Key Insights

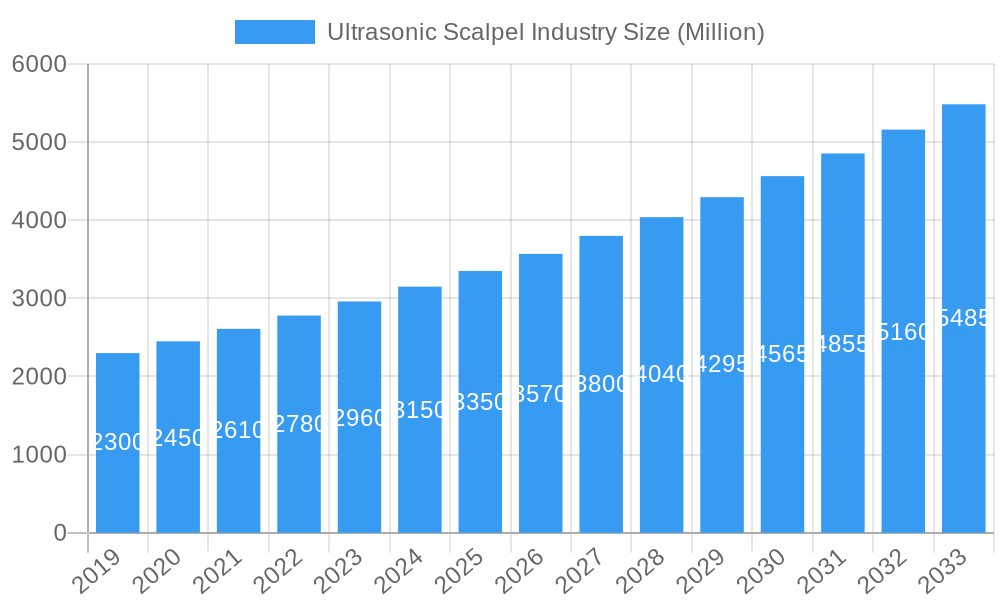

The global ultrasonic scalpel market is poised for robust expansion, projected to reach approximately $3,500 million by 2025 and sustain a Compound Annual Growth Rate (CAGR) of 6.50% through 2033. This impressive growth trajectory is primarily fueled by the increasing prevalence of minimally invasive surgical procedures across various specialties, including gynecology, general surgery, and ENT. The inherent benefits of ultrasonic scalpels, such as precise tissue dissection, reduced collateral thermal damage, and faster procedure times, are driving their adoption by surgeons seeking to enhance patient outcomes and optimize hospital efficiency. Furthermore, technological advancements leading to the development of more sophisticated and user-friendly ultrasonic scalpel systems, coupled with a growing demand for advanced surgical tools in emerging economies, are significant market drivers. The rising incidence of chronic diseases and the aging global population also contribute to the escalating need for effective surgical interventions, further bolstering market demand.

Ultrasonic Scalpel Industry Market Size (In Billion)

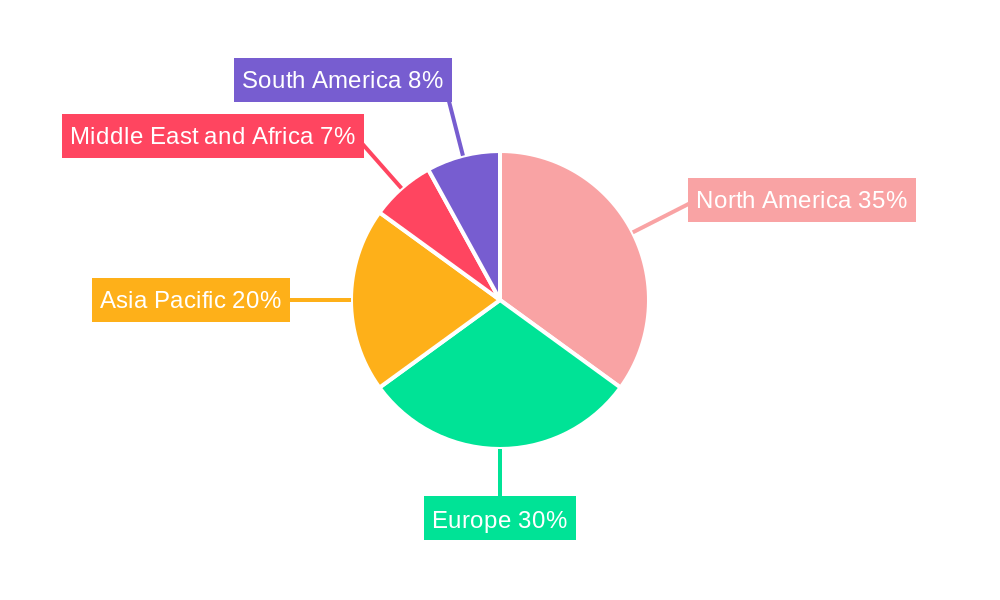

The market is segmented across key product categories, with Ultrasonic Scalpel Accessories, Ultrasonic Scalpel Generators, and Handheld Ultrasonic Scalpel Devices all playing crucial roles. Application-wise, lung biopsy, tonsillectomy, thyroidectomy, and gynecologic cancer surgeries represent significant areas of utilization, with "Other Applications" also indicating a diverse range of surgical uses. Geographically, North America and Europe currently dominate the market, owing to well-established healthcare infrastructures, high patient awareness, and early adoption of advanced medical technologies. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by increasing healthcare expenditure, a growing number of trained surgeons, and a large patient pool. Restraints, such as the high initial cost of ultrasonic scalpel systems and the need for specialized training, may pose challenges, but ongoing innovation and market competition are expected to mitigate these factors, paving the way for sustained market expansion.

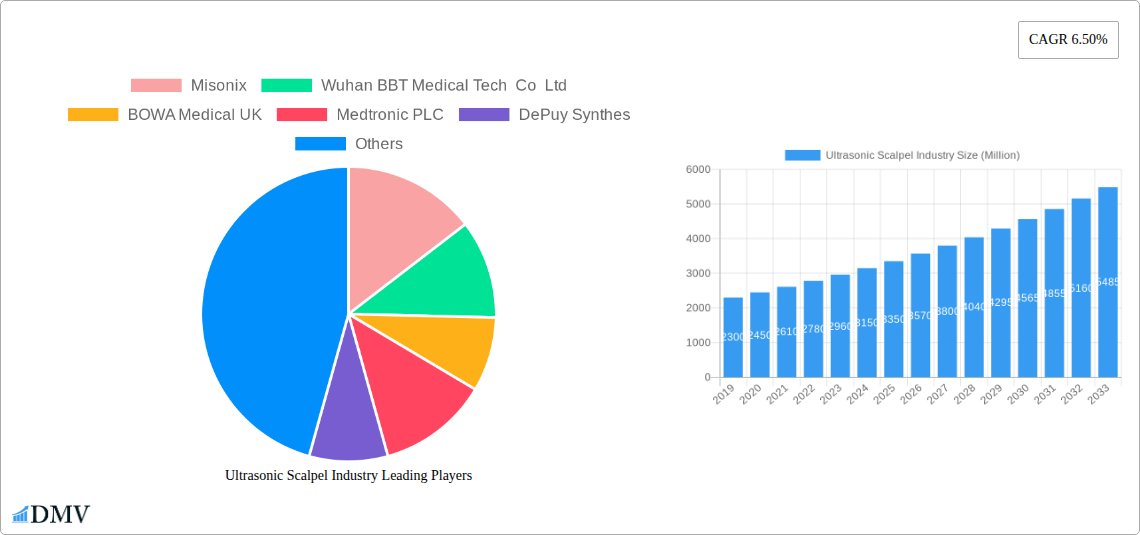

Ultrasonic Scalpel Industry Company Market Share

Unlock the Future of Precision Surgery: Ultrasonic Scalpel Industry Market Report (2019–2033)

This comprehensive report delivers an in-depth analysis of the global Ultrasonic Scalpel market, a critical segment in advanced surgical technology. Spanning 2019–2033, with a base year of 2025, this research provides actionable intelligence for stakeholders navigating the evolving landscape of surgical instruments, minimally invasive surgery, and healthcare innovation. Discover critical insights into market dynamics, growth drivers, emerging opportunities, and the competitive strategies of leading players shaping the future of ultrasonic dissection and surgical oncology.

Ultrasonic Scalpel Industry Market Composition & Trends

The global Ultrasonic Scalpel market exhibits a dynamic composition driven by continuous innovation and increasing adoption in advanced surgical procedures. Market concentration is influenced by key players like Medtronic PLC, Stryker Corporation, and Johnson & Johnson, who dominate significant portions of the ultrasonic surgical device market share. Innovation catalysts include the relentless pursuit of enhanced surgical precision, reduced tissue trauma, and improved patient outcomes, fueling demand for sophisticated handheld ultrasonic scalpel devices and ultrasonic scalpel generators. The regulatory landscape, while stringent, is increasingly supportive of novel technologies that demonstrate clear clinical benefits. Substitute products, such as electrosurgical devices, still hold a considerable market presence, but the unique advantages of ultrasonic technology in specific applications are driving its growth. End-user profiles are diverse, encompassing hospitals, specialty surgical centers, and academic medical institutions, all seeking advanced surgical tools for procedures like lung biopsy, thyroidectomy, and gynecologic cancer treatment. Mergers and acquisitions (M&A) activities are notable, with companies strategically acquiring smaller innovators to expand their product portfolios and market reach. For instance, the acquisition of Misonix, Inc. by Bioventus in October 2021 signifies a consolidation trend aimed at delivering advanced healing solutions. While specific M&A deal values are not publicly disclosed for all transactions, the strategic intent behind these moves is clear: to capture greater market share in the burgeoning medical device industry. The market is projected to witness steady growth, driven by the increasing prevalence of chronic diseases requiring surgical intervention and the ongoing technological advancements in ultrasonic cutting and coagulation technologies.

Ultrasonic Scalpel Industry Industry Evolution

The Ultrasonic Scalpel industry has undergone a remarkable evolution, transforming from niche technology to a mainstream surgical tool, particularly in minimally invasive procedures. Over the historical period of 2019–2024, the market has seen a consistent upward trajectory, fueled by increasing surgeon comfort and demonstrated efficacy in complex surgeries. The estimated market size for 2025 is projected to be in the range of $X Billion, with a projected growth rate of XX% annually during the forecast period of 2025–2033. This sustained growth is intrinsically linked to technological advancements that have refined the precision and safety of ultrasonic scalpels. Early iterations of ultrasonic devices focused on basic cutting capabilities, but modern ultrasonic surgical systems now incorporate advanced features such as adaptive energy delivery, tissue sensing technology, and ergonomic designs, enhancing their utility in delicate procedures. The introduction of ultrasonic scalpel accessories, such as specialized blades and handpieces, has further broadened their application scope. Consumer demand, in this context, refers to the increasing preference of healthcare providers and institutions for technologies that offer improved patient outcomes, shorter recovery times, and reduced hospital stays. Procedures like tonsillectomy, lung biopsy, and thyroidectomy have seen significant adoption of ultrasonic technology due to its ability to minimize collateral tissue damage and bleeding. The launch of the Sonicision curved jaw cordless ultrasonic dissection system by India Medtronic Private Limited in September 2020 exemplifies the industry's focus on developing next-generation devices that offer enhanced precision, convenience, and safety in the operating room. This strategic product launch demonstrates a commitment to innovation that directly addresses the evolving needs of surgeons. The industry's evolution is also marked by a growing emphasis on value-based healthcare, where the cost-effectiveness and superior clinical outcomes associated with ultrasonic scalpels are becoming increasingly recognized, further propelling their adoption and market expansion across diverse surgical specialties. The integration of AI and advanced robotics into surgical procedures also presents a symbiotic growth opportunity for ultrasonic scalpel technology, paving the way for even more sophisticated and automated surgical interventions.

Leading Regions, Countries, or Segments in Ultrasonic Scalpel Industry

North America currently stands as the dominant region in the Ultrasonic Scalpel industry, driven by a confluence of factors that foster advanced surgical technology adoption and innovation. This dominance is largely attributable to several key drivers within the region:

- High Healthcare Expenditure & Advanced Infrastructure: North America boasts the highest per capita healthcare expenditure globally, enabling widespread investment in cutting-edge medical devices and sophisticated surgical equipment. This robust financial capacity allows hospitals and surgical centers to readily acquire and implement advanced ultrasonic surgical equipment.

- Pioneering Research & Development: The region is home to leading research institutions and medical technology companies, fostering a culture of innovation. This environment stimulates the development of new ultrasonic scalpel products and novel applications, ensuring a continuous pipeline of advanced solutions.

- Surgeon Adoption & Training: There is a strong emphasis on minimally invasive surgical techniques in North America, with surgeons actively seeking and being trained on advanced technologies like ultrasonic scalpels. The prevalence of advanced training programs and professional development opportunities further accelerates adoption.

- Favorable Regulatory Environment: While stringent, the regulatory framework in North America, particularly in the United States, is designed to facilitate the approval of innovative medical devices that demonstrate safety and efficacy, thus supporting market entry and growth.

Within the Ultrasonic Scalpel market, the Handheld Ultrasonic Scalpel Devices segment is a primary driver of regional dominance. This is due to their versatility and ease of use in a wide array of surgical specialties.

- Key Drivers for Handheld Ultrasonic Scalpel Devices:

- Minimally Invasive Surgery Growth: The increasing demand for less invasive procedures directly fuels the need for precise and efficient handheld tools.

- Versatility in Applications: These devices are essential for lung biopsy, thyroidectomy, tonsillectomy, and various gynecologic cancer surgeries, demonstrating their broad applicability.

- Technological Advancements: Continuous improvements in energy delivery, blade design, and ergonomic features enhance their performance and surgeon appeal.

The Application segment of Gynecologic Cancer is also witnessing significant growth in North America, reflecting the region's focus on advanced oncological treatments.

- Key Drivers for Gynecologic Cancer Applications:

- Improved Precision in Delicate Procedures: Ultrasonic scalpels offer superior control and reduced thermal spread, crucial for intricate gynecological surgeries.

- Reduced Blood Loss & Faster Recovery: The hemostatic properties of ultrasonic technology contribute to better patient outcomes and shorter hospital stays.

- Focus on Oncological Outcomes: The drive for more effective cancer treatments necessitates the use of the most advanced surgical modalities.

Beyond North America, Europe is a significant market, characterized by a strong healthcare system and a growing appetite for technological advancements. Asia-Pacific, while a rapidly growing market, is expected to witness substantial expansion driven by increasing healthcare investments, a rising prevalence of surgical interventions, and a growing number of local manufacturers contributing to the ultrasonic scalpel market.

Ultrasonic Scalpel Industry Product Innovations

Product innovations in the Ultrasonic Scalpel industry are primarily focused on enhancing surgical precision, minimizing tissue damage, and improving surgeon ergonomics. Leading companies are developing advanced ultrasonic scalpel generators with adaptive energy control, allowing for real-time adjustments based on tissue density, thereby optimizing cutting and coagulation. Handheld ultrasonic scalpel devices are now incorporating lighter materials, cordless designs for greater maneuverability, and specialized blade geometries tailored for specific surgical tasks, such as dissecting delicate structures during thyroidectomy or performing precise tumor excisions in gynecologic cancer procedures. These innovations translate to reduced operative times, decreased blood loss, and faster patient recovery, significantly improving the overall surgical experience and patient outcomes.

Propelling Factors for Ultrasonic Scalpel Industry Growth

Several key factors are propelling the growth of the Ultrasonic Scalpel industry. The increasing prevalence of minimally invasive surgical procedures globally is a primary driver, as ultrasonic scalpels offer superior precision and reduced collateral damage compared to traditional methods. Technological advancements, including the development of more sophisticated ultrasonic scalpel generators and ergonomic handheld ultrasonic scalpel devices, are enhancing surgical outcomes and surgeon experience. Furthermore, rising healthcare expenditure, particularly in emerging economies, is expanding access to advanced medical technologies. Government initiatives promoting advanced healthcare infrastructure and the growing demand for better patient outcomes in procedures like lung biopsy, tonsillectomy, and thyroidectomy also contribute significantly to market expansion.

Obstacles in the Ultrasonic Scalpel Industry Market

Despite robust growth, the Ultrasonic Scalpel industry faces certain obstacles. The high initial cost of ultrasonic surgical equipment, including both handheld ultrasonic scalpel devices and ultrasonic scalpel generators, can be a barrier to adoption, especially for smaller healthcare facilities or in price-sensitive markets. Stringent regulatory approval processes for new medical devices can lead to prolonged market entry times and increased development costs. Moreover, a lack of sufficient trained personnel to operate and maintain these advanced systems can also hinder widespread adoption. Supply chain disruptions, as witnessed in recent global events, can impact the availability of critical components and finished products.

Future Opportunities in Ultrasonic Scalpel Industry

The future opportunities within the Ultrasonic Scalpel industry are substantial. The expansion of minimally invasive surgery into new therapeutic areas, such as advanced cardiac and neurological procedures, presents a significant avenue for growth. The development of next-generation ultrasonic scalpel accessories with enhanced functionalities and compatibility with robotic surgical platforms will further drive market penetration. Increased focus on value-based healthcare models will favor technologies like ultrasonic scalpels that demonstrate improved patient outcomes and cost-effectiveness in the long run. Furthermore, the growing demand for ultrasonic dissection in emerging markets, coupled with strategic partnerships and collaborations between manufacturers and healthcare providers, will unlock new market potential.

Major Players in the Ultrasonic Scalpel Industry Ecosystem

- Misonix

- Wuhan BBT Medical Tech Co Ltd

- BOWA Medical UK

- Medtronic PLC

- DePuy Synthes

- Axon Medical Solutions Pvt Ltd

- Johnson & Johnson

- Innolcon Medical Technology Co Ltd

- Stryker Corporation

- Olympus Corporation

- Reach Surgical

Key Developments in Ultrasonic Scalpel Industry Industry

- October 2021: Bioventus acquired Misonix, Inc. This acquisition assists the company to deliver innovative products for active healing to patients and providers.

- September 2020: India Medtronic Private Limited, launched the Sonicision curved jaw cordless ultrasonic dissection system, a next-generation ultrasonic dissection device that delivers the combined benefits of enhanced precision to surgeons with convenience and safety in the operating room.

Strategic Ultrasonic Scalpel Industry Market Forecast

The Ultrasonic Scalpel market is poised for continued robust growth, fueled by the relentless pursuit of surgical precision and patient-centric care. The forecast period of 2025–2033 will witness an accelerated adoption of advanced ultrasonic surgical devices, driven by their proven ability to minimize trauma and improve recovery times in critical procedures such as gynecologic cancer surgery and thyroidectomy. Strategic investments in research and development by leading players like Medtronic PLC and Stryker Corporation will introduce novel ultrasonic scalpel generators and handheld ultrasonic scalpel devices, further expanding their application scope. The increasing integration of these technologies into minimally invasive and robotic surgery platforms signifies a future where ultrasonic scalpels are indispensable tools for achieving optimal surgical outcomes.

Ultrasonic Scalpel Industry Segmentation

-

1. Product

- 1.1. Ultrasonic Scalpel Accessories

- 1.2. Ultrasonic Scalpel Generators

- 1.3. Handheld Ultrasonic Scalpel Devices

-

2. Application

- 2.1. Lung Biopsy

- 2.2. Tonsillectomy

- 2.3. Thyroidectomy

- 2.4. Gynecologic Cancer

- 2.5. Other Applications

Ultrasonic Scalpel Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Ultrasonic Scalpel Industry Regional Market Share

Geographic Coverage of Ultrasonic Scalpel Industry

Ultrasonic Scalpel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Chronic Diseases; Increased Demand for Minimally Invasive Procedures

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulation; High Cost Associated with the Procedure

- 3.4. Market Trends

- 3.4.1. Gynecologic Cancer Segment is Expected to Show Better Growth in the Forecast Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultrasonic Scalpel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Ultrasonic Scalpel Accessories

- 5.1.2. Ultrasonic Scalpel Generators

- 5.1.3. Handheld Ultrasonic Scalpel Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Lung Biopsy

- 5.2.2. Tonsillectomy

- 5.2.3. Thyroidectomy

- 5.2.4. Gynecologic Cancer

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Ultrasonic Scalpel Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Ultrasonic Scalpel Accessories

- 6.1.2. Ultrasonic Scalpel Generators

- 6.1.3. Handheld Ultrasonic Scalpel Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Lung Biopsy

- 6.2.2. Tonsillectomy

- 6.2.3. Thyroidectomy

- 6.2.4. Gynecologic Cancer

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Ultrasonic Scalpel Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Ultrasonic Scalpel Accessories

- 7.1.2. Ultrasonic Scalpel Generators

- 7.1.3. Handheld Ultrasonic Scalpel Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Lung Biopsy

- 7.2.2. Tonsillectomy

- 7.2.3. Thyroidectomy

- 7.2.4. Gynecologic Cancer

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Ultrasonic Scalpel Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Ultrasonic Scalpel Accessories

- 8.1.2. Ultrasonic Scalpel Generators

- 8.1.3. Handheld Ultrasonic Scalpel Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Lung Biopsy

- 8.2.2. Tonsillectomy

- 8.2.3. Thyroidectomy

- 8.2.4. Gynecologic Cancer

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Ultrasonic Scalpel Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Ultrasonic Scalpel Accessories

- 9.1.2. Ultrasonic Scalpel Generators

- 9.1.3. Handheld Ultrasonic Scalpel Devices

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Lung Biopsy

- 9.2.2. Tonsillectomy

- 9.2.3. Thyroidectomy

- 9.2.4. Gynecologic Cancer

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Ultrasonic Scalpel Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Ultrasonic Scalpel Accessories

- 10.1.2. Ultrasonic Scalpel Generators

- 10.1.3. Handheld Ultrasonic Scalpel Devices

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Lung Biopsy

- 10.2.2. Tonsillectomy

- 10.2.3. Thyroidectomy

- 10.2.4. Gynecologic Cancer

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Misonix

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wuhan BBT Medical Tech Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BOWA Medical UK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Medtronic PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DePuy Synthes

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Axon Medical Solutions Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson & Johnson

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Innolcon Medical Technology Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Stryker Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Olympus Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Reach Surgical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Misonix

List of Figures

- Figure 1: Global Ultrasonic Scalpel Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Ultrasonic Scalpel Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Ultrasonic Scalpel Industry Revenue (undefined), by Product 2025 & 2033

- Figure 4: North America Ultrasonic Scalpel Industry Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Ultrasonic Scalpel Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Ultrasonic Scalpel Industry Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Ultrasonic Scalpel Industry Revenue (undefined), by Application 2025 & 2033

- Figure 8: North America Ultrasonic Scalpel Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Ultrasonic Scalpel Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Ultrasonic Scalpel Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Ultrasonic Scalpel Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Ultrasonic Scalpel Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Ultrasonic Scalpel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Ultrasonic Scalpel Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Ultrasonic Scalpel Industry Revenue (undefined), by Product 2025 & 2033

- Figure 16: Europe Ultrasonic Scalpel Industry Volume (K Unit), by Product 2025 & 2033

- Figure 17: Europe Ultrasonic Scalpel Industry Revenue Share (%), by Product 2025 & 2033

- Figure 18: Europe Ultrasonic Scalpel Industry Volume Share (%), by Product 2025 & 2033

- Figure 19: Europe Ultrasonic Scalpel Industry Revenue (undefined), by Application 2025 & 2033

- Figure 20: Europe Ultrasonic Scalpel Industry Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Ultrasonic Scalpel Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Ultrasonic Scalpel Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Ultrasonic Scalpel Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Ultrasonic Scalpel Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Ultrasonic Scalpel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Ultrasonic Scalpel Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Ultrasonic Scalpel Industry Revenue (undefined), by Product 2025 & 2033

- Figure 28: Asia Pacific Ultrasonic Scalpel Industry Volume (K Unit), by Product 2025 & 2033

- Figure 29: Asia Pacific Ultrasonic Scalpel Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: Asia Pacific Ultrasonic Scalpel Industry Volume Share (%), by Product 2025 & 2033

- Figure 31: Asia Pacific Ultrasonic Scalpel Industry Revenue (undefined), by Application 2025 & 2033

- Figure 32: Asia Pacific Ultrasonic Scalpel Industry Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Ultrasonic Scalpel Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Ultrasonic Scalpel Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Ultrasonic Scalpel Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Ultrasonic Scalpel Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Ultrasonic Scalpel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Ultrasonic Scalpel Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Ultrasonic Scalpel Industry Revenue (undefined), by Product 2025 & 2033

- Figure 40: Middle East and Africa Ultrasonic Scalpel Industry Volume (K Unit), by Product 2025 & 2033

- Figure 41: Middle East and Africa Ultrasonic Scalpel Industry Revenue Share (%), by Product 2025 & 2033

- Figure 42: Middle East and Africa Ultrasonic Scalpel Industry Volume Share (%), by Product 2025 & 2033

- Figure 43: Middle East and Africa Ultrasonic Scalpel Industry Revenue (undefined), by Application 2025 & 2033

- Figure 44: Middle East and Africa Ultrasonic Scalpel Industry Volume (K Unit), by Application 2025 & 2033

- Figure 45: Middle East and Africa Ultrasonic Scalpel Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Ultrasonic Scalpel Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East and Africa Ultrasonic Scalpel Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East and Africa Ultrasonic Scalpel Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Ultrasonic Scalpel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Ultrasonic Scalpel Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Ultrasonic Scalpel Industry Revenue (undefined), by Product 2025 & 2033

- Figure 52: South America Ultrasonic Scalpel Industry Volume (K Unit), by Product 2025 & 2033

- Figure 53: South America Ultrasonic Scalpel Industry Revenue Share (%), by Product 2025 & 2033

- Figure 54: South America Ultrasonic Scalpel Industry Volume Share (%), by Product 2025 & 2033

- Figure 55: South America Ultrasonic Scalpel Industry Revenue (undefined), by Application 2025 & 2033

- Figure 56: South America Ultrasonic Scalpel Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: South America Ultrasonic Scalpel Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Ultrasonic Scalpel Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Ultrasonic Scalpel Industry Revenue (undefined), by Country 2025 & 2033

- Figure 60: South America Ultrasonic Scalpel Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Ultrasonic Scalpel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Ultrasonic Scalpel Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 8: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 20: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 21: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: France Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Italy Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Spain Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 38: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 39: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 40: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: China Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Japan Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: India Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Australia Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: South Korea Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 56: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 57: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 58: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: GCC Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: South Africa Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 68: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 69: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 70: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 71: Global Ultrasonic Scalpel Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Global Ultrasonic Scalpel Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Brazil Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Argentina Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Ultrasonic Scalpel Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Ultrasonic Scalpel Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultrasonic Scalpel Industry?

The projected CAGR is approximately 10.44%.

2. Which companies are prominent players in the Ultrasonic Scalpel Industry?

Key companies in the market include Misonix, Wuhan BBT Medical Tech Co Ltd, BOWA Medical UK, Medtronic PLC, DePuy Synthes, Axon Medical Solutions Pvt Ltd, Johnson & Johnson, Innolcon Medical Technology Co Ltd, Stryker Corporation, Olympus Corporation, Reach Surgical.

3. What are the main segments of the Ultrasonic Scalpel Industry?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Chronic Diseases; Increased Demand for Minimally Invasive Procedures.

6. What are the notable trends driving market growth?

Gynecologic Cancer Segment is Expected to Show Better Growth in the Forecast Years.

7. Are there any restraints impacting market growth?

Stringent Government Regulation; High Cost Associated with the Procedure.

8. Can you provide examples of recent developments in the market?

In October 2021, Bioventus acquired Misonix, Inc. This acquisition assists the company to deliver innovative products for active healing to patients and providers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultrasonic Scalpel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultrasonic Scalpel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultrasonic Scalpel Industry?

To stay informed about further developments, trends, and reports in the Ultrasonic Scalpel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence