Key Insights

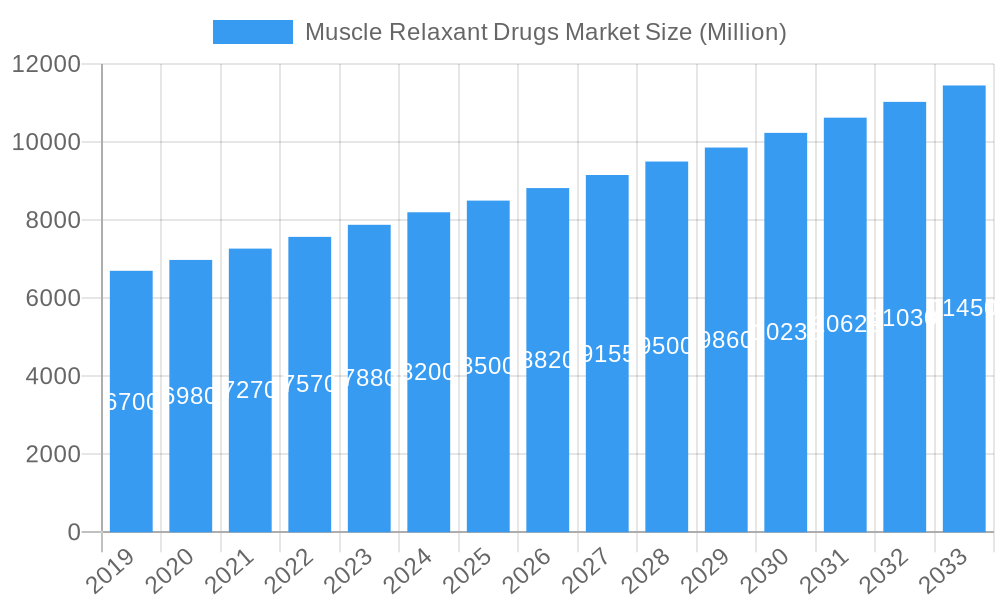

The global Muscle Relaxant Drugs Market is poised for significant growth, projected to reach an estimated market size of approximately USD 8,500 Million by 2025, and expand at a robust Compound Annual Growth Rate (CAGR) of 5.60% through 2033. This expansion is primarily fueled by the escalating prevalence of musculoskeletal disorders, chronic pain conditions, and neurological diseases, all of which necessitate effective muscle relaxation therapies. The aging global population, coupled with increased sedentary lifestyles and sports-related injuries, further contributes to the rising demand for muscle relaxant medications. Advancements in drug development, leading to the introduction of more targeted and effective formulations with fewer side effects, are also key drivers. The market is segmented into distinct drug types, including Facial Muscle Relaxants, Skeletal Muscle Relaxants, and Neuromuscular Blocking Agents, each catering to specific therapeutic needs. Distribution channels, encompassing Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies, are evolving to improve patient access and convenience.

Muscle Relaxant Drugs Market Market Size (In Billion)

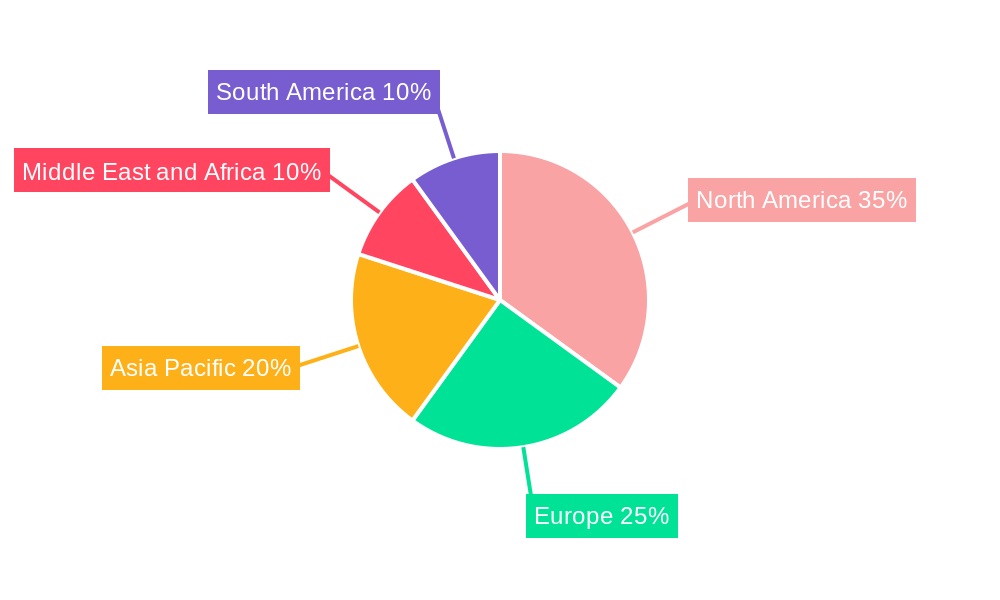

The market dynamics are shaped by several influencing factors. Key growth drivers include the increasing incidence of conditions like back pain, fibromyalgia, and spasticity associated with multiple sclerosis and cerebral palsy. The growing awareness among healthcare professionals and patients about the benefits of muscle relaxants for pain management and improved quality of life is a significant propellant. However, the market also faces certain restraints, such as the potential for drug dependence and abuse, the availability of alternative therapies like physical therapy and acupuncture, and stringent regulatory approvals for new drug launches. Geographically, North America is expected to lead the market, driven by high healthcare expenditure and the widespread adoption of advanced treatments. Asia Pacific presents a substantial growth opportunity due to its large population, increasing healthcare infrastructure, and rising disposable incomes, leading to a greater accessibility of these drugs.

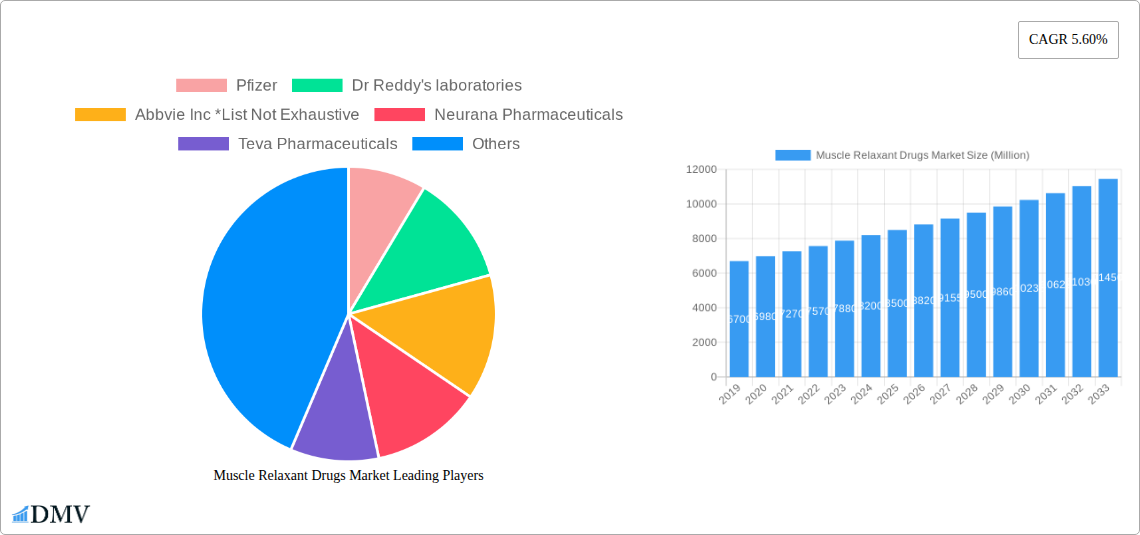

Muscle Relaxant Drugs Market Company Market Share

This in-depth report offers a panoramic view of the global Muscle Relaxant Drugs Market, delving into its current landscape and projecting its future trajectory. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, this analysis provides critical insights for pharmaceutical manufacturers, healthcare providers, investors, and regulatory bodies. We dissect the market by type of drugs, including Facial Muscle Relaxants, Skeletal Muscle Relaxants, and Neuromuscular Blocking Agents, and analyze its reach through distribution channels such as Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy. With the estimated year of 2025 underpinning current market assessments, this report meticulously examines historical trends from 2019–2024 to paint a complete picture. Discover market composition, innovation drivers, regulatory hurdles, and a detailed competitive landscape featuring key players like Pfizer, Dr Reddy's Laboratories, AbbVie Inc (list not exhaustive), Neurana Pharmaceuticals, Teva Pharmaceuticals, Acorda Therapeutics, Unichem Laboratories, SteriMax Inc, Endo Pharmaceuticals Inc, Ipsen Biopharmaceuticals Inc, Zydus Cadila, and Lannett.

Muscle Relaxant Drugs Market Market Composition & Trends

The Muscle Relaxant Drugs Market exhibits a dynamic composition shaped by evolving therapeutic needs and technological advancements. Market concentration is moderately fragmented, with established pharmaceutical giants and emerging specialty players vying for market share. Innovation catalysts are primarily driven by the demand for more targeted therapies with fewer side effects, advancements in drug delivery systems, and a growing understanding of neurological disorders. The regulatory landscape, while stringent, plays a crucial role in ensuring product safety and efficacy, influencing market entry and product approvals. Substitute products, such as physical therapy and alternative pain management techniques, exert some pressure, but the efficacy of pharmacological interventions remains paramount for severe spasticity and acute muscle pain. End-user profiles range from individuals suffering from chronic pain and musculoskeletal injuries to post-operative patients and those with neurological conditions like multiple sclerosis and cerebral palsy. Merger and acquisition (M&A) activities are significant, with companies seeking to expand their product portfolios, gain access to new technologies, and consolidate their market positions. For instance, recent M&A deals in the muscle relaxant sector have seen valuations ranging from tens of millions to hundreds of millions of dollars, reflecting the strategic importance of this market segment. The market share distribution is influenced by the prevalence of specific conditions requiring muscle relaxation and the availability of effective treatments. The presence of blockbuster drugs and the development of novel formulations continue to shape the competitive environment, with estimated M&A deal values in the sector projected to exceed XXX Million by 2025.

Muscle Relaxant Drugs Market Industry Evolution

The Muscle Relaxant Drugs Market has undergone a significant industry evolution, driven by a confluence of factors that have reshaped its growth trajectories, technological advancements, and consumer demands. Historically, the market was dominated by older, less targeted muscle relaxants, often associated with considerable side effects. However, the historical period of 2019–2024 witnessed a paradigm shift towards the development of more sophisticated and specific agents. Technological advancements in drug discovery and formulation have been instrumental in this evolution. Researchers have focused on developing drugs that offer better efficacy with improved safety profiles, leading to a decline in the use of certain older medications and a rise in demand for newer, specialized treatments. The adoption of novel drug delivery systems, such as extended-release formulations and targeted delivery mechanisms, has further enhanced patient compliance and therapeutic outcomes. Consumer demands have also played a pivotal role. Patients are increasingly seeking treatments that not only alleviate pain and spasticity but also minimize sedation, cognitive impairment, and addiction potential. This demand has spurred innovation in the development of non-opioid muscle relaxants and those with a more favorable side-effect profile. The prevalence of chronic pain conditions, including back pain, fibromyalgia, and neuropathic pain, has seen a steady increase, creating a larger patient pool requiring effective muscle relaxation therapies. Furthermore, the growing aging population worldwide contributes to a higher incidence of musculoskeletal disorders and age-related neurological conditions, further augmenting the demand for these drugs. The focus on personalized medicine and targeted therapies has also influenced the market, with a growing interest in identifying specific patient subgroups that would benefit most from particular muscle relaxant drugs. This personalized approach, coupled with advancements in pharmacogenomics, allows for more precise treatment selection and improved patient care. The market's growth rate, which hovered around X% in the historical period, is projected to accelerate in the forecast period, driven by these evolving dynamics. The overall market size, estimated to be in the billions of dollars, is poised for substantial expansion, with projected compound annual growth rates (CAGRs) expected to be in the range of X% to Y% between 2025 and 2033. This growth is underpinned by sustained investment in research and development, a robust pipeline of innovative products, and an expanding global patient base. The industry's evolution is not merely about incremental improvements but a fundamental transformation towards safer, more effective, and patient-centric muscle relaxant therapies.

Leading Regions, Countries, or Segments in Muscle Relaxant Drugs Market

The Muscle Relaxant Drugs Market exhibits distinct regional dominance and segment preferences, with North America consistently emerging as a leading force. This supremacy is driven by several key factors, including a high prevalence of conditions requiring muscle relaxation, advanced healthcare infrastructure, significant R&D investments, and favorable regulatory environments that encourage innovation. The United States, in particular, accounts for a substantial portion of the global market share due to its large patient population, high disposable income, and the presence of major pharmaceutical manufacturers.

Within the Type of Drugs segment, Skeletal Muscle Relaxants command the largest market share. This is primarily attributable to the widespread incidence of musculoskeletal disorders, acute injuries, chronic back pain, and spasticity associated with neurological conditions like stroke, spinal cord injury, and multiple sclerosis. The continuous development of novel skeletal muscle relaxants with improved efficacy and safety profiles further fuels their dominance. Neuromuscular Blocking Agents represent a significant segment, particularly within hospital settings for surgical procedures and intensive care units, where precise muscle relaxation is critical. While Facial Muscle Relaxants, often used for cosmetic purposes or conditions like blepharospasm, constitute a smaller but growing niche, their market penetration is steadily increasing with advancements in aesthetic medicine and the development of targeted formulations.

The Distribution Channel analysis reveals Hospital Pharmacy as the most dominant channel. This is due to the critical role of hospital pharmacies in dispensing prescription medications for acute conditions, post-surgical care, and severe neurological disorders requiring in-patient treatment. The direct administration and monitoring of muscle relaxants in hospital settings contribute to this dominance. Retail Pharmacies play a crucial role in providing access to medications for chronic pain management and outpatient care, catering to a broad spectrum of patients managing their conditions at home. The growing influence of Online Pharmacy is an emerging trend, offering convenience and accessibility, especially for repeat prescriptions and for patients in remote areas. However, regulatory oversight and the need for prescription verification remain key considerations for this channel.

Key drivers for the dominance of North America and the Skeletal Muscle Relaxants segment include:

- High Investment in R&D: Significant funding allocated to research and development of novel muscle relaxants, leading to a robust pipeline of innovative products.

- Favorable Reimbursement Policies: Strong insurance coverage and reimbursement policies in countries like the United States facilitate patient access to a wide range of muscle relaxant drugs.

- Prevalence of Chronic Pain and Neurological Disorders: A rising incidence of chronic pain, back pain, and neurological conditions such as multiple sclerosis and stroke directly translates to increased demand for muscle relaxant therapies.

- Advanced Healthcare Infrastructure: Well-established healthcare systems with sophisticated diagnostic capabilities and treatment protocols support the widespread use and prescription of muscle relaxants.

- Growing Geriatric Population: An increasing elderly population is more susceptible to musculoskeletal ailments and age-related neurological conditions, driving the demand for muscle relaxant drugs.

- Technological Advancements in Drug Delivery: Innovations in formulation and delivery systems enhance drug efficacy, reduce side effects, and improve patient compliance, further boosting the market.

- Regulatory Support for Innovation: While stringent, regulatory bodies in leading regions often provide clear pathways for the approval of novel and effective muscle relaxant therapies.

Muscle Relaxant Drugs Market Product Innovations

Product innovations in the Muscle Relaxant Drugs Market are predominantly focused on enhancing efficacy, minimizing side effects, and improving patient convenience. Companies are actively developing novel formulations of existing drugs, such as extended-release and long-acting injectables, to provide sustained relief and reduce dosing frequency. Research is also progressing on drugs with more targeted mechanisms of action, aiming to specifically address the underlying causes of muscle spasms and spasticity with fewer systemic effects. Furthermore, there's a growing interest in non-opioid muscle relaxants to combat the opioid crisis, with a focus on developing alternatives that offer comparable pain relief without the risk of addiction. Performance metrics are centered on achieving rapid onset of action, prolonged duration of effect, and a reduced incidence of sedation, dizziness, and cognitive impairment.

Propelling Factors for Muscle Relaxant Drugs Market Growth

The Muscle Relaxant Drugs Market is propelled by a confluence of potent factors. The increasing global prevalence of chronic pain conditions, musculoskeletal injuries, and neurological disorders like multiple sclerosis and cerebral palsy directly fuels demand. Technological advancements in drug discovery and formulation are leading to the development of more effective and safer muscle relaxants with targeted mechanisms of action, such as Skeletal Muscle Relaxants and novel Neuromuscular Blocking Agents. Favorable reimbursement policies in key markets, coupled with a growing aging population susceptible to these conditions, further amplify market growth. Additionally, increased awareness among healthcare professionals and patients regarding the benefits of appropriate muscle relaxant therapy for improving quality of life and functional mobility is a significant growth catalyst.

Obstacles in the Muscle Relaxant Drugs Market Market

Despite robust growth prospects, the Muscle Relaxant Drugs Market faces several obstacles. Stringent regulatory approval processes for new drugs can lead to lengthy development timelines and high costs. The potential for side effects, including sedation, dizziness, and dependence, remains a concern, limiting the use of certain older medications and necessitating careful patient selection and monitoring. The emergence of generic competition for established drugs can impact pricing and profitability for branded manufacturers. Furthermore, supply chain disruptions, as observed in recent global events, can affect the availability and cost of raw materials and finished products. Intense competition among existing players and the development of alternative therapies, such as physical rehabilitation and non-pharmacological pain management, also present challenges.

Future Opportunities in Muscle Relaxant Drugs Market

The Muscle Relaxant Drugs Market is ripe with future opportunities. The burgeoning interest in developing non-opioid muscle relaxants presents a significant avenue for innovation and market penetration, addressing the global opioid crisis. Advancements in personalized medicine and pharmacogenomics offer the potential to tailor muscle relaxant therapies to individual patient profiles, optimizing efficacy and minimizing adverse events. The expansion of healthcare access in emerging economies will drive demand for muscle relaxant drugs in new geographical markets. Furthermore, the development of novel drug delivery systems, such as long-acting injectables and transdermal patches, promises to improve patient compliance and therapeutic outcomes, creating opportunities for differentiation and market leadership.

Major Players in the Muscle Relaxant Drugs Market Ecosystem

- Pfizer

- Dr Reddy's Laboratories

- AbbVie Inc

- Neurana Pharmaceuticals

- Teva Pharmaceuticals

- Acorda Therapeutics

- Unichem Laboratories

- SteriMax Inc

- Endo Pharmaceuticals Inc

- Ipsen Biopharmaceuticals Inc

- Zydus Cadila

- Lannett

Key Developments in Muscle Relaxant Drugs Market Industry

- June 2022: Amneal Pharmaceuticals launched LYVISPAH, a baclofen oral granules specialty product. This USFDA-approved product is designed to treat spasticity related to multiple sclerosis and other spinal cord disorders, marking a significant advancement in accessible oral treatment options.

- January 2022: Amneal Pharmaceuticals completed the acquisition of Saol's Baclofen franchise. This strategic move included Lioresal and LYVISPAH, along with a promising pipeline product under development. The acquisition significantly expanded Amneal's commercial institutional and specialty portfolio within the neurology segment and bolstered its commercial infrastructure prior to its entry into the biosimilar institutional market.

Strategic Muscle Relaxant Drugs Market Market Forecast

The strategic Muscle Relaxant Drugs Market forecast indicates sustained growth driven by increasing diagnoses of chronic pain and neurological conditions, coupled with a growing demand for safer and more effective treatment options. The development of innovative Skeletal Muscle Relaxants and advanced Neuromuscular Blocking Agents will be key growth catalysts. Expansion into emerging markets and the adoption of novel drug delivery systems will unlock significant new opportunities. Investments in R&D focused on non-opioid alternatives and personalized medicine approaches are expected to reshape the competitive landscape, positioning companies that prioritize patient-centric solutions for long-term success. The market is projected to reach an estimated value of over XXX Million by 2033, with a robust CAGR driven by these strategic imperatives.

Muscle Relaxant Drugs Market Segmentation

-

1. Type of Drugs

- 1.1. Facial Muscle Relaxants

- 1.2. Skeletal muscle Relaxants

- 1.3. Neuromuscular Blocking Agents

-

2. Dristibution Channel

- 2.1. Hospital Pharmacy

- 2.2. Retail Pharmacy

- 2.3. Online Pharmacy

Muscle Relaxant Drugs Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Muscle Relaxant Drugs Market Regional Market Share

Geographic Coverage of Muscle Relaxant Drugs Market

Muscle Relaxant Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Geriatric Population; Increasing Prevalence of Musculoskeletal Disorders

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Muscle Relaxants

- 3.4. Market Trends

- 3.4.1. Neuromuscular Blocking Agents Segment is Expected to Witness Significant Growth Over the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Muscle Relaxant Drugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Drugs

- 5.1.1. Facial Muscle Relaxants

- 5.1.2. Skeletal muscle Relaxants

- 5.1.3. Neuromuscular Blocking Agents

- 5.2. Market Analysis, Insights and Forecast - by Dristibution Channel

- 5.2.1. Hospital Pharmacy

- 5.2.2. Retail Pharmacy

- 5.2.3. Online Pharmacy

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type of Drugs

- 6. North America Muscle Relaxant Drugs Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Drugs

- 6.1.1. Facial Muscle Relaxants

- 6.1.2. Skeletal muscle Relaxants

- 6.1.3. Neuromuscular Blocking Agents

- 6.2. Market Analysis, Insights and Forecast - by Dristibution Channel

- 6.2.1. Hospital Pharmacy

- 6.2.2. Retail Pharmacy

- 6.2.3. Online Pharmacy

- 6.1. Market Analysis, Insights and Forecast - by Type of Drugs

- 7. Europe Muscle Relaxant Drugs Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Drugs

- 7.1.1. Facial Muscle Relaxants

- 7.1.2. Skeletal muscle Relaxants

- 7.1.3. Neuromuscular Blocking Agents

- 7.2. Market Analysis, Insights and Forecast - by Dristibution Channel

- 7.2.1. Hospital Pharmacy

- 7.2.2. Retail Pharmacy

- 7.2.3. Online Pharmacy

- 7.1. Market Analysis, Insights and Forecast - by Type of Drugs

- 8. Asia Pacific Muscle Relaxant Drugs Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Drugs

- 8.1.1. Facial Muscle Relaxants

- 8.1.2. Skeletal muscle Relaxants

- 8.1.3. Neuromuscular Blocking Agents

- 8.2. Market Analysis, Insights and Forecast - by Dristibution Channel

- 8.2.1. Hospital Pharmacy

- 8.2.2. Retail Pharmacy

- 8.2.3. Online Pharmacy

- 8.1. Market Analysis, Insights and Forecast - by Type of Drugs

- 9. Middle East and Africa Muscle Relaxant Drugs Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Drugs

- 9.1.1. Facial Muscle Relaxants

- 9.1.2. Skeletal muscle Relaxants

- 9.1.3. Neuromuscular Blocking Agents

- 9.2. Market Analysis, Insights and Forecast - by Dristibution Channel

- 9.2.1. Hospital Pharmacy

- 9.2.2. Retail Pharmacy

- 9.2.3. Online Pharmacy

- 9.1. Market Analysis, Insights and Forecast - by Type of Drugs

- 10. South America Muscle Relaxant Drugs Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Drugs

- 10.1.1. Facial Muscle Relaxants

- 10.1.2. Skeletal muscle Relaxants

- 10.1.3. Neuromuscular Blocking Agents

- 10.2. Market Analysis, Insights and Forecast - by Dristibution Channel

- 10.2.1. Hospital Pharmacy

- 10.2.2. Retail Pharmacy

- 10.2.3. Online Pharmacy

- 10.1. Market Analysis, Insights and Forecast - by Type of Drugs

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pfizer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dr Reddy's laboratories

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Abbvie Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Neurana Pharmaceuticals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Teva Pharmaceuticals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Acorda Therapeutics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Unichem Laboratories

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SteriMax Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Endo Pharmaceuticals Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ipsen Biopharmaceuticals Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zydus Cadila

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Lannett

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Pfizer

List of Figures

- Figure 1: Global Muscle Relaxant Drugs Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Muscle Relaxant Drugs Market Revenue (undefined), by Type of Drugs 2025 & 2033

- Figure 3: North America Muscle Relaxant Drugs Market Revenue Share (%), by Type of Drugs 2025 & 2033

- Figure 4: North America Muscle Relaxant Drugs Market Revenue (undefined), by Dristibution Channel 2025 & 2033

- Figure 5: North America Muscle Relaxant Drugs Market Revenue Share (%), by Dristibution Channel 2025 & 2033

- Figure 6: North America Muscle Relaxant Drugs Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Muscle Relaxant Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Muscle Relaxant Drugs Market Revenue (undefined), by Type of Drugs 2025 & 2033

- Figure 9: Europe Muscle Relaxant Drugs Market Revenue Share (%), by Type of Drugs 2025 & 2033

- Figure 10: Europe Muscle Relaxant Drugs Market Revenue (undefined), by Dristibution Channel 2025 & 2033

- Figure 11: Europe Muscle Relaxant Drugs Market Revenue Share (%), by Dristibution Channel 2025 & 2033

- Figure 12: Europe Muscle Relaxant Drugs Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Muscle Relaxant Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Muscle Relaxant Drugs Market Revenue (undefined), by Type of Drugs 2025 & 2033

- Figure 15: Asia Pacific Muscle Relaxant Drugs Market Revenue Share (%), by Type of Drugs 2025 & 2033

- Figure 16: Asia Pacific Muscle Relaxant Drugs Market Revenue (undefined), by Dristibution Channel 2025 & 2033

- Figure 17: Asia Pacific Muscle Relaxant Drugs Market Revenue Share (%), by Dristibution Channel 2025 & 2033

- Figure 18: Asia Pacific Muscle Relaxant Drugs Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Muscle Relaxant Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Muscle Relaxant Drugs Market Revenue (undefined), by Type of Drugs 2025 & 2033

- Figure 21: Middle East and Africa Muscle Relaxant Drugs Market Revenue Share (%), by Type of Drugs 2025 & 2033

- Figure 22: Middle East and Africa Muscle Relaxant Drugs Market Revenue (undefined), by Dristibution Channel 2025 & 2033

- Figure 23: Middle East and Africa Muscle Relaxant Drugs Market Revenue Share (%), by Dristibution Channel 2025 & 2033

- Figure 24: Middle East and Africa Muscle Relaxant Drugs Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Muscle Relaxant Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Muscle Relaxant Drugs Market Revenue (undefined), by Type of Drugs 2025 & 2033

- Figure 27: South America Muscle Relaxant Drugs Market Revenue Share (%), by Type of Drugs 2025 & 2033

- Figure 28: South America Muscle Relaxant Drugs Market Revenue (undefined), by Dristibution Channel 2025 & 2033

- Figure 29: South America Muscle Relaxant Drugs Market Revenue Share (%), by Dristibution Channel 2025 & 2033

- Figure 30: South America Muscle Relaxant Drugs Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Muscle Relaxant Drugs Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Type of Drugs 2020 & 2033

- Table 2: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Dristibution Channel 2020 & 2033

- Table 3: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Type of Drugs 2020 & 2033

- Table 5: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Dristibution Channel 2020 & 2033

- Table 6: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Type of Drugs 2020 & 2033

- Table 11: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Dristibution Channel 2020 & 2033

- Table 12: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Type of Drugs 2020 & 2033

- Table 20: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Dristibution Channel 2020 & 2033

- Table 21: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Type of Drugs 2020 & 2033

- Table 29: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Dristibution Channel 2020 & 2033

- Table 30: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Type of Drugs 2020 & 2033

- Table 35: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Dristibution Channel 2020 & 2033

- Table 36: Global Muscle Relaxant Drugs Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Muscle Relaxant Drugs Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Muscle Relaxant Drugs Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Muscle Relaxant Drugs Market?

Key companies in the market include Pfizer, Dr Reddy's laboratories, Abbvie Inc *List Not Exhaustive, Neurana Pharmaceuticals, Teva Pharmaceuticals, Acorda Therapeutics, Unichem Laboratories, SteriMax Inc, Endo Pharmaceuticals Inc, Ipsen Biopharmaceuticals Inc, Zydus Cadila, Lannett.

3. What are the main segments of the Muscle Relaxant Drugs Market?

The market segments include Type of Drugs, Dristibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Geriatric Population; Increasing Prevalence of Musculoskeletal Disorders.

6. What are the notable trends driving market growth?

Neuromuscular Blocking Agents Segment is Expected to Witness Significant Growth Over the Forecast Period..

7. Are there any restraints impacting market growth?

Adverse Effects of Muscle Relaxants.

8. Can you provide examples of recent developments in the market?

In June 2022, Amneal Pharmaceuticals launched LYVISPAH, a baclofen oral granules specialty product approved by the USFDA for treating spasticity related to multiple sclerosis and other spinal cord disorders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Muscle Relaxant Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Muscle Relaxant Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Muscle Relaxant Drugs Market?

To stay informed about further developments, trends, and reports in the Muscle Relaxant Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence