Key Insights

The global Non-invasive Prenatal Testing (NIPT) market is projected for substantial growth, anticipated to reach $6.28 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 14.9% through 2033. This expansion is driven by increasing maternal age, heightened awareness of NIPT benefits, and advancements in genetic sequencing offering greater accuracy and detection capabilities. Early detection of conditions like Down, Edwards, and Patau syndromes is a key demand driver, providing a safer alternative to invasive prenatal diagnostics. Growing NIPT service accessibility, supported by reimbursement policies and integration into standard prenatal care in North America and Europe, further fuels market expansion. The market's value is reported in billions of USD.

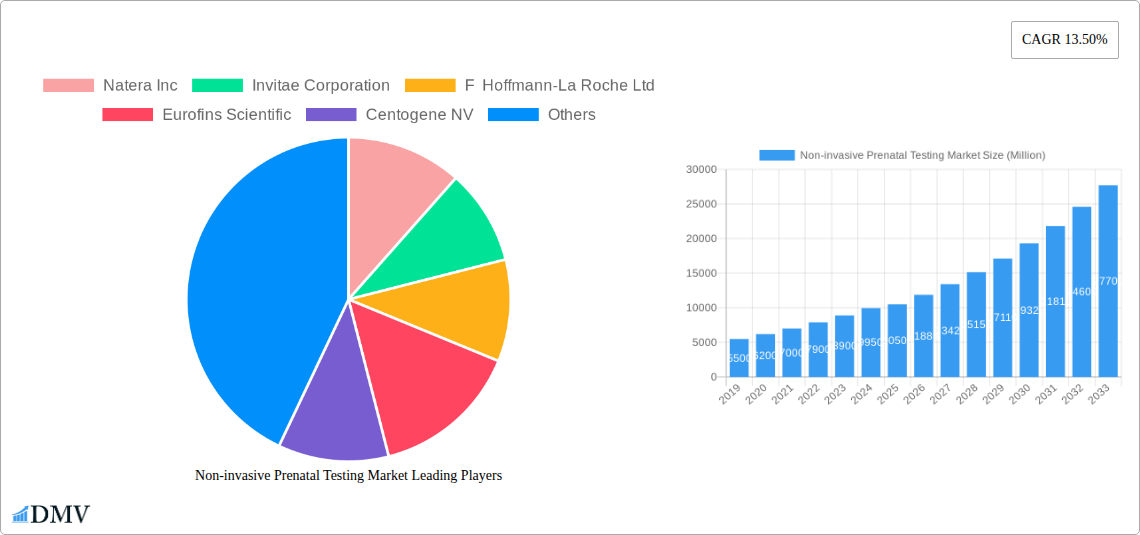

Non-invasive Prenatal Testing Market Market Size (In Billion)

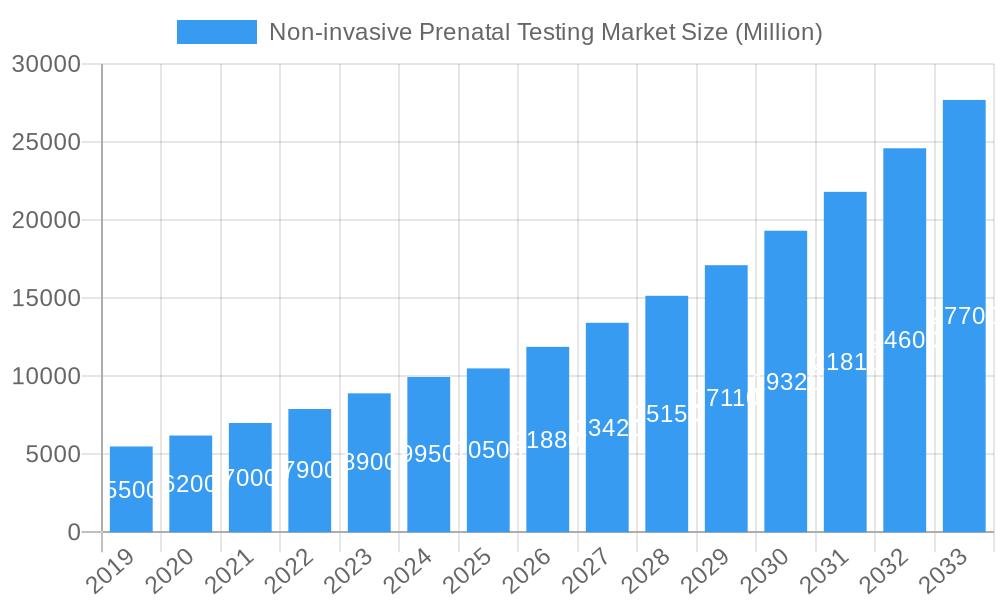

The NIPT market features a dynamic competitive environment and diverse segmentation. Key segments include Instruments, Kits & Reagents, and Services, with Services expected to grow significantly due to increased demand for comprehensive genetic analysis. Trisomy 21 (Down Syndrome), Trisomy 18 (Edwards Syndrome), and Trisomy 13 (Patau Syndrome) dominate applications, with rising interest in conditions like Turner Syndrome. End-users span hospitals, diagnostic laboratories, and direct-to-consumer offerings. Leading companies like Natera Inc., Invitae Corporation, and F. Hoffmann-La Roche Ltd. are actively investing in R&D. North America and Europe currently lead the market, with Asia Pacific showing considerable growth potential due to rising healthcare expenditure and adoption of advanced diagnostics.

Non-invasive Prenatal Testing Market Company Market Share

This comprehensive report analyzes the global NIPT market from 2019 to 2033, with a base year of 2025. It provides critical insights into market composition, industry evolution, regional dynamics, product innovations, growth drivers, challenges, and future opportunities. This analysis is an indispensable resource for stakeholders seeking to understand the current and future NIPT market landscape. Key segments analyzed include Instruments, Kits & Reagents, and Services. Applications covered are Down Syndrome (trisomy 21), Edwards Syndrome (trisomy 18), Patau Syndrome (trisomy 13), Turner Syndrome, and Other Applications. End-user analysis focuses on Hospitals and Diagnostic Labs.

Non-invasive Prenatal Testing Market Market Composition & Trends

The Non-invasive Prenatal Testing (NIPT) market exhibits a moderate level of concentration, driven by continuous innovation and a dynamic regulatory environment. Key catalysts for growth include advancements in next-generation sequencing (NGS) technologies and increasing awareness among expectant parents about genetic screening. The regulatory landscape is evolving, with some regions establishing clearer guidelines for NIPT adoption, while others are still developing frameworks. Substitute products, such as traditional prenatal screening methods like amniocentesis and chorionic villus sampling (CVS), are gradually being replaced by NIPT due to its safety profile. End-user profiles reveal a growing preference for NIPT in both hospital settings and specialized diagnostic laboratories, driven by its accuracy and non-invasive nature. Merger and acquisition (M&A) activities are significant, reflecting the strategic importance of this market. For instance, the acquisition of EasyDNA by Genetic Technologies Limited in July 2022 underscores consolidation and expansion efforts. While specific M&A deal values are not universally disclosed, the consistent interest from major players indicates substantial investment flow, estimated to be in the hundreds of millions. Market share distribution is influenced by proprietary technologies and established brand presence.

Non-invasive Prenatal Testing Market Industry Evolution

The Non-invasive Prenatal Testing (NIPT) market has witnessed remarkable evolution over the historical period (2019–2024) and is projected to experience robust growth throughout the forecast period (2025–2033). This expansion is fundamentally driven by a confluence of technological breakthroughs, increasing adoption rates, and a growing global emphasis on proactive genetic health monitoring during pregnancy. The journey began with initial implementations of NIPT, primarily focusing on common aneuploidies like Trisomy 21. However, rapid advancements in sequencing technologies, particularly next-generation sequencing (NGS), have dramatically enhanced the accuracy and broadened the scope of NIPT. This technological leap has allowed for the detection of a wider array of chromosomal abnormalities and microdeletions with unprecedented precision.

The market growth trajectory has been consistently upward, with an estimated Compound Annual Growth Rate (CAGR) projected to exceed 15% from 2025 to 2033. This impressive growth rate is a testament to several factors. Firstly, the shift from invasive diagnostic procedures to safer, non-invasive screening methods is a primary adoption driver. Expectant parents and healthcare providers alike are increasingly favoring NIPT due to its inherent safety, eliminating the risks associated with miscarriage or fetal injury. Secondly, the expanding clinical utility of NIPT, moving beyond basic aneuploidy screening to include detection of rare genetic disorders and copy number variations (CNVs), has significantly increased its perceived value. Diagnostic labs are investing heavily in NIPT platforms, with adoption metrics showing a steady increase in the number of tests performed annually, reaching tens of millions globally by the base year of 2025.

Furthermore, the decreasing cost of sequencing, a direct consequence of technological innovation, has made NIPT more accessible to a larger demographic, thereby fueling market penetration. The increasing prevalence of genetic disorders, coupled with a heightened awareness of genetic counseling and screening benefits, further propels market expansion. Regulatory approvals and endorsements from key medical bodies have also played a crucial role in building trust and encouraging wider clinical integration. The market has transitioned from a niche offering to a mainstream prenatal screening option, supported by collaborations between technology providers and healthcare institutions. This ongoing evolution signifies a mature yet dynamic market poised for sustained expansion driven by ongoing innovation and increasing demand for comprehensive prenatal genetic insights.

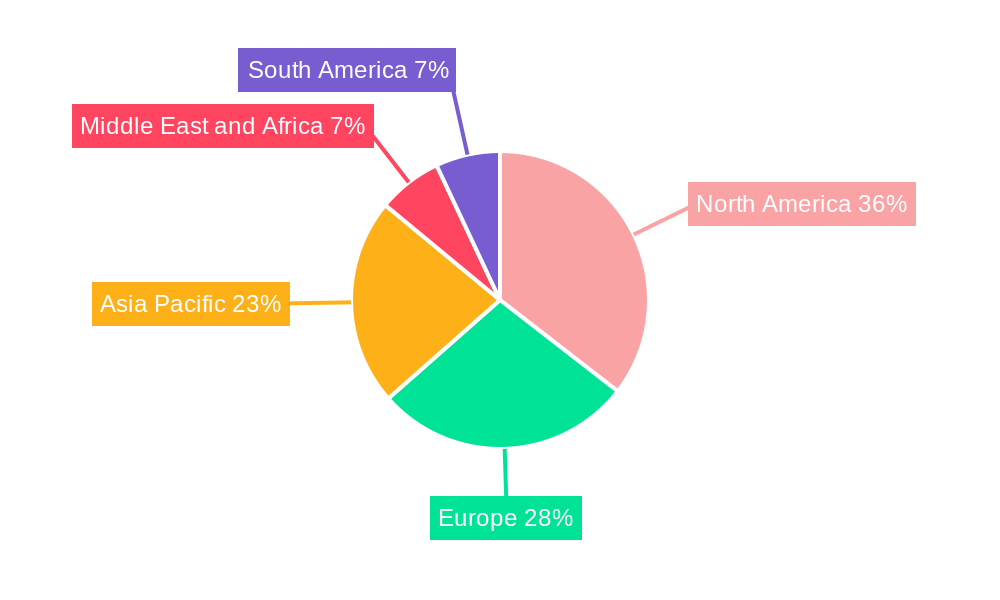

Leading Regions, Countries, or Segments in Non-invasive Prenatal Testing Market

The global Non-invasive Prenatal Testing (NIPT) market's dominance is characterized by regional strengths and segment-specific growth. North America has emerged as a leading region, driven by a combination of high healthcare expenditure, advanced technological infrastructure, and a strong emphasis on personalized medicine. The presence of key market players like Natera Inc. and Invitae Corporation within the region significantly contributes to its leadership.

Within the Component segment, Kits and Reagents currently hold the largest market share, estimated to be over 50% of the total market value in the base year 2025. This dominance is attributed to the recurring need for these consumables in high-throughput NIPT analysis and the increasing adoption of diverse NIPT panels. The Services segment, encompassing laboratory analysis and data interpretation, is also experiencing rapid growth, projected to capture a substantial share due to the specialized expertise required.

In terms of Application, Down Syndrome (trisomy 21) screening remains the most prevalent, accounting for over 60% of all NIPT tests performed. However, significant growth is observed in "Other Applications," which includes the detection of microdeletions and rare chromosomal abnormalities, indicating a trend towards more comprehensive genetic analysis.

For End Users, Diagnostic Labs represent the largest segment, projected to account for approximately 70% of the market value by 2025. This is due to the outsourcing of NIPT testing by hospitals and the specialized nature of genetic testing services.

Key Drivers for Dominance in North America:

- Investment Trends: Significant venture capital and corporate investment in NIPT companies, fostering research and development.

- Regulatory Support: Favorable regulatory frameworks, such as the FDA's evolving stance on NIPT, encouraging innovation and adoption.

- Technological Adoption: High adoption rates of advanced sequencing technologies and bioinformatics platforms.

- Healthcare Infrastructure: Well-established healthcare systems and insurance coverage for NIPT services.

- Awareness and Demand: High public awareness and demand for advanced prenatal screening options.

The strong performance of North America is mirrored by significant contributions from Europe and Asia-Pacific, with the latter expected to witness the fastest growth due to increasing healthcare spending and a growing population.

Non-invasive Prenatal Testing Market Product Innovations

Product innovation in the NIPT market is a relentless pursuit of higher accuracy, broader scope, and improved user experience. Companies are actively developing advanced sequencing platforms and sophisticated bioinformatics algorithms to detect a wider spectrum of genetic abnormalities beyond common trisomies, including microdeletions and copy number variations. For example, recent advancements have focused on single-nucleotide polymorphism (SNP)-based NIPT, offering enhanced accuracy and the ability to determine fetal sex with higher precision. Innovations in multiplexing technologies are enabling simultaneous testing for multiple genetic conditions from a single blood sample, improving efficiency and reducing costs. The development of proprietary software for data analysis and interpretation is also a key area of innovation, ensuring reliable and clinically actionable results. These advancements collectively enhance the performance metrics of NIPT, offering improved sensitivity and specificity, thereby solidifying its position as the gold standard in prenatal genetic screening.

Propelling Factors for Non-invasive Prenatal Testing Market Growth

The Non-invasive Prenatal Testing (NIPT) market is propelled by a confluence of powerful factors. Technological advancements, particularly in next-generation sequencing (NGS) and bioinformatics, are continuously improving accuracy and expanding the range of detectable genetic conditions. The increasing awareness among expectant parents about the benefits of early and safe genetic screening is a significant driver, leading to higher demand for NIPT. Furthermore, the declining cost of sequencing is making NIPT more accessible to a broader population, boosting market penetration. From an economic perspective, the shift towards preventative healthcare and the associated cost savings from early diagnosis and intervention further support NIPT adoption. Regulatory support and endorsements from major medical organizations are also crucial in fostering trust and encouraging widespread clinical integration. The growing incidence of genetic disorders globally also contributes to increased demand for screening.

Obstacles in the Non-invasive Prenatal Testing Market Market

Despite its promising growth, the Non-invasive Prenatal Testing (NIPT) market faces several obstacles. Regulatory challenges persist in some regions, with inconsistent guidelines and approval processes potentially hindering market access and adoption. Reimbursement policies can be complex and vary significantly across different healthcare systems, impacting affordability for a broader patient base. Ethical considerations and public perception surrounding genetic testing and selective termination can also pose challenges. Technical limitations, such as the need for robust quality control and the interpretation of results in cases of low fetal fraction or mosaicism, require ongoing research and development. Supply chain disruptions for essential reagents and components, as highlighted by global events, can impact manufacturing and timely delivery. Intense competition among key players can lead to pricing pressures, impacting profit margins.

Future Opportunities in Non-invasive Prenatal Testing Market

The Non-invasive Prenatal Testing (NIPT) market is ripe with future opportunities. The expansion into emerging markets in Asia-Pacific and Latin America, driven by increasing healthcare expenditure and growing awareness, presents a significant growth avenue. Technological advancements, such as the development of NIPT for single-gene disorders and the integration of artificial intelligence for enhanced data analysis, will unlock new testing capabilities. The increasing demand for comprehensive prenatal genetic screening, moving beyond trisomies to include a wider array of microdeletions and structural variations, represents a key opportunity for expanded test menus. Partnerships between NIPT providers and telehealth platforms can improve accessibility and patient engagement. Furthermore, the growing interest in carrier screening and preconception genetic testing can create synergistic opportunities for NIPT providers.

Major Players in the Non-invasive Prenatal Testing Market Ecosystem

- Natera Inc.

- Invitae Corporation

- F Hoffmann-La Roche Ltd

- Eurofins Scientific

- Centogene NV

- Myriad Womens Health Inc

- BGI

- Qiagen

- PerkinElmer Inc.

- Illumina Inc.

- MedGenome Labs Ltd

Key Developments in Non-invasive Prenatal Testing Market Industry

- August 2022: Natera Inc. filed a pre-submission to the Food and Drug Administration (FDA) for its panorama non-invasive prenatal test (NIPT) as part of the Q-Sub process. The company filed its pre-submission in June 2022 for fetal chromosomal aneuploidies and 22q11.2 deletion syndrome.

- July 2022: Genetic Technologies Limited acquired EasyDNA as the company expanded the availability on its websites of Carrier Testing and Non-Invasive Prenatal Tests (NIPT) in Europe.

Strategic Non-invasive Prenatal Testing Market Market Forecast

The strategic Non-invasive Prenatal Testing (NIPT) market forecast indicates a robust growth trajectory driven by escalating demand for advanced prenatal diagnostics and a continuous pipeline of technological innovation. Key growth catalysts include the increasing adoption of NIPT for a broader spectrum of genetic conditions beyond common trisomies, such as microdeletions and single-gene disorders. The ongoing decline in sequencing costs will further enhance accessibility, particularly in emerging economies, unlocking significant market potential. Strategic collaborations between diagnostic laboratories, healthcare providers, and technology developers will be crucial for expanding NIPT's reach and clinical integration. The market's future is characterized by a move towards more comprehensive, personalized prenatal genetic assessments, positioning NIPT as an indispensable tool in modern obstetrics.

Non-invasive Prenatal Testing Market Segmentation

-

1. Component

- 1.1. Instruments

- 1.2. Kits and Reagents

- 1.3. Services

-

2. Application

- 2.1. Down Syndrome (trisomy 21)

- 2.2. Edwards Syndrome (trisomy 18)

- 2.3. Patau Syndrome (trisomy 13)

- 2.4. Turner Syndrome

- 2.5. Other Applications

-

3. End User

- 3.1. Hospitals

- 3.2. Diagnostic Labs

Non-invasive Prenatal Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Non-invasive Prenatal Testing Market Regional Market Share

Geographic Coverage of Non-invasive Prenatal Testing Market

Non-invasive Prenatal Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Babies with Chromosomal Disorders Owing to Increasing Number of Late Pregnancies; Increasing Demand for Early and Non-invasive Fetal Diagnosis; Favorable Reimbursement Policies

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals; Stringent Regulations and Ethical Concerns

- 3.4. Market Trends

- 3.4.1. Down Syndrome Segment Dominates the Non-invasive Prenatal Testing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Non-invasive Prenatal Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Instruments

- 5.1.2. Kits and Reagents

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Down Syndrome (trisomy 21)

- 5.2.2. Edwards Syndrome (trisomy 18)

- 5.2.3. Patau Syndrome (trisomy 13)

- 5.2.4. Turner Syndrome

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Diagnostic Labs

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Non-invasive Prenatal Testing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Instruments

- 6.1.2. Kits and Reagents

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Down Syndrome (trisomy 21)

- 6.2.2. Edwards Syndrome (trisomy 18)

- 6.2.3. Patau Syndrome (trisomy 13)

- 6.2.4. Turner Syndrome

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Diagnostic Labs

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Non-invasive Prenatal Testing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Instruments

- 7.1.2. Kits and Reagents

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Down Syndrome (trisomy 21)

- 7.2.2. Edwards Syndrome (trisomy 18)

- 7.2.3. Patau Syndrome (trisomy 13)

- 7.2.4. Turner Syndrome

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Diagnostic Labs

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Non-invasive Prenatal Testing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Instruments

- 8.1.2. Kits and Reagents

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Down Syndrome (trisomy 21)

- 8.2.2. Edwards Syndrome (trisomy 18)

- 8.2.3. Patau Syndrome (trisomy 13)

- 8.2.4. Turner Syndrome

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Diagnostic Labs

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East and Africa Non-invasive Prenatal Testing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Instruments

- 9.1.2. Kits and Reagents

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Down Syndrome (trisomy 21)

- 9.2.2. Edwards Syndrome (trisomy 18)

- 9.2.3. Patau Syndrome (trisomy 13)

- 9.2.4. Turner Syndrome

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Diagnostic Labs

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. South America Non-invasive Prenatal Testing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Instruments

- 10.1.2. Kits and Reagents

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Down Syndrome (trisomy 21)

- 10.2.2. Edwards Syndrome (trisomy 18)

- 10.2.3. Patau Syndrome (trisomy 13)

- 10.2.4. Turner Syndrome

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Diagnostic Labs

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Natera Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Invitae Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 F Hoffmann-La Roche Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eurofins Scientific

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Centogene NV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Myriad Womens Health Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BGI

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Qiagen*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PerkinElmer Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Illumina Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MedGenome Labs Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Natera Inc

List of Figures

- Figure 1: Global Non-invasive Prenatal Testing Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Non-invasive Prenatal Testing Market Revenue (billion), by Component 2025 & 2033

- Figure 3: North America Non-invasive Prenatal Testing Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Non-invasive Prenatal Testing Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Non-invasive Prenatal Testing Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Non-invasive Prenatal Testing Market Revenue (billion), by End User 2025 & 2033

- Figure 7: North America Non-invasive Prenatal Testing Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Non-invasive Prenatal Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Non-invasive Prenatal Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Non-invasive Prenatal Testing Market Revenue (billion), by Component 2025 & 2033

- Figure 11: Europe Non-invasive Prenatal Testing Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Non-invasive Prenatal Testing Market Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Non-invasive Prenatal Testing Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Non-invasive Prenatal Testing Market Revenue (billion), by End User 2025 & 2033

- Figure 15: Europe Non-invasive Prenatal Testing Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Non-invasive Prenatal Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Non-invasive Prenatal Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Non-invasive Prenatal Testing Market Revenue (billion), by Component 2025 & 2033

- Figure 19: Asia Pacific Non-invasive Prenatal Testing Market Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Pacific Non-invasive Prenatal Testing Market Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Non-invasive Prenatal Testing Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Non-invasive Prenatal Testing Market Revenue (billion), by End User 2025 & 2033

- Figure 23: Asia Pacific Non-invasive Prenatal Testing Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Non-invasive Prenatal Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Non-invasive Prenatal Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Non-invasive Prenatal Testing Market Revenue (billion), by Component 2025 & 2033

- Figure 27: Middle East and Africa Non-invasive Prenatal Testing Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East and Africa Non-invasive Prenatal Testing Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Non-invasive Prenatal Testing Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Non-invasive Prenatal Testing Market Revenue (billion), by End User 2025 & 2033

- Figure 31: Middle East and Africa Non-invasive Prenatal Testing Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Non-invasive Prenatal Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Non-invasive Prenatal Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Non-invasive Prenatal Testing Market Revenue (billion), by Component 2025 & 2033

- Figure 35: South America Non-invasive Prenatal Testing Market Revenue Share (%), by Component 2025 & 2033

- Figure 36: South America Non-invasive Prenatal Testing Market Revenue (billion), by Application 2025 & 2033

- Figure 37: South America Non-invasive Prenatal Testing Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Non-invasive Prenatal Testing Market Revenue (billion), by End User 2025 & 2033

- Figure 39: South America Non-invasive Prenatal Testing Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Non-invasive Prenatal Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Non-invasive Prenatal Testing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Component 2020 & 2033

- Table 6: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Component 2020 & 2033

- Table 13: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United kingdom Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Component 2020 & 2033

- Table 23: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by End User 2020 & 2033

- Table 25: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Component 2020 & 2033

- Table 33: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by End User 2020 & 2033

- Table 35: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Component 2020 & 2033

- Table 40: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by End User 2020 & 2033

- Table 42: Global Non-invasive Prenatal Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Non-invasive Prenatal Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-invasive Prenatal Testing Market?

The projected CAGR is approximately 14.9%.

2. Which companies are prominent players in the Non-invasive Prenatal Testing Market?

Key companies in the market include Natera Inc, Invitae Corporation, F Hoffmann-La Roche Ltd, Eurofins Scientific, Centogene NV, Myriad Womens Health Inc, BGI, Qiagen*List Not Exhaustive, PerkinElmer Inc, Illumina Inc, MedGenome Labs Ltd.

3. What are the main segments of the Non-invasive Prenatal Testing Market?

The market segments include Component, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.28 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Babies with Chromosomal Disorders Owing to Increasing Number of Late Pregnancies; Increasing Demand for Early and Non-invasive Fetal Diagnosis; Favorable Reimbursement Policies.

6. What are the notable trends driving market growth?

Down Syndrome Segment Dominates the Non-invasive Prenatal Testing Market.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals; Stringent Regulations and Ethical Concerns.

8. Can you provide examples of recent developments in the market?

August 2022: Natera Inc. filed a pre-submission to the Food and Drug Administration (FDA) for its panorama non-invasive prenatal test (NIPT) as part of the Q-Sub process. The company filed its pre-submission in June 2022 for fetal chromosomal aneuploidies and 22q11.2 deletion syndrome.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Non-invasive Prenatal Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Non-invasive Prenatal Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Non-invasive Prenatal Testing Market?

To stay informed about further developments, trends, and reports in the Non-invasive Prenatal Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence