Key Insights

The Global Colostomy Bag Market is projected for significant expansion, expected to reach $2.56 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This growth is fueled by the rising incidence of gastrointestinal disorders and cancers, necessitating increased ostomy surgeries. Technological advancements in colostomy bags, focusing on comfort, discretion, and skin-friendliness, are key market drivers. Enhanced awareness and accessibility of ostomy care solutions, particularly in developing economies, further support this upward trend. Home care is emerging as a crucial end-user segment, indicating a preference for personalized patient management.

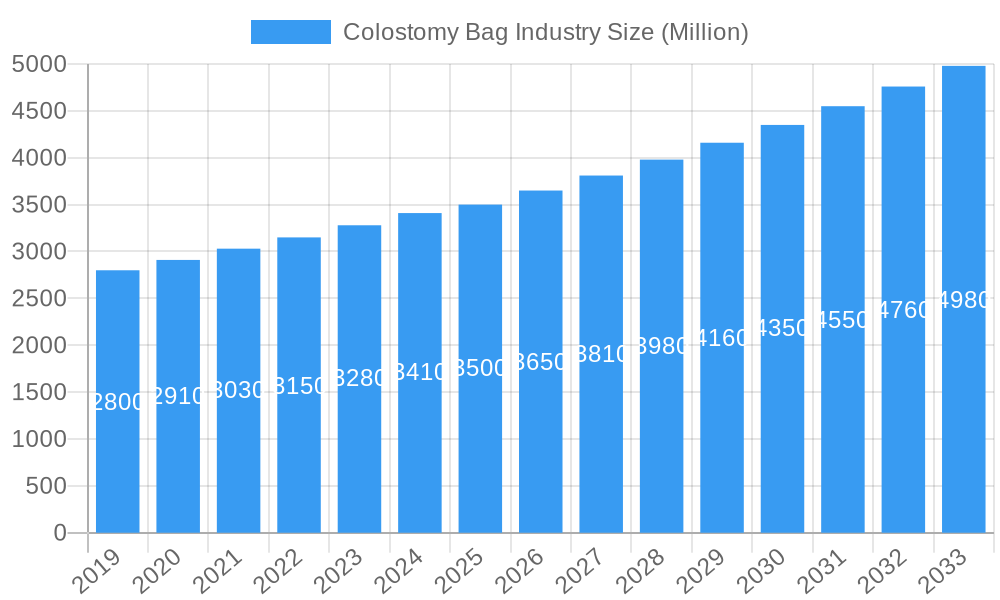

Colostomy Bag Industry Market Size (In Billion)

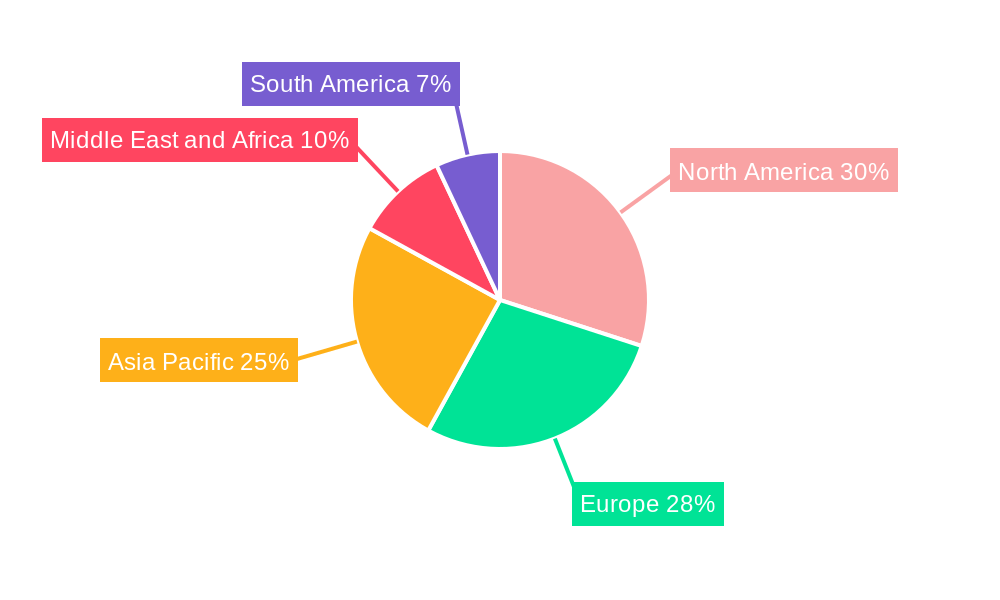

The market encompasses Colostomy Bags, Ileostomy Bags, and Urostomy Bags, alongside other ostomy types. North America and Europe dominate current market share due to advanced healthcare infrastructure and high adoption of advanced stoma management. The Asia Pacific region is anticipated to exhibit the fastest growth, driven by an expanding patient base, increasing disposable income, and a developing healthcare sector. Leading companies such as Coloplast A/S, ConvaTec Inc., and B Braun Melsungen AG are investing in R&D for product innovation and global expansion. While high costs and reimbursement challenges exist, the emphasis on improving patient quality of life and the escalating need for effective stoma management are expected to sustain market growth.

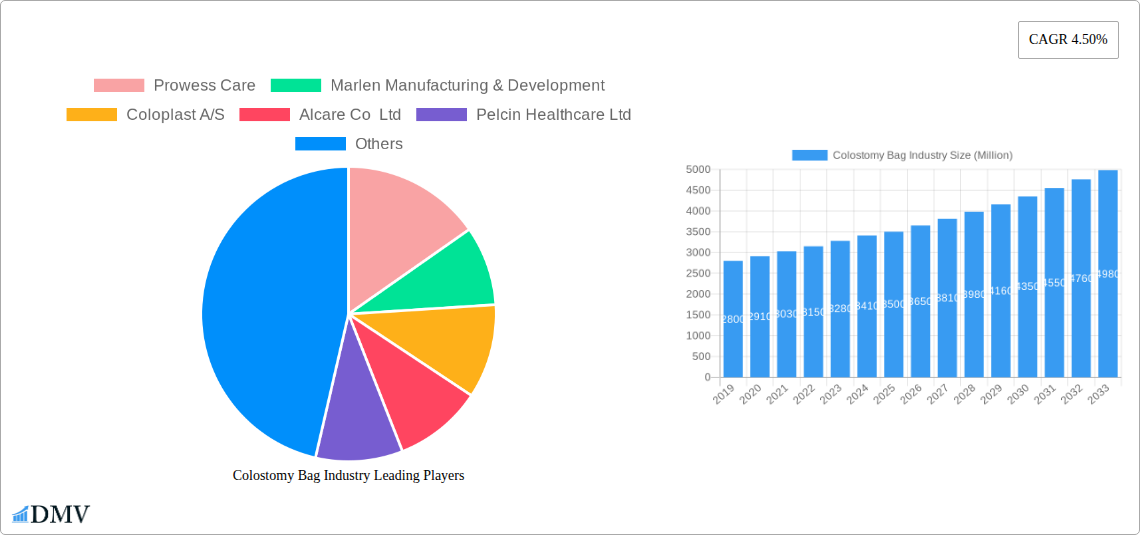

Colostomy Bag Industry Company Market Share

Colostomy Bag Industry Market Composition & Trends

The Colostomy Bag Industry is characterized by a dynamic market composition, driven by increasing incidences of colorectal cancers, inflammatory bowel diseases (IBD), and lifestyle-related conditions necessitating ostomy procedures. Market concentration is moderately fragmented, with key players like Coloplast A/S, ConvaTec Inc., and B Braun Melsungen AG holding significant market share, estimated at over 35% combined. Innovation remains a crucial catalyst, focusing on enhanced patient comfort, discretion, and skin health. Regulatory landscapes, while stringent, are also evolving to accommodate advanced ostomy care solutions. The prevalence of substitute products is minimal, with few direct alternatives offering the same functionality. End-user profiles are diverse, encompassing hospitals, home care setups, and increasingly, direct-to-consumer channels driven by online accessibility. Merger and acquisition (M&A) activities are on the rise as larger entities seek to consolidate market presence and acquire innovative technologies. Notably, recent M&A deals within the broader ostomy care market have reached a cumulative value exceeding 200 Million. Understanding these intricate market dynamics is paramount for stakeholders navigating this essential healthcare sector.

- Market Share Distribution: Leading companies hold a significant portion, with the top five players estimated to control over 60% of the global market.

- Innovation Catalysts: Focus areas include odor control, leak prevention, skin barrier technology, and discreet designs.

- Regulatory Landscape: FDA and CE marking are critical for market entry, with increasing emphasis on biocompatibility and sustainability.

- Substitute Products: Limited direct substitutes exist, but advancements in pouching systems and peristomal skin care act as indirect competition.

- End-User Focus: Growing demand from home care settings due to an aging population and preference for personalized care.

- M&A Activities: Strategic acquisitions aim to expand product portfolios and geographical reach.

Colostomy Bag Industry Industry Evolution

The Colostomy Bag Industry has witnessed a remarkable evolution, marked by consistent market growth trajectories and significant technological advancements that have fundamentally reshaped patient care and product offerings. Over the historical period from 2019 to 2024, the market experienced a steady upward trend, fueled by a confluence of factors including rising global ostomy patient populations and increasing healthcare expenditure. The estimated market size in the base year of 2025 is projected to be around 1.5 Billion, indicating substantial economic activity within this sector. This growth has been intrinsically linked to shifting consumer demands, with patients and healthcare providers alike prioritizing products that offer enhanced comfort, improved discretion, superior skin integrity, and greater ease of use.

Technological advancements have been a pivotal force in this evolution. The introduction of innovative materials, such as advanced hydrocolloid barriers that are gentler on the skin and promote faster healing, has significantly improved the quality of life for individuals with ostomies. Furthermore, the development of one-piece and two-piece pouching systems with improved sealing mechanisms and integrated odor control technologies has addressed key patient concerns, leading to higher adoption rates. The market has also seen a surge in the popularity of customizable and aesthetically discreet ostomy solutions, reflecting a growing awareness and acceptance of ostomy care as a manageable aspect of daily life.

Adoption metrics reveal a positive correlation between technological innovation and market penetration. As new, more advanced products enter the market, they are quickly adopted, particularly in developed regions with greater access to healthcare resources and patient education programs. The growth rate of the Colostomy Bag Industry has consistently averaged between 5% to 7% annually, a testament to its resilience and the unwavering need for these essential medical devices. The forecast period from 2025 to 2033 anticipates this growth to continue, driven by further innovations in smart ostomy devices, sustainable materials, and personalized patient support systems. The industry's evolution is a clear narrative of adapting to and anticipating the needs of its user base, ensuring continued relevance and expansion.

Leading Regions, Countries, or Segments in Colostomy Bag Industry

The Colostomy Bag Industry is a global market, but its dominance and growth patterns are distinctly shaped by regional dynamics and specific product segments. From the Type perspective, Colostomy Bags consistently hold the largest market share, representing approximately 45% of the total market value. This is directly attributable to the higher incidence of conditions leading to colostomy, such as colorectal cancer and diverticulitis, compared to other ostomy types. Ileostomy Bags follow closely, capturing around 30%, while Urostomy Bags account for roughly 20%, and Other Ostomy Types make up the remaining 5%.

Geographically, North America and Europe currently lead the Colostomy Bag Industry, jointly accounting for over 60% of the global market revenue. This leadership is driven by several key factors.

- Investment Trends: These regions boast robust healthcare infrastructures with significant investment in advanced medical technologies and patient care. The total market value for these regions is estimated to be in the billions.

- Regulatory Support: Favorable regulatory frameworks, coupled with strong reimbursement policies for ostomy supplies, encourage the adoption of high-quality products.

- Prevalence of Chronic Diseases: High rates of colorectal cancer and inflammatory bowel diseases in these developed nations directly contribute to a larger patient pool requiring ostomy solutions.

- Awareness and Education: Extensive patient education programs and readily available healthcare services enhance awareness and facilitate access to ostomy products and support.

Within these leading regions, Hospitals remain a primary end-user segment, contributing significantly to market revenue due to a high volume of surgical procedures and post-operative care. However, the Home Care Setups segment is experiencing rapid growth. This surge is propelled by an aging global population, a preference for managing care in familiar environments, and the increasing availability of direct-to-consumer sales channels and telehealth services that support home-based ostomy management. The market value attributed to home care is projected to grow at a CAGR of 7% over the forecast period. The overall market for ostomy bags is estimated to reach 3 Billion by the end of the forecast period, with these key regions and segments driving this expansion.

Colostomy Bag Industry Product Innovations

Product innovations in the Colostomy Bag Industry are laser-focused on enhancing patient quality of life through improved comfort, discretion, and skin health. Leading companies are developing advanced ostomy pouches featuring highly breathable and skin-friendly hydrocolloid adhesives that minimize irritation and promote rapid peristomal skin healing, a key differentiator. Innovations include one-piece systems for simplicity and two-piece systems offering greater flexibility, alongside features like integrated filters for discreet odor management and anti-reflux valves to prevent backflow. The performance metrics of newer products demonstrate superior leakage protection, extended wear time, and increased patient satisfaction, with many products now offering enhanced flexibility and a more natural body contour. These technological advancements are crucial in addressing the evolving needs of ostomy patients and solidifying market leadership.

Propelling Factors for Colostomy Bag Industry Growth

Several key factors are propelling the growth of the Colostomy Bag Industry.

- Rising Incidence of Chronic Diseases: The increasing prevalence of colorectal cancer, inflammatory bowel diseases (IBD) like Crohn's disease and ulcerative colitis, and obesity-related complications globally drives the demand for ostomy procedures and, consequently, ostomy bags.

- Technological Advancements: Continuous innovation in materials science and product design leads to more comfortable, discreet, and skin-friendly ostomy bags, improving patient compliance and satisfaction. Features like enhanced odor control, improved adhesion, and flexible pouching systems are key drivers.

- Aging Population: The growing elderly population is more susceptible to conditions requiring ostomy surgery, directly expanding the addressable market for ostomy care products.

- Increased Healthcare Spending and Awareness: Growing healthcare expenditure worldwide, coupled with greater awareness and acceptance of ostomy care, contributes to market expansion.

Obstacles in the Colostomy Bag Industry Market

Despite its growth, the Colostomy Bag Industry faces significant obstacles.

- Regulatory Hurdles: Stringent regulatory requirements for medical device approval in different regions can increase development costs and time-to-market for new products.

- Supply Chain Disruptions: Global supply chain vulnerabilities, as witnessed during recent pandemics, can lead to shortages and price volatility for raw materials and finished goods, impacting accessibility and affordability.

- Cost of Advanced Products: While innovative, newer ostomy bags often come at a higher price point, posing a challenge for cost-sensitive healthcare systems and individual patients, particularly in lower-income regions.

- Stigma and Lack of Awareness: Despite improvements, a lingering social stigma surrounding ostomies can lead to delayed diagnosis or reluctance in seeking appropriate care and products, impacting market penetration in certain demographics.

Future Opportunities in Colostomy Bag Industry

The Colostomy Bag Industry is poised for significant future opportunities.

- Emerging Markets: Expanding healthcare infrastructure and increasing medical awareness in developing economies in Asia-Pacific and Latin America present substantial untapped market potential.

- Smart Ostomy Devices: The integration of sensor technology into ostomy bags for real-time monitoring of output, skin condition, and leakage offers a significant avenue for innovation and value-added services.

- Sustainable and Biodegradable Materials: Growing environmental consciousness creates an opportunity for manufacturers to develop and market eco-friendly ostomy products, appealing to a wider consumer base and meeting corporate social responsibility goals.

- Personalized Ostomy Care Solutions: Tailoring ostomy products and support services to individual patient needs, preferences, and lifestyles, leveraging data analytics and direct patient feedback, will drive customer loyalty and market differentiation.

Major Players in the Colostomy Bag Industry Ecosystem

- Prowess Care

- Marlen Manufacturing & Development

- Coloplast A/S

- Alcare Co Ltd

- Pelcin Healthcare Ltd

- Goodhealth Inc

- Welland Medical Ltd

- Oakmed Healthcare

- Flexicare Medical Ltd

- Salts Healthcare Ltd

- B Braun Melsungen AG

- Torbot Group Inc

- ConvaTec Inc

Key Developments in Colostomy Bag Industry Industry

- 2023: Coloplast launches a new generation of Brava® skin barrier products, focusing on enhanced adhesion and skin protection.

- 2023: ConvaTec introduces AuraFit™ technology for improved pouch security and wearer comfort.

- 2022: B. Braun Melsungen AG expands its ostomy care portfolio with advanced pouching systems designed for sensitive skin.

- 2022: Salts Healthcare Ltd announces strategic partnerships to enhance distribution networks in emerging markets.

- 2021: Flexicare Medical Ltd receives regulatory approval for a new line of biodegradable ostomy bags, addressing sustainability concerns.

- 2020: Pelcin Healthcare Ltd acquires a smaller competitor to broaden its product range and market reach.

Strategic Colostomy Bag Industry Market Forecast

The strategic Colostomy Bag Industry market forecast indicates sustained robust growth driven by an expanding patient base due to rising chronic disease prevalence and an aging global population. Technological advancements, particularly in smart ostomy devices and sustainable materials, will be key growth catalysts, offering enhanced patient outcomes and appealing to eco-conscious consumers. The increasing adoption of ostomy care solutions in home settings, supported by digital health platforms and direct-to-consumer sales, presents a significant opportunity. Emerging markets in Asia-Pacific and Latin America are expected to contribute substantially to market expansion as healthcare access and awareness improve. Overall, the market is projected to reach an estimated 2.5 Billion by 2033, with innovation and patient-centric solutions at the forefront of this expansion.

Colostomy Bag Industry Segmentation

-

1. Type

- 1.1. Colostomy Bags

- 1.2. Ileostomy Bags

- 1.3. Urostomy Bags

- 1.4. Other Ostomy Types

-

2. End User

- 2.1. Hospitals

- 2.2. Home Care Setups

- 2.3. Other End Users

Colostomy Bag Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Colostomy Bag Industry Regional Market Share

Geographic Coverage of Colostomy Bag Industry

Colostomy Bag Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidence of Inflammatory Bowel Disease and Crohn's Disease; Rapidly Growing Aging Population; Rising Colorectal and Bladder Cancer Cases

- 3.3. Market Restrains

- 3.3.1. Reimbursement Issues

- 3.4. Market Trends

- 3.4.1. Colostomy Bags Segment is Expected to a Hold Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Colostomy Bag Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Colostomy Bags

- 5.1.2. Ileostomy Bags

- 5.1.3. Urostomy Bags

- 5.1.4. Other Ostomy Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Home Care Setups

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Colostomy Bag Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Colostomy Bags

- 6.1.2. Ileostomy Bags

- 6.1.3. Urostomy Bags

- 6.1.4. Other Ostomy Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Home Care Setups

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Colostomy Bag Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Colostomy Bags

- 7.1.2. Ileostomy Bags

- 7.1.3. Urostomy Bags

- 7.1.4. Other Ostomy Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Home Care Setups

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Colostomy Bag Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Colostomy Bags

- 8.1.2. Ileostomy Bags

- 8.1.3. Urostomy Bags

- 8.1.4. Other Ostomy Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Home Care Setups

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Colostomy Bag Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Colostomy Bags

- 9.1.2. Ileostomy Bags

- 9.1.3. Urostomy Bags

- 9.1.4. Other Ostomy Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Home Care Setups

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Colostomy Bag Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Colostomy Bags

- 10.1.2. Ileostomy Bags

- 10.1.3. Urostomy Bags

- 10.1.4. Other Ostomy Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Home Care Setups

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Prowess Care

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Marlen Manufacturing & Development

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Coloplast A/S

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alcare Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pelcin Healthcare Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Goodhealth Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Welland Medical Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oakmed Healthcare

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Flexicare Medical Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Salts Healthcare Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 B Braun Melsungen AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Torbot Group Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ConvaTec Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Prowess Care

List of Figures

- Figure 1: Global Colostomy Bag Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Colostomy Bag Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Colostomy Bag Industry Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Colostomy Bag Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Colostomy Bag Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Colostomy Bag Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Colostomy Bag Industry Revenue (billion), by End User 2025 & 2033

- Figure 8: North America Colostomy Bag Industry Volume (K Unit), by End User 2025 & 2033

- Figure 9: North America Colostomy Bag Industry Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Colostomy Bag Industry Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Colostomy Bag Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Colostomy Bag Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Colostomy Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Colostomy Bag Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Colostomy Bag Industry Revenue (billion), by Type 2025 & 2033

- Figure 16: Europe Colostomy Bag Industry Volume (K Unit), by Type 2025 & 2033

- Figure 17: Europe Colostomy Bag Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Colostomy Bag Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Colostomy Bag Industry Revenue (billion), by End User 2025 & 2033

- Figure 20: Europe Colostomy Bag Industry Volume (K Unit), by End User 2025 & 2033

- Figure 21: Europe Colostomy Bag Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Colostomy Bag Industry Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Colostomy Bag Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Colostomy Bag Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Colostomy Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Colostomy Bag Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Colostomy Bag Industry Revenue (billion), by Type 2025 & 2033

- Figure 28: Asia Pacific Colostomy Bag Industry Volume (K Unit), by Type 2025 & 2033

- Figure 29: Asia Pacific Colostomy Bag Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Colostomy Bag Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Colostomy Bag Industry Revenue (billion), by End User 2025 & 2033

- Figure 32: Asia Pacific Colostomy Bag Industry Volume (K Unit), by End User 2025 & 2033

- Figure 33: Asia Pacific Colostomy Bag Industry Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Pacific Colostomy Bag Industry Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia Pacific Colostomy Bag Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Colostomy Bag Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Colostomy Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Colostomy Bag Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Colostomy Bag Industry Revenue (billion), by Type 2025 & 2033

- Figure 40: Middle East and Africa Colostomy Bag Industry Volume (K Unit), by Type 2025 & 2033

- Figure 41: Middle East and Africa Colostomy Bag Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: Middle East and Africa Colostomy Bag Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: Middle East and Africa Colostomy Bag Industry Revenue (billion), by End User 2025 & 2033

- Figure 44: Middle East and Africa Colostomy Bag Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Middle East and Africa Colostomy Bag Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Middle East and Africa Colostomy Bag Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Middle East and Africa Colostomy Bag Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East and Africa Colostomy Bag Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Colostomy Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Colostomy Bag Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Colostomy Bag Industry Revenue (billion), by Type 2025 & 2033

- Figure 52: South America Colostomy Bag Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: South America Colostomy Bag Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: South America Colostomy Bag Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: South America Colostomy Bag Industry Revenue (billion), by End User 2025 & 2033

- Figure 56: South America Colostomy Bag Industry Volume (K Unit), by End User 2025 & 2033

- Figure 57: South America Colostomy Bag Industry Revenue Share (%), by End User 2025 & 2033

- Figure 58: South America Colostomy Bag Industry Volume Share (%), by End User 2025 & 2033

- Figure 59: South America Colostomy Bag Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: South America Colostomy Bag Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Colostomy Bag Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Colostomy Bag Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Colostomy Bag Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Colostomy Bag Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Colostomy Bag Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Colostomy Bag Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Global Colostomy Bag Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Colostomy Bag Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Colostomy Bag Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Colostomy Bag Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Colostomy Bag Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Global Colostomy Bag Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Global Colostomy Bag Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Colostomy Bag Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Colostomy Bag Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Colostomy Bag Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Global Colostomy Bag Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 22: Global Colostomy Bag Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global Colostomy Bag Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Colostomy Bag Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: France Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Spain Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Colostomy Bag Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Colostomy Bag Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 39: Global Colostomy Bag Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 40: Global Colostomy Bag Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 41: Global Colostomy Bag Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Colostomy Bag Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Australia Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Colostomy Bag Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 56: Global Colostomy Bag Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 57: Global Colostomy Bag Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 58: Global Colostomy Bag Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 59: Global Colostomy Bag Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Colostomy Bag Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: GCC Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: South Africa Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Colostomy Bag Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 68: Global Colostomy Bag Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 69: Global Colostomy Bag Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 70: Global Colostomy Bag Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 71: Global Colostomy Bag Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Colostomy Bag Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Brazil Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Argentina Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Colostomy Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Colostomy Bag Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colostomy Bag Industry?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Colostomy Bag Industry?

Key companies in the market include Prowess Care, Marlen Manufacturing & Development, Coloplast A/S, Alcare Co Ltd, Pelcin Healthcare Ltd, Goodhealth Inc, Welland Medical Ltd, Oakmed Healthcare, Flexicare Medical Ltd, Salts Healthcare Ltd, B Braun Melsungen AG, Torbot Group Inc, ConvaTec Inc.

3. What are the main segments of the Colostomy Bag Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidence of Inflammatory Bowel Disease and Crohn's Disease; Rapidly Growing Aging Population; Rising Colorectal and Bladder Cancer Cases.

6. What are the notable trends driving market growth?

Colostomy Bags Segment is Expected to a Hold Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Reimbursement Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colostomy Bag Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colostomy Bag Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colostomy Bag Industry?

To stay informed about further developments, trends, and reports in the Colostomy Bag Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence