Key Insights

The global Companion Animal Vaccines market is poised for substantial growth, currently valued at approximately $3.58 billion and projected to expand at a robust Compound Annual Growth Rate (CAGR) of 6.02% through 2033. This upward trajectory is primarily fueled by the increasing humanization of pets, leading owners to invest more in their animals' health and well-being, including preventative care like vaccinations. The rising incidence of zoonotic diseases, coupled with growing awareness among pet owners about the importance of disease prevention and the availability of advanced vaccine technologies, further drives market expansion. Key market segments include Live Attenuated Vaccines, Inactivated Vaccines, Toxoid Vaccines, and Recombinant Vaccines, each offering distinct advantages in terms of efficacy and safety. The market caters to a diverse range of animal types, with a significant focus on dogs and cats, alongside other companion animals.

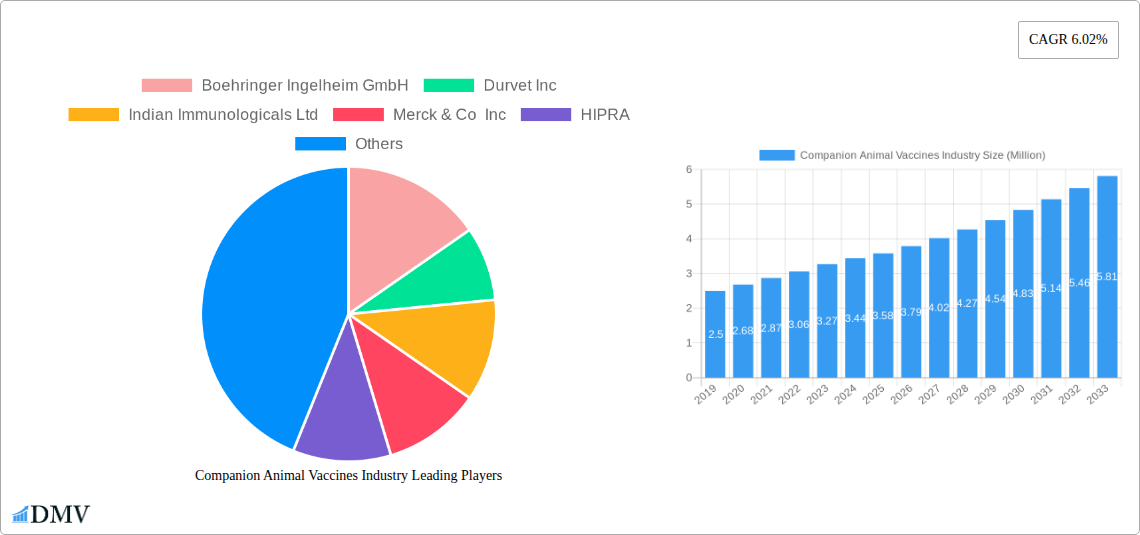

Companion Animal Vaccines Industry Market Size (In Million)

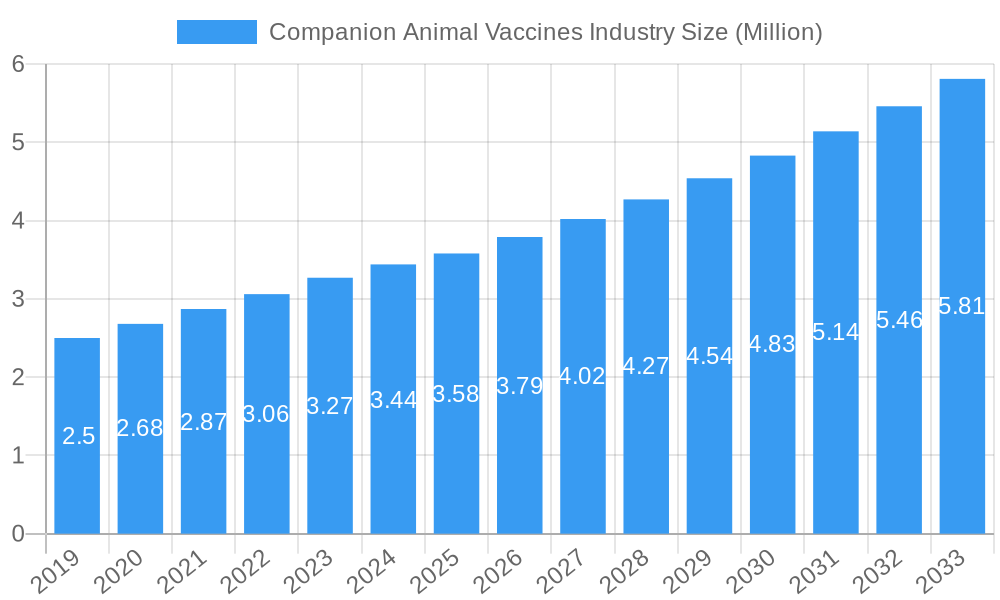

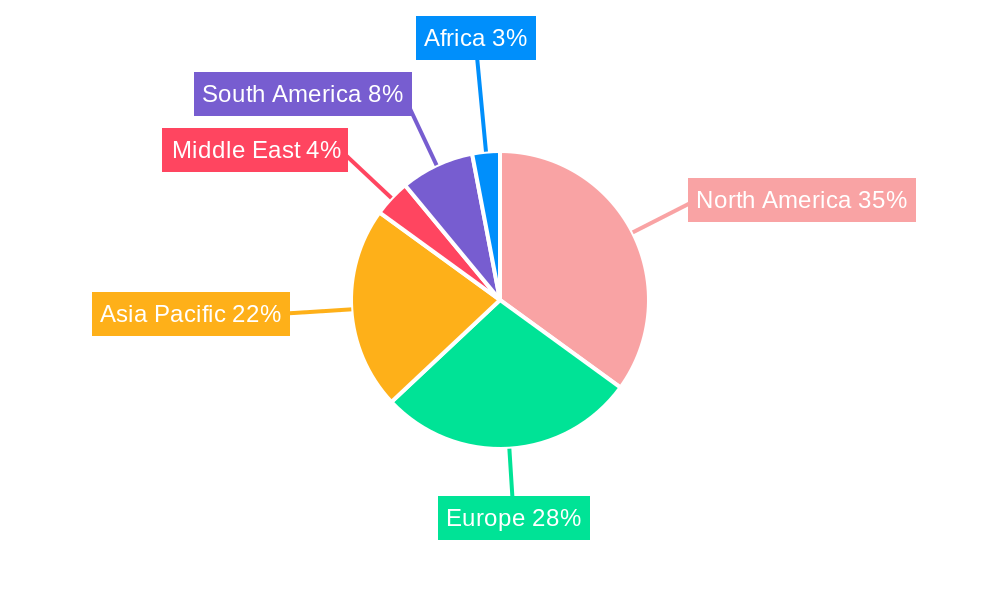

Geographically, North America currently holds a dominant position, driven by high pet ownership rates and advanced veterinary healthcare infrastructure. Europe and the Asia Pacific region are also witnessing considerable growth, spurred by increasing disposable incomes and a rising pet population. Leading companies such as Zoetis Inc., Boehringer Ingelheim GmbH, and Merck & Co. Inc. are at the forefront of innovation, investing heavily in research and development to introduce novel vaccine solutions. However, challenges such as the high cost of some advanced vaccines and varying regulatory landscapes across different regions may present moderate headwinds. Despite these challenges, the overarching trend of enhanced pet care and the continuous development of safer and more effective vaccines are expected to ensure a healthy and sustained growth for the companion animal vaccines industry.

Companion Animal Vaccines Industry Company Market Share

Companion Animal Vaccines Industry Market Composition & Trends

The Companion Animal Vaccines Industry is a dynamic and rapidly expanding sector driven by increasing pet ownership, heightened awareness of animal health and welfare, and advancements in veterinary medicine. Market concentration is moderate, with key players vying for dominance through strategic acquisitions and product innovation. The industry's robust growth is fueled by several catalysts, including the rising demand for preventative healthcare in companion animals and the development of novel vaccine technologies. Regulatory landscapes are continually evolving to ensure vaccine efficacy and safety, impacting market entry and product approval processes. While substitute products like general parasite control exist, the specific preventive power of vaccines remains indispensable. End-user profiles encompass a broad spectrum, from individual pet owners to veterinary clinics, shelters, and governmental organizations focused on zoonotic disease control. Mergers and acquisitions (M&A) are a significant trend, with deal values estimated to reach hundreds of millions of dollars as companies seek to consolidate market share and expand their product portfolios. For instance, acquisitions of smaller biotech firms specializing in novel vaccine platforms are prevalent, aiming to integrate cutting-edge technologies. The market share distribution is characterized by a few large, established companies holding significant portions, while a growing number of specialized and emerging players contribute to the competitive landscape. Key market segments include vaccines for dogs, cats, and other companion animals, each with distinct epidemiological profiles and market demands. The overall market value is projected to cross XX Million during the forecast period.

Companion Animal Vaccines Industry Industry Evolution

The Companion Animal Vaccines Industry has undergone a significant transformation over the Study Period (2019–2033), marked by substantial growth, technological leaps, and a palpable shift in consumer priorities regarding pet health. During the Historical Period (2019–2024), the market witnessed a Compound Annual Growth Rate (CAGR) of approximately XX%, driven by increasing disposable incomes and a deepening human-animal bond that elevates pets to family member status. This era saw a surge in demand for vaccines against prevalent diseases like rabies, distemper, parvovirus, and feline leukemia.

Technological advancements have been a cornerstone of this evolution. The shift from solely relying on traditional Inactivated Vaccines and Live Attenuated Vaccines to incorporating more sophisticated platforms like Recombinant Vaccines and Toxoid Vaccines has been pivotal. These newer technologies offer improved safety profiles, enhanced efficacy, and the potential for multi-valent vaccines, reducing the number of injections required. For example, the development of recombinant rabies vaccines has opened new avenues for disease control in canine populations. The adoption of these advanced technologies has accelerated, with Recombinant Vaccines projected to capture an estimated XX% of the market share by the Estimated Year (2025).

Shifting consumer demands have played an equally crucial role. Pet owners are increasingly proactive in their approach to their pets' well-being, seeking out preventative care and investing in high-quality veterinary services. This includes a greater demand for vaccines that offer longer-lasting immunity and broader protection. The desire for convenient and less stressful vaccination protocols, such as intranasal or oral vaccines, is also gaining traction. Furthermore, the growing concern over zoonotic diseases, which can be transmitted from animals to humans, has amplified the importance of vaccinating companion animals, particularly dogs, against diseases like rabies. This growing awareness is expected to propel the market towards an estimated value of XX Million by the end of the forecast period (2033). The market's trajectory is thus characterized by a virtuous cycle: enhanced technological capabilities drive the development of more effective and appealing vaccines, which in turn fuels increased owner investment in preventative pet healthcare, further stimulating market growth.

Leading Regions, Countries, or Segments in Companion Animal Vaccines Industry

The Companion Animal Vaccines Industry is experiencing robust growth across various regions, with North America and Europe currently leading the market due to high pet ownership rates, advanced veterinary infrastructure, and strong consumer spending on pet healthcare. However, the Asia-Pacific region is emerging as a significant growth engine, driven by increasing disposable incomes, a rising pet humanization trend, and greater awareness of animal diseases.

Within the Technology segment, Recombinant Vaccines are witnessing the fastest growth.

- Key Drivers for Recombinant Vaccines:

- Enhanced Safety Profiles: Reduced risk of reversion to virulence compared to live attenuated vaccines.

- Specific Antigen Presentation: Ability to target specific viral or bacterial components, leading to highly effective immune responses.

- Potential for Combination Vaccines: Facilitates the development of multi-valent vaccines, reducing injection frequency.

- Technological Advancements: Ongoing research and development in genetic engineering and molecular biology are continuously improving production methods and efficacy.

The dominance of Dogs as the primary recipient of companion animal vaccines remains unchallenged.

- Key Drivers for Dog Vaccines:

- High Global Dog Population: Dogs constitute the largest pet population worldwide.

- Prevalence of Canine Diseases: Diseases like rabies, parvovirus, distemper, and adenovirus are widespread, necessitating regular vaccination.

- Rabies Elimination Programs: Significant global initiatives, like the one involving Merck Animal Health, are boosting demand for rabies vaccines.

- Zoonotic Disease Concerns: The role of dogs in transmitting diseases to humans further emphasizes the importance of their vaccination.

The Animal Type: Dogs segment is expected to continue its dominance, capturing an estimated XX% of the market share by 2025. This segment is propelled by the sheer volume of the dog population globally and the comprehensive vaccination protocols recommended by veterinarians for disease prevention. Live Attenuated Vaccines and Inactivated Vaccines continue to hold a significant share due to their established efficacy and cost-effectiveness for core vaccines. However, the increasing demand for innovative solutions and improved safety profiles is steadily paving the way for Recombinant Vaccines to gain further traction, especially for non-core vaccines and for animals with specific sensitivities. The investment trends in R&D are heavily skewed towards developing next-generation vaccines within the canine segment, supported by favorable regulatory frameworks in developed nations.

Companion Animal Vaccines Industry Product Innovations

Product innovation in the Companion Animal Vaccines Industry is primarily focused on enhancing efficacy, safety, and convenience. Advances in recombinant DNA technology and viral vector platforms are leading to the development of next-generation vaccines offering broader spectrum protection and longer-lasting immunity. For instance, novel adjuvants are being incorporated to improve immune response and reduce antigen load. The trend towards multi-valent vaccines, combining protection against multiple diseases in a single injection, is also a significant innovation, simplifying vaccination schedules for pet owners and veterinarians. Furthermore, the development of thermostable vaccines aims to improve accessibility in regions with limited cold chain infrastructure. These innovations are directly addressing unmet needs in disease prevention, contributing to improved animal welfare and owner satisfaction.

Propelling Factors for Companion Animal Vaccines Industry Growth

Several key factors are propelling the Companion Animal Vaccines Industry forward.

- Rising Pet Humanization: An increasing number of households view pets as integral family members, leading to greater investment in their health and longevity.

- Growing Awareness of Preventable Diseases: Pet owners and veterinarians are more informed about the risks of infectious diseases and the benefits of vaccination, driving demand for preventative care.

- Technological Advancements: Development of novel vaccine technologies like recombinant and mRNA vaccines promises improved efficacy, safety, and convenience, attracting significant R&D investment.

- Governmental Initiatives and Regulations: Support for zoonotic disease control and animal welfare programs often encourages higher vaccination rates.

- Expansion of Veterinary Services: Increased accessibility to veterinary care globally means more pets receive routine check-ups and vaccinations.

Obstacles in the Companion Animal Vaccines Industry Market

Despite robust growth, the Companion Animal Vaccines Industry faces certain obstacles.

- Regulatory Hurdles: Stringent approval processes for new vaccines can be time-consuming and costly, delaying market entry.

- Cold Chain Management: Maintaining the efficacy of many vaccines requires a reliable cold chain, which can be challenging in certain geographical regions.

- Vaccine Hesitancy: A small but vocal segment of pet owners express concerns about vaccine safety or necessity, impacting uptake.

- Economic Downturns: While pet care is relatively resilient, significant economic recessions can lead to reduced discretionary spending on veterinary services, including vaccinations.

- Intellectual Property Protection: Ensuring robust patent protection for novel vaccine technologies is critical for recouping R&D investments amidst intense competition.

Future Opportunities in Companion Animal Vaccines Industry

The Companion Animal Vaccines Industry presents numerous future opportunities.

- Emerging Markets: The growing middle class in developing nations presents a vast untapped market for companion animal vaccines.

- Novel Vaccine Platforms: Continued research into mRNA, viral vector, and DNA vaccines offers potential for highly effective and adaptable preventative solutions.

- Personalized Vaccinations: The possibility of developing customized vaccination protocols based on an individual animal's risk profile and lifestyle.

- Preventing Zoonotic Diseases: Increased focus on companion animals as vectors for zoonotic diseases will drive demand for vaccines protecting both animals and humans.

- Therapeutic Vaccines: Exploration of vaccines for treating existing conditions, beyond preventative measures, could open new market segments.

Major Players in the Companion Animal Vaccines Industry Ecosystem

- Boehringer Ingelheim GmbH

- Durvet Inc

- Indian Immunologicals Ltd

- Merck & Co Inc

- HIPRA

- Brilliant Bio Pharma

- Hester Biosciences Limited

- Phibro Animal Health Corporation

- Virbac

- Bioveta AS

- Elanco Animal Health Incorporated

- Zoetis Inc

Key Developments in Companion Animal Vaccines Industry Industry

- September 2022: Merck Animal Health donated more than five million doses of its NOBIVAC rabies vaccine to key partners Mission Rabies and Rabies Free Africa through the Afya Program, significantly contributing to canine-mediated rabies elimination efforts.

- May 2022: Ceva Santé Animale (Ceva) acquired Canadian oral rabies vaccine manufacturer Artemis Technologies Inc., expanding its presence and capabilities in the North American oral rabies vaccine segment.

Strategic Companion Animal Vaccines Industry Market Forecast

The Companion Animal Vaccines Industry is poised for continued strong growth, driven by the enduring trend of pet humanization and increasing owner recognition of preventative healthcare's value. Technological innovations, particularly in recombinant and mRNA vaccine platforms, will be key growth catalysts, offering enhanced efficacy and convenience. The expanding veterinary infrastructure in emerging economies and a sustained focus on combating zoonotic diseases will further fuel market expansion. Strategic investments in research and development, alongside potential mergers and acquisitions to consolidate market share and access new technologies, will shape the competitive landscape. The industry is expected to reach an estimated market value of XX Million by 2033, underscoring its significant potential and critical role in global animal health.

Companion Animal Vaccines Industry Segmentation

-

1. Technology

- 1.1. Live Attenuated Vaccines

- 1.2. Inactivated Vaccines

- 1.3. Toxoid Vaccines

- 1.4. Recombinant Vaccines

- 1.5. Other Technologies

-

2. Animal Type

- 2.1. Dogs

- 2.2. Cats

- 2.3. Other Animal Types

Companion Animal Vaccines Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Companion Animal Vaccines Industry Regional Market Share

Geographic Coverage of Companion Animal Vaccines Industry

Companion Animal Vaccines Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Adoption of Companion Animals

- 3.2.2 such as Dogs and Cats; Increasing Cases of Zoonotic Diseases

- 3.3. Market Restrains

- 3.3.1. High Cost of Vaccine Development and Regulatory Concern

- 3.4. Market Trends

- 3.4.1. Dogs Segment is Expected to Hold a Major Share in the Companion Animal Vaccine Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Live Attenuated Vaccines

- 5.1.2. Inactivated Vaccines

- 5.1.3. Toxoid Vaccines

- 5.1.4. Recombinant Vaccines

- 5.1.5. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs

- 5.2.2. Cats

- 5.2.3. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East

- 5.3.5. GCC

- 5.3.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Live Attenuated Vaccines

- 6.1.2. Inactivated Vaccines

- 6.1.3. Toxoid Vaccines

- 6.1.4. Recombinant Vaccines

- 6.1.5. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Dogs

- 6.2.2. Cats

- 6.2.3. Other Animal Types

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Live Attenuated Vaccines

- 7.1.2. Inactivated Vaccines

- 7.1.3. Toxoid Vaccines

- 7.1.4. Recombinant Vaccines

- 7.1.5. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Dogs

- 7.2.2. Cats

- 7.2.3. Other Animal Types

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Live Attenuated Vaccines

- 8.1.2. Inactivated Vaccines

- 8.1.3. Toxoid Vaccines

- 8.1.4. Recombinant Vaccines

- 8.1.5. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Dogs

- 8.2.2. Cats

- 8.2.3. Other Animal Types

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Live Attenuated Vaccines

- 9.1.2. Inactivated Vaccines

- 9.1.3. Toxoid Vaccines

- 9.1.4. Recombinant Vaccines

- 9.1.5. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Dogs

- 9.2.2. Cats

- 9.2.3. Other Animal Types

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. GCC Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Live Attenuated Vaccines

- 10.1.2. Inactivated Vaccines

- 10.1.3. Toxoid Vaccines

- 10.1.4. Recombinant Vaccines

- 10.1.5. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Dogs

- 10.2.2. Cats

- 10.2.3. Other Animal Types

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. South America Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Live Attenuated Vaccines

- 11.1.2. Inactivated Vaccines

- 11.1.3. Toxoid Vaccines

- 11.1.4. Recombinant Vaccines

- 11.1.5. Other Technologies

- 11.2. Market Analysis, Insights and Forecast - by Animal Type

- 11.2.1. Dogs

- 11.2.2. Cats

- 11.2.3. Other Animal Types

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Boehringer Ingelheim GmbH

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Durvet Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Indian Immunologicals Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Merck & Co Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 HIPRA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 6 COMPETITIVE LANDSCAPE6 1 COMPANY PROFILES

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Brilliant Bio Pharma

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Hester Biosciences Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Phibro Animal Health Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Virbac

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Bioveta AS

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Elanco Animal Health Incorporated

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Zoetis Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Boehringer Ingelheim GmbH

List of Figures

- Figure 1: Global Companion Animal Vaccines Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Companion Animal Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Companion Animal Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Companion Animal Vaccines Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 5: North America Companion Animal Vaccines Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 6: North America Companion Animal Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Companion Animal Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Companion Animal Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Companion Animal Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Companion Animal Vaccines Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 11: Europe Companion Animal Vaccines Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: Europe Companion Animal Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Companion Animal Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Companion Animal Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Companion Animal Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Companion Animal Vaccines Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 17: Asia Pacific Companion Animal Vaccines Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 18: Asia Pacific Companion Animal Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Companion Animal Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East Companion Animal Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Middle East Companion Animal Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Middle East Companion Animal Vaccines Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 23: Middle East Companion Animal Vaccines Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: Middle East Companion Animal Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East Companion Animal Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: GCC Companion Animal Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 27: GCC Companion Animal Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: GCC Companion Animal Vaccines Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 29: GCC Companion Animal Vaccines Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 30: GCC Companion Animal Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: GCC Companion Animal Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Companion Animal Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 33: South America Companion Animal Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 34: South America Companion Animal Vaccines Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 35: South America Companion Animal Vaccines Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 36: South America Companion Animal Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: South America Companion Animal Vaccines Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 3: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 6: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 12: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 20: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 21: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 29: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 30: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 32: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 33: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South Africa Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 37: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 38: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Brazil Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Argentina Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of South America Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Companion Animal Vaccines Industry?

The projected CAGR is approximately 6.02%.

2. Which companies are prominent players in the Companion Animal Vaccines Industry?

Key companies in the market include Boehringer Ingelheim GmbH, Durvet Inc, Indian Immunologicals Ltd, Merck & Co Inc, HIPRA, 6 COMPETITIVE LANDSCAPE6 1 COMPANY PROFILES, Brilliant Bio Pharma, Hester Biosciences Limited, Phibro Animal Health Corporation, Virbac, Bioveta AS, Elanco Animal Health Incorporated, Zoetis Inc.

3. What are the main segments of the Companion Animal Vaccines Industry?

The market segments include Technology, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Companion Animals. such as Dogs and Cats; Increasing Cases of Zoonotic Diseases.

6. What are the notable trends driving market growth?

Dogs Segment is Expected to Hold a Major Share in the Companion Animal Vaccine Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Vaccine Development and Regulatory Concern.

8. Can you provide examples of recent developments in the market?

In September 2022, Merck Animal Health donated more than five million doses of its NOBIVAC rabies vaccine to help eliminate canine-mediated rabies to their key partners Mission Rabies and Rabies Free Africa through Afya Program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Companion Animal Vaccines Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Companion Animal Vaccines Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Companion Animal Vaccines Industry?

To stay informed about further developments, trends, and reports in the Companion Animal Vaccines Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence