Key Insights

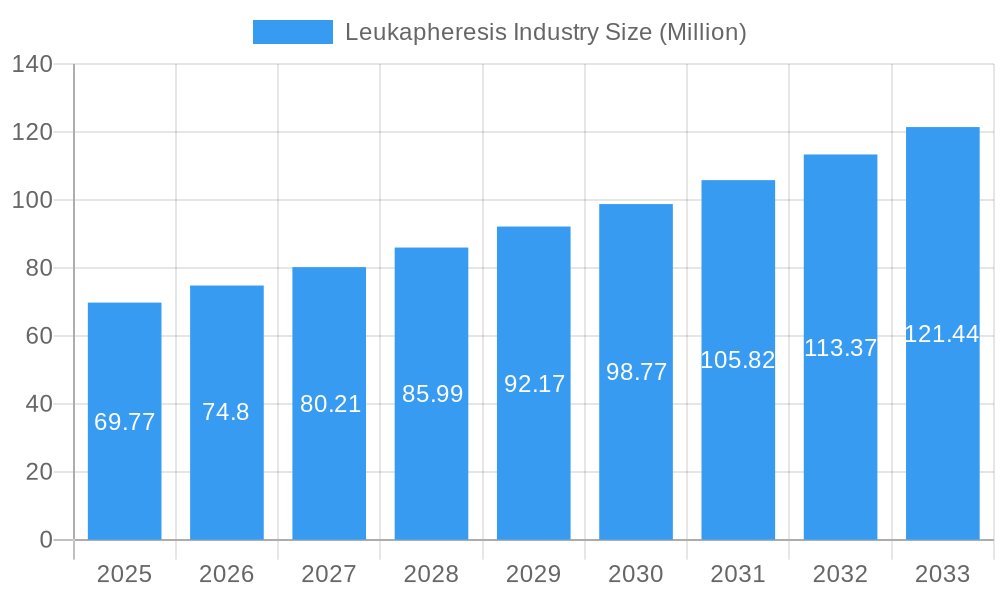

The global Leukapheresis market is poised for robust expansion, projected to reach approximately $69.77 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 7.15% expected to drive sustained growth through 2033. This dynamic market is significantly influenced by escalating adoption of advanced cell therapy treatments, such as CAR T-cell therapy, which necessitate efficient and precise leukapheresis procedures for patient preparation. Furthermore, the increasing prevalence of hematological disorders and cancers, including leukemia and lymphoma, directly correlates with the demand for leukapheresis services and associated technologies. Ongoing research and development in regenerative medicine and immunotherapy are also fueling market expansion, as leukapheresis plays a crucial role in isolating specific cell populations for experimental and therapeutic purposes. Technological advancements in apheresis devices, focusing on improved efficacy, patient comfort, and automated workflows, are key drivers of this upward trajectory.

Leukapheresis Industry Market Size (In Million)

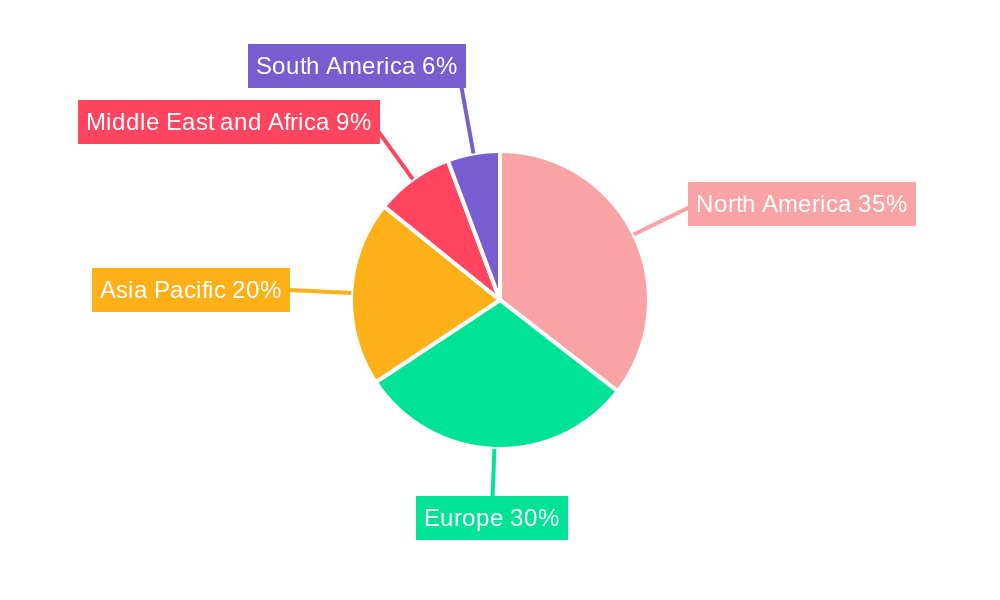

The market's growth is further propelled by strategic collaborations and investments aimed at enhancing product development and market reach. While the therapeutic applications segment dominates owing to its critical role in treating various blood-related conditions, the research applications segment is witnessing significant growth driven by breakthroughs in cell and gene therapies. Geographically, North America and Europe are expected to maintain their leading positions due to advanced healthcare infrastructure, high R&D spending, and a strong presence of key market players. However, the Asia Pacific region is anticipated to emerge as a high-growth market, driven by increasing healthcare expenditure, growing awareness of advanced medical treatments, and a rising patient pool. Despite the promising outlook, challenges such as the high cost of advanced leukapheresis devices and the need for specialized trained personnel could pose moderate restraints to market penetration in certain regions. Nevertheless, the overarching trend towards personalized medicine and the continuous innovation in the field of cell therapies underscore a very positive future for the leukapheresis market.

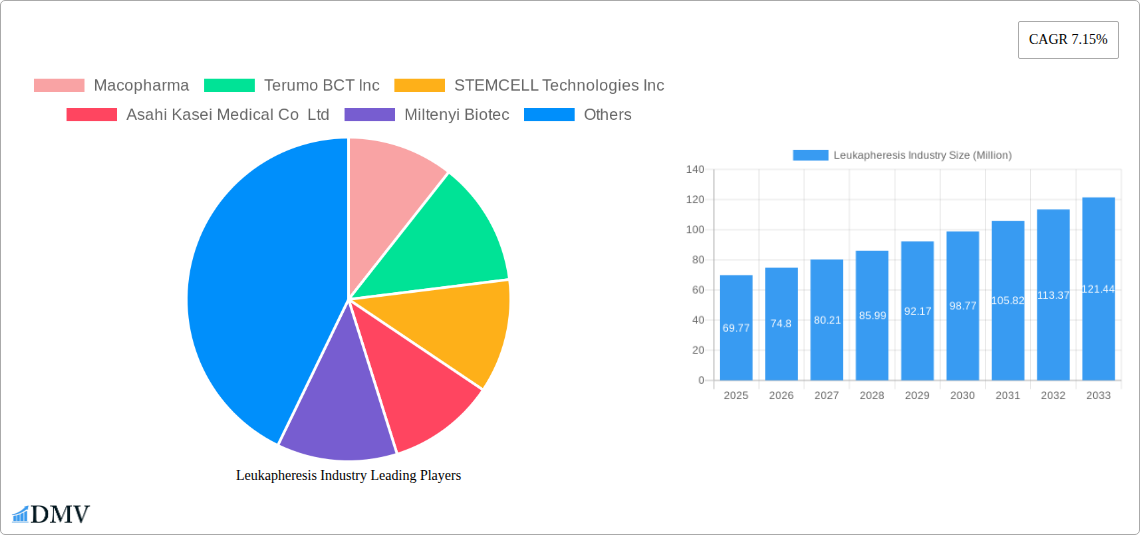

Leukapheresis Industry Company Market Share

This in-depth leukapheresis market research report offers a strategic analysis of the leukapheresis industry, examining its current landscape, historical trends, and projecting its future trajectory from 2019 to 2033. The report delves into critical market dynamics, including leukapheresis devices, leukapheresis disposables, and their applications in therapeutic applications and research applications. With a base year of 2025 and a forecast period extending to 2033, this report provides actionable insights for stakeholders navigating the evolving cell therapy market and blood processing technology.

Leukapheresis Industry Market Composition & Trends

The leukapheresis industry exhibits a moderately consolidated market structure, with a few key players holding significant market share. Innovation is primarily driven by advancements in apheresis devices and the development of highly efficient leukoreduction filters and leukapheresis columns. The regulatory landscape is evolving, with stringent approvals for new technologies and increased focus on patient safety and efficacy. Substitute products are limited, as leukapheresis remains a cornerstone for specific cell collection and processing procedures. End-user profiles span hospitals, specialized clinics, blood banks, and research institutions, each with distinct needs and purchasing behaviors. Mergers and acquisitions (M&A) activity is a notable trend, with strategic deals aimed at expanding product portfolios and geographical reach.

- Market Concentration: Dominated by a mix of established medical device manufacturers and specialized cell therapy solution providers.

- Innovation Catalysts: Driven by demand for higher cell yields, improved apheresis efficiency, and advanced cell separation techniques.

- Regulatory Landscapes: Strict adherence to FDA, EMA, and other regional regulatory guidelines for medical devices and biotechnological applications.

- Substitute Products: Minimal direct substitutes, emphasizing the unique role of leukapheresis in cell-based therapies and research.

- End-User Profiles: Hospitals (oncology, hematology), research institutions, contract development and manufacturing organizations (CDMOs), and blood processing centers.

- M&A Activities: Ongoing consolidation to acquire innovative technologies and expand market presence. Recent M&A deal values are estimated in the range of tens to hundreds of Million.

Leukapheresis Industry Industry Evolution

The leukapheresis industry has witnessed remarkable evolution, driven by significant technological advancements and a burgeoning demand for cell-based therapies. Over the historical period (2019-2024), the market has experienced consistent growth, propelled by the increasing prevalence of hematological disorders and the rapid expansion of the immunotherapy market. The development of more sophisticated leukapheresis devices has been a cornerstone of this growth, offering enhanced precision, speed, and patient comfort. Adoption of these advanced systems, alongside specialized leukapheresis disposables, has surged as healthcare providers recognize their critical role in enabling effective treatments and cutting-edge research.

The forecast period (2025-2033) is poised for even more accelerated expansion. Key growth drivers include the expanding pipeline of CAR-T cell therapies and other autologous and allogeneic cell therapies, which directly rely on efficient leukapheresis for patient-derived cell collection. Furthermore, the increasing utilization of leukapheresis in regenerative medicine and for the collection of stem cells for various therapeutic applications further solidifies its market position. Technological innovations, such as automated apheresis systems and improved leukoreduction filters, are expected to enhance efficiency and reduce costs, thereby broadening access to these life-saving treatments. The rising investment in life sciences research and development, particularly in areas like personalized medicine and gene therapy, will continue to fuel the demand for high-quality leukapheresis procedures and associated products. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7-9% during the forecast period, reaching an estimated market size of over XXX Million by 2033. The increasing focus on precision medicine and the development of novel cell-based treatments will be paramount in shaping the future trajectory of the leukapheresis market.

Leading Regions, Countries, or Segments in Leukapheresis Industry

North America currently dominates the leukapheresis industry, driven by a robust healthcare infrastructure, substantial investment in cell therapy research, and a high prevalence of diseases treated with leukapheresis. The United States, in particular, leads in the adoption of advanced leukapheresis devices and leukapheresis disposables, largely due to its pioneering role in CAR-T cell therapy development and widespread use in various therapeutic applications.

- Dominant Region: North America (particularly the USA).

- Key Drivers for Dominance:

- High R&D Investment: Significant funding for cell therapy and immunotherapy research fuels demand for leukapheresis.

- Advanced Healthcare Infrastructure: Widespread availability of hospitals and specialized treatment centers equipped for apheresis procedures.

- Favorable Regulatory Environment: Streamlined approval processes for innovative medical devices and therapies.

- Early Adoption of Cell Therapies: Leading the charge in clinical trials and commercialization of CAR-T and other cell-based treatments.

- Increasing Incidence of Target Diseases: Higher prevalence of hematological malignancies and autoimmune disorders treated via leukapheresis.

The leukapheresis devices segment, encompassing apheresis devices, leukapheresis columns and cell separators, and leukoreduction filters, holds the largest market share within the industry. This is directly attributable to their indispensable role in every leukapheresis procedure. The continuous innovation in these devices, leading to greater efficiency, safety, and automation, further solidifies their market leadership. Leukapheresis disposables represent another significant and rapidly growing segment, driven by the single-use nature of many apheresis components, ensuring sterility and preventing cross-contamination. The therapeutic applications segment, especially in oncology and hematology, is the primary revenue generator, while research applications are steadily contributing to market growth as novel cell-based discoveries expand.

Leukapheresis Industry Product Innovations

The leukapheresis industry is characterized by continuous product innovation focused on enhancing cell yield, purity, and procedural efficiency. Manufacturers are developing next-generation apheresis devices with improved automation, user-friendly interfaces, and real-time monitoring capabilities. Advanced leukoreduction filters and leukapheresis columns are being designed with novel materials and membrane technologies to achieve higher selectivity in cell separation and reduce red blood cell contamination. These advancements are crucial for optimizing the collection of high-quality starting material for potent cell therapies and research protocols. Performance metrics are consistently improving, with higher collection rates of target cell populations and reduced procedure times, leading to better patient outcomes and reduced healthcare costs.

Propelling Factors for Leukapheresis Industry Growth

The growth of the leukapheresis industry is propelled by several interconnected factors:

- Advancements in Cell Therapy: The exponential growth of the CAR-T therapy market and other immunotherapies directly drives the demand for efficient leukapheresis procedures for cell collection.

- Rising Incidence of Hematological Disorders: Increasing global prevalence of leukemias, lymphomas, and other blood cancers necessitates effective apheresis treatments.

- Technological Innovations: Development of sophisticated, automated, and user-friendly leukapheresis devices and high-performance leukoreduction filters.

- Growing R&D in Regenerative Medicine: Expansion of stem cell therapies and regenerative medicine research further boosts demand for specialized cell collection.

- Increased Healthcare Expenditure: Rising healthcare spending globally, particularly in developed nations, supports the adoption of advanced medical technologies like leukapheresis.

- Favorable Reimbursement Policies: Improved reimbursement frameworks for cell therapies and apheresis procedures in various regions.

Obstacles in the Leukapheresis Industry Market

Despite its robust growth, the leukapheresis industry faces certain obstacles:

- High Cost of Devices and Disposables: The significant initial investment and ongoing costs associated with advanced leukapheresis equipment and single-use disposables can be a barrier for some healthcare facilities.

- Complex Regulatory Pathways: Navigating stringent regulatory requirements for medical devices and new cell therapy applications can be time-consuming and costly.

- Skilled Workforce Shortage: A need for trained personnel to operate complex apheresis equipment and manage cell processing procedures.

- Reimbursement Challenges: In certain regions or for specific niche applications, reimbursement policies may not fully cover the costs of leukapheresis procedures and associated therapies.

- Supply Chain Vulnerabilities: Potential disruptions in the global supply chain for critical components and raw materials can impact manufacturing and availability.

Future Opportunities in Leukapheresis Industry

The leukapheresis industry is ripe with future opportunities:

- Expansion into Emerging Markets: Untapped potential in developing countries with growing healthcare infrastructure and increasing demand for advanced medical treatments.

- Personalized Medicine Applications: Growing role in collecting patient-specific cells for personalized therapies and diagnostics.

- Development of Portable and Point-of-Care Devices: Innovation in miniaturized and portable apheresis systems for greater accessibility and use in diverse settings.

- Integration with AI and Machine Learning: Application of AI for optimizing apheresis protocols, predicting cell yields, and enhancing data analysis.

- Biologics Manufacturing: Increasing use of leukapheresis for collecting cells for the production of therapeutic biologics and recombinant proteins.

Major Players in the Leukapheresis Industry Ecosystem

- Macopharma

- Terumo BCT Inc

- STEMCELL Technologies Inc

- Asahi Kasei Medical Co Ltd

- Miltenyi Biotec

- Fresenius SE & Co KGaA

- StemExpress

- B Braun Melsungen AG

- Haemonetics Corporation

- Medica SPA

- BioIVT LLC

Key Developments in Leukapheresis Industry Industry

- May 2022: Plandai Biotechnology Inc. signed a strategic non-binding letter of intent to enter into a new business through a proposed product and technology rights licensing agreement with the holder of rights to the unique Puriblood leukocyte reduction blood filtration system. Puriblood Medical Co., Ltd. develops and sells blood cell separation products, including its leukocyte reduction filters. This development signifies potential advancements in filtration technology, aiming to improve the efficiency and effectiveness of leukocyte removal in blood products.

- February 2022: Cryoport Inc. entered a strategic partnership with Cell Matters SA to deliver end-to-end cryopreservation services for leukapheresis-derived therapies supporting both autologous and allogeneic cell therapies to the life sciences industry. This partnership highlights the growing importance of integrated solutions for cell therapy logistics, ensuring the viability and integrity of collected cells from apheresis through to therapeutic application.

Strategic Leukapheresis Industry Market Forecast

The leukapheresis industry is poised for sustained and robust growth in the coming years, driven by a confluence of accelerating technological innovation, expanding therapeutic applications, and increasing global healthcare investments. The burgeoning field of cell therapy, particularly CAR-T therapies and other personalized treatments for hematological malignancies and solid tumors, will remain a primary growth catalyst. Continued advancements in leukapheresis devices, including enhanced automation and precision, alongside the development of more efficient leukoreduction filters, will further optimize cell collection and improve patient outcomes. The growing emphasis on regenerative medicine and the increasing research into stem cell applications also present significant future opportunities. Emerging markets, coupled with evolving reimbursement landscapes, are expected to contribute to market expansion. The strategic integration of leukapheresis technologies with broader cell therapy manufacturing and logistics solutions will shape the future market dynamics, ensuring its continued vital role in modern medicine.

Leukapheresis Industry Segmentation

-

1. Type

-

1.1. Leukapheresis Devices

- 1.1.1. Apheresis Devices

- 1.1.2. Leukapheresis Columns and Cell Separators

- 1.1.3. Leukoreduction Filters

- 1.2. Leukapheresis Disposables

-

1.1. Leukapheresis Devices

-

2. Application

- 2.1. Therapeutic Applications

- 2.2. Research Applications

Leukapheresis Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Leukapheresis Industry Regional Market Share

Geographic Coverage of Leukapheresis Industry

Leukapheresis Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Leukemia; Growing Demand for Leukopaks in Clinical Research Activities

- 3.3. Market Restrains

- 3.3.1. High Cost of Therapeutic Leukapheresis; Stringent Regulatory Issues for Donor Recruitment

- 3.4. Market Trends

- 3.4.1. Apheresis Device Segment is Expected to Hold a Significant Share in the Leukapheresis Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Leukapheresis Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Leukapheresis Devices

- 5.1.1.1. Apheresis Devices

- 5.1.1.2. Leukapheresis Columns and Cell Separators

- 5.1.1.3. Leukoreduction Filters

- 5.1.2. Leukapheresis Disposables

- 5.1.1. Leukapheresis Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Therapeutic Applications

- 5.2.2. Research Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Leukapheresis Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Leukapheresis Devices

- 6.1.1.1. Apheresis Devices

- 6.1.1.2. Leukapheresis Columns and Cell Separators

- 6.1.1.3. Leukoreduction Filters

- 6.1.2. Leukapheresis Disposables

- 6.1.1. Leukapheresis Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Therapeutic Applications

- 6.2.2. Research Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Leukapheresis Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Leukapheresis Devices

- 7.1.1.1. Apheresis Devices

- 7.1.1.2. Leukapheresis Columns and Cell Separators

- 7.1.1.3. Leukoreduction Filters

- 7.1.2. Leukapheresis Disposables

- 7.1.1. Leukapheresis Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Therapeutic Applications

- 7.2.2. Research Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Leukapheresis Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Leukapheresis Devices

- 8.1.1.1. Apheresis Devices

- 8.1.1.2. Leukapheresis Columns and Cell Separators

- 8.1.1.3. Leukoreduction Filters

- 8.1.2. Leukapheresis Disposables

- 8.1.1. Leukapheresis Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Therapeutic Applications

- 8.2.2. Research Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Leukapheresis Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Leukapheresis Devices

- 9.1.1.1. Apheresis Devices

- 9.1.1.2. Leukapheresis Columns and Cell Separators

- 9.1.1.3. Leukoreduction Filters

- 9.1.2. Leukapheresis Disposables

- 9.1.1. Leukapheresis Devices

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Therapeutic Applications

- 9.2.2. Research Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Leukapheresis Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Leukapheresis Devices

- 10.1.1.1. Apheresis Devices

- 10.1.1.2. Leukapheresis Columns and Cell Separators

- 10.1.1.3. Leukoreduction Filters

- 10.1.2. Leukapheresis Disposables

- 10.1.1. Leukapheresis Devices

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Therapeutic Applications

- 10.2.2. Research Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Macopharma

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Terumo BCT Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 STEMCELL Technologies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Asahi Kasei Medical Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Miltenyi Biotec

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fresenius SE & Co KGaA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 StemExpress

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 B Braun Melsungen AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Haemonetics Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Medica SPA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BioIVT LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Macopharma

List of Figures

- Figure 1: Global Leukapheresis Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Leukapheresis Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Leukapheresis Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Leukapheresis Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Leukapheresis Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Leukapheresis Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Leukapheresis Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Leukapheresis Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Leukapheresis Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Leukapheresis Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Leukapheresis Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Leukapheresis Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Leukapheresis Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Leukapheresis Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Leukapheresis Industry Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe Leukapheresis Industry Volume (K Unit), by Type 2025 & 2033

- Figure 17: Europe Leukapheresis Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Leukapheresis Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Leukapheresis Industry Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe Leukapheresis Industry Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Leukapheresis Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Leukapheresis Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Leukapheresis Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Leukapheresis Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Leukapheresis Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Leukapheresis Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Leukapheresis Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia Pacific Leukapheresis Industry Volume (K Unit), by Type 2025 & 2033

- Figure 29: Asia Pacific Leukapheresis Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Leukapheresis Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Leukapheresis Industry Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Pacific Leukapheresis Industry Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Leukapheresis Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Leukapheresis Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Leukapheresis Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Leukapheresis Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Leukapheresis Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Leukapheresis Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Leukapheresis Industry Revenue (Million), by Type 2025 & 2033

- Figure 40: Middle East and Africa Leukapheresis Industry Volume (K Unit), by Type 2025 & 2033

- Figure 41: Middle East and Africa Leukapheresis Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: Middle East and Africa Leukapheresis Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: Middle East and Africa Leukapheresis Industry Revenue (Million), by Application 2025 & 2033

- Figure 44: Middle East and Africa Leukapheresis Industry Volume (K Unit), by Application 2025 & 2033

- Figure 45: Middle East and Africa Leukapheresis Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Leukapheresis Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East and Africa Leukapheresis Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Leukapheresis Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Leukapheresis Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Leukapheresis Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Leukapheresis Industry Revenue (Million), by Type 2025 & 2033

- Figure 52: South America Leukapheresis Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: South America Leukapheresis Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: South America Leukapheresis Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: South America Leukapheresis Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: South America Leukapheresis Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: South America Leukapheresis Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Leukapheresis Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Leukapheresis Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Leukapheresis Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Leukapheresis Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Leukapheresis Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Leukapheresis Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Leukapheresis Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Leukapheresis Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Leukapheresis Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Leukapheresis Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Leukapheresis Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Leukapheresis Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Leukapheresis Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Leukapheresis Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Leukapheresis Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Leukapheresis Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Leukapheresis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Leukapheresis Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Leukapheresis Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Global Leukapheresis Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Leukapheresis Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Leukapheresis Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Leukapheresis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Leukapheresis Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Leukapheresis Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 39: Global Leukapheresis Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Leukapheresis Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Leukapheresis Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Leukapheresis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Australia Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Leukapheresis Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 56: Global Leukapheresis Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 57: Global Leukapheresis Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 58: Global Leukapheresis Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Leukapheresis Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Leukapheresis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: GCC Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Leukapheresis Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 68: Global Leukapheresis Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 69: Global Leukapheresis Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 70: Global Leukapheresis Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 71: Global Leukapheresis Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Leukapheresis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Leukapheresis Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Leukapheresis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Leukapheresis Industry?

The projected CAGR is approximately 7.15%.

2. Which companies are prominent players in the Leukapheresis Industry?

Key companies in the market include Macopharma, Terumo BCT Inc, STEMCELL Technologies Inc, Asahi Kasei Medical Co Ltd, Miltenyi Biotec, Fresenius SE & Co KGaA, StemExpress, B Braun Melsungen AG, Haemonetics Corporation, Medica SPA, BioIVT LLC.

3. What are the main segments of the Leukapheresis Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Leukemia; Growing Demand for Leukopaks in Clinical Research Activities.

6. What are the notable trends driving market growth?

Apheresis Device Segment is Expected to Hold a Significant Share in the Leukapheresis Market.

7. Are there any restraints impacting market growth?

High Cost of Therapeutic Leukapheresis; Stringent Regulatory Issues for Donor Recruitment.

8. Can you provide examples of recent developments in the market?

May 2022: Plandai Biotechnology Inc. signed a strategic non-binding letter of intent to enter into a new business through a proposed product and technology rights licensing agreement with the holder of rights to the unique Puriblood leukocyte reduction blood filtration system. Puriblood Medical Co., Ltd. develops and sells blood cell separation products, including its leukocyte reduction filters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Leukapheresis Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Leukapheresis Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Leukapheresis Industry?

To stay informed about further developments, trends, and reports in the Leukapheresis Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence