Key Insights

The global Creatinine Assay Kits market is projected to reach $195.52 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 3%. This significant market expansion is driven by the increasing prevalence of chronic kidney diseases (CKDs), rising demand for early diagnostic tools, and growing global healthcare expenditure. The aging global population and advancements in assay kit development, leading to enhanced accuracy and faster results, further fuel sustained demand for creatinine testing. Innovations in immunoassay and enzymatic methods improve diagnostic capabilities for conditions like hypertension and diabetes, often precursors to CKD.

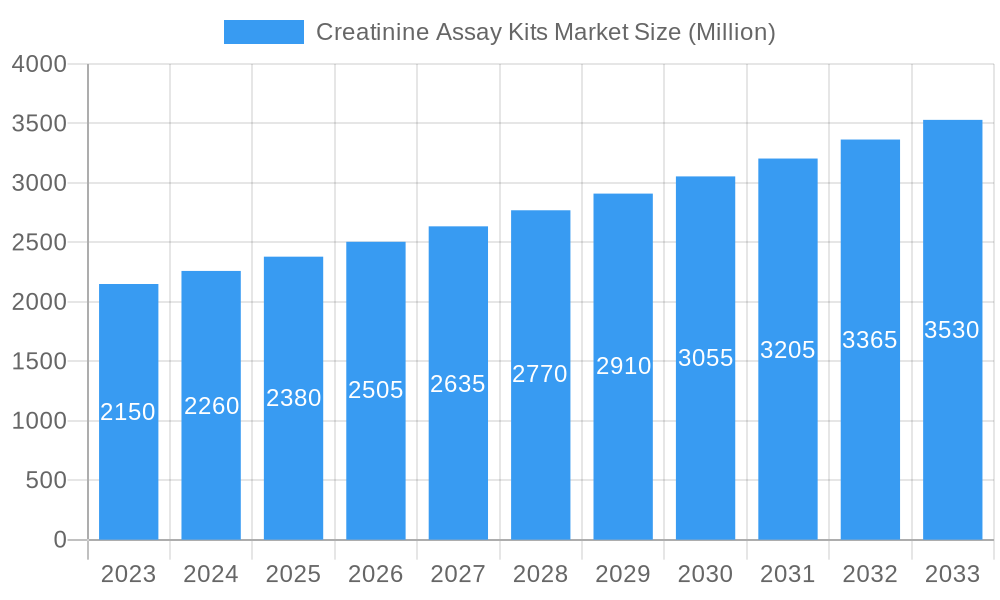

Creatinine Assay Kits Market Market Size (In Million)

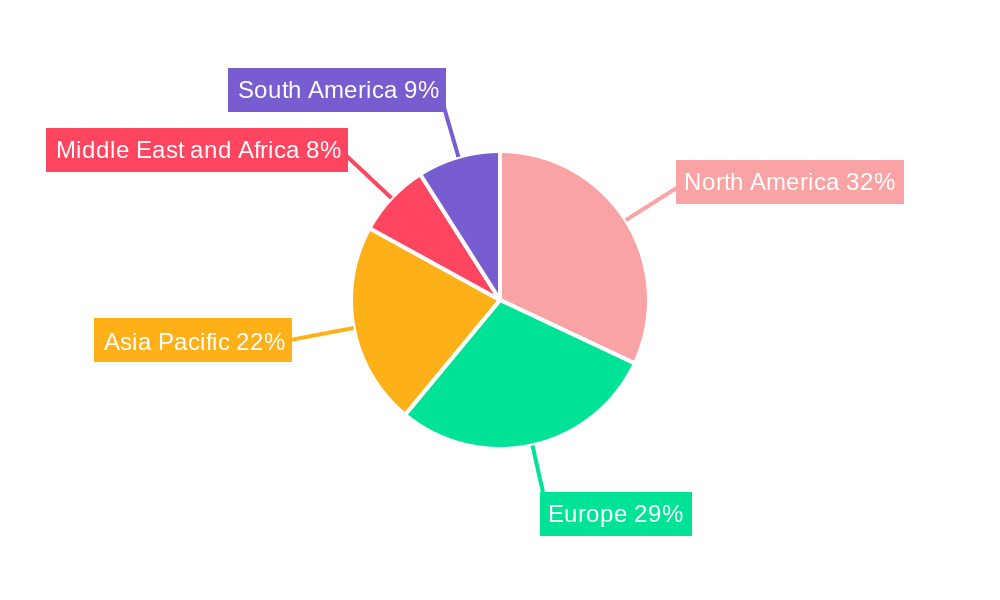

The market is segmented by kit type, including Jaffe's Kinetic, Creatinine-PAP, and ELISA test kits, and by sample type, with Blood/Serum and Urine being predominant. Geographically, North America and Europe lead due to established healthcare infrastructures and R&D investments. However, the Asia Pacific region is poised for substantial growth, driven by its large population, increasing healthcare access, and rising burden of lifestyle-related diseases. Key players are actively engaged in product innovation and strategic collaborations.

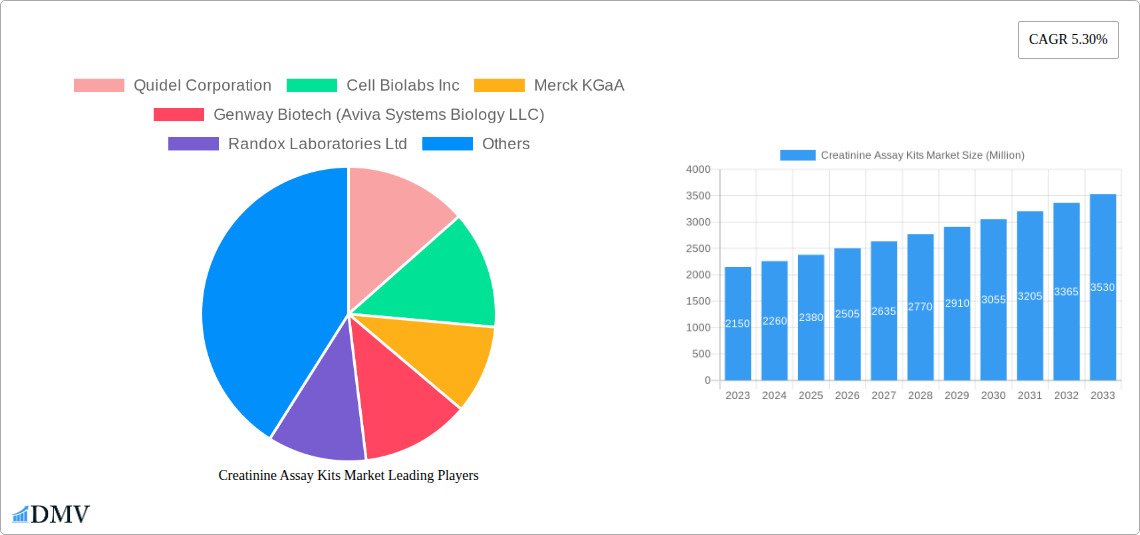

Creatinine Assay Kits Market Company Market Share

This report provides a strategic analysis of the global Creatinine Assay Kits market, offering comprehensive insights into market dynamics, competitive landscapes, and future growth trajectories from 2019-2024 with a base year of 2025, projecting to 2033. It examines market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities, supported by robust data and expert analysis. The report leverages high-ranking keywords such as "creatinine assay kits," "kidney function tests," "eGFR testing," "diagnostic kits," "biomarker testing," and "point-of-care diagnostics" for maximum search visibility.

Creatinine Assay Kits Market Market Composition & Trends

The global Creatinine Assay Kits market exhibits a moderately consolidated structure, characterized by the presence of key players like Thermo Fisher Scientific, Abbott Laboratories, and Sysmex Corporation, alongside specialized manufacturers such as Quidel Corporation and Cell Biolabs Inc. Innovation remains a critical catalyst, driven by the continuous need for faster, more accurate, and user-friendly diagnostic solutions for kidney disease detection. Regulatory landscapes, particularly those governed by the FDA and EMA, significantly influence product development and market access, emphasizing stringent quality control and efficacy standards. Substitute products, though present in the broader diagnostic testing domain, face challenges in replicating the specificity and cost-effectiveness of dedicated creatinine assay kits. End-user profiles span clinical laboratories, hospitals, physician offices, and point-of-care settings, each with distinct purchasing behaviors and demands for assay performance. Mergers and acquisitions (M&A) are increasingly shaping market concentration, with strategic partnerships aimed at expanding product portfolios and geographical reach. For instance, the acquisition of smaller diagnostic firms by larger corporations is a recurring trend, bolstering their market share. M&A deal values in the diagnostic sector have seen a steady increase, reflecting the strategic importance of acquiring innovative technologies and established market presence. While market share distribution is dynamic, a significant portion is held by the top five to seven players, indicating a competitive yet accessible market for innovative entrants. The market is projected to experience substantial growth, driven by increasing healthcare expenditure and a growing emphasis on preventative medicine and early disease detection, particularly for chronic kidney disease (CKD).

- Market Concentration: Moderately consolidated with key players holding significant market share.

- Innovation Catalysts: Demand for high-throughput, accurate, and point-of-care solutions.

- Regulatory Landscapes: Stringent approvals from FDA, EMA, and other regional bodies.

- Substitute Products: Limited direct substitutes for specific creatinine measurement.

- End-User Profiles: Hospitals, clinical labs, physician offices, point-of-care facilities.

- M&A Activities: Active consolidation to expand portfolios and market reach.

- Market Share Distribution: Top players command a significant share, with room for niche players.

- M&A Deal Values: Increasing trend reflecting strategic acquisitions in the diagnostic space.

Creatinine Assay Kits Market Industry Evolution

The Creatinine Assay Kits market has undergone a significant evolution, transitioning from traditional laboratory-based testing to increasingly sophisticated and accessible diagnostic methods. This evolution is primarily propelled by the escalating global prevalence of chronic kidney disease (CKD), a silent epidemic that necessitates early and accurate detection. The historical period (2019-2024) witnessed a steady demand for creatinine assay kits, driven by routine health check-ups and the management of pre-existing conditions like diabetes and hypertension, which are major risk factors for kidney impairment. Technological advancements have been at the forefront of this evolution. Initially, Jaffe's kinetic test kits dominated the market due to their cost-effectiveness and widespread adoption. However, the pursuit of higher specificity and reduced interference led to the rise of enzymatic methods, such as Creatinine-PAP (Peroxidase-Antidrogue-Amidinium) Test kits, offering improved accuracy. Furthermore, the advent of Enzyme-Linked Immunosorbent Assay (ELISA) test kits has provided researchers and clinical laboratories with highly sensitive and specific tools for complex studies and diagnostic applications.

The market growth trajectory has been consistently upward, with projected Compound Annual Growth Rates (CAGRs) for the forecast period (2025-2033) indicating sustained expansion. This growth is underpinned by several factors, including an aging global population, which is inherently more susceptible to kidney-related ailments, and a growing awareness among healthcare professionals and the public regarding the importance of kidney health screening. The shift towards personalized medicine and a greater emphasis on early intervention have further amplified the demand for reliable creatinine testing. Consumer demands have also evolved; patients are increasingly seeking faster turnaround times for diagnostic results, leading to a surge in the development and adoption of point-of-care (POC) creatinine testing devices and kits. These POC solutions enable rapid assessment of kidney function directly at the patient's bedside or in physician offices, facilitating timely clinical decisions and improving patient outcomes. The integration of creatinine testing into comprehensive metabolic panels and kidney function screening protocols further solidifies its position as a critical diagnostic tool. Adoption metrics show a clear trend towards automated and semi-automated systems in clinical laboratories, enhancing throughput and minimizing human error. The development of novel assay chemistries and improved reagent formulations continues to address challenges like interfering substances, ensuring the robustness and reliability of creatinine measurements. The market is adapting to a more integrated healthcare ecosystem, where diagnostic data seamlessly flows between POC devices, laboratory analyzers, and electronic health records, creating a more efficient and patient-centric approach to kidney disease management. The global burden of kidney disease, estimated to affect millions worldwide, creates a perpetual and expanding market for accurate and accessible creatinine assay kits, ensuring their continued relevance and growth in the coming years. The forecast period is expected to see further diversification in assay formats and an increased focus on multiplexing capabilities, allowing for the simultaneous measurement of creatinine alongside other kidney biomarkers for a more holistic patient assessment.

Leading Regions, Countries, or Segments in Creatinine Assay Kits Market

North America currently stands as the dominant region in the global Creatinine Assay Kits market, driven by a confluence of robust healthcare infrastructure, high healthcare expenditure, and a significant burden of kidney-related diseases, particularly among its aging population and those with prevalent comorbidities like diabetes and hypertension. The United States, in particular, leads this regional dominance due to its advanced diagnostic technology adoption, extensive network of clinical laboratories, and proactive approach to public health initiatives focusing on chronic disease management. The regulatory framework in North America, spearheaded by the Food and Drug Administration (FDA), while stringent, also fosters innovation by providing clear pathways for the approval of novel diagnostic tools, including advanced creatinine assay kits.

Within the segmentation of Type of Sample, the Blood/Serum segment commands the largest market share. This is primarily due to the established clinical practice of assessing kidney function through blood tests, which are less invasive than traditional kidney biopsies and provide readily available data for routine monitoring. Creatinine levels in blood are a primary indicator of glomerular filtration rate (GFR), making blood/serum samples the go-to for most clinical scenarios involving kidney function assessment.

When considering the Type of Test Kits, Jaffe's Kinetic Test kits continue to hold a significant market presence due to their historical widespread use, cost-effectiveness, and availability in many laboratory settings. However, the market is witnessing a progressive shift towards more specific and less interferable methods. Creatinine-PAP Test kits are gaining traction for their improved accuracy and reduced interference, especially in complex biological matrices. ELISA Test kits, while generally more expensive and time-consuming, are crucial for specialized research applications and situations demanding exceptionally high sensitivity and specificity, thus maintaining a vital niche.

Key drivers underpinning North America's dominance include:

- High Investment Trends in Healthcare R&D: Significant funding for research and development in diagnostics and biotechnology fuels the innovation and adoption of advanced creatinine assay kits.

- Supportive Regulatory Environment for Innovation: The FDA's efficient approval processes for novel diagnostic technologies encourage manufacturers to launch cutting-edge products.

- Prevalence of Kidney Disease Risk Factors: High rates of diabetes, hypertension, and an aging population contribute to a sustained and growing demand for kidney function testing.

- Established Healthcare Infrastructure: The presence of a vast network of hospitals, diagnostic laboratories, and clinics equipped with advanced analytical instruments facilitates widespread adoption.

- Patient Awareness and Demand for Early Detection: Increasing public awareness about kidney health and the demand for early diagnosis of diseases like CKD drive market growth.

The market's trajectory indicates that while North America will likely maintain its leading position, other regions such as Europe and Asia-Pacific are expected to exhibit substantial growth rates due to increasing healthcare investments, rising awareness of kidney disease, and improving diagnostic capabilities in emerging economies. The Blood/Serum sample type will continue to dominate, but advancements in urine-based creatinine analysis for at-home monitoring might see increased adoption in the long term, offering a less invasive alternative for certain applications.

Creatinine Assay Kits Market Product Innovations

Product innovations in the Creatinine Assay Kits market are primarily focused on enhancing assay speed, accuracy, and ease of use, particularly for point-of-care (POC) applications. Novel enzymatic and electrochemical detection methods are being developed to minimize interference from common endogenous and exogenous substances that can affect traditional Jaffe-based assays. Thermo Fisher Scientific and Abbott Laboratories are at the forefront, introducing kits with improved linearity, sensitivity, and reduced assay times. The development of reagent stabilization technologies allows for longer shelf lives and greater flexibility in storage conditions, crucial for POC devices. Furthermore, integration with digital health platforms and smartphone connectivity is enabling real-time data sharing and remote patient monitoring, revolutionizing kidney disease management. These advancements are critical in improving diagnostic efficiency and patient outcomes, particularly in resource-limited settings.

Propelling Factors for Creatinine Assay Kits Market Growth

The Creatinine Assay Kits market is propelled by several robust factors, ensuring sustained growth and expansion.

- Rising Global Incidence of Kidney Diseases: The escalating prevalence of chronic kidney disease (CKD), driven by factors like aging populations, increasing rates of diabetes, hypertension, and obesity worldwide, creates a persistent and growing demand for diagnostic tools like creatinine assay kits for early detection and monitoring.

- Technological Advancements in Assay Development: Continuous innovation in assay chemistries, automation, and miniaturization, leading to more accurate, sensitive, faster, and user-friendly kits, particularly for point-of-care (POC) settings, fuels market adoption.

- Increased Healthcare Expenditure and Awareness: Growing investments in healthcare infrastructure, coupled with heightened public and medical awareness regarding kidney health and the importance of routine screening, are significant growth drivers.

- Favorable Regulatory Scenarios and Reimbursement Policies: While regulations are stringent, streamlined approval processes for innovative diagnostic technologies and favorable reimbursement policies for kidney function tests in key markets encourage manufacturers and healthcare providers.

Obstacles in the Creatinine Assay Kits Market Market

Despite its strong growth prospects, the Creatinine Assay Kits market faces several obstacles that can impede its full potential.

- Stringent Regulatory Approvals and Compliance Costs: Obtaining regulatory clearance from bodies like the FDA and EMA for new assay kits is a time-consuming and expensive process, potentially delaying market entry for innovative products.

- Interference from Endogenous and Exogenous Substances: Traditional creatinine assay methods can be susceptible to interference from various compounds present in biological samples, leading to inaccurate results and necessitating more complex or costly alternative assays.

- Price Sensitivity in Emerging Markets: While demand is growing in emerging economies, the cost of advanced assay kits and associated instrumentation can be a barrier to widespread adoption, leading to a preference for more affordable, albeit potentially less accurate, alternatives.

- Supply Chain Disruptions and Raw Material Volatility: The global supply chain for diagnostic reagents and components can be vulnerable to disruptions, impacting production timelines and costs, as evidenced by recent global events.

Future Opportunities in Creatinine Assay Kits Market

The Creatinine Assay Kits market is ripe with future opportunities, driven by emerging trends and unmet needs.

- Expansion of Point-of-Care (POC) Diagnostics: The growing demand for rapid, accessible, and user-friendly kidney function testing at the point of care presents a significant opportunity for developing compact, cost-effective, and highly accurate POC creatinine assay kits.

- Development of Multiplex Assays: Opportunities exist in creating kits that simultaneously measure creatinine alongside other kidney biomarkers (e.g., cystatin C, NGAL) for a more comprehensive and earlier assessment of kidney health.

- Integration with Digital Health and AI: The incorporation of creatinine assay data into digital health platforms and the application of Artificial Intelligence (AI) for predictive diagnostics and personalized treatment plans offer substantial growth avenues.

- Growth in Emerging Markets: Increasing healthcare investments, improving diagnostic infrastructure, and rising awareness of kidney diseases in regions like Asia-Pacific and Latin America present vast untapped market potential.

Major Players in the Creatinine Assay Kits Market Ecosystem

- Quidel Corporation

- Cell Biolabs Inc

- Merck KGaA

- Genway Biotech (Aviva Systems Biology LLC)

- Randox Laboratories Ltd

- Nova Biomedical

- Abbott Laboratories

- Sysmex Corporation

- Thermo Fisher Scientific

- ACON Laboratories

Key Developments in Creatinine Assay Kits Market Industry

- July 2022: Creative Enzymes, one of the leading diagnostic enzyme production companies, launched new enzymes for the production of creatinine assay kits, enhancing the development and manufacturing capabilities of kit producers.

- June 2022: Nova Biomedical launched the CE-marked Nova Max Pro creatinine/eGFR meter system in the European market. Nova Max Pro was designed to improve kidney care through kidney function screening and early detection of kidney disease in point-of-care settings outside the hospital, highlighting the trend towards portable and integrated diagnostic solutions.

Strategic Creatinine Assay Kits Market Market Forecast

The Creatinine Assay Kits market is poised for significant and sustained growth over the forecast period (2025-2033). This expansion will be driven by the confluence of rising global kidney disease incidence, continuous technological advancements leading to more accurate and accessible diagnostic tools, and increasing healthcare investments worldwide. The growing emphasis on early detection and preventative healthcare strategies will further fuel demand for routine kidney function screening. Key growth catalysts include the expanding adoption of point-of-care diagnostics, enabling faster clinical decision-making, and the development of multiplex assays that offer comprehensive patient insights. Emerging markets, with their burgeoning healthcare sectors and increasing awareness of chronic diseases, represent a substantial opportunity for market penetration and growth. Strategic initiatives by major players, focusing on product innovation, market expansion, and partnerships, will shape the competitive landscape and drive the overall market potential. The market forecast indicates a robust CAGR, underscoring the critical role of creatinine assay kits in modern healthcare.

Creatinine Assay Kits Market Segmentation

-

1. Type

- 1.1. Jaffe's Kinetic Test kits

- 1.2. Creatinine-PAP Test kits

- 1.3. ELISA Test kits

-

2. Type of Sample

- 2.1. Blood/Serum

- 2.2. Urine

- 2.3. Other Samples

Creatinine Assay Kits Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Creatinine Assay Kits Market Regional Market Share

Geographic Coverage of Creatinine Assay Kits Market

Creatinine Assay Kits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidence of Renal and Other Chronic Disorders Impacting Renal Function; Technological Advancements in Biomedical Research Pertaining to Kidney Disorders; Increasing Research and Development Initiatives

- 3.3. Market Restrains

- 3.3.1. Identification of Novel Renal Dysfunction Biomarkers; Limited Usage of Creatinine Assay Kits in Invitro Diagnostic Device (IVD)

- 3.4. Market Trends

- 3.4.1. Blood/Serum Segment is Expected to Witness Rapid Growth over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Creatinine Assay Kits Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Jaffe's Kinetic Test kits

- 5.1.2. Creatinine-PAP Test kits

- 5.1.3. ELISA Test kits

- 5.2. Market Analysis, Insights and Forecast - by Type of Sample

- 5.2.1. Blood/Serum

- 5.2.2. Urine

- 5.2.3. Other Samples

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Creatinine Assay Kits Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Jaffe's Kinetic Test kits

- 6.1.2. Creatinine-PAP Test kits

- 6.1.3. ELISA Test kits

- 6.2. Market Analysis, Insights and Forecast - by Type of Sample

- 6.2.1. Blood/Serum

- 6.2.2. Urine

- 6.2.3. Other Samples

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Creatinine Assay Kits Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Jaffe's Kinetic Test kits

- 7.1.2. Creatinine-PAP Test kits

- 7.1.3. ELISA Test kits

- 7.2. Market Analysis, Insights and Forecast - by Type of Sample

- 7.2.1. Blood/Serum

- 7.2.2. Urine

- 7.2.3. Other Samples

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Creatinine Assay Kits Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Jaffe's Kinetic Test kits

- 8.1.2. Creatinine-PAP Test kits

- 8.1.3. ELISA Test kits

- 8.2. Market Analysis, Insights and Forecast - by Type of Sample

- 8.2.1. Blood/Serum

- 8.2.2. Urine

- 8.2.3. Other Samples

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Creatinine Assay Kits Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Jaffe's Kinetic Test kits

- 9.1.2. Creatinine-PAP Test kits

- 9.1.3. ELISA Test kits

- 9.2. Market Analysis, Insights and Forecast - by Type of Sample

- 9.2.1. Blood/Serum

- 9.2.2. Urine

- 9.2.3. Other Samples

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Creatinine Assay Kits Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Jaffe's Kinetic Test kits

- 10.1.2. Creatinine-PAP Test kits

- 10.1.3. ELISA Test kits

- 10.2. Market Analysis, Insights and Forecast - by Type of Sample

- 10.2.1. Blood/Serum

- 10.2.2. Urine

- 10.2.3. Other Samples

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Quidel Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cell Biolabs Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Genway Biotech (Aviva Systems Biology LLC)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Randox Laboratories Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nova Biomedical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Abbott Laboratories

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sysmex Corporation*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thermo Fisher Scientific

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ACON Laboratories

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Quidel Corporation

List of Figures

- Figure 1: Global Creatinine Assay Kits Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Creatinine Assay Kits Market Revenue (million), by Type 2025 & 2033

- Figure 3: North America Creatinine Assay Kits Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Creatinine Assay Kits Market Revenue (million), by Type of Sample 2025 & 2033

- Figure 5: North America Creatinine Assay Kits Market Revenue Share (%), by Type of Sample 2025 & 2033

- Figure 6: North America Creatinine Assay Kits Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America Creatinine Assay Kits Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Creatinine Assay Kits Market Revenue (million), by Type 2025 & 2033

- Figure 9: Europe Creatinine Assay Kits Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Creatinine Assay Kits Market Revenue (million), by Type of Sample 2025 & 2033

- Figure 11: Europe Creatinine Assay Kits Market Revenue Share (%), by Type of Sample 2025 & 2033

- Figure 12: Europe Creatinine Assay Kits Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Creatinine Assay Kits Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Creatinine Assay Kits Market Revenue (million), by Type 2025 & 2033

- Figure 15: Asia Pacific Creatinine Assay Kits Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Creatinine Assay Kits Market Revenue (million), by Type of Sample 2025 & 2033

- Figure 17: Asia Pacific Creatinine Assay Kits Market Revenue Share (%), by Type of Sample 2025 & 2033

- Figure 18: Asia Pacific Creatinine Assay Kits Market Revenue (million), by Country 2025 & 2033

- Figure 19: Asia Pacific Creatinine Assay Kits Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Creatinine Assay Kits Market Revenue (million), by Type 2025 & 2033

- Figure 21: Middle East and Africa Creatinine Assay Kits Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Creatinine Assay Kits Market Revenue (million), by Type of Sample 2025 & 2033

- Figure 23: Middle East and Africa Creatinine Assay Kits Market Revenue Share (%), by Type of Sample 2025 & 2033

- Figure 24: Middle East and Africa Creatinine Assay Kits Market Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Creatinine Assay Kits Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Creatinine Assay Kits Market Revenue (million), by Type 2025 & 2033

- Figure 27: South America Creatinine Assay Kits Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Creatinine Assay Kits Market Revenue (million), by Type of Sample 2025 & 2033

- Figure 29: South America Creatinine Assay Kits Market Revenue Share (%), by Type of Sample 2025 & 2033

- Figure 30: South America Creatinine Assay Kits Market Revenue (million), by Country 2025 & 2033

- Figure 31: South America Creatinine Assay Kits Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Creatinine Assay Kits Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Creatinine Assay Kits Market Revenue million Forecast, by Type of Sample 2020 & 2033

- Table 3: Global Creatinine Assay Kits Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Creatinine Assay Kits Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Global Creatinine Assay Kits Market Revenue million Forecast, by Type of Sample 2020 & 2033

- Table 6: Global Creatinine Assay Kits Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Creatinine Assay Kits Market Revenue million Forecast, by Type 2020 & 2033

- Table 11: Global Creatinine Assay Kits Market Revenue million Forecast, by Type of Sample 2020 & 2033

- Table 12: Global Creatinine Assay Kits Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Germany Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: France Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Italy Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Spain Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Creatinine Assay Kits Market Revenue million Forecast, by Type 2020 & 2033

- Table 20: Global Creatinine Assay Kits Market Revenue million Forecast, by Type of Sample 2020 & 2033

- Table 21: Global Creatinine Assay Kits Market Revenue million Forecast, by Country 2020 & 2033

- Table 22: China Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Japan Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: India Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Australia Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Creatinine Assay Kits Market Revenue million Forecast, by Type 2020 & 2033

- Table 29: Global Creatinine Assay Kits Market Revenue million Forecast, by Type of Sample 2020 & 2033

- Table 30: Global Creatinine Assay Kits Market Revenue million Forecast, by Country 2020 & 2033

- Table 31: GCC Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Global Creatinine Assay Kits Market Revenue million Forecast, by Type 2020 & 2033

- Table 35: Global Creatinine Assay Kits Market Revenue million Forecast, by Type of Sample 2020 & 2033

- Table 36: Global Creatinine Assay Kits Market Revenue million Forecast, by Country 2020 & 2033

- Table 37: Brazil Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Creatinine Assay Kits Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Creatinine Assay Kits Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Creatinine Assay Kits Market?

Key companies in the market include Quidel Corporation, Cell Biolabs Inc, Merck KGaA, Genway Biotech (Aviva Systems Biology LLC), Randox Laboratories Ltd, Nova Biomedical, Abbott Laboratories, Sysmex Corporation*List Not Exhaustive, Thermo Fisher Scientific, ACON Laboratories.

3. What are the main segments of the Creatinine Assay Kits Market?

The market segments include Type, Type of Sample.

4. Can you provide details about the market size?

The market size is estimated to be USD 195.52 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidence of Renal and Other Chronic Disorders Impacting Renal Function; Technological Advancements in Biomedical Research Pertaining to Kidney Disorders; Increasing Research and Development Initiatives.

6. What are the notable trends driving market growth?

Blood/Serum Segment is Expected to Witness Rapid Growth over the Forecast Period.

7. Are there any restraints impacting market growth?

Identification of Novel Renal Dysfunction Biomarkers; Limited Usage of Creatinine Assay Kits in Invitro Diagnostic Device (IVD).

8. Can you provide examples of recent developments in the market?

July 2022: Creative Enzymes, one of the leading diagnostic enzyme production companies, launched new enzymes for the production of creatinine assay kits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Creatinine Assay Kits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Creatinine Assay Kits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Creatinine Assay Kits Market?

To stay informed about further developments, trends, and reports in the Creatinine Assay Kits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence