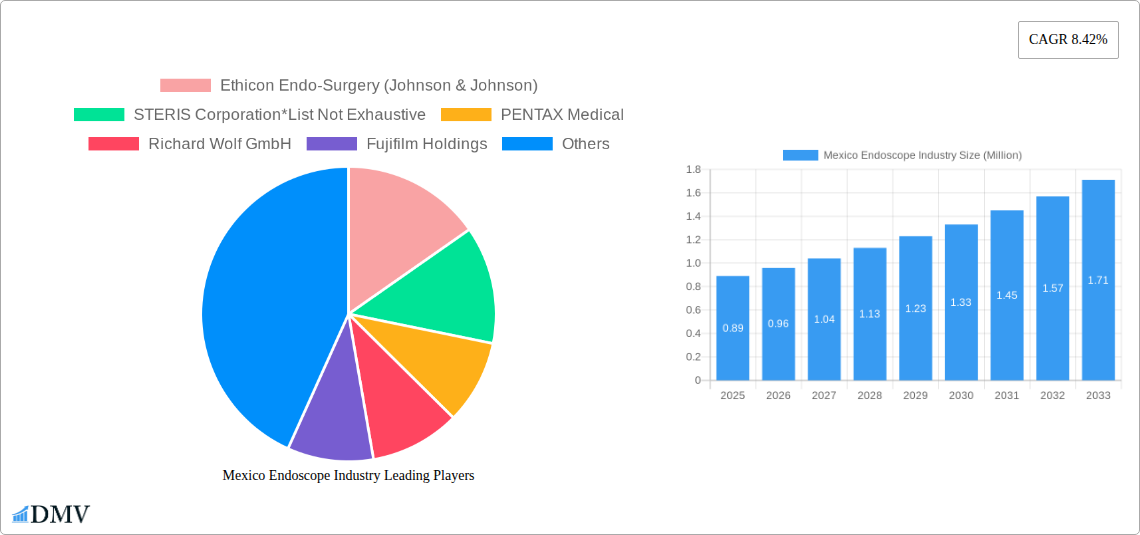

Mexico Endoscope Industry Company Market Share

Mexico Endoscope Industry Market Composition & Trends

The Mexico endoscope industry is a dynamic and evolving sector, characterized by a moderate level of market concentration. Key players like Ethicon Endo-Surgery (Johnson & Johnson), STERIS Corporation, PENTAX Medical, Richard Wolf GmbH, Fujifilm Holdings, Conmed Corporation, Boston Scientific Corporation, Olympus Corporation, and Medtronic plc command significant market shares, though the presence of emerging domestic manufacturers and distributors contributes to a competitive landscape. Innovation is a primary catalyst, driven by advancements in imaging technology, miniaturization, and the development of minimally invasive surgical tools. Regulatory frameworks, while evolving to ensure patient safety and product efficacy, can present both opportunities and challenges. The proliferation of single-use endoscopes is a notable trend, addressing concerns related to infection control and reprocessing costs. End-user profiles are diverse, ranging from large hospital networks and specialized surgical centers to individual clinics and diagnostic facilities. Mergers and acquisitions (M&A) activities, though not yet extensive in Mexico, are anticipated to play a crucial role in shaping market consolidation and expanding product portfolios in the coming years. The market share distribution indicates a strong presence of global manufacturers, with an increasing focus on localized distribution and support networks.

Mexico Endoscope Industry Industry Evolution

The Mexico endoscope industry has witnessed substantial growth and evolution throughout the historical period of 2019–2024, driven by a confluence of factors including an aging population, increasing prevalence of chronic diseases requiring diagnostic and therapeutic endoscopic interventions, and a growing awareness of minimally invasive surgical procedures. The forecast period of 2025–2033 projects continued robust expansion, with the base year of 2025 setting a strong foundation for future developments. Technological advancements have been pivotal in this evolution, with a consistent shift from traditional rigid endoscopes to more flexible and maneuverable devices, including the nascent but promising growth of capsule endoscopes. The adoption of high-definition imaging, artificial intelligence (AI) integration for diagnostic assistance, and the development of advanced therapeutic endoscopic tools have significantly improved patient outcomes and procedure efficiency. Market growth trajectories are further bolstered by increased healthcare expenditure in Mexico and a growing demand for specialized medical devices that offer enhanced diagnostic accuracy and therapeutic capabilities. Consumer demands are increasingly leaning towards less invasive procedures, shorter recovery times, and improved patient comfort, directly influencing the product development and market penetration of advanced endoscopic technologies. The industry has seen a steady year-on-year growth rate, estimated to be around XX% during the historical period, with projections indicating a similar or accelerated pace in the forecast period. This growth is underpinned by a growing installed base of endoscopic equipment and the continuous need for upgrades and replacements, alongside the introduction of novel applications across various medical specialties. The expansion of healthcare infrastructure and increased access to advanced medical technologies in Mexico are also significant contributors to this positive market evolution.

Leading Regions, Countries, or Segments in Mexico Endoscope Industry

Within the Mexico endoscope industry, the Gastroenterology application segment stands out as a dominant force, consistently driving demand for a wide array of endoscopic devices and operative instruments. This dominance is fueled by the high prevalence of gastrointestinal disorders, including inflammatory bowel disease, peptic ulcers, and various forms of gastrointestinal cancers, necessitating frequent diagnostic and therapeutic endoscopic procedures. The Flexible Endoscope sub-segment within the Type of Device category is particularly prominent, owing to its versatility in navigating the intricate pathways of the gastrointestinal tract, lungs, and urinary system.

Key Drivers for Gastroenterology Dominance:

- High Disease Burden: The pervasive nature of digestive health issues in Mexico directly translates to a continuous and substantial demand for gastroenterological diagnostics and treatments.

- Minimally Invasive Appeal: Endoscopic procedures offer patients less pain, shorter recovery times, and reduced scarring compared to traditional open surgeries, making them highly favored.

- Technological Advancements: Innovations in high-definition imaging, therapeutic capabilities (like polyp removal and stent placement), and the integration of AI for polyp detection enhance the efficacy and appeal of gastrointestinal endoscopy.

- Growing Awareness and Screening Programs: Increased public awareness about early detection of gastrointestinal cancers and the implementation of screening programs further boost demand.

Dominance Factors for Flexible Endoscopes:

- Versatility: Flexible endoscopes are essential for examining a wide range of anatomical regions, including the esophagus, stomach, intestines, bronchi, and bladder.

- Patient Comfort: Their pliable nature allows for easier insertion and navigation, leading to a more comfortable patient experience.

- Diagnostic and Therapeutic Capabilities: They are equipped with working channels that enable the passage of instruments for biopsies, polyp removal, dilation, and other therapeutic interventions.

- Technological Sophistication: Continuous improvements in optics, illumination, and articulation enhance visualization and maneuverability.

While Gastroenterology leads, significant growth is also observed in Pulmonology and Urology, reflecting the expanding applications of endoscopy in diagnosing and treating respiratory and urinary tract conditions, respectively. The visualization device segment, crucial for all endoscopic procedures, also shows strong growth due to the demand for higher resolution and advanced imaging features.

Mexico Endoscope Industry Product Innovations

Product innovations in the Mexico endoscope industry are rapidly transforming patient care. The introduction of single-use flexible endoscopes, exemplified by Ambu's focus, significantly mitigates infection risks and streamlines workflow for hospitals. Advancements in capsule endoscopy are offering non-invasive visualization of the small intestine. Furthermore, integration of AI algorithms with visualization devices is enhancing diagnostic accuracy for conditions like polyps and early-stage cancers. These innovations not only improve performance metrics like diagnostic yield and procedural success rates but also reduce patient recovery times and overall healthcare costs, making them highly sought after by medical professionals.

Propelling Factors for Mexico Endoscope Industry Growth

Several key factors are propelling the growth of the Mexico endoscope industry. Technological advancements in imaging, robotics, and AI are leading to more sophisticated and efficient devices. The increasing prevalence of chronic diseases such as gastrointestinal disorders, respiratory illnesses, and urological conditions directly drives the demand for diagnostic and therapeutic endoscopic procedures. Furthermore, growing healthcare expenditure and an expanding healthcare infrastructure in Mexico are improving access to advanced medical technologies. Government initiatives and private sector investments aimed at enhancing healthcare services also contribute significantly to market expansion.

Obstacles in the Mexico Endoscope Industry Market

Despite its growth potential, the Mexico endoscope industry faces several obstacles. High initial investment costs for advanced endoscopic equipment can be a barrier for smaller healthcare facilities. Stringent regulatory approvals for new medical devices, although necessary for patient safety, can slow down market entry. Supply chain disruptions, as experienced globally, can impact the availability of crucial components and finished products. Additionally, limited access to specialized training for a rapidly growing number of endoscopists in certain regions can hinder the widespread adoption of complex endoscopic techniques.

Future Opportunities in Mexico Endoscope Industry

Emerging opportunities in the Mexico endoscope industry are significant. The increasing adoption of AI-powered diagnostic tools presents a substantial growth avenue, promising enhanced accuracy and efficiency. The expanding market for single-use endoscopes will continue to be a key growth driver, addressing infection control concerns and procedural cost-effectiveness. Furthermore, untapped potential in rural and underserved areas of Mexico offers opportunities for market penetration and expansion of endoscopic services. The development of more affordable and user-friendly endoscopic solutions will also be crucial for capturing these markets.

Major Players in the Mexico Endoscope Industry Ecosystem

- Ethicon Endo-Surgery (Johnson & Johnson)

- STERIS Corporation

- PENTAX Medical

- Richard Wolf GmbH

- Fujifilm Holdings

- Conmed Corporation

- Boston Scientific Corporation

- Olympus Corporation

- Medtronic plc

Key Developments in Mexico Endoscope Industry Industry

- October 2022: Ambu Ambu celebrated the grand opening of its expansive new manufacturing facility in Ciudad Juárez, Mexico. Spanning nearly 323,000 square feet, this state-of-the-art plant marks Ambu's largest production site to date, significantly enhancing the company's capacity for future product manufacturing and supply. Ambu's focus at this facility will be on the production of single-use endoscopes across key endoscopy segments, including pulmonology, urology, ENT, and gastrointestinal.

- April 2022: Endoscopia Guadalajara initiated the SONOSCAPE gastrointestinal project for Mexico. The company brought together a dedicated team of vendors, technicians, and distributors on a national scale to deliver top-tier service to Mexican Gastroenterologists, ensuring the highest quality standards are met.

Strategic Mexico Endoscope Industry Market Forecast

The strategic forecast for the Mexico endoscope industry is exceptionally positive, driven by a potent combination of escalating healthcare needs and continuous technological innovation. The growing adoption of advanced diagnostic and therapeutic endoscopic devices, coupled with the increasing preference for minimally invasive procedures, will sustain robust market growth. Expansion of healthcare infrastructure and increased patient access to specialized medical care are anticipated to further fuel demand. The focus on developing integrated AI solutions and single-use endoscopes signifies a strategic shift towards enhanced safety, efficiency, and improved patient outcomes, positioning the Mexico endoscope market for significant expansion in the coming years.

Mexico Endoscope Industry Segmentation

-

1. Type of Device

-

1.1. Endoscopy Device

- 1.1.1. Rigid Endoscope

- 1.1.2. Flexible Endoscope

- 1.1.3. Capsule Endoscope

- 1.1.4. Other Endoscopy Devices

- 1.2. Endoscopic Operative Device

- 1.3. Visualization Device

-

1.1. Endoscopy Device

-

2. Application

- 2.1. Gastroenterology

- 2.2. Pulmonology

- 2.3. Urology

- 2.4. Cardiology

- 2.5. Gynecology

- 2.6. Other Applications

Mexico Endoscope Industry Segmentation By Geography

- 1. Mexico

Mexico Endoscope Industry Regional Market Share

Geographic Coverage of Mexico Endoscope Industry

Mexico Endoscope Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements Along with Increasing Demand for Minimally Invasive Surgeries; Increasing Prevalence of Endoscopy for Treatment and Diagnosis

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Technicians; Infections Caused by Endoscopes

- 3.4. Market Trends

- 3.4.1. Capsule Endoscope Segment is Expected to Show Lucrative Growth in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Endoscope Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Endoscopy Device

- 5.1.1.1. Rigid Endoscope

- 5.1.1.2. Flexible Endoscope

- 5.1.1.3. Capsule Endoscope

- 5.1.1.4. Other Endoscopy Devices

- 5.1.2. Endoscopic Operative Device

- 5.1.3. Visualization Device

- 5.1.1. Endoscopy Device

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gastroenterology

- 5.2.2. Pulmonology

- 5.2.3. Urology

- 5.2.4. Cardiology

- 5.2.5. Gynecology

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethicon Endo-Surgery (Johnson & Johnson)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 STERIS Corporation*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PENTAX Medical

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Richard Wolf GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fujifilm Holdings

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Conmed Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boston Scientific Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Olympus Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Medtronic plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Ethicon Endo-Surgery (Johnson & Johnson)

List of Figures

- Figure 1: Mexico Endoscope Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Endoscope Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Endoscope Industry Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 2: Mexico Endoscope Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Mexico Endoscope Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Mexico Endoscope Industry Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 5: Mexico Endoscope Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Mexico Endoscope Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Endoscope Industry?

The projected CAGR is approximately 8.42%.

2. Which companies are prominent players in the Mexico Endoscope Industry?

Key companies in the market include Ethicon Endo-Surgery (Johnson & Johnson), STERIS Corporation*List Not Exhaustive, PENTAX Medical, Richard Wolf GmbH, Fujifilm Holdings, Conmed Corporation, Boston Scientific Corporation, Olympus Corporation, Medtronic plc.

3. What are the main segments of the Mexico Endoscope Industry?

The market segments include Type of Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements Along with Increasing Demand for Minimally Invasive Surgeries; Increasing Prevalence of Endoscopy for Treatment and Diagnosis.

6. What are the notable trends driving market growth?

Capsule Endoscope Segment is Expected to Show Lucrative Growth in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled Technicians; Infections Caused by Endoscopes.

8. Can you provide examples of recent developments in the market?

October 2022: Ambu Ambu celebrated the grand opening of its expansive new manufacturing facility in Ciudad Juárez, Mexico. Spanning nearly 323,000 square feet, this state-of-the-art plant marks Ambu's largest production site to date, significantly enhancing the company's capacity for future product manufacturing and supply. Ambu's focus at this facility will be on the production of single-use endoscopes across key endoscopy segments, including pulmonology, urology, ENT, and gastrointestinal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Endoscope Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Endoscope Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Endoscope Industry?

To stay informed about further developments, trends, and reports in the Mexico Endoscope Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence